-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2019; 9(1): 11-16

doi:10.5923/j.economics.20190901.02

Impact of Export Subsidies on Pakistan’s Exports

Babar Nawaz Abbasi1, Muhammad Umer2, Syed Ibrahim Shah2, Jingjing Tang1, Ihsan Ullah3, Hifza Abbas4, Imran Khan5

1Center for Experimental Economics in Education, Shaanxi Normal University, Xi’an Shaanxi, China

2Institute of Management Sciences KPK Peshawar, Pakistan

3University of Peshawar Statistics Department, Pakistan

4Federal College of Education Islamabad, Pakistan

5University of Peshawar Department of Economics, Pakistan

Correspondence to: Babar Nawaz Abbasi, Center for Experimental Economics in Education, Shaanxi Normal University, Xi’an Shaanxi, China.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The purpose of this research is to discuss the importance of exports in the economic development of Pakistan and to analyze the relationship between export and export subsidies in Pakistan. Throughout Pakistan’s history, the policy has sought to promote exports through government support and incentives. The government machinery is geared to export promotion, especially through direct and indirect subsidies. Surprisingly, these policies have been continued without serious examination. This research makes an attempt to evaluate these policies by estimating the impact of export subsidies—on export performance. Our analysis shows that export subsidies have a positive relationship with exports in Pakistan. If Government increases subsidies given to exporters so exports of the country will increase and economic development will be enhanced. Export subsidies, FDI and exchange rate are taken as independent variables while export is a dependent variable. The impact of these variables on export has been analyzed. It is necessary to know these key variables of exports so that we can promote exports. These variables affect export positively. Export subsidies FDI and exchange rate have a positive relationship with the exports in Pakistan. Because due to a high ER the price of domestic goods go up and as a result demand for exports decreases. The government has provided different policies for the promotion of exports. Pakistan, through proper policies and planning with positively related determinants, can improve her exports sector up to the required extent.

Keywords: Export, Export Subsidies, Economic Development

Cite this paper: Babar Nawaz Abbasi, Muhammad Umer, Syed Ibrahim Shah, Jingjing Tang, Ihsan Ullah, Hifza Abbas, Imran Khan, Impact of Export Subsidies on Pakistan’s Exports, American Journal of Economics, Vol. 9 No. 1, 2019, pp. 11-16. doi: 10.5923/j.economics.20190901.02.

Article Outline

1. Introduction

- The Government policy to encourage the export of goods and discourage the sale of goods on the domestic market through low-cost loans or tax relief for exporters or government financed international advertising or research and development. The WTO prohibits most subsidies directly linked to the volume of exports. Exports are decisive for economic growth, especially in downturn cycles when domestic aggregate demand is weak. On the other hand, it is well known that firms, in order to export, must overcome several difficulties and costs. So, most governments apply various export promotion policies, even if direct export subsidization is forbidden by World Trade Organization rules. In this framework, general production related subsidies may have an important role in promoting exports, without violating WTO rules. Complementarily, some recent theoretical models and some recent empirical studies found the existence of entry sunk costs of exporting; such costs could be surpassed through the benefits of public supports like subsidies. In this line, export promotion policies may enhance domestic firms to exporting activities. However, there are few proofs that governmental exporting promotional policies are, indeed, effective in removing or at least reducing such difficulties to exports. This lack of evidence may result from the fact that there are diverse institutional arrangements (both formal and informal designed to help to reduce such sunk costs of exporting) deriving complex the task of distinguishing the mechanisms which are effective in promoting exports and which are not; moreover, such complexity may open path to misuses, abuses and even for a practical impossibility of controlling firms´ subsidies. Also important is the fact that the existence of complete data, at the firm level, on public subsidies designed to help to export is scarce, making difficult such test. Additionally, there is a methodological difficulty to such test given that it is impossible to observe the same firms with and without such subsidies and supports; in fact, only indirectly the impact of public support to exports has been analyzed. All these facts increase the doubt on this subject are public policies of export promotion ineffective or are we not methodologically able to obtain proofs of it?Pakistan has pursued export-promoting policies since the late 1950s. One of the prominent tools of this policy adopted in 1959 was the export bonus scheme, which introduced multiple exchange rates in the country. This scheme was abandoned in 1972 after the devaluation of Pakistani rupee. In order to promote the export of manufactured goods, since the late 1970s, an elaborate export incentive system was introduced. This system included: exemption of exports from sales tax and central excise duty, duty drawback scheme covering sales tax, central excise duty, and customs duty on inputs used in the production of exports, taxation of export of domestically produced raw materials, Concessionary export finance and export credit guarantee scheme, and income tax rebates. Out of the above list of incentives, three measures induce exporters to indulge in export over invoicing: concessionary export finance, duty drawback on exports, and income tax rebate on profits from exports. Concessionary export finance provides short-term pre-shipment and post-shipment finance in local currency to direct exporters. Limited availability of concessional export finance induces exporters to over invoice the value of exports so that they can obtain a large size of a loan from the bank. In 1994, the annual interest rate on concessional loans was 11 percent, with a maximum loan period of 180 days. In contrast to this; the market interest rate was 22-23 percent. About 70 percent of exports 'fell within the concessionary export credit scheme. In 1993, US$ 2.7 billion of export credits were extended to exporters. Export refinance borrowings are either exempted from the payment of excise duty or taxes are included in the export rebates. Pakistan allows drawback on customs duties and sales taxes on imported inputs, and on excise duties and sales taxes on indigenous inputs. Rebates for 54 broad industrial groups covering more than 250 products have been standardized as a specified percentage of the f.o.b. value of export or a specific amount per unit of goods exported. The customs duty drawback rate, as a percent of manufactured exports on which duty drawback is applied, was 12.5 percent in 1994. The gap between the duty drawback rate and the exchange rate premium attracts exporters to indulge in over invoicing exports. This is mainly due to the fact that with little effort, corrupt exporters with the connivance of corrupt government and bank officials manage to receive drawbacks from the exchequer. They, in fact, exploit the weaknesses of the duty drawback system (DDS) while indulging in unfair trade practices. The major weaknesses of the DDS are as follows:1. Duty drawback rates are not automatically adjusted to take account of additional taxes imposed by the government from time to time.2. Due to the fixed nature of the system, exporters, in general, are unable to draw back the full amount of taxes and duties paid by them.3. The Revenue Division sometimes confronts exporters with an arbitrary downward revision in export prices without any prior notification.Up to 1988, the government allowed income tax rebate at the rate of 55 percent of the profits earned through exports of manufactured goods. In 1989, the government introduced a three-tier system, in which the income tax rebate was graduated with the degree of processing. On semi-manufactured goods, such as cotton yarn, the income tax rebate was 25 percent. On manufactured exports, in general, it was 50 percent. But on the exports of some manufactured goods, viz., leather garments, engineering, and electrical goods, the rebate was 75 percent. In 1993, exports of furniture, doors, and windows were also allowed a 75 percent income tax rebate. Later on, the income tax rebate rate was increased to 90 percent in the case of all goods receiving a rebate of 75 percent. Thus by showing large export value out of their total domestic production, exporting firms earn a large income tax rebate.Pakistan launched its programmes of industrialization under the influence of import-substituting (IS) strategy of advancing development. The IS strategy, pursued for many decades, however, has not satisfied the goals of the industrial policy. Dissatisfaction with the outcome of IS policies has to lead to a partial shift from the IS strategy to the export-promoting (EP) strategy. In the process of this strategic shift, Pakistan has offered many attractive incentives to encourage the production of export-oriented manufactured products, whereas export incentives have helped the country to manage a respectable growth rate in exports, exporters have exploited the weaknesses of the incentive system and developed some unfair export practices (by over invoicing the value of the transaction). These illicit practices result in a significant financial loss to the country and undermine the effectiveness of the policies to achieve their stated goals. At the same time, many exporters who do not indulge in such practices have to suffer losses, as their bargaining position in the marketplace is affected adversely. The menace of over invoicing of exports calls for immediate attention of policy-makers, because without recognizing it they may limit the scope of the export- promoting schemes and the trade liberalization program. Ideally, the implications of export over invoicing should be integrated with the usual policy prescriptions. Likewise, it is important to determine the presence and magnitude of export over invoicing, so that policy-makers are reminded of the extent of the problem. An exporter is tempted to over invoice exports if (say) the duty drawback rate is higher than the premium on foreign currency that he has to purchase from the curb market to meet the export-earning surrender requirement of the State Bank. When there are no foreign exchange controls, so that all exchange transactions take place only within an insignificant range legally permitted around the parity value, i.e., the premium is nil, then there is a clear incentive to over invoice exports in the presence of a scheme of duty drawback. Where, however, there is exchange control, and the exporter must surrender all declared export receipts to the State Bank, the exporter will have to purchase illegal foreign exchange in the curb market to an amount excess of the declared over the actual value of exports. In this case, if the curb market premium on foreign exchange is less than the rate of duty drawback, then again the exporter will be induced to over invoice exports. There is, however, some risk (of being caught by law enforcement agencies) attached to getting involved in illegal activities. Hence, over invoicing of exports will not cease unless the differential between the duty drawback and the premium in the curb exchange market is greater than the risk factor evaluated by the exporter.

2. Theoretical Background and Econometric Methodology

2.1. Introduction

- At the start of any research study, it is important to consider relevant theory underpinning the knowledge base of the phenomenon to be researched. By addressing simple questions, the researcher can begin to develop a loosely-structured theoretical background to guide them. In the theoretical background, we explain different variables related to the topic concerned. We show the relationship of deferent variables with the topic concerned.

2.2. Theoretical Background

- The role of exports in the economies of developing countries has been examined in a wide range of empirical and theoretical studies. It goes back to the classical economic theories of Adam Smith and David Ricardo, who argued that international trade plays an important role in economic growth and there are economic gains from specialization. It has been commonly viewed that being a component of GDP, exports contribute directly to national income growth and are among the most important sources of foreign exchange earnings that ease the pressure on the balance of payments and generate employment opportunities. Moreover, it is also recognized that the exports sector contributes to GDP growth more than other sectors. There is a positive relationship between export financing scheme and exports. There is also a positive relationship between the duty drawback scheme and exports. When the government gives subsidies on exports so it means that exporters are encouraged to export more and more which increases the foreign reserves in the country.The rate of the exchange rate of different currencies is a ratio that specifies how much one currency is worth with respect to other currency. Simply it is the value of foreign currency in term of the domestic currency. The value of the exchange rate affects the demand for export. An appreciation of currency will lead to export becoming more expensive and have a negative impact; in turn, leads to leakage from the circular flow of income. Where depreciation of the currency causes the opposite effect. The extent to which change in exchange rate effects exports will depend upon the elasticity of demand for the product and the nature of the contract that been agreed. Mostly, the impact of the exchange rate on export is adverse in developing countries like Pakistan, but its impact changes from country to country, depending upon the macroeconomic policies and international trade. FDI refers to long term participation by one country into another country. It usually involves participation management, joint venture transfer of technology and expertise. Effect of FDI in Pakistan is controversial but mostly its impact is positive. Because government provides facilities for export promotion and these kinds of facilities attract foreign investors, so through comparative advantage, FDI contributes to export growth. Multinational Corporation who often use developing countries as a platform for export and location for foreign direct investment have legitimate reasons to worry about those legislations that propose to link market access with labor standard.The idea of linking trade to labor standard is not new, ignoring labor standard donor play a significant role in the trade performance. By comparing skilled and unskilled labor force in developed and developing countries, the impact of the labor force is both positive and negative on export. If labor is skilled, then it contributes ore in the production of domestic goods and has a positive impact on export and unskilled causes negative impact.

2.3. Econometric Methodology

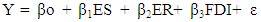

- In this research, we have used exports as a dependent variable also called explained variable and export subsidies, exchange rate and foreign direct investment as independent variables also called explanatory variables. Y, ES, ER, and FDI have been used as variable notations of exports, export subsidies, exchange rate and foreign direct investment respectively whose data is based on secondary data which has been collected from various issues of Economic surveys of Pakistan and Pakistan Bureau of statistics. The variables which are used along with exports to explain the relation of export subsidies with exports are given in equation (1):

| (1) |

3. Data and Variables

- In this chapter, I will explain the various sources of data that from where the data have been collected and then I will explain the construction of variables that how I have constructed my variables. It is very important to get data from reliable & registered sources and variable construction is the most important part of the study.

3.1. Sources of Data

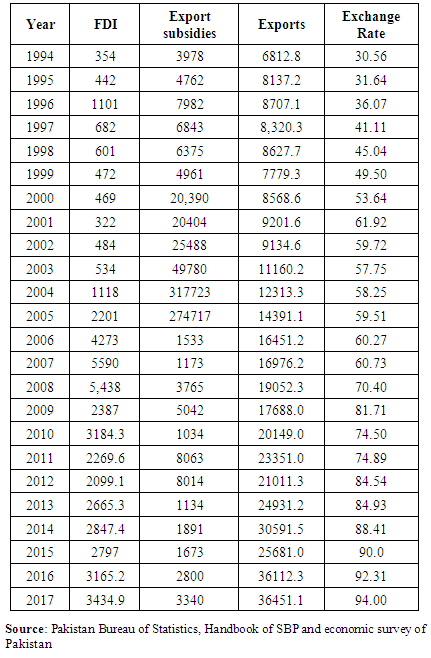

- The data has been collected from Pakistan Bureau of statistics and from various economic surveys of Pakistan. The data is secondary in nature and it is time series data. Exports and all other variables are taken in the form of million dollars. The study covers the data over the period of 1994 to 2017 which is mostly collected from various issues of the Economic surveys of Pakistan and Pakistan Bureau of statistics.The data which are collected from various issues of Economic survey of Pakistan and Pakistan Bureau of statistics are given in table 4.1.

|

3.2. Construction of Variables

- Export is taken as an explained variable while all other variables are taken as explanatory variables. These variables and their relationship with export function are as follow.1) Export SubsidiesSubsidies given on exports of a country is called an export subsidy. These subsidies are given by the government of Pakistan to exporters to encourage them to export more and to compete in the international market. It can either increase or decrease the exports of Pakistan.2) Exchange rateThe rate of the exchange rate of different currencies is a ratio that specifies how much one currency is worth with respect to other currency. Simply it is the value of foreign currency in term of the domestic currency. The value of the exchange rate affects the demand for export. An appreciation of currency will lead to export becoming more expensive and have a negative impact; in turn, leads to leakage from the circular flow of income. Where depreciation of currency causes the opposite effect. The extent to which change rate effects exports will depend upon the elasticity of demand for the product and the nature of the contract that been agreed. Mostly, the impact of exchange rate on export is adverse in developing countries like Pakistan, but its impact changes from country to country, depending upon the macroeconomic policies and international trade.3) Foreign Direct Investment (FDI)FDI refers to long term participation by one country into another country. It usually involves participation management, joint venture transfer of technology and expertise. Effect of FDI in Pakistan is controversial but mostly its impact is positive. Because government provides facilities for export promotion and these kinds of facilities attract foreign investors, so through comparative advantage, FDI contributes to export growth.

4. Results and Interpretation

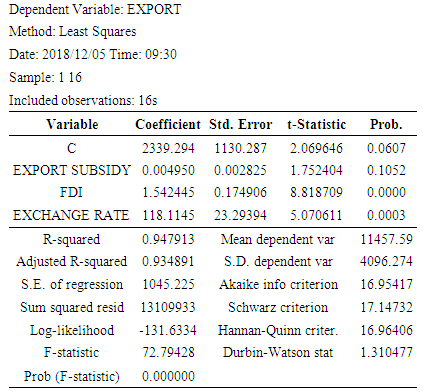

- Results and interpretation of the data are discussed through the multiple regression model. The relationship among the variables is promoted through regression analysis The summary of the results is that export subsidies positively affects exports which means that when the government of Pakistan increases export subsidies so the exports will increase and when the government of Pakistan decreases export subsidies so the exports will decrease. There is a positive relationship between exports and export subsidies when one increases the other one is also increased.Results of the data are given in the following tables below:

4.1. Interpretation

- The results indicate all variables with insignificant t-value positive signs. The variables are a foreign direct investment with t-value 8.818 is insignificant, export subsidies with t-value 1.752 are insignificant and exchange rate with t-value 5.070 is also insignificant. Since the F-Statistic for the F-test of the overall equation is 72.794. This model has statistically significant explanatory power at 5% significance level for export subsidies. R Square denotes the coefficient of determination. The R2 value is 0.948 which means that 94% of the variation in exports over these 16 observations for Pakistan is explained by the variation in the following variables as below:Export subsidies, Foreign direct investment, and Exchange rate which are explanatory variables of exports. As all the variables have a positive sign which means that the relationship is positive. As the value of R-square is greater than 60% so the model is a good fit.If foreign direct investment increases by 5%, exports increase by 1.542% when other variables in the model do not change. Similarly, if export subsidies increase by 5% exports increases by 0.005% when other variables in the model do not change, in the same way, when exchange rate increases by 5% exports increase by 118.115% when other variables in the model do not change.

5. Conclusions and Recommendations

- The study reveals that no country can be self-sufficient in the world economy. The requirements and necessities of one economy are related to the economies of other countries. That is why the scope of international trade shows its importance. From the history of Pakistan, it can be observed that there have been ups and down in Pakistan exports but due to the economic policies and planning it has developed its export structure economically and still developing. Economic growth depends upon trade. If the trade is up to the required extent then it shows the stability of the country’s economic performance. For the promotion of export lead growth, it is very important to know the important factors which positively or negatively affect exports of the country.

5.1. Conclusions

- The present research has investigated the relationship between exports and export subsidies in the case of Pakistan economy for the period from 1994 to 2017. The econometric multiple regression model was applied by using SPSS. There is a positive relationship between exports and export subsidies in Pakistan. It means that if export subsidies increases then exports also increases and if export subsidies decrease then exports also decreases. Foreign direct investment and exchange rate are also used to investigate the relationship of exports with these explanatory variables. The result shows that there is a positive relationship between foreign direct investment and exchange rate with exports meaning that if foreign direct investment and exchange rate increase then exports also increase in Pakistan.

5.2. Recommendations

- In evaluating the impact of different variables on exports and the role of exports in the economic development of Pakistan economy. Here are some suggestions which if followed can give improved results.Ÿ Economic policies and planning should be improved further to boost up exports.Ÿ The Government should provide facilities to attract FDI inflows to the economy.Ÿ Exports should be diversified and it should be dynamic in quantity and quality.Ÿ There should be proper training for labors to make them more skilled full and effective in order to produce more goods and services.Ÿ Trade procedures should be simple and amenable to modern trade environment.Ÿ There should be an improvement in the export infrastructure of the economy.Ÿ There should be saving incentives by the financial institutions and government. Ÿ There should be a reduction in export duties and reduction in prices of imports which are used in exports as raw materials.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML