-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2019; 9(1): 1-10

doi:10.5923/j.economics.20190901.01

Income Inequality Effects of Globalization in Oil-Rich Nigeria: Evidence from Time Series

Ebele Stella Nwokoye1, Nnenna Nneka Ezeaku1, Nkechinyere R. Uwajumogu2

1Department of Economics, Nnamdi Azikiwe University Awka, Anambra State, Nigeria

2Department of Economics and Development Studies, Alex Ekwueme Federal University, Ndufu-Alike, Ikwo, Ebonyi State, Nigeria

Correspondence to: Ebele Stella Nwokoye, Department of Economics, Nnamdi Azikiwe University Awka, Anambra State, Nigeria.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Incidences of rising income inequality in Nigeria have raised questions on its link with globalization. Using quarterly time-series data on an empirical model which is hinged on Stolper-Samuelson theorem, the Johnson cointegration test and error correction model showed that globalization, technology and foreign direct investment significantly heightened income inequality while that of productivity significantly diminished income inequality in Nigeria in the long run. This study recommends support for domestic entrepreneurship through import substitution and export promotion strategies so that Nigeria to enjoy gains from globalization. Furthermore, increased access to public service such as health care and high quality education among the poor and vulnerable is desirable for sustained increase in labour productivity.

Keywords: Globalization, FDI inflow, Income inequality, Nigeria, Productivity, Wage

Cite this paper: Ebele Stella Nwokoye, Nnenna Nneka Ezeaku, Nkechinyere R. Uwajumogu, Income Inequality Effects of Globalization in Oil-Rich Nigeria: Evidence from Time Series, American Journal of Economics, Vol. 9 No. 1, 2019, pp. 1-10. doi: 10.5923/j.economics.20190901.01.

Article Outline

1. Introduction

- In the past two decades, there has been a continuous rise in inequality in many developed and developing countries [1]. Global income inequality is possibly the most important policy threats facing the world at present. While there is full understanding about the seriousness of the problem, there are considerable contentions about its worsening over time. The issue is important for policy; anti-globalization agitators often times argue that globalization leads to ever-rising inequality, both within and between nations. The opponents of free trade are however, not alone when maintaining that global inequality has risen; large international organizations have also supported this perception - especially concerning inequality between countries as high level of income inequality exists in developing countries [2]. Contrary to the impressions fuelled by inaccurate economic statistics, the welfare issue in Nigeria, Africa’s most populous nation, is not only that poverty is rising nor that unemployment is extremely high but that the challenge facing its government include that of dealing with increasing income inequality, particularly, the disparity in income for people living in different parts of the country. Although the national poverty rate was 33.1 percent in 2012-2013, the rate was 44.9 percent in rural areas but only 12.6 percent in urban areas [3]. Perhaps more disturbing is the wealth inequality among Nigeria’s different geographical regions, with more destitute found in the North than in the Southern part of Nigeria. Whereas the poverty headcount in the relatively more industrialized South-west, with the lowest poverty rate, fell from 21.2 percent in 2010-2011 to 16 percent in 2012-2013, the count in North-east rose from 47.1 percent to 50.2 percent over the same period [4]. Some of the consequences of the widening income gaps are the negative impact on socio- economic indices brought about by the large disparity between the rich and the poor which produce a series of cyclic reactions [5]. Large income gap results in inadequate consumption which reduces market demand and creates a vicious cycle of decreased business efficiency. It also creates a situation where the weaker SMEs go bankrupt, unemployment rate increases, socio-economic statues decline and state revenue dwindles. Income inequality is a big problem in both developed and developing countries. It hinders economic opportunity and innovation [6]. Rising income disparity affects how people perceive things around them (including government policies); it affects level of happiness, and makes people feel that life is too hard and unfair.Some of the most popular explanations for increasing income inequality in Nigeria are increase in literacy rate [7], rural/urban disparity [8], profession and occupation, lack of skills and gainful employment [9]. Other explanations for raising inequality in both developed and developing countries are the role of skill-biased technological progress [10] and [11], skill-skewed demand of foreign investors [12], complementarily between lower cost of capital (which comes in form of financial reforms that accompany trade liberalization) and skilled labour [13, 14]. It is arguable that wage-setting rules may also be a cause as the study found that wage inequality was greater in poor countries because the highly skilled workers’ wages responded to global wage-setting conditions, while low skilled wages depended on local conditions [15]. Nevertheless, much less emphasis has been put on the analysis of income inequality and globalization in least developed countries (LDC) and in Nigeria particularly. The principal intuition is that if trade was behind the relative wages movements in developed countries, we should observe a movement in the opposite direction in the relative wages of developing countries. That is, if trade with developing countries was increasing the income inequality in developed countries, we should observe a corresponding reduction in the income inequality in developing countries. Similarly, if skill-biased technological change was the main force behind the relative income movements in developed countries, a similar pattern should be present in developing countries too. There is therefore the need to investigate the relationship between globalization and income inequality in Nigeria.A fundamental prediction of trade theories is that the adjustment process to trade reform would involve labour reallocations from sectors that experience price increases and hence expand. Thus, the greater demand for low-skilled labour is expected to lead to higher income in the long run and consequentially close up the gap between the skilled and low skilled workers and in turn reduce poverty. No wonder the last decades have witnessed tremendous pressure on developing countries to liberalize their trade. The free trade mantra advocated by developed nations and major international development organizations has become like a religion, holding out the promise, if only poor countries will accept.Contrary to free trade predictions, several developed and developing countries have experienced a substantial increase in income inequality following globalization and increased international trade [16]. Nigeria’s experience with globalization has attracted much attention because it has also been experiencing rising income inequality [17]. The coincidence of globalization and income inequality has cast a serious doubt on the efficacy of the neoclassical trade theory, the Heckscher-Ohlin model in general and the Stolper-Samuelson theorem in particular. Surprisingly, much less emphasis has been put on the analysis of income inequality in less developed countries but no known study on globalization and income inequality in Nigeria has measured globalization from a broader perspective. Those carried out in other countries had inconsistencies in their results hence the need to carry out a detailed analysis of the relationship between globalization and income inequality in Nigeria. Certainly, such an analysis is capable of yielding results which would serve to resolve the conundrum faced by the country’s policy-makers in their considerations on further opening of the Nigerian borders. The general objective of this study is therefore to examine the effect of globalization on rising income inequality in Nigeria. Unlike the several existing studies, which are based on the United States and Latin American data, this paper focuses on Nigeria. In view of this, this paper seeks to provide answers to the following research questions: Is there a long run relationship between income inequality and globalization index, foreign direct investment inflow, productivity and technological advancement in Nigeria? What short run impact does globalization, foreign direct investment inflow, productivity and technological advancement have on income inequality in Nigeria?To this end, the paper is arranged thus: Following this introductory section is Section two which contains the relevant literature upon which this study is based; Section three describes the theoretical and empirical frameworks adopted by this study; Section 4 is reports the empirical results and discusses the important findings of this study while Section 5 concludes the paper and proffers policy recommendations.

2. The Literature

2.1. Review of Conceptual Literature

- 1. Concept of InequalityThe standard measure of inequality is based on comparisons of individuals’ well-being over their entire lifetime. Arguably, the most appropriate variable for capturing lifetime well-being is consumption [18]. Measures of inequality are consumption, income and wages but when compared with income, consumption offers three advantages. First, consumers can inter-temporally shift resources through lending and borrowing, so current consumption, more appropriately, captures lifetime well-being. This argument may not have much relevance for developing economies which are majorly characterized by severe capital market imperfections. Second, consumption is less associated with reporting problems as compared to income and third, trade policies affect the relative prices of consumer goods so that they impact consumers not only through changes in the purchasing power of their current incomes. To this effect, consumption seems a better suited measure of inequality. In spite of these advantages, the use of consumption as a measure of inequality is rarely seen in empirical studies on the effects of globalization. This is because many developing countries do not consistently report expenditures in their household surveys [18]. To date however, most empirical studies employ income based measures of inequality, given that some measure of income is always included in household surveys. The most frequently used inequality indices is the gini coefficient. The suitability of these indices for capturing the real changes in inequality, especially over longer periods of time, has been questioned recently for a variety of reasons. To avoid these problems, many studies have focused on a more narrow measure of inequality-wage inequality. Another potential problem of inequality measurement is that household surveys are often redesigned so that the wage and income data are not comparable across years. In addition to this reporting problem all inequality studies face conceptual issue of whether to focus on households or individuals. To take this into account, many studies have focused on some variant of per capita income.The rise in inequality reported in developing countries has been associated with an increase in the skill premium, that is, the wage difference between skilled and unskilled workers. This explains why a substantial amount of related work has focused on an even more narrow measure of inequality; the inequality between skilled and unskilled workers. The definition on skill depends on the kind of data employed. For the purpose of the study, the researcher measures inequality based on income; share of income shared by the highest and lowest class in Nigeria.2. Concept of GlobalizationGlobalization is a broad concept which describes a variety of phenomena that reflects increased economic interdependence of countries. Such phenomena include flows of goods and services across borders, reduction in policy and transport barriers to trade, free international capital flows, increased multinational activities, increased foreign direct investment flows, increased outsourcing, increased exposure to exchange rate volatility and increased international migration. These movements of goods, services, capital, firms and people are believed to contribute to the spread of technology, knowledge, culture and information across borders. Research on globalization has concentrated on those aspects of globalization that are easier to capture empirically. Measurement challenges abound and the first obstacle is data availability. Detailed information on trade barriers, outsourcing and foreign direct investment are often not readily available, especially when the analysis requires highly disaggregate data or longer periods of time that span periods of policy liberalization. This is especially pronounced in developing countries. Consequently, researchers have often measured globalization using trade volume data, which in most cases, is readily available. Trade volume is not exclusively determined by policy thus, studies that used trade volumes to measure inequality basically study the impact of trade volume on inequality. This is because many other factors can influence a country’s trade volume such as technology, country’s geography, demand conditions in importing countries, weather, competitor’s supply conditions etc [19].

2.2. Review of Basic Theories

- There are two important economic theories which seek to explain the link between income inequality and the movement of other macroeconomic aggregates in a country. These theories are the Heckscher-Ohlin trade theory and the Stolper-Samuelson theorem and are briefly discussed below.1. Heckscher-Ohlin Trade TheoryThe perceptive insight about the links between international trade and income distribution arise from the static neoclassical trade theory developed by Eli Heckscher and Bertil Ohlin in 1933. This theory states that a country should specialize in production and export using the factor that is most relatively abundant and thus cheaper. Based on a two-country, two-factor, two-good setting, with identical technology in the two countries assumptions, the this theory concludes that if country one is abundant in skilled labour, and country two, in unskilled labour, trade will increase country one skilled wages and country two unskilled wages. Thus trade leads to an increase in the demand for abundant (and cheap) factors of production, thus raising their price, while trade leads to a decline in the demand for scare (and expensive) factors of production, thus lowering their price. It also recognizes that migration of unskilled workers from country two to country one, or of skilled workers from country one to country two, will have identical effects on factor prices.Though critics of the Heckscher-Ohlin theory argue that the theory is based on unrealistic assumptions, this theory is relevant because it gives useful insights in explaining how differences in countries factor endowment affects trade. This theory predicts that trade leads to greater wage inequality in the country one and lower wage inequality in country two. 2. Stolper Samuelson TheoremWithin the Heckscher-Ohlin framework, Wolfgang Stolper and Paul Samuelson in 1941 propounded the Stolper-Samuelson theorem. This theorem describes the link between globalization and wage inequality as a relationship between the relative output prices and relative wages. An increase in the relative price of skill intensive goods could explain an increase in the relative wage of skill workers, even in a developing (or labour-abundant) country. Stolper-Samuelson theorem has been criticized as being too restrictive. Nevertheless, the relevance of this theorem still stands as it provides a definite insight to a central question in applied economics on the effect of changes in prices of goods caused by changes in tariff on the prices of factors of production.The central prediction of this theorem is that trade reduces wage inequality in unskilled-labor-abundant countries, and vice versa in skilled-labor-abundant countries through changes in relative prices.

2.3. Review of Empirical Literature

- Various strands of empirical literature show how openness can impact on income inequality. For instance, some of the studies which provide support that openness to international trade increases income inequality include that of [20] which examined the increase in relative wages for skilled workers in Mexico in the period 1975 to 1988. This study measured FDI using regional data on foreign assembly plants and trade (outsourcing) and found that increases in FDI positively correlated with the relative demand for skilled workers. The study concluded that rising wage inequality in Mexico is linked to foreign capital inflows and that trade can cause increases in wage inequality in developing countries, just as it does in developed countries.[21] examined the relationship between globalization and wage inequality using a panel data on 20 countries during the period 1970 to 2011. The variables used in the regression model were FDI inward ratio of GDP, globalization index, average income of highest and lowest 1% in the countries. The results showed that income inequality increased as FDI inflow increased. [22] also examined the effects of trade openness on income inequality in Brazil, the Russian Federation, India and China (BRIC) during the period 1975 to 2013. The variables in the model include GINI coefficient, trade, import, export, terms of trade, real effective exchange rate index, education and GDP per capita. Using the GMM estimator, the study found a positive and significant relationship between trade openness and income inequality in the BRIC countries.In contrast, a strand of studies found openness to significantly reduce income inequality. For instance, [23] got a similar result in its study of openness and wage inequality in Kenya for the period of 1964 to 2000. This study measured wage inequality by the ratio of wages in manufacturing sector to the wages in the agricultural sector. Other variables in the regression model included capital-labour ratio, educational attainment, relative labour productivity and the ratio between agricultural and manufacturing prices in Kenya. This study concluded that changes in relative wages had primarily been driven by the degree of openness and that international market integration had reduced wage inequality in Kenya.Some other studies argue that openness did not directly affect inequality but rather skill-biased technological change. For instance, [24] in a cross-country analysis covering the period of the 1970s to the 1990s argued that increased openness can also induce technical changes; there can be productivity growth through scale effects and increased awareness of best-practice technology and production techniques abroad. When technological change is skill-biased, then lower tariffs might lead to higher wage-premiums, and a tariff reduction could increase the relative wages of skilled labor. [25] looked at the impact of various policies (trade, financial liberalization, privatization, and tax reform) either jointly or independently on wage differentials in Latin America during the previous 20 years. The study concluded that more liberal trade regimes did not have an impact on wage differentials between different education categories. Financial liberalization and high technology exports in the context of a liberal trade regime, however, contributed to the rising inequality. Thus, it was not increases in trade but changes in technology that were associated with growing wage gap.There is a strand of studies which found weak evidences that income inequality was associated with increasing income disparities. For instance, [26] analyzed trade and inequality in Bangladesh over the period of 1973 to 2002. The study found no evidence that trade liberalization had changed the relation between wages of unskilled and skilled workers. Hence, it concluded that greater openness had not decreased wage inequality, as predicted by the Stolper-Samuelson theorem. [27] also adopted the GMM estimator to analyze the evolution and determinants of skilled/unskilled wage premium in a group of 20 European countries for the period 1995 to 2005. This study found that trade was not a significant determinant of growth skilled/unskilled wage gap in the selected 20 countries in the European Union.A review of various studies that have been conducted on globalization and income inequality has shown that scholars had employed different measurements and various definitions of key variables used including the measure of openness, with some authors using quantities (trade volumes or flow of FDI) and some others using policies (tariff levels). There is also scanty literature in this area of study especially in Nigeria and Africa as a whole. The few studies found in this area were conducted in Latin America and United States. Thus, the available empirical literature, however, does not lead easily to robust conclusions regarding the relationship between globalization and income inequality in Nigeria.This study fills this knowledge gap in the measurement of globalization by using the KOF globalization index which, as defined by [28], captures both trade volumes, flow of FDI and policies into one aggregate index, as opposed to other studies that proxied openness using just one aspect of measuring openness or using two or more variables to represent measurements of openness in their models.

3. Theoretical and Empirical Framework

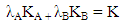

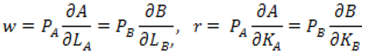

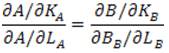

- The general equilibrium model developed by Hecksher-Ohlin is a widely used model for explaining the link between trade and its distributional effects. Under the assumption of two homogeneous goods, with each freely mobile between the two countries, the theory focused on differences in relative factor intensities across industries and relative factor endowment across countries. The Stolper-Samuelson model formalized the logic of the Hecksher-Ohlin model to link trade directly with relative prices and indirectly with factor rewards - wages. The factor price equalization theorem, as it is commonly known as, explains that trade increases the real return to the factor that is relatively abundant in a country and lowers the real return to the other factor that is relatively scarce [29]. The Stolper-Samuelson theorem assumed two homogeneous goods A and B, each produced under constant returns to scale using labour L and capital K but with good A using more capital relative to good B and good B using more labour than good A. This is to say, that good A is capital intensive and good B is labour intensive. The two factors are assumed to be freely mobile between the two countries’ industries and assumed fixed in total supply. Mathematically, this is expressed in (1) as:

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

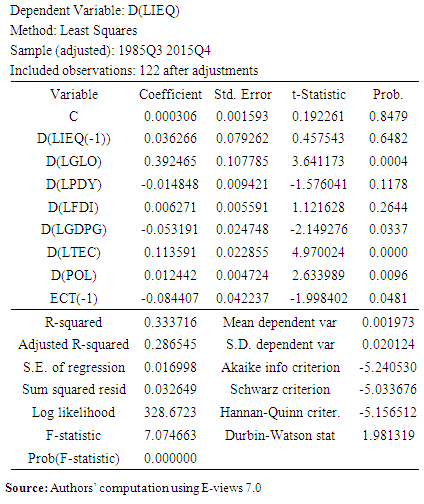

4. Result Analysis and Discussion of Major Findings

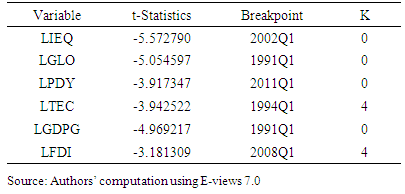

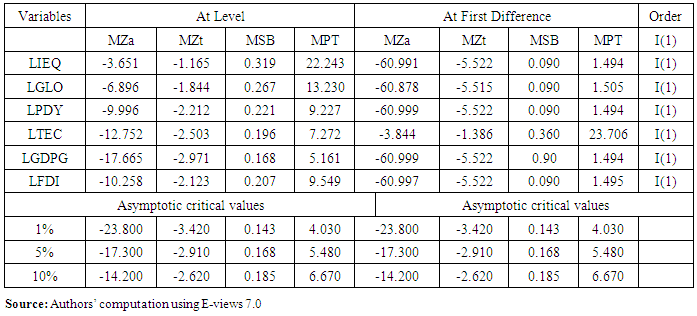

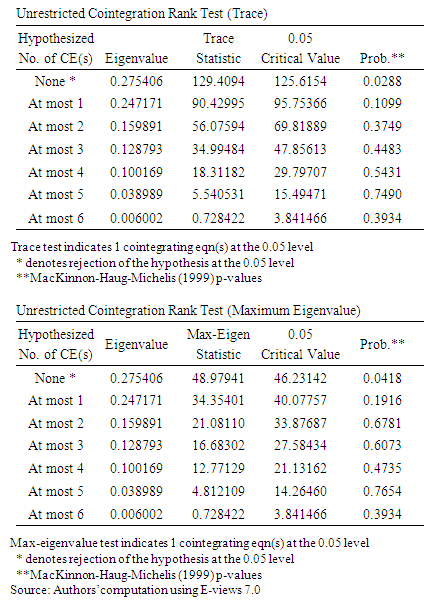

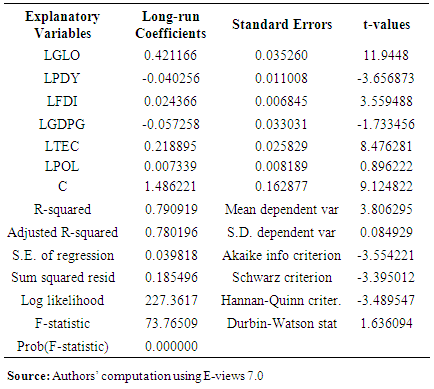

- First, we begin with the result of Zivot-Andrew Unit Root Test which shows the critical values as 5.57, -5.08 and -4.82 at 1%, 5% and 10% level of significance respectively.Table 1 shows the periods where structural breaks occur in the series. LIEQ, LGLO, LPDY, LTEC, LGDPG and LFDI experience structural breaks in 2002Q1, 1991Q1, 2011Q1, 1994Q1, 1991Q1 and 2008Q1 respectively. Sequel to this, the Ng-Perron modified unit root test was employed for the stationarity test on the time series in order to determine the order of integration which is a prerequisite for determining the lag length.

|

|

|

|

|

5. Conclusion and Policy Recommendations

- The dearth of literature on globalization and income inequality together with variations in the measurements of globalization have all raised questions on the relationship between globalization and income inequality in Nigeria. The study was undertaken to examine the effect of globalization on income inequality in Nigeria. Several studies adopted different measures of globalization with some studies using one aspect or two aspects of globalization to measure openness. Their findings differed and did not lead to a robust conclusion on the link between globalization and income inequality. This study fills up this knowledge gap in measurement of globalization by using the KOF globalization index which captures all aspects of globalization which are social, economic and political aspects.Since globalization had a long run positive and significant effect on income inequality, this study therefore advocates that economic policies targeted at international trade should neither be aimed at deterring the advancement of domestic industries nor discouraging competitiveness of the young industries. The government must embark on protectionist domestic policies that breed innovation and entrepreneurship, while providing adequate infrastructure for diversification of the non-oil sectors. This will be effective in shrinking the gap between incomes of skilled and unskilled workers. Policies, which boost affordability, availability and effectiveness of Nigeria’s educational system, and encourage people to seek enlightenment, should be put in place. This will help to improve people's productivity. Innovations should be encouraged and promoted in all field and technology adoption should be preferred to technology adaptation. Technical schools should therefore focus on constructive and innovative changes as well as improvement on foreign technologies.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML