-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2024; 14(2): 39-54

doi:10.5923/j.economics.20241402.01

Received: Jun. 2, 2024; Accepted: Jun. 17, 2024; Published: Jun. 20, 2024

Exploring Practicable Commercial Strategies for Viability of Micro Cultural and Creative Industries

Aleck C. H. Lin

Department of Arts and Creative Industries, National Dong Hwa University, Shoufeng, Hualien, Taiwan

Correspondence to: Aleck C. H. Lin, Department of Arts and Creative Industries, National Dong Hwa University, Shoufeng, Hualien, Taiwan.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This article addresses the challenges faced by firms and proprietors of Micro Cultural and Creative Industries (MCCI) in formulating practical commercial strategies, a task made more difficult by evolving consumer patterns. The study aims to ascertain a set of distinctive commercial strategies for sustaining MCCI businesses, aligning with their distinct characteristics. To fulfill this, a long-term study applied in-depth interviews with current MCCI proprietors who operate their businesses in the east side of Taiwan. The in-depth interviews served as the data collection method, while content analysis was employed for data interpretation. This approach allowed the study to encapsulate a set of practical commercial strategies that could inform the business operations of MCCI firms. The insights gathered provide a robust framework for developing sustainable MCCI businesses, offering valuable guidance for existing businesses seeking to adapt and grow, as well as new entrepreneurs entering the industry. Furthermore, this research aims to stimulate scholarly debate on the importance of tailored, multidisciplinary business strategies for MCCI, given their unique needs and characteristics. The evolving consumer patterns have heightened the challenges faced by MCCI firms and proprietors in formulating practical commercial strategies, necessitating a fresh perspective on sustainable business practices tailored to this sector.

Keywords: Micro Cultural and Creative Industries, Commercial Strategies, New Consumer Group, Core Sustainable Revenue Product

Cite this paper: Aleck C. H. Lin, Exploring Practicable Commercial Strategies for Viability of Micro Cultural and Creative Industries, American Journal of Economics, Vol. 14 No. 2, 2024, pp. 39-54. doi: 10.5923/j.economics.20241402.01.

Article Outline

1. Introduction

- The term “New Normal” introduced by Kessler [22] suggests that even when life returns to normalcy after the 2019 to 2023 pandemic, things will never be exactly the same as before. While business opportunities for Micro Cultural and Creative Industry (MCCI) firms may not disappear thoroughly, this sector will inevitably face new consumption patterns. Individuals are expected to have an unprecedented demand for personalized and customized products, such as wall art or creative accessories, due to extended work-from-home periods, giving rise to novel demands for MCCI products and services.Despite the internet industry’s two decades of experience in implementing and advancing practical industrial strategies and frameworks, as outlined by experts like Chaffey et al. [5], Jelassi and Martinez-Lopez [19], and Laudon and Traver [25], most of these commercial strategies were designed for conventional enterprises and traditional brick-and-mortar firms. Chaffey et al. [5] provided a structured approach to review, plan, and implement a digital business strategy for all types of organizations, encompassing digital marketing techniques, social media commerce, and content marketing. They distinguished between the buy-side of e-commerce, which consists of transactions between the organization and its suppliers and other partners, and the sell-side, which includes all transactions between the organization and its customers. This comprehensive framework offers valuable insights into the various aspects of digital business strategies and their implementation. Similarly, Jelassi and Martinez-Lopez [19] offered extensive coverage of the evolution, current state, and practice of e-business strategies, presenting a thorough e-Business strategy framework. The framework is designed to be applicable to both traditional bricks-and-mortar corporations, such as Sony or BMW, and pure online companies, like Amazon, Google, or eBay. By providing a versatile approach, Jelassi and Martinez-Lopez contributed significantly to the understanding and application of e-business strategies across a wide range of organizations. Furthermore, Laudon and Traver [25] supplied a wealth of examples from prominent companies, such as Meta, TikTok, Netflix, YouTube, Walmart, and Amazon, illustrating how e-commerce is altering business practices and driving shifts in the global economy. Their work highlights the transformative impact of e-commerce on various industries and the importance of adapting to these changes to remain competitive in the digital age.Despite these valuable contributions to the field of e-commerce and digital business strategies, there remains a lack of appropriate and sustainable commercial strategies tailored specifically to the unique characteristics of MCCI firms [18]. Given the local, small-scale nature and distinctive cultural and creative context of these firms, it is crucial to develop strategies that address their specific needs and challenges. The existing frameworks and approaches, while informative, may not fully capture the nuances and complexities faced by MCCI firms in their pursuit of successful e-commerce and digital business strategies.Many MCCI proprietors have educational and training backgrounds geared towards becoming artists, craftspeople, or designers. Consequently, formulating practical commercial strategies that comprehensively address the mandatory characteristics and activities of this sector has become a critical issue, as it relates to the business sector’s notions [39]. Furthermore, previous studies indicate that many MCCI proprietors lack sufficient knowledge and practical means to devise appropriate business strategies, especially in the gradually maturing era of ubiquitous internet access [18,31,33].This study aims to tackle this challenging issue by revealing new commercial strategies for small-scale MCCI firms, drawing insights from proprietors in this realm. Moreover, it hopes to draw further attention and debates about the scope of culture and creativity, as it seems necessary to consider “business” ideas for MCCI firms and proprietors, moving beyond traditional concepts of “art”, “culture”, ‘craft”, and “novelty”.In this context, the article argues that the specific characteristics of MCCI proposed by prior studies – emphasis on originality and uniqueness, cross-domain integration, enhancing sensibility and spirituality, emphasis on personalized micro-production, and emphasis on constructing a product ecosystem – appear insufficient when confronted with the distinctive features of MCCI. It is expected that new commercial strategies can associate with business activities, focusing on balancing creativity and commerce while incorporating two new concepts: “The New Consumer Group” and “Core Sustainable Revenue Product”. Consequently, this study poses a major research question: “What are the distinct practical commercial strategies crucial for the sustainable development of firms that align with the unique characteristics of MCCI?”The manuscript is organized as follows. First, the defining characteristics of MCCI and related notions, as well as the concepts of the new consumer group and core sustainable revenue product, are explored in-depth. Second, the compounded research methods employed for data collection and analysis are illustrated at length. Third, findings are portrayed based on the viewpoints of current MCCI proprietors by converging the results with preceding literature. Finally, the article arrives at conclusions and advice on the implications for theory and practice.

2. Conceptual Context

- Previous literature has mentioned the importance of applying commercial strategies for Micro Cultural and Creative Industries (MCCI) development [15,54]. However, due to the distinct cultural and creative contexts, as well as the local, small-scale nature of MCCI firms [18,47], the existing commercial strategies proposed by researchers for online and/or offline businesses (e.g., [19,25]) did not fit in the MCCI.To address this gap, it is crucial to explore the transformation of traditional business strategies to develop a set of specialized commercial strategies that align with the unique characteristics of MCCI firms. This section delves into the specific characteristics of MCCI, highlighting the existing research gaps, and introduces two new concepts that could be integrated into the product development, management, and marketing processes of the MCCI.First, the study examines the distinct features of MCCI in detail, shedding light on the areas that require further research. Subsequently, the concept of “new consumer groups” is clarified and discussed, as understanding and catering to these emerging segments is crucial for MCCI firms’ success. Furthermore, the concept of “Core Sustainable Revenue Product (CSRP)” is introduced, which could potentially be adapted and incorporated into the product development, management, and marketing processes of MCCI. By leveraging this concept, MCCI proprietors might have better opportunities to formulate and implement commercial strategies that address their unique challenges while capitalizing on their strengths.

2.1. The Micro Cultural and Creative Industries (MCCI)

- The United Nations Education Scientific and Cultural Organization (UNESCO) defines “Cultural and Creative Industries” as “… refers to industries which combine the creation, production and commercialization of creative contents which are intangible and cultural in nature. The contents are typically protected by copyright and they can take the form of a good or a service” [57, p.2]. Based on this internationally accepted definition, companies engaged in the design and production of related crafts, publishing, performances, film/media, and digital content production can all be considered part of the cultural and creative industries.Countries motivated to connect traditional culture with an open economic market, such as Japan, South Korea, Taiwan, etc. [11], as well as economically and culturally advanced countries like U.K., France, U.S.A., Australia, etc. [56], are strongly supporting the development of cultural and creative industries. According to a report provided by the United Nations Industrial Development Organization [58], most cultural and creative industry businesses operate in a “micro-enterprise model”. The concept of “micro-enterprises” was proposed at the 2002 Asia-Pacific Economic Cooperation (APEC) Small and Medium Enterprises Ministerial Meeting, referring to business entities with fewer than five staff members, including individual workshops, sole proprietors, or partnerships [2].The U.S. Small Business Administration also defines micro-enterprises as having no more than 5 employees; most US micro-enterprises have an initial capital of less than $35,000 dollars. These micro-enterprises typically lack access to corporate financing and financial management channels, such as business credit loans or asset management and wealth management services [55]. In the Australian economic system, a large portion of businesses are also micro-enterprises, providing most employment opportunities in the labor market and continuously driving industrial innovation [40]. Furthermore, according to the France Small Business Act (SBA) Sheet [14], small businesses account for more than four-fifths of all enterprises in France, with a total output accounting for 52.5% of France’s gross domestic product (GDP). Based on the information above, micro-industries would be the fertile soil for global economic growth. Since the goods and services provided by the MCCI differ from daily necessities, most of the them have the following characteristics [54]:(1) Emphasis on originality and uniqueness: The core of the cultural and creative industries lies in cultural inheritance and creative value-adding. The related goods and services have a certain degree of originality, often reinterpreting and recreating based on the evolution of human civilization and regional cultural elements.(2) Cross-domain integration: The cultural and creative industries involve aesthetics, art, literature, crafts, design, music, performances and related fields. The forms of goods and services are diverse, and have recently incorporated elements of technology, fashion, etc., exhibiting a multi-disciplinary and cross-domain integration model.(3) Enhancing sensibility and spirituality: Cultural and creative goods and services embody substantial cultural connotations and innovative wisdom value-added. They not only meet consumers’ specific functional needs, but can also bring spiritual pleasure or inner emotional resonance.(4) Emphasis on personalized micro-production: Considering originality and operating scale, cultural and creative goods and services are often produced in small quantities, with most able to accept customized orders to meet personal needs. Most customers are also willing to pay higher prices for customized products.(5) Emphasis on constructing a product ecosystem: Based on their own product positioning and core value propositions, they can link suppliers, distributors, customers and other partners through big data analysis to precisely target customer needs and create unique goods/services as well as a complete industry ecosystem.Moreover, from the perspective of industry operation, the cultural and creative industries have four notable differences from other industries [18]:(1) This is a high-risk industry that requires continuous effort to achieve sustainability: Most cultural and creative products have a highly sensory and experiential nature, and consumer preferences are difficult to predict. Successful creative products need to be based on precise market positioning and consumer psychology analysis. At the same time, the initial capital required to engage in the MCCI is relatively high, especially for production tools and independent equipment (e.g. kilns and pottery wheels needed for handmade ceramic products). However, the return on assets takes a relatively long time, requiring proprietors to have lasting passion and capital investment to achieve long-term stable returns.(2) A balance needs to be struck between cultural value, innovative thinking, and business operations: The MCCI must convey cultural values and connotations while also achieving business benefits. In pursuing profit maximization, the cultural heritage and originality of products cannot be ignored. Proprietors need to find a balance between commercial operations, cultural communication, and innovative creativity, allowing creative products to have a positive social impact while also gaining market recognition and substantial returns.(3) Initial production costs for creative products are higher, but replication costs are relatively lower: During the research and design phase, a lot of human effort (including creativity and craftsmanship) and material resources (including materials, tools and equipment) need to be invested, resulting in higher initial costs. However, once the prototype design and development is completed, marginal costs can be reduced through technology-assisted production. This provides economies of scale for proprietors, but also need to be careful to avoid over-commercialization impacting the cultural and creative value of the products.(4) Cross-domain integration of heterogeneous industries: The integration of MCCI with technology, fashion, innovation and other industries has become increasingly closer, forming many new emerging fields such as digital content, intelligent design, and new media art. The complementarity and integration of different fields can inject new thinking and vitality into the cultural and creative industries. Proprietors can realize synergies in industry operations by integrating and expanding new types of products and services through the concept of industrial innovation.However, most MCCI firms are responsible for all operations from daily business execution to financial accounting. As many Australian MCCI firms are home-based businesses, they tend to conduct operations within households rather than in offices or storefronts like conventional businesses. In general, proprietors must also bear most of the commercial risks associated with entrepreneurship, whether it’s the initial capital investment, using personal assets such as savings or property, or obtaining bank loans or financing. If their business is successful, they can earn considerable profits, but most micro-enterprises still face adversity and crises [13].Given the above characteristics and concepts of MCCI, relevant literature and technical reports suggest that such firms face the following challenges: Firstly, a shortage of funds, as the small scale of the business means limited financing channels and difficulty obtaining bank loans. Secondly, weaker resistance to business cycles and difficulty with market promotion. Due to limited advertising and promotion budgets, it’s also difficult to make products known to the general public. If in the event of financial crises or prolonged pandemics [7,34], the situation could be very difficult.Furthermore, these businesses heavily rely on the personal capabilities of the proprietors, including management abilities, coordination and communication skills, efficient problem-solving abilities, language proficiency, etc. Usually the operation process lacks stability due to the small economic scale, and proprietors lack complete accounting of funds and resources, making it difficult to determine business performance. Additionally, due to inadequate investment in product research and design, innovation capabilities, talent development, information technology, as well as a lack of clear marketing strategy guidance, sales channel development becomes very challenging [6].According to the relevant literature mentioned above, although the characteristics of MCCI are described, as well as how they differ from other industries, and are aware of the difficulties and challenges that this small-scale operation mode may face. However, the current literature does not provide clear practical guidance on how to enable proprietors of MCCI to operate their business sustainably.

2.2. The New Consumer Group

- In order to sustainably operate MCCI firms, there is another new concept that needs to be clarified - the new consumer groups. This type of groups has a new consumption pattern that is different from most consumers in the past. When the young internet generation enters society, new forms of consumer groups have arisen. These groups of people usually have good educational and knowledge backgrounds, belongs to the middle class of society, and has a certain purchasing power [60]. Their rise could bring business opportunities to the MCCI, especially for the demand for new cultural and creative products and services.The new consumer groups favor personalized and differentiated goods and services [36]. They have willingness to express their own characteristics and identity through consumption. Most of the goods and services they purchase contain a niche custom tendency, and they hope that proprietors could provide more choices, or produce personalized design solutions to provide customized goods and services [17]. Based on these thoughts, the ideas of “niche”, “custom-made”, “more choices”, “personalization”, and “customization” are related to the nature of the goods and services of MCCI.They also value the message effects generated by online community and opinion leaders [42]. They usually access and disseminate product information through online platforms. If proprietors collaborate with online community opinion leaders to develop spreadable and interactive digital content, it would increase the new consumer groups’ attention to specific cultural and creative products and services. For example, if an MCCI firm could provide customers with a home product series that they can assemble with their own chosen colors and patterns, offer an in-store DIY assembly experience, launch limited edition products, and/or hold online interaction events on some community platforms, etc., these activities might attract new consumer groups and increase their willingness to consume. In summary, these new consumer groups have the following consumption characteristics [26,28,30]:(1) Value time cost and service quality: Due to busy work, the new consumer groups value time cost, they are willing to purchase high-quality, cost-effective goods and services, but the time cost required is also a key consideration. If proprietors can improve the quality of their services, such as providing fast checkout services, product packaging that is easy to visually identify, product descriptions that match the essence of the product, comfortable rest areas in physical stores, etc., it can increase their purchase willingness.(2) Expect surprises during consumption: The new consumer groups not only pursue products, but also expect unexpected surprises during consumption. If proprietors provide additional small gifts or promotional activities beyond the product, it can create a positive impression. If proprietors can extend services and maintain contact with customers after product sales, such as providing after-sales services beyond the general standard (for example, providing regular cleaning or brushing services for handcrafted metal jewelry that has been sold), birthday discounts, etc., these surprises can increase the satisfaction and re-consumption willingness of the new consumer groups.(3) Purchase goods based on spiritual connotations: The new consumer groups place more emphasis on the cultural and spiritual connotations behind cultural and creative products. If proprietors can actively shape the personality and unique positioning of their products, convey a unique product value, it will allow the new consumer groups to develop a sense of identification. For example, collaborating with public welfare organizations to give back profits to society, shaping the social image of products, combined with the power of social networks etc... These all can create attractive spiritual product image.(4) Emphasize personalization and interactivity: Most new consumer groups hope that the consumption process can be more personalized and interactive. If proprietors can provide customization options to allow consumers to participate, or even use artificial intelligence and other technologies to achieve intelligent interaction, such as developing online interactive experiences to allow consumers to interact with products remotely before purchase. Or if proprietors allow consumers to participate in assembling or designing products they want to buy in physical stores etc., these can also increase the participation and satisfaction of the new consumer groups.(5) Value sharing and economic cooperation: The new consumer groups prefer the sharing economy model, and they may even hope that proprietors can provide shared spaces or platforms to promote resource integration. For example, if proprietors can establish a product information sharing platform or build a product alliance to share channel resources, or even hold joint exhibitions or festivals, allowing customers to share their ideas about products, this kind of sharing and collaboration can effectively integrate resources, reduce costs, and align with the concept of the new consumer groups to gather attractiveness.After understanding the characteristics of the new consumer groups, what operational strategies should the MCCI proprietors adopt to attract the attention of these customers with purchasing power as they would like to enhance their quality of life and product heterogeneity? Most proprietors might likely agree that high engagement and deep participation are key factors. Nonetheless, in a highly information-connected environment, the main challenge faced by the MCCI proprietors is how to integrate digital technology and physical experiential objects to form a complete consumer experience. This is still ambiguous in the literature.

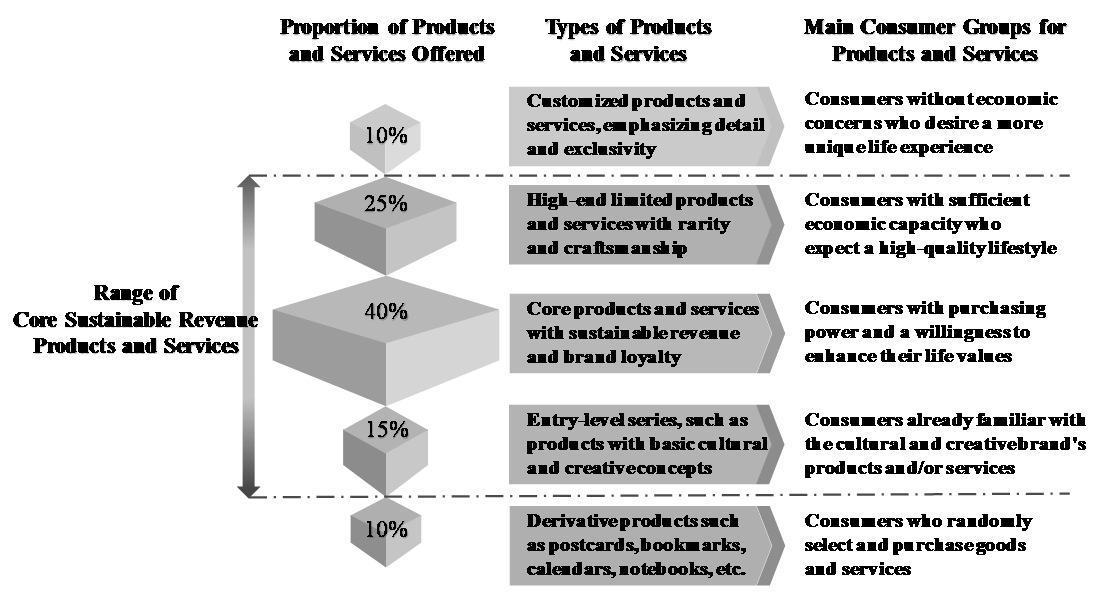

2.3. Core Sustainable Revenue Product (CSRP)

- The “Core Sustainable Revenue Product (CSRP)” is a relatively new concept in business operations and management [32,53,61]. The concept was initially applied to developing high-end luxury products [21], but it could be adapted and incorporated into the product development, management, and marketing processes of MCCI. If proprietors could plan and produce their core cultural and creative products and services based on this concept, their MCCI business might have long-term supports and receive continuous sources of income for making industrial operations more stable. According to the literature, CSRP have the following characteristics [9,32,53,61]:(1) Satisfy the needs of specific groups with long-term consumer loyalty: Most of the CSRP cater to the preferences and needs of some specific consumer groups. For example, cultural and creative products can be designed according to the styles favored by new consumption groups. Through market analysis, proprietors can target the product themes and elements preferred by these groups. If loyal customers can be encouraged to share through their communities, it might create word-of-mouth effects, making it easier for new customers to accept these products.(2) Reflect the core value proposition: Most of the CSRP highlight the individuality, design philosophy, and cultural connotations of a specific MCCI proprietor, and be able to convey the intrinsic value of the products, such as handmade or eco-friendly attributes. These products and services should have a good story behind them, allowing consumers to identify with the core value proposition.(3) Express uniqueness: CSRP usually incorporate local cultural elements, such as historical stories or the maker’s craftsmanship techniques. Normally they could convey to consumers the unique characteristics of limited-edition materials, such as the use of rare plant-based dyes, to enhance their uniqueness and make the products and services representative and topical. Furthermore, these products are sold in limited quantities to increase their perceived rarity, making them difficult to commoditize.(4) Enclose feasible business model: The profit margin of CSRP must be sufficient to support the operations of MCCI businesses. Normally, it is expected that when a CSRP could be sold in a given period (e.g., a week or a month), the overall profit could be maximized and covered most of the production and operating costs. These products should have clear targeted customer groups and appropriate pricing strategies. By estimating the various costs and expected profits, as well as sharing product information through multiple channels, the feasibility of business operations could be secured.CSRP could provide MCCI firms with a stable cash flow. Other complementary products can be developed around these core products, forming a product portfolio with complementary effects. Proprietors could also expand peripheral services based on their core products to increase added value. Overall, “CSRP” are an important support for the long-term development of the MCCI.One more thing should be mention here. Regarding CSRP, the proprietors of MCCI are recommend to recognize a thought that is fundamentally different from other industrial products: “Quality should not be the selling point for MCCI products and services”. On the contrary, “quality” is only a basic necessary condition for CSRP [21]. While most industries emphasize the quality of their products and services, the proprietors of MCCI when producing cultural and creative products or services must highlight the characteristics of CSRP mentioned above to differentiate their offerings from general industrial products.Figure 1 illustrates the concept of CSRP built upon the foundation of MCCI’s products and services. The range of products and services offered by most commercial brands can be classified like a pyramid and corresponds to public consumption behavior [21]. However, for most of the proprietors of MCCI that only provide products and services to regional markets (see Figure 1).

| Figure 1. Range of Core Sustainable Revenue Products and Services for Micro Cultural and Creative Industries |

3. Methodology

- Micro Cultural and Creative Industries (MCCI) have gained significant attention in recent years, yet there is a dearth of qualitative research exploring the practical commercial strategies employed by MCCI proprietors. This study aims to bridge this gap by providing an in-depth analysis of the experiences and perspectives of MCCI proprietors.The conceptual background section highlighted the importance of understanding the unique challenges and opportunities faced by MCCI proprietors in formulating effective commercial strategies. Previous studies have primarily focused on quantitative data analysis, overlooking the nuanced insights that can be gained through qualitative methods [15]. This research endeavors to fill this empirical knowledge gap by employing long-term, semi-structured in-depth interviews with 68 MCCI proprietors in eastern Taiwan.The data collection process adhered to strict ethical guidelines to safeguard the rights of participants. Only individuals aged 18 and above were invited to participate, and the study protocol (NCKU HREC-E-1103222) received approval from the Human Research Ethics Committee of National Cheng Kung University, Taiwan. This committee operates under the authority of the Ministry of Education, ensuring compliance with governmental laws and regulations. Informed consent was obtained from all subjects involved in the study, guaranteeing their voluntary participation and realizing of the research purposes.Through this qualitative approach, the study aimed to uncover the hidden but crucial potential commercial strategies employed by MCCI proprietors. By delving into their experiences and perspectives, the research sought to establish a comprehensive viewpoint for guiding the future development of MCCI.

3.1. Data Collection

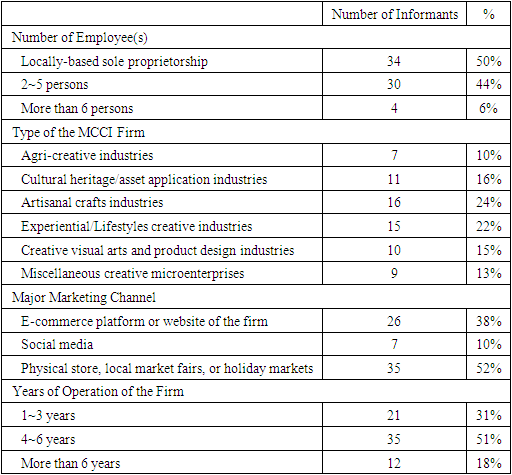

- The interview is a valuable research method for collecting primary data and gaining insights into individuals’ perspectives, experiences, and situations [16,44]. Through carefully crafted semi-structured questions, researchers can elicit informants’ opinions and thoughts on specific topics, such as the operational circumstances of MCCI firms [44]. In-depth interviews involve a researcher engaging in a conversation with participants to understand their unique viewpoints, lived experiences, and contextual realities [52].This qualitative approach is particularly useful in exploratory studies, where researchers aim to develop a deeper understanding of a field or phenomenon, rather than testing pre-existing theories [35]. By employing in-depth interviews, researchers can uncover rich, nuanced data that may not be accessible through quantitative methods alone. Additionally, this method allows researchers to bridge theoretical concepts with practical considerations, fostering a more holistic comprehension of the social reality under investigation [35].In-depth interviews facilitate the exploration of complex issues by providing a platform for participants to share their stories, experiences, and perspectives in their own words [24]. This interactive approach enables researchers to probe further, clarify ambiguities, and gather contextual details that enrich the research findings [45]. Moreover, in-depth interviews can reveal unexpected insights and uncover new dimensions of the research problem, ultimately contributing to the development of novel theories and conceptual frameworks [8].The selection of interview participants was a crucial step in this study, as it aimed to gather rich and insightful data from individuals directly involved in the MCCI sector. The study utilized a “purposive sampling” approach [16] to recruit information-rich informants from a MCCI database established by a county government in eastern Taiwan. Initially, 93 MCCI proprietors were contacted, and 76 of them agreed to participate. However, due to various reasons, only 68 interviews were successfully conducted. Most of the MCCI firms have been operated 4 to 6 years (51%), then 31% of them are startup firms (1~3 years), and only 12 firms (18%) have been established for more than 6 years.The demographics of the interviewed participants are illustrated in Table 1. A significant portion of the MCCI firms had a small workforce, as 50% of them are sole proprietorships and 44% of the firms only have 2 to 5 employees. The majority of the participants were heads of local MCCI firms, while a few had international customers, highlighting the diverse nature of the sample [37]. The types of MCCI firms including Agri-creative industries (10%), Cultural heritage/asset application industries (16%), Artisanal crafts industries (24%), Experiential/Lifestyles creative industries (22%), Creative visual arts and product design industries (15%), Miscellaneous creative microenterprises (13%). This diverse range of participants allowed the study to capture a comprehensive understanding of the operational circumstances and experiences of MCCI firms.

|

3.2. Data Analysis

- Qualitative data analysis demands a rigorous and systematic approach [16,44]. In this study, content analysis was employed to explore the insightful opinions provided by MCCI proprietors, with the aim of encapsulating a set of operational commercial strategies suitable for their unique needs. Content analysis is particularly appropriate for describing cognitive and behavioral reactions, as well as identifying the inclinations or intentions of individuals or groups [59]. The data analysis process integrated the guidelines provided by Eisenhardt [12] with the rigorous processes outlined by Rossman and Rallis [44].To ensure the reliability of the content analysis, an independent multi-level coding procedure was implemented. Three academics – two from Australia and one from Taiwan – were invited to serve as consultants, leveraging their formidable expertise in qualitative data analysis methods. The author of this manuscript, who possesses theoretical training and extensive practical and academic knowledge about MCCI and the implementation of diverse business strategies, conducted the primary coding process using open-coding and ranking techniques (Flick, 2018). The software ATLAS.ti 8 was utilized to assist with the data analysis, with coding and labeling performed manually, without reliance on automatic functions.After each coding phase, the results were shared with the three consultants, who served as quality controllers, applying their expertise to review and validate the findings. This collaborative approach ensured a comprehensive and rigorous analysis, leveraging the collective knowledge and experience of the research. Through this systematic and multifaceted content analysis process, the study aimed to extract meaningful insights from the proprietors’ perspectives, ultimately leading to the formulation of operational commercial strategies that address the unique challenges and opportunities faced by MCCI firms.

3.2.1. Stage 1 – First and Second Level of Content Analysis

- Initially, 1,862 coded key terms were selected based on their relevance to the core idea of this study, including related verbs, nouns, adjectives, adverbs, and synonyms (singular or plural) with similar meanings. After analyzing the relationships between the original interview data and these keywords, eight categories were defined: product and value, price of MCCI products, reliability development, digital channel usage, persistence and reliability, compliance, business anticipation, and supply-oriented tactics.Further analysis yielded a second level of concepts, with eight explicit potential spheres derived: value proposition for products and services, innovative pricing positioning, customer cultivation, considerations for using online channels, authenticity and consistency, trend unconventionality, market scope projection, and supply-driven provision. Most spheres extended knowledge from prior literature reviewed in Section 2. Notably, the last three spheres – trend unconventionality, market scope projection, and supply-driven provision – emerged as particularly new and interesting perspectives from the informants.

3.2.2. Stage 2 – Emergence of Practicable Commercial Strategies for MCCI

- The purpose of this stage was to establish a solid theoretical foundation for the derived concepts and further theorize about them. The same quality assurance procedures used in Stage 1 were followed. The analysis focused on concepts and literature related to eight spheres of practicable commercial strategies. Consequently, if an MCCI proprietor wishes to formulate workable commercial strategies, this study proposes considering at least the following eight new practical aspects:(1) Balancing product supply and perceived value;(2) Promoting unconventional pricing strategy for MCCI products;(3) Fostering devoted fans and cultivating their loyalty;(4) Using online channels and sales cautiously;(5) Maintaining consistent style and ensuring product authenticity;(6) Better not relying on current tastes and trends;(7) Projecting product and service market scope;(8) Supply-oriented, leaving the purchase decision to customers.

4. Results and Discussions

- The content analysis of opinions and comments from 68 informants revealed eight distinct spheres of practicable commercial strategies. These strategies are categorized and elucidated below, with only the most valuable cases or descriptions selected and quoted.

4.1. Balancing Product Supply and Perceived Value

- This strategic and practicable approach is a solution for “output control” in the Micro Cultural and Creative Industries (MCCI). As consumers recognize and demand the products and services of particular MCCIs, the demand for these products would gradually increase. Some proprietors have similarly stated, “If the demand for my products is real, I would definitely like to respond to it because it will affect the sustainability and profitability of my business. But what should I do so that it might not damage the products' perceived value?” (Info07, 26, 29, 46, 61). For effectively managing this increasing demand, proprietors of MCCIs might follow two key steps suggested by experts and scholars [1, 43]: first, launch the next new advanced product in a limited quantity and at a higher selling price; second, consistently set the predicted price higher than the actual selling price of the current MCCI product.Regarding the first step, when proprietors gain control over the products of their Core Sustainable Revenue Product (CSRP), certain customers may demand increased output, especially if they fail to acquire the product initially. When this situation happened, MCCI proprietors said that they faced a dilemma: “While I knew increasing output could potentially increase profits, but it could also dilute the perceived value of the product” (Info 26, 46, 61). This is because as more customers acquire the product, its rarity and exclusivity decrease, ultimately affecting its value.To address this issue, there is an operational solution that responds to customer demands without compromising brand value. First, MCCI proprietors must control the output quantity of their product within a certain range during a specific time period. If a batch of products sells out, customers should be informed that the item is temporarily unavailable due to constraints, but that the next version will be launched soon and available for purchase. When launching the new version, proprietors should raise the selling price to signal to customers that the new version incorporates new characteristics, elements, and techniques, thereby justifying the higher price. Furthermore, this new version should also be subject to a limited quantity [1,43]. By operating in this manner, increased demands can be satisfied while gradually increasing the perceived value of the product. Moreover, various marketing campaigns can be continuously created to promote the product.This approach demonstrates why the average price of MCCI products should be continuously raised. It also highlights the importance of proprietors simultaneously improving the inherent value of their products and services to match the higher price point.

4.2. Promoting Unconventional Pricing Strategy for MCCI Products

- Many MCCI proprietors are still using conventional low-pricing strategies to attract customers, as evidenced by informants of 02, 03, 08, 11, 12, 13, 16, 17, 19, 22, 26, 29, 33, 34, 35, 36, 37, 43, 45, 46, 47, 53, 59, 60, 62, 63, 64, and 67 in this study. However, for MCCI products, an unconventional pricing strategy would be more effective. This inverted approach involves setting higher prices than traditional products, as the perceived value of MCCI products increases significantly when consumers recognize their unique creativity and cultural connotations.Firstly, when the price of a MCCI product is overestimated due to its uniqueness, consumers feel a sense of honor in owning it. As one proprietor shared, “A customer told me, ‘When I wore the handcrafted silver necklace and ring you made for me to work, my colleagues were all amazed. Especially when I told them these were handcrafted and one-of-a-kind, they looked at me with envious eyes’” (Info20). The proprietor’s anecdote highlights the power of handcrafted, one-of-a-kind jewelry in creating a sense of uniqueness and exclusivity for the wearer. The customer’s experience demonstrates how MCCI products can serve as conversation starters and status symbols, eliciting admiration and envy from others. This story underscores the potential for MCCI firms to capitalize on the growing consumer demand for distinctive, artisanal products that allow individuals to express their personal style and stand out from the crowd. Particularly when MCCI products are given as gifts, the recipients appreciate them more because of the perceived higher value. Another proprietor stated, “One of my royal customers said, ‘I gave the handmade silver jewelry you made to a friend as her birthday gift. When she opened it, she was surprised and said, ‘This must be very expensive? How can I accept this!’ But when I honestly told her the purchasing price, she didn’t believe such a price could buy handmade silver jewelry like that” (Info28). The proprietor’s conversation with their royal customer reveals several important insights into the perception and value of handcrafted silver jewelry. Firstly, the friend's initial reaction to the gift, assuming it must be very expensive, suggests that handmade silver jewelry is often associated with high value and luxury. This perception can be advantageous for MCCI proprietors, as it positions their products as desirable and prestigious. However, the friend’s disbelief upon learning the actual purchasing price indicates a disconnect between the perceived and actual value of the handcrafted jewelry. This presents an opportunity for MCCI proprietors to educate their customers about the intrinsic value of their products, emphasizing the skill, creativity, and effort that goes into each handmade piece. By effectively communicating the unique qualities and craftsmanship behind their jewelry, MCCI firms can justify their pricing and build a greater appreciation for the value of their products.Secondly, while introducing threshold products to attract new customers is necessary, MCCI firms should target consumer groups that resonate with the lifestyle and cultural identity associated with the global economy’s growth. These consumer groups are willing to purchase MCCI products as a reward for themselves and to improve their living standards or quality. They also want to showcase their unique taste and reduce the use or purchase of industrial products. As one proprietor shared, “A customer told me, ‘When I invited friends over for dinner on the weekend, I used the handmade ceramic dinnerware I purchased from you to serve the food. My friends thought I had great taste, using handcrafted pieces instead of industrially-made dinnerware to host them’” (Info39). The proprietor's conversation with their customer showcases the impact that handmade ceramic dinnerware can have on social gatherings and the perception of the host. By choosing to serve food on handcrafted pieces, the customer demonstrated their appreciation for unique, artisanal products and their desire to create a memorable and impressive dining experience for their friends.The friends’ positive reaction to the handmade dinnerware highlights the potential for MCCI products to elevate social occasions and reflect positively on the taste and style of the user. This anecdote suggests that MCCI proprietors can market their products as a way for customers to express their individuality, sophistication, and ability to curate a distinctive and inviting atmosphere in their homes. Furthermore, the conversation underscores the role that word-of-mouth recommendations can play in the success of MCCI firms. By creating products that leave a lasting impression on customers and their guests, MCCI proprietors can encourage organic promotion of their brand and attract new customers who aspire to emulate the style and taste of their peers. Sustainable existence and development are likely to be achieved only when targeting people who can afford the real price and pay equivalent consideration to MCCI products, extending the study by Sinkovics et al. [49].

4.3. Fostering Devoted Fans and Cultivating Their Loyalty

- For the proprietors of MCCI to gain a firm foothold in the market, they must embrace a new concept of commercial strategies. Traditional sales methods and business strategies emphasize “efficiency”, believing that resources should be allocated towards potential target audiences; spending on non-target audiences is undoubtedly a waste of resources. This kind of thoughts were also revealed from some interviewees, including Info03, 10, 16, 23, 29, 35, 49, 56, 61, and 64. However, the path to survival for the firms of MCCI is vastly different. Proprietors are suggested to carefully select their real target customer groups and strive to cultivate a group of loyal supporters.An interviewed plant fragrance mist manufacturer shared her experience. She found that although most customers who used the fragrance mists she developed were deeply impressed by her products, “… but there was also a small group of loyal customers who were particularly enamored with one of the blue bottle fragrance mist, describing it as an unprecedented, brand new scent, and they repeatedly purchased this bottled fragrance mist” (Info05). It was this group of loyal supporters that allowed her products to stand out in the market. The more proprietors can differentiate between their main customer group and non-main customer group, the higher the perceived value of their specific MCCI products will be among the main customer group.Additionally, one of the proprietors of MCCI provided an insightful idea that could be learned by others, he said that “… I finally realized that I should aim to have a much larger group of people who know or are familiar with my products than the group who actually has the purchasing power to afford them, in order to attract more potential customers” (Info45). Therefore, in addition to implementing precise business strategies targeting their customer groups, they must also raise the profile of their products on a broader level. After all, if the general public cannot identify the source of a specific MCCI product, that product will lose some of its uniqueness and value. In summary, the key to success for MCCI firms lies in cultivating a group of loyal supporters and differentiating the main customer group.

4.4. Using Online Channels and Sales Cautiously

- The internet should not become the primary channel and tool for marketing and selling Core Sustainable Revenue Products (CSRP) of MCCI. As it is clearly seen from Table 1, approximately half (26+7) of MCCI firms or proprietors use online platforms or websites, or even social media as their major marketing channel.However, one interviewee who still operates a physical store stated: “I hope my products can allow customers to experience another level of ‘spiritual life’, rather than remain in the concept of using ordinary industrial products.” (Info30). Another proprietor also said that “I hope to establish a one-on-one relationship with each customer, rather than having customers face an automated virtual electronic transaction platform.” (Info55).Under the global trend of digitization, how can one not provide online sales and services? This is a problem faced by many MCCI firms. Nevertheless, upon further consideration, although the advantages of the internet, including timeliness, updatability, constant change, convenience, accessibility, discounted prices, and automated services, are extremely valuable for industrial and mass-produced goods [4], they conflict with the characteristics of MCCI products. When a product is produced to incorporate human creativity or carry cultural symbols, it undergoes a constantly accumulating process, so it cannot be produced instantly, and this nature is conflicting with the internet’s concepts of timeliness, constant updates, and constant change.Furthermore, based on cultural connotations and complex production processes, the prices of CSRPs should be set according to accurate, actual raw material prices and craft technique levels, which cannot be sold at discounted prices. In other words, the internet can serve as an auxiliary channel, providing relevant information or services to existing customers and introducing potential new consumer groups about the product information, product history, or product overview [23]. It would be better not be used as the primary sales channel for CSRPs. Most MCCI firms and proprietors should be aware of these commercial strategic ideas.

4.5. Maintaining Consistent Style and Ensuring Product Authenticity

- This strategic sphere is also an important commercial principle for operating MCCI. Customers often question or raise objections to the appearance, color, or functionality of newly launched cultural and creative products, claiming the designs are unreasonable or fail to meet their actual needs. However, if these new products have undergone careful consideration and feature unique and creative designs, proprietors should stick to the original style rather than arbitrarily changing it to cater to some customers’ demands, as doing so would undermine the product’s integrity and original intent [10,38].A bag designer once launched a canvas wallet that could hold both coins and bills. Not only did it win the prestigious German Red Dot Design Award, but it also catered to a main target audience of young people aged 25 to 35. When a customer requested online and hoped him to make the same wallet style using leather material, “I declined,” he said. “I believed that leather would give off a more ‘dated vibe’ contrary to my original intent” (Info49). Hence, he ultimately stuck to his original creative design concept without changing the material.Another ceramic craftsman created a batch of fully flat plates for a Japanese restaurant to present sashimi and sushi, intentionally removing any indentations or curved surfaces. “… my goal was to allow for more direct plating and presentation of the sushi while also making the plates easier to clean …” (Info33). Initially, the Japanese restaurant owner had doubts about this design but later accepted the innovation and requested the craftsman to produce several more of the same plates.Only by adhering to original design concepts can MCCI firms maintain stylistic consistency across all its product lines, further reinforcing the products’ authenticity, appeal, unique charm, and even an air of mystery. Under traditional business rules, companies often modify products to cater to customer opinions [20]. However, in the MCCI realm, proprietors are suggested to have their own creative concepts and adhere to their unique style rather than readily changing it due to customer demands.

4.6. Better Not Relying on Current Tastes and Trends

- The proprietors of MCCI would be better to avoid over-catering to current popular trends and mass preferences. Instead, it would be better to pursue classicism and cultural connotations. Some inexpensive creative products, in order to generate sufficient profits, often blindly follow customer tastes and trends, resulting in intense homogeneous competition in the market. For example, one interviewee mentioned, “… there was a period when plant-dyed clothing was highly popular, as the public believed such clothing was healthier for the body without chemical dyes. So I produced some of them and tried to sell them in some local holiday fairs, but sales were extremely poor due to too many other people selling similar products …” (Info41). The interviewee's experience with plant-dyed clothing highlights the challenges that MCCI proprietors face when trying to capitalize on popular trends. While the public's belief in the health benefits of plant-dyed clothing created a demand for such products, the interviewee found that the market quickly became saturated with similar offerings from other sellers.This anecdote illustrates the importance of differentiation and unique selling points in the MCCI sector. When a particular trend gains popularity, it is common for many businesses to jump on the bandwagon, leading to increased competition and difficulty standing out in the market. To succeed in such an environment, MCCI proprietors must find ways to distinguish their products from those of their competitors.One potential strategy could be to focus on the specific techniques, materials, or designs used in the creation of their plant-dyed clothing. By emphasizing the unique qualities of their products, such as the use of rare or locally-sourced dyes, innovative dyeing techniques, or distinctive design elements, MCCI proprietors can create a compelling narrative around their offerings that sets them apart from the crowd. Additionally, the interviewee's experience underscores the significance of market research and adaptability in the MCCI sector. Before investing heavily in a new product line, MCCI proprietors should conduct thorough research to assess the potential demand, competition, and long-term viability of the trend. By staying informed about market conditions and being prepared to pivot their strategies as needed, MCCI firms can minimize the risk of overcommitting to a trend that may quickly become oversaturated.Another handmade bag designer also stated: “due to substantial capital, medium and large companies can mass-produce products at lower prices for profits, making it difficult for handicraft businesses to win those price wars” (Info52). It’s evident that merely pursuing short-term popular trends will inevitably lead to pointless homogeneous competition and a loss of unique positioning.In contrast, MCCI products should shape tomorrow’s classics rather than following fleeting trends. This kind of products should utilize aesthetic values, cultural symbols, design concepts and other elements to become trendsetters and pioneers of classic tastes. One ceramics artist said, “… based on traditional handicraft techniques, I incorporate modern artistic elements and expressive methods, allowing my works to not only be functional but also imbued with aesthetic connotations and cultural significance” (Info21). A knitting master also believes that “… outstanding knitwear can convey lifestyles, ideologies, and cultural symbols” (Info25). Another wood-carving artist expressed: “my works carry the quintessence of centuries-old traditional craftsmanship and convey peace and happiness through patterns and text, inspiring customers’ spiritual experiences” (Info31).Hence, truly enduring MCCI products should not merely chase temporary fads and tastes but should infuse cultural connotations, aesthetic truths, and philosophical ideas into the products to elevate customers’ tastes. MCCI proprietors should uphold this operational philosophy, positioning themselves as educators of living tastes to achieve sustainability in the market.

4.7. Projecting Product and Service Market Scope

- Proprietors of MCCI are recommended carefully project and plan the market scope for their products and services. It is an insightful idea that includes closely examining actual and potential commercial value domains. This not only represents the important concept of mapping different levels of products to different target groups, but is also the key to future business transformation and diversified development.One informant shared an interesting experience, stating that “… initially I did not know that Hemerocallis fulva, once used as a plant for dyeing fabrics, also had cosmetic effects. It wasn’t until a facial mask manufacturer informed me that, and I suddenly ignited a new entrepreneurial inspiration. This gave me a new way out. ... it led me to start reforming my business strategy to achieve a diversified business” (Info03). Subsequently, she began developing a series of cosmetic skin care products, expanding her originally single Agri-creative industry into a diversified operation.Another interviewee said that due to the large price differences for handmade wooden lamps, ranging from a few thousand to hundreds of thousands of dollars, he therefore formulated different product levels for different customer groups, “… especially for those customized products, I set at special prices targeting specific market scopes” (Info65). By broadening the product line, he could meet mainstream market demands while also focusing on developing high-value products for specific niche customer groups.From the above cases, it can be seen that for MCCI proprietors, carefully evaluating the potential commercial value of their own products and appropriately adjusting the business direction will help revitalize their business and explore more diversified niche markets. Conversely, if confined to a single narrow market scope, opportunities for transformation and development will inevitably be lost. Therefore, constantly grasping product characteristics and accurately projecting market potential is the only way for MCCI firms to achieve sustainable operation. These valuable narratives are consistent with the idea of projecting and setting market scopes expressed in the literature [51], but from a new perspective, they prove the feasibility for MCCI proprietors to transform themselves if they understand the concept of market scope projection.

4.8. Supply-Oriented, Leaving the Purchase Decision to Customers

- There are significant differences between MCCI products and general industrial products in terms of pricing logic, operation, and sales methods. MCCI products belong to “supply-oriented” goods, unlike traditional products that adopt a “demand-oriented” approach. Proprietors first create the products, and then determine the appropriate pricing method based on the cultural connotations and creative input invested, rather than formulating products based on market demand. The more customers recognize the cultural and creative value, the higher the pricing will naturally be.Product pricing cannot completely determine levels of value, but an MCCI product imbued with cultural codes or creative design concepts naturally has much higher value than ordinary goods. For this reason, customers are usually more willing to pay a higher price. This contrasts sharply with traditional industrial products. Before launching new products, enterprises or companies typically first conduct market research to assess the salability of different price points before deciding on production strategies.Here are two good examples extracted from the interviews. One informant explained, “Recently, I developed a new type of product - wooden pen holders embedded with scallop shells. Many wood pieces have chips or indentations, so I insert these shell fragments to fill up those imperfections before crafting the pen holders. This way, parts of the pen holder shine with the brilliance of the shells. I explained the uniqueness and creative connotations of the works to customers, thereby convincing consumers to recognize their value. It has become one of my staple products and is selling really well” (Info36). The informant’s story about their wooden pen holders embedded with scallop shells is an excellent example of how innovation and creativity can lead to success in the MCCI sector. By combining two seemingly disparate materials - wood and scallop shells - the informant has created a unique and eye-catching product that stands out in the market.The use of scallop shell fragments to fill imperfections in the wood is a clever solution that not only enhances the aesthetic appeal of the pen holders but also adds to their unique selling point. The informant's ability to turn what could have been seen as flaws in the wood into a distinctive design feature demonstrates their ingenuity and resourcefulness.Moreover, the informant's approach to marketing their product is noteworthy. By explaining the uniqueness and creative connotations of the pen holders to customers, they have effectively communicated the value and appeal of their product. This strategy has allowed them to convince consumers to recognize the worth of their innovative design, leading to strong sales and establishing the pen holders as one of their staple products.Another proprietor said, “We have started adding aboriginal totems to the base of our wooden clocks. Even for customized clock orders, some customers now request us to incorporate these aboriginal elements into their designs” (Info11). In this sales process, proprietors are expected to explain to customers the inherent stories, creative concepts, and craftsmanship of the products to justify the pricing. In other words, the high or low pricing of MCCI products depends on the extent to which customers recognize their cultural and/or creative value.In summary, MCCI products have a unique positioning, and their business operation strategies differ significantly from traditional industries, essentially being supply-driven goods. The focus of proprietors is on continuously creating works with uniqueness, creativity, and cultural value, rather than passively catering to demand. Ultimately, whether to make a purchase or not is left to the customers’ own decision.

5. Conclusions

- This study presents eight new conceptual spheres to aid proprietors in the micro cultural and creative industries (MCCI) in formulating practical commercial strategies. These strategies are based on the opinions and insights of experienced MCCI business owners. The research has two vital theoretical implications that address significant gaps in the existing literature and provide valuable insights for the operation and management of small-scale MCCI firms with low market identification.First, the study directly addresses an urgent need for guidance on operating and managing these unique businesses, which often face a multitude of challenges. Many MCCI businesses are home-based, with proprietors conducting their operations from personal residences rather than offices or storefronts [2,15,18]. This unconventional setup can lead to several obstacles, such as poor credit, excessive reliance on personal management capabilities, difficulties in determining business performance, short product life cycles, insufficient innovation and IT investment, unclear marketing strategies, and challenges in developing diverse marketing channels. The proposed new commercial strategies in this research directly correspond to and aim to address these identified obstacles, offering practical solutions that could potentially improve the businesses' financial standing and access to credit. By providing targeted guidance, the study fills a crucial gap in the existing literature and offers valuable insights for MCCI proprietors seeking to overcome the unique challenges they face.Second, the research contributes to the limited body of comprehensive qualitative investigations into how MCCI firms can formulate appropriate and efficient business strategies. The eight new conceptual spheres presented in this study have not been thoroughly discussed in prior literature such as Flew [15], Hesmondhalgh [18], or Salvador et al. [47], representing a significant advancement in the understanding of MCCI business strategies. By exploring these spheres in depth, the research provides a clearer blueprint for constructing more workable commercial strategies specifically tailored to the needs of MCCI firms and proprietors. This contribution is particularly valuable given the lack of focused research on the strategic aspects of managing and growing MCCI businesses, which often operate in a highly dynamic and competitive environment.The eight conceptual spheres identified in this study differ somewhat from those expounded in previous literature and theories within the cultural and creative realm, highlighting the unique nature of the MCCI sector and the need for specialized strategies. By bridging the essential knowledge gap between the Cultural and Creative Industry (CCI) and business development and industrial operations, this research offers a fresh perspective on the challenges and opportunities faced by MCCI firms. The implications of the study extend beyond theoretical understanding, shedding light on practical strategies that can stimulate growth and employment opportunities in the socio-economically valuable MCCI sector. As such, the research has the potential to drive positive change and support the development of a thriving and sustainable MCCI ecosystem, benefiting not only the businesses themselves but also the wider economy and society.However, certain research limitations should be acknowledged. First, although the study gathered information from currently operating firms, there may be gaps between the current results and broader real-world phenomena due to differences between countries or cultures. Second, the eight new commercial strategies are derived from the perspectives of MCCI practitioners combined with insights from experts and scholars in the relevant field, without incorporating consumer perspectives. Third, all participants faced a new global consumption pattern unlike anything they had experienced before due to the post-pandemic era, potentially missing some emerging consumer behaviors.In conclusion, this research contributes to the existing body of knowledge on MCCI and their business development strategies, providing specific guidance to MCCI proprietors and fostering broader cultural policy discussions. Through continuous exploration and implementation of the proposed key elements, the study aims to facilitate sustainable and resilient development of the MCCI sector amidst evolving global circumstances.

Appendix A

- Could you please share some background information about yourself, including your education, previous work experience, and how long you have been operating your current business?• What are your observations regarding the current circumstances and market conditions within the cultural and creative industries?• Have you received any mentorship or taken any courses that taught you how to formulate practical approaches or commercial strategies for operating in the cultural and creative industries?• If you answered 'Yes' to the previous question, could you explain how you formed or formulated those approaches or strategies?• If you answered 'No' to the previous question, do you hope to understand and learn some mechanisms to help you develop a proper business model for your venture in the future?• Which of the following aspects are you currently implementing in your business operations?a. Adding cultural and creative value to your products and services.b. Understanding the cultural and creative market and trade environment.c. Seeking to achieve business benefits.d. Formulating specific marketing strategies for your firm.e. Any other aspects you would like to mention.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML