-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2021; 11(1): 36-48

doi:10.5923/j.economics.20211101.05

Received: Dec. 31, 2020; Accepted: Feb. 5, 2021; Published: Feb. 26, 2021

External Financing Inflow, Growth, and Trade in the Gambia and Nigeria

Akeem Shoaga, Chukwuemeka Amaefule, Igwe Justice Ibeabuchi, Ibekwe Manfred A.

Department of Economics, University of Port Harcourt, Nigeria

Correspondence to: Chukwuemeka Amaefule, Department of Economics, University of Port Harcourt, Nigeria.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper examined the dynamic impact of external financing inflows on growth and trade in The Gambia and Nigeria. External Financing Inflow is proxy by Foreign Direct Investment Inflow (FDII), Official Development Assistance Inflow (ODAI), and Inflow loans from World Bank (IBRDI). Similarly, growth is proxy by Real Gross Domestic Product (RGDP), and trade is decomposed into trade percentage of Gross Domestic Product (TRD), multilateral trade (MLT), and trade robustness (TRB). Time series data obtained from World Development Indicators for the period covering 1970-2017 were employed for this study. We adopted a Non-Linear Autoregressive Distributed Lag framework pioneered by Shin et al (2011). The study found a mixed impact of external financing inflows on selected macroeconomic in the Gambia and Nigeria. Specifically, (i) the study found that FDII inflows positively impact RGDP in the Gambia and negatively impact RGDP in Nigeria, (ii) the sign of the impact of ODA inflow (ODAI) on RGDP in the Gambia and Nigeria are similar, (iii) FDI inflow into the Gambia and Nigeria has negative impact on TRD (iv) ODA inflow (ODAI) impact on TRD is negative in the Gambia and mixed in Nigeria, (v) dynamical nature of FDI Inflow (FDII) in The Gambia and Nigeria has a positive impact on MLT in both countries, (vi) the impact of ODAI on MLT is negative in Nigeria and mixed in Gambia (vii) on TRB in the Gambia and Nigeria, FDII negatively impact TRB in the Gambia and positively impact TRB in Nigeria. Lastly, ODA inflow into the Gambia generates a negative impact on TRB and a mixed impact on TRB in Nigeria.

Keywords: External financing, Nonlinear ARDL, Growth, and Trade

Cite this paper: Akeem Shoaga, Chukwuemeka Amaefule, Igwe Justice Ibeabuchi, Ibekwe Manfred A., External Financing Inflow, Growth, and Trade in the Gambia and Nigeria, American Journal of Economics, Vol. 11 No. 1, 2021, pp. 36-48. doi: 10.5923/j.economics.20211101.05.

Article Outline

1. Introduction

- The interdependence of the global economy and the signs of a global recession portends that the global economies are not insulated from the disruption in economic activities caused by lockdown shock as a result of COVID-19 pandemic (IMF, 2020). According to the World Investment Report, the health-related shock e.g., COVID-19 presently ravaging global economies has disrupted global reinvestment earning (UNCTAD, 2020). What is the nature of external financing inflows into The Gambia and Nigeria economies? How would trade and growth respond in the Gambia and Nigeria due to changes in external financing inflows? Globally, external financing inflow is an important revenue-source component for development for low-income countries e.g., The Gambia, and low-middle-income countries e.g., Nigeria. However, the external financing that flows into developing economies depends on the structure, magnitude, and size of global reinvested earnings. Sadly, the losses in global reinvested earnings in wake of COVID-19 pandemic have stirred interest in the dynamical impact of fluctuation in external financing inflow (a major determinate of global reinvested earnings) on developing economies a case study of the Gambia and Nigeria.Additionally, an important area to consider, which has motivated this study is the direction of trade in the Gambia and Nigeria. From the direction of trade statistics, Gambia’s export free on board (fob) rose from 0.7 in 2012 to 0.9 in 2014 and dropped to 1.0 in 2017. Similarly, import cost, insurance, and freight (cif) grew from 0.1 in 2012 to 0.2 in 2017 (IMF, 2018). For Nigeria, export (fob) grew from 20.8 in 2012 to 27.0 in 2014 and dropped to 20.0 in 2017. Also, import (cif) in Nigeria grew from 28.5 in 2012 to 20.8 in 2017 (IMF, 2018). Subsequently, it is therefore imperative to assert whether the dynamical external financing is responsible for these changes in trade values in The Gambia and in Nigeria? It is on this basis; the study tries to seek answers to the dynamic impact of external financing on growth and trade in the Gambia and Nigeria.Overtime, the vexed interests on the impact of external financing on both the recipient and the donor economies exist without a non-linear examination. Several studies have focused on the impact of global external financing on the economic behaviour of global economies. The studies on the impact of external financing as a critical component of economic growth and development include viz; external financing: hurts growth (Gourinchas and Obstfeld, 2012); slows productivity (Reis, 2013), and improves growth (McKinnon and Shaw, 1973). On the disaggregated level, Foreign Direct Investment (FDI) and growth have a mixed relationship viz FDI hurt growth (Carkovic & Levine, 2002; Agbanike 2012), FDI, and growth relationship (Moyo, 2013) and FDI crowd out domestic investment (Agosin and Mayer, 2000). Studies on Official Development Assistant (ODA) on the economy could be understood from the positions that ODA has linked with the Dutch Disease argument (Nkusu, 2004); ODA, and growth relationship (Moyo, 2011). Nevertheless, the debates on the impact of external financing inflows on the recipient’s economic outlook are inconclusive. The findings of previous studies are robust and divergent. Based on the current economic shock caused by COVID-19 pandemic (health-related shock) and the associated lockdown. With the recent happenings, revisiting the foregoing debate viz-a-viz on the global imperativeness of external financing is apt for emerging and developing economies. Information from the dynamical impacts of external financing on developing economies e.g., The Gambia and Nigeria, would provide a springboard to explore the effectiveness of globalization policy (economic openness) on the character and dimension of economic activities in the Gambia and Nigeria economies. It is in furtherance to the inevitability of external financing inflows on the development needs of The Gambia and Nigeria that this paper considers an evaluation of the impacts of positive (increase) external financing (exogenous) inflows and negative (decrease) external financing on growth and trade performances in The Gambia and Nigeria. This is because the comparative-dynamical impacts of external financing inflows on the growth and trade in the Gambia and Nigeria remain silent. The findings of how dynamical external financing impact macroeconomic behaviour in The Gambia and Nigeria would richly improve the debates surrounding the global imperativeness of external financing in developing economies. This gap explains the exigency of this study. The Gambia and Nigeria are members of the West African Monetary Zone (WAMZ), in broad frontier members of the Economic Community of West African State (ECOWAS), nevertheless the global income classification. It is imperative to assess the impact of FDI inflow and ODA inflow on WAMZ. This is because the region seeks to achieve trade and growth inclusiveness and regional trade growth in its Macroeconomic Convergence Criteria and in its African Free Trade Continental Agreement (AfTCA). Thus, this study significantly connects with the policy strategy (pillar III) of WAMZ’s Banjul Action Plan (BAP) of 2009. Pillar III of BAP focuses on global financial integration with an aim towards leverage on financial intermediation which in turn would strengthen markets fundamental through the process of risk-sharing and diversification of capital. The impact of external financing on the economic outlook of The Gambia and Nigeria would provide a purview of how exposed the region is to globalization. This paper meets the evolving global debate on the healthiness and responsiveness of developing countries to globalization policy. More so, major concern on globalization policy has squarely focused with how developing countries perform under the dynamical environment of external financing. Hence, the question whether external finance inflow improves trade and growth in the Gambia and Nigeria. This paper aims to foster a robust understanding of the dynamical impact of external financing inflows on growth and trade amongst selected West African Monetary Zone (WAMZ) countries, e.g. The Gambia and Nigeria. This examination, in turn, would deepen the discourse on the role of external financing as an integral component of capital account liberalization policy and globalization. External financing in terms of Foreign Direct Investment (FDI) inflow, Official Development Assistant (ODA) inflow, International Bank for Reconstruction and Development (IBRD) and International Development Assistance credits (IDA) inflows, remittances, foreign portfolio investment inflows, external borrowing, etc play a critical role in the development policy of developing economies. To account for the impacts of dynamic changes in external financing on economic behaviour in the Gambia and Nigeria, we attempted an assumption that only FDI inflow and ODA inflow are two important external financing variables. The Gambia and Nigeria are performing economies in WAMZ in terms of macroeconomic convergence criteria, notwithstanding the perceived limitations in the two economies. The leadership position of Nigeria and the Gambia would be leveraged to investigate how external financing impacts growth and trade in WAMZ. Therefore, the motivating question adduced for this paper becomes, does FDI inflow and ODA inflow hurts growth and trade in The Gambia and Nigeria? The focus of this paper is to empirically investigate the impact of increase (decrease) in FDI inflow and increase (decrease) in ODA inflow on growth, on trade (% of GDP), on multilateral trade, and trade robustness (openness) in The Gambia and Nigeria. This paper is divided into the following sections namely viz; I. Introduction, II. Literature Review, III. Method, IV. Analytical framework, V. Results Discussion, VI. Conclusion, VII. Limitation of the Study.

2. Literature Review

- Romer (1986) and Lucas (1988) in endogenous theories posit that openness affects growth. Also, Romer (1994), Grossman and Helpman (1991), and Barro and Sala-i-martin (1995) provides a robust argument on the empirical significance that economic openness generates development. We based our analytical framework on endogenous growth theory (see Romer, 1994).Amaefule, Onuchuku, Kalu & Shoaga (2019) found in the NARDL framework that ODA does not have a long-run impact on trade. The study found a negative impact of both an increase in ODA inflows and a decrease in ODA inflows on trade size in WAMZ. Thus, ODA does not matter to cause long-run trade growth in The Gambia, Ghana, Nigeria, and Sierra Leone. The result implies that dependence on ODA inflows could distort trade volume. And ODA inflows do not reduce trade cost in WAMZ, which in turn could reduce the capacity of WAMZ to benefit from the African Continental Free Trade Agreement (ACFTA) and Aid for Trade (AfT). Sedai (2019) in a study of why so serious about foreign capital, the study found a strong casualty FDI equity flows and a weak and lagged causality between short-term capital flows and economic growth. In the short term, there exists bi-directional causality in growth and equity flows.Combes et al (2017) the study examined the impact of capital inflows on growth and real exchange rate on developing economies. The study adopted GMM. The study found that (i) a 1 percent increase in total net capital inflows appreciates the real exchange rate by 0.5 percent; (ii) the real exchange rate appreciation effect of remittances is twice as big as the effect of aid, and ten times bigger than the effect of FDI; (iii) overall, capital inflows are associated with higher economic growth after netting out the negative impact of real exchange rate appreciation. Doubling capital inflows per capita would increase growth by about 50 percent, resulting in a gain of roughly 2 additional percentage points on top of the 3.7 percent annual growth rate observed within the sample over the period 1980-2012. Igan, Kutan & Mirzaei (2016) in a study of the real effect of capital inflows in 22 emerging markets found that capital inflow generated faster disproportionate growth in the pre-crisis period of 1998-2007. They conclude that a stable financial system is required for an emerging market to harness the growth benefits of capital inflows. Mileva (2008) this study employed a dynamic panel technique. The study found that FDI has a spillover effect and portfolio flows into transition economies have no effect on capital formation. In this partial adjustment setup, capital flows can have contemporaneous and long-term effects on investment.To deepen the study initiated by Igan, Kutan, and Mirzaei (2016), we adopted Shin, Yu, and Greenwood-Nimmo’s (2011) asymmetric cointegration framework. We expanded on Igan, Kutan, and Mirzaei (2016) by investigating how dynamical external financing inflows impact growth and trade in selected countries in West Africa e.g., in the Gambia and Nigeria.

3. Method

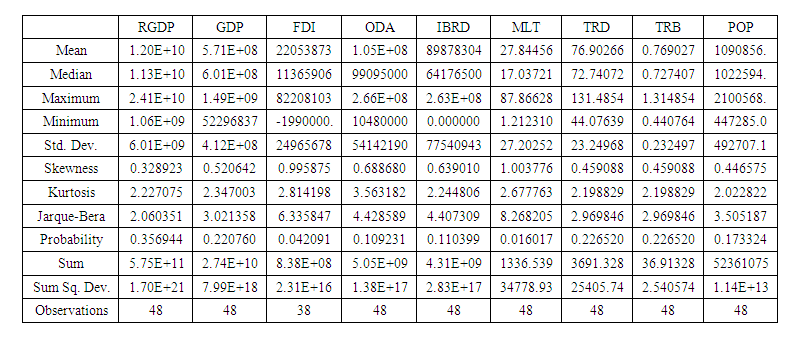

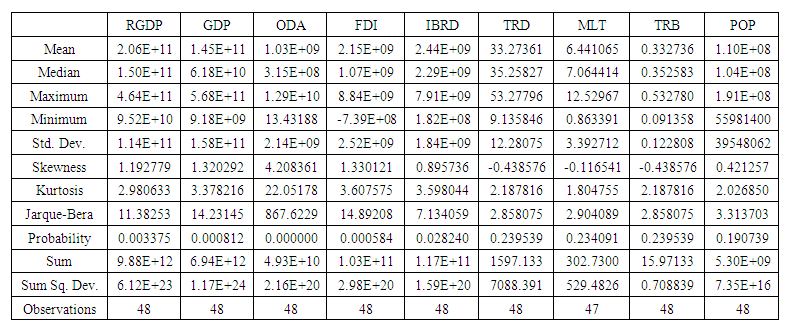

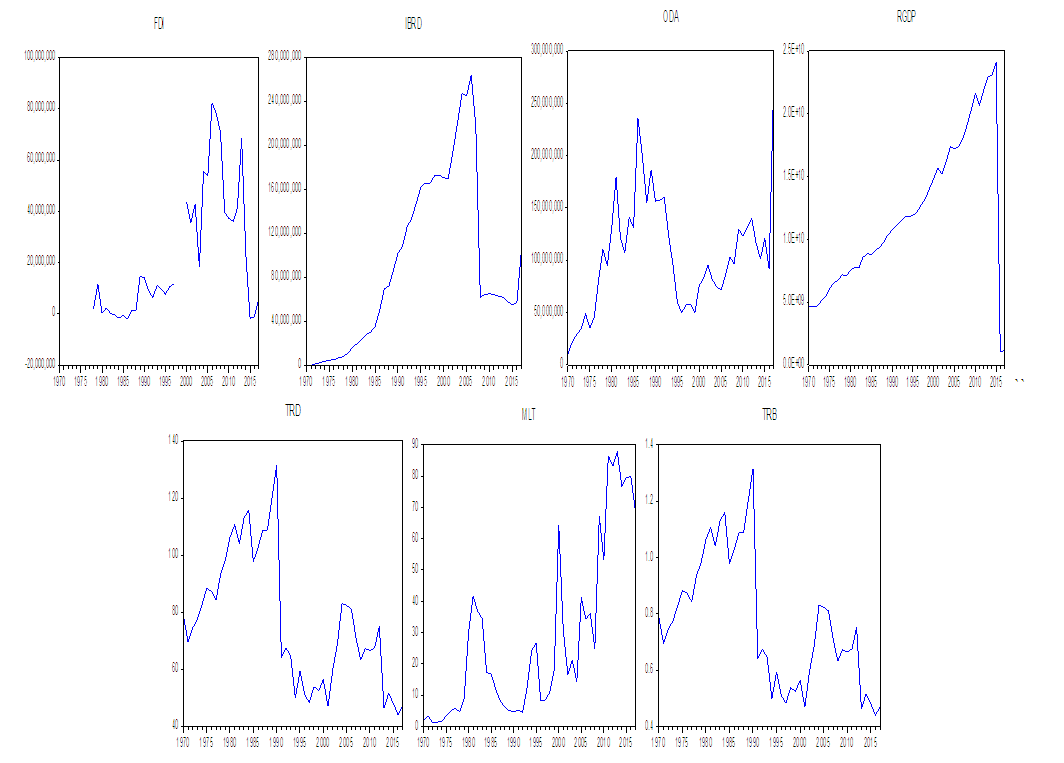

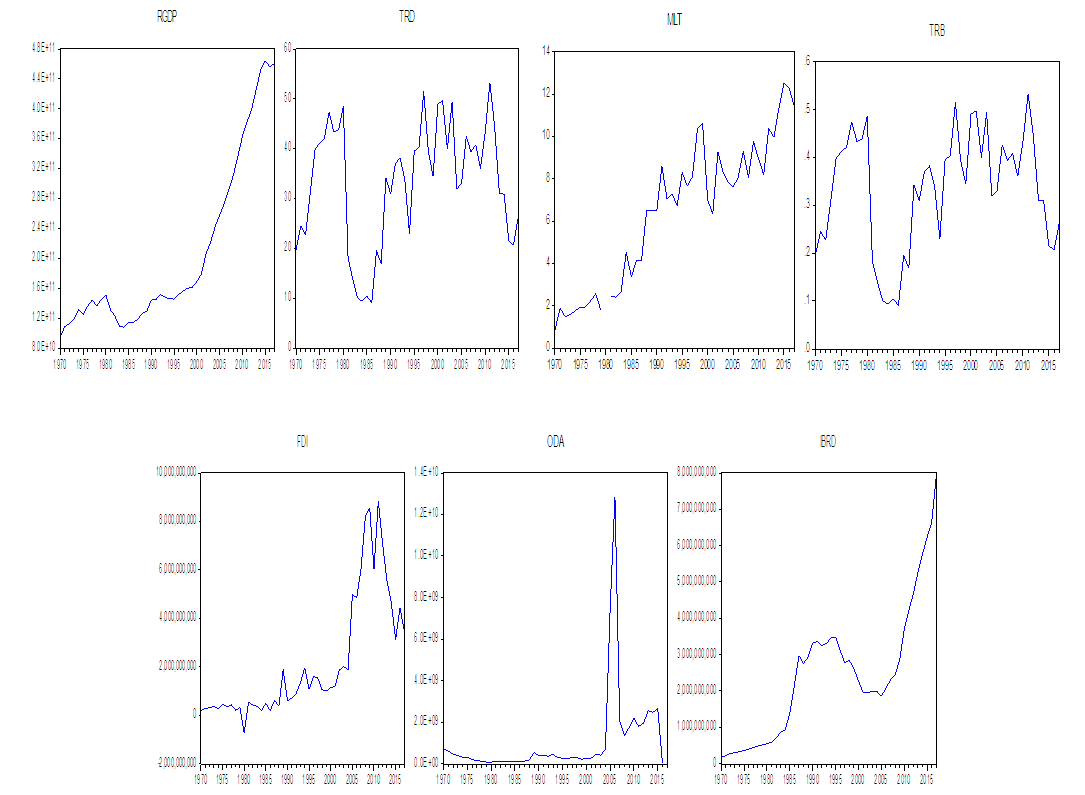

- This study employed an ex post facto research design. The hypotheses for this study from the foregoing analyses are (i) Dynamical external financing (exogenous inflows) improve growth in The Gambia and Nigeria, (ii) Dynamical external financing (exogenous inflows) improve trade in the Gambia and Nigeria. The research design would enable the researchers to conduct a control experiment on the impact of regressors (external financing) on the regressands (growth and trade) whereby some factors are held constant. Ex post facto research design provides us with a template to investigate the hypothesis for this study.This study is purely a time series of secondary data analysis. We adopted a quasi-experimental design. In line, with the research design, we empirically examined the dynamical impact of external financing on growth and trade outcomes in The Gambia and Nigeria. We employed a controlled experiment whereby other factors that account for dynamic changes in external financing on growth and trade in The Gambia and Nigeria are held constant. The basic significance of this study is to determine the impact of the dynamical effect of external financing proxy by FDI inflow and ODA inflow on growth and trade in the Gambia and Nigeria. External financing inflows into the Gambia and Nigeria has been observed to be dynamic. Hence to fill the existing gap in the literature which has focused on explicit external financing in this study we estimate the impact of increase and the impact of a decrease of external financing. It is imperative to explore these dynamic changes in external financing in FDI inflow and ODA inflow on growth and trade in the Gambia and Nigeria. In fact, every economy is essentially part of the global economy. Efforts to investigate how developing economies perform in the global economy would suffice to improve the global economy. To undertake this empirical task, we adopted Nonlinear Autoregressive distributed Lag (NARDL). The justification for utilizing NARDL is that NARDL provides robust instrumentation in measuring and estimating the impact of the dynamical changes in the regressors on the regressands. NARDL is preferable to Autoregressive Distributed lag (ARDL) in that the latter does not account for the dynamical changes in the explanatory. ARDL is a one-way dynamical model while NARDL is a two-dimensional tool applied to evaluate the impact of increase and decrease of external financing. It is understandable from this point that NARDL is suitable to evaluate exogenous inflows because of its unstable nature.Additionally, the time series data sourced from World Development Indicators were primarily used for this study for the period covering from 1970-2017. For data analysis, we conducted a descriptive statistic (see appendix) and trend analyses (see figures) for The Gambia and Nigeria. We found that the trend analysis is the first test to ascertain the non-stationary of the data set, hence the justification to conduct a unit root test. The presence of trends in the figures below is the rationale for conducting the ADF unit root test to avoid issues of spurious and misleading results. The graphical result below is the visual representation of variables for the Gambia and Nigeria.

| Figure 1. Trend Analysis in the GAMBIA (Source: Eviews) |

| Figure 2. Trend Analysis in Nigeria (Source: Eviews 9) |

4. Analytical Framework

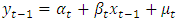

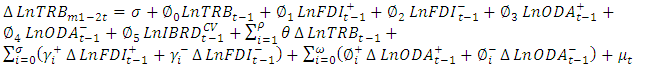

- Given a simple dynamic two-gap model depicting a functional relationship between growth (trade)

and external finance inflow variable

and external finance inflow variable  of the form

of the form | (1) |

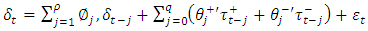

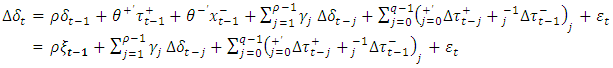

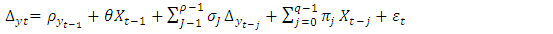

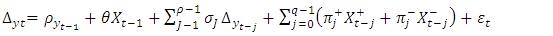

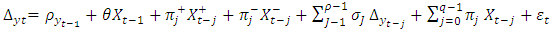

measures the external finance elasticity of the growth (trade) in which based on the two-gap model takes a positive magnitude. The nexus becomes that any perceptible increase in external finance inflow impacts positively on growth (trade). To capture the impact of the dynamic behaviour of external finance inflow simultaneously on growth, we adopt the Non-linear ARDL model developed by Shin et al (2011). Non-linear Autoregressive Distributed Lag Model (NARDL) captures the asymmetric effects of positive and negative changes in the explanatory variables on the dependent variables, hence permit the application of non-linear model. Unlike, the ARDL techniques the impact of the explanatory variables is the same and has a linear functional relationship in the model. However, the ARDL provides the analytical background for NARDL as given in Pesaran and Shin (1998).Thus, given the Pesaran and Shin (1998) ARDL, Nonlinear ARDL (p,q) model is therefore established as

measures the external finance elasticity of the growth (trade) in which based on the two-gap model takes a positive magnitude. The nexus becomes that any perceptible increase in external finance inflow impacts positively on growth (trade). To capture the impact of the dynamic behaviour of external finance inflow simultaneously on growth, we adopt the Non-linear ARDL model developed by Shin et al (2011). Non-linear Autoregressive Distributed Lag Model (NARDL) captures the asymmetric effects of positive and negative changes in the explanatory variables on the dependent variables, hence permit the application of non-linear model. Unlike, the ARDL techniques the impact of the explanatory variables is the same and has a linear functional relationship in the model. However, the ARDL provides the analytical background for NARDL as given in Pesaran and Shin (1998).Thus, given the Pesaran and Shin (1998) ARDL, Nonlinear ARDL (p,q) model is therefore established as  | (2) |

| (3) |

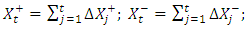

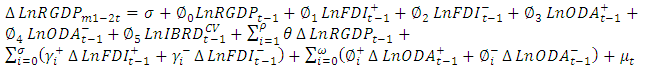

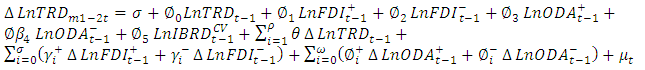

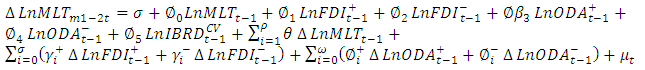

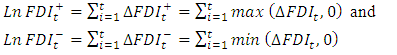

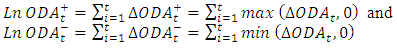

and

and  and implying partial changes in the explanatory variable (inflow). Under the NARDL

and implying partial changes in the explanatory variable (inflow). Under the NARDL  denoting external financing inflow is defined as

denoting external financing inflow is defined as  | (4) |

| (5) |

| (6) |

| (7) |

| (8) |

| (9) |

| (10) |

| (11) |

| (12) |

| (13) |

| (14) |

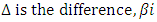

account for slope coefficient,

account for slope coefficient,  speed of convergences,

speed of convergences,  represents regressors,

represents regressors,  captures dummy variables in intercept, and

captures dummy variables in intercept, and  regressand (dependent variable), FDI = foreign direct investment, IBRD = International bank for reconstruction and development, ODA = official development assistance, GDP = gross domestic product, TRD = trade size, MLT = multilateral trade, TRB = trade robustness. m1 = Gambia, m2 = Nigeria.

regressand (dependent variable), FDI = foreign direct investment, IBRD = International bank for reconstruction and development, ODA = official development assistance, GDP = gross domestic product, TRD = trade size, MLT = multilateral trade, TRB = trade robustness. m1 = Gambia, m2 = Nigeria.5. Results Discussion

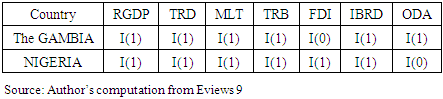

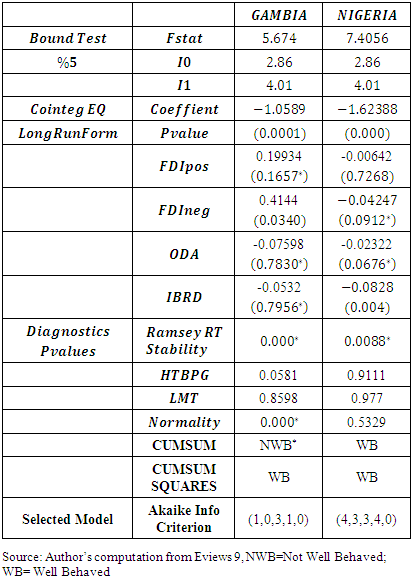

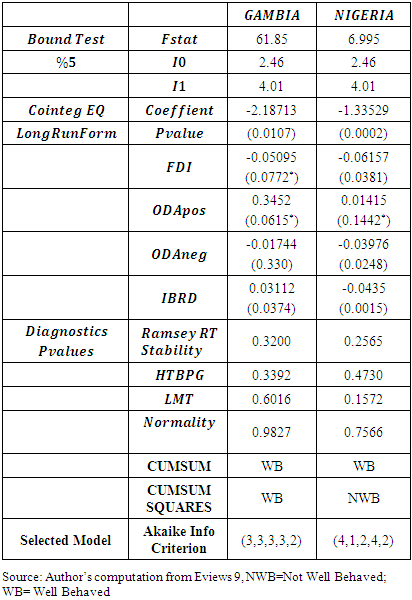

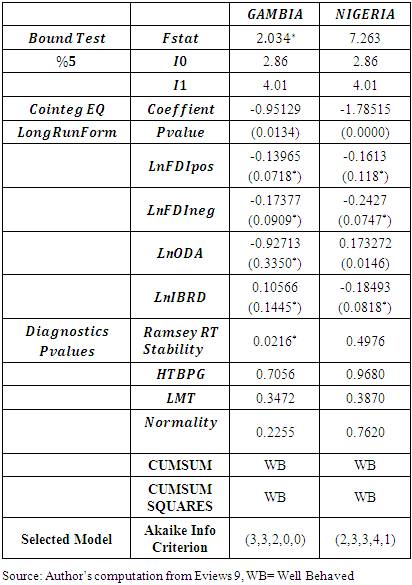

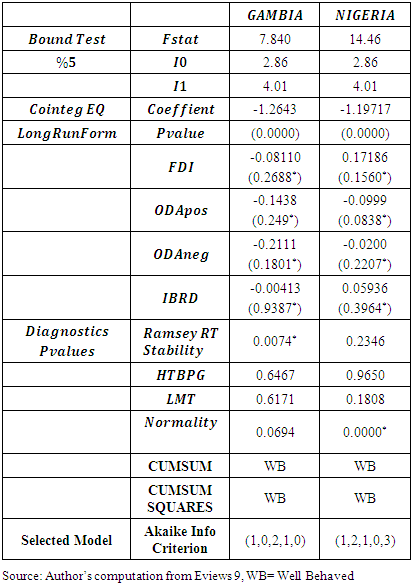

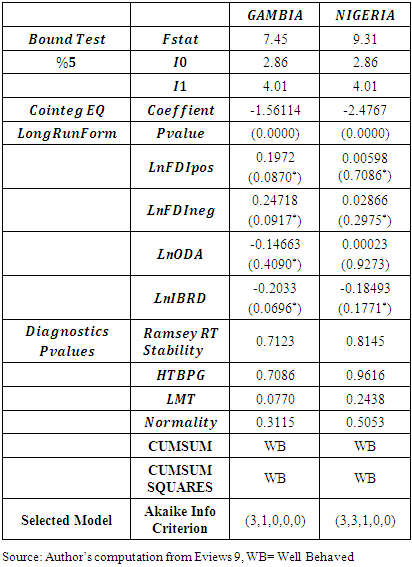

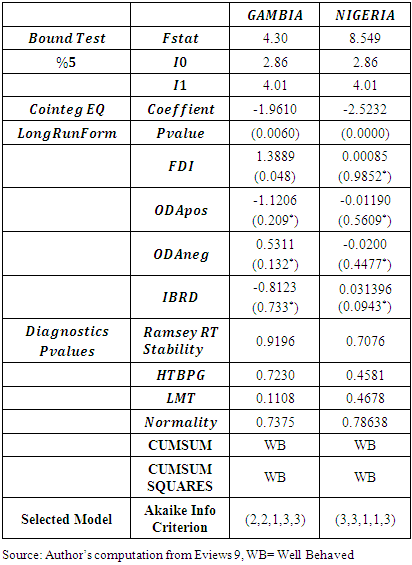

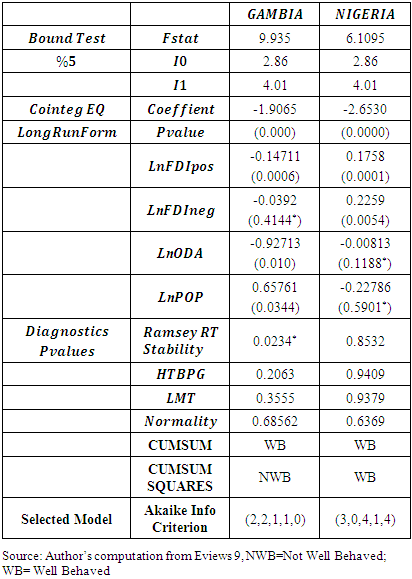

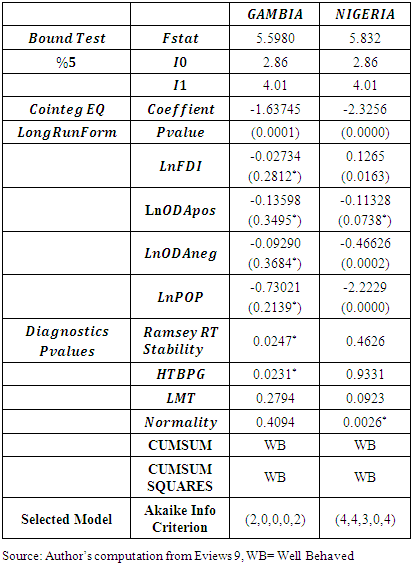

- It is pertinent to restate the two fundamental research questions were proposed in this paper. 1. What is the nature of external financing inflows into the Gambia and Nigeria economies? 2. How would trade and growth values in the Gambia and Nigeria respond to the dynamism in external financing inflows? Based on the nature of the trend illustrated in Fig 1 and Fig 2 above, we were able to establish a dynamic pattern of external financing inflows into the Gambia and Nigeria economies. From Fig. 1, FDI inflow into the Gambia depicts missing data. However, the study adjusted the trend through the interpolation method. Table 1 was conducted to determine the extent of stationarity in the data whether it is suitable for empirical analysis. For clarity, each model has dual effects based on FDI inflow and ODA inflow. So, therefore, Table 2-9 illustrates the NARDL output showing the asymmetric impact of FDI inflow and ODA inflow on Real GDP, TRD % GDP, MLT, and TRB. In order words, the results justify the rationale for eight tables presented in the paper. Based on the graphical results in the foregoing section, the ADF unit root test was conducted on time series data obtained from World Development Indicators for The Gambia and Nigeria. Table 1 illustrates that the data were stationary at level I(0) and at the first difference I(1). Thus, the time-series data are suitable for empirical analyses after differencing.

|

|

|

|

|

|

|

|

|

6. Conclusions

- From the findings, we can state that dynamical changes in external financing affect growth and trade in The Gambia and Nigeria. This further implies that Nigeria and The Gambia are susceptible to the impact of COVID-19. Specifically, through the changes in the structure and magnitude of external financing. COVID-19 generally disrupted economic trends in emerging economies through its impact on global reinvested earnings (a major component of external financing (exogenous inflows). Based on the result we can infer that in the long-run COVID-19 could disrupt domestic investment through a decline in external financing and labour participation through social distancing that in turn cause shocks that would lead to a decline in productivity, GDP, and trade hence recession in The Gambia and Nigeria. The study, therefore, concludes that The Gambia and Nigeria are susceptible to global fluctuation in external financing (external financing inflows) and global reinvested earnings. Thus, fiscal tightening and expansionary monetary policy are needed to insulate the developing economies from dynamical changes inherent of the global economy as such as experienced due to COVID-19 (heath-economic shock) of 2020 and unpredictable plummeting global oil price (supply) in the long-run. Thus, it is important to recognize that this paper, carried out the post-diagnostic adjustment process by adjusting the models to recognize structural breaks in the Gambia and Nigeria. After the process, the results were well behaved and normality outcome satisfactory stable and efficient (see table 2, table 3, and table 8).

7. Limitation of the Study

- This paper did not consider asymmetric cumulative shocks of external financing inflows on growth and trade called the dynamic multiplier effects of a unit change in

which exist due to adjustment dynamism in the NARDL framework (p,q). Also, the time range, 1970-2017 did not fully capture the COVID-19 period of 2020. The idea of the COVID-19 was conceptualized and introduced in this paper to motivate the study, as well as denote the inevitability of global shock that causes dynamical movement of external finance inflows. In fact, the dynamical movement necessitated the credence to the choice for NARDL over the ARDL framework. We adjusted the missing data in the FDI inflow values for the Gambia. This adjustment might have some effect on the outcome of the result for the Gambia ceteris paribus. Due to the presence of heterogeneity, this result cannot be generalized as true for other WAMZ and developing economies. The result is a pointer to the impact of external financing inflows on developing economies taking into account the trade and growth responses in the Gambia and Nigeria.

which exist due to adjustment dynamism in the NARDL framework (p,q). Also, the time range, 1970-2017 did not fully capture the COVID-19 period of 2020. The idea of the COVID-19 was conceptualized and introduced in this paper to motivate the study, as well as denote the inevitability of global shock that causes dynamical movement of external finance inflows. In fact, the dynamical movement necessitated the credence to the choice for NARDL over the ARDL framework. We adjusted the missing data in the FDI inflow values for the Gambia. This adjustment might have some effect on the outcome of the result for the Gambia ceteris paribus. Due to the presence of heterogeneity, this result cannot be generalized as true for other WAMZ and developing economies. The result is a pointer to the impact of external financing inflows on developing economies taking into account the trade and growth responses in the Gambia and Nigeria.  Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML