-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2021; 11(1): 10-18

doi:10.5923/j.economics.20211101.02

Received: Dec. 14, 2020; Accepted: Dec. 31, 2020; Published: Jan. 25, 2021

Military Expenditure and Economic Growth: Evidence from Nigeria

Laniran Temitope J.1, Ajala Olayinka2

1Centre for Petroleum, Energy Economics & Law, University of Ibadan, Nigeria, and Institute of Development Studies, Brighton, U.K.

2University of York, U.K.

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The impact of military expenditure on economic growth has continued to be a subject of debate in the literature. In several African countries, military expenditure has been on the increase in the last few decades making it imperative to explore the impact of military expenditure on the growth of the economy. This study investigates the relationship between military expenditure and economic growth in Nigeria using annual time series data from 1981 – 2017. In achieving this objective, the study adopted a simple growth model that incorporates military expenditure as a share of government expenditure for the period of study. The autoregressive distributed lag (ARDL) estimation technique was used in testing the relationship between the variables in the model. The result of the study shows that there is a significant positive long-run relationship between military expenditure and economic growth.

Keywords: Military expenditure, Defense, Military industry, Security, Government spending

Cite this paper: Laniran Temitope J., Ajala Olayinka, Military Expenditure and Economic Growth: Evidence from Nigeria, American Journal of Economics, Vol. 11 No. 1, 2021, pp. 10-18. doi: 10.5923/j.economics.20211101.02.

Article Outline

1. Introduction

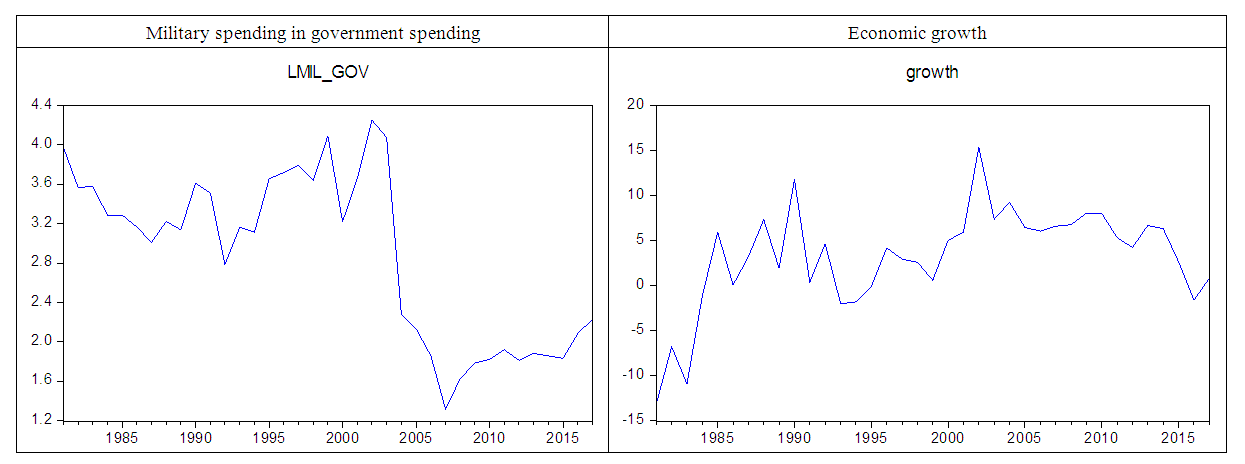

- The relationship between military expenditure and economic growth is a major debate in the development literature. There is evidence that a significant fraction of the fiscal provision of developing economies is expended on the military at the expense of other social needs (Khalid and Mustapha, 2014). The main motivation for testing the relationship between military expenditure and economic growth is to enable policymakers judge the economic impact of the government expending their scarce resources and revenue for military and defense purposes. Military expenditure can affect an economy positively through an expansion of aggregate demand or through increased security or negatively through crowding out of investment (Enimola and Akoko, 2011). The levels of fiscal provision for the various sectors of the economy have varied implications for them. A disproportionately large military expenditure would usually be at the cost of social service provision and also impact on other critical sectors of the economy that require significant fiscal provisions. For instance, on the one hand, a disproportionate military expenditure impedes economic efficiency, although it is important to highlight the importance of stability for economic development (Deger and Sen, 1995; Pieroni 2009). On the other hand, authors such as Benoit (1978) and Alptekun and Levine (2012) provide evidence that military spending can accelerate economic growth in less developed countries (LDCs). The debate has therefore centred around whether or not military expenditure has a positive impact on economic growth.Using annual time-series data for Nigeria from 1981 – 2017, this article explores the impact of military expenditure on economic growth in a developing country. The case of Nigeria is significant due to a steady increase in the country’s military expenditure in the last decade as well as the country’s position as a regional power. The country has at almost every point in time continued to be plagued with different security challenges such as a Boko Haram insurgency in the North-Eastern part of the country, unrest in the Niger Delta (the oil-producing region of the country) as well as other issues such as kidnapping, armed banditry and clashes between herdsmen and farmers in several states of the country (Ajala 2018 and Abbass, 2012). These issues have contributed to the rise in military expenditure in Nigeria in more recent times. The choice of Nigeria is premised on the unique dynamism in the trend of its military spending as a fraction of aggregate government spending. Nigeria had in previous years maintained high military spending as a fraction of aggregate government spending ranging from 20 to above 50 per cent from the 1980s through to the early 2000s, however, by mid-2000s after the country had begun consolidating on its return to civilian rule there was a sharp drop to below 10 per cent of aggregate government expenditure (see figure 1 below).

| Figure 1. Trend of Military Spending in Government Spending and Economic Growth in Nigeria |

2. Theoretical Framework

- Theoretically, the relationship between military expenditure and economic growth has mainly been debated along three strands. The first strand highlights how military expenditure stimulates economic growth through security, technological and aggregate demand effect. In this Keynesian type submission, defense expenditure is viewed as an integral part of government expenditure which serves as an injection to the economy, and as such through its multiplier effect, positively stimulates the economy. The increase in any of the aggregate demand variables will increase the capital stock in the society, which will lead to higher profit and may induce higher investment, thus generating short-run multiplier effects and higher growth rates on the aggregate economy. Benoit (1973, 1978) argued that with an increase in military expenditure, economic growth can be promoted by increasing human capital capabilities of the workforce through the provision of education and the military industries can provide valuable skill. There are also externalities in defense spending that are crucial to economic growth like the provision of road infrastructure which can be used by both the military and civilians (Barro and Sala-i-Martin 1995).Proponents of this strand posit that military expenditure helps in stabilizing a country both internally and externally as well as provides much-needed infrastructures such as road and communication infrastructures needed for military operations, but, also critical for economic activities. More importantly, they posit that countries can benefit from spillover effects of investments in research and development (R&D) in the military industry, bearing in mind the well-established R&D-Growth relationship within the economic growth literature. According to Yakovlev (2012), military R&D can result in the development of new technology such as radar, jet engine, nuclear technology which could spill over for economic development and eventually economic growth. Leading proponents of this strand include (Benoit, 1973; 1978; and MacNair et al., 1995). Critics of this perspective have, however, often argued that military expenditure could channel human and monetary resources away from civilian research and development activities (Levine and Renant, 1992). Defense spending may also crowd out not only private investment but other government spending that could stimulate human capital formation (Shieh et at, 2002). Given that the government sector is prone to low productivity, the diversion of resources away from civilian to military purposes may impede long term country productivity, technological projects and growth (Enimola and Akoko, 2011). The second strand argues that military expenditure hinders economic growth through its private investment crowding out effect. This framework posits that increased military expenditure uses up scarce revenue from taxpayers which could have been used for other socio-economic purposes such as health and education services. In achieving its other non-military obligations, the government would tend to increase the tax burden, incur deficit or a combination of both thereby frustrating savings and private investment. Leading proponents of this strand include (Deger and Smith, 1983 and Huang and Mintz, 1990). Using a case study of Turkey and utilising the Granger causality test to analyze the direction of the causal relationship between the variables, Gokmenoglu et al (2015) argue that military expenditure hinders economic growth. The authors argue that two main reasons explain the lack of equivalent economic growth in the country as military expenditure increases. First, in a developing country with limited resources, military spending is constrained by low income and growth and extra military spending hinders economic growth. Second, when a country is a net arm importer as in the case of Turkey, military expenditures will be financed by scarce resources and foreign exchange reserves putting additional economic stress on the country (Gokmenoglu et al, 2015). The third strand argues that there is a lack of a significant relationship between military expenditure and economic growth. The proponents argue that both the positive spillover effect and negative crowding-out effect are vague and ambiguous at best. Leading proponents of this strand include (Biswas and Ram, 1986; Alexander, 1990 and Adams et al., 1991). The lack of consensus on the nature of the relationship between military expenditure and economic growth as well as the variations in interpretations of empirical findings have often been linked to country and study-specific contexts such as methodology and techniques employed. Quite a lot of existing empirical evidence have utilized cross-sectional and panel data set (Yildirim et.al, 2005; Chang et.al, 2011 and Hou and Chen, 2013). Because, socio-economic and security challenges of countries vary, it is almost impossible to expect the same impact of military expenditure on economic growth across the board. This, therefore, provides justification for country-specific studies using time-series data such as this, which focuses on Nigeria using annual data from 1981 – 2017 based on data availability. According to Ram (1995), the examination of the relationship between military expenditure and economic growth within country-specific contexts provides findings with higher explanatory powers. Overall, while some studies have argued that military expenditure stimulates economic growth through security, technological and aggregate demand effect, a second strand have argued that military expenditure hinders economic growth through its private investment crowding out effect and a third strand have argued that there is a lack of a significant relationship between military expenditure and economic growth claiming that both the positive spill-over effect and negative crowding-out effect are vague and ambiguous at best. Pivotal to the observable divergence in the three strands is the choice of methodology and approach used. For instance, Sala-i-Martin et al. (2004) considered 67 variables, including the initial share of military spending, as possible determinants of growth for 1960 – 1996 in a cross-section of 88 countries. Using Bayesian averaging, they found 18 variables that appear significant, with a posterior inclusion probability of better than 10%. The share of military spending ranks 45, with a probability of 2.1%. Dunne et.al (2005) posits that there are many similar findings. They however, argued that on the contrary, many papers in the defense economics literature have found military expenditure to be a significant determinant of growth. The difference seems to come largely from the use of different models. In defense economics, the Feder–Ram model is quite widely used, on the other hand in the economic growth literature variants of the Solow growth model is widely used. In a recent defence-growth literature survey, Dunne and Tian (2013) found that out of the about 168 studies conducted since the seminal study of Benoit (1973), military spending had negative effects on economic growth in 44% of cross-country studies and 31% of case studies. Only 20% of studies found positive results, while about 40% reported mixed and unclear results. On the one hand, time series studies such as Karagol and Palaz (2004) using a cointegration framework found a long-run equilibrium relationship between GNP and defense expenditures in Turkey, although, the long-run coefficients suggest that defense expenditures can reduce growth through a crowding-out effect on investment which could have had other alternative uses. Shabaz et.al (2013) using the ARDL cointegration framework found a similar relationship for Pakistan. On the other hand, studies such as Wijeweera and Webb (2009) found a positive relationship between military spending and economic growth albeit minimal when compared to non-military spending in Sri Lanka. Tiwari and Shahbaz (2013) using the ARDL cointegration framework for India found a positive relationship between defense spending and economic growth. Dunne et.al (2005) presents a robust critical review on the various models and channels through which the military expenditure and economic growth relationship could be examined. They argued that the ambiguity in the mainstream growth literature on the role of military expenditure is a function of specification challenges. They suggested two alternative theoretical approaches; the Augmented Solow and the Barro models, which they suggested provides a more promising avenue for future research.For this study, we adapted existing theoretical framework for investigating the relationship between military spending and economic growth which is a Barro (1990) type model as put forward by D’Agostino et.al, (2017). The D’Agostino et.al, (2017) model characterizes some broad principles with an optimal government size that maximizes economic growth. They argued that some “public” components of government spending can influence the long-run growth rate. These components are modelled as inputs influencing private production function (D’Agostino et.al, 2016). They specified an estimable form of the model, using a general formulation of the endogenous growth model of Devarajan, et.al (1996).

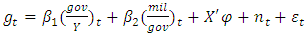

| (1) |

is the growth rate of GDP in the country at time t,

is the growth rate of GDP in the country at time t,  is the time fixed effect and

is the time fixed effect and  is the error term. The variables

is the error term. The variables  and

and  are government spending in GDP and military expenditure in government spending. A set of control variables are also introduced; Gross capital formation as a share of GDP to proxy for the level of Investment

are government spending in GDP and military expenditure in government spending. A set of control variables are also introduced; Gross capital formation as a share of GDP to proxy for the level of Investment  and gross school enrolment to proxy for the level of human capital development (HC).The model describes an endogenous growth specification with permanent fiscal policy growth effects. D’Agostino et.al, (2017), however, highlighted the importance of the persistent Solow-type transitional dynamics, and mean reversion particularly in the case of annual data as suggested by Gemmel et.al (2016). In a similar manner to D’Agostino et.al, (2017), we specify an autoregressive distributive lag ARDL [(p, q)] model, in an error correction model (ECM) form. The ECM form of the ARDL (p, q) is stated in the equation as below:

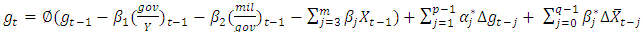

and gross school enrolment to proxy for the level of human capital development (HC).The model describes an endogenous growth specification with permanent fiscal policy growth effects. D’Agostino et.al, (2017), however, highlighted the importance of the persistent Solow-type transitional dynamics, and mean reversion particularly in the case of annual data as suggested by Gemmel et.al (2016). In a similar manner to D’Agostino et.al, (2017), we specify an autoregressive distributive lag ARDL [(p, q)] model, in an error correction model (ECM) form. The ECM form of the ARDL (p, q) is stated in the equation as below:  | (2) |

measures the speed with which the model returns to equilibrium after a shock

measures the speed with which the model returns to equilibrium after a shock  explains the long-run equilibrium relationships between

explains the long-run equilibrium relationships between  and

and  and

and  are the short-run parameters.

are the short-run parameters.  includes both

includes both  and the vector of control variables X in difference form. It is important to note that since the equation above is specified in ARDL form when estimated, the result will account for the effects in the long-run level.

and the vector of control variables X in difference form. It is important to note that since the equation above is specified in ARDL form when estimated, the result will account for the effects in the long-run level. 3. Data and Methodology

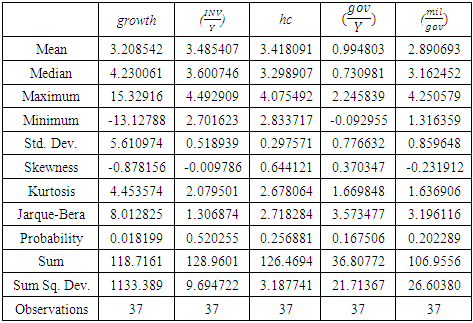

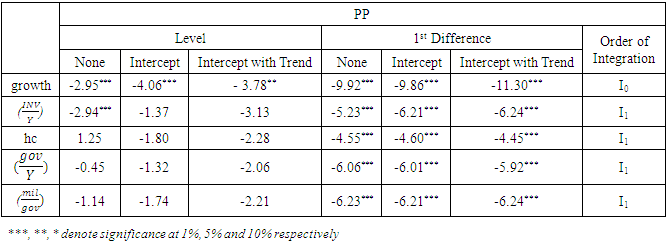

- The annual time-series data for the period 1981–2017 for the underlying study have been extracted mainly from the World Development Indicator of the World Bank Data Bank. Data were log-transformed to stabilize the variance of the series except for the GDP growth rate. The use of eviews-10 statistical package was utilized in analyzing the data used in the study. The summary statistics of all the variables used in the analysis are presented in table 1.

|

|

|

|

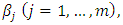

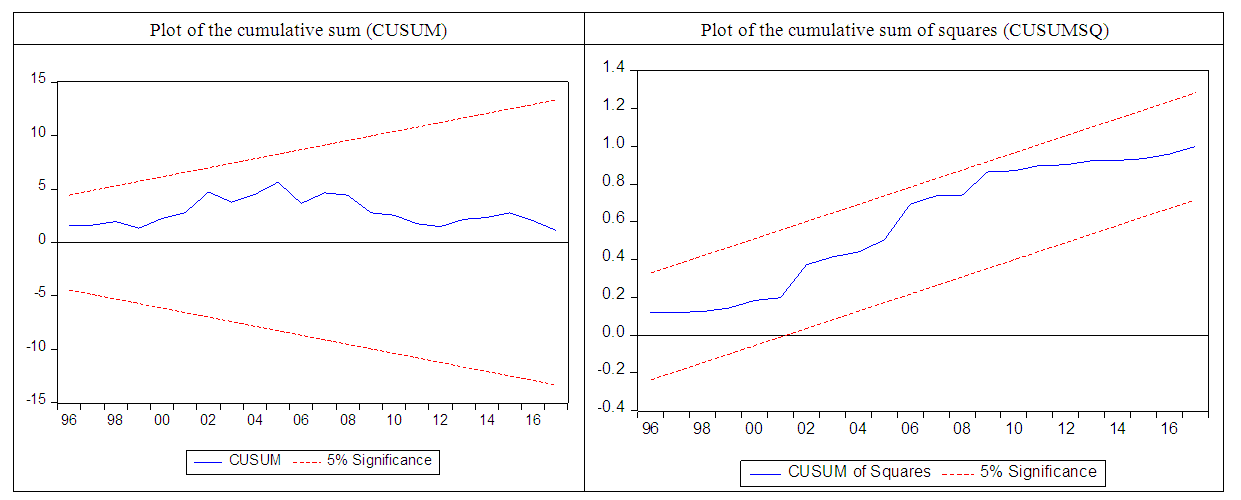

| Figure 2. Plots of Cumulative sum (CUSUM) cumulative sum of squares (CUSUMSQ) |

4. Discussion

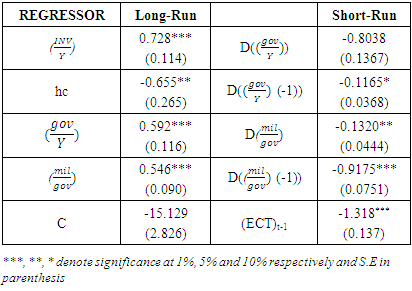

- Because of the increase in the level of threats faced by Nigeria, as well as the resultant increase in military expenditure in the face of dwindling economic growth in some instances, it becomes imperative to explore the impact of military expenditure on economic growth. Key issues neccessitating exploring the relationship between military expenditure and economic growth in Nigeria include; First, there has been a relatively high level of military expenditure in Nigeria. This spendings in some instances can be said to be disproportionate when considering the economic standing of the country and other competing needs. Second, different methodologies used previously have produced different and sometimes contradictory results, making it imperative to explore a more nuanced methodology that could adequately explore the relevant variables. Third, the argument by policy makers that the prevailing security situation requires an increase in military expenditure to strengthen the economy is worth exploring. Our finding presents an interesting outcome where there is an initial negative relationship between military spending and economic growth in the short-run and a positive relationship in the long-run. This finding corresponds with the findings of previous studies such as Wijeweera, and Webb, (2009), although their long-run positive impact is small and diminishing. Our findings may be explained by country-specific factors that obtain in Nigeria and the differences between Nigeria and the countries used in other studies. For example, Madden and Haslehurst, (1995) explained that in countries with a defense industry, military expenditure exerts a greater positive impact on economic growth.In the case of Nigeria, the lack of a domestic arms industry means that it must purchase almost all its military equipment from overseas suppliers. Consequently, any increase in military spending will be more likely to bloat Nigeria’s current account deficit than its GDP. Also, Wijeweera, and Webb, (2009) explained that studies that found an outright positive relationship between economic growth and military expenditure were mostly conducted during stability time and not in the middle of security challenges. However, in developing economies faced with security challenges like Nigeria, the prerequisites for defense spending to boost the economy may be absent. For instance, skilled military personnel may be killed before they have a chance to transfer their acquired knowledge to the private sector and the depreciation rate of military hardware and infrastructure improvements may be accelerated (Sarvananthan, 2004). In essence, there are at least two possible explanations for our findings: First, Nigeria, as a developing country with limited resources, is still in a position that military spending is constrained by the low income and growth. So, only when the economy grows can the government increase its expenditures to strengthen its military power or otherwise, source fund for military expenditure which may have an initial unfavorable impact on the economy such as the crowding out effect. The second explanation is related to the first one. According to the Stockholm International Peace Research Institute, Nigeria is a net arms importer which means military expenditures would be financed by the scarce resources and foreign exchange reserves of the country. So, military expenditure is an initial leakage to the country as it imports almost all military equipment and expends funds to bring the technical know-how to make use of the new equipment into the country. However, the economy can benefit from the military expenditure in the long-run not necessarily because of the spending effect on the economy, but rather possible security and safety effects on the economy.Furthermore, while our estimates suggest that increased military expenditure as a share of total government spending has a positive effect on GDP in the long-run, more interesting is that public spending on the military has better long-run returns than public spending on human capital. This is quite counterintuitive to neo-classical assumptions that posit human capital as a progressive contributor to economic growth. Indeed, the role of improved schooling as a proxy for human capital has been central to the economic growth and development discuss at both national and international levels. This has led to improvements in enrolment numbers and narrowing the enrolment gap between the developed and developing world, however, this has not necessarily guaranteed the much-needed improved economic conditions in the developing countries (Easterly, 2001; Pritchett, 2006). According to Hanushek (2013), developing countries have over the years obsessed with increasing school attainment which entails improving enrollment numbers and spending as against improving educational achievement, or cognitive skills. These countries, while, improving school attainment, have not necessarily improved in quality terms, hence, low cognitive ability, which essentially should drive economic growth and productivity. More recent empirical evidence from some Asian countries suggests that human capital alone may not be a significant contributor to economic growth. According to Aslam (2020), institutions reinforce the impact of human capital on economic growth; as they provide necessary conditions to amplify the impact of human capital development. Situating this into the Nigerian context, the possibility of the counterintuitive finding, therefore, becomes clear as institutions in Nigeria have largely remained weak (Laniran, 2018; Sala-i-Martin, X. and Subramanian, A., 2013).

5. Conclusions

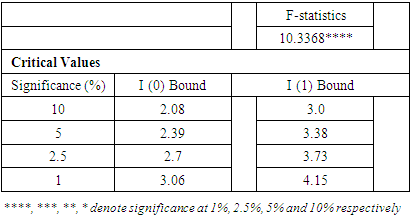

- This study investigates the relationship between military expenditure and economic growth in Nigeria since 1981. The study utilized the Bounds test/ARDL estimation technique. From the estimates generated, the study found that there is a significant long-run relationship between military expenditure and economic growth but found an inverse relationship in the short-run. The study found a similar relationship between government spending and economic growth. The study also found a positive long-run relationship but no short-run relationship between the level of investment and economic growth, however in the case of the level of human capital development, the study found an inverse long-run relationship and no short-run relationship with the economic growth of Nigeria. The results from the ARDL estimation, therefore suggest that in the short-run, there might not be immediate positive economic growth gains from government military expenditure, however, in the long-run, the positive impact of such military expenditure on economic growth will be gained. This corresponds with expectations from previous studies as highlighted earlier that for net arms importing countries that are faced with insecurity challenges and are forced to spend on their military in the face of other competing needs, suchj expenditure may not drive growth in the immediate short term, but may have a long run growth effect.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML