-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Energy and Power

p-ISSN: 2163-159X e-ISSN: 2163-1603

2013; 3(4): 37-43

doi:10.5923/j.ep.20130304.01

Political Economy of Phasing out Fuel Subsidy in Nigeria

Akinwale Y. O., Olaopa O.R., Ogundari I., Siyanbola W. O

National Center for Technology Management, Obafemi Awolowo University, Ile-Ife, Nigeria

Correspondence to: Akinwale Y. O., National Center for Technology Management, Obafemi Awolowo University, Ile-Ife, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

One of the contentious issues in Nigeria is the removal of fuel subsidy on Petroleum Motor Spirit (PMS). The purpose of this paper is to evaluate the argument for and against subsidy removal. An empirical investigation of the impact of fuel subsidy removal on fuel consumption was conducted using Least Square method. The result of the twenty six years under review shows that subsidy removal will reduce fuel consumption which will lead to efficient fuel demand and reduction in carbon emission. The money saved can be used for transforming the economy by building infrastructure, establishing new refineries and maintaining the old ones through improved technology management among others. However, the study also shows that there are weak and non-transparent institutional frameworks which cause lack of credibility and trusts of the government by the citizens. This study therefore recommends that that fuel subsidy should be removed gradually instead of one-off and that government should provide a strong and transparent institutional framework as well as a sound infrastructure for her citizens before subsidy is totally phased out in Nigeria.

Keywords: Subsidy, Fuel, Phase-Out, Nigeria, Price

Cite this paper: Akinwale Y. O., Olaopa O.R., Ogundari I., Siyanbola W. O, Political Economy of Phasing out Fuel Subsidy in Nigeria, Energy and Power, Vol. 3 No. 4, 2013, pp. 37-43. doi: 10.5923/j.ep.20130304.01.

Article Outline

1. Introduction

- Fuel subsidy is one of the critical issues that dominate public debate in oil exporting developing nations and among the G-20. In Nigeria, larger proportion of the citizens are seriously resisting the government-planned policy to remove fuel subsidy which according to them is against the Millennium Development Goals (MDGs) of the government which aim to reduce the number of people living in poverty to less than 50% by 2015. Some public analysts believed that the pressure to remove subsidy is designed by experts with insufficient understanding of the Nigerian economy or who choose to ignore the inability of client governments to effectively implement anti poverty programmes. However, the proponents of fuel subsidy removal highlighted low efficiency in energy use, wastage of huge sum of resources on subsidies which are needed to transform national development, reduction of CO2 emissions, higher benefits for the rich with little or no benefits for the poor, and poor technology management of the refinery among others as part of the problems of oil subsidy.This paper therefore critically reviews the pros and the cons of the fuel subsidy removal in Nigeria. The impact of subsidy removal on energy demand, standard of living and the technology management of the local refinery through turn around maintenance will also be reviewed. Section two focuses on the theoretical framework and literature review, section three discusses the methodology and data presentation, section four analyses the data while the last section summarises the findings and make policy recommendations for the government.

2. Theoretical Framework and Literature Review

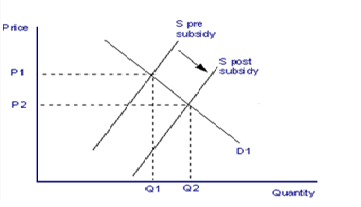

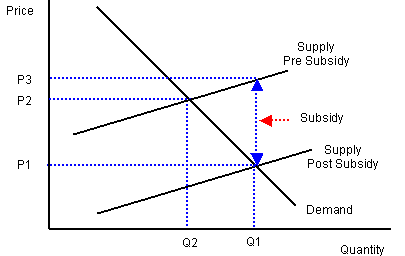

- This section discusses the economic theories of government subsidy and the related literatures.

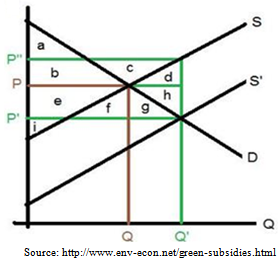

| Figure 1. Diagram showing the Effect of a Producer Subsidy |

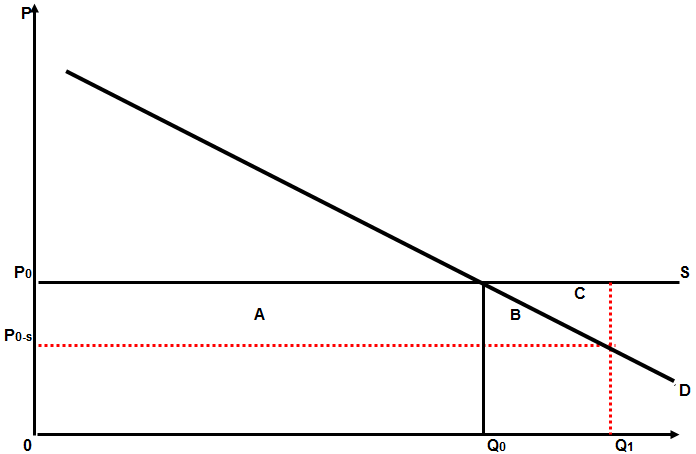

| Figure 2. Diagram showing the amount spent on Subsidy |

| Figure 3. Diagram showing the Cost-Benefit Analysis of subsidies |

| Figure 4. Oil Price Subsidy |

2.1. Literature Review on Fuel Subsidy Removal in Nigeria

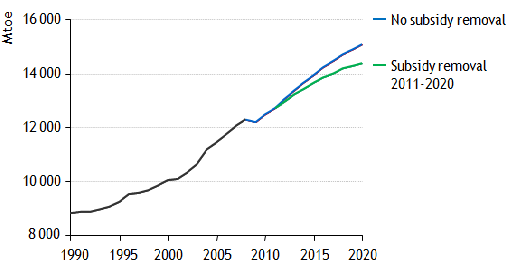

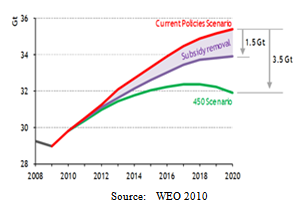

- There have been diverse views about the fuel subsidy removal in Nigeria and other parts of the world. Some of these views are base on emotions while others are based on empirical findings. According to Strategic Union of Professionals for the Advancement of Nigeria (SUPA) there is no subsidy on the price of fuel after carrying out a cost determination analysis that the actual cost of fuel is lower than the current retail price[3]. Also,[4] claimed that subsidy removal will further deepen poverty in Nigeria, thus, it is more sensible to delay the removal of subsidy until the government delivers on the electricity supply required to service industries and may be the citizens must have developed confidence in accountability and good governance. This will ensure a more transparent privatisation process that will respond to the market magic of enterprise and ‘trickle down’ effect. Alexander Oil and Gas Connections[5] also argued that the current price of fuel in Nigeria covers the cost of producing it. He concluded that there is no subsidy in the prevailing official prices of fuel in Nigeria. Also[6] in the sun newspaper argued that though the subsidy removal of the Nigeria’s government sound beneficial but Nigerian citizens do not trust the government as corruption, mismanagement of fund, poor maintenance of refineries and all forms of ill practices still persist in petroleum agencies like NNPC and the country. For instance, about 50 percent of the oil exploration activities in the country are unaccounted for, while bunckering and other illegal activities are taking place across the Nigerdelta creeks on daily basis. One other major challenge to the oil sector is the failure of the local refineries over the years. All efforts to ensure the revival of Nigeria’s four refineries in the past years have failed, as the installations have turned to drain pipes on the economy they are meant to support[7]. Instead, the feedstock, which are sold at ridiculous prices to the cartel, are refined into marketable petroleum products in other countries and imported to Nigeria at prevailing international market price[8]. It is on this note that those people belonging to the anti-subsidy removal school of thought posited that the call for subsidy removal is the greatest acts of insensitivity on the part of the government[9]. As an alternative, it was advised that the federal government should block all loopholes of corruption in the fuel and power sector and other areas as its constitutional responsibilities rather than passing the burden to the poor citizens. In the last 33 years, the price of petroleum has gone up from nine kobo to sixty-five naira. It thus defies comprehension that the subsidy has remained unremoved. It is indeed apparent to everybody, except to the political and powerful elites, that the problem has nothing to do with the subsidy but with the (mis) management of the oil wealth. The present administration has consistently agreed that the so-called subsidy does not get to the ordinary people it is meant for, and it’s equally aware of the existence of a cartel whose stranglehold on fuel importation frustrates its objectives on fuel subsidy, yet it has not done anything substantial to address these. However, there are other authors who believe oil subsidy only creates deadweight loss. Kemp (2011) argued that petroleum product should be priced to reflect its full values to the economy (i.e market price), the nation should obtain benefit from production through tax revenues and assists the poor consumers through direct financial assistance schemes. An empirical analysis was conducted by[10] whether fuel subsidy is a fact or fallacy, and they concluded that fuel subsidy is a fact and that government should control the level of fuel subsidy prevailing in the country. Kojima and Bacon[11] argued that subsidizing fuels has high costs. More so, universal price subsidies always favour high income households more than the poor, because richer households consume more energy. The undesirable consequences include rampant abuses in fuel markets and an inefficient downstream petroleum sector languishing for need of reform. Subsidies only give the consumers financial incentives to over consume the subsidised commodity which leads to deadweight loss. Also,[12] concluded, after reviewing some developing countries, that fuel price subsidies though help the poor but place a large cost on the society and governments. They therefore advise the governments to move away from fuel subsidies as rapidly as possible and substitute them with targeted aids to the poor. An efficient ways to identify the targeted beneficiaries and deliver such aids to them should be given an utmost priority.Some members of staff in International Monetary Fund (IMF) projected that global consumer pretax subsidy to reach $250 billion in 2010 from $60 billion in 2003; and the tax-inclusive subsidies are estimated to reach $740 billion in 2010, which is 1% of the global GDP[13]. Meanwhile, G-20 countries account for 70% of tax-inclusive subsidies with emerging countries among the G-20 account for the sizable share. Thus, cutting tax-inclusive subsidies by one-half could reduce projected fiscal deficits by one-sixth in subsidizing countries and could reduce greenhouse emissions by around 15 percent over the long run. Revenue generation and environmental degradation should be put into considerations; hence, petroleum products should be taxed at a rate that reflects the marginal environmental damage caused by their consumption. They concluded by suggesting subsidy reform such as compensating the poor, transparency in government accounts among others.[14] also studied the impact of subsidy phase out in oil exporting developing countries specifically Algeria, Iran and Nigeria. They confirmed that fuel subsidies bring about excessive demand and supply by the consumers and the producers respectively which lead to wastages. The outcomes of their investigations showed that policy geared at more rational use of energy lead to energy-efficiency. This, according to them, will enable these countries to save enough oil to meet future increases in demand while maintaining stable production capacity which would enhance their economic development. According to World Energy Outlook[15], the annual level of fossil-fuel consumption subsidies fluctuates with changes in international prices, domestic pricing policies, exchange rates and demand. Iran was identified as the country with the highest subsidies in 2008 which stood at $101 billion and the value was around a third of the country’s annual central budget. This has placed a major burden on the economy that is forcing reliance on imports of refined products.

| Figure 5. Impact of subsidy phase-out on global primary energy demand |

| Figure 6. Impact of Subsidy phase-out on global energy-related CO2 emissions |

3. Methodology and Empirical Analysis

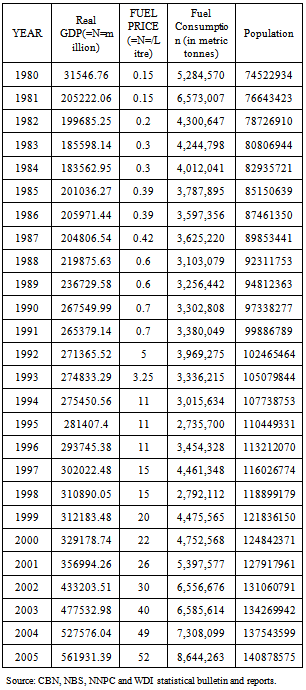

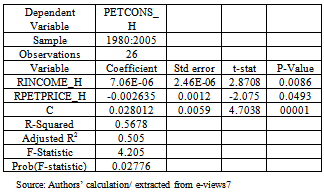

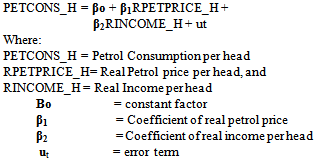

- This section focus on the methodology adopted for the study and the explanations of the results.According to[20], research methodology considers and explains the logic behind research methods and techniques. This research method and techniques include the procedures, modalities adopted in the collection of data, determination and identification of the population, sample size, sampling procedures, validity and reliability of data collected during the study. Also the sources of data used and methods of analysing the data collected for the purpose of the study. In pursuant of this study, the Ordinary Least Squares method (OLS) of multiple regressions is adopted in estimating a specified model. This statistical technique seeks to determine the nature of relationship between selected variables[21]. This aims to examine whether changes in one variable leads to changes in other variable(s). Linear Multiple regression is employed as a result of more than one independent variable that is involved. This statistic is necessary when occasion is such that the objective is to investigate the possibility that movement in the dependent variable are caused by several independent factors. The data used in this study were obtained from secondary sources. The data were collated from different sources such as Annual statistical bulletin of the Central Bank of Nigeria (CBN), National Bureau of Statistics (NBS), Nigeria National Petroleum Corporation (NNPC) and World Bank Development Indicator (WDI) reports. The study focused on time series data between 1980 and 2005. The scope was selected because the price of fuel prior to 1980 was extremely small while the fuel consumption data beyond 2005 and the time series data for fuel subsidy per litre for the period under review were not available in any of the NNPC, CBN, NBS and WDI statistical reports as at the time of this study. The econometric model is stated as follow:

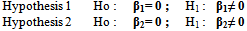

The model explains the relationship between petrol consumption per head which is a dependent variable and real petrol price (specifically PMS in this case) and real income per head which are independent variables. One of the relationships will show the impact of fuel subsidy removal on fuel consumption which is proxy by the increase in petrol price. The other will show the impact of increase in income per head on petrol consumption. Two hypotheses will be formulated to examine whether changes in petrol price and income per head have significant effect on household petrol consumption. These hypotheses are:

The model explains the relationship between petrol consumption per head which is a dependent variable and real petrol price (specifically PMS in this case) and real income per head which are independent variables. One of the relationships will show the impact of fuel subsidy removal on fuel consumption which is proxy by the increase in petrol price. The other will show the impact of increase in income per head on petrol consumption. Two hypotheses will be formulated to examine whether changes in petrol price and income per head have significant effect on household petrol consumption. These hypotheses are: Ho which represent the Null hypothesis stated that price of fuel and income per head have no significant effect on petrol consumption while the Alternative hypothesis H1 means that price of fuel and income per head have a significant effect on household petrol consumption .

Ho which represent the Null hypothesis stated that price of fuel and income per head have no significant effect on petrol consumption while the Alternative hypothesis H1 means that price of fuel and income per head have a significant effect on household petrol consumption .

|

|

4. Policy Recommendations

- This paper suggests few recommendations to the government base on its findings. The Nigerian government should firstly focus on various ways to improve the performance of the local refineries since none of them is working at optimum. The private sectors should be allowed to invest in the refineries’ operation so that the necessary technology management can be harnessed. Also, government should provide a conducive environment and policies that will motivate the development of various renewable energies.Furthermore, there should be an effective publicity campaign that lasts for a long period sensitising the citizens about the benefits of removing petrol subsidy and the cost of leaving subsidy. The campaign should cut across the Academic Staff Union of Universities, polytechnics, all the labour unions and the entire ministries. This should then be followed by the transparent policy on how the government will spend the money saved from subsidy on infrastructure such as good roads, on targeted education, on health care, on job creation, on electricity provision among others that will benefit the no/low income earners. Afterwards, the subsidy can then be removed gradually before it is finally phased out.Nigerian government should engage independent consultant who will audit the activities surrounding the price of fuel and also how the money saved is spent. The consultant will then publish its reports regularly for public accessibility.

5. Conclusions

- This paper has critically reviewed the pros and cons of fuel subsidy in Nigeria. The empirical result shows that phasing out fuel subsidy will reduce indiscriminate fuel consumption which will lead to reduction in carbon emission, and money saved could be channelled towards infrastructural development, revitalising the local refineries among other factors that will transform Nigerian economy. However, the strong and transparent institutional framework that could transform the money saved from subsidy removal to economic growth is very weak in Nigeria. Nigeria government should ensure that policies that will improve the welfare of the low income citizens, strong institutional framework and improved refinery technology are enforced before fuel subsidy is totally phased out.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML