Fred Nelson Ossou Ndzila1, Vianney Philauguy Moussana2

1Ph.D. Student of Finance at Shanghai University

2Master Student of Economics at Marien Ngouabi University

Correspondence to: Fred Nelson Ossou Ndzila, Ph.D. Student of Finance at Shanghai University.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

The purpose of this study is to analyze the impact of foreign trade on the economic growth of the Republic of Congo from 1966 to 2016. In this paper, we will model the link between foreign trade and economic growth. This study aims more precisely at setting up an economic model to capture the effects of foreign trade on Congo's economic growth through a multidimensional linear regression. In the course of this research, it has been shown that the role of foreign trade is not only fully compensated because exports of goods and services in the short and long term are important, but these R² are also greater than 50%, as well as its probabilities significant less than 5%. On the other hand, imports are not significant in the short and long term and do not influence economic growth in the Republic of Congo.

Keywords:

Economic growth, Foreign trade

Cite this paper: Fred Nelson Ossou Ndzila, Vianney Philauguy Moussana, Foreign Trade and Economic Growth in the Republic of Congo, American Journal of Economics, Vol. 10 No. 2, 2020, pp. 62-68. doi: 10.5923/j.economics.20201002.02.

1. Introduction

At independence in 1960, the Republic of the Congo hoped to achieve rapid economic and social development that would ensure the well-being of its people. The optimism was great especially since the country had inherited important infrastructures with an oversized industrial apparatus, and had enough intellectuals cadres compared to most Central African countries. For this purpose, most economies, whatever their structures, their political regimes, their dimensions, participate in international exchange. Moreover, a number of studies bear witness to the leading role of exports in the growth of both national economies separately and world economy. This argument has its roots in one of the economic theories considered as the best scientifically established that of the comparative advantage of David Ricardo (1817).According to the theory of comparative advantage, a country gains in exporting the goods it produces with lower relative costs, and in importing the production of which is relatively more expensive. Other international trade theorists: HECKSCHER-OHLIN-SAMUELSON has contributed to this theory. According to them, this theory seeks to explain the international exchange by the abundance or the scarcity of the various factors of production which are endowed with the countries. Thus, each country tends, firstly, to specialize in goods requiring factors of production that it has in abundance relative to other countries, secondly, to export goods that contain many factors that it has in abundance, and thirdly, to import goods that require many factors that are missing.Indeed, the opening of a country to international trade makes it possible to exploit comparative advantages and to develop sectors where there are economies of scale to acquire, in the counterpart of the more productive foreign technologies and consumer goods cheaper (Ekodo and Ngomsi) [1]. Thus, the international exchange then allows each country to improve the welfare of its population, since the quantity of goods available on the national territory is greater than it could have been for the same productive effort (even use of factors) in a state of autarky.Thus, foreign trade between nations of the world dates back to a very long time to a concept that went from a mercantilist approach to a socio-economic development approach. Their impact on economic and social development has led nations to organize it; hence the importance of the establishment of the World Trade Organization (WTO), of which Congo has been a member since March 27, 1997.This organization aims to help the least developed countries better integrate into the international trading system.

1.1. Background and Justification

Africa achieved an economic growth rate of 4.5% in 2005, 0.8% lower than in 2004. Africa continues to benefit from improved macroeconomic policies, remittances from Heavily Indebted Poor Countries (HIPC) initiative and progress in structural reforms. On the other hand, the net impact of soaring oil prices on Africa's economic performance would be small as, to the gains of the oil-producing countries, the extra costs incurred by non-oil countries must be subtracted.Projections of 2006 showed a growth recovery of 5.9%, in the CEMAC (Central African Economic and Monetary Community), Interim Implementation Report of Multilateral Surveillance 2005 and perspective 2006. However, in the particular case of Congo, the factors of economic growth are numerous. As part of our study, the focus will be on the factor, foreign trade.The interest that we individually have for this work is the fact of being able to model the link between foreign trade and economic growth with software Eviews 9 more precisely in the field of econometrics. Moreover, this work is of major interest to the political powers in the economic field and represents a major stake for the Congo.In the sense of the economy, we will proceed by econometric models, to show the impact of foreign trade on economic growth. The model will be an analytical tool for formulating and conducting a national economic policy.

1.2. Problematic

The economic and trade problems in this work revolve around foreign trade which would be one of the greatest factors of economic growth. Hence the question: what impact would this foreign trade have on Congo's economic growth?The experience of emerging countries indicates that countries that are more involved in international trade can accelerate growth and reduce poverty more than those that participate less. China and India are the most recent examples of the effect of openness to foreign trade on growth, even for large countries with large domestic markets. The importance of foreign trade is especially higher for countries with narrow domestic markets like Congo. The analysis of Congo's export structure indicates a predominance of commodities. Exports are heavily concentrated on a primary product, oil.The macroeconomic outlook for the year 2015 was carried out under the following assumption: externally by a drop of 40.2% (against -48.6% initially forecast) of the average price of crude oil/barrel Congolese, 56.7 $ in 2015 domestically by a decline in oil production (-5.9%), a drop in raw wood, an increase in natural gas and sugar respectively of 1.0%, 75.8%, and 8.7%. Taking into account these pieces of information has led to the following results: the GDP growth rate in real terms would be 3.7% in 2015 (instead of 4.9% initially forecast), mainly in relation to the dynamics of the non-oil sector, especially manufacturing industries, buildings and public works and services (organization of African games, etc.) on the demand side, growth would be mainly driven by continued oil investments and public investments.In 2015, the dynamism of economic activity was slightly lower than in 2014, mainly due to a foreseeable drop in crude oil production. The downward revision of growth compared to the initial forecasts results mainly from a small contribution from Building and Public Works (in connection with the downward revision of planned state capital expenditure).Foreign trade, especially exports, is an important factor for economic growth.

1.3. General Objectives

Like any study, this work aims at achieving a global goal through several effects on the real economy by analysing the effects of foreign trade on economic growth. Thus the purpose of this work is to identify the origins of this problem in order to provide the necessary solutions for its improvement.

1.4. Specific Objective

Specifically, the study aims at setting up an economic model to capture the effects of foreign trade on Congo's economic growth through a multidimensional linear regression.

1.5. Research Hypothesis

In the logic of the above question, we have made a hypothesis. To this end, it is assumed in this work that foreign trade would influence economic growth in the Congo.

2. Empirical Review

According to the economic literature, several authors support the positive impact of exporting on economic growth. Rodrik and Rodriguez [2] questioned the empirical results on foreign trade and growth, pointed out some methodological problems associated with the measurement of openness and the specification of the equations we will estimate by econometric analysis. This challenge suggests two directions of research:• Improve existing measures of openness• Be more explicit about how trade openness could affect growth by specifying more clearly the channels linking the two variables.Erfani [3] examined the relationship between export performance and economic growth between 1965 and 1995 in several Asian and Latin American countries. The result showed a positive and significant relationship between these two variables. The study also advanced assumptions with which export will lead to strong economic growth.Jordaan and Hinaunye [4] analyzed the relationship between export and economic growth in Namibia for the period going from 1970 to 2005. The export-led economic growth assumption was tested by the causality and wedge Granger, more specifically, the direction of causality between export and economic growth. The result revealed that export from Granger’s point of view is a cause of economic growth and that the country's export promotion strategy has a positive impact on economic growth.In the same vein, Gurmeet [5] examined the relationship between exports and economic growth from April 2005 to March 2014. He used the index of industrial production as an indicator of economic growth. He also applied Johansen's Grange cointegration and causality tests to explore the short- and long term equilibrium relationship between exports and economic growth. Exports and the index of industrial production as an indicator of economic growth are found to be positively related. Export is crucial for economic growth, which has a significant impact on exports. In the sense of Granger causality, export is a source of economic growth, and economic growth is the source of export, hence there is a two-way causality between exports and economic growth in the short and long term. In the same vein, N'Zué [6] in a study on the Ivory Coast analyzed the Granger causality relationship between the expansion of exports and economic growth and its implications for job creation. His study was based on tests of stationarity, cointegration and, causality by Granger and concluded that, despite the absence of cointegration between exports and economic growth, there is a circular relationship. In addition, there is no cointegration between labor, export, government spending, and economic growth.Afaf et al. [7] also examined the impact of exports and imports on the economic growth of Tunis over the period 1977-2012. The study used the Granger Causality and Johansen Cointegration approach for a long-term relationship. Using the Dickey-Fuller stationarity test (ADF) and Phillip-Perron (PP) augmented, the variable was found to be integrated from one 1 (1) order to the first difference. The cointegration test of Johansen and Juselius was used to determine the presence or absence of a cointegration vector in the variables. Economic growth was found to Granger cause import and Export was found to Granger cause import. The results show that there is unidirectional causality between exports and imports and between exports and economic growth.On the other hand, other authors argue that there is no effect of export to economic growth, if not that of growth towards export. Mishra [8] examined the dynamics of the relationship between exports and economic growth for the period 1970-2009. The results of the cointegration test based on the Johansen procedure indicate the existence of cointegration between exports and real GDP. As a result, the two variables in the study have a long-term equilibrium relationship with each other, although they may be out of balance in the short term. These results indicate the existence of one-way causality ranging from real GDP to exports. The Granger causality test indicates that there is a cause and effect relationship ranging from GDP to long-term exports, but not in the short term. The results of the empirical analysis concluded that exports and economic growth are related to past discrepancies (error correction terms) in relation to the long-term empirical relationship.Sayef and Mohamed [9] analyzed the relationship between economic growth, exports and, imports in Morocco. They used VAR modeling and Granger causality techniques in empirical works. The study demonstrated the existence of a causal effect that ranges from economic growth to export. This shows that economic growth promotes exports. So, there is no effect that goes from exporting to growth.Finally, for other authors, the relationship between export and economic growth has been nuanced. Vohra [10] studied this relationship for India, Pakistan, the Philippines, Malaysia and, Thailand from 1973 to 1993. His results indicated that exports have a significant impact on economic growth if a country reaches a certain threshold of development. The study also showed the importance of market liberalization policies to support export expansion strategies and to attract foreign direct investment (FDI).

3. Methodology

In neoclassical theory, economic growth is a function of several variables, including labor (L), exports (X), terms of trade (E), expenditures (G) and imports (M). But in the analysis between foreign trade and economic growth, these other variables do not intervene.For the verification of our hypothesis, we have chosen an empirical approach (econometrics) to explain and analyze the phenomenon.

3.1. Data Source

The data selected are from 1966 to 2016. This period provides a series of 50 annual observations to ensure the soundness of the various econometric tests. These statistics come from the World Bank through the "World Perspective" site of the University of Sherbrooke an Canada. Some variables considered interesting to carry out this work were selected. These are GDP, imports, exports.GDP (y), which we consider the endogenous or explained variable.Exports (EXP) and imports (IMP) are considered as exogenous or explanatory variables.With time series of foreign trade and economic growth, the study of causality between them will go through the analyzes of stationarity, cointegration and the causal relationship of Granger.

3.2. The Methodological and Empirical Approach

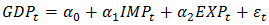

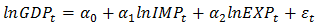

The verification of our hypotheses is made from econometric regression by using Eviews 9 software and Excel 2007 spreadsheet.• Methodological approachFor the verification of our hypotheses, we will use the following model: | (1) |

Our study shows a hypothesis that will be presented by the same model through an equation. Thus the verification of these hypotheses is made from the following equation:The model becomes: | (2) |

In order to be able to directly measure the changes in the rate of GDP in relation to each of the explanatory variables, we will take a logarithmic form of GDP. Represents the natural logarithm

Represents the natural logarithm Model specification error term

Model specification error term indicates the period

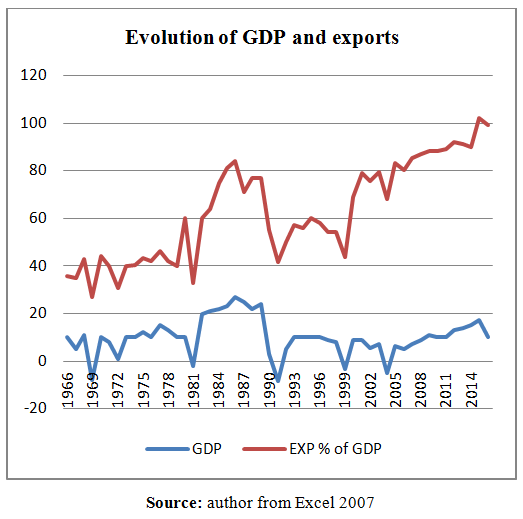

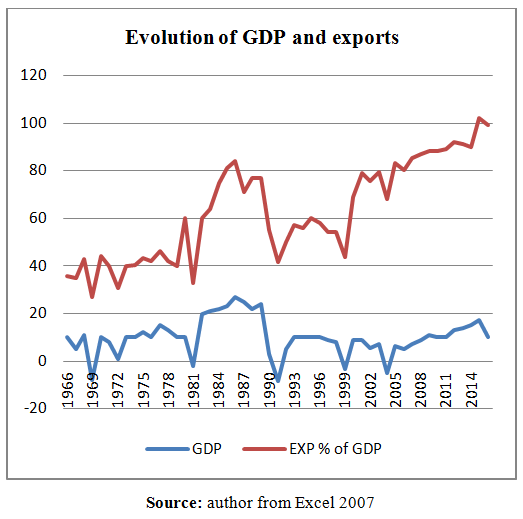

indicates the period Parameters to estimate• Empirical approach§ Stationarity testWe have the data in time series, the variables resulting from these data have been tested to judge their stationarities. Indeed, several econometric data presented in time series are for the most part non-stationary, rendering the application of conventional statistical testing techniques invalid. We will use the graph to analyze variables with irregular upward trends that would suspect non-stationarity.Graph 1 shows that exports and economic growth appear to be evolved in a synchronized manner between 1966 and 2016. However, this semblance of a trend hides the true variations of this magnitude in time from 1966 to 2016; between 1984 and 1994 economic growth has evolved. So the series have a tendency and seasonality because between 1984 and 1994 there is a hollow and a spade. We will proceed by the Augmented Dickey-Fuller test to check if the series is stationary.

Parameters to estimate• Empirical approach§ Stationarity testWe have the data in time series, the variables resulting from these data have been tested to judge their stationarities. Indeed, several econometric data presented in time series are for the most part non-stationary, rendering the application of conventional statistical testing techniques invalid. We will use the graph to analyze variables with irregular upward trends that would suspect non-stationarity.Graph 1 shows that exports and economic growth appear to be evolved in a synchronized manner between 1966 and 2016. However, this semblance of a trend hides the true variations of this magnitude in time from 1966 to 2016; between 1984 and 1994 economic growth has evolved. So the series have a tendency and seasonality because between 1984 and 1994 there is a hollow and a spade. We will proceed by the Augmented Dickey-Fuller test to check if the series is stationary. | Graph 1. Evolution of GDP and exports of Congo in billions of FCFA from 1966 to 2016 |

3.3. Presentation of the Results of Different Hypotheses

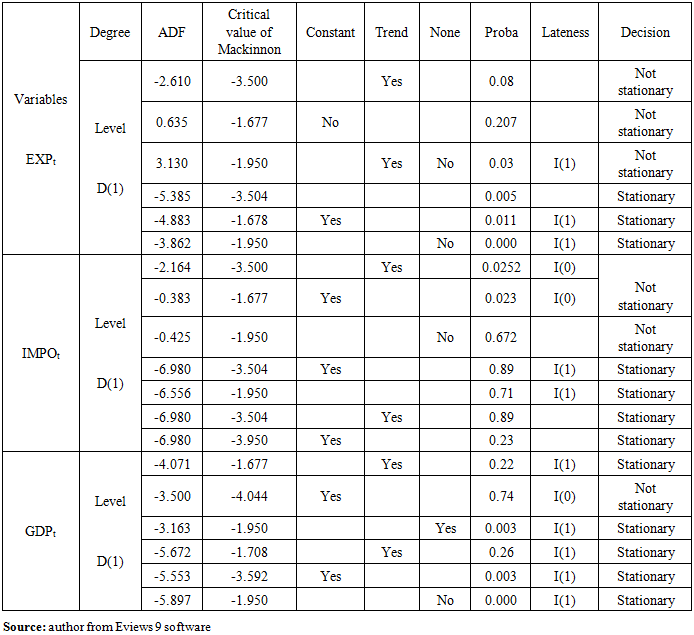

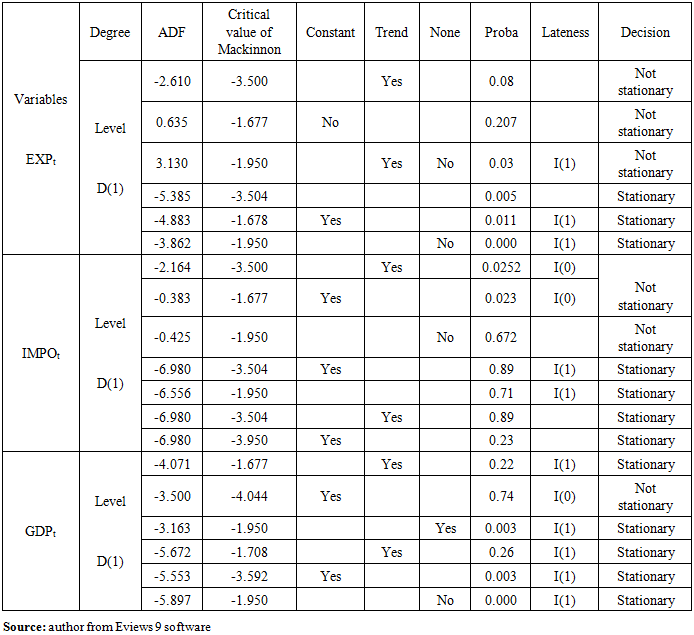

In order to verify the hypothesis of our study, we will proceed with the various stationarity tests and the cointegration test according to Grange Engel's approach.§ Stationarity test ADF 5%Table 1. ADF stationarity test results

|

| |

|

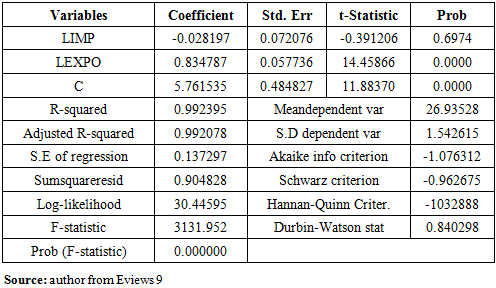

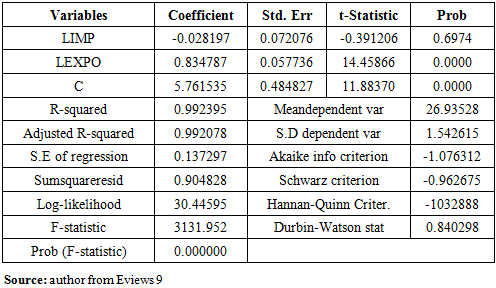

Based on the result of the test, we conclude that the three variables are stationary with a difference of 1 (1) at the 5% threshold. It is now time to verify the existence of a cointegration relationship, i.e say a long-term relationship between the variables taken into the difference.§ Cointegration testThe approach used for cointegration is that of Granger and Engle. This approach requires that variables be at the same level of integration first. The variables respond to this condition because they are all integrated of order 1. Thus, we can proceed to the next step which consists of regressing by Ordinary Least Squares (OLS) the linear combination of the model variables. The estimation is made, it is concluded that there is a stable long-term relationship between the variables.Table 2. Results of OLS

|

| |

|

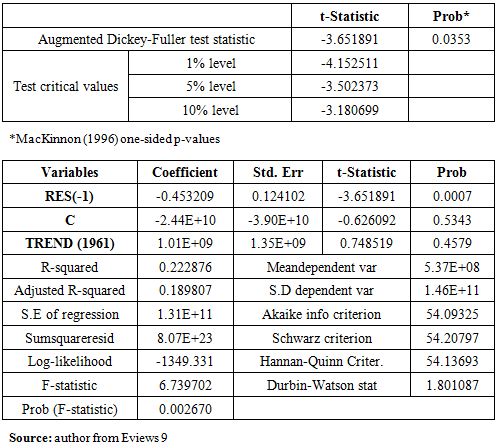

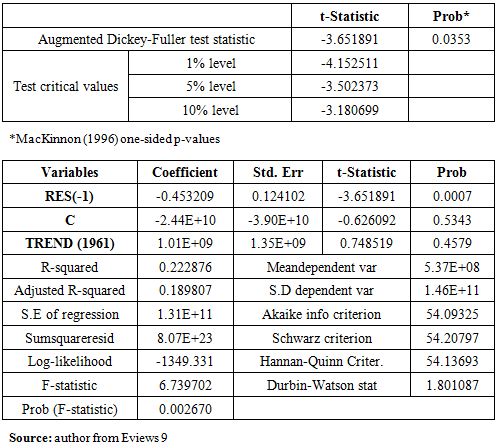

Table 3. Results of the stationarity test of the error

|

| |

|

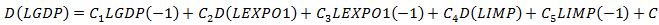

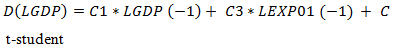

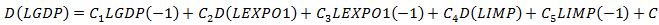

Table 3 shows that ADF statistics are all below critical values at 5%. The results are integrated of order 0, that is to say stationary. There is, therefore a stable relationship between the variables, even though they are not stationary.There is no misleading relationship in the estimation of the long-run model, that is, if the long-run model satisfies the conventional OLS assumptions, then the correct model would have been estimated.§ Error Correction Model (ECM)A cointegration relationship is a long-term equilibrium relationship, but in the short term, there may be imbalances. The estimation of OLS relates to variables calculated in difference. In the case of this study, Y follows an autoregressive process with a distributed delay of order 1. So the variables will be computed in the first difference. These variables are the explanatory variables and the error correction is presented in Table 4.Estimate equation: | (3) |

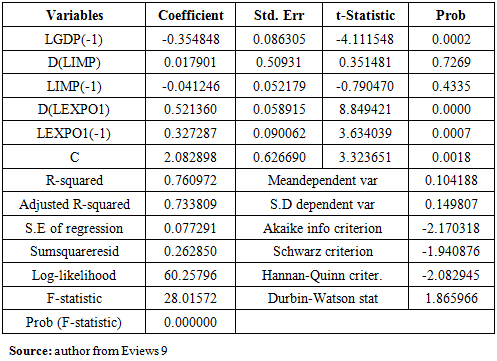

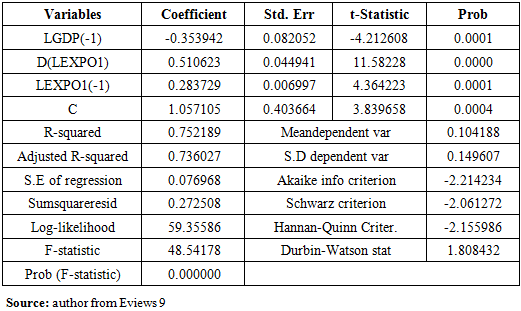

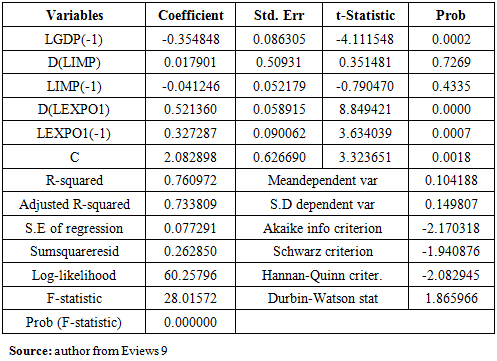

Table 4. Results of Error Correction Model Estimation

|

| |

|

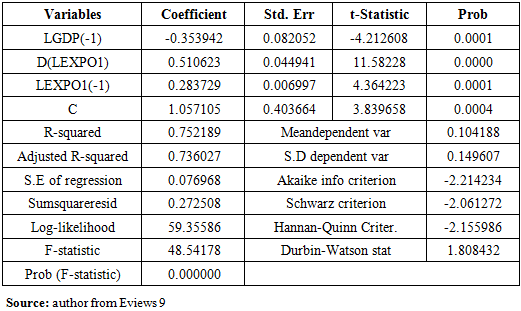

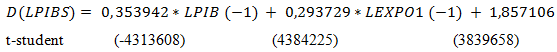

It is found that short and long-term import variables LIMP (-1) and D (LIMP) are not significant and are then removed from the model.The error correction model is validated since the coefficient of the imbalance error is significantly different from 0 and negative; it corresponds to the restoring force.The coefficient associated with the restoring force is negative (-0.353942) and significantly different from zero. So there is an error-correcting mechanism. The error correction model is valid. In view of the coefficient of determination, 75.21% of Congo's foreign trade fluctuations seems to be explained by the model, the shock of Congo's foreign trade is corrected to 35.394%, in 2 years and 10 months which following the year of the shock because of primary resources such as oil that generates needed foreign exchange on long-term and short-term exports. It can be seen that the model we present in Table 5 has two parts, the short and the long term, respectively. For the model analysis, we find that the adjusted R2 (75%) and R2 (73%) are above average (50%). Which proves that the model is of good quality? Fisher's statistics and probabilities are significant.Table 5. Estimate without the non-significant variables

|

| |

|

These two points will be the subject of in-depth analysis in the section devoted to the analysis of the econometric approach. However, we will present the equations constituting the series and make an econometric analysis of the model in the short term and in the long term.

4. Results and Discussions

4.1. Analyzes of Results and Policy Implications

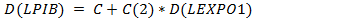

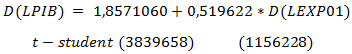

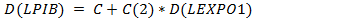

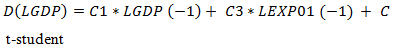

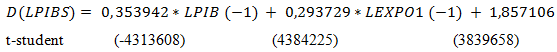

• Results analysis§ Short-term equationC (2), represents the short-term dynamics.By separating the model in two, we obtain the short-term and long-term equation. With regard to the short term it is written in the following way: | (4) |

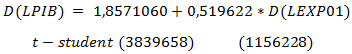

| (5) |

This equation reveals that in terms of the short-term coefficient variables such as dLGDP, dLexp01: present the expected signs (positive) and that the dlexp01 variable is significant, this means that an increase of 1 unity in expenditure exports of goods and services would lead to an increase in economic growth of 0.519622 or 51.96%.§ Long-term equationC (1) is the error correction coefficient (restoring force towards the equilibrium C (1), and C (3) representing the long-term dynamic.The long-term equation retrieved from the previous table can be written as follows: | (6) |

| (7) |

It follows from this equation that all the coefficients are significant; the long-term coefficient of the variables like LGDP (-1), LEXP01 (-1): present the expected signs (positive) and that the variable LEXP01 (-1) is significant, that is to say, that an increase of 1 unity in exports of goods and services would increase economic growth by 0.293729 or 29.37%.These results indicate the existence of a cointegrating relationship between economic growth and exports in Congo, which has evolved together at the same pace over the study period under consideration. In other words, it is possible that an increase in exports will be followed by an economic growth and that economic growth will lead to an expansion of exports. But there is a relationship between exports and economic growth in Congo.• Economic implicationThe results of the OLS model estimators revealed that exports account for the 75% growth rate, both in the short and long term. That is, they have an influence on the explained variable. And the probability of Fisher is significant and less than 5%. It should also be pointed out that the expected results are obtained, since the sign of the coefficient is positive, in accordance with that which was predicted by economic theory, such is the case of the aggregate exports.• The analysis of significant coefficients with expected signs§ Relationship between economic growth and exportsThe fact that the expected sign is significant in the short and long term allows us to say that the relationship between economic growth and exports is positive. It reflects the importance of improving economic growth. In economic literature, several authors support the positive impact of exporting on economic growth.These results confirm the work of Vohra [10], who studied this relationship for India, Pakistan, the Philippines, Malaysia, and Thailand from 1973 to 1993. The result indicated that export has a significant impact on economic growth if a country reaches a certain threshold of development. The study also showed the importance of market liberalization policies to support export expansion strategies and to attract foreign direct investment (FDI).In the same vein, Gurmeet [5] examined the relationship between exports and economic growth over the period from April 2005 to March 2014. The result revealed the bi-direction of the causal relationship between the two variables, that is, export is a determinant of term growth. Conversely, N'Zué [6] in a study on Côte d'Ivoire analyzed the Granger causality relationship between exports and economic growth and its implications for job creation. His study was based on tests of stationarity, cointegration, and causality in the Granger and concludes that despite the absence between exports and economic growth, there is a circular relationship. In addition, there is no co-integration between the labor factor, exports, public expenditure, and economic growth.Indeed, an increase in exports of goods and services would increase economic growth by 51.96% in the short term. Like developing countries, Congo's exports consist mainly of petroleum products. Exports of refined petroleum products amounted to 260,100 tons in 2006, after a steady decline in volume since 2003, mainly because of the difficulties encountered by CORAF, but they rose to 281,000 tons in 2007, and they show an increase in value due to the higher price of the source oil. (Perspectives Economiques en Afrique 2012)§ Relationship between economic growth and importsThe fact that the expected sign is not significant in the short and long run allows us to say that there is no relationship between economic growth and imports. It does not reflect the importance of improving economic growth because imports are influenced by exports in Congo. In other words, imports are endogenous variables in an open economy.

5. Conclusions

The policies of liberalization and opening up to the external world adopted by Congo in the early sixties have been perceptible. Since the exports have registered a global upward trend moderately strong, despite the successive political crises that shock the economy of the country.In the course of this research, it has been shown that the role of foreign trade is not only fully offset since exports of goods and services in short and long term are significant, but these R² are also greater than 50%, as well as its significant probabilities of less than 5%. In contrast, imports are not significant in the short and long term and do not influence economic growth in Congo, because it is an endogenous variable. Imports are funded by exports.This objective only seems to be unilaterally reached by the already industrialized countries with which the third world has commercial relations. Imports from these countries cost double or three times the price of raw materials exported by developing countries. This inequality results from the act of deteriorating terms exchange, and the pace is far from being halted.Nevertheless, the intended objective in the making of this policy, namely foreign trade as an engine of economic growth, seems far from being achieved. Indeed, Granger confirms that there is an inverse relationship between foreign trade and economic growth in the short and long term.To address this weak export contribution to economic growth, Congo should pursue a policy of promoting its exports, directing investment to export industries, i.e promoting products likely to be exported. Although the instability of exports has not been significant on the economic growth, this situation is not sustainable in the long term insofar as the financing of the external challenge, following the fall of the export revenues come the foreigner's partners, thus, a diversification of the national economy non-oil must attract foreign partners.

References

| [1] | Ekodo R et Ngomsi A. (2017): Ouverture Commerciale et Croissance Economique En Zone CEMAC, [J]. Journal of Economics and Development Studies, vol. 5, No. 3, Pp. 58-67. |

| [2] | Rodríguez F and Rodrik D. (2000): Trade Policy and Economic Growth: A Skeptic's Guide to the Cross-National Evidence, [J]. NBER/Macroeconomics Annual, vol 15(1), Pp 261-325. |

| [3] | Erfani G.R. (1999): Export and Economic Growth in Developing Countries, [J]. International Advances in Economic Research, vol. 5. |

| [4] | Jordaan A.C and Hinaunye J. E. (2007): Export and economic growth in Namibia: a Granger causality analysis, [J]. South African Journal of Economics, vol.75, Issue3, Pp540-547. |

| [5] | Gurmeet S. (2016): Causality Between Export and Economic Growth: A Case Study of India, [J]. Indian Journal of Accounting, XIVII (1), Pp 109-120. |

| [6] | N’Zue F.F. (2003): Le rôle des exportations dans le processus de la croissance économique de la Cote d’Ivoire: ses implications pour des stratégies de création d’Emplois Durables, [J]. African Development Review. Pp 199-217. |

| [7] | Afaf A J, Saaed and Majeed A H. (2015): Impact of exports and imports on economic growth: Evidence from Tunisia, [J]. Journal of Emerging Trends in Economics and Management Sciences. 6(1): (ISSN: 2141-7016). Pp 13-21. |

| [8] | Mishra P. K. (2011): The dynamics of relationship between exports and economic growth in India, [J]. International Journal of Economic Sciences and Applied Research, ISSN 1791-3373, Kavala Institute of Technology, Kavala, vol. 4, Iss. 2, Pp. 53-70. |

| [9] | Sayef B et Mohamed M. (2016): La Relation entre la Croissance Economique, les Exportations et les Importations en Maroc: Une Validation Empirique Basée sur des Techniques de Modélisation VAR et de Causalité au Sens de Granger. MPRA Paper No. 76440, online at https://mpra.ub.uni-muenchen.de/76440/. |

| [10] | Vohra R. (2001): Export and economic growth: Further time-series evidence from less- developed countries, [J]. International Advances in Economic Research, Vol. 7, Issue 3, Pp 345–350. |

Represents the natural logarithm

Represents the natural logarithm Model specification error term

Model specification error term indicates the period

indicates the period Parameters to estimate• Empirical approach§ Stationarity testWe have the data in time series, the variables resulting from these data have been tested to judge their stationarities. Indeed, several econometric data presented in time series are for the most part non-stationary, rendering the application of conventional statistical testing techniques invalid. We will use the graph to analyze variables with irregular upward trends that would suspect non-stationarity.Graph 1 shows that exports and economic growth appear to be evolved in a synchronized manner between 1966 and 2016. However, this semblance of a trend hides the true variations of this magnitude in time from 1966 to 2016; between 1984 and 1994 economic growth has evolved. So the series have a tendency and seasonality because between 1984 and 1994 there is a hollow and a spade. We will proceed by the Augmented Dickey-Fuller test to check if the series is stationary.

Parameters to estimate• Empirical approach§ Stationarity testWe have the data in time series, the variables resulting from these data have been tested to judge their stationarities. Indeed, several econometric data presented in time series are for the most part non-stationary, rendering the application of conventional statistical testing techniques invalid. We will use the graph to analyze variables with irregular upward trends that would suspect non-stationarity.Graph 1 shows that exports and economic growth appear to be evolved in a synchronized manner between 1966 and 2016. However, this semblance of a trend hides the true variations of this magnitude in time from 1966 to 2016; between 1984 and 1994 economic growth has evolved. So the series have a tendency and seasonality because between 1984 and 1994 there is a hollow and a spade. We will proceed by the Augmented Dickey-Fuller test to check if the series is stationary.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML