Joseph Davies1, Mohamed Osman Turay2, Samuel Koroma3

1School of Postgraduate Studies, Ernest Bai Koroma University of Science and Technology (EBKUST), Magburaka Town, Sierra Leone

2Economics Department, University of Makeni (UNIMAK), Makeni Town, Sierra Leone

3Dean of Commercial Management and Entrepreneurship, Freetown Polytechnic College, Kissy Campus, Freetown, Sierra Leone

Correspondence to: Joseph Davies, School of Postgraduate Studies, Ernest Bai Koroma University of Science and Technology (EBKUST), Magburaka Town, Sierra Leone.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

Commercial banks play a very significant role in the growth of most economies particularly in low and middle-income economies with a large portion of Small and Medium Enterprises (SMEs) in the informal sector and largely the private sector with big corporations that require commercial loans to fund high capital-intensive projects. However, this study through longitudinal or time-series data collected and primary data gathered through a semi-structured interview with respondents from a sample of commercial banks and microfinance institutions discovered that borrowers are saddled with the cost of interest rates. The study further found out that the loan interest rates in Sierra Leone are not only high but are acerbated by the rate of inflation and the downward turn of the economy coupled with interest rate volatility. This study employed both quantitative and qualitative analysis. The quantitative analysis used descriptive analysis to evaluate the impact of high-interest rates on borrowing. The Qualitative analysis examines and analyse existing literatures on loan policy frameworks by commercial banks and microfinance institutions. Therefore, this study recommends that the Central Bank should through its monetary policy influence the fixing of interest rates by commercial banks and microfinance institutions by insisting on its reserve requirements as well as buying and selling risk-free treasury and government securities to affect the deposits the commercial banks have at the Central Bank.

Keywords:

Small and medium enterprises, Low and middle-income economy, Borrowers, Loan interest rate, Inflation rate, Interest rate volatility, Reserve requirements, Government securities

Cite this paper: Joseph Davies, Mohamed Osman Turay, Samuel Koroma, The Effects of High Lending Interest Rates on SMEs in Sierra Leone: A Glance at Lenders’ Perspectives, American Journal of Economics, Vol. 12 No. 1, 2022, pp. 20-29. doi: 10.5923/j.economics.20221201.03.

1. Introduction

What is the effect of high lending interest rate on the economy of Sierra Leone? This is one of the questions that this paper seeks to answer. According to Dr. Tisa Silver Canady “rate cut equal good news for everyone? Rate cuts tend to favor borrowers, but hurt lenders and savers” (DR. TISA SILVER CANADY, 2020). Interest rate is one of the essential conditions in the lending decision procedure of commercial banks (Bhattarai, Y. R., 2015). The lending interest rate is the fraction of the loan sum that the lender charges to loan money (Bhattarai, Y. R., 2015). However, we argue that high lending interest rates by commercial banks and microfinance institutions negatively influence business and economy as a whole. High interest rates slow down business growth and has a rippling effect on the economy that depends on commercial activities. Nevertheless, our argument is strongly supported by Kevin L. Kliesen who emphasized that, to most economists, the prime benefit of low interest rates is its simulative effect on economic activity (Kevin L. Kliesen, 2010). The Association of Commercial Banks in Sierra Leone noticed the influence of loans commercial banks gives to their customer and how it impacts the economic growth of Sierra Leone. It is argued that the monetary policy affects the supply of bank credit and commercial banks being the players in the market, contribute to the transformation of the monetary policy into macroeconomic outputs in the economy.However, Kimberly Amadeo defines economic growth as “an increase in the production of goods and services over a specific period excluding the effects of inflation” (Amadeo, 2020). Therefore, commercial bank lending is one of the catalysts for macroeconomic outputs in the economic growth of Sierra Leone. Sierra Leone is a developing market that is leaning towards ensuring that credit is made available to citizens as an approach to spurring economic growth in the country. On the other hand, the lending rate reduces the expendable income of the individual and enterprises whose profit margins are reduced because of the interest repayment, which in most times seems higher and non-competitive. According to Cecilia Maigua and Gekara Mouni referencing (Crowley, 2007), interest rate is one of the furthermost significant causes that affect the bank financial performance. Interest rate is the expense a borrower incur for the use of money they borrow from a lender or a financial establishments or fee paid on borrowed assets (Cecilia MAIGUA and Gekara MOUNI, 2016).

1.1. Challenges

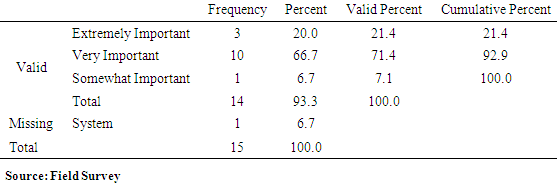

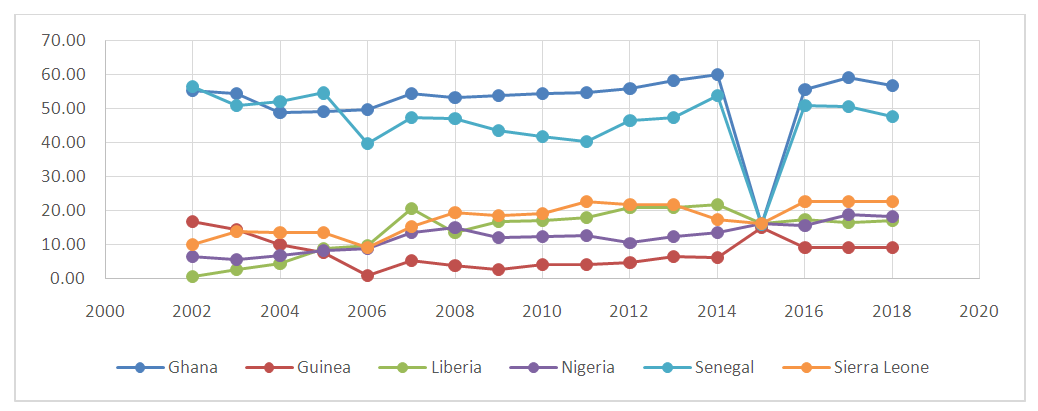

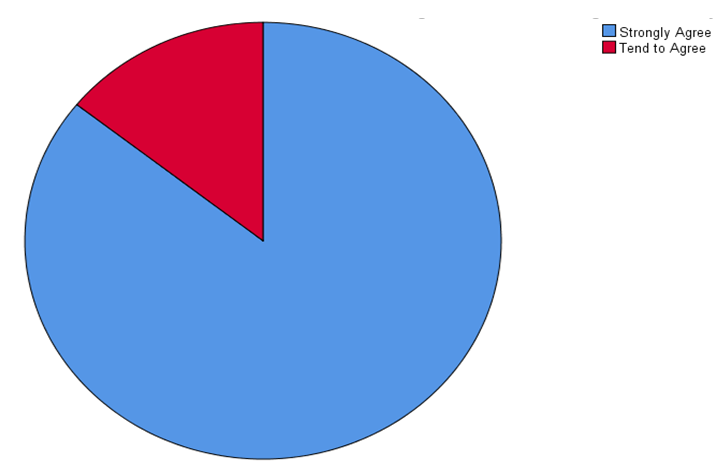

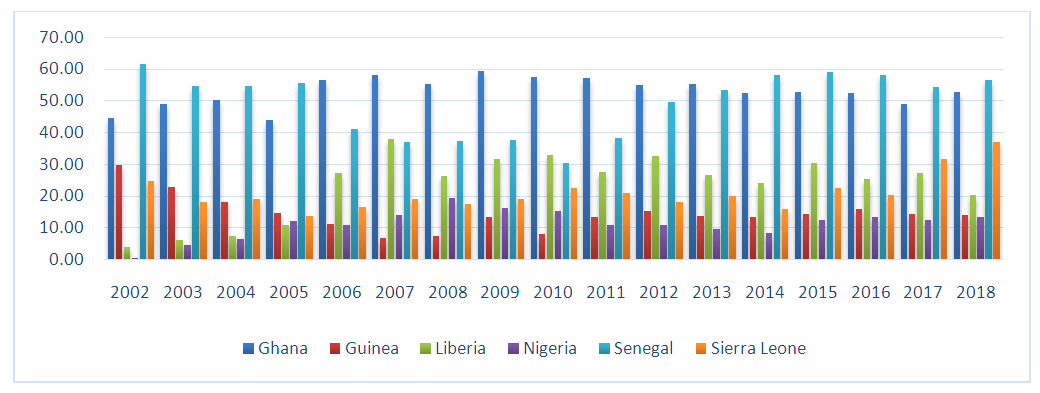

Sierra Leone is a small country in West Africa, with a population of about 6.7 million as shown in Figure 1 below. However, the male and female population accounted for about 49.9% and 50.1% respectively of the total population of Sierra Leone.  | Figure 1. Sierra Leone's Total Population, Male and Female from 2002-2018 (Source: World Bank Data Bank World Development Indicators) |

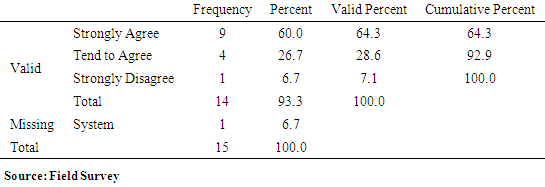

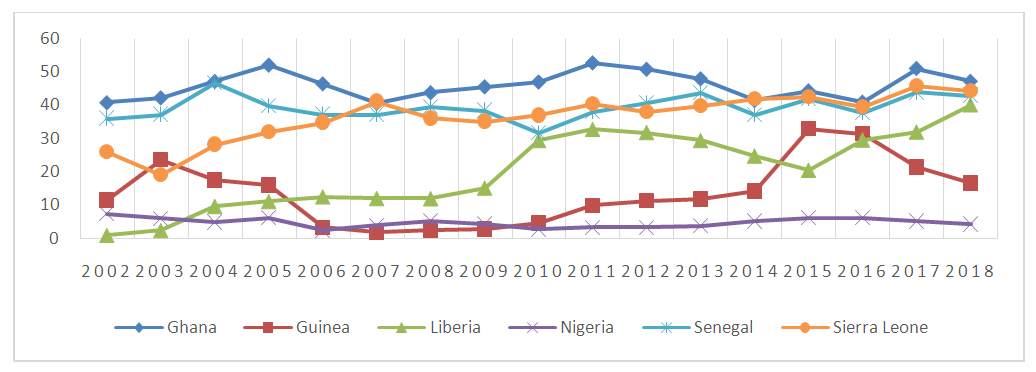

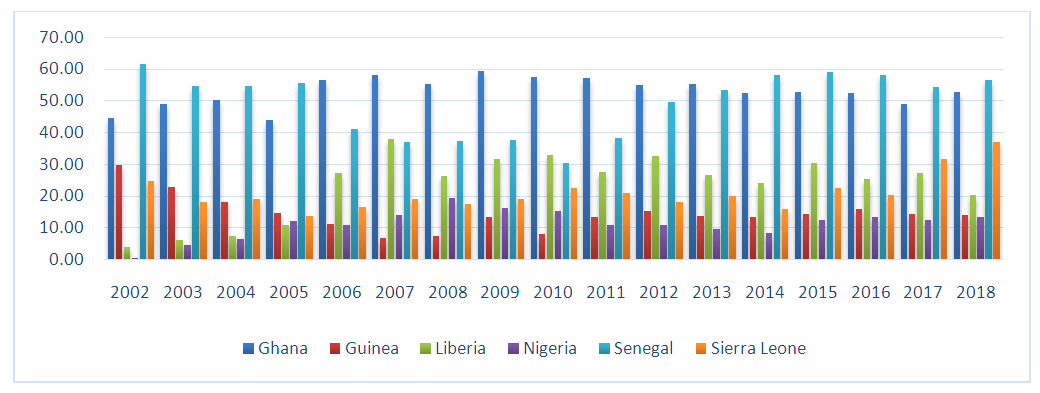

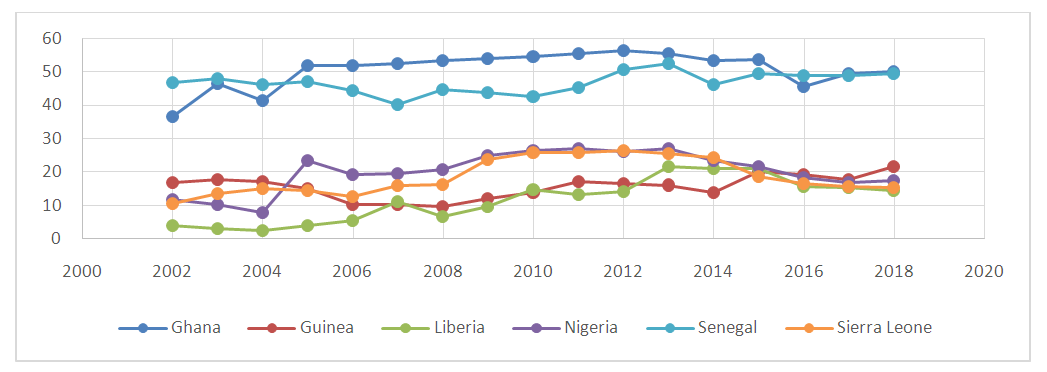

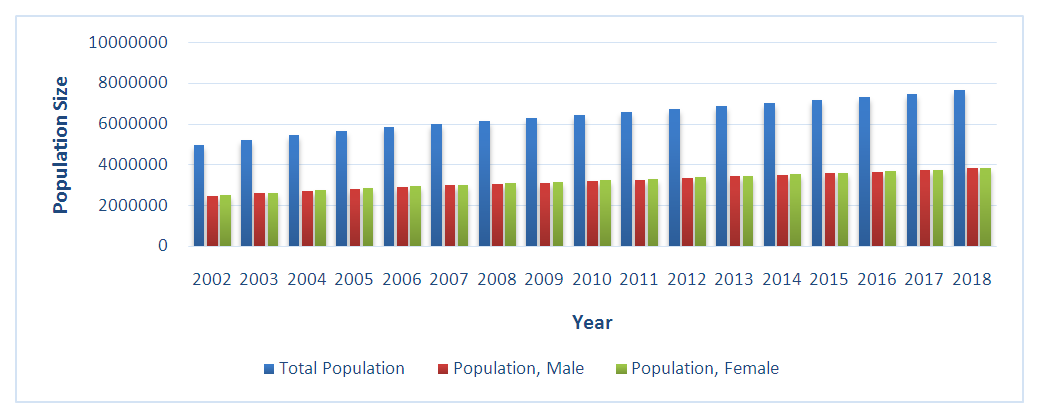

However, the country started experiencing severe economic downturn by the end of 1980s. These economic circumstances were exacerbated with the emergence of the past eleven years’ senseless civil carnage that ruined the entire economic fabric of the country. In addition, two major economic shocks, the Ebola Virus Disease (EVD) and the sharp fall in the price of iron ore in the world market crushed the slow economic recovery of the country after the civil war which is the country’s major export creating an imbalance in the national income budget and to a greater extent economic austerity.However, much as the banking sector was greatly affected by the economic downturn and dwindling economic activities both in the public and private sectors, that didn’t stop them from exercising their traditional banking activities of accepting deposits and giving out loans although at soaring interest rate for lending to their customers. On the other hand, regardless the political instability during the eleven years of war, Sierra Leone has slowly improved its governance indicators including political stability compared to other countries in the sub-region as shown in Figure 2 below. | Figure 2. Sierra Leone's Ranking on Political Stability/No Violence (Source: United Nation Governance Indicators) |

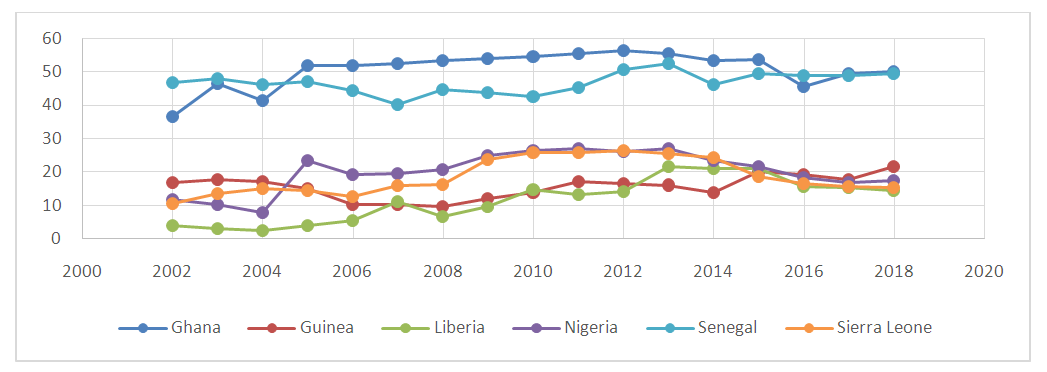

Nevertheless, the insolvency of a lot of private businesses or corporations due to the crumbling economic situation of the country is another problem that is making customers unable to settle their financial indebtedness with most of the commercial banks. Besides, it is essential to note that, the non-repayment of loans to commercial banks by their customers creates negative effects on the operations and turnover of the banks. The criminal behaviour of certain individuals and businesses in the country towards lending from commercial banks is another menace that has resulted to the toughen of the conditions for loans from commercial banks and other crediting agencies. Although the government of Sierra Leone has done a lot over the years to improve the rule of law as shown in Figure 3 below by empowering and establishing institutions that ensures compliance with the law and established rules for dealing with credits issues like the Financial Intelligence Unit (FIU) at the Bank of Sierra Leone. However, the government needs to do more to improve the bar on rule of law in the country. | Figure 3. Sierra Leone's Ranking on the Rule of Law (Source: United Nation Governance Indicators) |

Trust is anticipated to reduce transaction costs besides agency costs and therefore influence the cost of credit for SMEs (Howorth, C., & Moro, A., 2012). However, these fraudulent business activities are bent on deceiving the banks or its customers. The aim of these activities are not to do real business but to obtain these finances with bad intention thus creating loss to the parties involve. These are all indicators that the government of Sierra Leone has a dual role to protect both the interest of its citizens who transact with the commercial banks and the investable interest of these commercial banks through proper regulation or monitoring procedures. Although the country has been doing well in the fight against corruption as shown in Figure 4 below, however, data has it that Sierra Leone over the years has fall way below other countries in the sub-region in terms of regulatory quality as shown in Figure 5 below. | Figure 4. Sierra Leone's Ranking on the Control of Corruption (Source: United Nation Governance Indicators) |

| Figure 5. Sierra Leone's Ranking on Regulatory Quality (Source: United Nation Governance Indicators) |

Collateral is another very crucial aspect of lending and commercial banks in Sierra Leone take the issue of collateral security central in risk assessment when it comes to lending. These are security instruments required as a critical criterion by the financial institution in Sierra Leone to obtain loans and other forms of credit facilities. The unavailability of these collaterals from many business owners stalled the business activities. Besides, three quarters of households in sub-Saharan Africa do not have adequate collateral to submit in order to obtain a loan (Chikalipah S., 2020).

2. The Impacts Soaring Lending Interest Rates

The relevance of the commercial banks and microfinance institutions in the development of the economy cannot be underestimated especially in developing and transition countries like Sierra Leone. The rudimentary drive of the microfinance institutions is to accomplish the demand of poor section of the society by giving them credit facilities on reasonable interest rates (Abrar, A., 2019). Business enterprises and even big corporations as well as individuals needs loan or credit from commercial banks and microfinance institutions to start or grow their businesses while individuals need credit facilities for household consumption on food, education, housing, purchase of personal effects etc. However, the major challenge of especially Small and Medium Enterprises (SMEs) are the soaring interest rates attached to these loans, high inflation levels and overall slow growth of the economy. Access to financial facilities is important in developing an energetic Small and Medium Enterprises sector in any economy (Stanley Sachikonye and Mabutho Sibanda, 2016).The main components of expenditure, which are generally held to be affected by the interest rate, are consumption and investment (TAYLOR, 1999). Conceptualizing the relationship between an independent variable (Loan) and the dependent variables Investment and Household Consumption. It would illustrates that business corporations, SMEs and Households require loan to do procurement of goods and services, production, distribution and the payment of wages and salaries for investment purposes. On the other hand, households, require loans or credit facilities to pay for housing, transportation, food and medical facilities. Furthermore, the framework would suggest that loans are given by commercial banks at high interest rate in an economy with high level of inflation, which may be disadvantageous to the borrowers because repayment of loans will be attracted, by real interest rate. Higher lending interest rates reduces the value firms as well as households need to borrow (Santos, T. T. O., 2021). Commercial Banks play very important role in the development of economies especially those in developing or transition countries where there is a large scale of Small and Medium Enterprises (SMEs) which form the majority of the informal sector of those economies. Even large scale businesses or corporations needs access to finance for highly capital intensive projects that will require the commercial banks or other financial institutions to finance through commercial loans. However, the other key challenge of borrowers has been the cost of borrowing which seems to be soaring all the time coupled with the high rise in inflation and interest rate volatility. Commercial banks can surge their profit margins over higher lending rates as well as lesser deposit rates (Bhattarai, Y. R., 2015). Thus when inflation increase the cost of servicing debts or loans become expensive and borrowers will be compelled to pay at real interest rate. On the other hand, this will also have a negative impact on the economy of the country as well; it is the responsibility of the Central Bank to intervene in an indirect regulation through the implementation of its monetary policy. On the other side, such regulations must not make the commercial banks and microfinance institutions worse off as they depend on the Nominal Interest Rate (NIM) especially on the side of borrowers, as the commercial banks will have to honor their obligation of paying interest rate to depositors. The question of high interest rate and its effect on low-income customers has often confronted by Micro Finance Institutions (Abrar, A., 2019). One of the causes is the unavoidably higher servicing costs for small-size loans as compared to standard bank loans (Abrar, A., 2019).

3. Method

This section presents the study approach used in collecting data and analysis on the effects of high lending interest rates on SMEs in Sierra Leone. The primary data collection method was employed in the collection of the data presented below with the use of questionnaire done in a semi-structured interview approach at some commercial banks and microfinance institutions across Freetown. The 5 points Linkert method was used in the designing of the questionnaire and SPSS statistical software was used in the analysis of the data.

3.1. Data Presentation

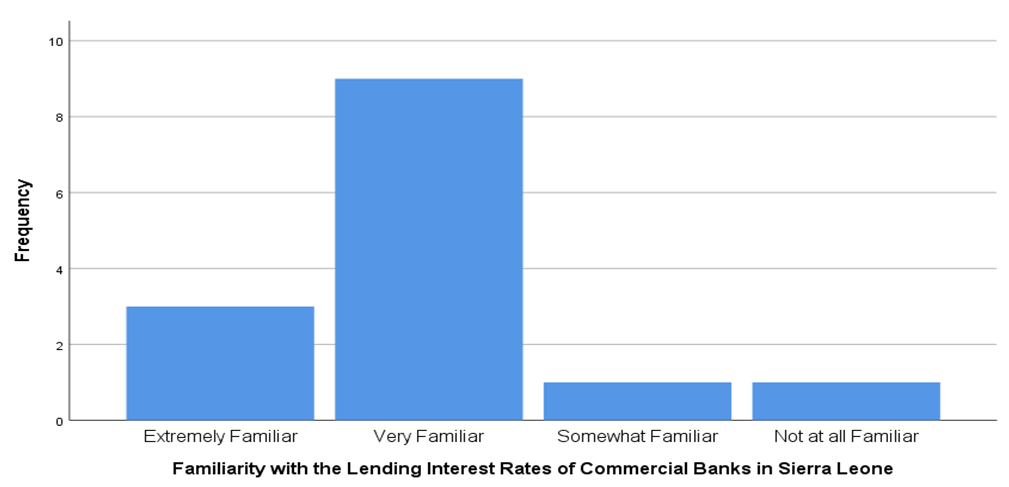

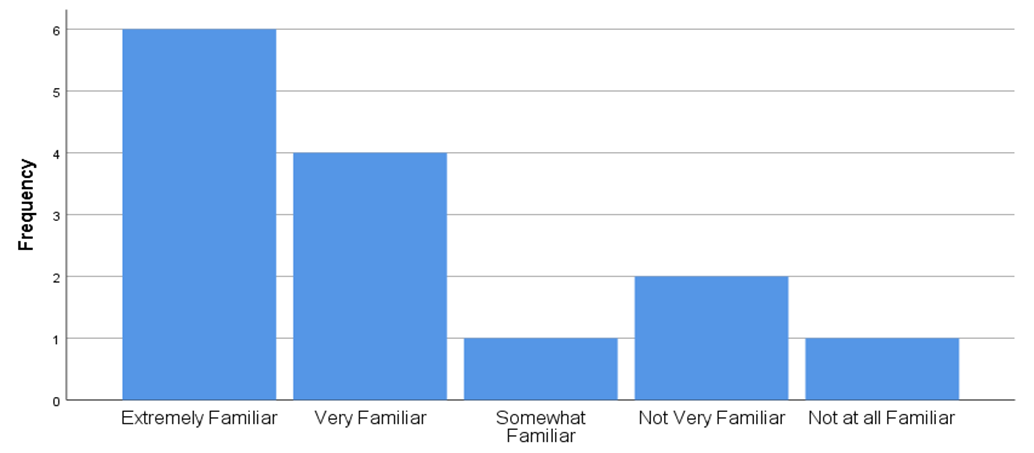

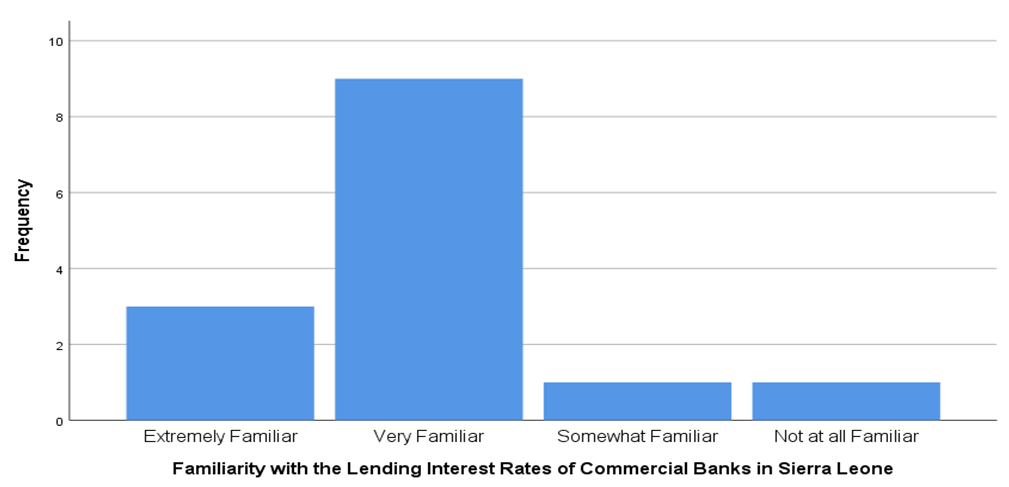

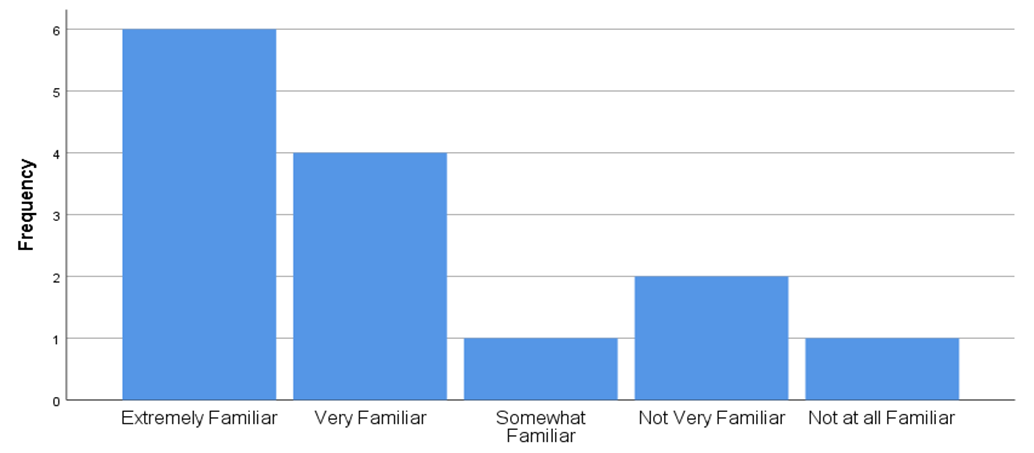

Figure 6 gives an illustration of respondent’s familiarity with lending interest rates of commercial banks in Sierra Leone. It illustrates that most of the respondents 64.3% were very familiar with the existing lending interest rate in the country followed by 21.4%, which is an indication, that interest rate matters when it comes to commercial loans from commercial banks and microfinance institutions. The significance of lending relationships in defining the lending interest rates of financial establishments has been extensively deliberated in finance literature, particularly as financial markets as well as establishments are becoming progressively competitive and globalized (Njimanted, Godfrey Forgha et al, 2018). | Figure 6. Respondents' Familiarity with Lending Interest Rates of Commercial Banks in Sierra Leone (Source: Field Survey) |

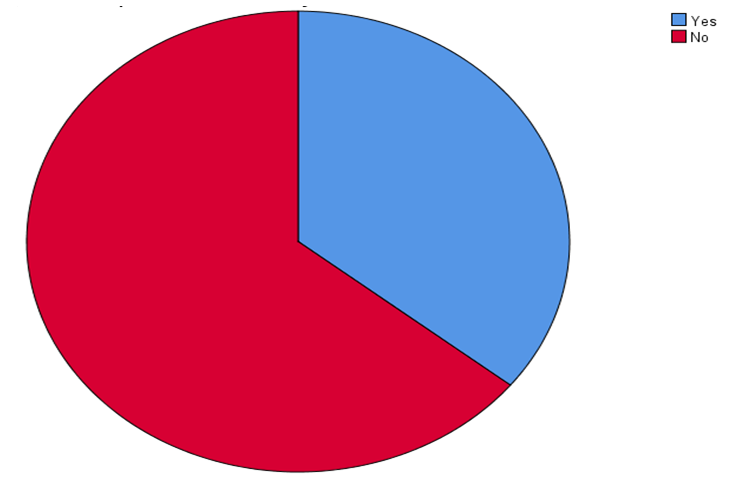

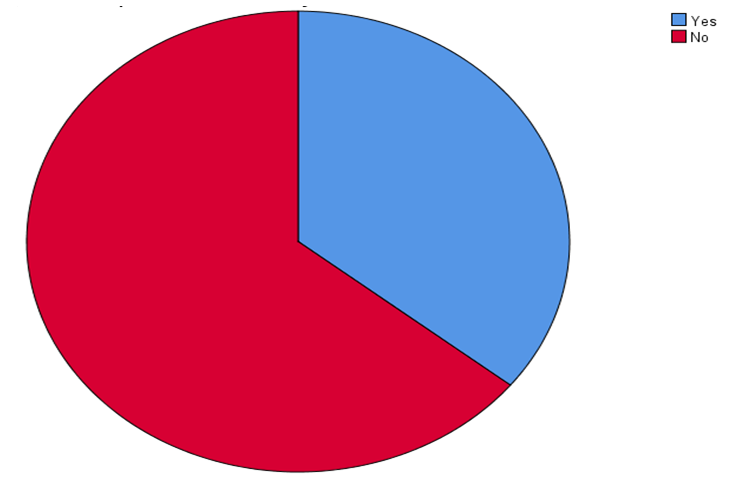

Figure 7 below gives an illustration of loan request by respondents from commercial banks or microfinance institutions in Sierra Leone. It illustrates that, 64.3%, which is the highest in the distribution, have never requested loan from any commercial bank or microfinance institution in Sierra Leone compared to 35.7% who have benefited from commercial loans from commercial banks and microfinance institutions in the country. This is an indication that there are challenges when it comes to the issue of access to commercial loans by Sierra Leoneans from different sectors of the economy but particularly so the informal sector who lacks the collateral security or guarantee to secure loan. | Figure 7. Loan Requests by Respondents from Commercial Banks or Microfinance Institutions in Sierra Leone (Source: Field Survey) |

Figure 8 below presents the perception of respondents on the contributions of commercial banks in promoting start-ups for SMEs to develop in Sierra Leone through loan facilities. It presents that, 42.9% of the employees interviewed are extremely familiar that commercial banks and microfinance institutions plays a very big role in promoting Small and Medium Enterprises (SMEs) through the provision of commercial loans. 28.6% of the respondents said that they were very familiar that commercial banks and microfinance institutions plays integral role in promoting SMEs compared to 7.1% who say they are not aware that commercial banks and microfinance institutions are essential in promoting SMEs in the country.  | Figure 8. The Contributions of Commercial Banks in Promoting Start-up for SMEs to Develop (Source: Field Survey) |

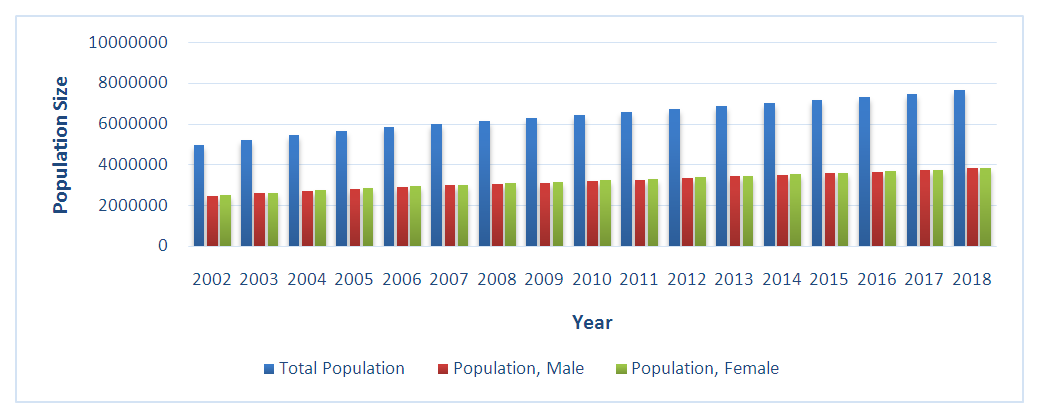

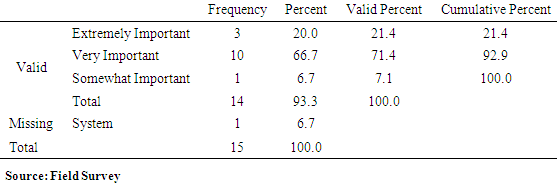

Data in Table 1 below shows that 66% of the respondents agreed that low lending real interest rate by commercial banks and microfinance institutions promotes Small and Medium Enterprises (SMEs) and other business enterprises in the country followed by 20% of the respondents who emphasized the relevance commercial banks and microfinance institutions play in promoting business growth in Sierra Leone. Table 1. The Impact of Low Lending Real Interest Rates by Commercial Banks and Microfinance Institutions in Promoting SMEs and Other Commercial Enterprises in Sierra Leone

|

| |

|

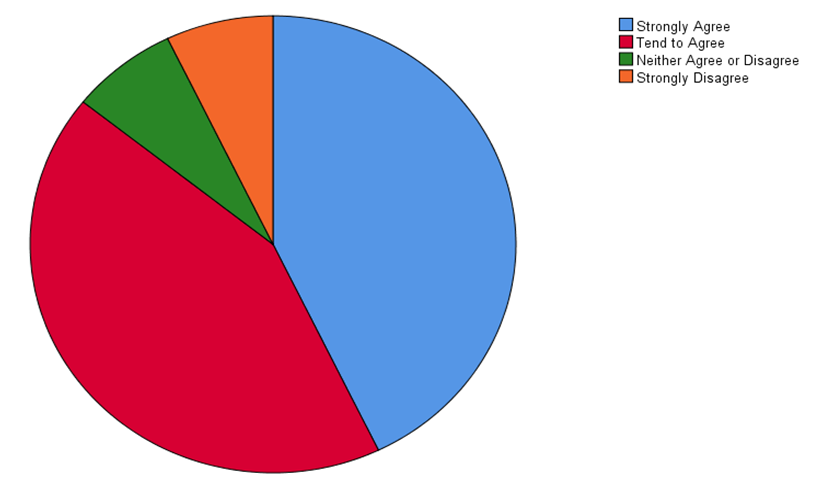

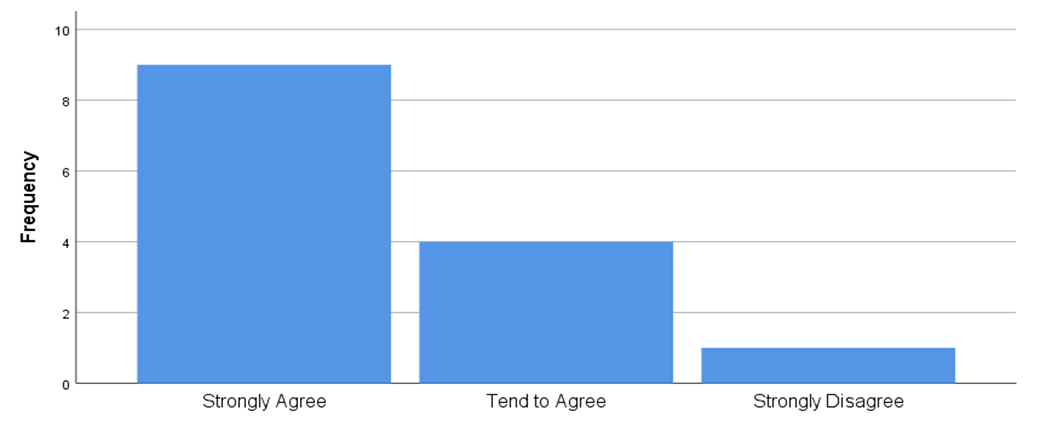

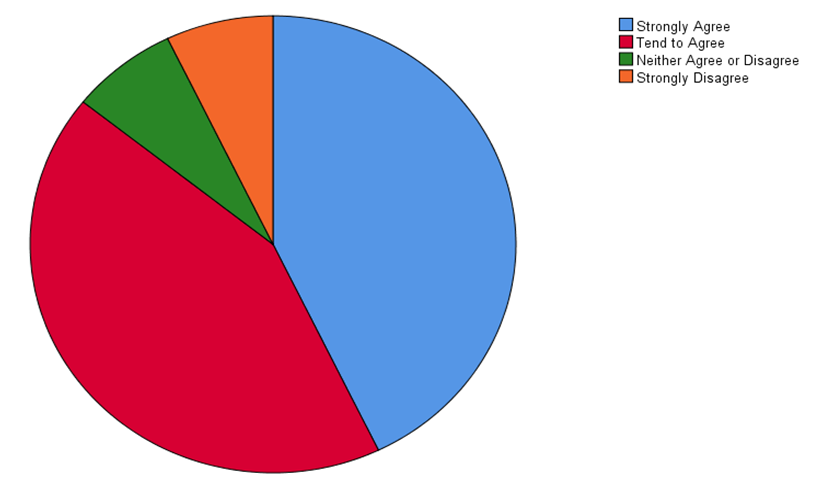

Figure 9 below presents data on respondents’ perception on the impact of high real interest rate on lending by commercial banks in Sierra Leone. It shows that, 42.9% of the respondents strongly agreed that high real interest rates on lending by commercial banks negatively affect the growth of business in the country as a good number of business people will be concentrating in servicing debts rather than the growth of their businesses. Equally, 42.9% of the respondents tend to agree that high real interest rate negatively affects the growth of businesses compared to 7.1% who strongly disagree in that respect.  | Figure 9. The Impact of High Real Interest Rates on Lending by Commercial Banks in Sierra Leone (Source: Field Survey) |

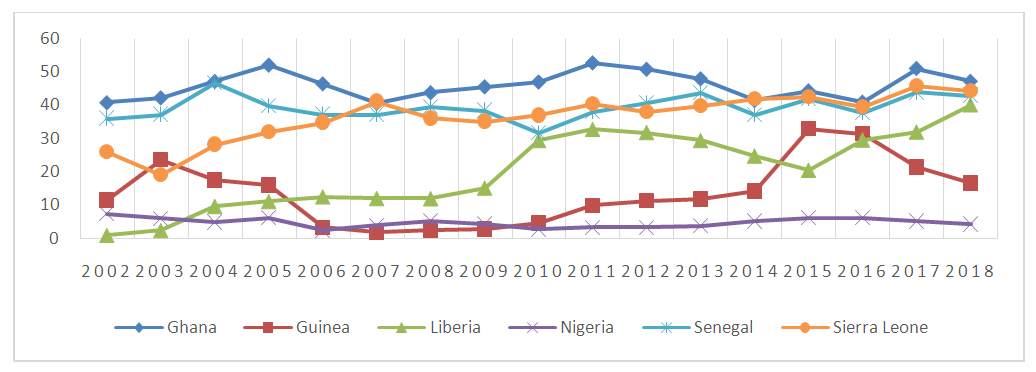

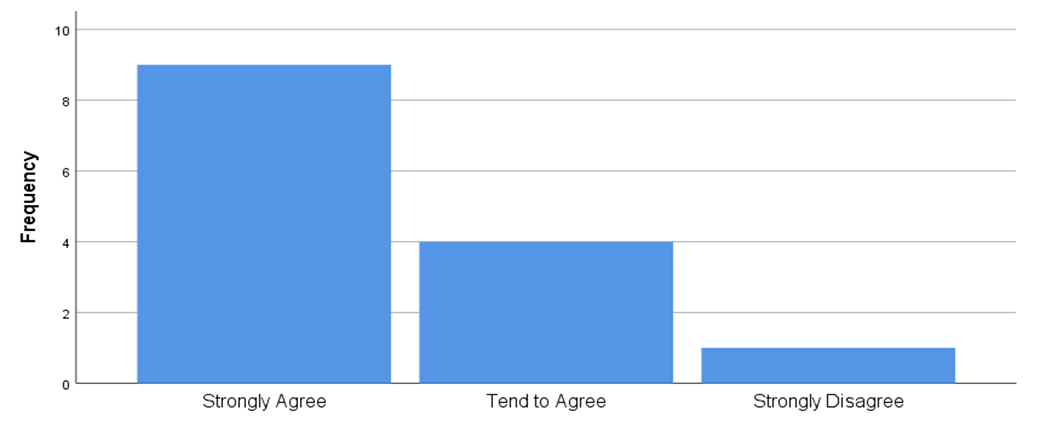

The data in Figure 10 below gives an indication of the negative effect of high lending interest rates on the economy of Sierra Leone. It indicates that, 71.4% of the respondents agreed that, high lending real interest rates does not only negatively affect businesses; it adversely affects the economy of the country. Thus when businesses are unable to service their loans or debts they either run bankrupt or shut down. The effects will be that these businesses will no longer pay their corporate taxes to government and the revenue streams of government will narrow down so also are its development programs because the government rely on revenue generated through taxes for most development programs and the provision of social services for its citizens. On the other hand, 28.6% of the respondents tend to agree that high real interest rates on lending has negative impacts on the economy of Sierra Leone compared to 71.4% who strongly agreed. | Figure 10. The Negative Effects of High Lending Interest Rates on the Economy of Sierra Leone (Source: Field Survey) |

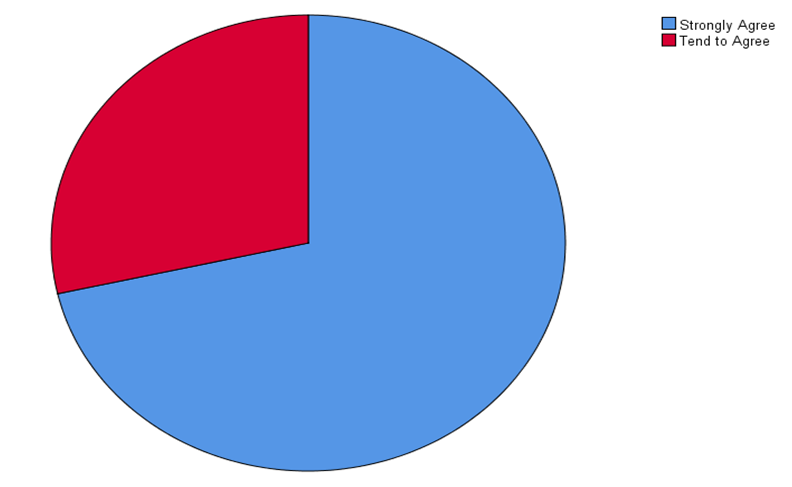

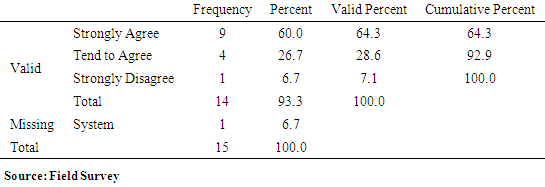

Table 2 and Figure 11 below illustrates the perception of respondents on the effect of high loan interest rates by commercial banks and microfinance institutions on businesses and investors who intend to invest in the country. The data in Table 4.1.8 and Figure 4.1.9 indicates that 64.3% of the respondents strongly agreed that high interest rates on loan with high inflation rate (real interest rate) negatively affects business and discourages investors who wish to do business in the country. The data also indicates that, 28.6% of the respondents tend to agree that high interest rates on loan discourages investors compared to 7.1% who strongly disagree with the effects of high loan interest rates on business and potential investors.Table 2. The Perceptions of Respondents on the Effects of High Loan Interest Rates on Businesses and Potential Foreign Investors in Sierra Leone

|

| |

|

| Figure 11. The Perceptions of Respondents on the Effect of High Lending Interest Rates on Businesses and Potential Investors in Sierra Leone (Source: Field Survey) |

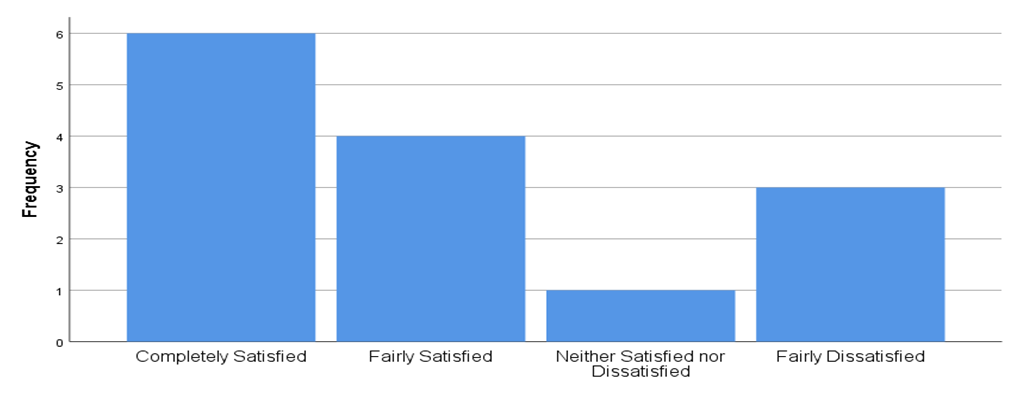

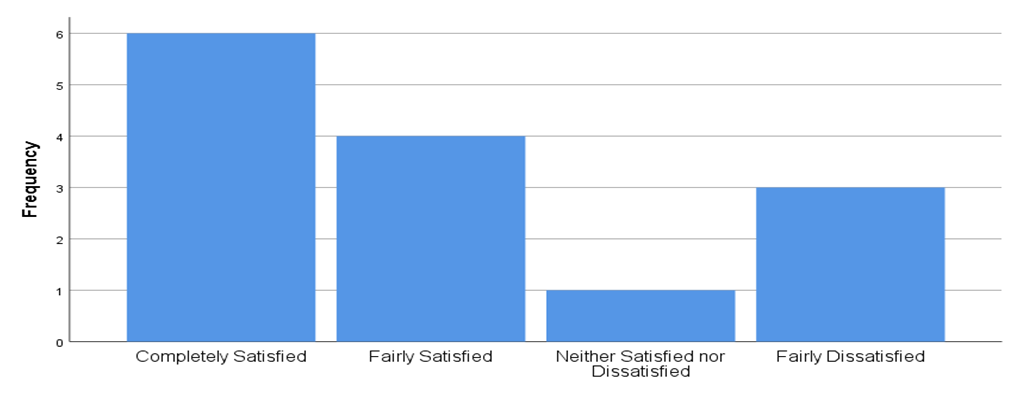

Figure 12 below gives an illustration of respondents’ views on the monitoring role of the central bank on commercial banks and microfinance institutions in Sierra Leone. It indicates that 42.9% of the respondents are completely satisfied with the monitoring role of the Central Bank on commercial banks and microfinance institutions in Sierra Leone. Besides, 28.6% of the respondents said that they were fairly satisfied with the monitoring role of the Central Bank compared to 21.4% who are fairly dissatisfied and 7.1% who are neither satisfied nor dissatisfied with the monitoring responsibilities of Central Bank over commercial banks and microfinance institutions in the country.  | Figure 12. Respondents' Views on the Monitoring Role of the Central on Commercial Banks and Microfinance Institutions in Sierra Leone (Source: Field Survey) |

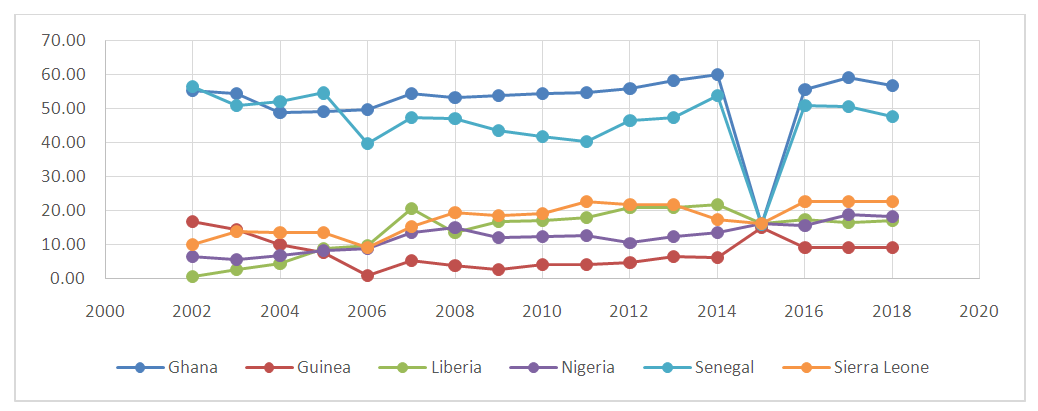

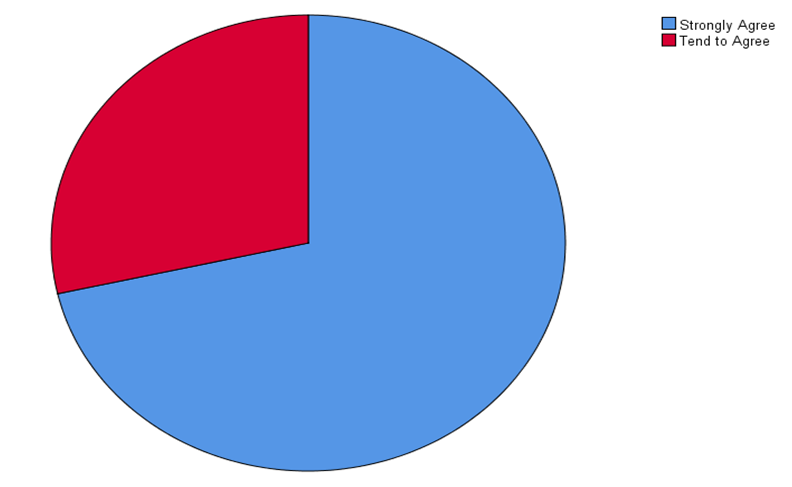

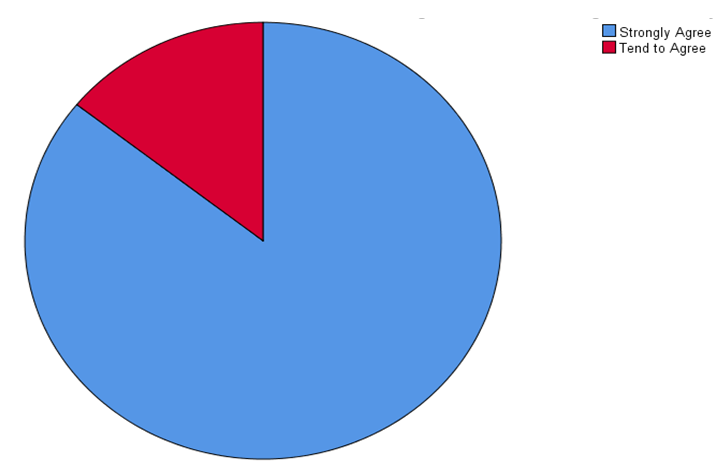

Figure 13 below gives an illustration of respondents’ views on the existing policy on the fixing of interest rates by commercial banks and micro finance institutions in Sierra Leone. It illustrates that 80% of the respondents strongly agreed that the Central Banks should review the existing policy on the fixing of interest rates by commercial banks and microfinance institutions in the country compared to 20% who tend to agree that the policy on the fixing on interest rates should be reviewed.  | Figure 13. Respondents' Views on the Existing Policy on the Fixing of Interest Rates by Commercial Banks and Microfinance Institutions in Sierra Leone (Source: Field Survey) |

4. Results

Below is a summary of the results based on the analysis above of the effect of high lending interest rates on SMEs from lenders’ perspectives in Sierra Leone.1. There is a negative effect of high lending interest rate in Sierra Leone due to the persistent high inflation rate in the country over the years. Therefore, SMEs are always disadvantage when they will have to service their debts because of high inflation. 2. Majority of Sierra Leoneans especially owners of SMEs find it very difficult to access loans from commercial banks and microfinance institutions. The access to loan requires collateral security which most of Sierra Leoneans do not have especially women that usually lack ownership to properties and SMEs that lack strong capital formation to request bigger amount of loan. However, 64.3% of the respondents interviewed says they have never got access to loan facilities compared to 35.7% who have accessed loans from various commercial banks and microfinance institutions in Sierra Leone.3. High lending interest rates (real interest rate) disadvantaged customers while low lending interest rates promotes businesses like SMEs that have very low profit or turnover. This is supported by 66% of the respondents interviewed who agreed that low interest rates promote business (SMEs) compared to 20% who are of the opposite view.4. High interest rates on loans also have an effect on the economy of Sierra Leone. Thus, with high lending interest rates, SMEs and other business enterprises finds it difficult to service their loans and most times goes bankrupt or fold up. When a good number of businesses fold up because of high interest rates on loan or ceteris paribus, the government will lose revenue from taxation (corporate tax) which will have a negative impact on the economy.

5. Discussion of Findings

The discussion is based on the results above which highlight interesting findings that touches on the effects of high interest rates on lending or borrowing from lenders’ perspectives in Sierra Leone. Obviously, there are negative effects of high interest rates on borrowing considering the state of the economy in terms of inflation levels and interest rate volatility. However, Small and Medium Enterprises (SMEs) that are the majority in the informal sector of the economy are the ones most affected especially when interest rates are fixed without given due consideration to future inflation rates (real interest rate) which will be disadvantageous to customers. Besides, this is the more reason why most of the loans have ended up being bad debts, although big corporate customers with good credit records have always been on prime interest rates and have serviced their debts. Access to finance or loans by the public and particularly small and Medium Enterprises (SMEs) from commercial banks is also another crucial issue that is discussed in this study. Most business owners in Sierra Leone are faced with the challenge of producing a collateral security, a requirement by commercial banks and microfinance institutions for loan request from interested borrowers. Women are the majority in SMEs and are the ones mostly faced with this challenge since in our culture it is difficult for a woman to own a property even legacies from parents in most instances are controlled by men. Consequently, the Central Bank has a fiduciary responsibility to use its monetary policy to regulate the fixing of interest rates by commercial banks and microfinance institutions in the country. Much as Commercial banks and microfinance institutions are given free hands to fix their interest rates on lending and deposits they should do taken into consideration their profitability and the welfare of businesses and the general economic growth of the country.

5.1. Policy Recommendations

The following are the recommendations based on the major findings of this study:1. To help commercial banks and microfinance institutions recover loans given to customers or Small and Medium Enterprises (SMEs), the charges or interest rates levied on loans should be reduced so that businesses like SMEs will be comfortable while paying such loans.2. The policy on the fixing of interest rates should be reviewed by the Central Bank to make the interest rates on loans more flexible and competitive.3. Since the Central Bank is the head lender (lender of last resort) of all commercial banks and microfinance institutions, it should vigorously monitor the traditional banking activities of all commercial banks and microfinance institutions. The Central Bank should also encourage them to limit their charges especially on Small and Medium Enterprises (SMEs) considering the rate of inflation (real interest rate) that will be disadvantageous to the SMEs who are in the majority in the informal sector of the economy.4. The Central Bank should through its monetary policy influence the fixing of interest rates by commercial banks and microfinance institutions by insisting on its reserve requirements as well as buying and selling risk free treasury and government securities to affect the deposits the commercial banks have at the Central Bank.5. The commercial Banks and Microfinance Institutions in fixing their loan or lending interest rates should consider the economic growth in terms Gross Domestic Product (GDP), inflation levels as well as interest rate instability in the country.

6. Conclusions

The Central Banks of most economies has a fiduciary responsibility to regulate the operations of commercial banks and other financial institutions. A Central bank ensures that its fiscal responsibilities of running the economy are upheld to ensure economic growth and the livelihood of the people. Therefore, as part of its responsibilities, a Central bank should ensure that interest rates on loan are flexible and payable to encourage business and discourage bad debts, which in turn has negative effects on commercial banks and microfinance institutions. Higher interest rates have a tendency to slow economic development. Higher interest rates upsurge the cost of lending, reduce disposable income as well as limit the high urge on consumer spending. Higher interest rates have a tendency to decrease inflationary burdens as well as cause an increase in the exchange rate. Consequently, Commercial banks and microfinance institutions should be encouraged to moderate their interest rates on loans to promote business especially SMEs that are in the majority in the informal sector of the economy.

References

| [1] | DR. TISA SILVER CANADY. (2020, May 5). How Interest Rate Cuts Affect Consumers. Investopidia, Paragraph 1. Retrieved October 28, 2020. |

| [2] | Amadeo, K. (2020, May 19). Effective Measurement of Economic Growth. The Balance, Paragh 1. Retrieved June 28, 2020. |

| [3] | Cecilia MAIGUA and Gekara MOUNI. (2016, April). Influence of Interest Rates Determinants on the Performance of Commercial Banks in Kenya. International Journal of Academic Research in Accounting, Finance and Management Sciences, 6(2), 1. Retrieved October 28, 2020. |

| [4] | Kevin L. Kliesen. (2010, October 1). Low Interest Rates Have Benefits ... and Costs. Federal Reserve Bank of St Louis, Paragraph 5. Retrieved October 28, 2020. |

| [5] | Njimanted, Godfrey Forgha et al. (2018). EFFECTS OF LENDING RELATIONSHIP ON THE INTEREST RATES OF COMMERCIAL BANKS IN CAMEROON. Asian Journal of Economic Modelling, 6(2), 208. Retrieved October 7, 2020. |

| [6] | Norhaziah Nawai and Mohd Noor Mohd Shariff. (2012, October 24). Factors Affecting Repayment Performance in Microfinance Programs in Malaysia. 62, 807. Retrieved October 7, 2020. |

| [7] | Stanley Sachikonye and Mabutho Sibanda. (2016). An Assessment of SMEs’ Financing by Commercial Banks in Zimbabwe. 12(6), 214. Retrieved October 23, 2020. |

| [8] | TAYLOR, M. P. (1999). REAL INTEREST RATES AND MACROECONOMIC ACTIVITY. Oxford Journal, 15(2), 110. Retrieved June 28, 2020. |

| [9] | Chikalipah, S. (2020). What influences microfinance lending interest rates in Sub-Saharan Africa?. Available at SSRN 3670240. |

| [10] | Bhattarai, Y. R. (2015). Determinants of lending interest rates of Nepalese commercial banks. Economic Journal of Development Issues, 39-59. |

| [11] | Santos, T. T. O. (2021). High Lending Interest Rates in Brazil: cost or concentration? Banco Central do Brasil. |

| [12] | Howorth, C., & Moro, A. (2012). Trustworthiness and interest rates: an empirical study of Italian SMEs. Small Business Economics, 39(1), 161-177. |

| [13] | Abrar, A. (2019). The impact of financial and social performance of microfinance institutions on lending interest rate: A cross-country evidence. Cogent Business & Management, 6(1), 1540072. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML