-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2020; 10(4): 225-240

doi:10.5923/j.economics.20201004.03

The Economic Factors That Affect a Change of Thai Baht Exchange Rate

Pitchayapa Siriratana

International Trade, Master’s Degree Economics School Shanghai University, Shanghai, China

Correspondence to: Pitchayapa Siriratana, International Trade, Master’s Degree Economics School Shanghai University, Shanghai, China.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This article gives research study about the different factors that affect to the change of selected currencies between the exchange rates of Thai Baht (THB) against the US dollar (USD), Japanese Yen (JPY) and Chinese Yuan (CNY) by using Thai Baht (THB) as the base currency to analyse through multiple regressive analysis and monthly exchange rates data of the independent factors which are Balance of Payment (BOP), Costumer Price Index (CPI), Interest rates (IN), Business Sentiment Index by Components (BSI) and Foreign Direct Investment (FDI) which this would be benefited to relevant field in order to reducing exchange rate risks.

Keywords: Factors that affect a change of currency, Exchange rate, Thailand currency, Currency exchange, Exchange rate theories

Cite this paper: Pitchayapa Siriratana, The Economic Factors That Affect a Change of Thai Baht Exchange Rate, American Journal of Economics, Vol. 10 No. 4, 2020, pp. 225-240. doi: 10.5923/j.economics.20201004.03.

Article Outline

1. Introduction

- In the globalization, every country has currency different from others; general use in particular country, but when trading between countries happened an “Exchange currency”. This foreign exchange market plays an important role in country’s trade performance. Moreover, the volatility of the exchange rate often influences the overall economic performance through the balance of payment and the policy about import or export conditions. The status of the exchange rate situation impacts to the microeconomic in term of the policy and also common news that every household should be following because it can be effect or cause of groceries, gas, fuel prices rising to the personal loan and etc. Thus, the exchange rate is one of the most critical determinants of a country's relative level of economic health. For general, currency exchange will be an activity when we buy, sell or exchange something from aboard. However, exchange rates also play a vital role in a country's level of trade, which is critical to most every free market economy in the world. For this reason, exchange rates are among the most watched, analysed, and governmentally manipulated economic measures. Thus these reasons lead to this study which mainly focus on factors that effect on Thai Baht (THB) currency and US dollar (USD), Japanese Yen (JPY) and Chinese Yuan (CNY) or Renminbi (RMB) which are the top-three trading partners with Thailand.For this study, Thailand is the base or a home currency which will show the symbol as the “direct quote.” As an illustration, a direct quote uses a variable amount of Thai Baht (THB) that required to buy or sell one unit of US dollar (USD), 100 units of Japanese yen (JPY) and one unit of Chinese yuan (CNY). A lower exchange rate means a domestic currency (THB) becomes stronger since the price of foreign currencies (USD, JPY, or CNY) is falling. Besides, the lower of the exchange rate as Thai Baht (THB) is a home currency means Thai Baht (THB) is appreciation against foreign currency.The US dollar (USD, $), a global currency is the one that accepted for worldwide trade. As in there is some of the world's currencies are accepted for most international transactions. US dollar refers monetary unit of the United States of America (USA), the biggest economies of the world with the total value of 20.4 trillion US dollar, the latest value in April 2018. (MIF, 2018) Moreover, USD is the official currency or global currency when we do the exchange to others currency. There is some more of the most popular in this world; the U.S. dollar, the Euro, and the Yen. Among these the U.S. dollar is the most popular since it makes up 64 percent of all known central bank foreign exchange reserves and because of that reason makes it becomes the global currency, even though it does not hold an official global title.The Yen (Japanese: 円 symbol: ¥; code: JPY) is the official currency of Japan. It is the third most traded currency in the foreign exchange market after the United States dollar and the euro. Also, widely used as a reserve currency after the U.S. dollar, the euro, and the pound sterling. [15] Although, the Japanese yen has risen again (2018, Aug) that is partial because of a slightly shifted in central-bank policy in Tokyo and dollar and quite fluctuated because of no growing sign in the Japan economic in recently which investors picture it as a haven, it has been boosted by uncertainty over trade and global growth [16], but as a haven, due to political worries such as the prelude to the Brexit vote, investors tend to gravitate toward, the Japanese yen still be the major currencies in the world and one of the top-list chosen by investors which has relation with Thailand economy.The Yuan (sign:

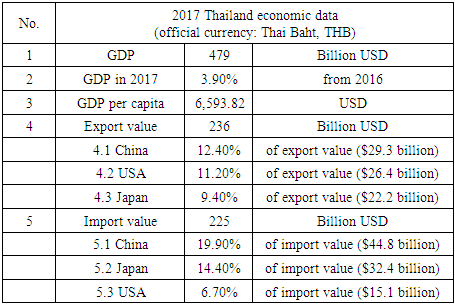

; Chinese: 元) is the base unit of several former and present-day Chinese currencies. The ISO 4217 standard code for renminbi is CNY. It’s has been growing in China economy brings so much more essential on CNY, and it is worth watching by the world. According to China plans to open up its market further and promote free global trade and investment, China has inked bilateral currency swap agreements with over 30 countries and regions since late 2008 to facilitate cross-border trade and investment. The data from international financial transaction agency SWIFT showed that about 1.66 percent of global payments processed in January 2018 were denominated in yuan, edging up slightly from the previous month but still lower than a record high of over 2 percent, there have been signs that international institutions are warming to the Chinese currency. However, Central banks in European countries including France and Germany are including the yuan in their forex reserve mix. However, a survey by the Bank of China showed about 60 percent of the surveyed 3,000-plus overseas firms and financial institutions mulls using yuan or increasing its usage, basically, the use of yuan on digital platforms has been growing fast as Chinese mobile payment platforms like Alibaba's Alipay and Tencent's WeChat Pay keep promoting a cashless society, according to a SWIFT report. For foreign firms, it increasingly pays to use Chinese yuan. In sum, using the yuan in trade and investment will make it easier and cheaper for foreign firms to do business with China while including the yuan into investment portfolios will help optimize investment structure and return.For Thailand economic information, Thailand is the 20th largest export economy in the world. [4] and the second largest economy in ASEAN after Indonesia, is an upper middle-income country with an open economy, a gross domestic product (GDP) of $479 billion, and 3.9% growth in 2017.. GDP per capita $6,593.82. (World Bank, 2018) Thai Baht (THB) value is around 33.57 THB/USD average five years (OFX, 2018) In 2017. Thailand shipped US$236 billion worth of goods around the globe in 2017. The top export destinations of Thailand are China amounted to $29.3 billion or 12.4% of its overall exports. As we can summarize in the following table.

; Chinese: 元) is the base unit of several former and present-day Chinese currencies. The ISO 4217 standard code for renminbi is CNY. It’s has been growing in China economy brings so much more essential on CNY, and it is worth watching by the world. According to China plans to open up its market further and promote free global trade and investment, China has inked bilateral currency swap agreements with over 30 countries and regions since late 2008 to facilitate cross-border trade and investment. The data from international financial transaction agency SWIFT showed that about 1.66 percent of global payments processed in January 2018 were denominated in yuan, edging up slightly from the previous month but still lower than a record high of over 2 percent, there have been signs that international institutions are warming to the Chinese currency. However, Central banks in European countries including France and Germany are including the yuan in their forex reserve mix. However, a survey by the Bank of China showed about 60 percent of the surveyed 3,000-plus overseas firms and financial institutions mulls using yuan or increasing its usage, basically, the use of yuan on digital platforms has been growing fast as Chinese mobile payment platforms like Alibaba's Alipay and Tencent's WeChat Pay keep promoting a cashless society, according to a SWIFT report. For foreign firms, it increasingly pays to use Chinese yuan. In sum, using the yuan in trade and investment will make it easier and cheaper for foreign firms to do business with China while including the yuan into investment portfolios will help optimize investment structure and return.For Thailand economic information, Thailand is the 20th largest export economy in the world. [4] and the second largest economy in ASEAN after Indonesia, is an upper middle-income country with an open economy, a gross domestic product (GDP) of $479 billion, and 3.9% growth in 2017.. GDP per capita $6,593.82. (World Bank, 2018) Thai Baht (THB) value is around 33.57 THB/USD average five years (OFX, 2018) In 2017. Thailand shipped US$236 billion worth of goods around the globe in 2017. The top export destinations of Thailand are China amounted to $29.3 billion or 12.4% of its overall exports. As we can summarize in the following table.

|

1.1. Purpose of the Study

- To analyse the different independent factors that effects to the changes of 3 (three) selected currencies which are THB/USD, THB/JPY, and THB/CNY in order to be benefited for who are involved in Thailand by reducing exchange rate risks.

1.2. Scope of Study

- By using monthly exchanged rate data between THB/USD, THB/JPY, and THB/CNY from 2007-2016 database (120 months) in order to achieve the purpose as above mentioned through Multiple Regression Analysis as the method and all secondary quantitative data as an input or variables data and using the Balance of Payment (BOP), Costumer Price Index (CPI), Interest rate (IN), Business Sentiment Index by components (BSI), and Foreign Direct Investment (FDI).

1.3. Related Theories

1.3.1. Purchasing Power Parity (PPP)

- PPP is the very first conventional theory for international trade from the basic concept that compares different countries' currencies through a "basket of goods." In another word, the same amount in different countries, two currencies are in equilibrium or at per when a basket of goods is priced the same in both countries.The relative version of PPP is calculated with the following formula:Purchasing Power Parity (PPP)

| (1) |

1.3.2. Relative Purchasing Power Parity (RPPP)

- RPPP is an expansion of the purchasing power parity theory to include changes in inflation over time. The theory holds that inflation will reduce the real purchasing power of a nation's currency.Relative Purchasing Power Parity (RPPP)

| (2) |

1.3.3. The Fisher Effect

- The Fisher effect is an economic theory created by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates. The Fisher effect states that the real interest rate equals the nominal interest rate minus the expected inflation rate.

| (3) |

1.3.4. International Fisher Effect (IFE)

- International Fisher Effect is a theory that combined the concept of The Fisher effect and PPP theory stating that the expected disparity between two currencies is approximately equal to their countries' nominal interest rates. (Investopedia, 2018).By calculation we can do as;

| (4) |

1.3.5. Interest Rate Parity (IRP) and Covered Interest Rate Parity (CIRP)

- Interest rate parity is a theory that suggests a strong relationship between interest rates and the movement of currency values. The way to predict what a future exchange rate will be simply by looking at the difference in interest rates in two countries. (LEMKE, 2018)

| (5) |

1.4. Literature Review

- There are some studied says that the specific factors which effects to the fluctuation of the exchange rate and as the results, they are most likely around 5 to 8 major factors. Those are also related to the existing theories, for example, in the country that has high purchasing ability effect to high inflation then the currencies will be more depreciated in the nearly future. In another factor that common use is the Interest rate according to Investopedia said, higher interest rates offer lenders in an economy a higher return relative to other countries. Therefore, higher interest rates attract foreign capital and cause the exchange rate to rise. From the theory, import and export also relate to the variability of the exchange rate, but from the studied in Pakistan, one study from University Islamabad found that the import and export have less impact to the object below than Inflation rate and Economic growth. [29] Political Stability and Economics are another factor that most economists give the weight on, these two factors are essential and have a relationship back and forth to each other. From the theories that referred above, many factors can influence the variations and fluctuations in exchange rates, but also each currency has a different character, and different factor can be affected.As the exchange rate is vital as mentioned so this topic is still an all-time interesting and attractive topic for economics students and researchers that’s why there are some related studied which will mention about it below in this part, however, the studied that conducted the information about Thai Baht currency has not that popular, and no one does about the THB with USD, JPY, and CNY yet.Mr. Sariz Nathapakti (2017), he us the Multiple Regression and Ordinary Least Squares: OLS methods to find out the economic factors relating to the exchange rate between Myanmar Kyat and Thai Baht. The Economic factors included a balance of trade (BOT), consumer price index (CPI), stock index (SI) and Money Supply M1 (M1) by collecting data from Jan 2013 to Jan 2017. As the result showed that the balance of trade (BOT) and the exchange rate between Myanmar Kyat and Thai Baht had a negative relationship. Consumer price index (CPI) and the exchange rate between Myanmar Kyat and Thai Baht had a positive relationship. Though, the stock index (SI) and Money Supply M1 (M1) did not have a significant relationship with the exchange rate between Myanmar Kyat and Thai Baht.Dr. Somyos Avakiat and Dr. Sittiporn Prawatrungruang (2015), They studied the Influencing of Important Factors on Exchange Rate of Thai Baht against the US Dollar, Thai Baht against the Euro, and Thai Baht against the Yen by using monthly data total 120 months (from Jan 2005-Dec 2014) and Multiple Regression as the method. The outcome of the study lead illustrated that the inflation rate was the factor that affected exchange rates between the Thai Baht against the US dollar, Euro and Yen in the same direction by statistically significant at a 95 percent confidence level. The other factors included the current account, the export value of goods from Thailand - United States, Thailand - the European Union and the value of exports of Thailand – Japan were factors which did not affect exchange rates between the Thai Baht against the US dollar, Euro, Yen by statistically significant at the 95 percent confidence level.Miss Nipaporn Chotipeaksawan (2011), studied factors that affect the change of Thai currency again US dollar, Euro and Yuan by using monthly data from Jan 2001 to May 2011 total 125 months. She used Multiple Regression and Ordinary Least Squares: OLS as a model. According to her study, it has been found that Inflation (INF) is a factor affecting the exchange rate between the Baht to US dollar, Baht to Euro and the Baht against the Yuan in the same direction, at a significant level of 95%. For the interbank interest rate (IBR) variable is a factor that affects the exchange rate between the Baht and Euro in the opposite direction at the .05 level, 95% confidential whist there is no effect on the exchange rate between the Baht and US dollar and the Baht per Yuan. Her studied is the primary model to this research, which in this study will develop in the perspective of currencies and factors, including the period are different that can affect the different result.Miss Somjai Panjan and Miss Wilailuck Thaiutsa (2007), their research studied in exchange rate forecasting between Baht and Thailand important transaction currencies (USD, JPY, GBP) which was focused on how to forecast the exchange rate by using three methods were Relative Purchasing Power Party, International Fisher Effect and Exponential Smoothing method which a last method is a statistical tool. Regarding to the comparison between forecasting and actual exchange rates insisting by the value of MAD, RMSE, and MAPE, it could be concluded that Exponential Smoothing Method was better accuracy fitting for forecasting Relative Purchasing Power Parity (RPPP) theory while International Fisher Effect (IFE) was not fitting at all.Miss Chureeporn Jeabna (2006), she using different factors to studied about the relationship and the changing of the exchange rate and also created the model to forecast the currencies. The different factors were the interest rate of Thailand, the interest rate of the United States of America, the inflation rate, the average gold price, and the total export (million baht). Her studied used the method of Quantitative Approach in Correlation, Coefficient, Multiple Regression, and One-Sample Statistic of t-test by used monthly data from January 2001 to October 2006 in order to analyze. The studied found that the average of gold price has a connection with exchange rate changed cause in US dollars and it can be used to create the equation for forecasting the rate with an error value of not more than 1.3 Baht while the total exports are correlated with changed in Pound sterling exchange rates at the confidence level of 95%. The model that can predict the Pound with having an error, not over 2.91 baht per 1 Pound Sterling. And the last model is Thai Interest rate correlated with exchange rate fluctuations of Japanese Yen at the confidence level of 95% and make for the forecasting model of having an error, not over 0.01 baht per 1 Yen of Japan.

1.5. Factor in the Study

- From those theories and literature review above, the way to choose the factors in this study in the subject to avoid what has studied but did not relate to the exchange rate or less effect to that. In the same time, it must be related to the theories. Therefore, the factors that have been choosing are;

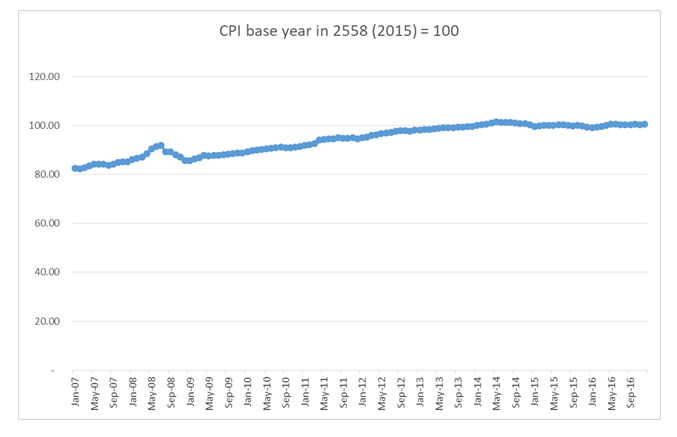

1.5.1. Consumer Price Index (CPI)

- CPI is an average change of price level from the market basket of consumer goods and service purchased by household. The standard of living can be lower if inflation is rising. That means in the same amount of money; a consumer can buy less than before. From PPP theory, the obvious idea is the law of one price, which means the same product should have the same price around the world. On the other hand, the exchange rate will be adjusted to make sure that the price will be at the same level. For example, if a cup of coffee in the country A is $2, country B is

5, so the exchange rate should be $1 equal to

5, so the exchange rate should be $1 equal to  2.5. For Thailand movements of the Costumer Price Index (CPI) data during the time period of study show as the following figure.

2.5. For Thailand movements of the Costumer Price Index (CPI) data during the time period of study show as the following figure. | Figure 1. Thailand Costumer Price Index (CPI) (Jan 2007- Dec 2016) |

1.5.2. Balance of Payment (BOP)

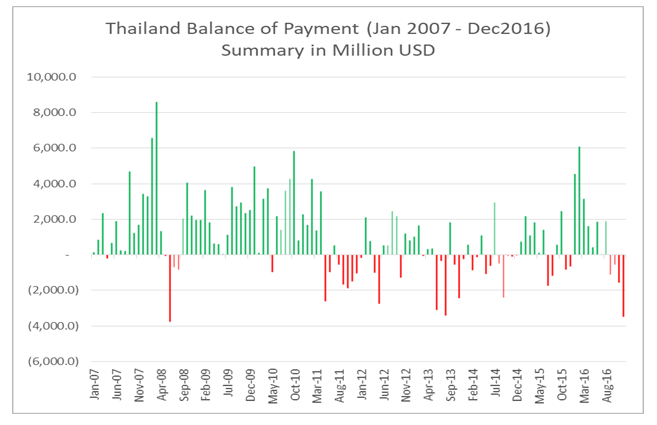

- The balance of payments (BOP) is a statement of all transactions made between entities in one country and the rest of the world over a defined period, such as a quarter or a year. [32] BOP of a country reveals its financial and economic status also can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating. The BOP statement also can help the Government to decide on fiscal and trade policies because it provides important information to analyse and understand the economic, financial dealings of a country with other countries. BOP can be separate to three accounts; (1) the current account includes any products and services for consumption purposes. (2) The capital account; tracking the movement of capital that is going in-and-out of the country for investment proposes. (3) Financial account records the payment flow and change of the ownership in the foreign assets and liabilities, which includes direct investment, portfolio investment, and reserve asset. That explanation can be linked to the Relative Purchasing Power Parity (RPPP) theory. For the moving of the Balance of Payment (BOP) data during the time period of study show as the following figure.

| Figure 2. Thailand Balance of Payment (Jan 2007- Dec 2016) |

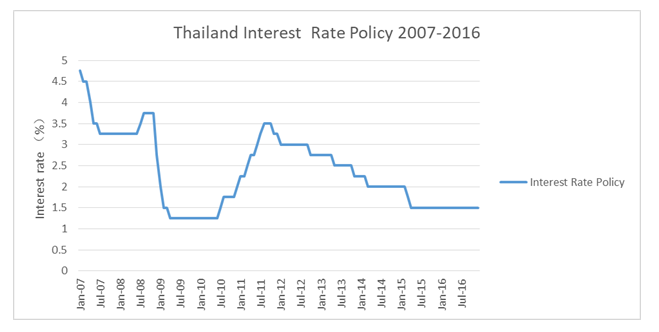

1.5.3. Policy Interest (IN)

- IN is an interest rate that the monetary authority (i.e., the central bank) sets in order to influence the evolution of the main monetary variables in the economy (i.e., consumer prices, exchange rate or credit expansion, among others). The policy of interest rate determines the levels of the rest of the interest rates in the economy since it is the price at which private agents-mostly private banks-obtain money from the central bank. These banks will then offer financial products to their clients at an interest rate that is normally based on the policy rate. [31] Bank of Thailand (BOT) Assistant Governor Paiboon Kittisrikangwan has the perception through the powerful tool of controlling the country’s economy as “The central bank must consider implementing its monetary policy with caution. The interest policy adopted by the bank must focus more on enhancing long-term stability than on responding to what happens in the short run,” he said. The relationship between inflation and interest rates is “In general, as interest rates are reduced, people can borrow more money. The result is that consumers have more money to spend, causing the economy to grow and inflation to increase. The opposite holds, through for raising an interest rate. As an interest rate is increased, consumers tend to save as returns from savings are higher. With less disposable income being spent as a result of the increase in the interest rate, the economy slows and inflation decreases” said Jean Folger through Investopedia. [33] Yet, it is another factor that has the direct relation to the exchange rate supported by Purchasing Power Parity (PPP), Relative Purchasing Power Parity (RPPP), Fisher Effect and International Fisher Effect theory. For the moving of the policy interest rate (IN) during the time period of study shows as the following figure.

| Figure 3. Thailand Interest Rate Policy (Jan 2007- Dec 2016) |

1.5.4. Business Sentiment Index (BSI)

- Business Sentiment Index (BSI) is compiled from the Bank of Thailand (BOT) survey data of 1,010 from Mid-Large size businesses (authorized capital is more than 50 million baht). The business type of sample survey is in production lines such as textile goods production houses, food, beverage and tobacco factories, machinery components factories and etc. and non-production line business such as construction companies, wholesale companies, retail-sale companies, Traveling, Hotels, Transportation companies, etc. The questionnaires are sent out during the last week of the previous month and are compiled by the third week of the reference month.Below is the interpretation of the index:Index = 50 indicates that business sentiment remains stableIndex > 50 indicates that business sentiment has improvedIndex < 50 indicates that business sentiment has worsenedThis index is a crucial index and can be reflected in the entrepreneur’s point of view in the real economic situation. The questionnaires of the survey combined both qualitative and quantitative data by using the Diffusion Index Method as in the USA, Japan, and Europeans. For the statistic test, BSI and another macro-economy index such as Industrial production index, Private sector investment, and economic expansion found that Cross-Correlation is between 0.5-0.7. Although the Bank of Thailand’s data, the BSI index has a relationship with the macroeconomic indicators at a moderate level as well. Nonetheless, it has the ability to use as a guideline index in the short term which can explain the rate of GDP change at a certain level, mainly when economic fluctuations occur and political instability. The reliable source for those factors is mainly from the Bank of Thailand (BOT). For the moving of the Business Sentiment Index (BSI) data during the time period of study, show as the following figure.

| Figure 4. Thailand Business Sentiment Index (Jan 2007- Dec 2016) |

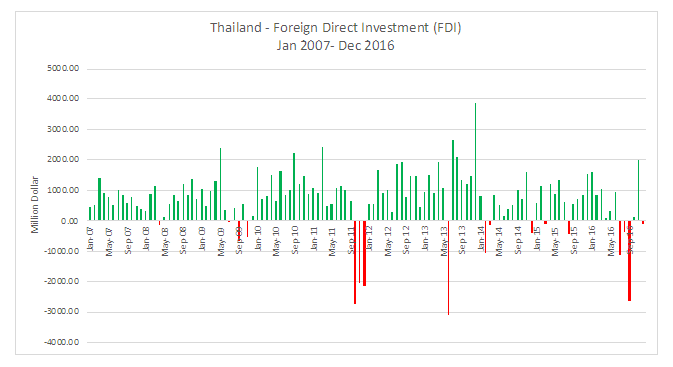

1.5.5. Foreign Direct Investment (FDI)

- The ownership of production facilities in a foreign country. To be classified as FDI, a foreign investor has to own at least 10 percent of a local company. Otherwise, if the ownership is less than 10 percent of the value of the local company, the investment is classified as portfolio investment which it could be in manufacturing, services, agriculture, or other sectors. It could have originated as green field investment (building something new), as acquisition (buying an existing company) or joint venture (joint ownership with a local company).

| Figure 5. Thailand-Foreign Direct Investment (Jan 2007- Dec 2016) |

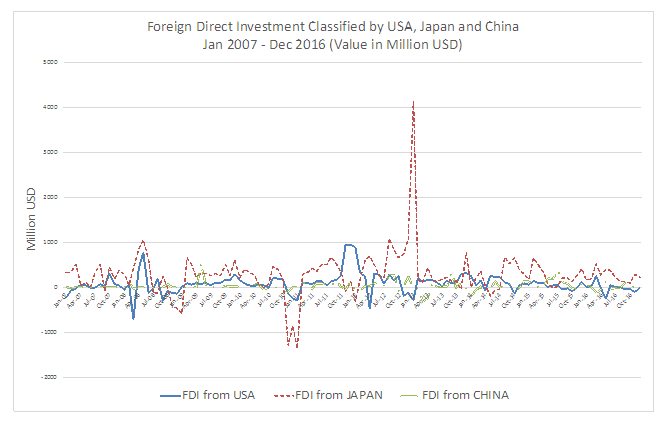

| Figure 6. Foreign Direct Investment classified by US, Japan and China Jan 2007-Dec 2016 (Value in Million USD) |

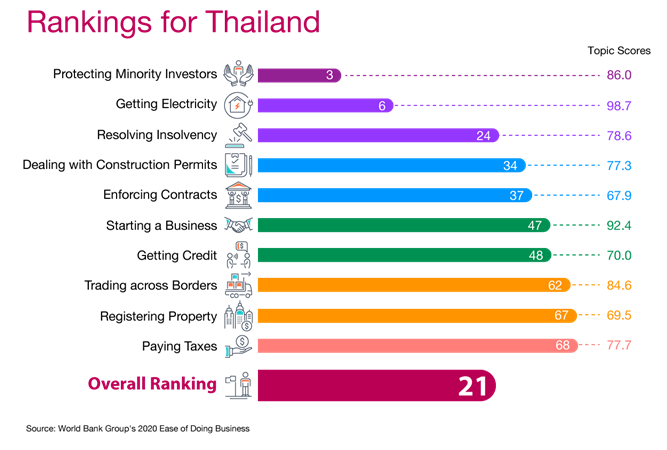

| Figure 7. Thailand got 21st. place out of 190 countries from Global Competitive Index 4.0 ranking by World Bank Group's |

1.6. Benefits from the Study

- Firstly, to know a potential possibility and be aware of the factors that apparently impact to the important currencies in Thailand which can lead to money in an outflow from the economy and finally it can be effective to the overall economy, also for the future, the study of this model can be extended to predict other currencies, which can reduce the risk of currency fluctuation for planning cash and currency management ahead. Moreover, the currency’s study is the basic knowledge of business running. The understanding of logic for the change of currency will be advantaged to extend the picture and helpful for future development in the world economy.

2. Data Introduction and Model Calculation

2.1. Data and Definitions

- From the related studies mentioned above, most of the studies was focused on macro-economic factors, and the most prevalent factors are inflation and interest rate, which will be tested in this study too. However, from many suggestions before, it’s suggest to follow the time-lapse data method and also other factors such as the country’s credit rating or Consumer Confidence Index might be affected by the change of currencies too. Therefore, this study will use major economic factors along with indirect economic indicators following below information.

2.1.1. USD (U.S. Dollar)

- Symbol is USD, meaning/calculation; the exchange rate between the THB and the USD in a direct quotation form calculate the average monthly of a commercial bank. Bank of Thailand (BOT), www.bot.or.th as source.

2.1.2. JPY (Japanese Yen)

- Symbol is JPY, the exchange rate between the Thai Baht (THB) and Japanese Yen in a direct quotation form. Calculate the average monthly of a commercial bank. Bank of Thailand (BOT), www.bot.or.th as source.

2.1.3. CNY (Chinese Yuan)

- Symbol is CNY, the exchange rate between Thai Baht (THB) and Chinese yuan in a direct quotation form. Calculate the average monthly of a commercial bank. Bank of Thailand (BOT), www.bot.or.th as source.

2.1.4. Consumer Price Index

- Symbol is CPI, the measurement of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. In Thailand, the most important categories in the consumer price index are Food and non-alcoholic beverages (36 percent of total weight), Transportation and communication (24 percent) and Housing and furnishing (23 percent). Others include: Medical and personal care (6 percent); recreation and education (6 percent). Division of Trade Information and Economics Indices, Ministry of Commerce, www.indexpr.moc.go.th/price/ as source.

2.1.5. Balance of Payment

- Symbol is BOP, summary of economic transactions in monthly data between residents and non-residents that takes place during a specific period. Balance of payments consists of 3 accounts Current Account, Capital and Financial Accounts and net errors & omissions. Bank of Thailand (BOT), www.bot.or.th as source.

2.1.6. Interest Rate

- Symbol is IN, policy interest rate announced by the Bank of Thailand monthly. Bank of Thailand (BOT), www.bot.or.th as source.

2.1.7. Business Sentiment Index by Components

- The symbol is BSI, The BSI was developed by the Bank of Thailand (BOT). The diffusion index is made up of six components: production, total order books, investment, production cost, performance, and employment. The public and government sector use them as indicators which help guide directions for the economy on a short-term basis. These indexes are also instrument that the public sector utilizes as an additional aid to their policy planning as well as a tool that the business sector can use to adapt their tactics to improve their production performance. Bank of Thailand (BOT), www.bot.or.th as source.

2.1.8. Foreign Direct Investment

- Symbol is FDI, a foreign direct investment (FDI) is an investment made by a firm or individual in one country into business interests located in another country. Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets in a foreign company. However, FDIs are distinguished from portfolio investments in which an investor merely purchases equities of foreign-based companies. Bank of Thailand (BOT), www.bot.or.th as source.

2.2. Hypothesis

- From the number of theories, many factors can influence influent a currency but the fact that “each currency can be affected by different factors or not,” which is the vital question for this study. Also, to reflect the purpose of this study, the hypothesis will cover all the questions from.

2.2.1. Each Currency must be at Least One Factor That Influent the Exchange Rate

- H0; No independent factor can affect the exchange rates.H1; At least one independent factor can affect the exchange rates.

2.2.2. Each Currency can be Affected by Different Factors (USD, JPY, CNY)

- H0; All three currencies (USD, JPY, and CNY) can be affected by the same factors. H1; All three currencies (USD, JPY, and CNY) can be affected from the at least one different factor.To prove the hypothesis, we will use Multiple Regression is as the method and all secondary quantitative data as input or variables data.

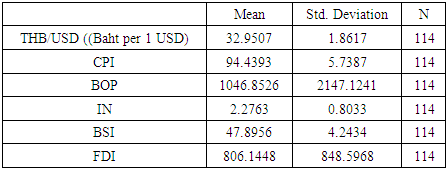

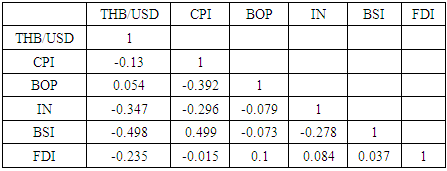

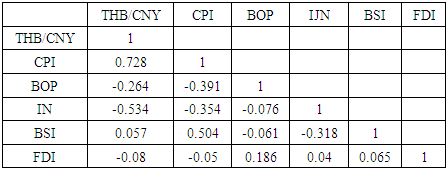

2.3. The Method

- This study used Multiple Regression with 95% confidential level, calculated through the statistic program by “ENTER” method. Revised the time series-data by using the Correlegram test (Correlegram and Q-statistic) then using dot graph to generate the data which should not be a slope graph or an exponential graph after that used Cook’s distance method for checking the Outlier data. Then, checked the “Autocorrelation problem” by checking the correlation value between the dependent factors which should not have more than 0.8 correlation and using Durbin-Watson value, if Durbin-Watson is in the value between 1.5-2.5 can be summarized as independent factors that be used in the study do not correlate with each other. Checking the relation between factors by looking at the Pearson correlation method.

2.4. The Regression Model and the Result

2.4.1. The Model Equation

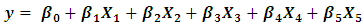

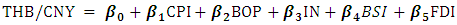

- For the multiple regression, the equation is

| (1) |

= Exchange rate between Thai baht (THB) and U.S. dollar (USD), Japanese Yen (JPY) or Chinese Yuan (CNY).

= Exchange rate between Thai baht (THB) and U.S. dollar (USD), Japanese Yen (JPY) or Chinese Yuan (CNY).

2.4.2. The Regression Model

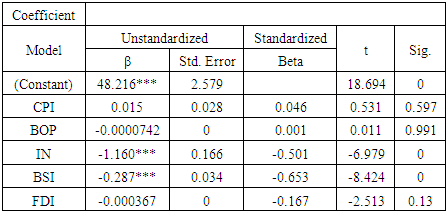

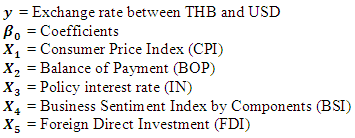

- The multiple regression of the THB/USD.

| (2) |

The equation result from the table below;

The equation result from the table below;

|

|

|

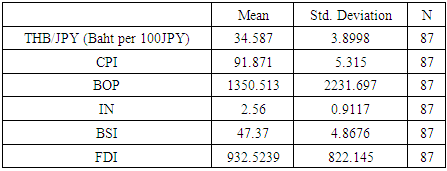

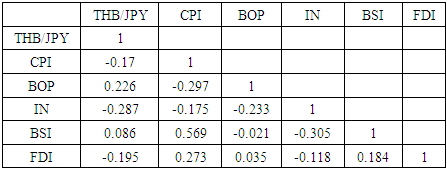

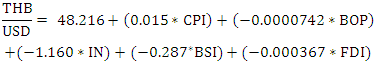

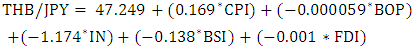

| (3) |

| (4) |

The equation result from the table below;

The equation result from the table below;

|

|

|

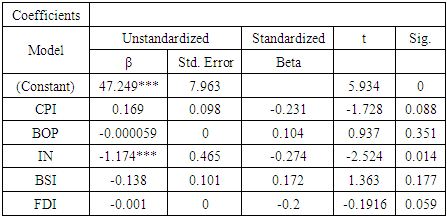

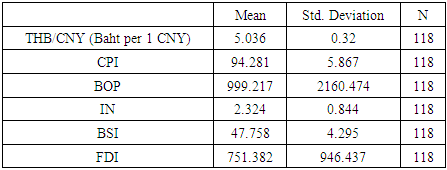

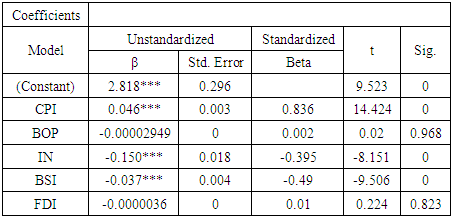

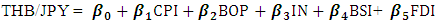

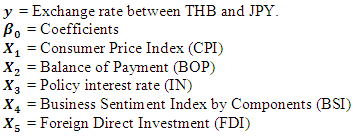

| (5) |

| (6) |

= Exchange rate between Thai Baht (THB) and Chinese Yuan (CNY).

= Exchange rate between Thai Baht (THB) and Chinese Yuan (CNY). The equation result from the table below;

The equation result from the table below;

|

|

|

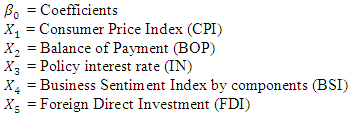

| (7) |

3. Summary

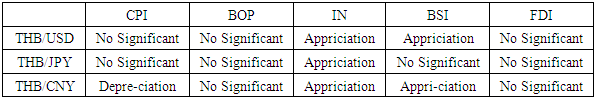

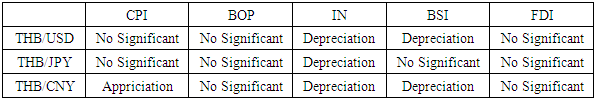

- From the results of the study above, in the first hypothesis, there is sufficient evidence at the 5% significance level to reject the claim that no independent factor can affect the exchange rates. For the second hypothesis, there is sufficient evidence at the 5% significance level to reject the claim that all of three currencies (USD, JPY, and CNY) can be affected from the same factors. For more clear explanation,

3.1. The Factors That Affect Changes in Thai's Baht and US Dollar Exchange Rate

- The Policy Interest Rate (IN) and Business Sentiment Index by components (BSI) had the impact to changes of exchange rate in the opposite direction and significantly affected changes at the 95 percent confidence level. To state this in term of macroeconomic, if there is an increase of IN or BSI, then the exchange currency of THB/USD will be appreciated. For the decreasing of IN or BSI will influence THB/USD to be depreciated. So, in the overall model, all the factors (CPI, BOP, IN, BSI and FDI) can be used to predict THB/USD exchange rate as 53%. However, there are still have other factors that should be considered and can explain the model in another 47% which understandable because the currency can be drives by multi factors related to the previous researches. THB/USD is the less fluctuated compares with those two exchanges rate. Lastly, another point for THB/USD, this exchange rate got effect from only domestic factors (IN, BSI) because those BOP and FDI are not significant through the calculation.

3.2. The Factors That Affect Changes in Thai's Baht and Japanese Yen Exchange Rate

- The Policy interest rate (IN) was the only factor that influenced to the change of THB/JPY exchange rate and it affects in the opposite direction at significantly affected changes at the 95 percent confidence level. For the macroeconomic, if there is an increase of IN then, the exchange currency of THB/JPY will be appreciated. Contrastly with a decrease of IN will brings the result as the depreciation of THB/JPY exchange rate whist the others selected factors are not significant with the calculated model. From figure 6 which shows the FDI value, Japan was invest in Thailand the most, compare to the others two countries. Thus, the people who has more involved in Thailand-Japan trading can be closely focus on the interest rate which easily to control because it less independent factor got involved. However, there is must have others independent factors still to explain the THB/JPY since the selected factors can described the equation for less than 30%.

3.3. The Factors That Affect Changes in Thai's Baht and Chinese Yuan Exchange Rate

- The Consumer Price Index (CPI), Policy interest rate (IN) and Business Sentiment Index by components (BSI) had the effect of changes in the exchange rate. However, the increasing of CPI will influence the THB/CNY exchange rate to be a depreciation. While the increasing of IN and BSI will make the appreciation of the exchange rate. Those results will show in the contrastly way if the independents factors are decreased. For the decreasing of CPI will influence the exchange rate of THB/CNY to appreciation but for the decreasing of IN and BSI will influence the exchange rate of THB/CNY to depreciation. While China is the most value trade partner with Thailand both in term of export and import but the THB/CNY currencies got fluctuated by many factors which hard to control the exchange rate. Therefore, the suggestion for people who need to due with Chinese such as department stores, hotels, tourism places, export-importers or investors better consider hedging as a tool to manage the exchange rate risk. The result from the study also can be predict that Chinese Yuan might not able to be the main currency for trading in recently years because its easily fluctuate by many factors. However, those selected independent factors, CPI – IN – BOP – BSI -FDI can described the THB/CNY as 79%.

4. Conclusions

- This research selected four independent factors to study the affect of the Thailand exchange currency (Thai Baht) against three most important trade partners Thailand that are USA, Japan and China. The result shows that, more one than one factor affects the fluctuation of the selected currencies and different exchange rate, got influenced by different factors.However, there is one interesting point of factor that will influence all the selected exchange rate which is the Policy Interest Rate (IN), wheter it is the exchange rate between Thai Baht against US dollar (THB/USD), Thai Baht against Japanese Yen (THB/JPY) or Thai Baht against Chinese Yuan (THB/CNY). The movement of the selected exchange rates also follow the studies theories as the increasing of the interest rate will influence the home currency to be an appreciation while the decreasing of the interest rate will be depreciated the home currency (in this researched refers to Thai Baht). This sensitive factor which could affect to every exchange rate, The Policy Interest rate (IN), is closely managed by the Bank of Thailand (BOT). To be summary, the movement of the Policy Interest rate will be influence to every exchange rate in the same way.For the relationship of each independent variable and the selected currencies will be shown in the following table;

|

|

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML