-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2023; 13(2): 35-51

doi:10.5923/j.economics.20231302.01

Received: Dec. 25, 2022; Accepted: Jan. 20, 2023; Published: Feb. 28, 2023

Innovative Policy Approach to Environmental Resource Management Through Green Banking Activities

Md Rahimullah Miah1, 2, Md Mehedi Hasan3, Jorin Tasnim Parisha4, Md Sher-E-Alam5, Alexander Kiew Sayok2, Md Shoaibur Rahman6, Md. Amir Sharif7, Mohammad Belal Uddin8, Shahriar Hussain Chowdhury9

1Department of IT in Health, North East Medical College and Hospital, Affiliated with Sylhet Medical University, Sylhet, Bangladesh. and PhD Awardee from the IBEC, UNIMAS, Sarawak, Malaysia

2Research Fellow, IBEC, Universiti Malaysia Sarawak (UNIMAS), Kota Samarahan, Sarawak, Malaysia

3Department of Law, Green University of Bangladesh, Dhaka, Bangladesh

4Government Satis Chandra Girls’ High School, Sunamganj Sadar, Sunamganj, Bangladesh

5Department of Law and Justice, Metropolitan University, Sylhet, Bangladesh

6Department of Agroforestry and Environment, Hajee Mohammad Danesh Science & Technology University, Dinajpur, Bangladesh

7Department of Accounting and Information Systems, Begum Rokeya University, Rangpur, Bangladesh

8Department of Forestry and Environmental Science, Shahjalal University of Science and Technology, Bangladesh

9Department of Dermatology, North East Medical College and Hospital, Affiliated with Sylhet Medical University, Sylhet, Bangladesh

Correspondence to: Md Rahimullah Miah, Department of IT in Health, North East Medical College and Hospital, Affiliated with Sylhet Medical University, Sylhet, Bangladesh. and PhD Awardee from the IBEC, UNIMAS, Sarawak, Malaysia.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Green Banking (GB) plays a proactive role in welfare economy by taking environmental and ecological aspects into consideration as part of the quality of assets and rate of returns in the long term. Environmental investment is the core field of GB’s accomplishments. Yet the GB authorities have been continually challenged, for several years, with a very important global issue: misuse of sensor networks through online banking. The study attempts to relook at the key banking network security tools that strengthen through authorized green investment for environmental management within and around the Lawachara National Park’s survey and field experiment in Moulvibazar district of Bangladesh. The study found that amendments to GB related legislation peaked in Bangladesh between the years 2010 to 2020 but security remained low for internet banking services within the same period. The study showed the existing GB policy instrument is inadequate and sluggish for effective environmental investment; hence several GB performances are still jeopardized. The study also revealed 53% of the respondents stated network control unit was essential for green investment, online transaction, data protection and community environmental awareness. The findings pointed out that sensor networks affect customer, banking transaction, bank personnel, institution, national parks and its peripheral communities through misuse of unwanted radio frequencies from network towers and wireless servers. The processed radiation reflects off the stakeholders causing physical and psychological damage at a one to fourth ratio, and GB activities are often not satisfied. These results reflect the importance of protected sensor networks that the State Bank also provides. The findings indicated that the GB sectors are in risks from misuse of sensor networks due to lack of active sensor networks security systems. Scientific secured banking knowledge is essential in this sector effectively but such knowledge is poorly recognized. Thus, it is evident a dynamic and adaptable secured SN can be applied for technology-based GB relevant to policy integration, customer care and administration in order to foster sustainability of environmental investment which link to national policies and sustainable development goals 2030.

Keywords: Environmental Resource, Green Banking, Awareness, Policy and Security

Cite this paper: Md Rahimullah Miah, Md Mehedi Hasan, Jorin Tasnim Parisha, Md Sher-E-Alam, Alexander Kiew Sayok, Md Shoaibur Rahman, Md. Amir Sharif, Mohammad Belal Uddin, Shahriar Hussain Chowdhury, Innovative Policy Approach to Environmental Resource Management Through Green Banking Activities, American Journal of Economics, Vol. 13 No. 2, 2023, pp. 35-51. doi: 10.5923/j.economics.20231302.01.

Article Outline

1. Introduction

- Green Banking is a new idea in Banking sector to contribute environmental resource management. But these resources lose day by day due to misuse of wireless technology, obsolete policy, human interferences and climate crises (Miah et al., 2017, 2018, 2019, 2020, 2021, 2022). Banking sector is the backbone of any economic systems which ensure the development through the effective channelization of financial resources (Girish, 2015). This sector is commonly reflected as environmentally friendly and economically sustainably in terms of emissions, pollutions and degradation catastrophe. The present era of industrialization and globalization indicates a lot of comfort and luxurious life where lead to an alarming situation of huge environmental degradation integrated with all the concerned activities. Everyone exploits them but none can conserve profoundly due to lack of scientifically effective policies and instruments in Banking Sectors. There are some major challenges regarding to Green Banking Policy and Technology, such as to access environmental information without Government support, difficulty launching voluntary emission-reduction projects, stopping lending to traditional high pollution and high emission sectors, for example tannery or textile sector immediately and lack of evidence for the business case (IFC, 2012) which impact on national environmental problems. Internal environmental impact of the banking sector such as use of natural resources like energy, paper and water are relatively low and clean. Environmental impact of Banks is not tangibly related to their banking operations but with the customer’s activities. So, environmental impact of banks’ peripheral activities is huge though difficult to estimate. Additionally, environmental management in the banking business is like risk management. This augments the enterprise value and lower loss ratio as a higher quality loan portfolio result in higher incomes. For this purpose, inspiring environmentally responsible investments and prudent lending should be one of the responsibilities of the banking sector. As far, some industries which have previously become green and which are making serious attempts for growing green, should be bestowed priority to lending by the banks. According to this method of finance can be called as “Green Banking”, an attempt by the banks to make the industries grow green and in the process of restoring the natural environment. The idea of Green Banking is mutually beneficial to the Banks, industries and the environmental economy. It is not only facilitated to ensure the greening of the industries but it will also improve the asset quality of the Banks in future (NPA, 2015). Internationally, there is a growing concern about the role of banking and institutional investors for environmentally responsible and socially suitable investment projects (Earth Summit, 1992). But there is no proper framework in Bangladesh to enhance Green Banking to foster the linkage between economic development and environmental sustainability. Green banking is functioning like a normal bank, which considers all the social and environmental/ecological factors with an aim to protect the environment and conserve natural resources (Thombre, 2011). Lack of reliable information and sound assessments can cause undesirable consequences for the understanding of Green Banking, thus the need to update rules and regulations and for the development of indicators and indices which permit changes and trends to be observed and transformed over time. For these reasons, this study attempts to develop a framework related to the Green Banking (GB) with alternative policies and update applications of technologies for sustainable environmental conservation indicating the adjacent areas of Lawachara National Park in Moulvibazar district of Bangladesh.

1.1. General Context

- “Green” in green banking principally indicates banks‟ environmental accountability and environmental performances in business operation (Bai, 2011). It means eco-friendly or environment-friendly banking to stop environmental degradation to make this planet more habitable (Azam, 2012). An orthodox Bank becomes a Green Bank by directing its core operations toward the betterment of environment to perform the Green Banking Activities from the existing State and Nations for getting environmentally benefits (Lalon, 2015). A green bank is also called ethical bank, environmentally responsible bank, socially responsible bank, or a sustainable bank, and is expected to consider all the social and environmental issues (Habib, 2010; Goyal and Joshi, 2011). The concept of 'Green Banking' originates in modern banking approaches. The concept has actually been derived from ethical banking which seeks to mitigate the hazards of climate change due to global warming. Climate change has direct impact on biodiversity, agriculture, forestry, water resources and human health. Due to unusual weather pattern, rising greenhouse gas, declining air quality etc. society demands that businesses also take responsibility of safeguarding the planet. Green finance as a part of green banking can make great contribution to the transition to resource-efficient and low-carbon industries i.e., green industry and green economy in general (Naim, 2015). Green Banking refers to the initiatives taken by the Banks to encourage environment-friendly investment. Green Banking is a simple phenomenon but its magnitude is significantly global wide covering social, economic, environmental and technological aspects. Green banking is a kind of banking conducted in selected area and technique that helps in reduction of internal carbon footprint and external carbon emissions (Bahl, 2012). It is a device that considers social and ecological dynamics to protect environment and conserve natural resources not only national but also regional and global perspectives. The persons who are involved in Green Banking activities, they think protecting environment and conserving power and energy in order to ensure a safer world for the present and upcoming generations. They also think that the green banking is their special agenda to take care of environment of the earth particularly afforestation and reforestation campaign programs. Human beings live in the society to work for the harmony for building congenial social environment. Corporate Social Responsibility (CSR) activities are concerned about development and prosperity of the society. Green Banking confirms the human-beings in the society both in mentally and physically to work sustainably which can mitigate credit risk, legal risk and reputation risk.

1.2. Green Banking Policy Adoption and Perspectives

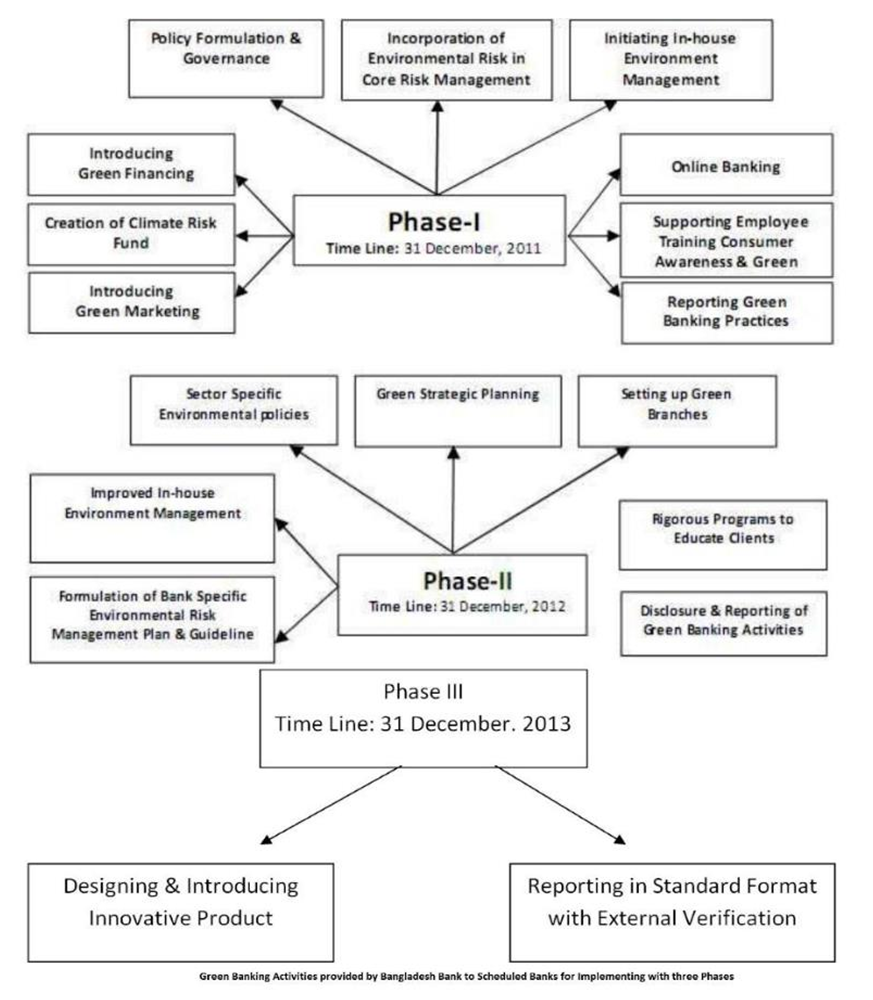

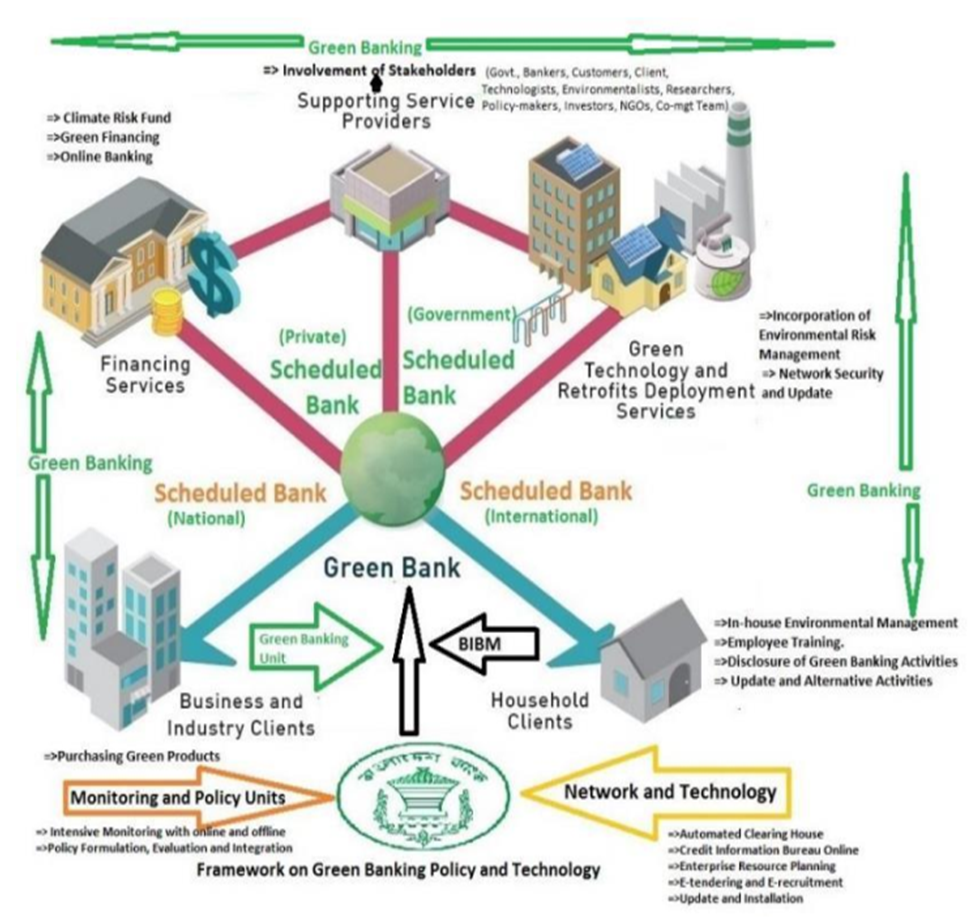

- Green Banking Policy is a formal and structured manner in line with global norms so as to protect environmental degradation and ensure sustainable Banking practices. With a view to developing Green Banking practices in the country, an indicative Green Banking Policy and Strategy framework has been developed for the Scheduled Banks which is covered through time frame work segregating into following 3 phases (BB, 2011; Lalon, 2015). There are several characteristics of Green Banking Activities to implementing by Scheduled Banks from 2011 to 2013 and continue which is shown in the Figure 1.

| Figure 1. Showing different phases of implementing Green Banking Activities provided by Bangladesh Bank to Scheduled Banks for implementing three phases (BB, 2011; Lalon, 2015) |

1.3. Environmental Degradation and Green Banking

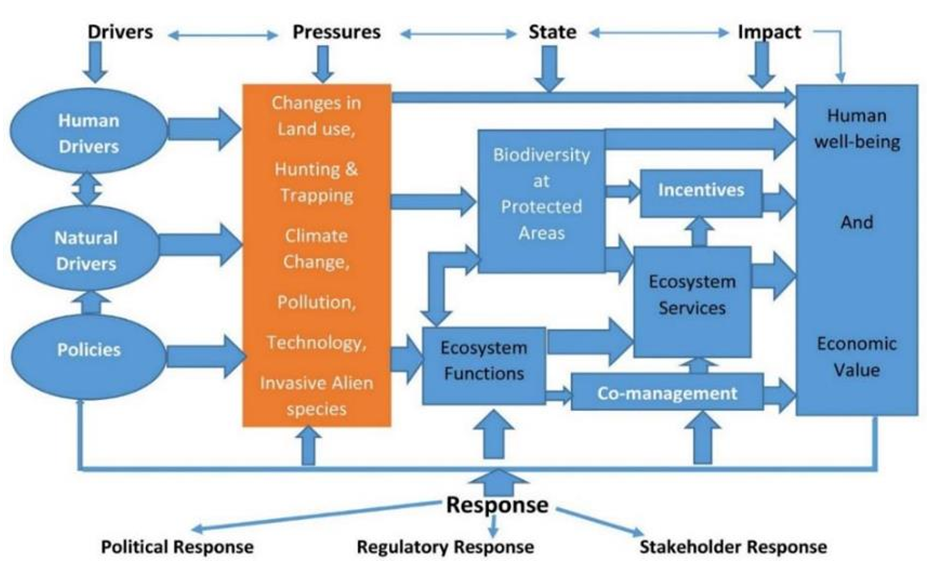

- The world is concerned and worried about environmental degradation including climate change, global warming, environmental pollution, deforestation, loss of biodiversity, land conversion, man-made fire and human interferences. The rapid changes in climate have direct impacts on biodiversity, agriculture, forestation, protected areas, land, water, air, human health and so on which are shown in the Figure 2 with DPSIR Framework including Drivers, Pressures, State and its Impact on the environment (Braat, et al., 2008). Urgent effective steps are needed to save the planet against climate change issues.

| Figure 2. DPSIR framework shown the Drivers, Pressure, State, Impact and Response to the environmental degradation with relevant parameters particularly environmental policy |

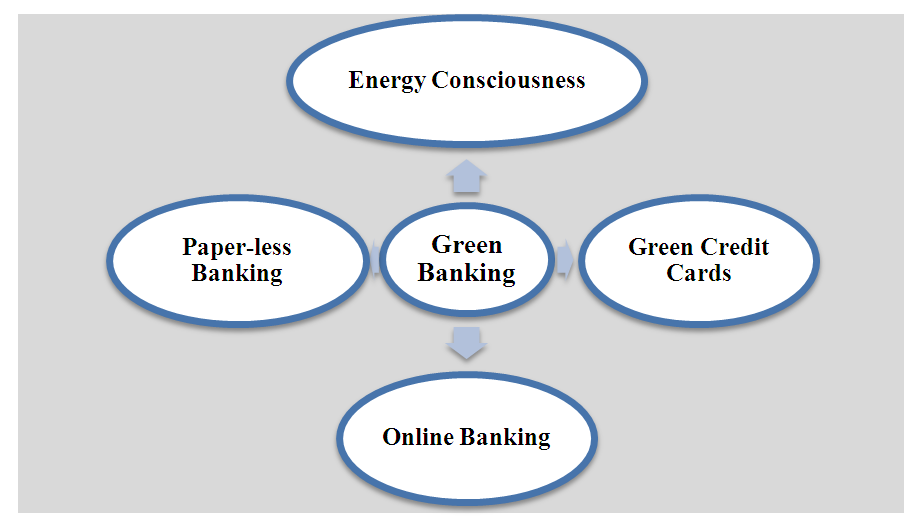

| Figure 3. Showing Green Banking Systems including Green Credit Cards, online and paperless Banking and energy consciousness |

2. Materials and Methods

2.1. Data Collection

- The survey on Green Banking systems was undertaken by Rupali Bank Limited, Moulvibazar district, Bangladesh regarding the existing policy reviews. Primary and secondary data collection was done from different Government Officials, Bank Managers, stakeholders, Customers, Clients, Technologists, Environmentalists, Researchers, policy-makers, investors, co-management team leader and NGO Officers at four villages (Lawachera Punji, Magurchera Punji, Duluchera, Langurpur) adjacent of the Lawachara National Park in Moulvibazar, Bangladesh. Data collection methods employed collected both secondary and primary including observations, semi-structured interviews, and questionnaires. Furthermore, key informants from the relevant Bank such as administrative, analyst, professionals, environmental lawyers and local customers were interviewed on the existing phenomena. The Secondary data were collected from journals, books, Bangladesh Bureau of Statistics (BBS), existing Bangladesh Bank Green Banking policies, Government institutions, Ministry of Environment and Forests, and Ministry of Commerce, Training Centre, Universities, International / National-NGOs, Stakeholders and relevant other sources.

2.2. Data Handling and Analysis

- Data obtained from the field were analyzed using standard data analysis software. In this study, deductive strategies were used to present the results through the combined interpretations made with the Supervisor and Investigator after collecting the data, organizing and classifying them in order to figure out the relationships that existed, using the relevant software, such as MS Excel, SPSS, Operating System and updated software on green Banking systems.

2.3. Data Compilation

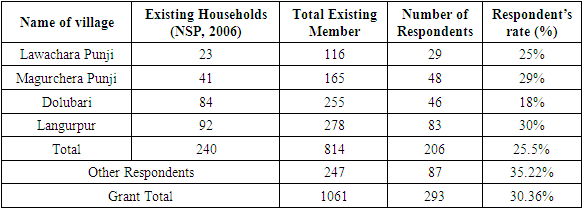

- After the data had been collected, they were checked properly for accuracy, by using the crosschecking method, i.e. checking the same information from different sources and verifying the sources of information. Information regarding the initiatives of the authority towards the Green Banking policy and technology was also collected through different relevant secondary sources. The compilation also included preparation of data master sheet and data manipulation into convenient forms used in the result and discussion section subsequently. The primary and secondary data were compiled with the MS Excel and relevant software. This method supports sustainable environmental conservation in relation to green banking data integration, data compilation, analysis and development of models related to biodiversity conservation, low-carbon investment instruments and decision-making processes. This research approach was connected with the whole research procedure including primary and secondary data collection on the priority of qualitative and quantitative data (Kothari, 2004). The research method uses raw and original data collection related to customers’ involvement towards green banking accomplishments. This research integrated its philosophy, approach, strategy, and time horizon with collected data sample size. The average sample size is 30.36% with respondents’ rate which as shown in Table 1.

|

2.4. Data Analysis and Interpretation

- The research method was associated with different parameters to enhance data collection, compilation, analysis and interpretation. Quantitative and qualitative data related to green banking were obtained through field observation, interviews, field surveys, focus group discussions, and informal discussion while secondary data were obtained from diverse sources with environmental investment assessment method. The data were compiled and analyzed for presentation and interpretation using standard data analysis software such as MS Office Suite 2021.

3. Results

3.1. Environmental Resource Instruments

- From the field observation, environmental instruments enable to promote the environmental conservation among diverse stakeholders surrounding the Lawachara National Park in Moulvibazar district. These include: (i) conservation resource awareness, (ii) attitudes, (iii) collaboration, (iv) environmental education, (v) visitor’s satisfaction, (vi) local settlement, (vii) low carbon investment, (viii) indigenous people involvement, (ix) gender participation, (x) integration of stakeholder, (xi) Green Investment, (xiii) community association, (xiv) Tourism Activities and Tourist Guiding, and (xv) media exposure. The findings of some of the Green Banking instruments are illustrated below successively.

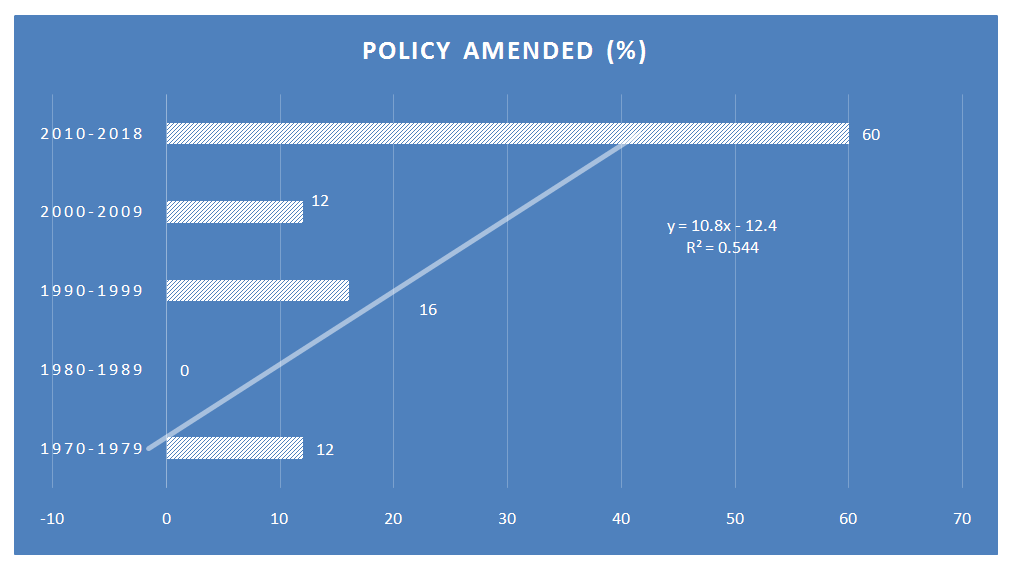

3.2. Enhancement on National legislation

- National rules and regulations lead to amend for enhancement of green banking activities for sustainable environmental conservation adjacent the National Parks in Bangladesh. Environmental conservation related national legislation produced maximum within the period of 2010-2020, as shown in Figure 4. The study found that most of legislations related to environmental management stated on Sustainable Development Goals 2030, meanwhile Convention on Biological Diversity (CBD) provided circulations to the state parties for update the national legislation in connection with Aichi Biodiversity Targets 2020. The Government of Bangladesh produced the rules and regulations except dynamic digital security within the stipulated period. The study suggested that the government takes initiatives policy integration for green banking services using secure wireless sensor networks among different banks operating surrounding the national parks in Bangladesh.

| Figure 4. Produced Number of Legislation in connection with green banking activities in Bangladesh |

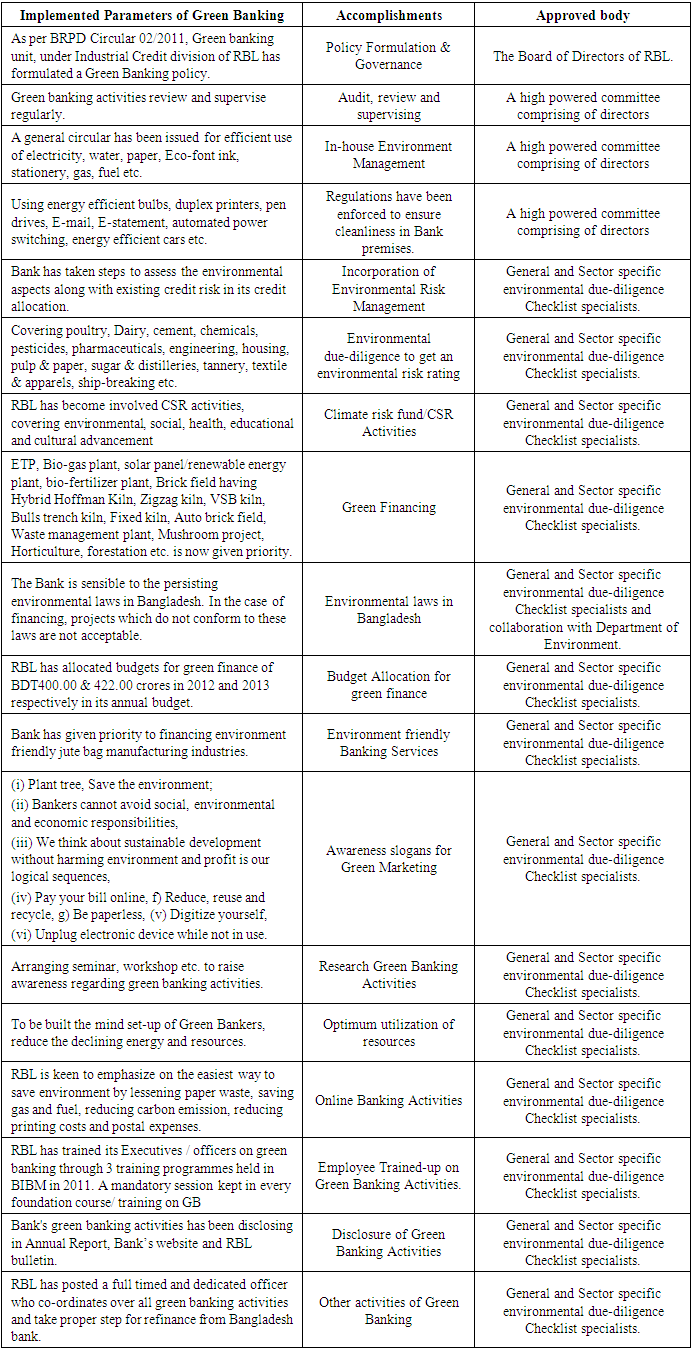

3.3. Green Banking Activities

- The study showed the different accomplishments of Green Banking to contribute for environmental resource management, which as shown in Table 2.

|

3.4. Green Banking Status

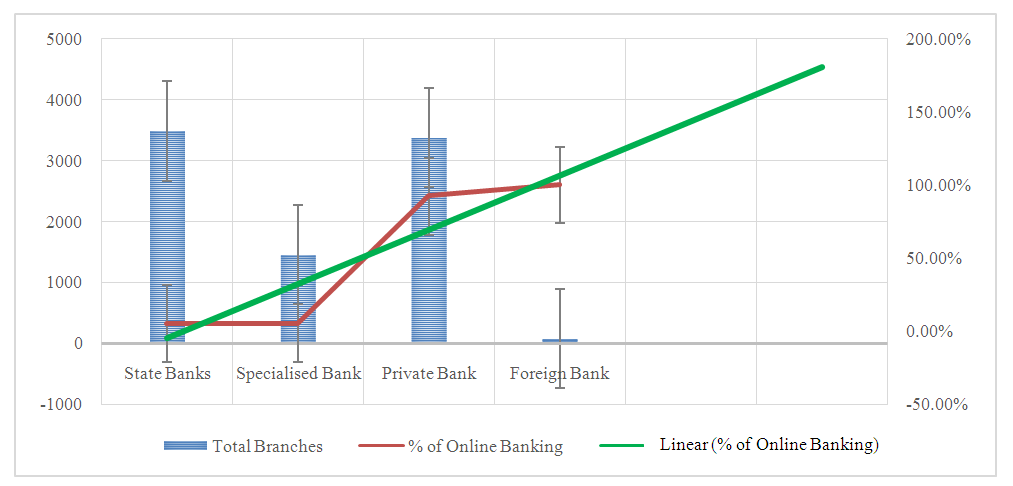

- In Bangladesh, there are four types of Green Banking services, which are State Green Banking Services, Specialized Green Banking Services, Private Green Banking Services and Foreign Green Banking Services. From figure 5, the graph showed that the rate of online services of State Bank is 5.08%, where Private and Foreign Banks are above 90% online services. The study also compares with Specialized Bank and State Bank for Online Banking Services.

| Figure 5. Green Banking Status Services among State Bank, Specialized Bank, Private Bank and Foreign Bank |

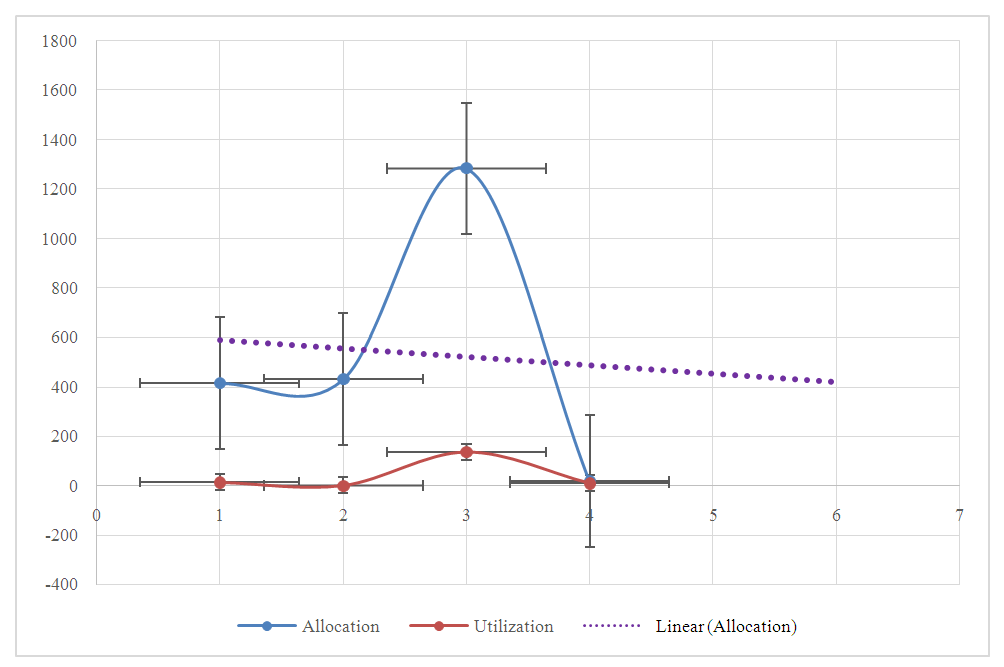

3.5. Status of Climate Risk Fund

- Climate Risk fund indicates on the fund for allocation and utilization of various banking services, such as: State Owned Commercial Banks, Specialized Commercial Banks, Private Commercial Banks and Foreign Commercial Bank. The grand total climate risk fund is 2145.35 BDT (in million) for allocation and used 157.65 BDT (in million) for utilization, which as shown in Figure 6. The study also compares with different commercial bank in connection with green banking activities in Bangladesh.

| Figure 6. Climate Risk Fund for allocation and utilization (in million BDT) |

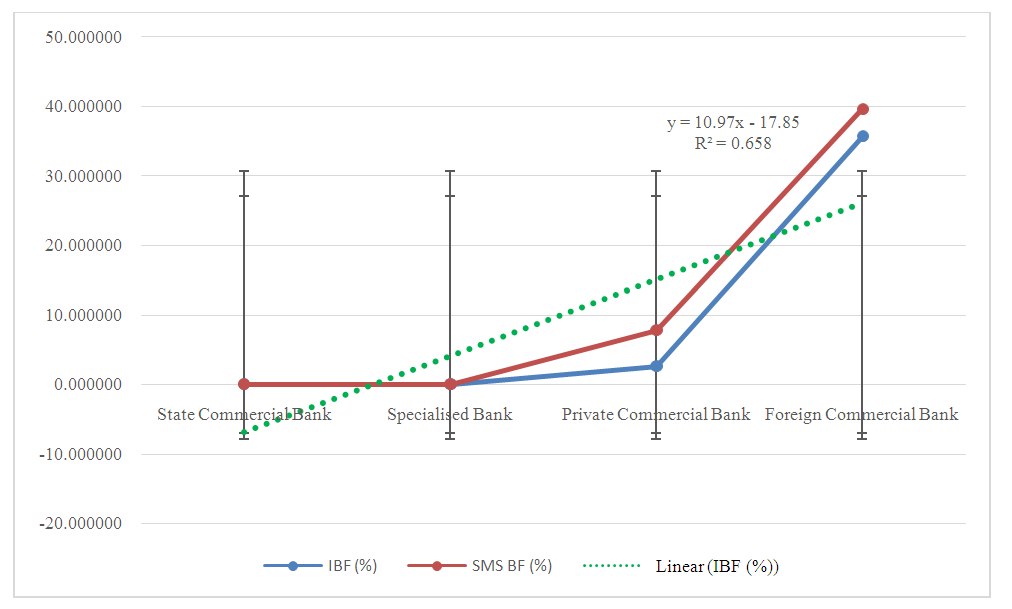

3.6. Scenarios of Internet and SMS Banking

- The study showed the scenarios of internet Banking and SMS Banking activities to lead the environmental resource management, which as shown in Figure 7.

| Figure 7. Scenarios of Internet and SMS Banking Facility in Bangladesh |

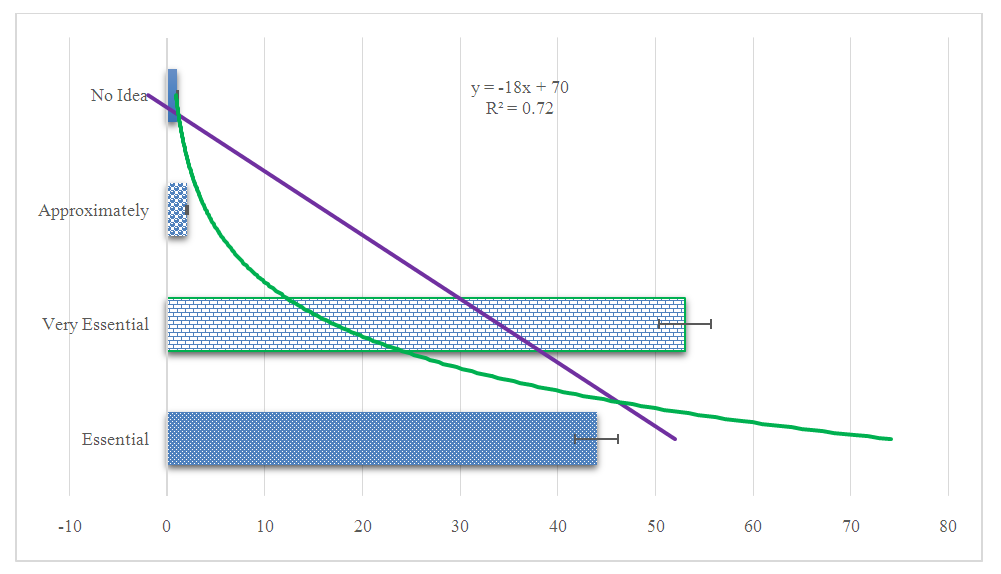

3.7. Community Environmental Awareness

- Knowledge of Respondents on Green Banking System (GBS) is imperative, since, along with the knowledge on GBS, they need to know the worth of relevant policies and technology that deals with the input, processing and output of the green banking systems. Environmental Protection is important in daily life. The respondents cannot perform a single task without its information. There are 100 respondents who are involved with Green Banking Activities either directly or indirectly in the community as well as adjacent villages who responded on environmental awareness in study areas which are shown in the Figure 8. About the 53% of the respondents opined the awareness as “very essential”, 44% as “essential”, 2% as “Approximately” and only 1% “No Comment”. These respondents were of different categories, such as Government Officials, Bank Managers, Clients, Customers, Environmentalists, Policy-makers, Environmental Lawyers, Co-management Team Leaders, Local people, NGOs Officers, Forest Officers and network specialists. Nowadays, an increasing number of customers of many conventional banks request for green financial products and investment opportunities (Arnsperger, 2012).

| Figure 8. Perception on Green Banking Activities with Environmental Awareness among the community respondents’ adjacent villages of Lawachara National Park in Moulvibazar district of Bangladesh |

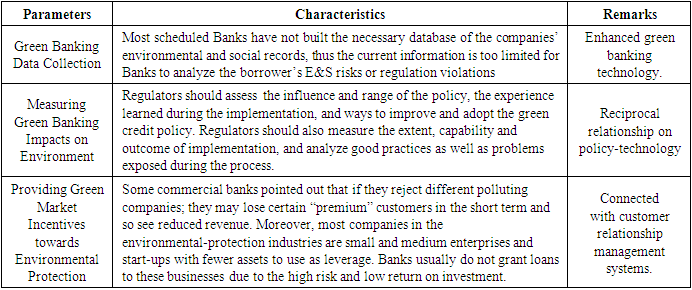

3.8. Green Banking Innovative Technology

- Green Banking Technology (GBT) is a new technology to work on banking activities including green finance, green economy, green card and so on. The GBT mainly uses data collection, data processing, measuring impact, providing green market incentives, Customer Relationship Management Systems (CMRS), Enterprise Resource Planning (ERP), Annual and Other Reports Preparing and Feedback Sharing, Automated Clearing House (ACH), Credit Information Bureau Online (CIBO), Enterprise Data ware House (EDH), and E-servicing (e-tendering and e-recruitment. These applications of GBT are identified as common standards themes in policy development and implementation and of them, three themes were explored in greater depth (Singh and Singh, 2012, pp.41–45) in the scheduled Banks which is showed in the Table 3.

|

| Figure 9. Framework on Green Banking Policy and Technology Adoption |

4. Discussion

4.1. Environmental Risks for Banks

- Environmental performance is highly correlated to financial performance and banks suffer from financial risk due to lack of environmental considerations in business practices (Hamilton, 1995, pp. 98–113); (Blacconiere and Pattern, 1994, pp. 357–377). Bangladesh is a signatory member of CBD (Convention on Biological Diversity). According to Aichi Policy Target 4 “ By 2020, at the latest, Governments, businesses and stakeholders at all levels should have taken steps to achieve, or have implemented plans for, sustainable production and consumption, and have kept the impacts of use of natural resources well within safe ecological limits” (CBD, 2010, pp. 8–9). For this purpose, Bangladesh Bank can take initiatives to update sustainable Banking policy and technological framework in order to articulate strategic commitments to sustainable development and approaches to risk management, particularly the Policy on Environmental and Social Sustainability, the Performance Standards with clients, responsibilities for managing their environmental and social risks and the Access-to-Information Policy with commitment to transparency. Banks with higher rating and total assets were also better accountable socially and environmentally (Cosmin et al., 2008, pp. 620–625). European Banks seem to be leaders in the international green market compared to other continents as a whole and have developed a unique environmental philosophy (Papastergiou and Blanas, 2011). Banks are exposed to many risks that may lead the Banks to face loss in terms of reputation and profit. Banks may not get the money used to finance their clients back and, can face credit risk and reputation risks. Green Banking integrates with people, planet and profit to save the environment, which as shown in Figure 10.

| Figure 10. The Triple Bottom Line Approach for Green Banking |

|

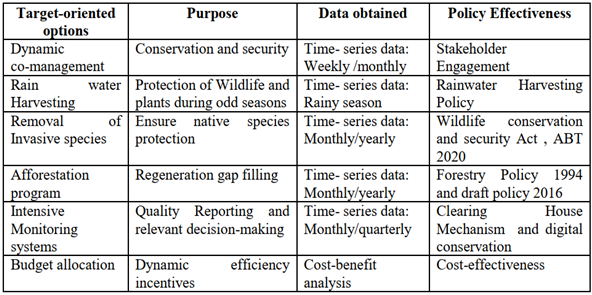

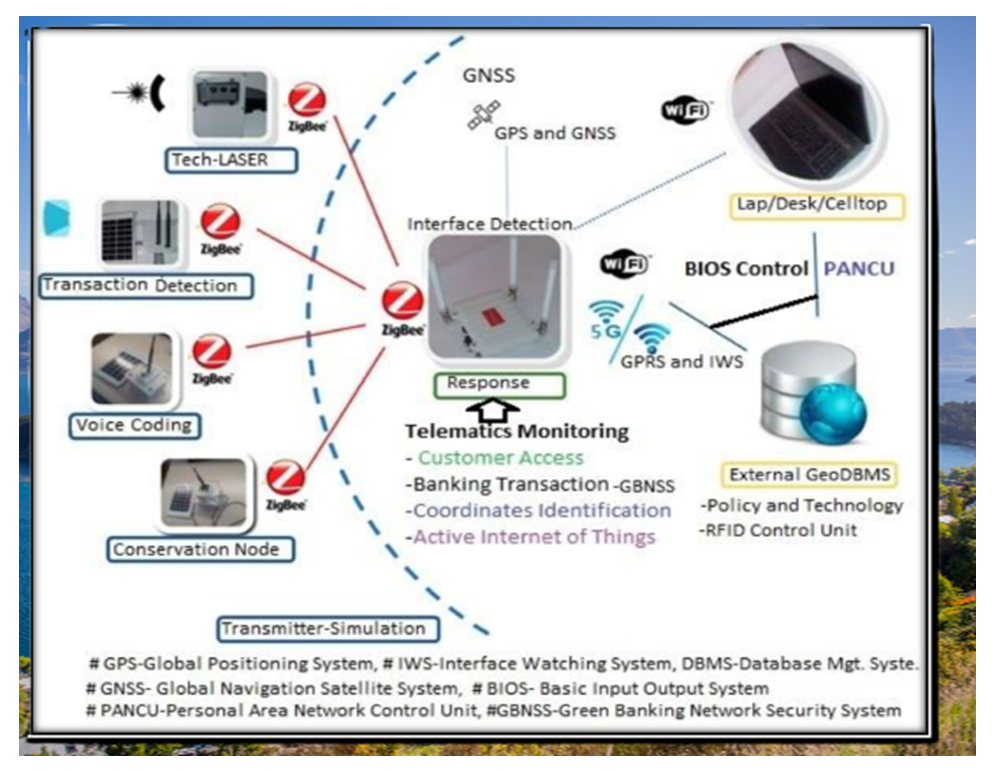

4.2. Adequate Policy and Advanced Security

- Effectiveness of environmental conservation policy is connected to the capacity of the relevant instrument to complete the policy strategies to achieve the target-oriented results linked to the anticipated objectives of the environmental policy instruments, for example: scarcity of water for wildlife in winter season, tourist guide and wireless network control unit. Wireless Sensor Networks (WSN) affect on customer care services with 19% physical and 81% of psychological changes through radiation pollution and banking transaction with creating false interface. Besides, WSN creates barrier on customer access, coordinates identification and environmental informatics due to lack of dynamic security. The security system indicates according to priority of advanced technology, which as shown in Figure 11.

| Figure 11. A Framework on Green Banking Network Security Systems |

4.3. Major Challenges

- Banking sector is the back bone of any economic systems which ensures development through effective channelization of financial resources (IFC, 2012). It is commonly reflected as environment friendly and economically sustainable in terms of emissions, pollutions and degradation catastrophes. The present era of industrialization and globalization indicates a lot of comfort and luxurious life which might lead to an alarming situation of huge environmental degradation, brought about by all the concerning activities. There are some major challenges regarding Green Banking Policy and Technology, such as access to environmental information without Government support, difficulty in launching voluntary emission-reduction projects, stopping lending to traditional high-pollution and high-emission sectors, for example tannery or textile sector, and lack of evidence for the business case (Singh and Singh, 2012, pp. 41–45), which impact on national and environmental problems. The internal environmental impact of the banking sector such as use of natural resources like energy, paper and water are relatively low and clean. Environmental impact of Banks is not tangibly related to their banking operations but with the customer’s activities. So, the environmental impacts of a bank’s peripheral activities are huge, though difficult to estimate. Additionally, environmental management in the banking business is like risk management. This augments the enterprise value and lowers loss ratio as a higher quality loan portfolio results in higher incomes. For this purpose, inspiring environmentally responsible investments and prudent lending should be one of the responsibilities of the banking sector. So, industries which have previously become green and which are making serious attempts to going green should be bestowed with a higher priority for service by the banks.

5. Conclusions

- The study shows that Green Banking is essential to the stakeholders of adjacent Lawachara National Park in Moulvibazar district of Bangladesh. The research focuses on policies, regulations and innovation technology for Green Banking that must shape more stable and efficient financial systems. These are also more connected to the mainstream economy, and the social and environmental changes that relate to domestic green economy. Policy innovations are evolving with great strides, especially in developing and emerging economies. Bangladesh is faced with immediate and long-term, social and environmental changes, and its financial systems are less constrained by prevailing norms and interests. This phenomenon affects sustainable progress which has emerged as the new paradigm for development in response to the discourse of the current development strategies that over-exploit the natural environment for economic prosperity. The policies and technologies of Green Banking systems are being used in the study to identify and sustain environmental protection in the study areas for the present and future generations, which is essential because it is a user-friendly innovation that helps to address both scientific and social issues around the studied area. Moreover, proper decision is essential for the sustainable development of environmental resources. Further investigations into stabilizing and enriching the policies and technologies of Green Banking are essential in order to successfully implement efforts to promote and harmonize environmental protection at the study area in the north-eastern part of Bangladesh. Last but not least, it is also worth stating, yet again, that for a Central Bank, the Bangladesh Bank, the biggest factor contributing to national financial stability is Green Banking which strengthens sustainable environmental conservation. Finally, we suggest future research trajectories of a new collaborative approach to drive the methodological agenda and recommend further incorporation of Green Banking policy and technology systems along with essential mechanisms in the Banking sectors for sustainable environmental conservation, not only at the national but also the global scale. To achieve an effective environmental conservation policy instrument, comfortable thinking, smart informed decision and knowledge of national park biodiversity are desired. Practical training and guidance, workshops on biodiversity conservation activities and career paths should be conducted for the organizations concerned, co-management team, local communities, officials and the public.

6. Declaration

- FundingThis research work is a part of ISNAPH (Impact of Sensor Networks towards Animals, Plants and Human beings) Experiment of the PhD Thesis, which was funded by the Zamalah Postgraduate Scholarship of UNIMAS, Malaysia and also sponsored by the Information and Communication Technology Division, Ministry of Posts, Telecommunication and Information Technology, Government of People’s Republic of Bangladesh. The funders had no role in the design of the research, in data collection, analyses or final interpretation of data, in the writings of the manuscript, or in the decision to publish the findings.Data AvailabilityThe data being used to support the findings of this research work are available from the corresponding author upon request. Competing InterestsThe authors declare no potential conflict of interests in this research work.

ACKNOWLEDGEMENTS

- The Authors acknowledged the authority of Dresden Nexus Conference (DNC) 2022, Germany on Biodiversity Stewardship for vital resources organized by UNU-FLORES, Leibniz Institute of Ecological Urban and Regional Development, and TU Dresden for acceptance abstract for oral presentation but failed to present due to bouncing false interface of cybercriminals. The authors also acknowledged the authority of Universiti of Malaysia Sarawak (UNIMAS), Malaysia for providing the Zamalah Postgraduate Scholarship for the completion of PhD degree. The authors are also grateful to the authority of the Information and Communication Technology Division, Ministry of Posts, Telecommunication and Information Technology, Government of People’s Republic of Bangladesh, for PhD Fellowship during the higher study in Malaysia. The authors acknowledged the authority of North East Medical College & Hospital, affiliated with Sylhet Medical University, Sylhet, Bangladesh for kind support.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML