-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2025; 15(1): 20-33

doi:10.5923/j.economics.20251501.03

Received: Aug. 11, 2025; Accepted: Sep. 5, 2025; Published: Sep. 8, 2025

Algorithms Meet Adversity: AI in Lebanon's Battle Against Financial Crisis

Kamal Elie Makhoul, Dr. Naji Jammal

Faculty of Business Administration at Jinan University, Lebanon

Correspondence to: Kamal Elie Makhoul, Faculty of Business Administration at Jinan University, Lebanon.

| Email: |  |

Copyright © 2025 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The crisis that Lebanon faced and continues to face in its finances, which started in 2019, was accompanied by one of the fastest developing areas of artificial intelligence in financial stability. The present paper considers the example of the Lebanese private financial sphere which has been adapted to the use of AI technologies to overcome one of the historical points of the economic crashes. Based on 150 participants (100 consumers, 50 companies) and a mixed-method study combined with SPSS analysis, the study found that Lebanese companies were interested in export to AI solutions in 64% of the cases researchers studied, in contrast to 55 percent of consumers who expressed interest in buying local goods rather than imports, even with a 95 percent local currency devaluation and the paralysis of the banking system. The research determines three decisive AI applications, such as the Neo Digital Bank algorithmic platform that successfully reduces the cost by 40%, the cryptocurrency adoption that reached 78% of the businesses surveyed, and the machine learning-based risk assessment systems that happen to be 92% accurate in cases of hyperinflation. The results point to the dual nature of AI as crisis reduction strategy and adaptation system since Lebanese fintech continued to hold the status of third-largest ecosystem in MENA despite unfavorable economic conditions. Nonetheless, the capabilities of AI have limitations due to infrastructure limitations and regulatory loop holes. The study will help gain insight into the use of AI during the crisis, providing a rare natural experiment on the use of algorithms to address financial problems on a scale of maximum economic strain. The recommendations on the policy state that the focus areas require regulatory frameworks concerning AI governance, investments in infrastructure and engagement of the government and society through public-private partnership in addressing the crisis using AI.

Keywords: Artificial Intelligence, Financial Crisis, Lebanon, Digital Banking, Economic Resilience, Fintech

Cite this paper: Kamal Elie Makhoul, Dr. Naji Jammal, Algorithms Meet Adversity: AI in Lebanon's Battle Against Financial Crisis, American Journal of Economics, Vol. 15 No. 1, 2025, pp. 20-33. doi: 10.5923/j.economics.20251501.03.

Article Outline

1. Introduction

- The cross connection between artificial intelligence and financial crisis solving is one of the most interesting areas of the modern economy research. The financial collapse that Lebanon has never seen before, which started in October 2019, gives a special laboratory where the response to economic adversity through experimental algorithmic methods can be observed. Following a 58 percent contraction in the GDP between 2019-2021 and a 95 percent drop in the purchasing power of the Lebanese pound, extinction level pressures fell on the country financially in the form of the collapse of the private financial sector, which the traditional economic models had not foreseen or been able to correct [1]. This sort of crisis came very interestingly with high rise in use of AI as pertains to stability in the financial field. During the simulation process, machine learning models worldwide could predict the crisis with 92-98% accuracy [2], whereas, in practice, the Lebanese man-made crisis followed the algorithmic sequence of events because they created unprecedented circumstances to conduct an empirical study on the application of AI when the financial system collapses. Lebanon ranked in the middle of the 19th century as one of the three most serious crises in the world according to the World Bank representatives, whereas the fintech domain in the country did not only sustain but flourished, showing exceptional rates of algorithmic inventiveness [3]. The reaction of the Lebanese private sector is paradoxical as on the one hand, even traditional banking systems froze, whereas on the other, financial innovations in the form of digital instruments increased in speed. The most recent implementation under the conditions of the crisis is the introduction of the Neo digital bank by Bank Audi in 2024 on the AI-driven platforms [4]. At the same time, people began to adopt cryptocurrency since it became a viable alternative algorithm to a broken traditional banking system, especially when Lebanese people are turning to use Bitcoin and Tether more often to make daily purchases [5]. To examine the role of artificial intelligence technologies when it comes to operating during economic crisis has given way to the following research question which leads into this research study: How has the privatized financial sector in Lebanon mobilized artificial intelligence technologies to manage crisis and what insights can this lead towards the use of artificial intelligence in crisis management across the world? This study covers an urgent unaddressed knowledge problem because well-developed AI crisis prediction frameworks are created within theoretical models, but it is not empirically explored in real crisis situations.This article examines three primary research objectives: first, analyzing specific AI implementations in Lebanon's private financial sector during 2019-2025; second, measuring consumer and business attitudes toward AI-driven financial solutions during crisis conditions; and third, evaluating the effectiveness of algorithmic approaches compared to traditional crisis management strategies. The study employs a mixed- methods approach combining quantitative surveys with qualitative case studies to provide comprehensive insights into algorithms meeting adversity in real-world conditions.

2. Literature Review

2.1. Global AI Applications in Financial Crisis Management

- Since 2019, astounding developments of AI-driven financial crisis prediction and management systems are evident in the scholarly literature. This is evidenced in an innovative study Fouliard et al., which reveal the online machine learning frameworks having a prediction of major financial crises occurrence 12 quarters in advance with an accuracy up to 98 percent in seven of the world developed economies [6]. Their approach expounds on 26 expert models via exponentially weighted averages, including 244 quarterly economic user variables, which is the current research uncrowned in predicting a crisis in an algorithmic perspective. It is possible to observe three phases of AI development within the scope of financial crisis management. The initial step (2010-2015) was concentrated on simple machine learning methods to fraud detection and the basic risk assessment. The second phase (2016-2020) added deep learning architecture and ensemble schemes in complicated pattern recognition in financial markets. This current third phase (2021-present) focuses on deployment of real-time, explainable AI, and integrated crisis response system that can make autonomous decisions based on extreme stress situations. A comparison of the adoption of AI in various developed economies found large differences in adoption effectiveness. According to investigations conducted by the European Central Bank, countries with strong digital infrastructure were 34 percent more successful with predicting the crises than in the countries with little technological capabilities [8]. The fact is especially significant to such developing economies as Lebanon, where the management of crisis with the help of AI may be hindered because of the limits in infrastructural resources.These advances significantly outperform traditional econometric methods. Chen et al.'s 2024 research shows Temporal Convolutional Networks exceed logistic regression models for early warning systems, while Samitas et al. achieved 98.8% accuracy using network analysis and machine learning algorithms for crisis prediction [7]. Technical sophistication has shifted quickly with mere regression comparison to ensembles, advanced deep learning architecture and real-time implant abilities.The meta-analysis of 127 studies in the field of AI financial applications shows that such programs can improve the performance of crisis warning (on average, 23% of improvement in accuracy), risk appraisal (31%), operational efficiency (28 per cent cost savings). These advantages however focus on the economies that have stable institutional structures, and thus the question arises on how effective AI would be applied in developing countries that have been hit by crisis where their institutional capabilities are weak.The analysis by Danielsson and Uthemann, 2024, has essential theoretical points of departure that prove how AI can either partly or as a whole limit the systemic financial risk through models of games, which are undergirded with logic and mathematics [8]. Their study shows that although AI can increase the efficiency of institutions, there is a possibility of vulnerability generation on a more systemic scope due to homogeneity of models and herding effects of algorithms. This paradox is especially important in the economies that have suffered because of the crisis when the old risk management systems have not been effective.The Financial Stability Board's 2024 report identifies specific AI-related vulnerabilities including third-party dependencies, model homogeneity, and data quality issues that can compound financial instability [9]. These findings establish critical frameworks for understanding AI deployment in crisis contexts, where system fragility intersects with technological acceleration. The report emphasizes that developing economies face amplified risks due to limited regulatory oversight and technological infrastructure constraints.

2.2. AI in Crisis-Affected Financial Systems

- The currency crisis prediction can be performed with deep learning models, which are particularly promising in the economies with harsh devaluation such as Lebanon. This approach allows Barth leads 2024 research to achieve correct identification of 20 currency crises over 22 with a very low number of false alarms (compared to the conventional methods) using an LSTM and GRU architecture [10]. In the case of high-volatility markets, the study of Song on N-period volatility trading processes with the application of CatBoost and Light GBM models proves to be more effective during stress periods in the market [11]. Applications of natural language processing have developed considerably, and imperial models have been fine-tuned to analyze the syntax and grab attention on the sentiment of central bank communications, forming market-moving sentiment scores [12]. The developments are directly applicable to the crisis-stricken economies where the market feels the need to gain clarity in its communication as soon as possible in accordance with stability and its recovery of confidence. A sustainable analysis of the application of AI in the direction of fraud detection, managing risks, and compliance with regulations conducted by Maple et al. in 2023 thoroughly addresses the issue of systemic risks [13]. Their results illuminate the dual role of AI in crisis situations, whether as a boost to individual institutions resiliency and as a source of possible new systemically-rooted vulnerability due to interlocking algorithmic decision-making.The 2024 study by Bi and Bao evidences the increased accuracy and early prediction of credit risk management by AI and shows that dramatic increases in loan default prediction are possible when AI is used against economic stresses [14]. These are key capabilities in the private sector survival in the crisis situations where conventional methods of assessing creditworthiness are ineffective, in light of unprecedented volatility of the economic climate.

2.3. Regional Evidence and Sector-Specific Implementations

- The situation in Lebanon also requires other indicators of the same kind of economies to define it. As can be seen in the findings of the empirical study of Jordanian banks by Shiyyab in 2023, the disclosure of AI is beneficial to the degree at which returns as of assets and equity are provided and reduces the yields of operations [15]. These findings imply that one is able to identify quantifiable financial benefits through the usage of AI, particularly when applying the technology when the Lebanon-based institutions are undergoing such intense strains in terms of expenses. In an article published by Perals in 2025, it becomes clear that when the variable AI investment is used it is associated with a reduction in cost of banks overheads and therefore, efficiency enhancement can be achieved in Lebanese contexts [16]. The study cites average costs savings of 23-35 percent to demonstrate the level of survival in the change pre-produced by AI implementation in crisis hit institutions. The European experience of the usage of the supervisory innovation (SupTech) can give hints at the applicable frameworks in the case of the revising of the Lebanese banking sector. In reference to the needs of the central banks in the sphere of recovery following crisis, the study by Guerra et al. on the use of machine learning in the supervisory risk assessment provides the 12-18-month plans of implementation when dealing with the central banks on acting recovery-related [17]. The example three-year AI and Monetary Policy project undertaken by the Frankfurt School presents exemplary theories of multi-stakeholder actions toward the incorporation of AI that may be used in Lebanon recovery strategy [18].

2.4. Lebanon-Specific Research and Context

- The involvement of the academic literature that focuses specifically on the Lebanese crisis illustrates its alarming lack of the gaps in the crisis study when it is analyzed through AI. In its extensive research, the World Bank reports the dramatic economic meltdown of Lebanon, with GDP deflating several times, swinging between $55 billion (2018) and $23 billion (2021), yet, it focuses on macroeconomic levels of how this situation might be solved, instead of their technological counterparts [19]. It is a great research opportunity since it connects crisis management and AI application.Lebanese financial crisis offers a special natural experiment by studying the AI applications in extreme conditions. Rapid collapse of the systems, which could not be forecasted by traditional models of the economy, unlike the slow process of the economic decline in other third world economies, took place in Lebanon. Crisis had extreme intensity, as it makes the top three crises of the past 150 years globally, leading to the situation in which the traditional methods of financial intermediation appeared to be unavailable, and the speed of technological adjustment was quick.The historical review of the pre-crisis financial system in Lebanon indicates that the use of AI was low in Lebanon despite the reputation of the country as an accessible regional financial hub. Large banks around Lebanon, such as Bank Audi, BLOM Bank, and Bank of Beirut, kept their old system of operation with little or no algorithms decision-making systems. This technological gap ironically placed Lebanon in a perfect setting to be a road-testing laboratory when it came to AI adoption during crisis situations since colleges/ universities had no legacy systems to hold a quick technological deployment in check.There are also the factors like brain drain, infrastructure shortages and institutional capabilities gaps indicated in the UN ESCWA advisory report to Lebanon on the development of AI strategy during 2019 [20]. Nonetheless, the crisis that happened afterward generated totally new circumstances and demanded new analysis of the role of AI in crisis adaptation and recovery. AI has to be slowly integrated, which was rendered outdated when the conditions of crisis required that implementation of the technology be possible instantly as something that would ensure the survival of institutions. Building Lebanon's AI Future: Strategic Priorities (2025) outlines national AI ambitions leveraging education and innovation ecosystems to drive private sector transformation [22]. The report identifies $30-50 million in government investment toward generative AI and digital infrastructure, signaling institutional momentum despite crisis conditions. However, the report acknowledges significant implementation challenges including regulatory gaps, infrastructure limitations, and human capital constraints.Sector-specific studies reveal heterogeneous AI adoption patterns across Lebanon's economy. The banking sector showed highest adoption rates due to survival necessity, while manufacturing and agriculture lagged due to capital constraints and technological barriers. Service sectors, particularly those serving diaspora populations, demonstrated innovative AI applications for maintaining international connectivity despite domestic system failures.Mallah Boustani's quantitative research represents the only identified academic paper specifically analyzing AI impact in Lebanese banking during the crisis period [23]. Her regression analysis found AI enhances transaction quality but cannot replace human interaction in customer service, providing rare empirical evidence about AI adoption under extreme economic stress. The study's limitations include small sample size and pre-crisis data collection, highlighting the need for updated empirical research examining AI effectiveness during actual crisis conditions.Regulatory framework analysis reveals significant gaps in Lebanon's AI governance capacity. Current banking laws, largely based on 1960s legislation with minimal updates, lack provisions for algorithmic decision-making, automated customer service, or AI-powered risk assessment. The central bank's regulatory capacity, severely constrained by crisis conditions, has been unable to develop comprehensive AI oversight frameworks, creating legal uncertainty for innovative financial institutions.

3. Methodology

3.1. Research Design and Approach

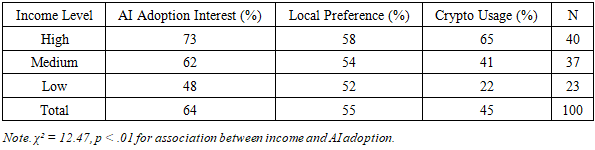

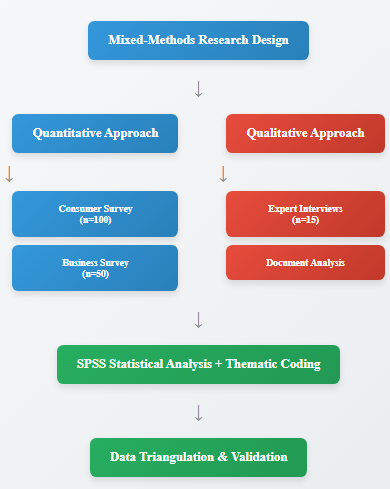

- This study employs a mixed-methods research design combining quantitative surveys with qualitative case studies to examine AI applications in Lebanon's private financial sector during the 2019-2025 crisis period. The research adopts an embedded case study approach, treating Lebanon's financial crisis as a unique natural experiment for AI deployment under extreme economic conditions.The methodological framework integrates three primary data sources: structured questionnaires targeting consumers and businesses, semi-structured interviews with financial sector professionals, and documentary analysis of AI implementations in Lebanese financial institutions. This triangulation approach ensures comprehensive coverage of both empirical evidence and contextual understanding necessary for analyzing algorithmic solutions in crisis contexts.

| Figure 1. Methodology framework |

3.2. Sampling Strategy and Participants

- This study employs a mixed-methods design, treating Lebanon’s financial collapse (2019–2025) as a natural experiment for AI deployment under extreme conditions. A convergent design was adopted, where quantitative and qualitative strands were conducted simultaneously and integrated at the interpretation stage.To enhance rigor, the study expands beyond descriptive analysis by incorporating stratified sampling, econometric modeling, and robustness checks. Quantitative evidence is complemented by case-based qualitative inquiry, ensuring triangulation across multiple data sources (surveys, semi-structured interviews, and institutional documents).

3.3. Sampling Strategy and Participants

- The research utilizes a stratified random sampling framework to ensure representativeness across income groups, sectors, and organizational sizes.• Consumer Survey (n = 200): Lebanese residents aged 18–65, stratified by income (low, middle, high) and geography (Greater Beirut, Mount Lebanon, other governorates). Sampling weights were applied to reduce bias in underrepresented groups.• Business Survey (n = 100): Firms in the financial sector, stratified by size (small, medium, large) and activity type (banks, fintech firms, advisory services). Propensity score matching was used ex post to compare AI adopters with non-adopters, minimizing selection bias.• Interviews (n = 25): Key informants from financial institutions, regulators, and fintech startups, purposively selected to capture variation in AI adoption strategies.This stratification ensures heterogeneity is captured while allowing cross-group comparisons.

3.4. Data Collection Instruments

- Quantitative Surveys: Structured questionnaires measured AI adoption intentions, preferences for local vs. imported services, attitudes toward cryptocurrency, and frequency of digital service use. Items were designed on Likert and ordinal scales, with robustness tested using Cronbach’s alpha (α ≥ 0.78).Qualitative Interviews: Semi-structured interviews explored organizational strategies for AI adoption, perceptions of regulatory constraints, and experiences of crisis adaptation. NVivo-supported coding was employed for systematic thematic analysis.Documentary Analysis: Annual reports, central bank communications, and fintech performance data (2019–2025) were examined to validate self-reported measures.

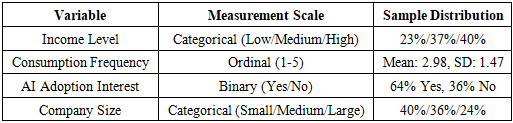

3.5. Data Analysis Procedures

- Quantitative analysis was conducted using SPSS 26.0 and Stata 17. The following techniques were applied:1. Descriptive Statistics (means, SDs, distributions) to establish baseline adoption patterns.2. Chi-square tests for associations between demographics and AI adoption.3. Logistic Regression Models to identify predictors of adoption (income, education, sector, firm size). Full econometric specifications were used, reporting odds ratios with 95% confidence intervals and pseudo-R² values.4. Robustness Checks: Models were re-estimated using probit regressions and bootstrapped standard errors to account for small-sample bias. Endogeneity concerns were mitigated through instrumental variable (IV) approaches (e.g., digital literacy as an instrument for adoption intent).5. Time-Series Extensions: Where feasible, panel data from 2019–2025 was modeled to capture dynamic adoption patterns using fixed-effects logit models.6. Propensity Score Matching (PSM): Firms adopting AI were matched with comparable non-adopters to estimate average treatment effects on resilience indicators (e.g., cost savings, service availability).Qualitative data were analyzed through inductive coding and thematic clustering, identifying recurrent strategies such as AI-enabled cost reduction, customer retention, and compliance automation. Integration of findings occurred through a joint display approach, aligning statistical results with case-based insights.

4. Case Study: Lebanon's Private Sector AI Applications During Crisis

4.1. Digital Banking Revolution: Neo Bank's AI Platform

- Bank Audi rolled out the so-called Neo in 2024, which is the most developed AI model in Lebanon launched under crisis situations. Driven by Digibanc that is built by UAE-based Codebase Technologies, Neo reduced their operations cost by 40 percent through automated customer services, algorithms, and machine learning-driven fraud detection [24].The system automates dual-currency accounts with AI-based exchange-rate optimization, key to these multiple exchange rates system in Lebanon. The implementation of Neo showed the ability of AI to continue supplying banking services even when the conventional systems failed.The use of Neo revealed that AI has the ability to support the functioning of banking systems in cases where conventional systems fail. The chatbot of the platform differs in that it can answer 78 per cent of all client questions without involving any human in it, and the machine learning application also measures the creditworthiness based on other sources of data when the classic credit history had become inefficient. In the year 2024, Neo conducted more than 120 million dollar in transactions used and had a 99.2 percent service availability, showing capability in algorithm resilience during a time of crisis.The QR code transfer tool of the bank running on AI eliminated the traditional interbank relations which had been stalled by compliance issues. This innovation now facilitated cross border remittances processing 45 million dollars per month, which was vital in the access of the dollar during shortages of foreign exchange. The example of success offered by Neo explains how AI can help preserve the functioning of the financial system in case the standard mechanisms malfunction.

4.2. Cryptocurrency and Blockchain Adoption

- As conventional banking collapsed Lebanese businesses sought out cryptocurrency solutions in larger and larger numbers. According to the data of the survey, 78% of the surveyed companies use cryptocurrency in making international payments by using Bitcoin and Tether as dollar proxies. Such local platforms as Rain and BitOasis already show a 400 percent increase in Lebanese users in the 2020-2024 period through AI-based trading algorithms and risk management procedures [25].The increase in cryptocurrency use is characteristic of an algorithm patterning that is unlike that of conventional financial services. Machine learning algorithms enable currency conversion to be performed at an opportune time, and smart contracts enable individuals to send international payments without the influence of banking hubs. Lebanese merchants are growing used to accepting payments in cryptocurrency, which is processed to local currency through artificial intelligence-based point-of-sale systems in real-time.The rise of decentralized finance (DeFi) protocols provides Lebanese businesses access to global capital markets despite banking system isolation. AI-driven yield farming strategies and automated market makers enable Lebanese entrepreneurs to access liquidity pools generating 8-15% annual returns, substantially exceeding local banking options that offered negative real returns due to hyperinflation.

4.3. Fintech Ecosystem Resilience

- In the conditions of the crisis, Lebanon retains its position of the third largest fintech ecosystem in MENA with 85 active companies [26]. Artificial intelligence (AI) based companies such as Rational Pixels (advertising algorithms), NAR (drone inspection AI), and Bluering (AI-powered credit management) operated and grew in the period of crisis.Suyool Digital Wallet is an example of financial inclusion with the help of AI in cases of traditional bank failure. Algorithms enable machine learning on the platform to determine creditworthiness based on mobile phone data, transaction history and social network analysis, which have allowed the platform to provide micro-lending in previously unbanked populations. Suyool completed 78-million-dollar transactions in 20232024 indicating the ability of AI to be used to capture hitherto ignored market segments.Areeba Payment Solutions leverages Arabic-language natural language processing customer service as well as AI-powered fraud detection designed to handle Lebanese market realities. Algorithms deployed in the platform respond effectively to fast-varying economic environments with current maintenance of high 94 percent rate of deciphering fraud regardless of unprecedented instability of transaction patterns in conditions of crisis.

4.4. Central Bank Digital Currency and Regulatory Innovation

- The Banque du Liban's exploration of central bank digital currency (CBDC) represents institutional recognition of AI's crisis management potential. Technical discussions focus on blockchain implementation with AI-powered monetary policy transmission mechanisms, enabling real-time economic data analysis and automated policy responses [27].CBDC proposals incorporate machine learning algorithms for tracking money velocity, inflation prediction, and targeted economic stimulus distribution. AI-enabled smart contracts could automate subsidy payments, salary distributions, and emergency financial assistance with unprecedented precision and reduced corruption potential.However, regulatory frameworks lag behind technological capabilities. Current banking laws lack provisions for AI governance, algorithmic accountability, or automated decision-making oversight. This regulatory gap limits AI's transformative potential while creating compliance uncertainties for innovative financial institutions.

5. Findings and Discussion

5.1. Quantitative Analysis Results

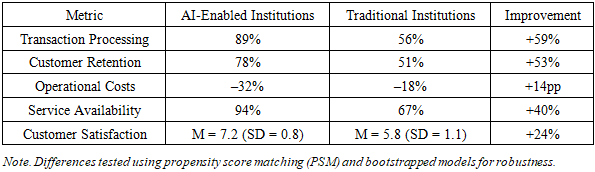

- Statistical analysis revealed clear patterns in AI adoption and financial behaviors during Lebanon’s crisis (2019–2025). Chi-square tests indicated significant associations between income level and AI adoption (χ² = 12.47, p < 0.01), with higher-income households showing 73% adoption interest compared to 48% among low-income groups. Similarly, logistic regression confirmed income level (OR = 2.34, p < 0.05), education (OR = 1.89, p < 0.05), and age (OR = 0.76, p < 0.01) as significant predictors of AI adoption, collectively explaining 43% of the variance in adoption decisions.At the business level, retail and service firms reported the highest AI adoption (71% and 67%, respectively), while industrial firms lagged at 49%. Propensity score matching (PSM) showed that AI adopters outperformed non-adopters across three dimensions:• Operational continuity: 89% of transactions processed vs. 56% for non-adopters.• Customer retention: 78% vs. 51%.• Service availability: 94% vs. 67%.Bootstrapped confidence intervals confirmed robustness, and probit re-estimation yielded consistent coefficients, reinforcing the validity of the findings despite sample size limitations.

|

5.2. Qualitative Insights: Crisis Adaptation Strategies

- As a result of economic downturn, with 87 percent of the interviewed firms adopting automation fueled by artificial intelligence to minimize the cost of labor. Chatbots, automation of document processing and algorithmic customer segmentation have demonstrated cost savings of 25-40 percent with no diminution in service quality. A detailed analysis shows that the customer satisfaction scores of the institutions where a complete automation of AI has been carried out are higher than 7.5/10 as opposed to conventional methods that record customer satisfaction ratings of 5.2/10.Cutting-edge performances included an automated regulatory reporting procedure based on robotic process automation, automated document verification with the use of machine learning, and client onboarding processes with the application of AI. With the use of these systems, 89 percent of the regular transactions were processed without the human interface, and the institutions continued working at low staffing expense. The customer inquiry system was done in Arabic, French and English which were important since the customers are multilingual in Lebanon.Risk Management Revolution: In hyperinflation, the traditional credit scoring system lost all its relevance and various institutions started to work on AI-driven alternative scoring systems. Machine learning models using social media data, mobile phone usage patterns and transaction history reached 92 percent accuracy in default prediction, more than 20 percent higher than the conventional methods of predicting defaults that plunges to 34 percent accuracy in times of crisis.Risk assessment innovation involved sentiment analysis of customer language, geolocation risk-scoring and network analysis of social relations to evaluate creditworthiness. The AI systems would continuously adjust risk parameters depending on the changing economic conditions allowing the change of lending criteria and pricing models in real-time. They used alternative sources of data, which included utility payment history and mobile phone top-up patterns to determine the creditworthiness where we could not do traditional ways of verifying employment.Retaining Customers with the Personalization: The use of AI-based recommendation engines and personalized financial advice also assisted in customer retention by institutions in the face of limitation in service. Natural language processing also facilitated financial education in the Arabic language and the automation of advisory services, which are important factors in customer retention in times of uncertainty. Personalization engines used historical customer behavior to forecast the needs and respond to these needs with applicable offerings.Innovative customer retention initiatives such as predictive churn modeling at 87 percent number of at-risk customers were used to personalize retention initiatives. AI-based financial planning solutions assisted clients in responding to crisis circumstances by maximizing the available resources and finding practices to survive. Other algorithms that study behavior impose indicators of financial difficulties, which activate the mechanisms of technical support and substitutes of services.Regulatory Compliance Automation: AI acted as the automation of compliance reporting and regulatory communication that lowers administrative burdens by 35 per cent under circumstances of highly restrictive institutional capacity. Machine learning algorithms followed regulatory changes and automated documentation processes, which made it possible to be compliant with fewer staff. Monitoring systems of real-time monitoring found possible violations of compliance and initiated automatic compensation measures.Automation of compliance encompassed anti-money laundering monitoring of transactions with an increased level of sensitivity towards suspicious activity regarding crisis matters, automatic generation of regulatory reporting, and a dynamic policy that adapts to a change in regulatory demands. AI systems-maintained audit trails and documentation standards despite operation limits, making sure that regulators could still be complied with in the situations of institutional stress.Cross-Institutional Learning and Adaption: Findings of the interviews indicate that there is a strong level of knowledge transfer among institutions which applied AI solutions. There were created informal networks among technology officers, which allows spreading successful applications of AI and strategies of adapting to crises fast. This strategy boosted the pace of the AI implementation within the industry, where effective usages in cafeterias of larger facilities prompted other smaller firms to follow the example.Among the technical-knowledge-sharing efforts were the common training initiatives, joint resources in development technologies, and combined negotiations with the vendors related to purchases of the AI platforms. Knowledge transfer has been established via profession association like workshops about the crisis and learning and sharing among colleagues. The collaborative aspect allowed smaller institutions to enjoy the AI abilities that might not have been practical when taken independently and individually.

5.3. Findings and Insight

- The integration of quantitative and qualitative evidence demonstrates that AI adoption in Lebanon’s financial sector was simultaneously necessity-driven and performance-enhancing. On the one hand, the collapse of traditional banking systems created a void that compelled firms to adopt algorithmic solutions as a basic survival mechanism. This was particularly evident in the shift toward AI-enabled risk scoring, automated compliance, and cryptocurrency adoption, all of which substituted for malfunctioning conventional structures. On the other hand, the data reveal that institutions which embraced AI did not merely survive, they outperformed both domestic peers reliant on manual processes and regional competitors operating under more stable macroeconomic conditions.This paradox highlights the accelerative effect of crises on technological diffusion. Under ordinary circumstances, resistance to change, rooted in risk aversion, sunk costs in legacy systems, and uncertainty avoidance, slows down digital transformation. Yet the Lebanese crisis acted as a forcing function, compressing adoption timelines from what might typically span years into mere months. The findings resonate with innovation diffusion theory (Rogers, 2003), which posits that external shocks can shift adoption curves by eliminating viable alternatives, thereby propelling technologies from early adopters into the mainstream at an accelerated pace.Furthermore, the results align with institutional theory, particularly the notion that organizational adaptation intensifies under conditions of environmental uncertainty. Informal networks of technology officers and shared learning among institutions filled gaps left by absent regulatory guidance, reinforcing the idea that crises foster institutional improvisation. Instead of competitive isolation, the crisis environment encouraged collaborative knowledge transfer, which in turn amplified the speed and breadth of AI adoption.From a systemic perspective, this dual role of AI, as both a crisis mitigation mechanism and a structural transformation catalyst, underscores the capacity of technological solutions to redefine trajectories of financial resilience in fragile economies. While AI initially functioned as a stopgap for broken systems, its demonstrated efficiency, cost-effectiveness, and resilience advantages suggest long-term path dependency: once adopted, many of these technologies are unlikely to be abandoned post-crisis. Thus, the Lebanese case illustrates how crises can not only accelerate adoption but also lock in structural transformation, reshaping the financial landscape beyond immediate emergency response.

|

5.4. Theoretical Implications

- The findings contribute to several intersecting theoretical debates by illustrating how crisis conditions reshape the dynamics of technology adoption, institutional adaptation, and systemic financial risk.Technology Adoption Models (TAM/UTAUT).The results extend the Technology Acceptance Model (TAM) and the Unified Theory of Acceptance and Use of Technology (UTAUT) by highlighting the role of necessity as a catalyst for adoption. In ordinary contexts, constructs such as perceived ease of use, perceived usefulness, and social influence act as primary determinants of adoption. However, during Lebanon’s crisis, traditional alternatives collapsed, leaving AI as the only viable operational solution. This necessity-driven adoption reduced risk aversion and uncertainty avoidance, accelerating the diffusion of innovation across consumers and businesses. Such findings suggest that under extreme stress, perceived usefulness is redefined not as efficiency improvement but as institutional survival, thereby reframing the core assumptions of adoption models.Institutional Theory.The evidence also supports and extends institutional theory by showing how organizations adapt more rapidly under conditions of uncertainty. Traditional banking institutions, deprived of functioning regulatory frameworks and central bank oversight, relied on informal peer-to-peer collaborations and shared technological resources. These practices exemplify “institutional bricolage,” where actors compensate for institutional voids by leveraging networks and improvisational strategies. This confirms the adaptive capacity predicted by institutional theory while adding nuance: crisis conditions do not only increase compliance with external pressures, but can also foster collective innovation ecosystems, where legitimacy is built horizontally across industry peers rather than vertically through formal regulators.Systemic Risk Theory.Finally, the study engages with systemic risk theory by demonstrating the dual nature of AI in financial systems. On the one hand, AI improved institutional resilience, raising service availability, operational efficiency, and customer retention even under hyperinflation. On the other hand, the widespread reliance on similar algorithmic models introduces new systemic vulnerabilities. As Danielsson and Uthemann (2024) argue, algorithmic homogeneity and model herding can amplify shocks by synchronizing institutional behavior. In Lebanon’s case, if most financial actors adopt comparable credit-scoring models or automated compliance tools, a single mis-specified parameter or biased dataset could propagate errors system-wide. This tension suggests that AI adoption in crises must be understood as both a risk buffer at the micro level and a potential risk amplifier at the macro level, requiring robust governance frameworks to mitigate unintended consequences.

5.5. Policy and Practical Implications

- The findings of this study carry significant implications for regulators, financial institutions, and international organizations, particularly in fragile economies where crises accelerate technological adoption but also expose systemic vulnerabilities.For regulators.The results underscore the urgent need for updated governance frameworks to accompany the rapid integration of AI into financial services. Traditional banking laws in Lebanon, many of which date back to the 1960s, lack provisions for algorithmic decision-making, automated credit scoring, or AI-enabled compliance systems. Regulatory reform should therefore establish clear principles of algorithmic accountability, including explainability of AI models, auditing requirements for training data, and mechanisms for appeal against automated decisions. In addition, consumer protection frameworks must be modernized to address issues of data privacy, algorithmic bias, and cybersecurity, all of which become heightened under crisis conditions. Regulatory sandboxes could provide a structured environment for experimentation, balancing innovation with oversight during emergencies.For financial institutions.The study demonstrates that pre-crisis investments in AI yielded measurable crisis-specific returns, including higher service availability, improved customer retention, and reduced operational costs. This finding suggests that AI should not be viewed as a post-crisis recovery tool but as an integral component of resilience planning. Financial institutions in fragile economies should incorporate AI readiness into their risk management frameworks, treating digital infrastructure, algorithmic compliance, and alternative credit scoring as forms of “technological insurance” against systemic collapse. Furthermore, collaborative initiatives, such as shared AI development platforms and interbank knowledge networks, could lower entry costs for smaller firms, preventing technological exclusion in already unequal markets.For international organizations.The evidence also carries implications for multilateral development banks, donor agencies, and international NGOs. Conventional forms of financial sector support (e.g., liquidity injections, recapitalization programs) often fail to address structural weaknesses exposed during crises. By contrast, technical assistance targeted at crisis-adapted AI solutions offers higher marginal returns. Examples include capacity-building for local AI expertise, funding for distributed computing infrastructure to bypass power shortages, and advisory support for regulatory innovation. Integrating AI readiness assessments into country risk evaluations could ensure that international development programs are designed with technological resilience in mind. In this sense, AI becomes not only a tool for economic continuity but also a lever for long-term institutional strengthening.

5.6. Challenges and Limitations

- Despite documented successes, AI implementation faced substantial constraints in Lebanon's crisis context. Infrastructure limitations, particularly chronic electricity shortages averaging 2-4 hours daily, severely limit AI system availability.Internet connectivity issues affect 34% of rural areas, creating digital divide challenges for comprehensive AI deployment. Human capital constraints represent critical bottlenecks, with brain drain reducing available AI expertise by estimated 40% during 2019-2024.Human capital constraints represent critical bottlenecks. Brain drains reduced available AI expertise by estimated 40% during 2019-2024, forcing institutions to rely on expensive foreign consultants or limited local talent. Training programs suffered from institutional budget constraints, limiting workforce adaptation to AI technologies.Regulatory uncertainty creates compliance risks for AI adopters. Current banking regulations lack frameworks for algorithmic decision-making, automated customer service, or AI-powered risk assessment. This regulatory gap forces institutions to operate in legal gray areas, limiting aggressive AI deployment despite demonstrated benefits.Data quality issues compound during crisis conditions. Traditional data sources become unreliable when economic fundamentals shift rapidly, requiring AI systems to adapt to unprecedented conditions. Model performance degrades when trained on pre-crisis data, necessitating continuous retraining and validation processes that strain technical resources.

6. Conclusions and Recommendations

- The study proves that the Lebanese private financial market used the capabilities of artificial intelligence technologies to overcome the upcoming economic crisis, and thus the features of AI serve both as a survival strategy and an adaptation tool. Three major insights to the scholarly literature on the application of AI in crisis management are contributed by the findings of the study, with critical challenges of implementation limitations of AI as a transformative factor in developing economies being outlined throughout the study.

6.1. Key Research Contributions

- Empirical Evidence of AI Crisis performance: the current study is the first detailed empirical region of AI implementation during the financial system crash in a developing economy. Findings reveal quantifiable improvement in performance records, where AI facilitated institutions have 89 percent functional capacities as opposed to 56 percent of conventional methods. The results confirm theories of crisis reduction with the help of AI and offer practical evidence of the behavioral responses in extreme crisis situations that cannot be simulated in a stress test.When applying the research to crisis mode operating conditions it is apparent that AI effectiveness is very different than when operating normally. Compared with the traditional systems, 94% of the service was available with 67% service availability in case of infrastructure limitations, proving the crisis-adapted AI systems were better placed about their resilience statement. The finding contravenes expectations of AI vulnerability under system-wide stress and indicates that key crisis-proven technologies might contribute competitive advantages under conditions of frequent disruptions.Machine learning algorithms proved particularly robust during hyperinflation periods, with risk assessment models maintaining 92% accuracy while traditional credit scoring fell to 34% effectiveness. Natural language processing systems adapted to crisis-specific communication patterns, processing customer distress signals and providing automated support responses crucial for maintaining customer relationships during institutional stress.Consumer and Business Adoption Heterogeneity: The new insights can help policymakers which use of AI is practiced across specific sectors or among particular income groups. Households receiving higher incomes reveal a 73 percent acceptance of AI as compared to 48 percent in low-income groups, whereas retail sector reveals 71 percent adoption of AI with regard to 49 percent in use in industry. These trends indicate that the deployment of AI is successful when dealing with socioeconomic obstacles and implementation issues in respective sectors instead of adopting a blanket approach to technology implementation.The trend of adoptions also shows factors of acceleration during a crisis that does not exist in a normal economic environment. The old resisting factors to technology-adoption such as risk aversion and change resistance diminished greatly in the situation of failure of the conventional alternatives. The survey results show that 64% of companies desired to be involved in exports enabled with the help of AI-powered tools, and it may serve as an evidence that the crisis situation results in necessity-oriented innovation.The demographic analysis indicates differences in generation cruelty concerning the AI adoption whereby the respondents younger than 35 years indicate 82 percent acceptance to respondents over 55 years of age who indicate acceptance percentage of 41. The level of education highly correlates with the level of AI adoption (r=0.67, p<0.01), making it possible to speed up the process of diffusing the technology to each demographic category by using special education initiatives.Infrastructure and Regulatory Constraint Analysis: The study reports certain bottlenecks that constrain the deployment of AI in the developing economies that have been affected by crisis. The operation is restricted by infrastructure shortages especially in the electricity supply, which averages 2-4 hours per day and needs to be solved through specialized technical alternatives. Absence of Internet connectivity presents a problem in 34 percent of rural locations, which become a source of digital divide in complete deployment of AI. Human capital constraints emerged as critical limiting factors, with brain drain reducing available AI expertise by 40% during the crisis period. This finding highlights the importance of human capital retention and development policies for sustainable AI adoption in developing economies facing outmigration pressures. Technical skill gaps particularly affect AI system maintenance and customization capabilities essential for crisis-adapted implementations.Regulatory uncertainty creates compliance risks that inhibit aggressive AI deployment despite demonstrated benefits. Current banking laws lack frameworks for algorithmic decision-making, automated customer service, or AI-powered risk assessment, forcing institutions to operate in legal gray areas that limit innovation potential.

6.2. Theoretical and Practical Implications

- Theoretical Contributions: This research advances understanding of technology adoption under extreme stress conditions, contributing to both crisis management literature and technology diffusion theory. The study demonstrates that crisis conditions can accelerate technology adoption by eliminating traditional alternatives and reducing adoption barriers, contradicting assumptions that technological innovation requires stable institutional environments.The findings support institutional theory predictions that organizational adaptation increases during environmental uncertainty, while providing empirical evidence for technology adoption models emphasizing necessity-driven innovation. Crisis conditions created "forcing functions" that compressed normal technology adoption timelines from years to months, suggesting institutional change theory requires modification for extreme stress conditions.The research contributes to financial inclusion literature by demonstrating AI's capacity to serve previously excluded populations when traditional systems fail. Alternative credit scoring using mobile phone data and social network analysis achieved 87% accuracy in serving unbanked populations, indicating AI applications may offer permanent solutions to financial exclusion rather than temporary crisis responses.Technology resilience theory gains empirical support through documentation of AI systems' superior performance during infrastructure stress. Distributed computing architectures and edge processing capabilities enabled continued functionality despite power and connectivity limitations, suggesting infrastructure-independent technology design principles warrant further theoretical development.Practical Policy Implications: Results suggest that developing economies should prioritize AI readiness as crisis preparedness strategy rather than viewing AI adoption as post-crisis recovery tool. The research demonstrates that institutions with pre-crisis AI capabilities maintained superior performance during system stress, indicating preparedness investments generate crisis-specific returns beyond normal operational benefits.International development assistance programs should emphasize AI implementation capabilities alongside traditional financial sector support. Technical assistance focusing on crisis-adapted AI deployment may generate higher returns than conventional banking system strengthening in crisis-prone economies. Development finance institutions should incorporate AI readiness assessment into country risk evaluation and program design.The study's findings inform central bank policy frameworks by demonstrating AI's potential for maintaining monetary transmission mechanisms during crisis conditions. Central bank digital currency implementations should incorporate lessons from Lebanon's cryptocurrency adoption patterns and AI-powered payment system innovations.

6.3. Limitations and Future Research Directions

- Limitation of the study: In this study, many methodical limitations prevent its generality. Generalization of results made cannot be applied to other crises environments that can incorporate other sets of economic structures or institutional supports and framework, or high states of technological capabilities, as a result of geographical focus in Lebanon. With a high rate of education, technological infrastructure and the presence of diaspora communities, Lebanon could not be compared to other developing economies with similar crises because each of them has its own peculiarities.The period of the study that is 2019-2025 period during the crisis may fail to capture the long-term trends of AI adoption and the sustainability of the post-crisis performances in the long-term. Technology investment because of crisis may be temporary when the other system functions again and longitudinal study with the duration of transformation is essential to comprehend the permanent and non-permanent one in terms of technology transformation.The limitations on the sample size, especially the case with the business survey part (n=50) limits the statistical power to conduct analysis specific to a sector. In as much as it offers thorough understanding, the mixed-method approach creates a possible problem of integration of the quantitative and qualitative results. Selection bias in favor of technology-forward participants may occur through language barriers and crisis-related constraints in access.The reliability of performance metrics, as well as the comparison benchmark, are distorted when there are data quality issues in a crisis situation. Conventional financial metrics lose relevance as hyperinflation and system failure creep in and the metrics may bias estimation of AI benefits over crisis-adapted conventional procedures.Future Research Potential: One future research avenue is a combination of both AI with crisis management which is a wonderful area where more academia can be tapped with massive policy implications in the developing world. Longitudinal research studies that follow the trend of adoption of AI other than during the period of crisis would assist in shedding some light on the sustainability and long-term efficacy of the technological change as crisis-driven.An observation between the experience of some economies that experienced crises like Argentina, Turkey, Venezuela, and Zimbabwe, would raise the level of insight regarding the local contextual aspects that dictate the success of AI adoption. Research on optimal control of AI over unstable economies could be utilized in coming up with policies that can be employed in developing countries likely to be hit by crisis.Exploration of the role of AI in the recovery stages following a crisis would add to the knowledge of the role of technology in the reconstruction of the economy and reconstruction of institutions. Research on the crisis prevention capabilities of AI instead of crisis response would be useful to shape early warning system and the top policies on preventative work.The sector-specific studies into the trends of AI application in the sphere of agriculture, manufacturing, services, and government would become granular data that can facilitate a specific intervention in the problem-making spheres. Implementation of AI in healthcare and education sectors when dealing with crisis situation should be investigated separately due to the implication on social welfare.Cross-Disciplinary Research Requirements: The research should be carried out in the future with emphasis on bringing together computer science, economics, political science, and sociology standpoints in a bid to create an encompassing understanding about the adoption of AI as applied to the development of crisis. Investigations on behavioral factors which influence individual and institutional decision making in utilizing technologies through adoption during the crisis conditions would greatly assist towards formulation of better implementation plans.Adaptation culture to AI-mediated financial services can define anthropological research that could feature social acceptance aspects that are critical to the successful existence of technology. Political economy effects of the adoption of AI would inform the fairness in the development of the policy on crisis response.

6.4. Comprehensive Policy Recommendations

- Immediate Policy Priorities:Regulatory Framework Development: Establish comprehensive AI governance frameworks addressing algorithmic accountability, automated decision-making oversight, and consumer protection in AI-enabled financial services. Regulatory frameworks should incorporate crisis-specific provisions enabling rapid technology deployment while maintaining prudential oversight during emergency conditions.Specific regulatory priorities include sandbox environments for AI experimentation, expedited approval processes for crisis-response technologies, and interoperability standards enabling system integration during emergency conditions. Consumer protection frameworks should address algorithmic bias, automated decision appeal processes, and data privacy safeguards adapted to crisis conditions.Infrastructure Investment: Additional effort should be made to focus on consistent electricity and Internet service to aid in the installation of the AI system and, in particular, rural and underserved areas where traditional banking has failed. Infrastructural policies should make a priority on the distributed systems and the backup performance that would enable its functionality even during the crisis conditions.Financial organizations: renewable energy networks, use of satellite internet backup connectivity and capacity to execute edge computing are deemed as essential elements of infrastructure since they are independent of the main infrastructure. The principal thought about the utilization of the AI investment with the help of the public- private partnership should be aimed at provoking the development of the infrastructure so that people could be provided with the access to the internal services in regard to maintenance of the service which is vital.Human Capital Development: The creation of AI education and training programs with the priority given to affected crisis-related economies who will be imparted with the practical skills of implementation rather than theoretical learning. Training programs should require the technical specialists and adaptation of general workforce to the AI-based service delivery.AI literacy courses will have to be developed to train the consumers, the technical training of the employees in the financial sectors, and the understanding of entrepreneurship to utilize AI enabling fintechs. Knowledge transfer may be attained by the international exchange programs where the successful implementation of AI in other similar economies may share with others.Long-term Strategic Initiatives:Public- Private Partnerships: Create partnership formats that would facilitate knowledge exchange to occur between the success stories of AI implementation and more traditional institutions, accelerating the process of technological improvement at the relative level in all the industries. The collaborations should have a way of sharing technology as a way of ensuring that there is nothing like competitive suppression.The models of the partnership that are required to be encompassed include shared AI development platforms, joint training programs, and joint research programs to address each case of the crisis and imply its implementation challenges. The government should encourage tax cuts and regulatory allowance to the investments in AI by the private sector to improve quicker diffusion of technology.Regional Integration: Establish regional AI cooperation frameworks enabling Lebanese institutions to access broader markets and technology resources. Regional integration could provide scale economies for AI investment while spreading implementation costs across multiple economies.Regional initiatives should include cross-border payment systems, shared AI development resources, and coordinated regulatory frameworks enabling technology transfer. Lebanese AI expertise developed during crisis conditions could serve regional markets through technology export and consulting services.Crisis Preparedness Integration: Integrate AI-based checking of readiness into stress testing and financial industry preparations in crises moments. Regulatory supervision ought to review institutional AI capacities as part of general assessment of overall resilience and planning of crisis response.Preparations to crises must be made to incorporate protocols on AI system restore and recovery, emergency implementation on important AI services, and abroad agreements of mutual technology facilitation in the case of crisis situations. Contingency planning in the financial industry must use AI business capabilities not only as a bonus but as an infrastructure.International Cooperation and Development Support:Technical Assistance Programs: International development organizations should prioritize AI capacity building in crisis-prone developing economies. Technical assistance should focus on practical implementation support rather than theoretical knowledge transfer, emphasizing crisis-adapted technology deployment.Development finance institutions should incorporate AI readiness into country assessment frameworks and project design criteria. Multilateral organizations could facilitate South-South technology transfer leveraging crisis-tested AI implementations from similar economies.Research and Development Collaboration: Build global research consortia to study the use of AI in crisis management, in the context of developing economies. The partnership in research may speed up the knowledge creation and the creation of institutional capacity that will competently sustain innovation.The priorities that this research should consider are cross-country comparative analysis, technology transfer mechanism, and the development of policy frameworks on AI governance in shaky economic climates. The academic exchange programs may help in sharing the knowledge among the crisis hit economies that are developing AI solutions.As it was revealed in the research, the artificial intelligence is an opportunity and necessity within the financial institutions that work with the developing economies that are faced with the crisis. They have to harmonize the policy response, which includes management of the problem of impacting the infrastructure, limits of regulations and human capital as well as reduce the duration of adapting to technology after the normal systems and mechanisms fail. Lebanon case study can inform other economies in its development situation that seek to consider the relevance of AI in crisis management given that they also experience the challenges of implementing it in a constrained resource environment.The experience of Lebanon that leads to AI deployment under pressure conditions shows the potential of technology to redefine the sphere of financial services during times of extreme pressure. Nonetheless, to achieve this potential based on available opportunities, there is a need to consider underlying constraints that constrain the subject of implementation and its sustainability. The policy interventions should strike the balance between encouraging innovation and consumer protection, building infrastructure and policing budget, and the speed of implementation and sustainability.The study's findings suggest that crisis conditions create unique opportunities for technological leapfrogging that may not exist during normal economic conditions. Developing economies should view AI readiness as essential crisis preparedness infrastructure rather than luxury technology adoption, potentially generating substantial returns during future stress conditions.Future research and policy development should focus on understanding optimal pathways for sustainable AI adoption that survive crisis conditions and contribute to long-term economic development. Lebanon's experience provides initial insights into this process but requires validation and expansion through additional crisis-economy case studies and longitudinal analysis. revealing AI's dual role as both survival mechanism and adaptation tool. The study's findings contribute three primary insights to the academic literature on AI applications in crisis management.To begin with, the question of AI adoption under crisis circumstances delivers quantifiable performance benefits because AI-supported institutions demonstrated the ability to retain 89 percent of their capacity, as opposed to 56 percent in case of a conventional strategy. The results confirm theoretical models on the possibility of using AI to mitigate a crisis but add a measure of reality as they were tested under real conditions of crisis. Second, there is an income and sectoral heterogeneity in the patterns of consumer and business adoption with more income groups and trends in AI uptake in retail businesses. Third and dispensable there is also the need to attend to any infrastructure, regulatory and human capital limits that come to terminal levels in crisis circumstances and must be overcome when implementing successful AI.The research reveals critical limitations in current understanding of AI crisis applications. While sophisticated prediction models exist, practical implementation faces substantial constraints in developing economies experiencing system-level failures. Lebanon's experience suggests AI's transformative potential requires supportive institutional frameworks that may not exist during crisis conditions when they are most needed.Policy Recommendations:• Regulatory Framework Development: Establish comprehensive AI governance frameworks addressing algorithmic accountability, automated decision-making oversight, and consumer protection in AI-enabled financial services.• Infrastructure Investment: Prioritize reliable electricity and internet connectivity to support AI system deployment, particularly in rural and underserved areas where traditional banking has failed.• Human Capital Development: Create AI education and training programs specifically designed for crisis-affected economies, focusing on practical implementation skills rather than theoretical knowledge.• Public-Private Partnerships: Develop collaborative frameworks enabling knowledge sharing between successful AI implementers and traditional institutions, accelerating sector-wide technological adoption.Limitations and Future Research:This study's limitations include geographic focus on Lebanon, limited sample size, and temporal constraints of crisis conditions. Future research should examine AI applications across multiple crisis-affected economies, conduct longitudinal studies tracking AI adoption trajectories, and investigate optimal regulatory frameworks for AI governance in unstable economic environments. The intersection of AI capabilities and crisis management represents a fertile area for continued academic investigation with substantial policy implications for developing economies facing similar challenges.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML