-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2021; 11(2): 57-63

doi:10.5923/j.economics.20211102.02

Received: Feb. 11, 2021; Accepted: Mar. 19, 2021; Published: Apr. 25, 2021

The Impact of COVID-19 Shocks on Firms’ Performance and Innovation Activities: A Case of Bahir Dar City, Ethiopia

Zenebech Admasu

School of Economics, Shanghai University, Shangda, Shanghai, China

Correspondence to: Zenebech Admasu , School of Economics, Shanghai University, Shangda, Shanghai, China.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study examines the impact of COVID-19 pandemic on the manufacturing firms’ business activities. It assesses the impact of the pandemic on manufacturing firms’ business performance and financial stress; it also points out the innovation activities during the pandemic period. It particularly investigates the impact of the pandemic on firms’ access to key intermediate inputs, product market outlet, employment dynamics, financial stress, and innovation activities. Important information related to this are gathered through telephone interviews with key people of listed manufacturing firms. List of firms was taken from the Amhara Trade and Investment Bureau, one of the country's regional states, the city of Bahir-Dar. From the survey result it has found that related to pandemic firms face difficulty in accessing key raw materials principally inputs from foreign sources which is partly related to travel restriction related to pandemic in importing countries, and other is foreign exchange rationing in banks to prioritize items important to fight the pandemic itself. Firms also report change employment plans and layoff temporary employees; face financial stress related to loan repayment and generally pandemic impacted the innovation activities.

Keywords: Manufacturing Firm, Business Performance, COVID-19

Cite this paper: Zenebech Admasu , The Impact of COVID-19 Shocks on Firms’ Performance and Innovation Activities: A Case of Bahir Dar City, Ethiopia, American Journal of Economics, Vol. 11 No. 2, 2021, pp. 57-63. doi: 10.5923/j.economics.20211102.02.

Article Outline

1. Introduction

- COVID-19 is a shock to the world's health and economy which becomes both a health and economic crisis. It puts the public life in danger and causes many socio-economic disruptions in many countries across the globe. The disruptions arise from the measures taken to contain the pandemic. Countries close borders, suspending flights, put a restriction on mobility and declare lockdowns; and some put trade restrictions. These measures obstruct the movement of people, limit social interaction among people, and disrupt global trade. In this globalized world where the movement of people and the interdependence among nations is quite large, the social and economic impacts of virus containment measures are expected to be huge. The world economy is slowing down as a result, and it is predicted to shrink by 3% and the global growth is projected at -4.9 percent in 2020 according to the International Monetary Fund [1]. According to WTO statistics, the volume of world merchandise trade contracted by 3.5% in the first quarter; and it contracted by 14.3% in volume and 21% in value in the second quarter amid global lockdown due to the global pandemic [2] and [3]. Looking into the global trade indicators, for example, container shipping, new export order, and air traffic volumes which experience a historic fall amid COVID-19 global pandemic outbreaks [3]. The service trade also hit hard by the outcome of the pandemic as transport and travel restrictions in many countries [4]. The global tourism and travel business: hotels, restaurants, tour operators, and travel agencies are among who bear hardest challenge from the crisis. The pandemic threatens many households globally not just health wise but as it also causes many to lose jobs, daily income, and become insecure. Workplace closures and reduction in hours work lead to loss in labor income around the world [5]. For instance; the job loss in Organization for Economic Cooperation and Development [OECD] countries is the worst job crisis since the 1930’s great depression; and unemployment is projected to reach 10% in these countries from 5.3% a year before the pandemic [6]. Lower-middle-income countries are also among the hardest hit and experience an estimated decline in working hours of 23.3 percent in the second quarter of 2020 [7]. The job loss is more severe in the export-oriented sector, sectors with many unskilled workers who don’t have the opportunity to work from their home, and workers in sectors which are most affected by the pandemic such as tourism [8,9] and women who work in Small and Medium Scale Enterprise [SMSE] particularly in the informal sector [10]; for instance, in Africa about 86% of total employment is informal [11]. African countries are among countries hit by the pandemic disruptions; they are challenged from both supply and demand shock of the pandemic. They experience lower demand for their exports and tourism; supply side disruptions along the value chain; lessen foreign direct investment, loss in government revenue, and fall in remittance flow, rise in cost of doing business, among others [12]. For instance, according to World Bank estimation, the remittance inflow in SSA is expected to drop by 23.1 percent which is the second large decline next to the inflow in Europe and Central Asia which is expected to decline by 27.5 percent) [13]. Besides, countries in Africa face contractions in imports which likely to distress their ability to generate output and meet their debt servicing commitments [14]. Hence, the Sub-Saharan African economy is also predicted to shrink by 1.6% in 2020 [15], 2020).

1.1. Response to COVID-19 in Sub Saharan Africa

- Countries in SSA respond to the pandemic individually and collectively as a continent. To respond effectively to this global shock, they implement various strategies to shield people and firms, and protect jobs and lives of the most vulnerable. They face the pressures on their budgets while responding to this unanticipated health, economic and social crisis. One of the strategies is relaxing the fiscal room to respond in fighting the pandemic. These require mobilizing the necessary finance from private business, individuals, and international multilateral organizations. Moreover, requesting suspension of debt servicing commitments to free up financial resources. SSA countries already call for international multilateral cooperation and assistance to protect the fragile economy and protect their development momentum. So far commitments and responses are secured from multilateral financial institutions such as the IMF (provide emergency credit facilities debt service relief), World Bank (emergency budget support and development policy lending), G20 including China (suspension of principal and interest rate payments), European Union (finance for health support) and African Development Bank Union (budget support) [16].

1.2. Response to COVID-19 Pandemic in Ethiopia

- Ethiopia is one of SSA countries and its first COVID-19 case was reported on March 13, 2020, the country closed inland borders, shut all schools and partially courts. The government also declared a five month state of emergency since April 8th, 2020 which allows the government to take more strict measures such as prohibit public gatherings, transportation capacity limit, ban lay off employees, wearing masks in public areas, suspending the trade licenses for those hoarding goods and price controls. Moreover, the government took fiscal and monetary policy measures in response to the pandemic. These include food distribution for the most vulnerable section of the society, tax debt and income tax forgiveness support for firms and protect employment; enhance the productive safety net programs for urban poor; spend to consolidate the health sector. Moreover, lifting of taxes on import of intermediate inputs used for the production of COVID -19 essential goods; and minimum price on exportable also lifted. Further, the central bank provided liquidity funds to banks [17]. Moreover, the country integrates the response in line with the ongoing nation’s economic reforms that aimed to curb the existing macroeconomic imbalance and increase the participation of the private sector, and thereby unlocking the development potential of the country.Apart from the government and multilateral institutions, the private sector responds to calls to fighting the pandemic and protecting lives. They respond by providing support both in cash and in kind to the National COVID Response Fund following the call from the government. Some others divert their lines of business and join the fight by producing health protective goods such as face masks and hand sanitizers [18].Firms in the manufacturing sector is also have own response in their own business, and the objective here is to assess the economic impact of the pandemic on the performance of manufacturing sector and their innovation practice in response to the pandemic using primary data from manufacturing enterprises in capital of Amhara Regional state, city of Bahir Dar. The study assesses the impact of the pandemic from pandemic outbreak in the country, to the next the 6 months which include the 14days city lockdown.Following the introduction section, section 2 outlines the data sources and questionnaire administration. Section 3 provides descriptive statistics of the manufacturing sector in the study area and analyzes the main results. Finally, section 4 provides final concluding remarks.

2. Data Source and Methods

- To examine the effects of the COVID-19 pandemic on various indicators of manufacturing sector businesses performance and to assess the innovation activities, interview questionnaires are designed that help to capture the impact on business performance and innovation practices. Data on manufacturing sector with detail information such as location, contact person with telephone number, year of establishment, form of organization, capital, size, employment level and so on are available at Amhara Regional State, Trade and Investment Bureau; and we take the list of firms operating in the capital of Amhara Regional State, Bahir-Dar. According to the Trade and Investment Bureau of the region, the manufacturing sector is broadly grouped into four sectors such as Textiles, Chemical and Construction Materials, Metals and Wood, and Agro Processing.Since this research focuses on the manufacturing firms located in the Bahir-Dar city and we learnt that most agro processing firms are located in other parts of the region; hence, we don’t consider the agro-processing sector in this survey research but we will study them when we continue our research. Telephone interview is administered on samples of manufacturing firms that are stratified based on size and production line (sector). In the city a total of 234 firms are registered and stratified based on size as small, medium and large enterprises; and also sector wise as textiles which include tannery, wood based, metal based, chemical based products, construction materials. We found small scale metal and wood manufactures don’t register with phone numbers hence 29 firms are excluded. We left with a total of 206 firms and we took 10 percent from each size of a given sector. Hence, a total of 65 firms selected and of which 5 of them were not interested or registered with wrong numbers hence we precede with 7 percent of non-response rate. Finally, 58 firms are surveyed and considered in this survey research.

3. Descriptive Statistics

3.1. Background of Study Area

- Bahir-Dar city is the capital of Amhara regional State which is located 576 km North West of the country’s capital, Addis Ababa. The city is the third largest city with an estimated population of 170,000; it is known for its recreational and tourist attraction sites such as Tis-Esat Fall and Lake Tana Island Monasteries. Lake Tana is the largest lake in Ethiopia which is located at the heart of the regional state. Bahir Dar city is the main political and economic hub of the Amhara regional state. The city was in a complete lockdown for 14 days following one case was reported in the city and two cases in another town within the regional state while 25 cases were reported at national level on March 31, 2020.

3.2. Composition of Manufacturing Sector

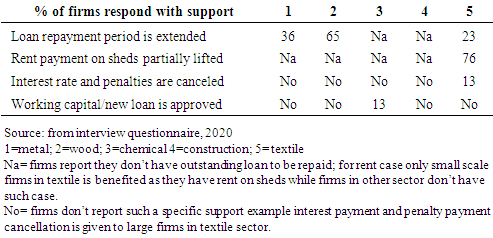

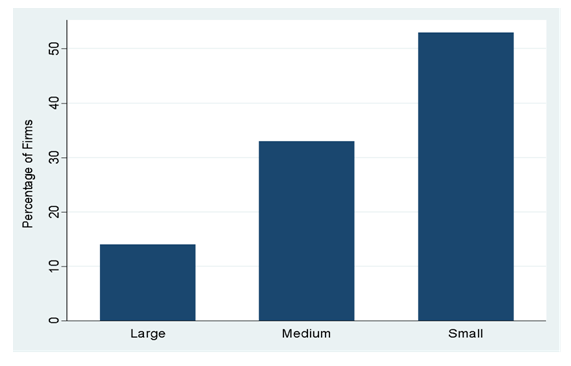

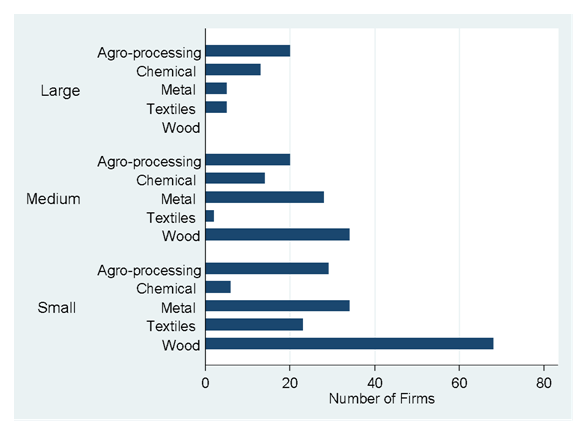

- The classification of manufacturing enterprises into small, medium and large scale is according to Ethiopian Central Statistical Agency (CSA) and Federal Micro and Small Enterprise Development Agency (FeMSEDA) depends on a number of factors such as level of employment, sales turnover, capital investment, production capacity, level of technology and subsector. According to the Amhara Industry and Investment Bureau, manufacturing firms are categorized as small, medium and large by the following criteria. Manufacturing firm categorized as small scale when firms employ from 6-30 people and with capital of 100, 001-1,500,000 birr excluding value of buildings; manufacturing firms categorized under medium manufacturing if firms employ 31-100 people and have capital of 1,500,001 up to 20,000,000 birr; and manufacturing firm categorized as large scale manufacturing when they employ more than 100 people and with capital of 20,000,000 and above. The composition of sector and size is presented in the figure 1, 2, and 3. The majority of manufacturing firms are small which is 53 percent and followed by medium 33 percent, and large firms constitute 14 percent of total manufacturing; that is medium and large firms together constitute (47 percent) of total manufacturing. Figure 1 displays this composition in proportion.

| Figure 1. Firm distribution by their size (Source: Own computation based on Industry and Investment Bureau, 2020.) |

| Figure 2. Distribution of firms across sectors (Source: Own computation based on Industry and Investment Bureau, 2020.) |

| Figure 3. Distribution of firms by sector and size (Source: own computation based on Industry and Investment Bureau, 2020.) |

4. Findings

4.1. Impact of COVID-19 Pandemic on Manufacturing Firms

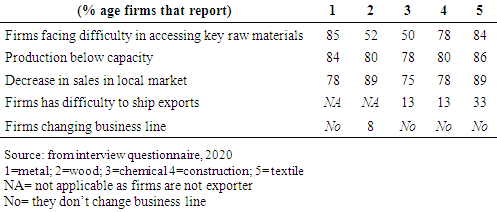

- The objective of this study is to assess the impact of COVID-19 pandemic on manufacturing firm business activities and particularly on innovation activities. Based on a sample survey of manufacturing firms located in the Bahir-Dar city of various sectors, we identify the impact of the COVID-19 pandemic, over the last 6 month from March to August 2020, on firms’ business performance and particularly on innovation activities. The survey was conducted during September 2020. Almost all firms report that they have difficulty in accessing key raw materials, especially inputs from foreign sources; and small sized firms also report the same but due to travel restrictions elsewhere and relatively high cases of pandemic in the capital. Most of foreign input suppliers mainly from China and input importing are affected due to COVID-19 which affects the production of pre-ordered inputs, especially immediately after the outbreak of the pandemic. In relation to this, firms report that the price of imported raw materials are revised upwards and shipment to home also took longer than usually expected partly because shipment of these inputs is not large enough to get into nearby ports. Firms generally report that the price of raw materials are increased than before and some importers of key raw materials offer it at higher price and this affects manufacturing firms also to revise their product price in response which again results in loss in customers. Firms also report foreign exchange shortage and rationing affects their important imports. Table 1 summarizes survey responses on how pandemic impacts business. It presents the proportion of firms in each sector report they have impacted given certain business indicators. Moreover, a detailed explanation is given how the impact varies by firm size within a sector. Numbers 1 up to 5 at the head of the table represent manufacturing sectors as 1=metal; 2=wood; 3=chemical 4=construction; 5= textile.For instance, about 85 percent of metal manufacturing are affected by the high price of metal materials already available in the home market, and direct importers of these raw materials also face foreign exchange shortage as the government prioritizes the foreign exchange service for urgently needed items such as COVID-19 fighting and protective measures medical.

|

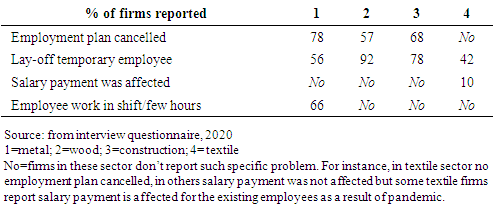

4.2. Impact of Pandemic on Firm’s Employment

- The manufacturing firms employ both permanent and temporary employees. Firms in wood and metal manufacturing report that they have cancelled their planned employment and employee promotions since low production and market demand for their product. Most firms also lay off their temporary employees, and some provide up to two month salary a head and terminate employment contract while other firms make them work in shifts for a few hours. Some other firms which retain permanent employees but they face difficulty to pay salary and they sadly postpone monthly salary for the next month for instance firms in textile sector; whereas other firms in textiles with good demand for their products retain workers implement safety measures to meet local orders for their product but they give annual leave for high risk works such as pregnant women, workers with chronic diseases and older ages. Table 2 presents the proportion of firms responding to employee and employment situations in each sector.

|

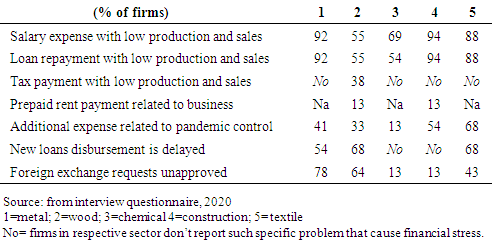

4.3. Firms Financial Stress Related to Pandemic

- Firms report the impact of the pandemic in terms of financial stress as production and sales are slowed down while they keep their workers and other recurrent expenses. Table 3 presents the proportion of firms and the financial stress they face aggregated in sector wise. Firms keep permanent employees even with low production and sales because of the government's order under decree of state of emergency and partly because they don’t want to lose the trained workers. Hence, they report that their financial stress is mainly related to employee salary mainly in metal (92%) construction materials (94%) and textiles (88%). Most firms reported that during the last 6 month expenses are higher than revenue. Some firms also reported interest rates are being calculated and taxes are enforced. 68% of small scale textile firms repaid previous loans loan and waiting for new loan to be approved but the process has been delayed due to pandemic. Table 3 presents the proportion of firms respond to a certain financial aspect firm is facing stress.

|

|

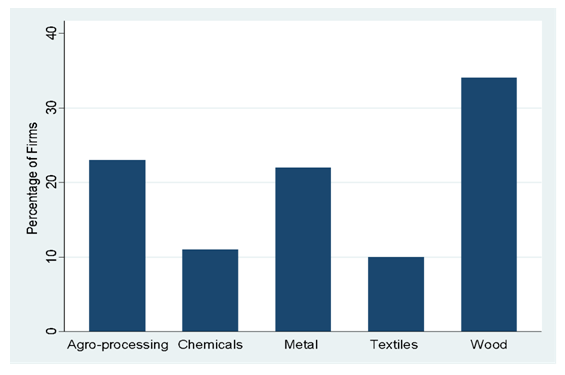

4.4. Institutional Support

- Most firms in the region have working premises at free or at a small lease rate from the government as incentive to promote investment in the region in line with the national investment commission directive. Firms were asked whether they have received any institutional support from banks, non-bank financial institutions and government related to the impact of the pandemic. Most report they don’t get any support related to pandemic but some report they have received some sort of support. The support include extending the loan repayment period up to 6 month for instance for the case of medium scale wood based manufacturers, and rent payment on sheds are partially lifted, up to 50 percent of rent reduction for 6 month for the case of small scale textiles, and accumulated interest and penalties are written off for large scale textiles. Moreover, new working capital is released for firms producing COVID-19 essentials. Table 5 presents the proportion of firms received institutional support aggregated by sector.

|

5. Conclusions

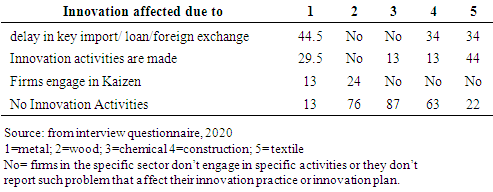

- The impact of COVID-19 pandemic on small, medium, and large scale manufacturing firms couldn’t be something we ignore. To assess the impact of the pandemic, a sample of a manufactured firm located in Bahir-Dar is surveyed through telephone interviews with key personnel in the firm. The survey was designed to solicit important business information which could be affected by the pandemic. Business information such as access to raw materials, cost of production and sales; firms employment; firms financial stress such as loan repayment, salary expense and rent expense; innovation activities; institutional support related to pandemic. Firms of different sizes (Small, Medium, and Large) and from different sectors (Textiles, Wood, Metal, Chemical and Construction Materials) are incorporated. Based on a survey sample of 56 firms and taking key indicators, we assess the impact of the pandemic. From our survey result we found that related to pandemic most of firms face difficulty in accessing key raw materials principally inputs from foreign sources which is partly related to travel restriction related to pandemic in importing countries, and other is foreign exchange shortage and rationing in banks to prioritize items important to fight the pandemic itself. Firms produce far below their capacity and sales become minimal except few firms' production line matches with COVID-19 essentials. Exporter firms report that they halt shipping their exports to the rest of the world as lockdowns and transportation restrictions in addition to demand cuts. Firms also report that they canceled employment promotion and new employment plans as production and sales are declined. They layoff temporary employees; firms retain employees who are challenged related to salary payment. Firms also face financial stress related to loan repayment. The pandemic also affects the innovation activities of firms which is mainly related to difficulty in accessing key inputs and planned product improvement activities, except few firms’ report they engage in product improvement activities. Regarding institutional support firms report no business support except some in wood based medium scale firms report they have received notice on extension of loan repayment period and small scale textiles report they benefited from partially lifted rent payment on sheds. Therefore, in order to survive, firms need to design outputs relevant to pandemic prevention such as chemical and textiles and other market oriented products. Moreover, firms need to use technologies and engage themselves in innovation activities to easily reach customers and access inputs. The government also shall give attention and facilitate importing of key raw materials as well as exporting to encourage firms to keep firms on track. These will help firms to retain employees as well as upgrade their manufacturing to the next higher level. Safety measures and guidelines should be implemented in each workstation and sale spots. Government also continues engaging in infrastructural development programs hence stimulating the activities of the manufacturing sector and helping them to revive. Government also shall analyze the status of firms further and special attention is required in small sized firms and recommends them to the financial institutions where they can access capital to mitigate the consequences of the pandemic.

ACKNOWLEDGEMENTs

- I’m thankful to the Amhara Industry and Investment Bureau for providing list of firms and their data with contact information. I also acknowledge respected interviewees for response and cooperation.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML