-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2022; 12(2): 31-39

doi:10.5923/j.economics.20221202.01

Received: Jul. 28, 2022; Accepted: Aug. 15, 2022; Published: Aug. 30, 2022

Decomposing the Relationship between Innovation Growth and Macroeconomic Instruments in Nigeria: A Quantile Regression Approach

Abdulgaffar Muhammad1, Ibitomi Taiwo2, Edirin Jeroh3, Mohammed Bello Idris4, Osaretin Igbinovia B.5

1Data Analyst and Consultancy, Nigeria

2Department of Business Administration, Achievers University, Owo, Ondo State, Nigeria

3Department of Accounting, Faculty of Management Sciences, Delta State University, Abraka

4Kaduna State University, Kaduna, Nigeria

5Ph.D. Student Nile University

Correspondence to: Abdulgaffar Muhammad, Data Analyst and Consultancy, Nigeria.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Innovation growth is a vital tool that drives the economic growth of a country and the economic growth is best measured using key macroeconomic tools that indicate the position of the country's economic growth and development. Nigeria suffers from an economic recession due to a severe decline in innovation growth which prompts the reason this research work. This research study is to investigate the decomposition of the link between innovation growth and macroeconomic instruments in Nigeria. Secondary data used for the innovation index was extracted from globaleconomy.com which spans from 2010 to 2021 and the secondary data for the macroeconomic instrument was extracted from the World Bank which spans from 1990 to 2021. This study adopts a quantile regression which shows that the model is statistically significant at a 1% level and this indicates that there is a significant relationship between innovation growth and the macroeconomic instruments in Nigeria. The quantile regression also reveals the decomposition of the three quantiles which shows that innovation growth has a positive and significant impact on the gross domestic growth in Nigeria for the 40th, 50th and 60th quantiles respectively. This implies that the innovation index is positively and significantly related to the GDP growth suggesting the higher the innovation index in Nigeria, the higher the gross domestic growth that brings about an increase in the economic growth of the country. Consequently, there is a need for the government to substantially invest in innovation activities that promote the human capital, infrastructure and research that contribute immensely to the economic growth of the country to revive Nigeria from its current recession.

Keywords: Innovation, Macroeconomic Instruments, Quantile Regression

Cite this paper: Abdulgaffar Muhammad, Ibitomi Taiwo, Edirin Jeroh, Mohammed Bello Idris, Osaretin Igbinovia B., Decomposing the Relationship between Innovation Growth and Macroeconomic Instruments in Nigeria: A Quantile Regression Approach, American Journal of Economics, Vol. 12 No. 2, 2022, pp. 31-39. doi: 10.5923/j.economics.20221202.01.

Article Outline

1. Introduction

- According to the European Central Bank (2017), innovation is the process of conceiving new ideas and implementing them to improve existing goods and services or to increase the efficiency of their production processes. Innovation growth of a country is a great catalyst that fast tracks the economic growth of the country. Nigeria recorded the highest innovation index of 28.2% in 2011 but declined to 20.1% in 2020 and 2021 respectively due to the global effect of the COVID-19 pandemic (Globaleconomy.com, 2022 and World Health Organization, 2022). It is noteworthy that innovation is a vital tool that enables innovation activities that promote the human capital, infrastructure and research that contribute immensely to the economic growth of the country. The economic growth of a country is measured by key macroeconomic instruments such as the inflation rate, unemployment rate, exchange rate, and gross domestic product (World Bank, 2022). Nigeria is currently suffering from an economic recession because of the serious decline in innovation and this adversely affected the country's economic development. This is very apparent in the economic indicator where inflation has suddenly risen to 18.6%, the unemployment rate hit 35% and gross domestic growth performance has dropped significantly (NBS, 2022; Augusto and Co, 2021). Numerous researches have confirmed that there is a positive link between innovation and macroeconomic instruments (Raghupathi and Raghupathi, 2017; World Bank, 2021). The findings of the research conducted by Raghupathi and Raghupathi (2017) show that innovation growth is an essential tool for economic growth. All the developed countries of the world are experiencing consistency in their economic growth and national development due to their incessant innovation growth (WBDI, 2022). It is therefore a clear indication that every country that must have a tremendous growth in her economy needs to improve in her innovation technology and development which is grossly measured by the innovation index. Undeveloped countries are traced to their country’s poor innovation growth.Therefore, this research as a new area of study seeks to decompose the connection between innovation growth and macroeconomic instruments in Nigeria using quantiles regression approach. This will also contribute immensely to the existing body of knowledge.

2. Literature Review

- Literature review of this research work is divided into two parts namely theoretical and empirical review.

2.1. Theoretical Review

- Following the Keynesian theory concept, innovation index of a country contributes significantly to the gross domestic product (GDP) as well as the country exchange which brings about economic growth and development. A simple equation that illustrated this expression is written as:

| (1) |

| (2) |

2.2. Empirical Review

- Rana, Maradana, Saurav, Kunal, Manju, and Debaleena (2017) examine the correlation between innovation and per capita economic growth from 1989 to 2014 in 19 European nations. The study studied the long-term relationship between economic growth per capita and six distinct innovation measures. These included the total amount spent on R&D, the number of researchers actively involved in R&D, exports of high-tech items, and scientific and technical journal articles. Also included was the number of patents held by residents and non-residents. In the majority of cases, the study reveals a long-term association between innovation and per capita economic development. This evidence typically pertains to the utilization of a specific innovation indication. Cointegration was the method utilized to conduct the study. The study, which employed the Granger causality test, concluded that there is a unidirectional and bidirectional causal relationship between innovation and per capita economic growth, although the direction of this relationship varies from country to country based on innovation indices that were examined. Importantly, the study reveals a strong association between the growth of the per capita GDP and each of these innovation criteria. Andreea, Olivera, and Florina (2015) investigate the connection between an economy's innovation potential and its rate of long-term economic growth. In the analysis, multiple regression models were employed, and the parameters for the Central and Eastern European nations of Poland, the Czech Republic, and Hungary were estimated. Several indicators, including the number of patents, trademarks, and R&D expenditures, were utilized in the study to determine innovation. The findings confirm that economic growth and inventiveness are strongly associated. The conclusion drawn from this indicates that innovation is a vital phase in the process of achieving growth.Westmore (2013) constructed a panel model using a sample of 19 OECD countries from 1980 to 2008 to assess the determinants impacting R&D spending and patents, as well as the connection between innovation and economic growth. According to the study's findings, financial incentives, government support for R&D and legal protection of intellectual property rights are used to promote innovation in the private sector. According to the research, there is no direct correlation between these laws and product development in general. The transfer of information from any source, internal or external, is highly dependent on standards that encourage competition. Petrariu, Bumbac and Cirbanu (2013) analyze the link between innovation and economic growth using an econometric model approach. According to the report, the allocation of resources to research and development is the primary driver of innovation and a good measure of an economy's level of progress.However, this study investigates the connection between innovation and macroeconomic tools in Nigeria, and as such make a significant contribution to the body of existing information.

3. Data and Methodology

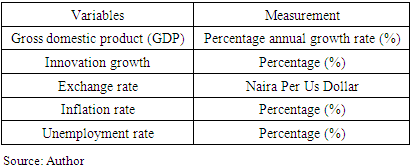

3.1. Data

- This research employed secondary data from World Bank data publications (data.worldbank.org) and globaleconomy.com for the period under consideration, 1990 to 2021, for macroeconomic tools while the data for innovation growth span from 2010 to 2021 as a result of the period of availability of innovation index. The selection of the selected macroeconomic indicators is based first on the availability of data and then on a method of purposive sampling.

3.2. Secondary Data

- Secondary data implies any forms of datasets that are collected by a source other than the person or entity that is meant to use it. In the other word, it is a set of data that have been collected already and made readily available and obtainable from other sources such as publications, books among other resource materials.

3.3. Methodology

- For this research study, a quantitative research design was employed, and descriptive statistics (mean and standard deviation for the data summary) and econometric models such as quantile regression were used for data analysis. Version 16 of the Stata computer software was be used to analyze this research.

|

3.4. Innovation Growth

- Innovation growth describes how products/services’ improvements is sustained and create the ability to meet the needs of the society along with a technological standard and established performance trajectory. Innovation growth generally gives the existing users more of what they were using previously, and generally maintains an improved technological standard and efficiency/performance.

3.5. Quantile Regression

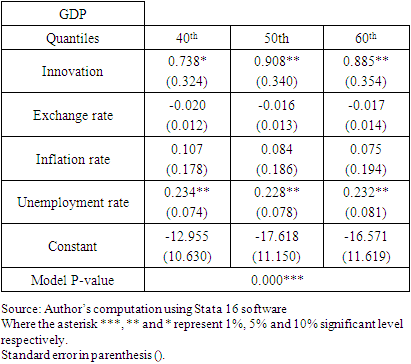

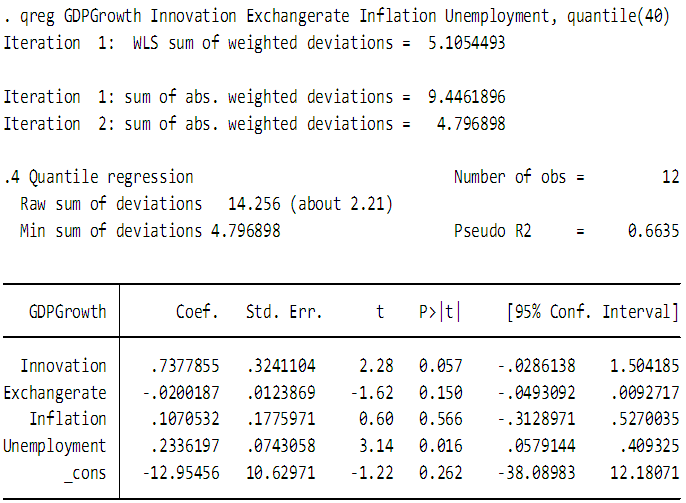

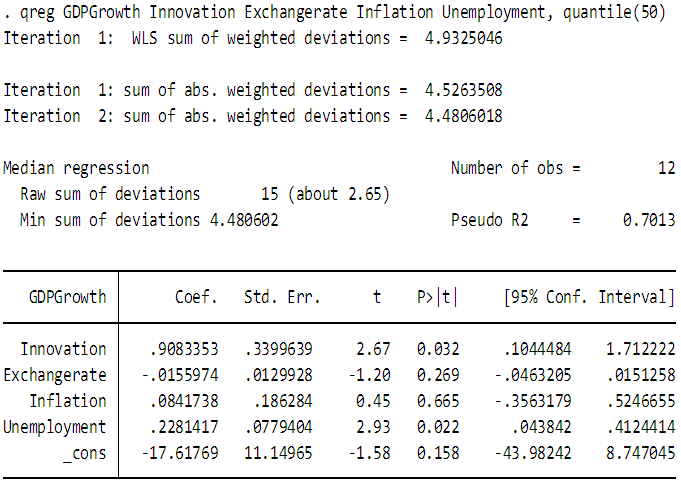

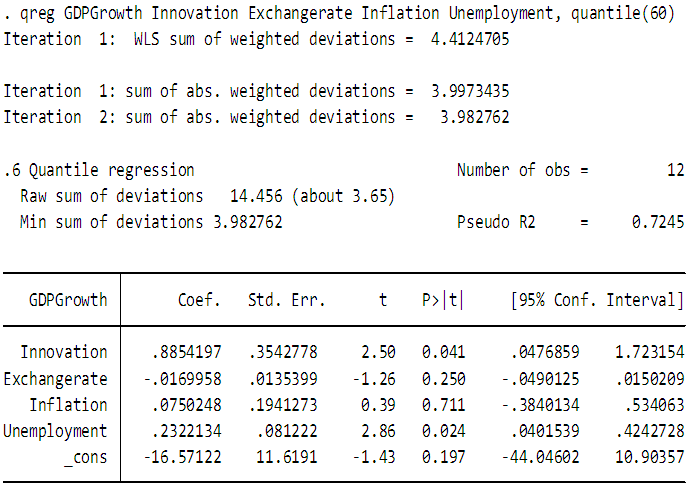

- Quantile regression is used to model and decompose the connection between a set of independent factors and the percentiles (or "quantiles") of a dependent outcome variable, typically the median. Quantile regression is very applicable when the basic least squares assumptions of linear regression are violated (i.e., linearity, homoscedasticity, normality, autocorrelation). In the meantime, appropriate quantile visualization was executed after model estimation.The generalized quantile regression model is written as;Q/(yit) = α’dit + β’xit + λi’ft + μit ………. i = 1……. N; t = 1, ……...TWhere the yit is the outcome variable representing the response for subject i at time t of varied quantiles (Q), d is a vector of endogenous variables, x is the vector of predictor variables, λi’f are treated as nuisance parameters while α and β are the parameters of interest and μ is the error term.Quantile regression permits decomposition utilizing various quantiles of the model, including Q40, Q50, Q60 etc. based on the quantile feasible estimations. Each of these quantiles models the link between the predictor variables and the dependent variable, and the estimate evaluated to identify the quantiles with the most significant coefficient. Additionally, the influence of the independent variables on the dependent variable was examined.The outcome/dependent variable is gross domestic product (GDP) while the independent/predictor variables are innovation growth, inflation rate, exchange rate, and unemployment rate.

4. Result and Discussion

4.1. Results

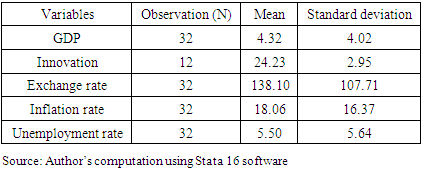

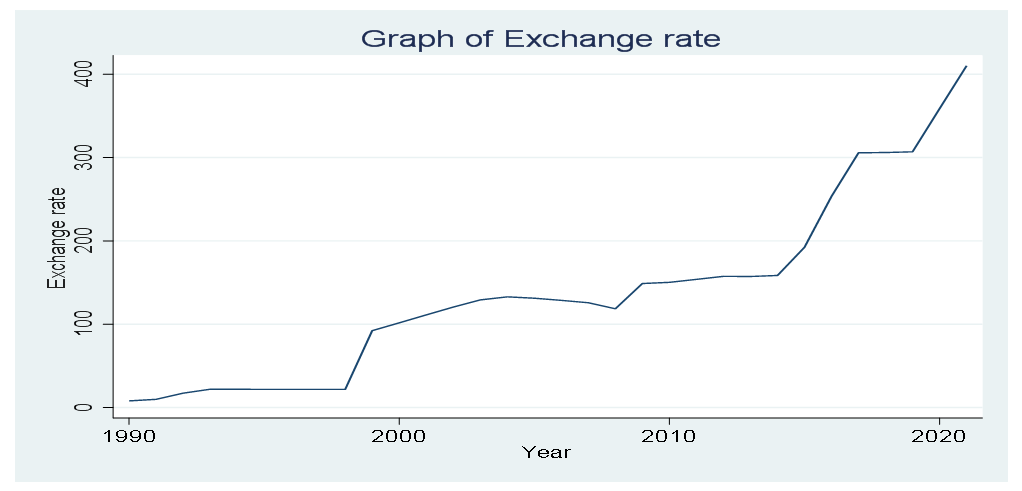

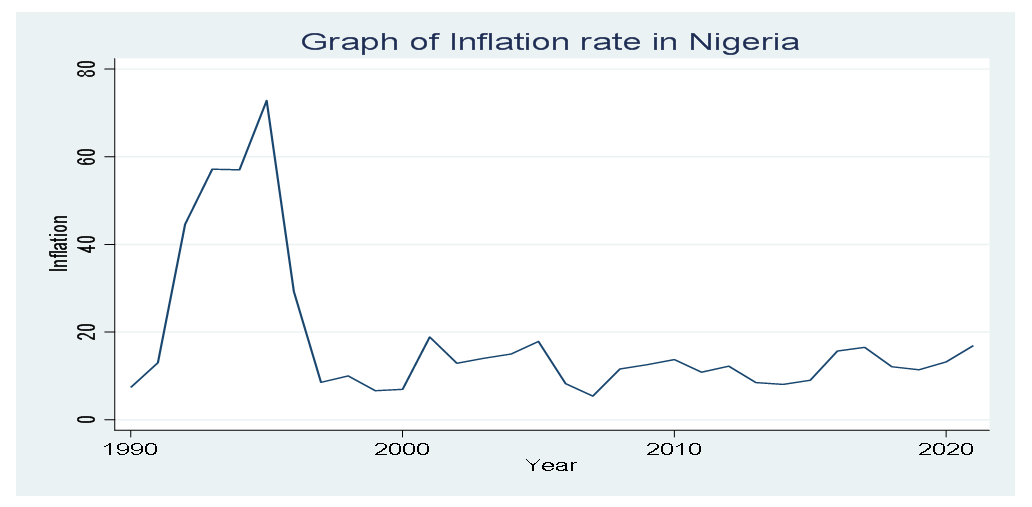

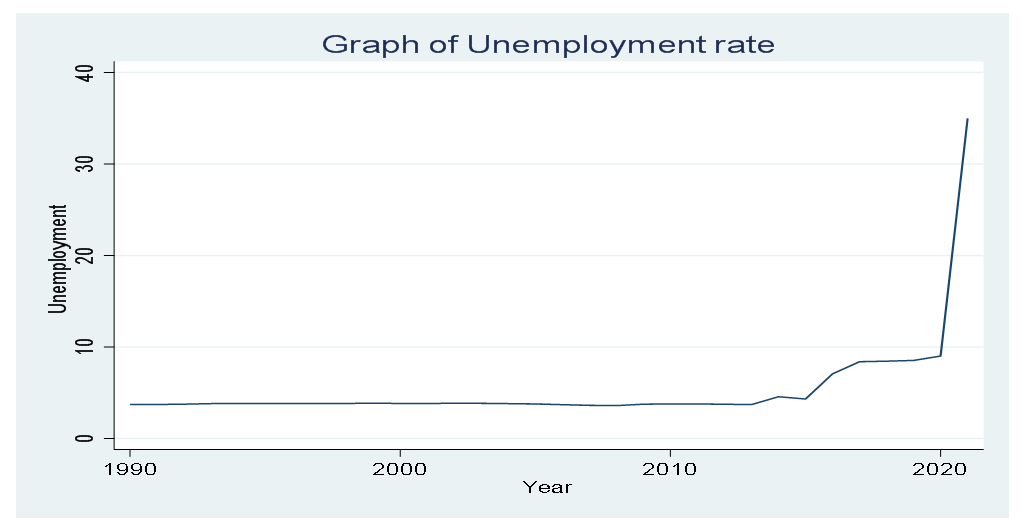

- Table 2 shows the summary statistics of the data and we can see that the gross domestic product in Nigeria has an average growth of 4.32% with variability of 4.02%, Innovation index in Nigeria has an average growth performance of 24.23% during the period under review with the variability of 2.95%, exchange rate in Nigeria on average is 138.10 Naira per dollar with the variability of 107.71 Naira, Inflation rate on average has grown by 18.06% with the variability of 16.37% while unemployment rate on average is 5.5% with high variability of 5.64% above the mean and this agreement with the current situation in Nigeria with high current unemployment and inflation rate respectively.

|

|

| Figure 1. Graph of Quantile Regression Coefficient Estimate |

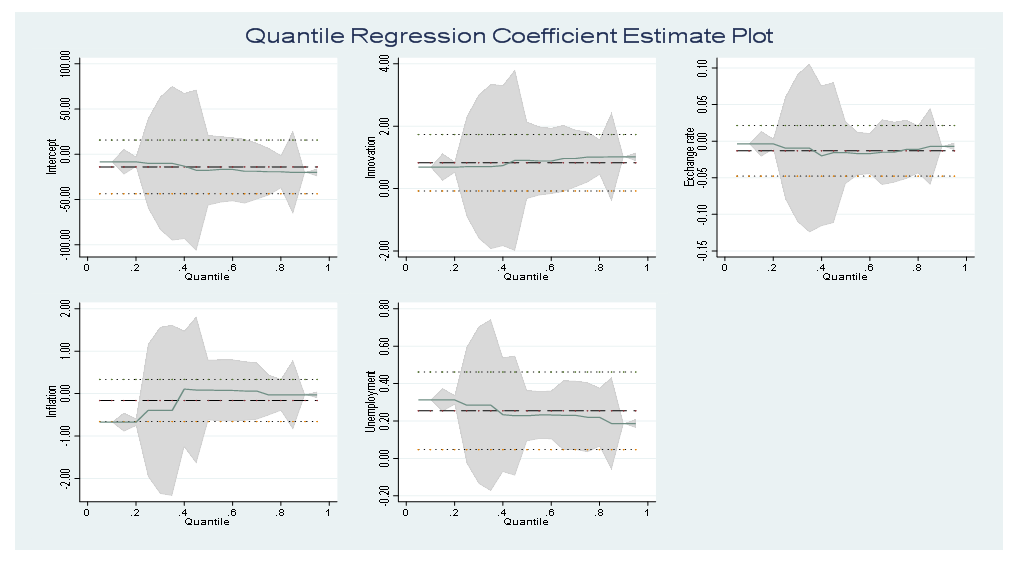

| Figure 2. Graph of Innovation Index Growth in Nigeria |

| Figure 3. Graph of Gross Domestic Product in Nigeria |

| Figure 4. Graph of Exchange Rate Per Dollar in Nigeria |

| Figure 5. Graph of Inflation Rate in Nigeria |

| Figure 6. Graph of Unemployment Rate in Nigeria |

4.2. Discussion of Findings

- As a result of the analysis of this research study, the following findings were discussed below.Table 2 shows the summary statistics of the data which indicates that the gross domestic product in Nigeria has an average growth of 4.32%, the Innovation Index in Nigeria has an average growth performance of 24.23% during the period under review, exchange rate in Nigeria on average is 138.10 Naira per dollar, Inflation rate on average has grown by 18.06% while unemployment rate on average is 5.5% with high variability of 5.64% above the mean and this agreement with the current situation in Nigeria with high current unemployment and inflation rate respectively.A quantile regression model was applied and it shows the analysis shows that the model is statistically significant and this implies that there is a significant relationship between the innovation index and the macroeconomic instruments. The result of table 3 shows that innovation growth has a positive and significant impact on the gross domestic growth in Nigeria for the 40th, 50th and 60th quantile respectively. This implies that the innovation index is positively and significantly related to the GDP growth which suggests that the higher the innovation index in Nigeria, the higher the gross domestic growth which brings about an increase in the economic growth of the country. This agreement with the work of (Raghupathi and Raghupathi, 2017) established that Nigeria's economy is solely dependent on macroeconomic instruments and innovation growth.The coefficient estimates of the exchange rate indicate that for a 1 Naira per dollar increase in Nigeria's exchange rate, gross domestic product growth will decline by 0.02%, 0.016% and 0.017% respectively across the three quantiles. This suggests that a high exchange rate will bring about a decline in GDP growth (see table 3).Figure 2 shows the graph of the innovation growth in Nigeria based on the available data for innovation from 2010 to 2020 which indicates that innovation has a maximum point of 28.2% in 2010/2011 which declined to 20.1 in 2020 and 2021 respectively as shown in Figure 2.Figure 4 shows the graph of the exchange rate in Nigeria and it shows an upward growth and ta hen high rate from 2020 to 2021 due to the global surge of a covid-19 pandemic.Figure 6 shows the graph of the Unemployment rate from 1990 to 2021 and shows that the unemployment rate hit 35% in 2021 as this support the work of Augusto and Co (2021).

5. Conclusions and Policy Implication

- Innovation growth is the significant driving force that is capable of boosting the economic growth and development of a country. Macroeconomic instruments such as gross domestic product, exchange rate, inflation rate and unemployment are good assessments of the economic performance of a country. This study contributed to the existing body of knowledge by decomposing the relationship between innovation growth and the macroeconomic instruments in Nigeria using quantile regression. The findings of this study reveal that the fitted quantile regression model is statistically significant and this suggests that there is a significant relationship between innovation growth and macroeconomic variables. More so, the quantile decomposition of the model shows that Innovation growth has a positive and significant impact on the gross domestic growth in Nigeria for the 40th, 50th and 60th quantile respectively. This implies that the innovation index is positively and significantly related to the GDP growth which suggests that the higher the innovation index in Nigeria, the higher would be the gross domestic growth that will bring about an increase in the economic growth of the country. As a result of this, the federal government need to adopt a budget policy that will make adequate provision for innovation activities that promote the human capital, infrastructure and research that contribute immensely to the economic growth of the country.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML