Diabate Nahoussé

Department of Economics, Alassane Ouattara University, Bouaké, Côte d’Ivoire

Correspondence to: Diabate Nahoussé, Department of Economics, Alassane Ouattara University, Bouaké, Côte d’Ivoire.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

The objective of our study is to analyze the effects of climate change on inflation in the WAEMU area. The equation of the Quantitative Theory of Money (QTM) and the generalized moments method (GMM) are retained. The annual data are from 1991 to 2015. We find that the main factors of inflation in WAEMU are economic growth, imported inflation and instability in rainfall. The authorities must therefore work to modernize agricultural techniques through the industrialization of the agricultural sector, literacy and the training of local farmers. In addition, states must make risk management a priority and allocate resources to it as part of local development plans.

Keywords:

Inflation, Climate change, GMM, WAEMU

Cite this paper: Diabate Nahoussé, Climate Change and Inflation in WAEMU, American Journal of Economics, Vol. 9 No. 3, 2019, pp. 128-132. doi: 10.5923/j.economics.20190903.05.

1. Introduction

Inflation creates instability, unrest and anxiety as it distorts the economic decision-making process and is an obstruction to economic growth (Ftiti, 2010). But the questions about the causes of inflation are vast. Monetarist economists such as Friedman (1963) argue that "inflation is always and everywhere a monetary phenomenon". For them, any increase in the amount of money put into circulation is followed by a surge in prices. According to monetarists, banks are influential players in rising prices. They see money as the sole cause of inflation. For these authors, banks participate in the process of inflation by the flow of additional purchasing power that they inject into the economy. The assumptions of the monetarists are at the base of the different formulations of the quantitative theory of money.As for Keynesian approaches, inflation is a macroeconomic phenomenon. It comes from multiple reactions or interactions between the variables of the economic circuit. In Keynesian theory, inflation is due to an imbalance between aggregate demand and the global supply of money. This is called inflation by demand. Keynesians also believe that inflation can come from a growth in the remuneration of factors of production greater than that of their productivity; we talk about inflation by costs. The New Phillips Keynesian Curves (NPKC) present current inflation as a linear function of expected inflation and output gap (Output Gap). Keynesians also commented on growth inflation. Their explanation is that inflation is a result of economic growth and the wage increases it generates. Thus, the risk of inflation would exist only in a situation of full employment and would be a consequence of economic overheating.For psychologists, one of the primary causes of inflation are expectations. For them, individuals are convinced that the process is cumulative and endless. They also consider mimetic contagions as determinants of inflation.As for the regulationist theory, the economic and political institutions of a country can also be considered as influential factors of the price surge through the mode of regulation.As an extension of the theory, several empirical studies to identify the determinants of inflation have been made in developed economies and developing economies. They resulted in the determination of several determinants.Indeed, Diabaté (2019) identifies the determinants of inflation in West Africa, mainly in the WAEMU zone, in order to help improve the conduct of monetary policy. Dynamic panel modeling (GMM) is used. The results of the estimation show that in addition to the rate of economic growth and the money supply, the devaluation has a significant effect on inflation. Moreover, Diabaté (2019) shows that inflation is not systematically a monetary phenomenon in West Africa.In their study, Musa and Yousif (2018) analyse the determinants of inflation in Sudan over the period 2000-2017. They use a GMM. Their work led to the conclusions that the increase in the money supply and the consumer price index rise to higher inflation. The reduction in the exchange rate leads to a high inflation rate. However, the increase in gross domestic product, the unemployment rate and government spending are leading to a fall in the inflation rate in Sudan.Nguyen et al., (2017) analyze the dynamics of inflation on sub-Saharan Africa (SSA) countries that are not in the African Financial Community (CFA) franc zone (NCFA) over the past 25 years. The authors use a Global VAR model. Their study shows that domestic demand pressures, global shocks, and especially those of production explain the dynamics of inflation in sub-Saharan African countries. They find that inflation factors in sub-Saharan Africa have changed considerably over the last decade. Indeed, their results show that domestic supply shocks and changes in exchange and currency rates have been the main factors of inflation in sub-Saharan Africa over the past 25 years. In addition, their study links food imports to country characteristics, including vulnerability to climate shocks, the economic importance of agriculture, and trade openness.In addition to these traditional determinants, Benson and Clay (2004) have shown a positive relationship between natural disasters caused by climate change and inflation.This implies a significant impact of climate shocks in the dynamics of inflation in the WAEMU countries, while most of these countries are suffering the effects of climate change. The authorities of the states of the West African Economic and Monetary Union (WAEMU) are not left behind.To our knowledge, there is no study that has addressed this aspect of price evolution in WAEMU. As a result, the states of the Union account for more than 60 percent of their populations dependent on agriculture. Moreover, the agricultural production system is traditional and uses archaic and rudimentary means; this strongly exposes peasants to the adverse effects of climate instability. Thus, the economies of WAEMU could be negatively impacted by the instability of climate factors such as rainfall and temperature, for example. Indeed, a very high rainfall could destroy crops causing a shortage of supply on the market and reduce the purchasing power of farmers. Also, very low rainfall will reduce crop and therefore the income of farmers; anything that has the effect of increasing prices beyond their usual level. In view of the above, it seems important to analyze the effects of these factors on these economies through their links to inflation. How climate change could it cause a fluctuation downwards or upwards of inflation? Our study therefore has the general objective of analyzing the effects of climate change on inflation in WAEMU. In concrete terms, we will first identify the theoretical determinants of inflation. Then we will evaluate the impact of climate change indicators on inflation in WAEMU.The rest of the article is as follows: the second section is the subject of the literature review. Section 2 outlines the methodology of the study. Section 3 presents the results of estimation. Section 4 outlines the conclusion and the resulting economic policy recommendations.

2. Methodological Approach

2.1. Basic Model

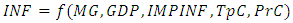

Based on the literature above among others Diabaté (2019), Musa and Yousif (2018), Nguyen et al., (2017), our model integrates the links between economies, as well as the role of regional and global demand and inflationary spillover effects. They find that domestic demand pressures as well as global shocks, and particularly those of production, have played a more important role in controlling inflation over the last decade. This implies that the factors mentioned above play a more or less important role in the dynamics of inflation in sub-Saharan African countries. Moreover, according to Benson and Clay (2004), there is a positive relationship between natural disasters caused by climate change and inflation. In addition, the indicators of climate change selected are variations in temperature and variations in rainfall. Thus, the supply side, we retain the gross domestic product, changes in temperature and changes in rainfall. From the above, we can write the model in the form of equation (1): | (1) |

Also, according to psychologists, there is a cumulative effect of memory at level of inflation, leading us to the choice of a dynamic model. Finally the equation of inflation will form: | (2) |

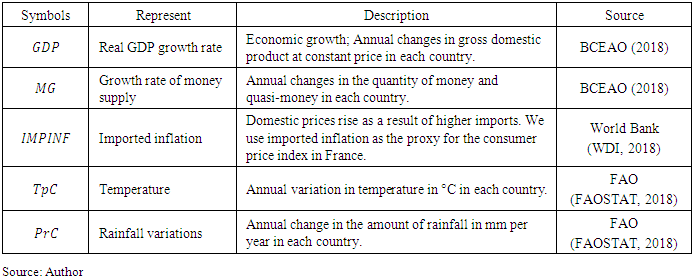

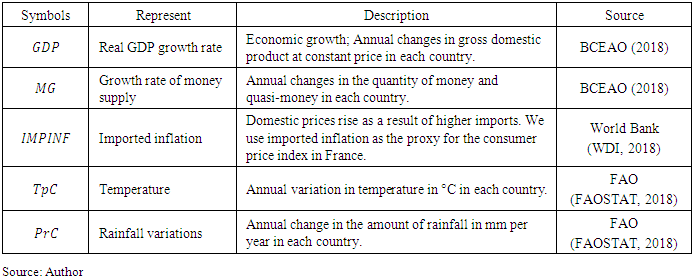

Table 1 gives some brief descriptions and notations for these variables that will be used in the data analysis. It should be mentioned that the rate of inflation is annual.Table 1. Description and measures of determinants

|

| |

|

These are annual data, with a study period from 1991 to 2015. Guinea-Bissau was not taken into account due to lack of data in some years. Indeed, Guinea-Bissau joined WAEMU in May 1997.

2.2. Estimation Method

The estimation method chosen is the generalized moments method (GMM) in dynamic panel introduced by Arellano and Bon (1991) and Arellano and Bover (1995). Unlike GMM dynamic panel, standard econometric techniques as OLS does not provide unbiased estimates because of the presence of the lagged dependent variable on the right of the equation. This results in biased estimates.The generalized method of moments (GMM) based on the orthogonality conditions between the lagged variables and the error term in both first difference in level. The generalized moments method has very specific advantages, namely the nature of the data panel and the solutions it provides. Indeed, the GMM dynamic panel allows to provide solutions to the problems of simultaneity bias, reverse causality and omitted variables. Also, this method allows both to control the individual and time specific effects. It also makes it possible to overcome the endogeneity biases of the variables, especially when there are one or more delays of the dependent variable as an explanatory variable. In case of endogeneity, estimates are made using instruments. An instrument for an endogenous variable is a variable that is not correlated with errors but correlates with the endogenous explanatory variable.Thus, it gives an efficient estimation of the model contrary to the Ordinary Methods.There are two variants estimator of GMM dynamic panel: The GMM in first differences of Arellano and Bond (1991) and the GMM in system of Blundel and Bond (1998). To estimate our model we use the GMM in difference "GMMDiff" of Arellano and Bond (1991). This estimator is based on the first difference of the variables, eliminating the specific effects of the country while taking appropriate levels of instruments lagged values (in level) for all potentially endogenous variables. Autocorrelation tests of the first difference errors are proposed by Arellano and Bond (1991) to verify the validity of these moment conditions. In addition, the Sargan (1958) and Hansen (1982) over-identification tests make it possible to check the exogeneity of the instruments and to validate them. After the methodological approach, we present the different results of the tests and the final estimation of the model.

3. The Results

3.1. Descriptive Statistics

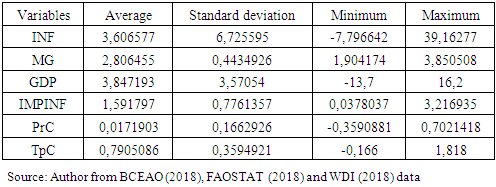

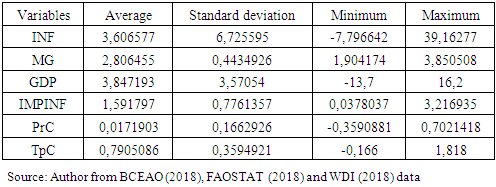

Table 2 summarizes the results of descriptive statistics for raw variables prior to modeling. The standard deviations of the different variables are small; a logarithmic transformation is not necessary.Table 2. Descriptive statistics on variables

|

| |

|

3.2. Presentation of Test Results

Table 3 presents the results of the interindividual dependence test of Pesaran and Smith (1995). It clearly indicates that there is a strong cross-sectional dependence between the different variables of our model because the p-values are less than 5%; we therefore reject the null hypothesis.Table 3. Pesaran and Smith Dependency Test (1995)

|

| |

|

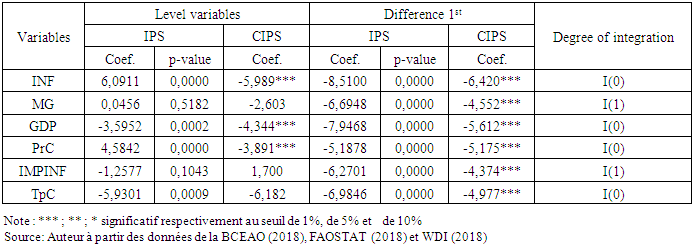

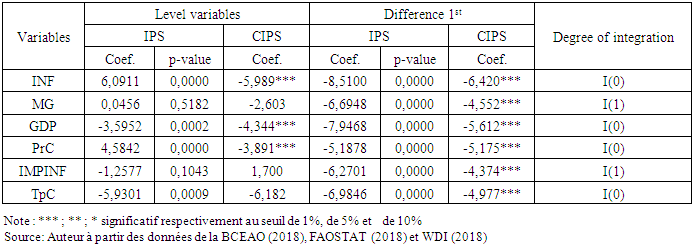

Table 4 presents the results of the unit root tests. The inflation and real GDP growth, changes in temperatures and changes in precipitation are stationary in level. Moreover, we find that the money supply growth and imported inflation are stationary in first differences.Table 4. Summary Table of IPS and CIPS Unit Root Tests

|

| |

|

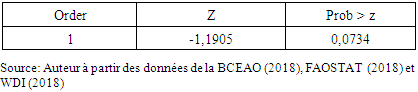

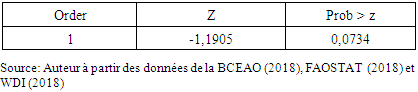

The result of the autocorrelation test gives a probability greater than 5% (Prob> z = 0.0734). We can’t reject the null hypothesis. There is no autocorrelation between the variables and the error term. The test result is shown in Table 5.Table 5. Result of the error autocorrelation test of Arellano and Bond (1991)

|

| |

|

The normality test of the residuals Jarque-Bera (1980) indicates rejection of H0 (Prob> chi2 = 0.000). We conclude that residues do not follow a normal distribution.

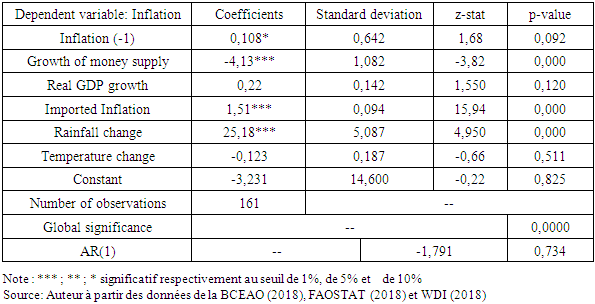

3.3. Result of the Model Estimation

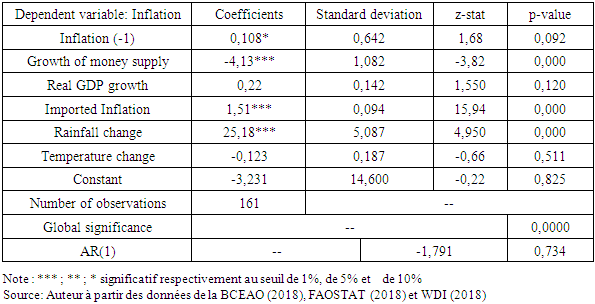

The estimate was done in one step and we used the "robust" option. This option makes it possible to overcome the negative effects on the estimators due to the presence of autocorrelation of errors and / or heteroscedasticity in the panel. The estimated model is globally significant at the 1% level. The autocorrelation test errors in first differences of order 1 of Arellano and Bond (1991) confirms the validity of the moment conditions and the estimator. The results are shown in Table 6.Table 6. Results of model estimation

|

| |

|

The results of the estimation show that within WAEMU, the determinants of inflation are the growth of the money supply, imported inflation and variations in rainfall. At the 1%, the growth rate of the money supply has a positive and significant effect on inflation in WAEMU. Indeed, an increase in the growth rate of the money supply leads to lower inflation of 4.13%. Imported inflation has a positive and significant effect on inflation. Indeed, an increase in imported inflation induces a 1.51% increase in domestic inflation in WAEMU. In fact, imported products account for about 34% of the goods and services in of the consumption basket in WAEMU. Moreover, first FCFA lashing the French franc and then to the euro requires a long-term inflation convergence in WAEMU and France. This result is in accordance with those of Diabaté (2019), Musa and Yousif (2018) and Nguyen et al., (2017) who find that the main drivers of inflation have been domestic supply shocks, shocks to the monetary variables and imported inflation.Regarding climate change, only the indicator of rainfall has a significant impact on inflation in WAEMU. Our results show that a high fluctuation in rainfall leads to a significant increase in prices in the economic area. Indeed, rainfall instability influences inflation to more than 25%. In addition, our results confirm those of Benson and Clay (2004) and Nguyen et al. (2017), which find the same main factors of inflation. Indeed, Benson and Clay (2004) and Nguyen et al. (2017) have highlighted the vulnerability to climatic shocks of a country characterized by a high level of traditional agriculture in this economy and its degree of trade openness.

4. Conclusions and Recommendations

The objective of our study was to analyze the effects of climate change on inflation in WAEMU. The estimation method chosen is the generalized moments method (MMG) in dynamic panel of Arellano and Bond (1991) and Arellano and Bover (1995). The estimation was done in one step and we used the "robust" option to free ourselves from the detrimental effects on the estimators due to the presence of autocorrelation of errors or heteroscedasticity in the panel. Empirically, we have been able to identify the factors influencing inflation in WAEMU’s economies.The results of the estimation show that, in addition to the rate of economic growth and the money supply, changes in precipitation have a significant effect on inflation. As can be seen, among the climate change indicators selected, only variations in rainfall have a significant impact on inflation in WAEMU. Indeed, our results highlight a stimulating effect of a high fluctuation of rainfall on prices in the economic space in accordance with the result of Benson and Clay (2004) and Nguyen et al., (2017); these authors find that the main factors of inflation its climatic conditions. The authorities must therefore work to modernize agricultural techniques through the industrialization of the agricultural sector, literacy and the training of local farmers. In order to reduce the vulnerability of populations to natural hazards, it is important to include in development strategies the economic structure of the country, its stage of development and the prevailing economic and political conditions. In addition, risk management must be prioritized and allocated resources as part of local development plans. Local capacities need to be supported and strengthened also through partnerships, through better coordination between the private sector, civil society groups, NGOs, UN agencies, local and national authorities, as well as international donors. Concretely, it is important to set up training courses in sustainable agricultural practices, promote sustainable diversification of income sources and then educate adults and children about the causes and consequences of environmental degradation.

References

| [1] | Arellano, M. and Bond, S. (1991), «Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations», The review of economic studies, Vol. 58, Issue 2, pp. 277-297. |

| [2] | Benson, C. and Clay, E. J. (2004), «Understanding the Economic and Financial Impacts of Natural Disasters», Disaster Risk Management series, N°4, Washington, DC: World Bank, World Bank. https://openknowledge.worldbank.org/handle/10986/15025 License: CC BY 3.0 IGO. |

| [3] | Blundell, R. and Bond, S. (1998), «Initial Conditions and Moment Restrictions in Dynamic Panel Data Models», Journal of Econometrics, Vol. 87, pp. 115-143. |

| [4] | Diabaté, N. (2019), «The Determinants of Inflation in West Africa», International Journal of Economics and Financial Research, Vol. 5, Issue. 5, pp: 100-105. |

| [5] | Eftekhari, M. and Kiaee, H. S. (2016), «Determinants of Inflation in Selected Countries», Journal of Money and Economy, Vol. 10, Issue 2. |

| [6] | Friedman, M. (1963), Inflation: Causes and Consequences, Asia Publishing House, New York. |

| [7] | Ftiti, Z. (2010), «The macroeconomic performance of the inflation Targeting Policy: an approach base on the evolutionary Co-Spectral Analysis», Economic Modeling, Vol. 27, Issue 1, 468-476. |

| [8] | Hansen, L.P. (1982), «Large sample properties of generalized method of moments estimators», Econometrica, Vol. 50, pp. 1029-54. |

| [9] | Jarque, C. M. and Bera, A. K. (1980), «Efficient Tests For Normality, Homoscedasticity And Serial Independence Of Regression Residuals», Economics Letters, Vol. 6, pp. 255-259. |

| [10] | Musa, A. M. A and Yousif, F. M. K. (2018), «Modeling The Determinants Of Inflation In Sudan Using Generalized Method Of Moments For The Period 2000-2017», International Journal of Information Research and Review, Vol. 05, Issue 02, pp.5154-5165. |

| [11] | Nguyen A.D.M., Dridi J., Unsal F.D. and Williams O. H. (2017), «On the drivers of inflation in Sub-Saharan Africa», International Economics, http://dx.doi.org/10.1016/j.inteco.2017.04.002. |

| [12] | Pesaran, M. H. and Smith, R. (1995), «Estimating Long-Run Relationships from Dynamic Heterogeneous Panels», Journal of Econometrics, Vol. 68, Issue 1, pp. 79-113. |

| [13] | Sargan, J. (1958), «The Estimation of Economic Relationships Using Instrumental Variables». Econometrica, 26, 393-415. http://dx.doi.org/10.2307/1907619. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML