-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2020; 10(5): 305-310

doi:10.5923/j.economics.20201005.05

Foreign Economic Policy Uncertainty: Does it Matter to Thailand’s Financial Market?

Wannakomol Supachart1, Kanyarut Chaisongkram2, Kashif Abbasi1

1Shanghai University, the School of Economics, Shanghai, P.R. China

2Lampang Rajabhat University, Faculty of Management Sciences, Lampang, Thailand

Correspondence to: Wannakomol Supachart, Shanghai University, the School of Economics, Shanghai, P.R. China.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The economic policy uncertainty does not always negatively impact the financial market. This is a very first empirical paper that intends to investigate the influence of economic policy uncertainty (EPU) from foreign regions that could make an effect on the financial market in Thailand. The Seemingly Unrelated Regression and Markov Switching approach are used in the study to analyze the power of the EPU from the world major economies, which are the United States, Europe, China and Japan, whether exist in Thailand’s financial market or not. The empirical results does not indicate only negative effects that the foreign EPU could affect the market but also positive influence, particularly the EPU from Europe and China in which are shown to be significantly correlated with the total return of Thailand’s stock market. Furthermore, the findings also reveal the influence of foreign EPUs that persistently exist in overall financial market suggested by high Markov switching filtered probabilities.

Keywords: Economic Policy Uncertainty, Thailand, Financial market, EPU

Cite this paper: Wannakomol Supachart, Kanyarut Chaisongkram, Kashif Abbasi, Foreign Economic Policy Uncertainty: Does it Matter to Thailand’s Financial Market?, American Journal of Economics, Vol. 10 No. 5, 2020, pp. 305-310. doi: 10.5923/j.economics.20201005.05.

Article Outline

1. Introduction

- In the open economy, the capital flow can be easily moved from place to place. The investors from one country are able to invest in the other countries regarding their expected returns of investment. Besides the pattern of foreign direct investment (FDI), investing in financial market is seemingly to have more liquidity in fund movement. However, the economic policy uncertainty (EPU) in one significant region may be transferred to abroad and makes the impact on the economic activities such as the spillover effect of the EPU which exist across developed countries, especially a transmission from the EU to the US (Antonakakis et al., 2018) with this share rising to one half during the financial crisis (Klößner and Sekkel, 2014). It brings difficulty in terms of issuing the economic policy implementation to maintain the economic stability in both real business and financial perspectives. Nowadays, the major events, such as trade conflicts between China and the US, Japan and South Korea, and even ambiguity of the UK referendum on the EU (Brexit), are expected to be relaxed due to the increasing in uncertainty that may affect the global economic phenomenon and tenor in negative outcomes.Flashing back to the big lesson from Asian financial crisis in 1997, Thailand was enthused to have more concern about financial stability to prevent such disaster for not to disrupt the financial system. Many economists suggest that the crisis was caused by the weakness of domestic financial and monetary policy prosecution, as well as the currency assault under the power of the foreign speculator especially hedge funds. From this case, it indicates that the interconnectedness between the global economic and domestic financial landscape are likely to be related. Even now, Thailand still facing both internal and external risks that reflect the uncertainty in economic and financial activities. According to the financial stability report of 2018, key sources of uncertainties include the financial market volatility due to monetary policy directions in major advanced G3 countries (the United States [US], Japan, and the European Union [EU]), as well as the impact of trade tensions between the US and its trading partners, which could become more widespread and intensified (Bank of Thailand [BOT], 2018). Furthermore, China is also an important country since it becomes one of the economic influencers and has a significant action on the US in the aspect of economic policy, in particular, trade policy regulation. Since the conflict between the two powerful countries has been intensified, meanwhile, the economic policy uncertainty (EPU) has also been increasing beside this aggressive situation. The economic uncertainty regarding changing policy has been increasing over the time. The co-movement of the EPU indices around the world are seemingly in the same direction and compatible with economic events. For example, a sharp increasing in the economic policy uncertainty in Europe in 2011, that is conformable to the starting of the European debt crisis. Moreover, the EPU seems to be greater in 2016, particularly in China when inauguration of trade-barrier came by Donald Trump in order to reduce the US trade deficit with Asian countries especially with China who has gained numbers of trade balance from the US. Nonetheless, changes in economic policy uncertainty could negatively affect the financial market regarding the raising in stock market volatility. This was led by the increase in economic policy uncertainty that causes the reduction in market liquidity and investment returns which is significant in time of financial crisis. Thus, the impact of the EPU on the financial market is a great interest to many economists and policy makers according to conducting proper policy regulations. Hence, the intention of this paper is to analyse and examine if the foreign EPUs whether take any role play in Thailand’s financial markets (bond, equity, and currency exchange) or not. Furthermore, the methodology in this study is considered under the two stages of Markov switching process which is subjected to the simultaneous multivariate equation system in order to analyse the current status of an existence of the foreign EPU power in Thailand’s financial market.

2. Literature Review

- The economic policy uncertainty (EPU) has rapidly been concerned by economists in order to capture the economic outlook that affected by unexpected events from policy changes. In particular, the finance organizations need to make investment decisions when a high uncertainty is perceived. The study about the EPU and its relevant circumstances has been widely focused once the EPU index (Baker, Bloom, and Davis, 2015; 2016) is introduced and calculated in accordance with newspaper coverage frequency. The main significant impact of the EPU is associated with both micro and macro financial economy, for example, increasing in stock price, reducing investment and employment as well as production output level. Moreover, it also causes difficulty to improve the social infrastructure. The higher EPU leads to significant increases in market volatility (Liu and Zhang, 2015) and helps to predict the market returns. Based on Vector Autoregressive Regression (VAR) and Markov-switching, some papers point out the negative responses of the returns on stock price and the negative effects are even stronger during the extreme volatility periods (Arouri, et al., 2016).The political uncertainty and economic policy uncertainty are related in according to positive correlation between these types of uncertainty from Hardouvelis et al. (2018). Thus, instable and fragile politics could play a significant role in economic policy uncertainty, and vice versa. In Thailand, the domestic political uncertainty was found has significant negative impacts on Thai economy, particularly private investment in short run, and economic growth in long run (Luangaram and Sethapramote, 2018). The policy uncertainty also causes reduction of demand for money as people prefer to hold more cash and keep less of other assets (Bahmani-Oskooee et al., 2015). For the impact of economic policy uncertainty (EPU), the responses of real economic activity such as real GDP and its component in Thailand are muted. However, foreign EPU does matter for the Thai economy (Apaitan, et al., 2018) driving volatility in currency exchange even though it has no ability to predict the exchange rate for Thai Baht (Juhro and Phan, 2018).The EPU abroad, particularly from the US, is emphasized to study for its impacts to Thailand’s Stock market because Thai stock market intensely observes economic policy conditions from the US, in particular Fed’s announcement during the financial crisis. According to dataset between 1985 and 2012, the results of the study show negatively significant linkage between changes in the EPU in the US and the returns of Thailand stock market, but Granger’s causality test found non-significance in Sum (2013). However, the significance of Granger’s test is later contradicted in the new study from Donadelli (2015) while the significant cross correlation is remained. In addition, although short run drops on market returns were found, surprisingly, the significant positive coefficient (beta) from the regression of Thailand’s stock market on changes in US EPU was suggested that an increase in the EPU in the US weakly increases the excess return of the stock market in Thailand (Donadelli, 2015).

3. Data and Variable Description

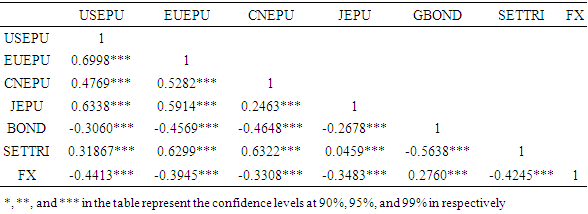

- The 174 observations of monthly data from January 2005 to June 2019 were retrieved from various data sources. The economic policy uncertainty index (EPU) from http://www.policyuncertainty.com regarding Baker et al. (2015; 2016) measurement, represents as proxy for the economic policy uncertainty in the United States (USEPU), Europe (EUEPU), China (CNEPU), and Japan (JEPU). For Thailand financial market data, the returns of bond market (BOND) is referred to ThaiBMA Bond index provided by Thailand Bond Market Association, the total returns index of Thailand’s stock market (SETTRI) from Thailand’s Stock Exchange database, and FX represents exchange rate between Thai Baht against US dollar at the end of the month announced on Bank of Thailand website. Then, all variables are modified to be the logarithmic values in order to standardize their numeric base for further estimation.Table 1 shows cross correlations among all variables in the study. The relationship of the EPU from the four regions are significantly found among each other, especially the relationship between the EPU in Europe and the United States that takes the highest correlation at 0.6998 of coefficient. However, the EPU in Japan and China has the smallest correlation in the test for about 0.2463 of coefficient. The returns in Thailand financial market apparently has the correlation between the EPU from abroad. Moreover, they also have the relationship among each market with 99 percent significance.

|

4. Methodology

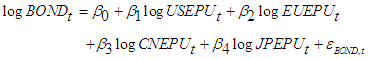

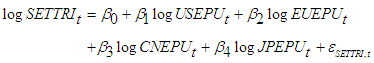

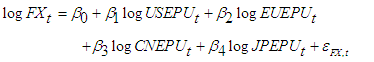

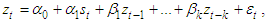

- Once the variables were adjusted to be in logarithm value, the multivariate Seemingly Unrelated Regression (SUR) combined with Markov Switching process model, follow (Pastpitpatkul et al., 2015), are employed with the variables described in above Data and variables section as following equations system:

| (1) |

| (2) |

| (3) |

| (4) |

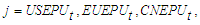

for

for  and

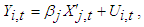

and  is 3×1 vector of dependent variables.

is 3×1 vector of dependent variables.  is 3×4 matrix of independent variables

is 3×4 matrix of independent variables  and

and  .

.  is 1×4 dimensional regression coefficient vector of

is 1×4 dimensional regression coefficient vector of  . And

. And  is 3×1 vector of the error term;

is 3×1 vector of the error term; where

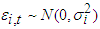

where  . When

. When  is assumed to correlate the errors across equations so that we can estimate all three equations simultaneously and the variance-covariance matrix (

is assumed to correlate the errors across equations so that we can estimate all three equations simultaneously and the variance-covariance matrix ( ) can be given as:

) can be given as: and

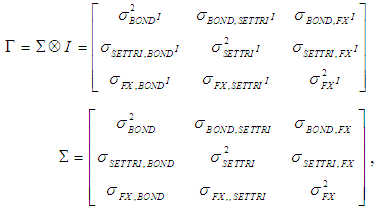

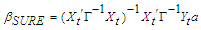

and  is an identity matrix. Then the estimated parameter from SUR can be written as:

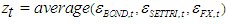

is an identity matrix. Then the estimated parameter from SUR can be written as: Once the error terms are obtained from each equation, it will be considered as a united power of foreign EPU. Thus, the averaged of error terms is calculated as

Once the error terms are obtained from each equation, it will be considered as a united power of foreign EPU. Thus, the averaged of error terms is calculated as  . Follow Hamilton (1989, 1994), then we can apply the Markov switching AR model for the variable

. Follow Hamilton (1989, 1994), then we can apply the Markov switching AR model for the variable  that allow more general dynamic structure of the model (Chung, 2002):

that allow more general dynamic structure of the model (Chung, 2002): | (5) |

and

and  are i.i.d. random variables with zero mean and variance

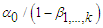

are i.i.d. random variables with zero mean and variance  .This is a stationary AR(k) process with mean

.This is a stationary AR(k) process with mean  when

when  , and it switches to another stationary AR(k) process with mean

, and it switches to another stationary AR(k) process with mean  when

when  changes from 0 to 1, where

changes from 0 to 1, where  are the Markovian state variables with the transition matrix,

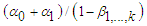

are the Markovian state variables with the transition matrix, | (6) |

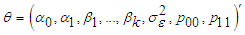

denote the transition probabilities of

denote the transition probabilities of  given, then

given, then  . The transition probabilities in (6) satisfy

. The transition probabilities in (6) satisfy  . Let

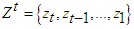

. Let  . Then

. Then  is the information set of the full sample, and the vector of parameters is

is the information set of the full sample, and the vector of parameters is  . Under the normality assumption on quasi-maximum likelihood estimation to compute the smoothing probabilities

. Under the normality assumption on quasi-maximum likelihood estimation to compute the smoothing probabilities  by follow Kim (1994) as:

by follow Kim (1994) as:

5. Empirical Results and Discussion

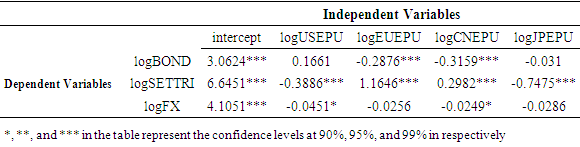

- Once the heteroscedasticity is checked to find the correlation among the error terms in order to perform SUR estimation. The estimation results from SUR model reveal that the effects of the foreign EPU on Thailand’s financial market are mostly negative. Table 2 demonstrates the significant negative effect of the EPU from China (logCNEPU) and Europe (logEUEPU) in respectively at -0.3159 and -0.2876 coefficient in Thailand’s bond market (logBOND). These significant negative coefficients refer to the increasing in the EPU would reduce bond yields, consistent with the explanation in Leippold and Matthys (2015), that is said when increasing EPU leads more demand on bond and therefore reduce bond yields. For stock market (logSETTRI), the EPU from the United States (logUSEPU) creates the significant negative effect by -0.3886 of coefficient as well as the EPU from Japan (logJPEPU) that also negatively affect the market by -0.7475 of coefficient. However, it can be seen that the EPU does not produce only negative effect in Thailand’s stock market. In contrast, the stock market apparently gains the benefit from the EPU in Europe and China, resulted in estimated parameters at 1.1646 and 0.2982 of coefficient in respectively.

|

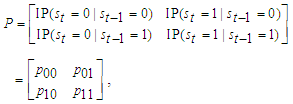

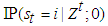

and

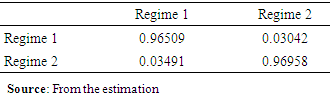

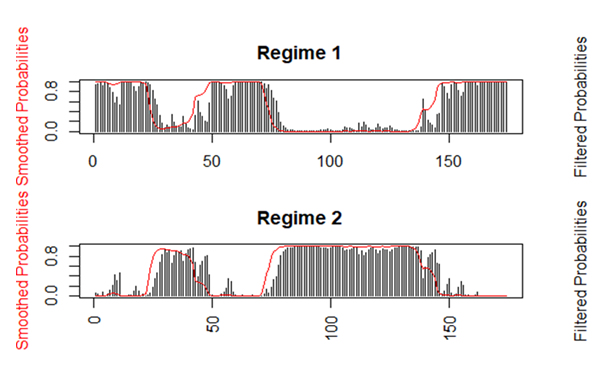

and  . These high probabilities illustrate the powerful persistency of the foreign EPU in Thailand’s financial market in holistic perspective. It also points that the foreign EPU is slightly more existed in regime 2 than in regime 1 about 0.04 percent. Nonetheless, the switching probability from one regime to another is bout about 0.03 as considered from the value of

. These high probabilities illustrate the powerful persistency of the foreign EPU in Thailand’s financial market in holistic perspective. It also points that the foreign EPU is slightly more existed in regime 2 than in regime 1 about 0.04 percent. Nonetheless, the switching probability from one regime to another is bout about 0.03 as considered from the value of  and

and  which are accounted to be very low.

which are accounted to be very low.

|

| Figure 1. Smoothed and Filtered Probabilities (Source: From the estimation) |

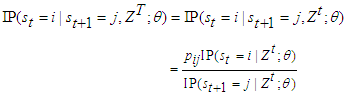

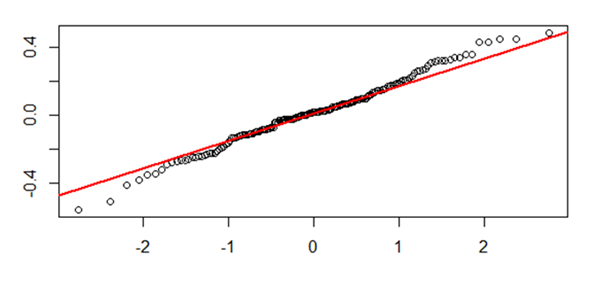

| Figure 2. Normal Quantile – Quantiles plot (Source: From the estimation) |

6. Conclusions

- Based on our results from SUR and the Markov switching, it confirms that the foreign economic policy uncertainty (EPU) has consistently existed and caused Thailand’s financial market in all circumstances. However, the consequences of the foreign EPU does not only produce the negative outcome to the market like many papers have generally claimed, but also be positive or said it potentially benefits the financial market in Thailand due to the significant positive relationship between Thailand’s stock market and the EPU from China and Europe was found in this study. Furthermore, the foreign EPU also play a major role in Thailand’s bond market. An increase in foreign EPU especially in China and Europe reduces bond yields in Thailand. This can reflect the confidence to confirm that Thai bonds are demanded when the economic policy uncertainty in these two regions is higher. Finally, increasing Chinese and US EPU may be related to unexpected trade policy between the two countries and leads to the effect as a stronger Thai Baht in currency exchange market. Therefore, the conclusion for this study can be expressed that the foreign economic policy uncertainty does matter to the financial market in Thailand, agreeably with Apaitan, et al. (2018).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML