-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2020; 10(5): 267-276

doi:10.5923/j.economics.20201005.01

Modelling Electric Power Consumption, Energy Consumption and Economic Growth in Zimbabwe: Cointegration and Causality Analysis

Raynold Runganga 1, Syden Mishi 2

1Department of Economics, University of Zimbabwe, Harare, Zimbabwe

2Department of Economics, Nelson Mandela University, Port Elizabeth, South Africa

Correspondence to: Raynold Runganga , Department of Economics, University of Zimbabwe, Harare, Zimbabwe.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper examines the causal relationship between electric power consumption, energy consumption and economic growth in Zimbabwe during the period 1970-2014. The Chow test showed that there is a structural break in the year 2008. Compared to previous studies, our model include both electric power consumption and energy consumption in influencing economic growth and for this purpose, Johansen cointegration test and Vector Error Correction Model (VECM) were used to analyse the short-run and long-run dynamics of the variables in the full sample (1970-2014). In the short-run model, the study results failed to establish any causal relationship between energy consumption, electric power consumption and economic growth in the short run. However, in the long run, there was a unidirectional causality running from electric power consumption and energy consumption to economic growth. The long-run model showed that electric power consumption has impact on economic growth while energy consumption was found to have no impact on economic growth. In the sub-sample (1970-2008), Autoregressive Distributed Lag (ARDL) model was used and a long-run relationship was found to exist between the variables but however, no short-run relationship was found. We conclude that in the Zimbabwean context, the growth hypothesis is supported in the long-run. Therefore, the study recommends relevant authorities to ensure supply of electricity by increasing investment in energy and electricity generation capacity since its availability in the long run is critical for economic growth.

Keywords: Economic Growth, Electric Power Consumption, Energy Consumption, Vector Error Correction Model

Cite this paper: Raynold Runganga , Syden Mishi , Modelling Electric Power Consumption, Energy Consumption and Economic Growth in Zimbabwe: Cointegration and Causality Analysis, American Journal of Economics, Vol. 10 No. 5, 2020, pp. 267-276. doi: 10.5923/j.economics.20201005.01.

Article Outline

1. Introduction

- The causal relationship between energy consumption and economic growth has become an area of contention in literature since the seminal work of Kraft and Kraft [1] and some studies concluded that there is a strong relationship between these variables (Yasar [2], Khobai [3], Eggoh et al. [4]). In Zimbabwe, recent efforts to revive the economy have seen an increase in electricity demand across all sector of the economy. According to Makonese [5], 40% of the households in Zimbabwe have access to electricity and in the near future, electricity demand is expected to increase as the country takes steps to revive all sectors of the economy. On the other hand, since the late 1990’s, Zimbabwe Electricity Supply Authority (ZESA) holdings has been failing to produce enough electricity to meet rising demand leading to unprecedented energy crisis which is being attributed to reduced water levels in Kariba dam, ageing power plants, transmission and distribution network which has suffered years of neglect and minimal maintenance among other factors. In addition to severe load-shedding in the country, there is unstable macroeconomic environment and economic growth has not been favourable, with predicted economic growth for 2019 of -6.5% (Reserve Bank of Zimbabwe [6]). It therefore becomes an issue of research curiosity and a matter of policy concern as to why? Answers to this question can be derived from the investigation of the causal relationship between electric power consumption1 as an alternative source of energy, energy consumption and economic growth.However, the causal relationship between electric power consumption, energy consumption2 and economic growth in ambiguous both empirically and at the level of theory. In empirical for example, while Shahateet [7] found no causal relationship between energy consumption and economic growth, Khobai [3] found a unidirectional causality from economic growth to electric power consumption in the long run. Yasar [2] found that the causal relationship between energy consumption and economic growth differs depending on the income group the country belongs to. The bidirectional causality was found to hold for upper middle income countries in the long-run and high income countries while unidirectional causality from economic growth to energy consumption was found to hold in upper-middle income countries in the short-run and lower middle-income countries in the long-run. However, no causality was found for low and lower-middle income countries in the short-run. Shahbaz et al. [8] found that electric power as an input has less importance at lower levels of economic growth and energy demand decreases with increases in the level of economic growth. The existing empirical evidence does not provide enough attestation on the causal relationship between electric power consumption, energy consumption and economic growth in Zimbabwe.At the level of theory, various explanations also exists on the relationship between energy consumption3 and economic growth and the outcome has been ambiguous. Four hypotheses regarding the link between economic growth and energy consumption exist in literature and these are growth hypothesis, conservative hypothesis, neutrality hypothesis and feedback hypothesis. Growth hypothesis assumes that there are countries in which energy consumption is an important element of economic growth, hence there is unidirectional causality running from energy consumption to economic growth. Furthermore, in addition to capital and labour from the Solow [9] growth model, energy consumption is indispensable for economic development and is an important intermediate input for economic growth (Shahbaz et al. [8]).The conservative hypothesis is based on the assumption that changes in energy consumption is based on changes in economic activities, hence there is unidirectional causality running from economic growth to energy consumption. The neutrality hypothesis states that there are some countries where energy consumption does not influence economic growth and economic growth does not influence energy consumption. The feedback hypothesis states that there are some countries in which there is bi-directional causality between energy consumption and economic growth. Whether economic growth is attributed to capital and labour or together with electricity consumption and energy consumption as an intermediate input is subject to empirical investigation since various contradicting hypotheses exist in empirical literature. The research issue is that economic growth relies heavily on energy consumption in production but the role of energy consumption on economic growth is not clear in literature, hence a matter of policy concern given severe load-shedding being experienced in Zimbabwe. Therefore, the objective of this study is to examine the causal relationship between energy consumption, electric power consumption and economic growth in Zimbabwe. The specific objectives are:§ To examine the relationship between energy consumption and economic growth.§ To examine the relationship between electric power consumption and economic growth.

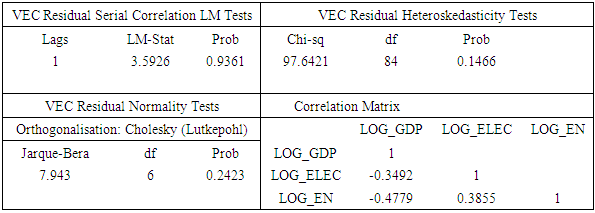

2. Overview of the Study

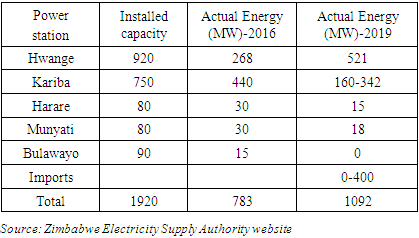

- The Zimbabwe’s electricity supply is dominated by state owned enterprise, ZESA holdings and has the mandate to generate, transmit and distribute electricity to all sectors of the economy. Less than 1 per cent of Zimbabwe’s electricity is produced by private companies such as Nyangani Renewable Energy (Pvt) Ltd (Makonese [5]). ZESA holdings delegate its tasks to its subsidiaries, Zimbabwe Power Company (ZPC) and Zimbabwe Electricity Transmission and Distribution Company (ZETDC). The power supply in Zimbabwe is sourced from local generation as well as imports and the domestic generation comes from Kariba hydropower, Hwange coal-power fire station and three small thermal power stations. The most reliable plant has been Kariba power station but from 2015, the capacity to generate electricity was constrained due to reduced water levels and supply from Hwange thermal power station is erratic due to age of the plant and lack of regular maintenance. In addition, high debt of the Government of Zimbabwe on electricity from ZESA holdings and foreign suppliers such as Eskom from South Africa has worsened power cuts. The table below shows the installed generation capacity and actual generation capacity as at 9 August 2019.

|

| Figure 1. Real GDP, Electric power consumption and Total energy consumption, Source: World Bank website and Author’s Illustration |

3. Theoretical and Empirical Literature

- Various theories exist to explain the causality between electricity consumption and economic growth such as the neoclassical and endogenous growth theories. The neoclassical and endogenous growth theories analyse the effects of primary factors of production such as labour and capital on economic growth. Energy and the type of energy used in the production process are often ignored as important element of economic growth, but is considered as an intermediate input. For example, while Solow growth model put more emphasis on technological progress to facilitate economic growth, the AK model of endogenous growth put more emphasis on technology as endogenous and high savings rate to promote economic growth. The Schumpeterian growth models highlight on the importance of capital accumulation and innovation to promote economic growth. The neoclassical growth model of economic growth by Solow [9] does not include resources and the theory argue that the only cause of continuing economic growth is technological progress, which is assumed to be exogenous. The endogenous growth model attempts to explain technological progress in the growth model as an outcome of decisions taken by firms and individuals (Yucel et al. [12]). Although the Solow growth model, AK model and Schumpeterian growth models does not explicitly state electric power and energy consumption as a driver of economics growth, the factors which these models posit as critical to economic growth, that is technological progress, capital accumulation and innovation highly depend on electric power and energy consumption. Thus, in these models, electric power consumption and energy consumption serves as an intermediate input in facilitating economic growth.In addition to these theoretical models, four hypotheses regarding the link between electricity consumption and economic growth exist in literature and these include the growth hypothesis, conservative hypothesis, feedback hypothesis and neutrality hypothesis. The growth hypothesis argue that energy consumption contribute directly to economic growth and development and work as a complement to labour and capital in the production process (Shahbaz et al. [8]). Thus, the growth hypothesis postulates that an increase in energy consumption lead to an increase in economic growth. The conservation hypothesis suggest that a country is less dependent on energy inputs and that energy conservation-oriented policies may not impede economic growth. This hypothesis implies that an increase in economic growth lead to an increase in energy demand (Dogan [13], Shahbaz et al. [8]). The feedback hypothesis stipulates that energy consumption and economic growth are interdependent and serve as complements to one another (Shahbaz et al. [8]). Thus, an increase (decrease) in energy consumption lead to an increase (decrease) in economic growth and likewise, an increase (decrease) in economic growth lead to an increase (decrease) in energy consumption (Shahbaz et al. [8]). The neutrality hypothesis postulates that energy inputs plays minor role on economic development of a country and does not significantly contribute to economic growth. As a result, energy conservation policies do not adversely affect economic growth. It is based on the argument that energy consumption represent a much smaller portion than labour and capital in production process and that this portion is so small to have a significance influence on economic growth. Thus, energy consumption and economic growth are independent and energy consumption play a minimal to non-existent role in production process (Sylvester and Okorie [11]). These hypotheses are inconsistent on the causality between energy consumption and economic growth. In the context of Zimbabwe, there has been high electricity consumption, low electric power supply leading to severe load-shedding and poor economic growth. It is worth to explore how the electric power consumption and energy consumption has an influence on economic growth.Despite the inconsistence in theory on impact of electric power consumption on economic growth, empirical evidence also show that the causality between energy consumption and economic growth is inconsistent depending on country of study, methodology among other factors. Some of the methodologies used include the Pedroni, Kao and Johansen cointegration tests, Auto-Regressive Distributed lag (ARDL) model, Structural Vector Autoregressive framework, Dynamic Ordinary Least Square and Granger causality test to analyse the long run relationship between variables and inconsistent results were found. Pedroni, Kao cointegration tests and Autoregressive Distributed lag boundary approach were used by panel data based studies.Some of the studies that used panel data include Bayar and Ozel [14] who analysed the relationship between electricity consumption and economic growth in emerging economies for the period 1991-2011. The study examined the long run relationship between the variables using Pedroni, Kao and Johansen Fisher cointegration tests and analysed the existence and direction of causality using the Vector Autoregressive Granger causality test. The study found that there is bidirectional causality between economic growth and electricity consumption. In investigating the causal links between economic growth, renewable energy, financial development and foreign trade in Gulf Cooperation Council Countries during the period 1980-2012, Hassine and Harrathi [15] used Pedron and Kao cointegration tests and the Engle and Granger [16] test to determine the direction of causality in the short run and long run. The variables used were gross domestic product, renewable energy consumption, private sector credit, exports, financial development, labour and capital. The study found that there is bidirectional causality in short run and long run between output and exports while no evidence of causality was found in the short run between output and renewable energy consumption, contrary to Bayar and Ozel [14] findings. The long run results showed that renewable energy consumption, private sector credit and exports had impact on output.In addition to mixed findings in different countries, the relationship has also been found to be inconsistent in different income country groups. A typical example is the study of Yasar [2] who examined the relationship between energy consumption and economic growth using panel Autoregressive Distributed Lag Boundary approach, Vector Error Correction Model (VECM) and Granger causality analysis techniques to determine the long run dynamics of the variables. The study found that there is a causal relationship between energy use and economic growth depending on which income group the county belongs to. Bidirectional causality was found to hold in upper-middle income groups in the long run and high income group while the unidirectional causality from economic growth to energy consumption (conservation hypothesis) was found to hold for upper-middle income group in the short run and lower-middle income group in the long run. No direction of causality was found in low and lower-middle income groups in the short run. Whether these results imply that Zimbabwe as an upper-middle income country has sufficient economic growth to influence energy consumption despite high loading-shedding and unstable macroeconomic environment is subject to investigation.Contrary to the findings of Yasar [2], Eggoh et al. [4] examined the relationship between energy consumption and economic growth in 21 African countries over the period 1970-2006 and found that there is a long run equilibrium between energy consumption, real gross domestic product, labour, capital for each group of countries as well as the whole set of countries. The study used Dynamic Ordinary Least Square and found a bidirectional causality between energy consumption and economic growth. Khobai [3] investigated the causal relationship between electricity consumption and economic growth on BRICS countries using panel data for the period 1990-2014. The study used the Kao panel cointegration and Johansen Fisher cointegration techniques to analyse the long run relationship between the variables, economic growth, electricity consumption, carbon dioxide emissions and urbanisation as used by Bayar and Ozel [14] and Hassine and Harrathi [15]. The variables used include electricity consumption, real gross domestic product, carbon dioxide emissions and urbanisation. Vector Error Correction Model Granger causality test was used to estimate the causal relationship between the variables and the study found that there is a long run relationship between the variables. In addition, the study found that there is unidirectional causality flowing from economic growth to electricity consumption in the long run in BRICS countries.Using Panel Vector Error Correction Model and Granger causality test as used by Khobai [3], Yucel et al. [12] analysed the relationship between renewable energy and non-renewable energy consumption and economic growth for a panel of fifteen European Union countries over the period 1990-2011. Heterogeneous panel cointegration test showed a long run equilibrium relation between real GDP, renewable energy and non-renewable energy consumption, greenhouse gases emissions and research and development. The study found a unidirectional causality running from non-renewable energy consumption to economic growth and a positive relationship between greenhouse gas emissions and real GDP.Dogan [13] investigated the causal relationship between energy consumption and economic growth in four low-income countries in Sub-Saharan Africa using time series data for the period 1971-2011. The variables used were real GDP per capita and energy consumption. Using Johansen cointegration test and Granger-causality test, no long run relationship between real GDP and energy consumption was found for Kenya and Zimbabwe, contrary to the findings of Yucel et al. [12] and Khobai [3]. Consistent with the findings of Bayar and Ozel [14], the study found a unidirectional causality running from energy consumption to economic growth in Kenya and no causality between these variables was found in Zimbabwe, which is inconsistent with results of Eggoh et al. [4] and Khobai [3].Shahbaz et al. [8] used a different approach from other panel studies, which is the quantile-on-quantile (QQ) approach to explore some nuanced features of the energy-growth nexus. The study examine the interlinkages between energy consumption and economic growth in top ten energy consuming countries, that is China, United States of America, Russia, India, Japan, Canada, Germany, Brazil, France and South Korea and found a positive association between economic growth and energy consumption with considerable variations across economic states in each country. In some countries, energy consumption was found to have less importance at low levels of economic growth and in some countries, energy consumption was found to decrease with increase in economic growth. The results of panel data studies were mixed and inconsistent and the same applies to time series studies that were done especially in developing countries. For example, Sylvester and Okorie [11] evaluated the causal relationship between electricity consumption and economic growth in Nigeria over the period 1980-2014 using Johansen cointegration and VAR based techniques. The study found a long run relationship between electricity consumption and economic growth. A unidirectional causality between electricity consumption and economic growth was also found. Contrary to the findings of Sylvester and Okorie [11], Kasperowicz [17] investigated the relationship between electricity consumption and economic growth in Poland and found a bidirectional causality between electricity consumption and economic growth and a bidirectional causality between capital and economic growth. The study used Granger causality test and electricity was found to be a pro-growth variable in Nigeria. The variables used include real GDP, electricity consumption, gross fixed capital in real prices and total employment.Jakovac [18] examined an empirical analysis on the relationship between economic growth and energy consumption in Croatia for the period 1952-2010 using Granger causality test. Chow break-point test showed a structural break in the year 1989, hence two subsamples were used. Johansen cointegration test showed a long run equilibrium relationship between economic growth and energy consumption. Consistent with the results of Kasperowicz [17], the study found a bidirectional causality between energy consumption and economic growth in the first subsample (1952-1989). After the structural break, the study found a unidirectional causality running from economic growth to energy consumption. Zeshan and Ahmed [19] investigated the impact of energy consumption on real GDP, capital stock and labour force using annual data for the period 1971-2012. The study employed the Structural Vector Autoregressive (SVAR) framework and found that economic growth increase demand for labour force. The same was found to hold for energy and capital stock and the variables used were energy consumption, real GDP, capital stock and labour force. In Zimbabwe, Tsaurai [20] examined an empirical analysis of the nexus between energy consumption and economic growth using time series data. The study used the Johansen cointegration test procedure and bi-variate causality test framework to examine the relationship. The variables used were real GDP, energy consumption and contrary to the finding of Dogan [13], Kasperowicz [17], Sylvester and Okorie [11] among other studies, the study failed to establish any direct causality relationship between energy consumption and economic growth. The study found an indirect bidirectional causality relationship between energy consumption and economic growth.Using panel data based on 17 Arab countries, Shahateet [7] examined the relationship between energy consumption and real economic growth. Using the Autoregressive Distributed Lag (ARDL) model and Granger causality test, the study found no causality relationship between economic growth and energy consumption in Arab countries except the case of Kuwait which showed to confirm a bidirectional causality between economic growth and energy consumption.Evidence from literature shows that electric power consumption and energy consumption, among other factors are important factors of economic growth but the relationship between these factors and economic growth is ambiguous and inconsistent, hence seeks further investigation.

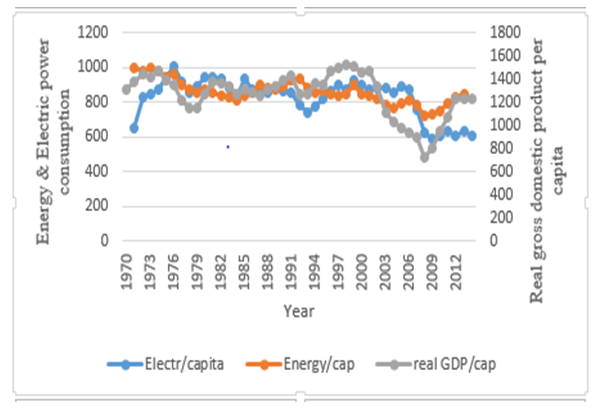

4. Data, Methodology and Results

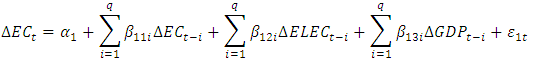

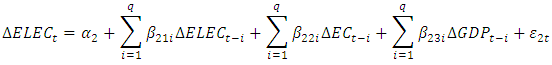

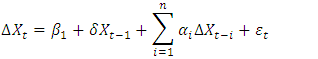

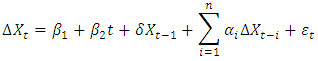

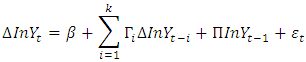

- The study used secondary time series data which covered the period, 1970-2014 and was collected from the World Bank website. The data included: data on electricity consumption defined as electric power consumption (kWh per capita), data on energy consumption defined as energy use (kg of oil equivalent per capita) and real gross domestic product as a proxy for economic growth. The relationship between these variables, expressed in the Vector Autoregressive Granger-causality frame work is stated as follows:

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

is a normally distributed white noise error term,

is a normally distributed white noise error term,  is a deterministic time trend,

is a deterministic time trend,  is the lagged value of the variable

is the lagged value of the variable  is the lagged values of the first difference of the variable

is the lagged values of the first difference of the variable  and

and  are the estimated coefficients. Several integration techniques have been used by previous studies to test for co-integration exist such as Pedron cointegration test, Kao cointegration test and Johansen cointegration test (Bayar and Ozel [14], Khobai [3], Sylvester and Okorie [11], Dogan [13]). This study used the Johansen cointegration procedure to analyse the long run relationship between electric power consumption, energy consumption and gross domestic product as widely used in literature. The Vector Error Correction Model was used to determine the speed of adjustment towards the long run equilibrium while the ARDL model was used to examine the existence of short-run causality and long-run relationship between economic growth, electric power consumption and energy consumption.

are the estimated coefficients. Several integration techniques have been used by previous studies to test for co-integration exist such as Pedron cointegration test, Kao cointegration test and Johansen cointegration test (Bayar and Ozel [14], Khobai [3], Sylvester and Okorie [11], Dogan [13]). This study used the Johansen cointegration procedure to analyse the long run relationship between electric power consumption, energy consumption and gross domestic product as widely used in literature. The Vector Error Correction Model was used to determine the speed of adjustment towards the long run equilibrium while the ARDL model was used to examine the existence of short-run causality and long-run relationship between economic growth, electric power consumption and energy consumption.4.1. Econometric Results and Discussion

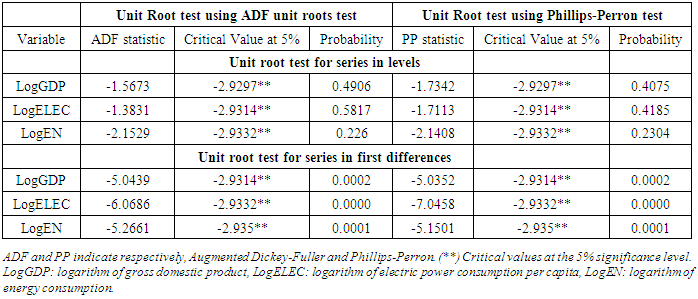

4.1.1. Stationarity

- After taking the natural logarithms of all the series, stationarity test as in Yasar [2] were done to find out whether the series are stationary or co-integrated. The Augmented Dickey-Fuller and Phillips-Perron (PP) unit root test were used to test for stationarity in order to avoid spurious relations among the variables. The results of the unit root test are shown in table 2 below.

|

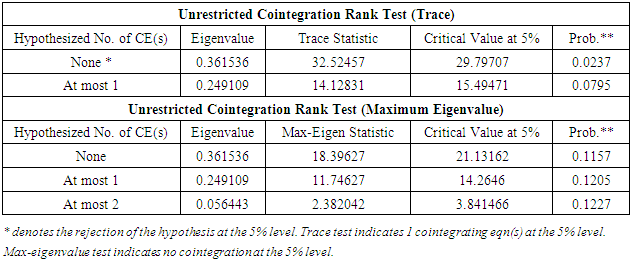

4.1.2. Johansen Cointegration Procedure

- Since all the variables were found to be non-stationary and integrated of the same order [I(1)], there is likely to be a long run relationship between these variables, making it worthwhile to test if co-integration exist. Before applying the Johansen co-integration test, optimal lag length of one was determined using the Akaike Information Criterion. The Johansen co-integration test was done using the following Vector Autogressive (VAR) model:

| (6) |

represents a n*1 vector of variables which are integrated of the same order. The parameters

represents a n*1 vector of variables which are integrated of the same order. The parameters  and

and  represent an

represent an  matrice of coefficients of the lagged variables and

matrice of coefficients of the lagged variables and  is an

is an  vector of innovations. If the rank (r) is zero, then there is no co-integrating relationship, if the rank (r) is one, there is one co-integrating relation and if the rank (r) is two, there are two co-integrating relation and so on. The results for co-integration using the Trace method and Maximum Eigen value method are shown in the table 3 below.

vector of innovations. If the rank (r) is zero, then there is no co-integrating relationship, if the rank (r) is one, there is one co-integrating relation and if the rank (r) is two, there are two co-integrating relation and so on. The results for co-integration using the Trace method and Maximum Eigen value method are shown in the table 3 below.

|

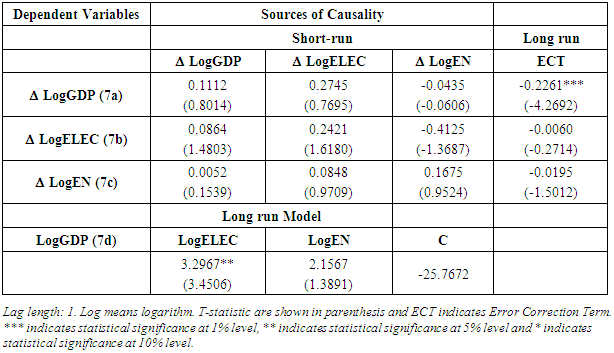

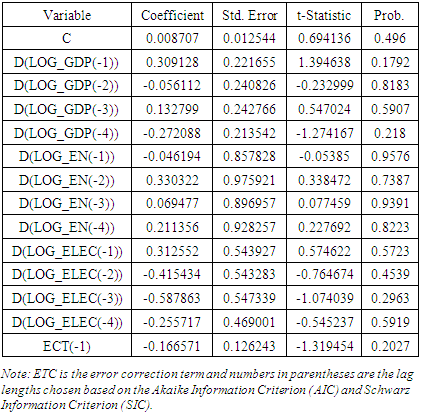

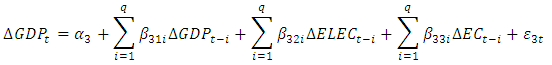

4.1.3. Vector Error Correction Model

- Since there is evidence of cointegration relationship among the series based on the Trace method, the Vector Error Correction Model was used to examine the long run dynamics of the variables. Before applying the VECM, Chow test was used to test if there is any structural break in the series. The null hypothesis that there is a structural break was tested using the F-test and the lag length was determined based on the Akaike Information Criterion. The F-statistic was found to be significant at 5% level and we cannot reject the null hypothesis that there is a structural break in the series. Therefore, the full sample (1970-2014) and subsample (1970-2008) was used. The subsample results showed that the variables are integrated of different orders, requiring the application of ARDL model. The results4 of the Wald test on the ARDL model show that there is a long run relationship between economic growth, electric power consumption and economic growth but however, the error correction term was insignificant and no short-run causality was found between the variables. The long run model for the full sample shows that there is a long run equilibrium relationship between economic growth, electric power consumption and energy consumption as shown in table 4.

|

|

|

5. Conclusions

- This paper investigates empirically the causal relationship between economic growth, electric power consumption and energy consumption in Zimbabwe using time series data for the period 1970-2014. The relationship between these variables can be explained using the growth hypothesis, neutrality hypothesis, feedback hypothesis and conservation hypothesis. The growth hypothesis argues that energy and electric power consumption promote economic growth while the conservation hypothesis insist that economic growth fosters energy consumption. While feedback hypothesis highlight that both energy consumption and economic growth causes each other, neutrality hypothesis argue that there is no causality between the variables in both short run and long run. Using the Johansen cointegration and Vector Error Correction Model, the study failed to establish any causal relationship between energy consumption, electric power consumption and economic growth in the short run. However, in the long run, there was a unidirectional causality running from electric power consumption and energy consumption to economic growth. The study therefore recommends the Zimbabwean government, Zimbabwe Electricity Supply Authority and relevant authorities to ensure supply of electricity by increasing investment in energy and electricity generation capacity since its availability in the long run is critical for economic growth. Furthermore, there is need to improve investment in infrastructure and industrial production by improving ease of doing business and rule of law.

Notes

- 1. This is a form of energy consumption that uses electric energy and it is the actual energy demand that is made against the existing electricity supply.2. In this study, energy consumption is the total amount energy or power used, which is the use of primary energy before transformation to other end-use fuels within the economy.3. While electricity is a form of energy that is used, which is actual energy demand against existing supply and electric power consumption is narrow relative to energy consumption.4. The results are shown in table 5. No serial correlation was found and the model was found to be stable using the Recursive Estimation CUSUM test.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML