Agu Okwudili Chijioke

School of Economics, Hebei University, Baoding, China

Correspondence to: Agu Okwudili Chijioke, School of Economics, Hebei University, Baoding, China.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

This study examines the effects of foreign direct investment on Africa’s economic growth from 2011-2020, firstly by creating an in depth theoretical understanding of what foreign direct investment means, its classifications as well as the various categories of FDI prevalent in Africa. The paper utilized selected African countries from the four major geographical regions as case study. The study deployed the use of secondary data, the variables considered were gross domestic product, total work force, degree of political stability, natural resource endowment, net export and import as well as net inflow of foreign direct investment into the selected host African countries, source of data is The world bank data (world development index). The method of data analysis are broadly divided into static and dynamic panel data approach, the fixed effect, the random effect and the Generalized Least Square (GLS) represents the static panel data approach, the Hausman’s test was utilized to select between the fixed effect and random effect model while a one-step system Generalized method of moments (GMM) represents the dynamic panel data approach. The results gotten from the static and dynamic panel data approach were compared on a coefficient significance basis. The study finds out that at 10% significance level, foreign direct investment exerts a negative effect on Africa’s economic growth over the period of 2011-2020.

Keywords:

Effects, Africa, Foreign Direct Investment, Economic Growth

Cite this paper: Agu Okwudili Chijioke, The Effects of Foreign Direct Investment on Africa’s Economic Growth, American Journal of Economics, Vol. 13 No. 3, 2023, pp. 95-104. doi: 10.5923/j.economics.20231303.04.

1. Introduction

Foreign direct investment has proven to be a bail out for many third world countries in today’s fractured global economy. According to (Miao et al, 2020); for developing countries, like Africa, the adoption of knowledge and tecchnology from the international market is vital, since it might be their only way to improve productivity, growth, upgrade industrialization process, foreign trade and technical progress. However, the continuous inflow of foreign direct investment into Africa has raised many eyebrows both academically and socially as many scholars have questioned the motive, effectiveness as well as the outcome of such investments in relation to the economic growth and development of the continent given its current economic situation. Countries such as Nigeria and South Africa have received great proportion of foreign direct investment funds in recent years, these investments and other foreign direct investment inflows into other African countries have its implied effects on Africa’s economy given the size of these investments, the cost of the investments as well as the end results of the investments, thus vesting on it the potential to significantly alter the direction of a country’s economic growth.While many have questioned the motive, effects and results of such foreign direct investment inflows into Africa, according to Naude and Krugell, 2011’s econometric research findings, the results proves otherwise, they rather insists that there is no significant impact of market seeking behavior of multinational companies investment in Africa. Though there seems to be varied views on the effect of such investments on Africa’s economic growth, their research provides different insights on the motives behind the increased inflow of foreign direct investments into Africa as well as the potency of the management system put in place by the government of African countries to ensure proper utilization of foreign direct investment to produce the required result.There have been many studies on the effect of foreign direct investment on Africa’s economic growth both by foreign experts and African elites (Asiedu, 2006; Zhang, 2010; Naude and Krugell, 2011), most of these scholars focused their research on a single African country thereby limiting the scope and the potency of the research to be used as a focal point to draw conclusions on the effect of foreign direct investment on the whole continent. Also important to note is the fact that there has not been many researches that sheds more light on the roles played by investing country’s motives in determining the outcome of foreign direct investments in Africa.This research sets out to empirically analyze the effect of foreign direct investment on Africa’s economic growth between the period of 2011-2020. This research is organized in two different sections. The first section is the theoretical review which covers a basic understanding of foreign direct investment, its classifications and categories of foreign direct investments existing on the African continent. The second session covers the empirical analysis which examines the effects of foreign direct investment on Africa’s economic growth using data obtained from world bank(world bank development indicators) and a sample size of eight African countries carefully selected from the continent’s four major geographical regions to ensure a more representative and accurate result. It employed econometric techniques and models to analyze the data, and finally drew conclusions and recommendations based on the findings of the empirical analysis.

2. Foreign Direct Investment as Defined by International Authorities and Experts

Economists of the 18th, 19th and early 20th century sought for a means to establish a linkage between national economies that will give rise to a world wide market for exchange of goods and services, as well as capital and this gave rise to the system popularly known today as “globalization”. Foreign direct investment being one of the most predominant component of globalization is being considered alongside international trade as the major driving force of globalization and world economic growth. Foreign direct investment being the main source of international capital has also become the most easily accessible source of external capital for most developing countries, of which most African countries belong to this category. Foreign direct investment as important as it sounds given its potentialities has become a core area of concern which have captured the attention of many research experts both internationally and on the continent.According to the definition of FDI by The International Monetary Fund (IMF) in (International Financial Statistics Database and Balance of Payment Database, 2020), defines foreign direct investment as thus: “foreign direct investment is the net inflows of investment to acquire a lasting management interest (at least ten percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. It is the sum of equity capital, re-investment of earnings, other long term capital and short term capital as shown in the balance of payments. It implies the investments made by residents of one country in order to set up an enterprise in another country to obtain lasting benefits. The purpose of the investor is to have a significant influence and effective voice in the management of the foreign enterprise. The IMF defines a direct investor as maybe an individual, an incorporated or unincorporated private or public enterprise, a government, a group of related individuals or group of related incorporated or unincorporated enterprises which have a direct investment enterprise, operating in a country other than the country of residence of the direct investor. On the other hand a direct investment enterprise is an incorporated or unincorporated enterprise in which a foreign investor owns at least 10% or more of the ordinary shares or voting power of an incorporated enterprise or the equivalent of an unincorporated enterprise. Direct investment enterprises may be subsidiaries, associates or branches. According to (UNCTAD, 2005); foreign direct investment is an investment involving a long term relationship and reflecting a lasting interest and control by a firm in an enterprise resident in a foreign country. FDI is further divided into three components namely; equity capital, re-invested earnings and intra-company loans or debts transactions. Even though majority of global FDI is concentrated in the developed and transition economies, (UNCTAD 2019) reports that the flow of FDI undeniably has also risen significantly and created a generous role for under-developed economies.Amendolagine and Negash et al., (2020) defines foreign direct investment as substantially providing an important method of transfers and other forms of assets from technologically advanced countries to another country where lack of capital and technology are considered to be one of the critical constraints to economic development.The rise of many countries as a source of foreign direct investment can be traced back to the period after the second world war and during the industrialization period. Foreign direct investment development was further enhanced by the establishment of international corporations like World Trade Organization (WTO), International Monetary Fund (IMF), Organization for Economic Co-operation and Development (OECD) and the subsequent accession of many countries into these organizations have further created good conditions for the continued development of foreign direct investment with remarkable improvements being recorded over the years. The volatility of global capital has created the scenario whereby developing countries are not only faced with the need to attract foreign direct investment but also ensure the diversification of the investment sources so as to make up for the shortfalls in domestic investment and resources. Foreign direct investment is not just an inflow of capital into a direct investment enterprise, it also extends to the integration of knowledge, skills and technology, thereby conferring on it the potency to alleviate the scarcity of other economic resources. (Li et al. 2017) notes that the absorption and utilization of foreign direct investment has become a major means of promoting economic growth in many developing countries as foreign direct investment serves as an important economic tool which helps to supplement the gap between savings investment and foreign exchange. It can also increase the general quality level of human capital, improve output, transfer skills and innovation capacity, and ultimately stimulate economic growth.

2.1. The Mechanism of How Foreign Direct Investment Affect Economic Growth

Economic boost effect One of the major reasons why a country embarks on foreign direct investment is as a result of the economic growth effect that comes along with it. Higher inflow of foreign direct investment into an economy leads to increased production both in the manufacturing sector and service sector, which will in turn lead to creation of more jobs and improved employment opportunity. Increase in employment rate will subsequently to increased income among the general population and this entails increased purchasing power which ultimately boosts the entire economy.Employment and job creation effectForeign direct investment has been found to have a job creation effect and also leads to a general increase in employment rate. Among the major significant reasons why countries embark on foreign direct investment especially developing countries is because FDI has the potential to create more jobs for the population. Creation of more jobs leads to a total decrease in crime rate and unemployment, which both have negative effects on the economy. Creation of more jobs as well as increased employment rate explicates higher income for the population and subsequently increases the population’s capacity to purchase the necessary goods and service. All these leads to an improvement in the standard of living which at the end translates to economic growth and development.Human capital expansion effect When foreign direct investment occurs in a country, it also comes along with it some spill over effects, among which include a general improvement and expansion in human capital. Human capital is mainly concerned with level of knowledge and skills attained by the work force. Foreign direct investment especially in the area of high-tech often comes with sophisticated skills and expertise, hence this requires re- educating the workforce to ensure the successful execution of certain projects. Thus, multi- national companies most times organize workshops and training with the aim of improving the general knowledge and skills of its workforce, this will in turn lead to an advancement in the country’s education system and human capital. The prolonged impact is that it helps in training the host country’s human resource in the areas of trades, services, entrepreneur etc and all these will lead to a an increase in the general literacy of the population.Technology diffusion effect In today’s economy, the need for a country to possess advanced technology in the core sectors of its economy cannot be over estimated. When multinational firms move into new locations, one of the major advantages it brings to its host country is technology diffusion and transfer. Technology diffusion can take place through multiple channels and this includes importation of high-tech products, adoption of foreign technology and acquisition of human capital. The above means are all conduits for international technology diffusion. Nowadays, most developing countries view foreign direct investment by multi national companies as a major channel to access advanced technology for many core areas of its economy. MNCs are among the most technologically advanced firms across the globe given that they account for a substantial part of world’s research and development investment. Many research experts from across the globe has emphasized the critical role played by foreign direct investment in bringing about technological advancement in a country. Findlay (1978) states that foreign direct investment increases the rate of technological progress through a contagion effect from the more advanced from the more advanced country’s system of management, technology etc introduced by the foreign firms.Increased export effectForeign direct investment can sometimes induce increased exportation of certain products into a host country’s economy. This happens when foreign firms in a bid to move its goods to its target market face the problem of higher transportation costs as well as other difficulties and restrictions associated with cross border trade. This will cause them to search for means to boycott the problem of high costs and most likely force them to establish a production plant in the host country’s economy that will subsequently replicate the trading activities of the parent company in the host country. This way, multi national firms will no longer engage in exportation of goods which is bedeviled by lots of uncertainties, but can now focus on the increased exportation of raw materials and production inputs to be utilized by its production plant in the host country. The above process brings about an increased export effect which is crucial for economic growth and development.

2.2. Why Foreign Direct Investment is Crucial for Africa

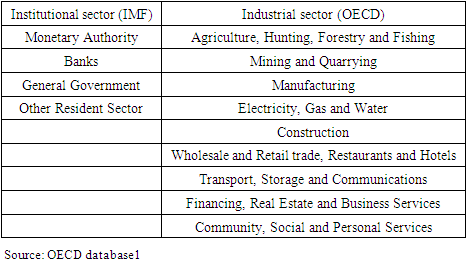

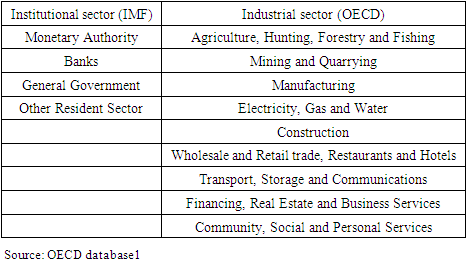

According to The International Monetary Fund (IMF)’s International Financial Statistics Database and Balance of Payment Database: foreign direct investment can be classified from three different standpoints, firstly is the direction of investment both for assets and liabilities, secondly from the standpoint of the investment instrument used in the course of administering foreign direct investment (loans, shares) and finally based on sector breakdown.Based on the standpoint of the direction of investment, foreign direct investment can be viewed from the home and host country perspectives. From the perspective of the home country, any type of project financing extended to it by the resident parent company will be calculated as direct investment from abroad. From the host country’s perspective, financing of any project kind extended by non-resident parent companies to its resident subsidiaries, associates or branches would be recorded under foreign direct investment in the country of residence of the affiliated companies. From the standpoint of the investment instruments, foreign direct investment is being split into three components namely; equity capital, re-invested earnings and other direct investment capital, and finally from the standpoint of sector breakdown, The International Monetary Fund (IMF) classified foreign direct investment flow into four institutional sector, depending on the sector which the resident party belongs. However, contrary to IMF classifications, The Organization for Economic Co-operation and Development (OECD) Benchmark definition makes an industrial classification of foreign direct investment into nine economic sectors. In its classification of foreign direct investment, it clearly states that foreign direct investment administered through resident holding company should be classified based on the industrial sector which the parent company belongs. The above rule implies that even transaction carried out by non-banking holding company would be recorded under banks, provided the parent company is a bank.Table 1. OECD industrial classification of FDI

|

| |

|

2.3. General Overview of Foreign Direct Investment Inflow into Africa (2011-2020)

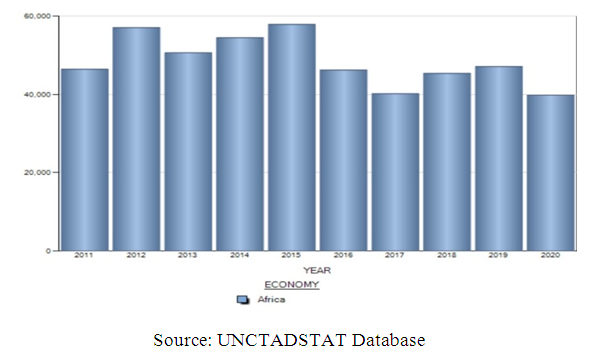

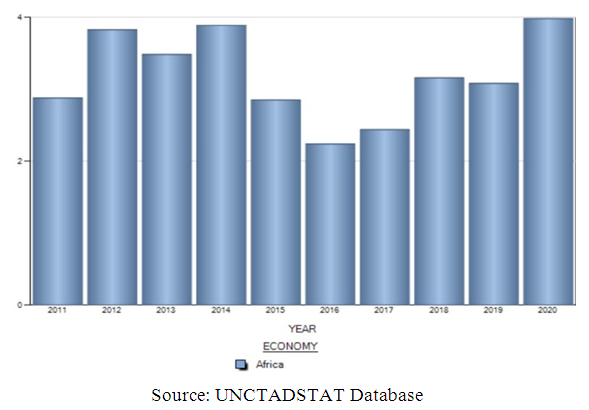

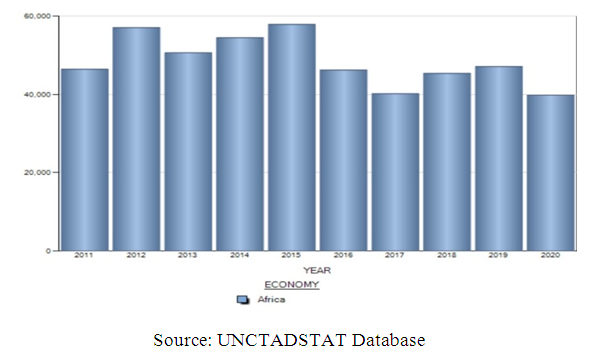

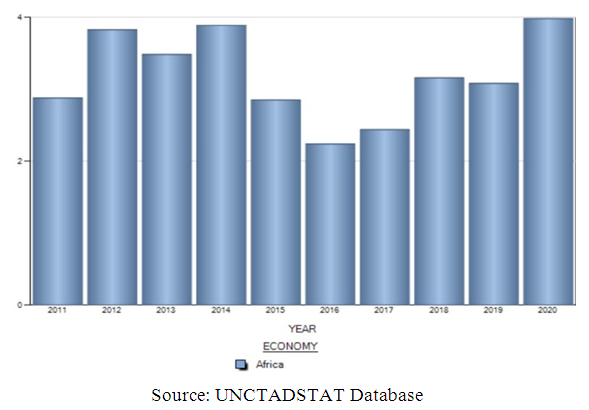

Africa’s Total Foreign Direct Investment Inflow (2011-2020) US Dollars at Current Price in Millions. | Figure 1 |

From the bar chart above, there is a clear case of fluctuation as regards foreign direct investment inflow into Africa. The period of 2011 records a total of over 62 billion dollars influx of foreign direct investment into Africa. The period between 2012-2015 witnesses a continued increment from the base year of 2011 with the highest foreign direct investment inflow being recorded in 2015, a record high of 57 billion dollars. The years from 2015-2020 records a continued decrease in foreign direct investment with the lowest investment inflow being recorded in 2020, a record low of 39 billion dollars inflow. Compared to 2014, 2015-2019 saw Africa’s foreign direct investment inflow go on a decrease until 2020. On the overall, Africa’s foreign direct investment inflow has been on the decline in the last half of the decade and issues such as the COVID-19 outbreak, as well as trade conflicts among countries could further pose a major challenge towards the road to recovery. | Figure 2. Africa’s Total Foreign Direct Investment Inflow (2011-2020) as a Percentage to World’s Total |

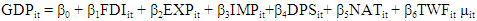

From the above bar-chart, it can be observed that Africa’s foreign direct investment inflow between 2011-2020 when ranked on the global stage merely account for less than four percent of global foreign direct investment.In 2011, Africa only accounted for 2.8percent of world investment. The period 2012-2014 recorded a slight continuous increase in foreign direct investment inflow, followed by a three year consecutive decrease between 2015-2017 with the lowest low coming in 2016 when Africa’s total foreign direct investment inflow only represented 2.2percent of world investment. This is followed by a consecutive three year increase with the highest high being recorded in 2020, a figure of 3.9 percent, nearly four percent of global investment.From the above data reviewed, it is fair to say that even though Africa’s foreign direct investment in relation to global percentage increased by 2020 (this is partly because there is a sharp fall in world investment brought about by the pandemic, global conflicts to mention a few), Africa still represent a very insignificant percentage of global investment.

2.4. Motives/Determinants of Foreign Direct Investment Inflow into Africa Based on Existing Literature

There has been a continued influx of foreign direct investment into Africa in the last two decades. However, behind these direct investments are motives and reasons which play an important role in determining the size, length and subsequent outcome of the investments. The discussions under this sub-topic is focused on the different categories of foreign direct investment coming into Africa and these are categorized based on the investing country’s motives and objectives while at the same time reviewing various literature from previous studies. For this reason the foreign direct investment is classified into two categories, namely: motives related to market-seeking view of foreign direct investment and motives related to input-seeking view of foreign direct investment. Motives Related to Market-seeking View of Foreign Direct Investment Host Country’s Marketability and Absolute Market SizeThe level of marketability, mobility of labor as well as the size of the host country’s market all play an important role in determining whether or not the investing country will go on to administer foreign direct investment. (Lim, 1983; Chang Shu-Chen, 2006) in their research works all noted that there is a positive linkage between market-seeking foreign direct investment and growth in demand. This suggests that foreign direct investment present more opportunities for making profit and are more likely to be favorable in rapidly growing economies than in economies that are growing at a slow pace. In their empirical research study, they confirmed that there is a positive co-relation between foreign direct investment inflow and economic growth as economic growth appears among host country’s variables that account for increased foreign direct investment inflow in both under-developed and fast developing countries as this signals favorable economic conditions in the future. Since host country’s rate of economic growth is a big determinant of foreign direct investment inflow especially in Africa, foreign direct investment has proven to be more attracted to countries with a steady growth rate. Studies from all over the world have shown different results with most authors attesting to the notion that there is a positive connection between foreign direct investment inflow and market size. Studies in Europe which includes (Orlic and Kersan-skabic, 2007; Fountas and Aristotelous, 1996; Janicki, 2004) showed a strong proof that increased inflow of the United States and Japanese foreign direct investment into countries belonging to the European union is strongly associated with the large market size in these countries due to the existence of a barrier free European market. Also from the empirical research results obtained from Central Europe, Eastern Europe and the Western Balkan countries, it was discovered that foreign direct investment are mainly attracted to destinations where the host country posses an appreciable market size. Among the findings of their research is the fact that market size was found to be one of the key factors that determine the foreign direct inflow into eight East and Central European countries yet to be admitted into the European Union.High Volume of Exports from Foreign Direct Investment Source CountryForeign direct investment may also arise as a result of the need for internationalization of production by countries so as to alleviate trade barriers, trade uncertainties, reduce cost of transportation, hence siting their subsidiary firms or branches in other countries so as to replicate goods produced in the parent firm country in the subsidiary’s country to reach a target market. Through this process, foreign direct investment is administered and as a result export flows between two countries is recorded as well, therefore foreign direct investment becomes a viable means of substituting export of goods and services especially where subsidiaries and branches are involved in the same line of industry and production as the parent firm. When foreign direct investment is administered through this means it termed as horizontal foreign direct investment and in this situation, export of goods and services are regarded as a core determinant for horizontal foreign direct investment. Market oriented firms can also extend their business activities to foreign locations for wider markets and also to service downstream product flow, this is termed downstream vertical foreign direct investment as it ensures wider sale of good quality products to customers thereby gaining customer’s loyalty. Motives Related to Input-seeking View of Foreign Direct InvestmentHigh Volumes of Intra-firms ImportsSince trade arises as a result of the need to exchange good and services that are in relative abundant supply in certain localities and in short supply in another, and given the fact that both foreign direct investment and bilateral trade in most cases are complementary, it is therefore safe to establish the notion that comparative advantages across countries of the world is also the embedding theory that necessitates foreign direct investment. When firms strive to secure upstream supply of production inputs as well as improvement on already produced outputs, value adding services, they are said to be engaging in vertical foreign direct investment. The main priority that motivates firms to engage in such activities is to reduce risks associated with market imperfections and irregularities such as problem of poor quality product and customer loyalty. In a situation where there is need to engage in importation of raw materials from another country which have comparative advantage over the actual production point, then there is need to implement upstream vertical foreign direct investment so as to mitigate the cost of procurement and transportation associated with such raw material input. Natural Resources Endowment(Asiedu, 2006; Anyanwu, 2012) noted that the hunt for natural resources and other forms of economic exploitation are the main motives behind the inflow and subsequent choice of location of foreign direct investment in Africa. The continued growth of European economy and the rapid growth of many Asian economies has given rise to government policies channeled towards foreign direct investment targeted towards securing natural resources so as to make up for domestic shortfalls. Africa compared to their European and Asian counterparts are still relatively less developed, and is being viewed by many developed and fast developing Asian nations as the perfect prey in its hunt for natural resources. Earlier research studies in this area pointed out that resources such as agricultural products, petroleum, minerals, fishery and timber are among the key resources being sort after by most foreign direct investment coming into Africa. Numerous empirical research have also proven that natural resources play a determinant role in attracting foreign direct investment. Studies on China’s foreign direct investment inflow into Africa (Buckley, 2007; Liu Hong and Wang Duan, 2010) all pointed out the resource seeking motive as a core determinant factor of Chinese foreign direct investment inflow into Africa. Their research noted that China’s outward foreign direct investment is based on a traditional trend which pursues economic growth solely from the stand point of increasing its natural resource input.

3. Research Methodology

3.1. Data and Data Description

The empirical research carried out in this section is based on panel data analysis. The basic data used for the course of this research is a set of panel data from 8 host African countries selected from the continent’s four major geographical regions between 2011-2020 to empirically analyze the effects of foreign direct investment on Africa’s economic growth. The variables considered were the GDP of the selected African countries, net import and export of goods and services as well foreign direct investment net inflow and the data were obtained from world bank data (world development indicators). To make for a better appreciation of the research results and ensure accuracy of the data analysis process, this paper deploys the use of Fixed-Effect method (FE), the Random Effect method (RE) method and the Hausman’s test to select between the two methods, also we made use of the Generalized Least Squares (GLS) method as well as the Generalized Method of Moment (GMM) techniques. The FE, RE, GLS all belong to the static panel approach while the GMM estimation belongs to the dynamic panel approach. All the data analysis process done in the course of this research were carried out using the STATA application.

3.2. Data Analysis Method

The Fixed Effect (FE) method is a static panel data approach that explores the relationship between predictor and outcome variables within an entity (country). Each unit has its own individual characteristics that may or may not influence the predictor variables. When using the FE we assume that something within the individual may affect or bias the predictor or outcome variable and we need to control for this. This is the idea behind the issue of correlation between entity’s error term and predictor variables. The FE removes the effect of those time invariant characteristics from the predictor variable so we can access its net effect. Also the uniqueness of those time invariant characteristic is assumed for the individual and should not be correlated with other individuals within the entity. Therefore the entity’s error term shouldn’t be correlated with the constant as the constant captures individual characteristics. If error terms are correlated, inferences would also be affected and this renders FE unsuitable thereby raising a need for choice for a more suitable method (which could be the RE).The Random Effect (RE) method is a static panel data approach which works on the assumption that the variations across entities is random and that the error term is not correlated with the predictor variable in the model which makes room for time-invariant variables to serve as explanatory variables. Those individual variables which may or may not influence the predictor variables therefore needs to be specified in a case of RE.Hausman’s Test is a generally acceptable way of choosing between the Fixed Effect and the Random Effect. It checks a more efficient model (RE) against a less efficient but consistent model (FE), thereby producing the best possible result that ensures that the more efficient model also gives consistent result. It tests the null hypothesis on the ground that the coefficients produced by the efficient Random Effect estimator is the same as the ones produced by the consistent Fixed Effect estimator. If it produces an insignificant P-value we will prefer the Random Effect, but if otherwise we will prefer the Fixed Effect method.The Generalized Least Squares (GLS) technique is a static panel technique that estimates the unknown parameter in a linear regression model. It is mostly applied in a situation of heteroskedasticity (when the variances of the observations are unequal) or when there is a certain degree of correlation in the observations. In the above cases, using the Ordinary Least Square (OLS) becomes inefficient since it no longer follows the rules of Gaussian distribution (homoskedasticity) and can lead to misleading results.The Generalized Method of Moment (GMM) is a dynamic panel data approach that was first developed by Holtz Eakin (1988), Arellano and Bover (1995), and Blundell and Bond (1997). The generalized method of moments addresses the issue of endogeneity of predictor variables and allows for the use of lagged dependent variable as a predictor, at the same time also accounts for unobserved country specific effects. This study employs a one-step generalized method of moments for this purpose.

3.3. Research Hypothesis

HO = Foreign direct investment has a positive effect on Africa’s economic growth.H1 = Foreign direct investment has a negative effect on Africa’s economic growth.

3.4. Empirical Model Specification

The linear equation model we developed below presents the variables to be used in the model in their logarithmic form below: | (1) |

All variables in the equation below are in their natural logarithm. Dependent variable: GDP= gross domestic product output (yearly amount) of host African countries.Independent variables: FDI= foreign direct investment net inflows into host African countries (yearly amount), EXP = net exports from host African countries (yearly amount), IMP= net import into host African countries (yearly amount), DPS= degree of political stability, NAT= natural resource endowment, TWF= total work force.µit = the general disturbance term (µit =ŋi +Vt + Ɛit) where ŋi represents unobservable country specific effects, Vt represents time specific effects, and Ɛit the error term; i = host African countries, t=time (years between 2011-2020).

4. Results and Discussions

4.1. Descriptive Statistics: Country Coverage for Equation 1

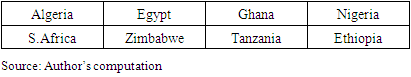

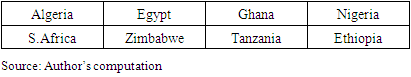

A panel of 8 African countries constituting of two countries each from the four major geographical regions of Africa were selected to serve as the sample size. Table 2. Below represents the country coverage for equation 1. Table 2. Country coverage for Equation 1

|

| |

|

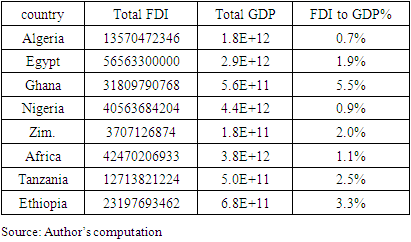

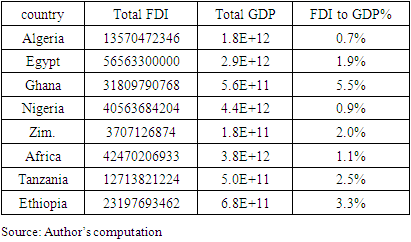

Table 3. FDI AND GDP breakdown of sample size 2011-2020

|

| |

|

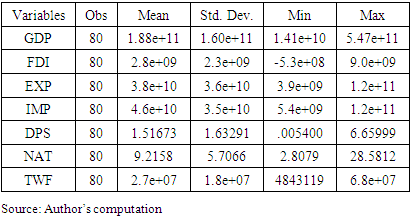

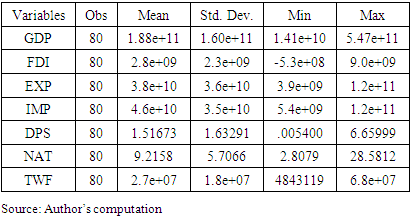

The above table 3. presents a breakdown of the general situation of foreign direct investment and gross domestic product of the countries that make up the sample size. The above data shows that FDI form almost 1% and above of the selected country’s GDP. Two countries were selected from each geographical regions based on their recent trends in economic growth and FDI inflow, hence this serves as a strong justification to use them as part of the sample size and make inferences based on the results obtained. Table 4. Summary Statistics for Equation 1

|

| |

|

Table 3. above represents the summary statistics of the variables in our model. The mean GDP value between the period of 2011-2020 stood at USD 188 billion and the standard deviation is USD 160 billion, Zimbabwe accounted for the minimum value in 2011 with USD 14.1 billion while Nigeria in 2014 represented the maximum with USD 547 billion. The mean FDI inflow into the selected African countries was USD 2.8 billion while the standard deviation stood at USD 2.3 billion, Algeria in 2015 represented the minimum FDI inflow with USD -538 million while Egypt in 2019 had the maximum with USD 9.01 billion. The export mean and standard deviation both stood at USD 38.8 billion and USD 36.3 billion respectively, Zimbabwe in 2015 represented the minimum with USD 3.96 billion while South Africa had the maximum with USD 127 billion. The mean and standard deviation for the imports were USD 46.3 billion and USD35.5 billion respectively, Zimbabwe in 2019 had the minimum with USD 5.4 billion and South Africa had the maximum import with USD 124 billion in 2012 while the total number of observation is 80. the mean value for the degree of political stability and natural resources stood at 1.5% and 9.21% respectively while the maximum total work force was 686 thousand people.

4.2. Correlation Matrix for Equation 1

The correlation matrix is a statistical analysis that shows the correlation between the variables in the model. For the purpose of this research we made use of the pairwise correlation. The variables in consideration are the gross domestic product of the selected countries, the foreign direct investment inflows into theses countries, the export from these countries and import of goods and services into these countries, all data for the variables in consideration are on yearly basis.From the correlation matrix shown in table 4. above, we can observe a positive correlation between foreign direct investment inflow and the gross domestic product of the selected African countries represented by a co-efficient of 0.5. Also a positive relationship is observed between foreign direct investment and export of goods and services, import of goods and services into African countries represented by a co-efficient of 0.5 and 0.5 respectively. There were also some cases of negative correlations observed between foreign direct investment and degree of political stability, natural resource endowment.Table 5. Correlation matrix of Equation 1

|

| |

|

4.3. Empirical Results and Interpretations

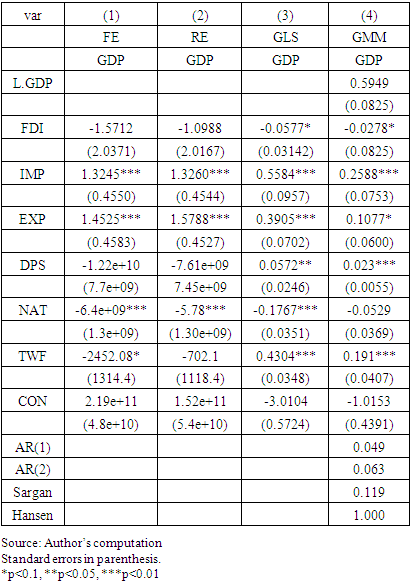

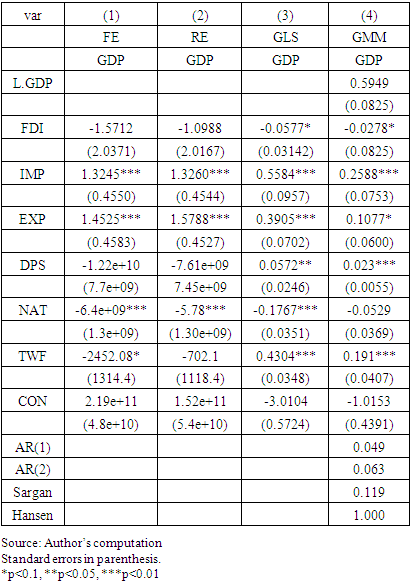

This part presents the FE, RE, GLS and GMM estimates on the effect of FDI on Africa’s economic growth.Table 6. Estimated Outcomes for Equation 1

|

| |

|

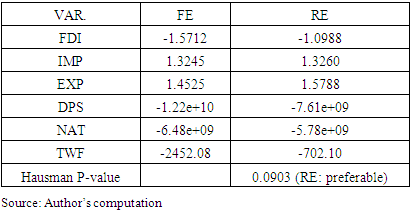

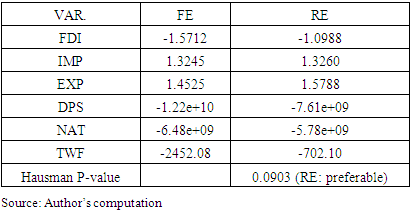

Table 7. Hausman test results

|

| |

|

In table 7. above, the Hausman test produces a P-value which is greater than 0.05, hence we accept the null hypothesis that RE is preferable over FE. In table 6. above, results gotten from the fixed effects provide statistically significant results except for FDI and DPS whose results were statistically insignificant. On the other hand, the random effects provide quite a similar result with the exception of the fact that the total work force turned insignificant.The Hausman’s test result accepted the null hypothesis and confirmed random effect (RE) model as more preferable to the fixed effect (FE) model given the co-efficient of (0.0903) which is more than 0.05.The GLS estimates provided much more better estimates as we observed that FDI which is our main variable of interest provided statistically significant result but with a negative coefficient. Also all the other variables in the GLS estimation were all statically significant. The one-step system GMM is a more preferable method of analysis given that it is dynamic in nature, takes into account the effect caused by the previous period value and also deploys the lagged dependent variable as an explanatory variable, thus it presents much more superior results. This leads us to the choice of GMM method for results interpretation given the superiority in quality of outcome in the GMM method.Even though there were some differences in statistical coefficients obtained from the four estimation technique, we observe a noticeable pattern in the results shown by the static panel approach where import, export and natural resource endowment all showed significant results while FDI which happens to be the main variable of interest only showed statistically significant result in the GLS and GMM techniques.Basing our findings on results obtained from the GMM estimates, ceteris paribus, foreign direct investment has a negative effect on Africa’s economic growth, exports from host African countries, imports into host African countries, degree of political stability and total work force all have a positive effects on the economic growth of African countries while natural resource endowment was found to be statistically insignificant.Our GMM technique shows that at 10% significance level, one unit increase of FDI into African countries will drive -0.0278 unit decrease of African countries GDP. On the other hand, at 1% significance level, a unit increase in import will lead to 0.2588 unit increase in GDP of African countries. At 10% significance level, a unit increase in export will lead to 0.1077 unit increase in the GDP of African countries. Lastly, at 1% significance level, a unit increase in degree of political stability and total work force will drive 0.023 and 0.191 increase respectively in Africa’s gross domestic product. The negative co-efficient obtained from foreign direct investment shows that foreign direct investment inflow into Africa exerts a negative effect on Africa’s economic growth. This finding is supported by Alfaro (2010), which states that there has been sufficient studies to prove that foreign direct investment will not always result in economic growth, he used the data of five developing countries to prove the above view through statistical and empirical research.

4.4. Conclusions

Africa’s foreign direct investment inflow has experienced a continuous decrease over the last half of the decade. Although Africa is among the areas with the widest foreign direct investment coverage on the global scale, however the distribution among African countries remain unbalanced. This can be attributed to the fact that most foreign direct investment inflow into Africa are mostly input seeking as well as resource seeking in nature and does not attach much attention to the economic growth and well being of the host African countries.This research analyzed the effect of foreign direct investment on Africa’s economic growth. It proceeds firstly, by giving a general understanding of what foreign direct investment is all about, the mechanism of how foreign direct investment affects economic growth and an overview of the current situation of foreign direct investment in Africa. This represents the theoretical aspect of the research before embarking on the empirical analysis. We used a panel data of African countries selected from the four major geographical regions in the continent over the period of 2011-2020. The results shows that export of goods and services from Africa and import of goods and services into Africa, degree of political stability and total workforce all have positively effects on Africa’s economic growth over the period of 2011-2020. On the opposite end, foreign direct investment which is the study’s main variable of interest has had a negative effect on Africa’s economic growth and this highlights the fact that Africa’s economic growth has been driven by other factors other than foreign direct investment between 2011-2020. The failure of foreign direct investment to affect economic growth can be attributed to the fact that most FDI inflows into Africa are mostly to provide for the shortfall of resources in investing country’s own economy with little emphasis on host African country’s economy, other arguments on the opposite side could be problem of poor utilization and management of FDI inflows by host country to yield the required economic growth purpose. The findings from the research proves that foreign direct investment has had a negative effect on Africa’s economic growth from 2011-2020 and that the continent’s economic growth has been driven by other economic factors other than FDI, thereby validating the alternative hypothesis that FDI has a significant negative effect on Africa’s economic growth.

4.5. Recommendations

In view of the above findings obtained in the course of the analysis, the study recommends:1. Re- Appraisal of old already existing investmentsThe results from the study shows the failure of FDI to drive economic growth in Africa. There is the existence of old investments that are counterproductive to economic growth, hence there is need for re-appraisal of these investments, so as to phase out the unproductive ones.2. Thorough Vetting of New Foreign Direct Investment inflows into AfricaInvestments with questionable credentials should not be approved, this is to avoid flooding the African economy with resource-seeking and input-seeking foreign direct investment packages which most times end up being counter-productive.3. Setting up a proper foreign direct Investment management system to ensure accountabilityThis will go a long way to arresting the problem of poor management as sometimes certain investments fail not because they are bad in itself but because there are no proper management systems to ensure accountability. Making efforts to set up proper management system will go a long way to increase the chances of success of foreign direct investment in Africa.4. There is need to ensure balanced distribution of foreign direct investments on the African continentFrom the empirical analysis carried out, research found out that certain African countries receive appreciable amount of foreign direct investment inflow while others receive little or next to nothing. Even though the rationale behind foreign direct investment flow makes it that it is mostly attracted to areas with favorable economic conditions, however unbalanced distribution will only make the African economy to be an individual success and at the same time a collective failure.

References

| [1] | I.D. Anic and Jovancevic, Foreign direct investment in the trade sector in Croatia,Faculty of economics and business, Maribor, review papers 1:2, 59-67, 2004. |

| [2] | J.C. Anyanwu, Why does foreign direct investment go where it goes? New evidence from African countries. Annals of economics and finance 13:2, 433-470, 2012. |

| [3] | P. Aroca and W.F. Maloney, Migration, trade, and foreign direct investment in Mexico, The world bank economic review, 19:3, 449-472, 2011. |

| [4] | P. Asheghian, The determinants of economic growth in The United States: The role of foreign direct investment, The international trade journal, 18:1, 63-83, 2004. |

| [5] | E. Asiedu, Foreign Direct Investment in Africa: The Role of Natural Resources. In Market Size, Government Policy, Institutions and Political Instability. The World, 2005. |

| [6] | E. Asiedu, The determinants of employment of affiliates of US multinational enterprise in Africa. Development policy review, 22:4, 371-379, 2004. |

| [7] | E. Asiedu, Foreign direct investment in Africa: The role of natural resources, market size, government policy, institutions and political instability. United Nations University, 63-77, 2006. |

| [8] | Q.A. Benassey, A.D Coupet and T. Mayer, Institutional determinants of total foreign direct investment. The world economy, 764-782, 2007. |

| [9] | M. Busse, Foreign direct investment, regulations and growth, the world economy, 861-886, 2008. |

| [10] | N.F. Campos, and Y. Kinoshita, Foreign direct investment as technology transferred, some panel evidence from the transition economics. The Manchester School, 70:3, 398-419, 2002. |

| [11] | S. C. Chang, The dynamic interactions among foreign direct investment. economic growth, exports and unemployment: evidence from Taiwan Econ Change 38:235-256. 2006. |

| [12] | E.N. Chen, and Wang, China’s outward foreign direct investment: An empirical test based on international panel data (2007-2009), journal of business economics, 8:238, 43-50. 2011. |

| [13] | S. Crotti, T. Cavoli and J.K. Wilson, The impact of trade and investment agreements on Australia’s inward foreign direct investment flows. Australian economic papers, 259-275. 2010. |

| [14] | Herzer and Dierk, ‘The long-run effect of outward FDI on domestic output in developing countries’ Applied Economics Letters 18, no. 14: 1355-1358. 2011. |

| [15] | H.P. Janicki and P.V. Wunnava Determinants of foreign direct investment: empirical evidence from EU accession candidates. Applied Economics, 36, 505-509. 2004. |

| [16] | R. Kaplinsky and M. Morris, Chinese FDI in Sub-Saharan Africa: Engaging with Large Dragons. To be published in European Journal of Development Research Special Issue, 24:1. 2009. |

| [17] | S. Kimino and D.S. Saal Macro determinants of foreign direct investment in Japan: An analysis of source country’s characteristics, The world Economy, 446-469, 2007. |

| [18] | Liu Hong, Wang and Duan-Yong. China’s Outward FDI of 2008 and 2009. The Status Quo and Characteristics. International Economics and trade research, 26:12, 63-68, 2010. |

| [19] | M.T. Majeed and E. Ahmad An analysis of Host Country Characteristics that determine FDI in developing countries: Recent Panel Data Evidence. The Lahore Journal of Economics, 14-2, 71-96, 2009. |

| [20] | W.F. Naude, and Krugell, Investigating geography and institutions as determinants of foreign direct investment in Africa using panel data, Applied Economics, 39, 1223-1233, 2007. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML