-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2020; 10(6): 325-331

doi:10.5923/j.economics.20201006.02

The Consequential Impact of the Covid-19 Pandemic on Global Emerging Economy

Mukut Sikder1, Wenzheng Zhang2, Ujjal Ahmod2

1College of Finance and Economics, Gansu Agricultural University, Lanzhou, P.R China

2College of Management, Gansu Agricultural University, Lanzhou, P.R China

Correspondence to: Wenzheng Zhang, College of Management, Gansu Agricultural University, Lanzhou, P.R China.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

An outbreak of the Covid-19 pandemic is not only a recent viral health disease from China, but the world also experienced an emergency economic issue and which case reported more than two hundred regions. The purpose of this study to analyze the potential impact on an economic push of the epidemic, including financial deeds or economic growth, supply chain, foreign investment, currency exchange ratio, overseas contribution, and figure-out few dimensions. The article has been used to secondary data those recently published. In 2020 the International Monitory Fund predicts that world GDP will improve from 3.7% in 2019 to 9.9%. Include China, Europe, Asia, and the UK each indicated funding sectors for the population at >10% of their annual GDP growth. The study suggested that mitigation volume might be put in space for all; hope it will boost on decreasing the global economic challenges from this pandemic.

Keywords: Covid-19, Economic growth, Global economy, Pandemic, Contribution

Cite this paper: Mukut Sikder, Wenzheng Zhang, Ujjal Ahmod, The Consequential Impact of the Covid-19 Pandemic on Global Emerging Economy, American Journal of Economics, Vol. 10 No. 6, 2020, pp. 325-331. doi: 10.5923/j.economics.20201006.02.

Article Outline

1. Introduction

- The COVID-19 has left the world in a place of turmoil, leaving the world's economies unable to resist the virus. The pandemic has had a crucial global economic effect. This year The World Health Organization formally expressed the outbreak of COVID-19 as a world pandemic on March 111. Though global financial implications are still unclear, trade markets have meantime reacted across scenic deportments (Zhanga, Hua, & Qiang, 2020). The United States within ten days stock market injury the limitation breaker system four times in March2. China is the key manufacturing hub for several trades and businesses worldwide. It has been break off the supply chain of international business and huge impede in the production sector (Hasanat, Hoque, Shikha, Anwar, Hamid, & Tat, 2020). In 2020 the Asian country’s several financial organizations predict economic growth to downfall by 2.7% and the largest decline revenue of $113bl likened to the previous year. The effects of the Covid-19 African continent calculate that in a day from 5 to 29 million citizens will decline under the ultimate poverty level3. The united states GDP ratio decline by 4.8% in the quarter of 2020 which initially information reported4. In 2020 the first three months Euro-zone economy data showed that yearly rate of 3.8% and it’s the highest fall since 19995. The world expecting more than $280 billion in losses over the first quarter of the year, at the same time China also expected to lose $ 62.21 billion (Ayittey, Ayittey, Chiwero, Kamasah, & Dzuvor, 2020).Moreover, the outbreak has affected the global economy and might drop through 13% to 32%. While the world economy is in fully risky, there is also some cause to be optimistic that this bad situation prospect may be getting off6. The Covid-19 recession to the large disappointment that began in 1929, several have likened the cruelty and quickness. As soon as the pandemic is brought control down, various will return to business as usual, probably seeking additional compensation for losses through much in-cursive enhancement (Gosslinga, Scottd, & Hallf, 2020).In this study, we have been tried to analyze the impact of the Covid-19 pandemic on the global economy and explain the particular information to accomplish the following query: What we got experienced since the Covid-19 outbreak? How do a decrease in global GDP growth, trade, and economic situation response to the Covid-19 prevalence? Do any systematic potential risks raises impact on globally?The article sought to gather valuable current data from secondary sources such as journal articles, international institutional reports, renowned newspapers, electronic literature databases, and website which related to global economy Covid-19 which mainly focuses on observation the motive.

2. Literature Review

- The COVID-19 pandemic affects the emerging economy with highly reducing international exports, foreign remittances, and tighten global credit positions which have to indicate for hardness. The limitations of business dynamism slowdown much broadly on these economies than in developed regions to hold the pandemic.

2.1. Initial Knowledge Regarding Pandemic

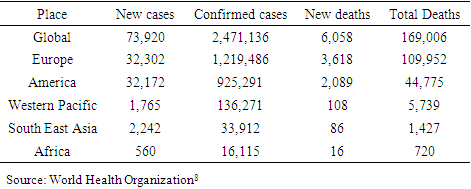

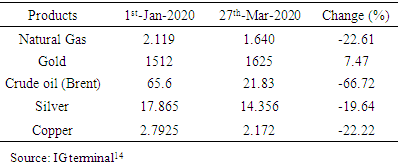

- In January 2020 first introduced in the world about Covid-19 and 23 January, the lockdown of the whole city of Wuhan pushed the entire world. In Hubei Province of China has first spread novel Coronavirus (SARS-CoV) which recent outbreak affected China to globally (P. Velavan & Christian, 2020). After one week the WHO is making a declaration a world health emergency founded on increasing case propaganda rates in China includes global regions. In the middle of February 2020, China would have borne the brunt of the epidemic and the death toll, while in other European, Asian, and African except American regions the incidence is still down.Evidently, proficient human-to-human transmission is a big-scale amplitude of this outgoing virus. A relationship maintains real whether it is consequences of a spread from an individual excess event (SARS-CoV) or from the revolved ascension of a category obstacle (MERS-CoVe) (Munster, Koopmans, Doremalen, Riel, & Wit, 2020). However, the cruelty of the illness is a significant circumstantial measure in the capability of the virus spread, as well as our efficiency to identify the transited case and take on. Furthermore, several studies suggest that older people especially those over 80 years and suffering from dangerous sickness, for example, respiratory problems, cardiac patients, kidney disease, and diabetes are at the highest risk of momentous illness and death(Weiss & Murdoch, 2020).Since 2003, severe acute respiratory syndrome (SARS) was calculated to cost value in the world from $30 to $100 billion (Smith, 2006). The Covid-19 pandemic has formerly turned into a global challenge, functioning such "the pathogen of a century at one time'' when the SARS was originally in China. Many more deep effects can be prospective on the world economy. China and South Korea are usually under control in March 2020 the center moving to Europe and the United States with more confirmed cases and Italy has the highest mortality ratio. The shows in figure 1 South Korea was the 2nd place got knowledge of a terrible outbreak of COVID-19, nearly pursued through Iran includes six highly affected nations. It exactly spends a week for more than a thousand cases to go through 31 cases in South Korea; and Iran from zero to more than a thousand confirmed cases within a couple of weeks.

| Figure 1. More confirmed cases affected regions from January to March 2020. (Source: John Hopkins Coronavirus Resource Center7) |

|

2.2. Global Economic Growth Impacts

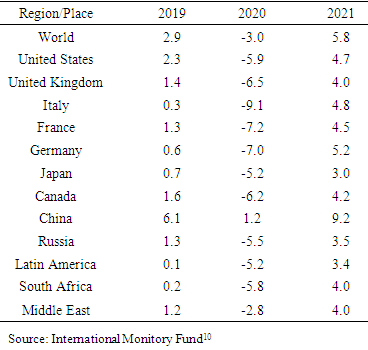

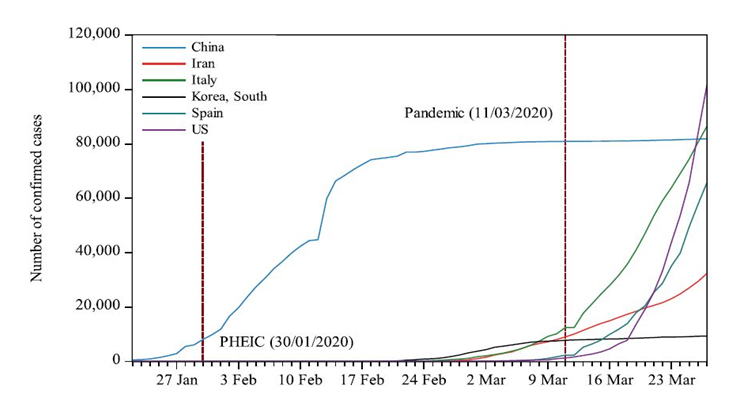

- On April 29, 2020, the United States Federal Reserve Chairman mentioned will use its "complete tools" to help the financial curriculum as the finance ministry calculated a 4.7% decline on 29th April 2020. Emerged on this conception the economic effects of the virus will reach the first quarter of 2020, On March 2, 2020, the Organization for Economic Co-operation and Development (OECD) humbled its world anticipation enhancement by 0.5% for 2020 from 2.9% to 2.4%9. Table 2 demonstrates that the International monitory fund (IMF) published current individual country economic growth base on particular data.

|

| Figure 2. Global GDP change in percentage. (Source: World Economic Outlook, International Monetary Fund (2020 and 2021 are estimates)) |

2.3. Covid-19 Impact on Money Exchange Rates

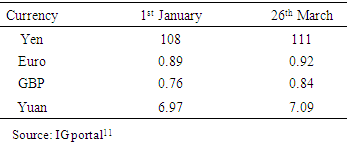

- Table 3 shows that the higher all currencies like Yuan, GBP, Euro, and Yen are collapsed versus the $US from this year January to March, particularly hardest shock in March 2nd to 3rd week. The foreign exchange platform responds to the fear-shifted situation in global and national markets.

|

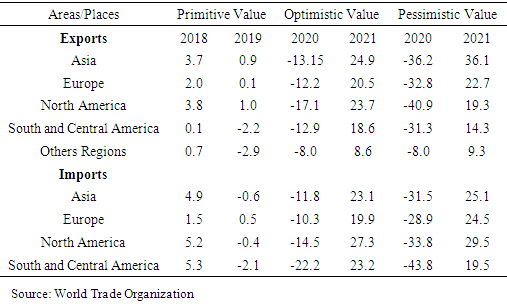

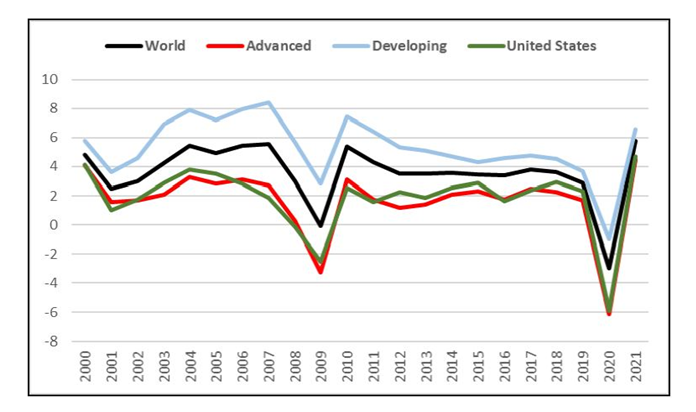

2.4. International Trade and Shock Products Markets

- Recently China becomes a major supplier of interior goods to overseas manufacturing associations and over the past two decades extremely playing a vital role in the world economy. Till now, the production of intermediate commodities about 20% of international business generates in China (UNCTAD, 2020). The WTO's massive upbeat scenario makes believe that business segments are swiftly recovering from their pre-epidemic aptitudes in the 2nd half of 2020. Table 4 mentions that information for 2020 and 2021 are projections; The calculation discloses that all places will concept a double-digit decline in business values, without for "other regions" which formation of the Commonwealth of independent countries, Africa and the Middle East.

|

|

2.5. Supply Chains Disordered

- The Covid-19 negatively affects hub regions, China, Europe, and including the US the supply chains which is another crucial segment of the world economy. China's industrial production declined by 13.5% between January and February simultaneously compared to the last year. The coronavirus has spread uncontrollably around the world alongside create complicated normal life and shocking global trades with the manufacturing industry. For manufacturers, it will probably not be labor or less supply raw materials, but the capability to have their goods delivered. For example, transport roads are in danger of being disrupted if lorry drivers fall diseased. It’s hard to prophesy correctly where disruptions will be decline more but particular supply chains have been influenced (Volkin, 2020).Recently, the International Monetary Fund has calculated incredibly US$3 bl in funds emission from outgoing markets, which the biggest outfall constantly listed, when at a similar time an unprecedented figure of over 60 regions have experienced financing crisis (Seric, Görg, Mösle, & Windisch, 2020). The reflection of the Covid-19 pandemic is during realized much highly along every momentary time, in the face of unheard term, and concerted endeavors commenced through administration, trade and separate to stalk the flow(Sengupta, 2020). Significantly, about 75% of organizations indicate supply Chain breakdowns in a few capabilities because of the Covid-19 epidemic connected transportation limitations, and higher than 80% rely on their company will have several effects due to pandemic disruption15. As a result, it has influenced the international business and supply chain which has nearly take place immovable by the current crisis (Kumar, 2020).

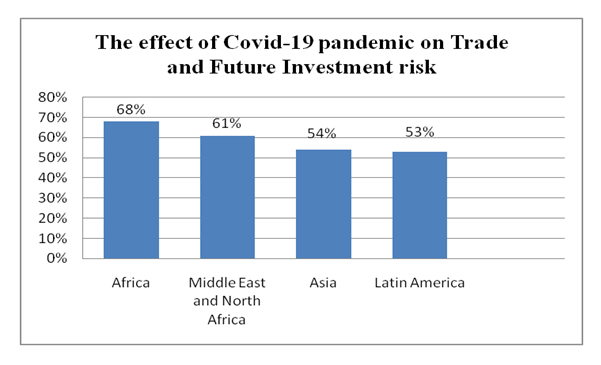

2.6. The Impact on Covid-19 Foreign Investment

- The prevalence and spread of Covid-19 will negatively impact the stream of international investment which under influence on Foreign Direct Investment will stand at -5% to -15% throughout the year 2020. An average of a maximum of 5,000 multinational enterprises has calculated a 9% undervalued retrial of 2020 revenues. The largest shock is the automobile industry (-44%), Aviation business (-42%), power, and primary raw materials companies (-13%) (UNCTAD U. N., 2020).The pandemic emergencies a modern, unprecedented source of investment risk that disappoints investor confidence. In the world's more than 60% have revised drop around hundred multinational enterprises in their earnings estimates, and higher than 85% of trades surveyed expect that will downward their income and profits, averaging through more than 40% (Saurav, Kusek, & Kuo, 2020). Figure 3 shows the impact of a pandemic on world business and investment risk. Risk experienced higher in Africa 68% and lower Latin America 53%. This risk is much indicated in the segments of hospitality 41%, aviation 30%, education 19%, and wholesale sales market 19%.

| Figure 3. Global impact on future investment risk in percentage. (Source: A global survey of YPO16) |

2.7. Global Economic Relations and Cooperation

- Few assured consequence in the part of relations between countries, as countries collaborate and try to battle the epidemic by neighborly cooperation (Barua, 2020). In March 2020 an urgent meeting of G-7 finance ministers, ferocious small of the obtrusive and figured concerted move by investors, and US and European stock markets fell rapidly after the meeting. The inspiration for raising collaboration in global business in the post-COVID-19 world will be sure that supply chains, especially medical equipment, medicines, medical supplies, and essential food continue open in stand by the crisis (Kerr, 2020). The G-20 included all nations that have pledged to inspire US$ 4.8 trillion into the world economy (Buss & Tobar, 2020).Asia and Europe have been deciding for often to enhance their relationship with efficient intentions. Addressing this World epidemic and become ready for incoming condition about public health emergency should be a vital begging part (Yeo, 2020). Another crucial issue that both continent need to keep in mind is to keep strong relations start between different countries.Furthermore, Sino-US relations remained unstable even during the epidemic; the two countries also discussed joint efforts to fight the epidemic, despite the word of mouth and complaints about the origin of the virus. The US and China have to try to make strong collaboration: sharing effective experience to overcome outbreak of Covid-19; invention particular medicine or vaccines as soon as possible; preparation for mass production and global distribution of vaccines; helping needy regions to fight this virus; managing the debt crisis in the emerging world; and to perpetuate world trade with legitimate opportunities (Christensen, 2020).However, In this pandemic situation, all region’s administration realized to ignore misunderstanding political point-scoring competitions, business war with each other and it is an appropriate time to create solidarity relationships with country-to-country. Besides, this deadly epidemic to overcome the health crisis, protect the world trade, and financial structure smoothly.

3. Discussion

- The study above execution analysis illustrates that apart from international cooperation, Covid-19 has introduced a negative effect on global economic growth, supply chain, foreign investment, and currency exchange ratio. This condition has left policymakers and health in the lurch individual in disturbance to under control worldwide deadly Covid-19. The effect of the 2nd-level of the world pandemic will result in an endurable to a huge diminution in demand. As supply barriers shut-down industries and workplaces, the customer will reduce their costing, declining GDP growth, increase jobless people, and raise product prices. Although few demands will be abidingly lost, thus decreasing long-term world financial enhancement.This epidemic has distributed unfavorable impacts on the workers, supply chains, and consumers economical market platform, summarized, more apparently it will reason a world economic regress. However, due to the indefinitely of the finish of this virus outbreak, both the long and measure of this diminution are unpredictable.The outbreak of COVID-19 has demonstrated the avowedly of human resources in financial activities. It is important to create our emergency emplacement framework that will be accountable for interactions in areas, regions, and territories to make emergency decisions with effective claims deniers.Predication that the epidemic could possibly infect 7.0 billion people globally, resulting in 40 million deaths. Which must gradually decline and stop of the outbreak the areas lockdowns, border closures, and several health conditions the have been an accomplishment in more than 136 regions (WHO, 2020). Assuredly, this ultimate case is just fictional and comes on the situation that not interference is attributed. The outbreak is having a profound effect on the world economy: trillions of dollars have concentrated from the international's stock exchanges before they closed their windows to eliminate a perfect downfall, either the brokers fell sick or the financial assets sank; countless of citizen have lost their works, leastwise not permanently and millions of unofficial employees have been trimmed from the social security policy through disregarded administration, they have a miserable choice to leave the house to earn a living and expose themselves to the virus or Stay socially isolated and starve to death. The outbreak will run to disarrange the international business places therefore it is necessary that we all job together to effectively obtain this challenging situation. The current time of Chinese goods in the international market is already reducing the demand for the products by reducing the purchasing conduct of the customers. Because of this reason, high impact is initiated on the international export business recently in the Chinese market. Indeed, to accomplish this result, policy creators have been forced to review policies to reduce the severity of the influence, but the virus remains the final factor that will determine whether each region may return to its regulation.

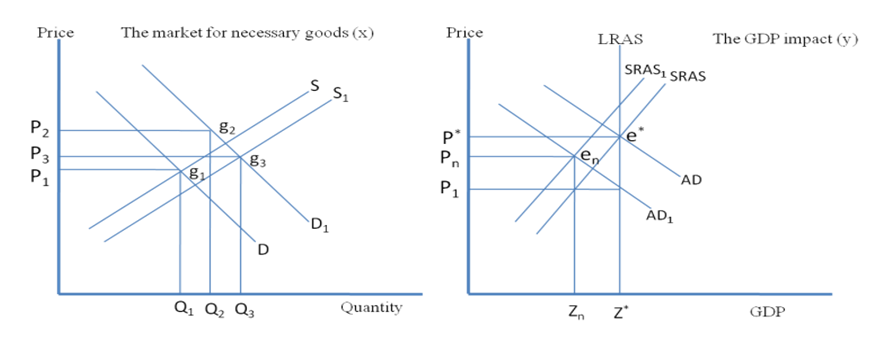

3.1. A Paradigm of Growth Impact and Regress Including Macroeconomic Simple Model

- Figure 4 focuses on two pictures that reflect the potential impact of Covid-19 on the necessary product markets and the GDP of the economy. In the picture (x), the mart’s elementary stability for indispensable products is at g1 alongside price P1 and quantity Q1. Besides, the raises in demand for the required products are reflected through move the main demand curve from D to D1. Earlier on the outbreak, demand for inevitable goods like Health equipment and food increased importantly as described in previous segments of this article.

| Figure 4. Pandemic impact on GDP and necessary product markets |

4. Conclusions and Recommendations

- In this study, we have analyzed the Covid-19 pandemic and the impact on the world economy that started the international recession during 2020. Based on the discussions represented in this paper, we abridge the potential economic intimidation and advantages in the global post-epidemic. The pandemic is endangering economies with no affairs long or short, developed, or whatever. The impact may be definitely observed in the shorter mortality ratio, and few international cooperation regarding health emergency types of equipment providers in this crisis with few administrative positive thinking indicate in this article. The world attains backpedal in terms of emerging economies annual growth, decline the currency value, collapses stock-market, health condition, and investment. The pandemic current results have shown that the world economical crisis has rise adequately in reaction. Therefore, the study highly recommends that policy-maker might over sure that habitation abide by hardly to various system and law set apart to resist the prevalence of the pandemic. The International collaboration, particularly in the globe of health and economic improvement is necessary. Also, financially sustainable all regions may have to play the role effectively. All countries governments should make rules strictly to identify who has travel records in outbreak places during December 2019, and moving forward might be extensively under screening machines before getting socially connected. General people should keep in mind the necessity for assembly, meeting, and deliver connectivity with official services like a video conference or e-mail. Eventually, we have to recline the generosity of humankind and the elasticity of cordial consciousness. Besides, prospects of a virus vaccine elevation which will be the pleasurable message.

ACKNOWLEDGEMENTS

- We are thankful to Esrat Mahmud Silvy and Shantwana Grimiri to highly encourage and crucial suggestions to write study regarding this topic. We would like to disclose our gratitude to Thander Masum for article review, comments, and essential support.

Notes

- 1. http://suo.im/5uQE6s 2. https://www.weforum.org/agenda/2020/03/stock-market-volatility-coronavirus/ 3. http://suo.im/5Rphpn 4. Gross Domestic Product, First Quarter 2020 (Advance Estimate), Bureau of Economic Analysis, April 29, 2020. https://www.bea.gov/data/gdp/gross-domestic-product 5. https://www.ft.com/content /3bf48b80-8fba-410c-9bb8-31e33fffc3b8 https://www.ft.com/content /36239c82-84ae-4cc9-89bc-8e71e53d6649 https://www.ft.com/content/dd6cfafa-a56d-48f3-a9fd-aa71d17d49a8 6. https://www.statista.com/topics/6139/covid-19-impact-on-the-global-economy/ 7. https://coronavirus.jhu.edu/ 8. http://suo.im/5JT4rs 9. OECD Interim Economic Assessment: COVID-19: The World Economy at Risk, Organization for Economic Cooperation and Development. March 2, 2020. http://www.oecd.org/economic-outlook/#resources 10. International Monetary Fund, April 14, 2020, p. v. https://www.imf.org/ 11. https://www.ig.com/en/ 12. Trade Set to Plunge as COVID-19 Pandemic Upends Global Economy, World Trade Organization, April 8, 2020. https://www.wto.org/english/news_e/pres20_e/pr855_e.htm 13. https://www.stanlib.com/2020/03/09/economic-and-financial-market-impact-of-covid-19/14. https://www.ig.com/en/ 15. https://www.instituteforsupplymanagement.org/news/NewsRoomDetail.cfm?ItemNumber=31171&SSO=1 16. https://www.ypo.org/2020/04/latest-ypo-survey-explores-covid-19-business-outlook/ 17. https://www.businessinsider.com/coronavirusgeneral-motors-ford-ventilator-production-progress-2020-3

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML