| [1] | Amal, M., Tomio, B., & Raboch, H. (2010). Determinants of Foreign Direct Investment in Latin America. GCG Georgetown University-UNIVERSIA, 4 (3), 116-133. |

| [2] | Asiedu, E., Esfahani, H.S. (1998). Ownership Structure in Foreign Direct Investment Projects. Department of Economics, University of Illinois. Retrieved from http://www2.ku.edu/~kuwpaper/Archive/papers/Pre1999/wp1998_3.pdf. |

| [3] | Асон, Т.А. (2018). Перспективы привлечения прямых иностранных инвестиций в российскую экономику. [Prospects for attracting foreign direct investment in the Russian economy.] Вектор экономики, 4, 24 – 40. |

| [4] | Azzimonti, M., & Sarte, P. (2007). Barriers to Foreign Direct Investment Under Political Instability. Economic Quarterly, 93 (3), 287–315. |

| [5] | Баженов, О.В., Засухина, Е.А. (2017). Эконометрический анализ факторов привлечения прямых иностранных инвестиций в развивающиеся страны.[An econometric analysis of factors attracting foreign direct investment in developing countries.] Экономический анализ: теория и практика, 1(460), 188 - 200. |

| [6] | Бараз, В.Р. (2005). Корреляционно-регрессионный анализ связи показателей коммерческой деятельности с использованием программы Excel [Correlation and regression analysis of the relationship between indicators of commercial activity using the Excel program.]Екатеринбург: ГОУ ВПО «УГТУ–УПИ». |

| [7] | Barro, R., Sala-i-Martin, X. (1992). Public finance in models of economic growth. The Review of Economic Studies, 4 (59), 645 - 661. |

| [8] | Borensztein, E., De Gregorio, J., Lee, J.W. (1998). How Does Foreign Direct Investment Affect Economic Growth? Journal of International Economics, 45 (1, Jun), 115 - 135. |

| [9] | Brainard, S.L. (1997). An Empirical Assessment of the Proximity Concentration Tradeoff between Multinational Sales and Trade. American Economic Review, 87(4), 520 – 544. |

| [10] | Buchanan, B. G., Le, Q. V., & Rishi, M. (2012). Foreign direct investment and institutional quality: Some empirical evidence. International Review of Financial Analysis, 21, 81–89. |

| [11] | Buckley, P.J., Clegg, J., & Wang, C. (2007). Is the relationship between inward FDI and spillover efects linear? An empirical examination of the case of China. Journal of International Business Studies, 38 (3), 447–59. |

| [12] | Buthe, T., & Milner, H. (2008). The Politics of Foreign Direct Investment into Developing Countries: Increasing FDI through International Trade Agreements. American Journal of Political Science, 52 (4), 741–762. |

| [13] | Данг, М.А. (2016). Пути и методы активизации привлечения прямых иностранных инвестиций в странах АСЕАН в условиях глобализации (на примере СРВ) [Ways and methods of activating the attraction of foreign direct investment in ASEAN countries in the context of globalization (on the example of SRV)] (Диссертация на соискание учёной степени кандидата экономических наук, Федеральное государственное бюджетное образовательное учреждение высшего образования «Государственный университет управления», Москва, Россия). Retrieved from https://guu.ru/files/dissertations/2016/03/dang_m_a/autoreferat.pdf. |

| [14] | De Gregorio, J. (2005). The role of foreign direct investment and natural resources in economic development. In Edward M. Graham (ed.), Multinationals and Foreign Investment in Economic Development, The United Kingdom: Palgrave Macmillan UK, 179 – 197. |

| [15] | Dellis, K., Sondermann, D., Vansteenkiste, I. (2017). Determinants of FDI inflows in advanced economies: Does the quality of economic structures matter? European Central Bank, Working Paper Series, 2066, 1 - 28. |

| [16] | De Mello, Jr L. R. (1997). Foreign direct investment in developing countries and growth: A selective survey. The journal of development studies, 1 (34), 1 - 34. |

| [17] | Fabry, N., & Zeghni, S. (2006). How former communist countries of Europe may attract inward foreign direct investment? A matter of institutions. Communist and Post-Communist Studies, 39, 201–219. |

| [18] | Fan, J.P.H. (2009). Institutions and Foreign Direct Investment: China versus the Rest of the World. World Development, 37 (4), 852–865. |

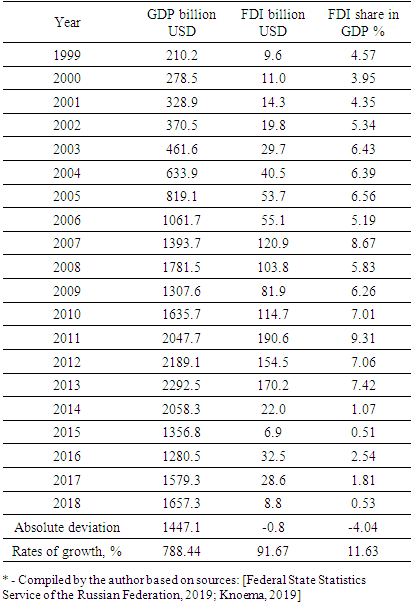

| [19] | Федеральная служба государственной статистики Российской Федерации (2019). [Federal State Statistics Service of the Russian Federation (2019).] Статистическая информация. Retrieved from http://www.gks.ru. |

| [20] | Федорова, Е.А., & Барихина Ю. (2015). Оценка горизонтальных и вертикальных спилловер-эффектов от прямых иностранных инвестиций в России. [Assessment of horizontal and vertical Spillover effects from foreign direct investment in Russia.] Вопросы экономики, 3, 5–21. |

| [21] | Федорова, Е.А., Коркмазова, Б.К., & Муратов, М.А. (2016). Спилловер-эффекты в российской экономике: региональная специфика. [Spillover effects in the Russian economy: regional specifics.] Экономика региона, 1 (12), 139 – 149. |

| [22] | Федорова, Е.А., Николаев, А.Э., Николаева, А.С., Алексеева, М.А. (2018). Оценка влияния прямых иностранных инвестиций на экономику России в период санкций на основе Спилловер-эффектов.[Assessing the impact of foreign direct investment on the Russian economy during the period of sanctions based on spillover effects.] Пространственная Экономика, 1, 37 - 58. |

| [23] | Галенкова, А.Д., Мариев, О.С., & Чукавина, К.В. (2018). Эконометрическое моделирование притока прямых иностранных инвестиций в развивающиеся страны. [Econometric modeling of foreign direct investment inflows to developing countries.] Журнал Экономической теории, 2 (18), 345 – 349. |

| [24] | Gokalp, M.F., & Yildirim, A. (2016). Institutions and Economic Performance: A Review on the Developing Countries. Procedia Economics and Finance, 38, 347–359. |

| [25] | Горбунова, О.А. (2018). Привлечение прямых иностранных инвестиций в российскую экономику в условиях действия санкций. [Attracting foreign direct investment in the Russian economy under the conditions of sanctions.] Российское предпринимательство, 8(19), 2185 - 2200. |

| [26] | Горная, М., Ищук, Я., & Халилова, Т. (2017). Условия и факторы формирования инвестиционной привлекательности стран Восточной Европы. [Conditions and factors of formation of investment attractiveness of the countries of Eastern Europe.] Международная экономическая политика, 2 (27), 137 – 155. |

| [27] | Grossman, G.M., Helpman, E. (1993). Innovation and Growth in the Global Economy. Cambridge: The MIT press. |

| [28] | Heckscher, Eli (2007). International Trade, and Economic History. Findlay, Ronald, Rolf G. H. Henriksson, Håkan Lindgren and Mats Lundahl, eds., The MIT Press. |

| [29] | Иванова, М.В. (2017). Спилловер – эффекты в российской экономике как фактор развития инвестиционной привлекательности регионов. [Spillover effects in the Russian economy as a factor in the development of investment attractiveness of regions.] Научный журнал, 10, 28-31. |

| [30] | Калініченко, А.В. et al. (2010). Прогнозування за допомогою функцій регресії. [Prediction using regression functions.] Вісник Харківського національного технічного університету сільського господарства імені Петра Василенка: Економічні науки, 104, 10–16. |

| [31] | Knoema (2019). Russian Federation - Gross domestic product in current prices. Retrieved from https://knoema.com/atlas/Russian-Federation/GDP?origin=knoema.ru. |

| [32] | Koboekae, T. (2012). The impact of political risk on foreign direct investment decisions by South African multinational corporations. University of Pretoria. Retrieved from https://repository.up.ac.za/handle/2263/30613. |

| [33] | Корицкий, А.В. (2014). Иностранные инвестиции и человеческий капитал. [Foreign investment and human capital.] Вестник НГУЭУ, 1, 58 - 63. |

| [34] | Кожина, Е.А., Лавренчук, Е.Н. (2017). Детерминанты прямых иностранных инвестиций в регионы Российской Федерации: результаты экономико-математического моделирования. [The determinants of foreign direct investment in the regions of the Russian Federation: the results of economic and mathematical modeling.] Вестник Пермского университета. Серия: Экономика, 3 (12), 404 – 420. |

| [35] | Lipsey, R.E. (2002). Home and host country effects of FDI. NBER Working Paper, 9293, 78. |

| [36] | Ма, Цзе Фэн (2011). Прямые иностранные инвестиции как фактор повышения инновационного потенциала Китая. [Foreign direct investment as a factor in increasing the innovative potential of China.] Автореферат диссертации на соискание ученой степени кандидата экономических наук. Иркутск: НИУ ГОУ ВПО «Иркутский государственный технический университет». |

| [37] | Makoni, P.L. (2014). Factors influencing the attraction of foreign direct investment and foreign portfolio investment into African economies. Corporate ownership & Control, 11 (4), 203 - 213. |

| [38] | Malley, J., Moutos, T. (1994). A prototype macroeconomic model of foreign direct investment. Journal of Development Economics, 2 (43), 295 - 315. |

| [39] | Mariev, O.S., Drapkin, I.M., Chukavina, K.V., Rachinger, H. (2016). Determinants of FDI inflows: the case of Russian regions. Economy of Region, 4(12), 1244 - 1252. |

| [40] | Maza, A., & Villaverde, J. (2015). The determinants of inward foreign direct investment: Evidence from the European region. International Business Review, 24, 209–223. |

| [41] | Мехлис, К.А. (2015). Основные тенденции взаимного прямого иностранного инвестирования между Российской Федерацией и странами Европейского Союза [The main trends in mutual direct foreign investment between the Russian Federation and the countries of the European Union.] (Диссертация на соискание учёной степени кандидата экономических наук, Московский государственный университет им. М.В. Ломоносова, Москва, Россия). Retrieved from https://www.twirpx.com/file/1627078. |

| [42] | Носова, О.В. (2011). Проблема макроэкономического равновесия в посткризисной экономике. [The problem of macroeconomic equilibrium in the post-crisis economy.] Посткризисные перспективы модернизации российской экономики: колл. моногр.; под ред. О.С. Белокрыловой. Ростов н/Д: Изд-во «Содействие ХХI век». |

| [43] | Panibratov, A., Ermolaeva, L. (2015). Outward investments from China and Russia: macroeconomic and institutional perspective. St. Petersburg State University, Graduate School of Management, Working Paper. |

| [44] | Петрикова, Е.М. (2009). Прямые иностранные инвестиции и экономический рост. [Foreign direct investment and economic growth.] Вопросы статистики: научно-информационный журнал, 9, 14 – 21. |

| [45] | Прохорова, М.Е., & Гадияк, А.Г. (2012). Факторы влияния на прямые иностранные инвестиции. [Factors of FDI influence.] Научный вестник Института международных отношений НАУ, 1-2 (1), 6 – 11. |

| [46] | Рогатнев, Н.С., (2015). Эффекты прямых иностранных инвестиций в развивающихся странах: типология, моделирование, регулирование. [The effects of foreign direct investment in developing countries: typology, modeling, regulation.] (Диссертация на соискание учёной степени кандидата экономических наук. Воронеж: Федеральное государственное бюджетное образовательное учреждение высшего профессионального образования «Воронежский государственный университет», Россия). |

| [47] | Silajdzic, S., Mehic, E. (2015). Knowledge spillovers, absorptive capacities and the impact of FDI on economic growth: Empirical evidence from transition economies. Procedia-Social and Behavioral Sciences, 195, 614 - 623. |

| [48] | Solomon, E.M. (2011). Foreign direct investment, host country factors and economic growth. Ensayos Revista de Economía (Ensayos Journal of Economics), 1 (30), 41 - 70. |

| [49] | Stančík, J. (2007). Horizontal and Vertical FDI Spillovers: Recent Evidence from the Czech Republic. CERGE-EI Working Paper, 340. Retrieved from https://www.cerge-ei.cz/pdf/wp/Wp340.pdf. |

| [50] | Сухарева, И.О., & Юнусова, Н.Н. (2013). «Компрессор» для экономики - эффекты притока прямых иностранных инвестиций. [“Compressor” for the economy - the effects of foreign direct investment.] Банковское дело, 4, 30-38. |

| [51] | The World Bank (2019). Gross Domestic Product, 2018. Retrieved from http://www.worldbank.org. |

| [52] | Tian, X., Lo, V., Lin, S., & Song, S. (2011). Cross-region FDI productivity spillovers in transition economies: evidence from China. Post-Communist Economies, 23 (1), 105–118. |

| [53] | Tintin, C. (2013). The determinants of foreign direct investment inflows in the Central and Eastern European Countries: The importance of institutions. Communist and Post-Communist Studies, 46, 287–298. |

| [54] | Tobin, J., & Rose-Ackerman, S. (2005). Foreign Direct Investment and the Business Environment in Developing Countries: The Impact of Bilateral Investment Treaties. Retrieved from http://law.wisc.edu/gls/documents/foreign_investment6.pdf. |

| [55] | Walz, U. (1997). Innovation, foreign direct investment and growth. Economica, 253 (64), 63 - 79. |

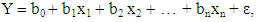

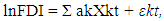

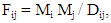

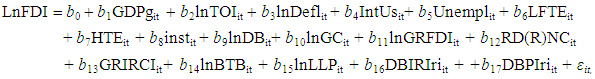

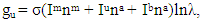

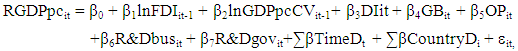

– regression coefficients;

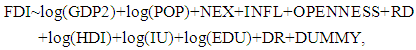

– regression coefficients;  - free term of the equation; σi – fixed effects; εit, - random value.Panibratov & Ermolaeva (2015), in the context of studying foreign investment from China and Russia, proposed the following model for attracting FDI into the economy of the recipient country:

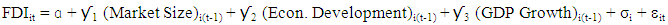

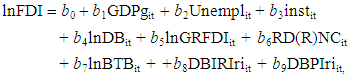

- free term of the equation; σi – fixed effects; εit, - random value.Panibratov & Ermolaeva (2015), in the context of studying foreign investment from China and Russia, proposed the following model for attracting FDI into the economy of the recipient country:

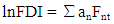

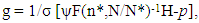

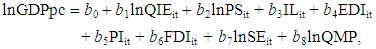

- free term of the equation; i – country of study; t – time period of the study.Kozhina & Lavrenchuk (2017), as part of a study of the FDI determinants in the regions of the Russian Federation, offer their model for assessing the influence of factors on attracting FDI to the economy of the recipient country:

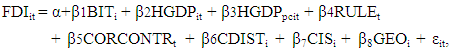

- free term of the equation; i – country of study; t – time period of the study.Kozhina & Lavrenchuk (2017), as part of a study of the FDI determinants in the regions of the Russian Federation, offer their model for assessing the influence of factors on attracting FDI to the economy of the recipient country:

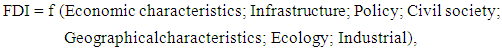

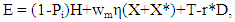

- the elasticity of the marginal rate of replacement of domestic capital by foreign; η – intertemporal elasticity of replacing domestic capital with foreign; p – intertemporal utility rate.Walz (1997), based on the Grossman&Helpman model of endogenous innovation (1993) proposed his model for assessing the impact of FDI on the host economy, with a focus on attracting new technologies to the economy of the recipient country through FDI and also arguing that discriminatory policies in relation to such investments have a discouraging effect on economic growth in the host state:

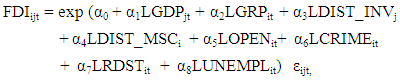

- the elasticity of the marginal rate of replacement of domestic capital by foreign; η – intertemporal elasticity of replacing domestic capital with foreign; p – intertemporal utility rate.Walz (1997), based on the Grossman&Helpman model of endogenous innovation (1993) proposed his model for assessing the impact of FDI on the host economy, with a focus on attracting new technologies to the economy of the recipient country through FDI and also arguing that discriminatory policies in relation to such investments have a discouraging effect on economic growth in the host state:

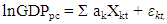

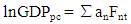

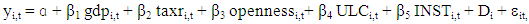

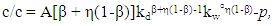

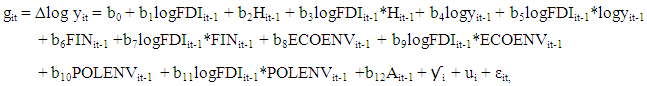

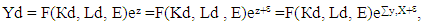

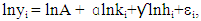

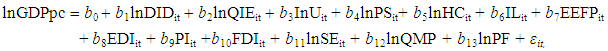

– time variables; u – variables specific to a particular state; b0 - constant; ε - residues; b1, 2, …, 12 - regression coefficients; i – country of the study; t – time period of the study; logFDIit-1*logyit-1 – the relationship between FDI and GDP per capita in the host country; logFDIit-1*FINit-1 – the relationship between FDI and the financial development of the recipient country; logFDIit-1*ECOENVit-1 - the relationship between FDI and the quality of the economic environment in the host economy; logFDIit-1*Hit-1 - the relationship between FDI and human capital in the recipient country; logFDIit-1*POLENVit-1 - the relationship between FDI and the quality of the political environment in the host economy. Ma (2011) proposes to consider the impact of FDI on the GDP of the country, for which he is using the modified Cobb-Douglas function in the form of a regressive model:

– time variables; u – variables specific to a particular state; b0 - constant; ε - residues; b1, 2, …, 12 - regression coefficients; i – country of the study; t – time period of the study; logFDIit-1*logyit-1 – the relationship between FDI and GDP per capita in the host country; logFDIit-1*FINit-1 – the relationship between FDI and the financial development of the recipient country; logFDIit-1*ECOENVit-1 - the relationship between FDI and the quality of the economic environment in the host economy; logFDIit-1*Hit-1 - the relationship between FDI and human capital in the recipient country; logFDIit-1*POLENVit-1 - the relationship between FDI and the quality of the political environment in the host economy. Ma (2011) proposes to consider the impact of FDI on the GDP of the country, for which he is using the modified Cobb-Douglas function in the form of a regressive model:

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML