-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2023; 13(2): 52-59

doi:10.5923/j.economics.20231302.02

Received: Mar. 2, 2023; Accepted: Mar. 15, 2023; Published: Mar. 21, 2023

Impact of Foreign Direct Investment on Economic Growth in Somalia: VAR Model Analysis

Dahir Mohamed Ali

Department of Economics, Management, Accounting and Statistics, Somali National University, Mogadishu, Somalia

Correspondence to: Dahir Mohamed Ali, Department of Economics, Management, Accounting and Statistics, Somali National University, Mogadishu, Somalia.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

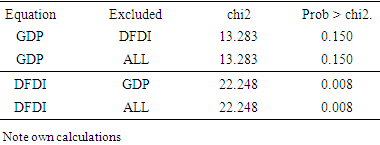

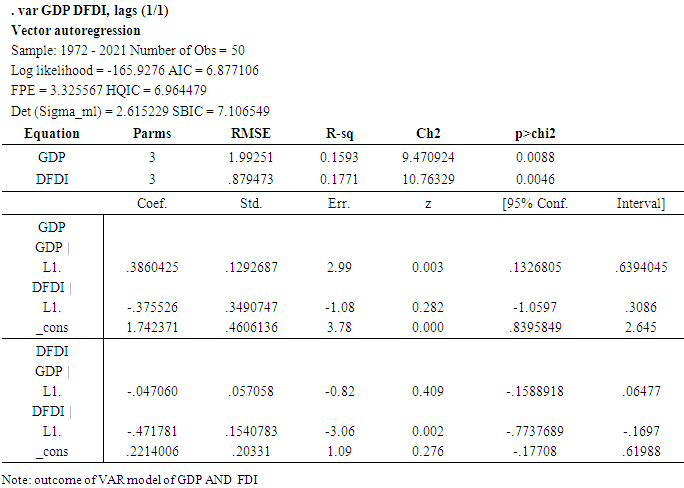

This paper investigates the impact of foreign direct investment on economic growth in Somalia: VAR model analysis with Granger causality Wald tests and lag criteria, stability of the VAR and impulse response function, and the augmented dickey Fuller (ADF) test. The Phillips-Perron test for unit root revealed that the series was of a different order, differing at the level and first differing to check stationarity Data sources: World Bank Data, 1970-2021. The result of the VAR analysis revealed that DFDI hurts GDP and is insignificant at the 5% level. The GDP value itself is noteworthy if we look at the GDP constant value at lag 1. But if we examine FDI, we can find that GDP hurts it, and it is significant at level 0.005. The outcome from Granger causality Wald tests is that GDP is the dependent variable and FDI is independent because the p-value is greater than 0.05, indicating that we cannot reject the null hypothesis and that FDI does not Granger cos GDP, indicating that FDI does not cause GDP in the short run. In the second case, the probability value is 0.008, indicating that we can reject the null hypothesis and accept the alternative hypothesis. The results support the unit-oriented relationship between GDP and FDI. Continuing the test to check for exceptional cases, we find that GDP and FDI are bidirectionally related only at lag 9.

Keywords: Foreign direct investment, GDP, Vector autoregressive, Granger causality, Somali economy

Cite this paper: Dahir Mohamed Ali, Impact of Foreign Direct Investment on Economic Growth in Somalia: VAR Model Analysis, American Journal of Economics, Vol. 13 No. 2, 2023, pp. 52-59. doi: 10.5923/j.economics.20231302.02.

Article Outline

1. Introduction

- The globalization of capital, especially foreign direct investment (FDI), has increased dramatically over the past two decades. FDI is the largest and most stable component of capital flows in developing countries. As a result, FDI has turned out to be an important alternative in the development financing process. FDI plays a key role in facilitating growth and economic transitions in developing countries and has seen massive inflows over the past three decades. Moreover, FDI is the largest source of external funding for developing countries. The effect of FDI on economic progress has been an interesting topic for decades. FDI has played an important in the then economy. Policymakers believe That foreign direct investment boosts productivity in host countries and boosts development (Finance and Vulnerability, 2005). The issue of economic development in Sub-Saharan Africa (SSA) countries remains a major challenge not only for the governments of these countries but also for international organizations. The latter has already set up economic and social programs with developing countries, especially those in the SSA region, which is considered one of the poorest countries in the world. Unfortunately, most of SSA's economic and social programs appear to be ineffective for economic and social development. Among most economic and social programs, foreign aid is of great interest not only to donors but also to recipient countries. The efficiency of foreign aid on economic progress has been widely debated in the literature, but how it can be improved remains the most important question (Ndambendia & Njoupouognigni, 2010). Besides the world economic and health crises brought on by the COVID-19 epidemic, foreign direct investment inflows to Somalia increased to USD 464 million in 2020 from USD 447 million in 2019. The foreign direct investment stock amounted to USD 3.6 billion in 2020. In 2021, worldwide FDI flows recovered powerfully; nonetheless, FDI flows to African nations (apart from South Africa) rose only moderately (UNCTAD’s Investment Trends Monitor). Strong unpredictability in the state remains a main source of anxiety, even though Al-Shabab's losses and its present weak location are positive indicators for investors. Mogadishu's capital is presently experiencing a construction boom, fueled mostly by Turkish investment, indicating that Somalia is improving. The parts that attract the most foreign direct investment are food processing (bananas and fish) and, more recently, the telecommunications segment. Germany and the United States are the main investors in Somalia (United National Conference on Trade and Development, 2021).

1.1. Foreign Direct Investment of Somalia

- Somalia has large areas of arable terrestrially that serially to industrial-scale agroindustry and food manufacture. The country also has a strong livestock industry, a long coastline with access to the untapped "blue economy," and countless other natural beauties. Investment in these industries will result in large commercial profits that will support the nation's efforts to attain food security and promote the health of its internal markets. Somalia's economy is consumed, determined, and financed mostly through remittances, foreign direct investment from Somalia's diaspora, and donor grants. Market inflation rose by 5.3% in 2017 and is expected to slow down in 2018. Minor oil prices and dollarization have assisted to retain inflation in patterned, but anticipated food scarcities, mainly in agricultural manufacture, may root prices to increase in the pending year (Central Bank of Somalia, 2017).In 2017, Somalia received 384 million in foreign direct investment, the majority of which came in the form of intra-company loans. The two largest investors in Somalia are the US and Germany. German-Agro Action Office, the largest subsidiary of a multinational firm in the country, is a result of a bilateral trade agreement between Somalia and Germany for the protection and promotion of investments, even if the US has invested more in the nation. Since 2012, Somalia has seen an increase in FDI inflow, largely as a result of the conclusion of the civil conflict. Greenfield investments, joint ventures, and the subsidiaries of multinational firms have received a growing amount of attention from FDI in recent years (African Development Bank, 2017). During the last decade, Turkey has emerged as one of Somalia's key partners, providing humanitarian assistance, development assistance, military training, and private investment. Turkish private sector involvement in Somalia has increased dramatically. According to Turkish Deputy Prime Minister Lutfi Ervan, Turkish companies invested US$100 million in Somalia in 2015, a significant increase from negligible investment levels in 2010 (Affairs, 2021). According to the Ministry of Planning, 2019 will remain extremely dependent on support and remittances. The official development assistance proportion in 2020 was 43%, while the remittances to gross domestic product ratio were 31%. Foreign direct investment and domestic revenue will remain low in comparison to GDP in 2020, at 9% and 34%, respectively.

2. Literature

- Theoretically, economic growth and FDI inflows have several advantages. In the following theoretical and empirical review, we concentrate on the effects of economic growth and FDI on the last one.

2.1. Theoretical Framework

- Today, considerable attention is paid to regulating factors that encourage economic growth, in addition to the great benefits that foreign direct investment flows have. There are a great number of theories that handle this matter, but three theories are fundamental: (1) The neoclassical theory, and (2) the new theory of endogenous growth.

2.1.1. The Neoclassical Theory

- The theory of growth, which was introduced by Adam Smith and probably even by his predecessors in "The Wealth of Nations," Solow followed in the footsteps of Harrod and Domar, who stated that "savings construct economic growth" in response to the growing difficulty issue. The Solow growth model emphasizes long-run economic growth. A main factor of economic growth is saving and investment. Economic policymakers are attentive to how to rise savings and investment. In the short run, advanced savings and investments rise the amount of growth of national income and products. The scarce-land case would principal to declining returns to scale in capital and labor, and the model would develop more Ricardian (Solow, 1956). The model uses metrics including gross domestic product per person, inbound foreign direct investment stock per person, gross fixed capital creation per person, an increase in the labor force, and human resources in science and technology as a proportion of the active population. before the crisis, the labor force growth rate augmented, and the real Gross Domestic Product per capita improved nearly in lockstep. Such deviations from Solow's neoclassical overgrowth model molds can designate meddling in approximation processes caused, for instance, by outside effects of around phenomena and intense variations in the examined economies experiencing widespread socioeconomic and political change (Hlavacek & Bal-Domanska, 2016). The Harrod-Domar model represents Keynesian economic growth theory, according to Harrod, 1936. In development economics, the growth rate of an economy is explained in terms of capital stock and saving behavior. It implies that an economy does not naturally experience balanced growth. Harrod’s equilibrium investigation was built on three assumptions: saving is relative to national income, and investment, the demand for saving, is comparative to the progress of state income, and finally saving equals investment, the demand for saving (Maneschi & Zamagni, 2020). Harrod and Domar independently established what turned out to be undistinguishable growth models, which we now denote as the Harrod-Domar model. Those dual economists would self-sufficiently produce a matching model was not surprising; their models were rational extensions of the similar Keynesian macroeconomic model. Constructed on Keynesian thoughts, in the 1940s, the growth model Harrod-Domar emerged and was extensively used in developing nations to observe the relationship between growth and capital desires (Thong & Hao, 2019).

2.1.2. New Theory of Endogenous Growth

- From the 1990s, numerous types of research appeared using the modern econometric approach to make time series data analysis and there is a common consensus that Foreign direct investment has a positive relationship with economic progress. Romer established endogenous growth theory, pointing out that technological conversion outcomes result from the impact of academics and entrepreneurs who respond to economic motivations (Romer, 1997) According to Barro’s endogenous growth models, he said that per-capital growth and the asset ratio tend to transfer together (Barro, 1991). To make the investigation less cluttered, Rebelo studies a model in which a social organizer maximizes the reduced sum of usefulness in an economy with an AK production function where we have expected zero population growth and zero devaluation. This complication can be answered with the similar Hamiltonian apparatus we used to solve the Ramsey/Cass-Koopmans model. With CRRA effectiveness and risk dislike, one can demonstrate that optimal conduct is needed (Rebelo, 1990). First, he suggests that the possibility of insufficient effective demand can be explained by rejecting the objectivity of money, which goes beyond nominal rigidity. Second, he connects Davidson's denial of the "gross substitution axiom" to Keynes' criticism of the liquidity preference market's position in coordinating investment and savings, as well as to the potential failure of wage and price adjustments to maintain full employment and aggregate demand. Third, I propose that human conduct is influenced by the intrinsic uncertainty implied by Davidson's notion of a nonergodic system (Fazzari, 2009). Four main conclusions Davidson spreads about the "revolutionary" features of Keynesian macroeconomic theory reverberate with me.The greatest direct, nearby determining factor of macroeconomic employment and productivity is aggregate demand There is no aim to assume, overall, that real demand will be suitable to reach full employment or possible production The demand effects on manufacturing and employment do not get up only since of nominal wages and price inflexibility. Because Keynesian macro consequences do not need nominal sticky-ness, the inspiration of aggregate demand encompasses outside short-run business cycles. Macro growth theory that summaries from Keynesian aggregate demand belongings is, at best, imperfect, and probably deeply ambiguous.According to the Izawa-Lucas model, economic growth in the long term is qualified for the build-up of human capital. education should be used. Thus, the model adopts that human capital is the only input component in the education sector (Uhlig, 2022). Prescott, on the other hand, characterized the revolution in macroeconomics as a change in approach that has altered how we carry out our scientific work. Macroeconomics used to be essentially distinct from the rest of economics proform change. Others before that the neoclassical underpinnings of the macro linkages discovered through empirical research would eventually be realized. Both positions turned out to be true. Finn Kierland and I have been fortunate to be a part of this revolution, and a significant portion of my presentation will be devoted to how we helped to advance this change (Prescott, 2006). A few recent papers argue that endogenous technology advancement has been a major factor in recent growth experiences. For instance, Coe and Helpmann (1993) demonstrate that both domestic and foreign "knowledge capital stocks"—i.e., the total amount of R&D expenditures made by a nation and by its trading partners—help to explain the rise in total factor productivity in the OECD countries. As an illustration, consider Grossman and Helpmann (1991a, ch. 4). We start with the scenario of a closed economy before moving on to the effects of global trade. Assume that a market for consumer products is competitive and that a single, homogenous product is produced using a variety of intermediate inputs. Suppose the production function is Cobb-Douglas with uniform input shares (although this last supposition may not be true). First, Grossman and Helpmann evaluated how profit-seeking investments in knowledge play a crucial role in the long-run growth process. Then, they considered the models of endogenous technological progress that have been constructed thus far and the lessons they may impart to us (Grossman & Helpmann, 1994).

2.2. Empirical Analysis

- This study confirms the result of HMA Siddique (2017) which explores the relationship between FDI and economic growth in Pakistan from 1980-2016. By using the ARDL test and Granger causality test, the results show a one-way causal relationship between Gross domestic product and FDI, physical capital, and trade. The results also demonstrate the one-way causal relationship between the labor force and physical capital and human capital. Bidirectional causality exists between physical capital, Foreign direct investment, and physical capital and human capital. According to the report, to increase FDI for economic growth, policies that improve human capabilities should be implemented. (Siddique et al., 2017). According to the prepared by Pesaran$ al (2001), this study observes the inspiration of FDI on economic growth in Algeria from 1990-2018. ARDL was established by Pesaran & al (2001), According to Cherakrak & Gaham. They conduct this study that displays that in the short and long run, FDI has a significant negative consequence on economic growth in Algeria. This shows that Algeria's economic growth has been negatively affected by FDI. The review also found that investments complete locally and imports assisted Algeria's economy to prosper (Cherakrak & Gaham, 2020). This research approves the outcome of Hlavacek & Bal-Domanska (2016). The effect of FDI on the economic growth of the Central and Eastern European nations was more observable from 2009 to 2012. The methodology functional in the first part involved a relative investigation of the tendencies in FDI and Gross domestic product and in the other growth model founded on the Endogenous Advance Model. The study implied an excessive pact of spatial variation in foreign investment influx and economic growth. Estonia, surveyed by Hungary, the Czech Republic, and Slovakia by margin reports the maximum capacity of foreign direct investment to produce the gross domestic product when recalculated to the workforce. In the second section, a growth model is created, which demonstrates the statistical significance of the relationships between economic growth, FDI, and investment growth. The rise in the gross domestic product serves as a good indicator of the expansion of foreign direct investment (Hlavacek & Bal-Domanska, 2016). Irakoze & YU (2014) Analyze the Effect of foreign direct investment on economic growth in the East Africa Community from 1970 to 2017. He used the VECM model test and discovered that FDI was statistically significant and positively correlated with economic growth in the East African Community member states (EAC). Government final consumption expenditure and trade were negatively and positively statistically insignificant, respectively, because gross capital formation and inflation were negatively and positively statistically significant while population growth and inflation were positively and negatively statistically significant (Irakoze & YU, 2020). According to the (Ali, 2023). His study explores the effect of international trade on the economic growth of Kenya by using the ARDL method with long-run and short-run coefficients, bound tests, and an error correction model. The result shows that export and exchange rates have a positive effect on economic growth. (Abala, 2014). Examines the key factors influencing both Kenya's foreign direct investment (FDI) and the country's actual Gross Domestic Product growth. Despite being a popular destination in the 1970s, Kenya has had a terrible track record in attracting FDI since the 1980s. The study's findings indicated that Foreign Direct investments are mostly market-driven and that these demand expanding GDPs, stable governments, adequate infrastructure, sizable markets, and lower levels of corruption. Insecurity and a high crime rate would be obstacles to FDI inflow. (Omar, 2018). Investigate the effect of foreign direct investment on economic growth in Somalia. This study conducted an econometrics test using Ordinary Least Squares (OLS). This finding indicates that foreign direct investment in an economy indicates a positive trend in investment, which ultimately leads to an increase in Somalia's GDP. According to the study, FDI, exports, and living standards all directly and considerably influence Somalia's economic output. While imports have a negative and considerable influence on the production of the Somalian economy.According to (Ayenew, 2022). The impact of foreign direct investment on the economic development of sub-Saharan African nations is examined in this study. The research looked at panel data from 22 sub-Saharan African countries between 1988 and 2019. The short- and long-term impacts of foreign direct investment on economic growth were examined using the PMG/ARDL model. The panel unit root and co-integration tests were employed to progress the model’s estimation. The results display that FDI has a positive and significant influence over the long run but is statistically negligible over the short run. According to the study, greater FDI encourages long-term economic growth. As a result, sub-Saharan African countries ought to concentrate on luring foreign direct investment.As reported by (Opoku et al., 2019). His previous studies on the effect of FDI on economic growth have not been informative, mainly because they were ineffective in observing the sectorial channels through which FDI grows. We re-examine the influence of FDI on economic development.

3. Methodology

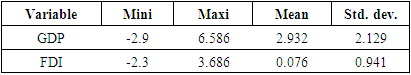

- This study investigated the impact of foreign direct investment and economic growth in Somalia. time series data was used between 1970 to 2021. Source of data on world bank data. The measurement of GDP is GDP growth (Annual percentage) while FDI is measurement of Foreign direct investment inflows annual percentage of GDP of Somalia.

|

3.1. Model Specification

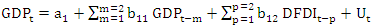

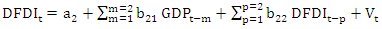

- Bivariate VAR (1) model of one lag: Variables are Gross domestic product and Foreign Direct Investment, A vector autoregressive process (VAR) with two variables and first-order dynamics as in

| (1) |

| (2) |

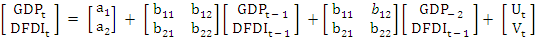

3.1.1. Matrix Representation

- Bivariate VAR (1): A vector autoregressive process (VAR) with two variables and first-order dynamics as in

| (3) |

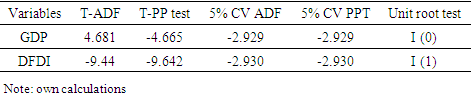

3.1.2. Augmented Dickey-Fuller Test

- The extended Dickey-Fuller and Phillips-Perron tests were used to test the steady-state properties of the series. The advantage of the PP test is that its results are robust to the general form of heteroskedasticity of the error term. An important value for ADF is provided by MacKinnon. Several tests for a unit root have been proposed, with the most popular being the Dickey-Fuller (DF) test, the augmented Dickey-Fuller (ADF) test, and the test developed by Phillips and Perron based on the Phillips (1987) Z test.’ However, with the DF and ADF tests, the presence of serial correlation will affect the distributions of the test statistics and therefore invalidate the tests (Harris, 1992). Dickey and Fuller (1981) proposed a solution that involves adding a distributed lag to the first-differenced variable being studied:On the other hand, testing data for stationarity is very important in research where the underlying variables are based on time (Mushtaq, 2011). Two common procedures for trend removal or de-trending are first differencing and time-trend regression. First-order differencing is appropriate for the I (1) time series, and time-trend regression is appropriate for the trend-stationary I (0) time series. Unit root tests can be used to determine if trending data should be first differenced or regressed on deterministic functions of time to render the data stationary (Herranz, 2017).

4. Result

|

|

|

|

|

|

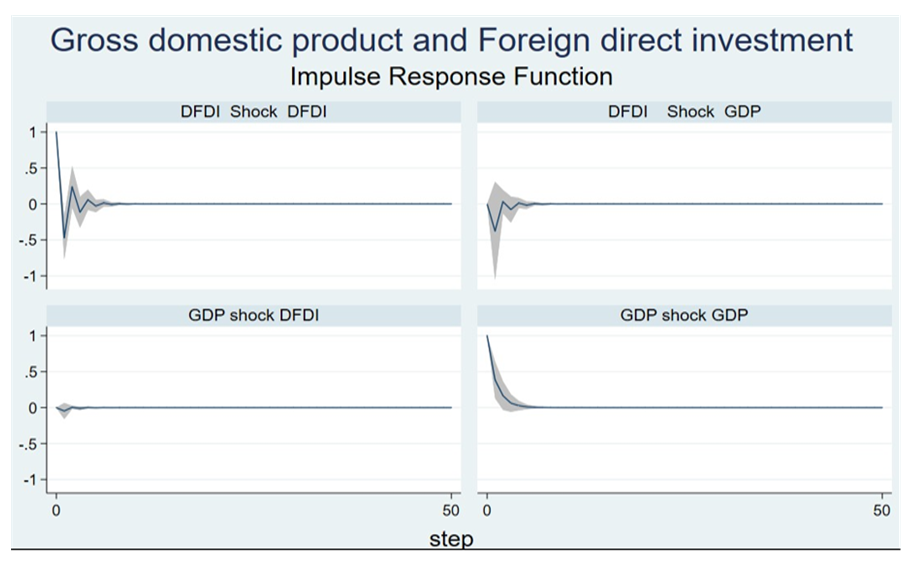

| Figure 1. Impulse Function of the VAR “GDP-DFDI” model |

5. Discussion of Findings

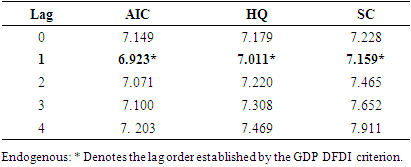

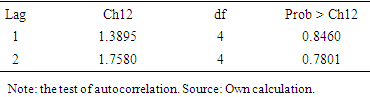

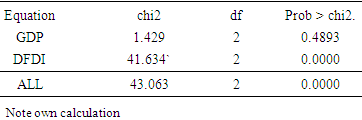

- Our 50 years analysis of the impact of foreign direct investment and economic growth in Somalia. Based on vector autoregressive (VAR) mode, and sources of data are World bank data and we use Stata of the findings. The analysis of the VAR model outcome demonstrates that the dependent variables GDP and DFDI, we can see that DFDI hurts GDP which is -0.375 and it is statistically insignificant at the 5% level. The GDP value itself is noteworthy if we look at the GDP constant value at lag 1. But, if we examine DFDI, we can find that GDP hurts it, and it is significant at level 0.002. HQ Hannan-Quinn, SC Schwarz, and the AIC Akaike information criterion are the three lag criteria that should be primarily considered. The lagged 1 order is accepted by everyone. The stability criteria are met by VAR. Given that all the eigenvalues are contained within the unit circle and the bar satisfies the stability requirements, we can infer that the VAR mode is stable and the best match for this study.Lagrange multiplies the test of autocorrelation because the probability values of the legs are 0.84 and 0.78, which are greater than the 5 percent crucial values, respectively; hence, in this case, we cannot reject the null hypothesis. the Jarque-Bera-Test null hypothesis is that the data are normally distributed, but the alternative hypothesis is that the data are not normally distributed. In the case of GDP, as the value is 0.48 and it is greater than 0.05, we cannot reject the null hypothesis that the GDP value is normally distributed. But in the case of foreign direct investment, we can see that the probability value is 0.0, which is lower than 5 percent, and the critical value of the FDI variable is not normally distributed.Because the p-value for the Granger causality Wald tests is more than 0.05 and does not allow us to reject the null hypothesis, which is that FDI does not causally influence GDP in the short term, the results suggest that GDP is the dependent variable and FDI is independent. The probability value in the second scenario is 0.008, meaning that we can accept the alternative hypothesis and reject the null hypothesis. The findings confirm that GDP and FDI have a relationship that is unit-oriented. Continuing the test to look for outliers, we see that the relationship between GDP and FDI is only two-way at lag 9. Due to the variance in GDP decomposition, the GDP reaction is the first Coolum impulse of GDP. Second, Coolum will describe how GDP shocks affect FDI. We can see that Cholesky's decomposition will result in the first period being zero. The impulse constraint in the matrix ensures that the GDP's initial response to a shock from FDI will be zero. We can predict that FDI will contribute 2.3 percent of GDP in 50 years. Finally, 98 percent of GDP variation is caused by shocks to the GDP itself. On the other hand, the DFDI variance decomposition. We can see that the first column will show how FDI reacts to shocks in GDP, and the second column will show how FDI reacts to shocks in FDI. We see that FDI mostly reacts to changes in GDP. We can see that up to 6% of variations in FDI in year 50 will be accounted for by shocks to GDP. Information about variance decomposition essentially gives us this. the difference between the dependent variable's shock variability and the variability of the shocks of the other system variables.

6. Conclusions

- This study examined the impact of foreign direct investment on economic growth in Somalia: vector autoregressive model analysis with Granger causality, lag criteria, stability of the VAR and impulse response function, and According to the results of the Phillips-Perron test for unit root and the augmented dickey Fuller (ADF), the series diverged at the level and initially differed to test stationarity. World Bank data, 1970–2021, is the source of the data. Foreign direct investment helps create a competitive situation as well as disrupt domestic monopolies. A strong competitive environment drives businesses to continuously develop their processes and product contributions, thereby developing innovation. Somalia has a competitive market, and in recent years, Somalia's security has improved, encouraging foreign direct investment to increase its investment in the country. This will also enhance economic growth and create a lot of jobs for Somali citizens.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML

07(01), 451. https://doi.org/10.35156/1433-007-001-030.

07(01), 451. https://doi.org/10.35156/1433-007-001-030.