-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2019; 9(2): 45-50

doi:10.5923/j.economics.20190902.01

Empirical Analysis of the Impact of Interest Rate Deregulation on the Performance of Deposit Money Banks in Nigeria from 1989-2017

Onoh Chukwunonso Francis

Peaceland College of Education Enugu, Nigeria

Correspondence to: Onoh Chukwunonso Francis, Peaceland College of Education Enugu, Nigeria.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The research examined the impact of interest rate deregulation on the performance of deposit money banks in Nigeria for the period of 1989-2017. The objective of the study is to examine the impact of interest rate deregulation on the performance of deposit money banks in Nigeria and to examine the causality relationship between interest rate deregulation and performance of deposit money banks in Nigeria. The estimation output of the research shows a positive relationship between interest rate and bank performance in Nigeria measured by Total Assets of Deposit money banks in Nigeria. The coefficient of determination (67%) also shows above average explanatory power of the independent variables on the dependent variable. The results of the study show a long and short run relationship between the dependent variable (Total Assets) and the independent variables (Interest rate, inflation rate, loans and advances). The result also shows unidirectional causality between Total Assets and Loans and Advances. The research recommended among others that the CBN should consider not frequently changing the MPR (monetary policy rate) and CRR (Cash reserve ration) which most of the time influence interest rate peg of the deposit money banks.

Keywords: Interest rate, Deregulation policy, Deposit money banks, Total Assets, Banks Performance, Peaceland

Cite this paper: Onoh Chukwunonso Francis, Empirical Analysis of the Impact of Interest Rate Deregulation on the Performance of Deposit Money Banks in Nigeria from 1989-2017, American Journal of Economics, Vol. 9 No. 2, 2019, pp. 45-50. doi: 10.5923/j.economics.20190902.01.

Article Outline

1. Introduction

- Interest rate deregulation as conceived and implemented by the Nigerian government was aimed at opening up the banking sector to high private sector participation to drive the economy positively. But since the commencement of the policy in 1989, the banking sector has not shown any improvement linked to deregulation, rather improvements in the sector are mainly from other policy actions of the Central Bank of Nigeria (CBN).The performance of the deposit money banks in Nigeria largely depends on total savings deposits in the sector and at such, that’s the main reason banks sets their staff on a high target of deposits to sustain their operations.Although officially the banks are under deregulation period, interest rate in Nigeria is still indirectly regulated. The monetary policy rate (MPR) which the Central Bank uses to control interest rate still determines the direction of interest rate flow in deposit money banks in Nigeria. A higher MPR means interest rate will be high and vice versa. Presently the MPR is 14% according to CBN (2018). Which means that banks in Nigeria cannot afford to lend at single digit rate this is because the total loans of the banks are not determined by bank savings rate, which ought to have influenced total customer deposits to a high trajectory but the rate at which banks borrow from CBN via MPR.The cash reserve ratio and liquidity ratio which the central Bank uses mainly to ensure stability and reduction of risk in the banking sector also exerts high influence on how interest rate are determined by the deposit money banks in Nigeria. In the ideal banking sector, the performance of bank loans and interest rate margin determines the growth of the sector.The market risk posed by interest rate volatility also goes beyond the performance of these banks to influence the flow of economic activities in an economy including considerable influence on inflation rate, and performance of the real sector mainly agriculture and manufacturing sector which the economy depends on to generate employment and revenue for economic wellbeing of the nation. Banks in its bid to enhance business, tends to manipulate savings rate to increase deposits, but in the realistic terms, greater percentage of deposits in the Nigerian banks are not basically because of the savings rate, but due to increase in financial literacy in the country and governments revenues often traced to the banks.Interest rate differs from bank to bank in the nation and also differs in the same bank based on customers credit records, the prime rate are given to the most preferred customers who have positive track record with the banks while maximum lending rate are open to all who can meet the criteria. Such has also made access to the benefits of the deregulation policy difficult for the Nigerian People. This research will use empirical method to analyze the impact of interest rate deregulation policy on the performance of deposit money banks in Nigeria, so as to help direct the monetary policy authority in Nigeria on how best to approach interest rate policies in Nigeria. Such will reposition the banking sector for a greater economic benefit.

1.1. Research Questions

- The following research questions will guide this research;1. What is the impact of interest rate deregulation on the performance of deposit money banks in Nigeria?2. What is the causality relationship between interest rate deregulation and performance of deposit money banks in Nigeria?

1.2. Objectives of the Study

- 1. To examine the impact of interest rate deregulation on the performance of deposit money banks in Nigeria.2. To examine the causality relationship between interest rate deregulation and performance of deposit money banks in Nigeria.

1.3. Statement of the Hypotheses

- H01: interest rate deregulation has no significant impact on performance of deposit money banks in Nigeria.H02: There is no causality relationship between interest rate deregulation and performance of deposit money banks in Nigeria.

2. Review of Literature

2.1. Theoretical Literature

- (a) Loanable funds TheoryIt is a neo-classical theory of interest rate, developed by the likes of Ohlin, Myrdal and Robertson. The theory stated that interest rate is determined by the forces of demand and supply of loanable funds. The theory further explained the purpose of demand or loanable funds which are (i) investment (ii) Hoarding and (iii) dissaving.For investment, the theory explained the inverse relationship between demand for loanable funds and interest rate. An investor desires for funds to invest in making of new capital goods, but such demand can only be actualized if the interest rate is less to the expected return on investment. If the interest rate is less, the demand will be high and if the interest rate is high, the demand will be low. For hoarding, the theory explained that the desire for liquidity triggers hoarding by some people which has inverse relationship with interest rate. Same inverse relationship still exists in dissaving. For supply of loanable funds, the theory explained it under savings, dishoarding, disinvestment and bank credit. For savings, the theory explains that people will save more with high interest rate and less with low interest rate. Such positive relationship was also utilized to explain dishoarding and disinvestment. Bank credits were also explained as it affects loanable funds. Since the banks also creates credit when they lend money out. The theory concluded that interest rate is determined by the point of equilibrium between demand for and supply of loanable funds.(b) Structure, conduct, performance paradigm explained relationship between market structure, market conduct and market performance. The model explains the buyers and sellers relationship as it relates to product, structure, conduct and performance of an establishment. Firms strategically choose behaviors, investment and total enhancement to better business, thus to assess performance. The model explains that ratios are utilized at price quantity, product quality and efficiency.

2.2. Empirical Literature

- Egbetunde, Ayinde and Balogun (2017) on Interest Rate Liberalization, Financial Development and Economic Growth in sub-Saharan African Economies, employed panel data cointegration and error correction model. The research shows that trade openness and price stability exert greater significance on the economic growth of Sub-Saharan Africa economy than interest rate. Interest rate was shown to have a negative relationship with the dependent variable which is the gross Domestic Product.Udoka, Agwenjang and Arzizeh (2012) on Empirical Analysis of the Effect of Interest Rate Management Policies in Nigeria employed Ex-post facto research design to analyze the data. The data employed for the research are interest rate and Gross Domestic Product. The research shows that there exist an inverse relationship between interest rate and economic growth in Nigeria that hinders growth of the real sector. They recommended that a strong monetary policy for Nigeria should be initiated that would enhance lending to the real sector economy of Nigeria for the sustenance of economic activities. The research ended without giving any specific monetary policy that should be employed to achieve the specified goal.Ugwuanyi (2012) carried out research on the Interest Rate Deregulation and Bank Lending in Nigeria to show the relevance of the hinges on the fact that credit and its costs (interest) perform a private role in shaping the economic future of Nigeria. The ordinary least square (OLS) techniques were employed using data such as Banks Lending, Money Supply, Interest Rate, Marginal rediscount Rate, Total Bank Deposit and Inflation Rate. The research found a significant relationship between the dependent variable and the independent variables. Thus the research recommended that government through Central Bank should implement stringent fiscal and monetary policies aimed at reducing inflation. The research methodology was poorly developed and recommendations does not show any significant contribution of the research to the society.Eke, Eke and Inyang (2015) on interest rate and commercial banks’ lending operations in Nigeria. The study performed a comparative study of two interest rate regimes in Nigeria, thus the regulated and the deregulated period. For regulated period, it was found that interest rate have negative relationship with bank loans whilst in the deregulated era, it was shown that there exist inelastic relationship between interest rate and loans of commercial banks. The research thus suggested that a revised version of deregulation should be developed with Monetary policy rate (MPR) used as a control tool.Makinde (2016) on effect of interest rate on commercial banks deposits in Nigeria, applied ordinary least square method to establish an empirically based output. The study reveals that interest rate is not the cause of costumer’s deposits in banks. Thus it stated that there is a negative relationship between interest rate and deposits in commercial banks. The study advocated for financial literacy to help boost deposits in banks.Afza, Raja, Imran & Saima (2018) on Interest Rate and Financial Performance of Banks in Pakistan employed Correlation and Regression analysis on interest rate changes, deposits with other banks, advances and loans and investment; return on assets, return on equity and earnings per share. The result shows that deposits with other banks and interest rate are negatively affecting the profitability of banks, while advances and loans and investment are having positive influence over profitability of banks. The research recommended that Government should make monetary policies which will increase the profitability of banks. But such policies were not defined.Odeke and Odongo (2014) on Interest Rate Risk Exposure And Financial Performance Of Commercial Banks in Ugnada, utilized a cross sectional survey and descriptive research design with a sample size of 9 commercial banks analyzed and interpreted using financial ratios of DuPont analysis of commercial banks. The research findings show that a combined variation of maturity gaps, basis risk and assets and liabilities margins for all the commercial banks accounted for up to 14.9% variation in their banks performance. The variation explained 20.19% of the performance of the commercial banks. The overall analysis of interest rate risk exposure and bank performance showed generally a positive relationship except basis risk. It recommended that Commercial Banks need to develop policies and resources tended to manage asset and liability duration mismatches effectively. Such recommendation is directionless.Alhassan, Anokye and Gakpetor (2018) on effect of interest rate spread on the profitability of commercial banks in Ghana. The research is based on a sample of 24 banks over a ten - year period using a panel data, interest rate spread, net interest margin Return on Assets and Return on Equity were the data for the study. The study shows that there is a positive and statistically significant association between interest rate spread and bank profitability in Ghana. The research recommended that policies aimed at reducing interest rate spread in Ghana should focus on making credit facilities available at a cheaper rate to compel commercial banks to reduce interest rate.Ubesie (2016) researched on the effect of financial sector liberalization on economic growth in Nigeria, applied vector Error Correction Model to assess the direction of the effect of liberalization policy on the economic growth rate of the nation. The research utilized variables such as gross domestic product, interest rate, inflation and exchange rate. The independent variables in the estimation result show a 92% explanatory power on the dependent variable. Thus the research concluded that liberalization has positive effect on economic growth of Nigeria.Matemilola, Bany-Ariffin and Muhtar (2014) did a research on the impact of monetary policy on banks’ lending rate in South Africa; they applied threshold autoregressive and asymmetric error correction model. The study which aims at assessing the financial sector reforms in South Africa found out that commercial banks put measures to lower interest rate but is appears upward permanently. The research then recommended that transparent and further developed banking system in South Africa.Guesmi (2015) researched on impact of financial liberalization on the performance of the Algerian public banks, applied panel data analysis method using data from five banks in Algeria. The research findings shows that size of intermediation and concentration of banks have positive impact on the banks whilst interest rate does not have such impact on banks.Manamba (2014) on empirical analysis of interest rate spreads in Tanzania, investigated the volatility of the interest rate since liberalization policy of 1991 in Tanzania. The research findings show that interest rate spreads are higher after liberalization than before the policy period. The research also shows that poor competition also affect interest rate spread in Tanzania. The research recommended building liquid assets for banks to help curtail interest rate and risk.

3. Research Design

- The ex-post facto research design will be adopted for this research. Such will show the effective relationship between the variables, the dependent and independent variable.

3.1. Model Specification

- The functional relationship which is a multiple regression is as follows:TA = f (INT, INFL, LD)The Econometrics model is specified as follows:TA = β0 + β1INT + β2INFL + β3LD + µWhere: TA = Total Assets of banksINT = Interest rate (Prime lending rate)INFL = Inflation rateLD = loans and Advancesβ0, β1, β2 and β3 = parameters and µ = Stochastic Error termApriori expectations are: β1, β2, > 0 and β2 < 0.

3.2. Explanation of the Data Used

- (i) Total Assets of banks is used to measure the total value of the deposit money banks as to ascertain the performance of the banks.(ii) Interest rate –the choice of prime lending rate to maximum lending rate is to ascertain on the average the effect of interest rate on the performance of commercial banks in Nigeria. It shows the average principal charged by the lender to the borrower for the use of its financial facilities usually measured in percentage.(iii) Inflation measures the general increase in price of commodities in a given economy. The addition of inflation in the model as control variable is because it assesses the purchasing power or value of money in the economy.(iv) Loans and Advances measures the debt and credit facilities granted by the deposit money banks in Nigeria for short and long period.

3.3. Method of Evaluation

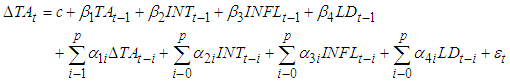

- The ordinary least square method will be adopted for data analysis. The entire test will be conducted at 5% level of significance. The first test will be Augmented Dickey-Fuller (ADF) test for stationarity. The test model is;yt = c + β1 *t +φ yt−1 +θεt−1 +ε tDecision rule• If p-value < level of significance (0.05); then null hypothesis is rejected.• If p-value > level of significance (0.05); then we fail to reject the null hypothesis.The second step is Bound test for cointegration, the rule of the bound test states that if the f-statistics is higher than the lower bound or lower bound, that there is cointegration.Empirical Model: TA= f (INT, INFL, LD)The Bound cointegration test model:

Where:C = ConstantTA = Total Assets of banksINT = Interest rate (Prime lending rate)INFL = Inflation rateLD = loans and AdvancesP = optimum lag lengthThe ECM –Error Correction mechanism will also be conducted to establish the short-run relationship, it is expected to be negative and most of the time, less than 1. Finally, the predictive power of the variables will be tested using Granger Causality test.

Where:C = ConstantTA = Total Assets of banksINT = Interest rate (Prime lending rate)INFL = Inflation rateLD = loans and AdvancesP = optimum lag lengthThe ECM –Error Correction mechanism will also be conducted to establish the short-run relationship, it is expected to be negative and most of the time, less than 1. Finally, the predictive power of the variables will be tested using Granger Causality test.4. The Augmented Dickey Fuller (ADF) test. Unit Root Test

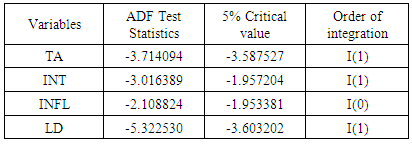

The ADF test for stationarity at 5% level of significance shows that Total Assets, Interest rate and Loan and Advances are stationary at first difference, hence at 1(1) while inflation is stationary at levels form 1(0).

The ADF test for stationarity at 5% level of significance shows that Total Assets, Interest rate and Loan and Advances are stationary at first difference, hence at 1(1) while inflation is stationary at levels form 1(0).4.1. The Cointegration Test

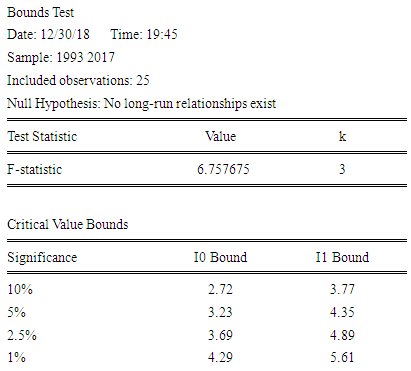

- According to Pesaran, Shin and Smith (2001), Bound testing technique can be used to test for cointegration in a mixture of variables of order I(0) and I(1). If the F-statistic is greater than the lower and upper bound, at chosen level of significance then we conclude that there is cointegration, hence long run relationship.

The Bound test output shown above, shows that the F-statistic is 6.757675 which is greater than 4.35, the upper bound at 5% of significant. Going by the rules of the cointegraion of mixed orders according to Pesaran, Shin and Smith (2001), we conclude that there is long run relationship between the variables then proceed to estimate the Error Correction mechanism (ECM).

The Bound test output shown above, shows that the F-statistic is 6.757675 which is greater than 4.35, the upper bound at 5% of significant. Going by the rules of the cointegraion of mixed orders according to Pesaran, Shin and Smith (2001), we conclude that there is long run relationship between the variables then proceed to estimate the Error Correction mechanism (ECM).4.2. Error Correction Mechanism (ECM)

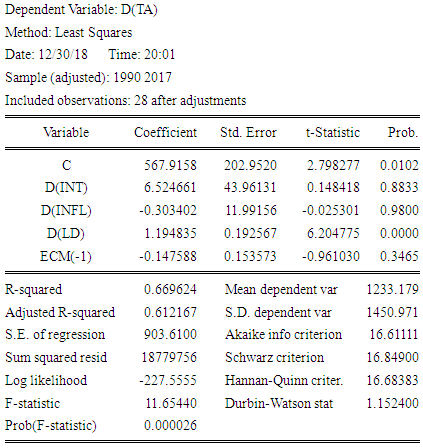

From the result above, the ECM is negative which means that the model is acceptable. The speed of adjustment to equilibrium is 15%. A change in interest rate will lead the Total Assets of the banks to increase by 6.524661 which is in line with a priori expectation. A change in loans and Advances of banks will also lead the Total Assets to increase by 1.194835. Inflation is negatively related to Total Assets as a change in Inflation lead to Total Assets to decrease by 0.303402. T-Statistics test shows that Loans and Advances are statistically significant at a P-Value of 0.0000, while the F-Statistics test shows that the variables are jointly significant at P-Value of 0.000026. The goodness of fit test shows that the independent variables explain 67% changes in the dependent variable. We then proceed to estimate the forecasting power of the variables using Granger Causality Test.

From the result above, the ECM is negative which means that the model is acceptable. The speed of adjustment to equilibrium is 15%. A change in interest rate will lead the Total Assets of the banks to increase by 6.524661 which is in line with a priori expectation. A change in loans and Advances of banks will also lead the Total Assets to increase by 1.194835. Inflation is negatively related to Total Assets as a change in Inflation lead to Total Assets to decrease by 0.303402. T-Statistics test shows that Loans and Advances are statistically significant at a P-Value of 0.0000, while the F-Statistics test shows that the variables are jointly significant at P-Value of 0.000026. The goodness of fit test shows that the independent variables explain 67% changes in the dependent variable. We then proceed to estimate the forecasting power of the variables using Granger Causality Test.4.3. Granger Causality Test

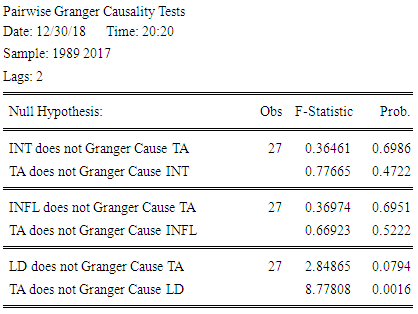

From the Granger Causality Output, there is unidirectional Causality between Total Assets (TA) and Loans and Advances (LD). Hence Total Assets (TA) Granger Causes Loans and Advances (LD) at 5% level of significances, The Granger Causality test could not establish relationship between interest rate (INT), Inflation (INFL) and Total Assets (TA), at 5% level of significance.

From the Granger Causality Output, there is unidirectional Causality between Total Assets (TA) and Loans and Advances (LD). Hence Total Assets (TA) Granger Causes Loans and Advances (LD) at 5% level of significances, The Granger Causality test could not establish relationship between interest rate (INT), Inflation (INFL) and Total Assets (TA), at 5% level of significance.5. Policy Implication

- From the research output, it has been established that deregulation policy is favorable to the robust function and performance of commercial banks in Nigeria. Hence deregulation policy should be strengthen to accommodate frequent volatility in the country’s financial sector.

5.1. Conclusion and Recommendations

- From the research analysis conducted, it is established that there is a nexus between interest rate deregulation and performance of deposit money banks measure by banks total assets. This shows the highly significant position of interest rates in the business of the banks. Thence, this calls for support from the regulatory bodies to see that such strengthen rather than weakens the deposit money banks. The researcher also notes the inability to establish forecasting relationship between interest rate and Banks Total Assets. From the forgoing, the research recommends that;• Interest rate deregulation policy should be maintained to enable the nation enjoy a robust financial sector capable of providing the financial facilities needed for economic development of the nation. Hence the CBN should consider not frequently changing the MPR (monetary policy rate) and CRR (Cash reserve ratio) which most of the time influence interest rate peg of the deposit money banks.• A 6.5 increase in Total Assets at a change in interest rate means that its empirically right to say that Nigerian banks use advantage of the deregulation policy to charge extremely high rate on loans, which means that the borrower may not actually be expanding their investment in the real sector. Hence the CBN should consider a Monetary policy rate of single digit to help drive down the interest rate of deposit money banks. So that the real sector can have a good benefit of the financial facilities they access. Such will go a long way to ensure steady economic growth in Nigeria and employment generation.• The unidirectional Causality between Total Assets and Loans and Advances of banks shows reason why commercial banks cannot provide facilities to capital intensive projects. Because total assets of some of the banks are not enough to finance huge projects. Thus the CBN should make provision for the establishment of specialized banks run under public private partnership to provide credit facilities for capital intensive projects.

5.2. Limitations and Future Research

- The research is constructively limited to the study of interest rate deregulations in Nigeria for the period of 1989-2017. This research can also be extended to the other financial institution in the country to assess the general effect of interest rate deregulation in the financial sector of the country. Since the deposit money banks have constant interaction with other financial institutions in the country.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML