-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2018; 8(6): 244-253

doi:10.5923/j.economics.20180806.03

A Study on Sector-based Need Assessment of Light Engineering Sector of Bangladesh

Tapas Chandra Banik1, Nahrin Rahman Swarna2

1Research Associate, Bangladesh Foreign Trade Institute (BFTI), TCB Bhaban, Kawran Bazar, Dhaka, Bangladesh

2Assistant Research Associate, Bangladesh Foreign Trade Institute (BFTI), TCB Bhaban, Kawran Bazar, Dhaka, Bangladesh

Correspondence to: Tapas Chandra Banik, Research Associate, Bangladesh Foreign Trade Institute (BFTI), TCB Bhaban, Kawran Bazar, Dhaka, Bangladesh.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Light engineering sector has notable significance in the overall manufacturing sector of Bangladesh. This paper tires to assess the Sector-based Need of the Light Engineering Sector of Bangladesh. Both qualitative and quantitative methods were applied in the study. This paper shows that non-existence of Common Facility Centre (CFC): lack of metal and heat treatment facilities, constraints related to finance, old and manual technology, unfair competition in the domestic market, accreditation of certification of standards etc. are the major issues for this sector. This paper provides some specific suggestions and recommendations that helps to increase the capacity, efficiency and competitiveness of this sector.

Keywords: Light Engineering, Needs Assessment, Capacity Building, Bangladesh

Cite this paper: Tapas Chandra Banik, Nahrin Rahman Swarna, A Study on Sector-based Need Assessment of Light Engineering Sector of Bangladesh, American Journal of Economics, Vol. 8 No. 6, 2018, pp. 244-253. doi: 10.5923/j.economics.20180806.03.

Article Outline

1. Introduction

- The Light Engineering sector, an important sub-sector of the overall manufacturing sector of Bangladesh, is fuelling the growth of many other industries of the country. It is providing support to agricultural, industrial and other sectors of the economy by manufacturing a wide range of spare parts, casting, moulds and dices, oil & gas pipeline fittings, light machinery, etc., as well as by providing extensive repair services to those. The sector has importance in the context of employment generation and poverty reduction in the country. Light engineering enterprises are scattered throughout the country and, therefore, are able to generate employment in a wider span of areas. The Light Engineering sector has the ability to produce a wide range of diversified products. The sector includes several sub-sectors like bi-cycle, engineering products, iron, steel etc. These sector produce both parts and raw materials for other products, and finished products. These products have both domestic and international demand and the demand would only be growing due to rapid industrialisation. Moreover, production of auto parts and exporting them enables the sector to get connected to the Global Value Chain. This sector has received the highest attention in the government policies. The Government of Bangladesh has declared light engineering sector as one of the special development sectors in the export policy 2015–2018, with a vision to encourage the growth of the sector.All these provide a basis for examining the sector’s needs in order to make it able to attain the potential growth. The sector, being different from many other manufacturing sector by nature, requires special attentions in many cases. The sector also requires some policy backing from the government and their effective implementations. The study aims to provide an assessment of the needs of the light engineering sector of Bangladesh, which has the potential to become one of the major export earning sectors for Bangladesh. A brief overview of the sector provides an insight on the present status. The assessment is based on first hand experiences of exporters, businessmen, and representatives from sector associations and, therefore, gives the real picture of the industry. The study chalks down specific training and other needs of the sector that have actual importance for development of the sector. Finally, an action matrix has been suggested with expected outcomes of the activities.

1.1. Objectives of the Study

- The specific objective of the study is to assess the needs and requirements of the Light Engineering Sector. Other objectives are:• Assessment of the needs of several sub-sector of Light Engineering sector of Bangladesh;• Identification of challenges faced by different sub-sectors of the Light Engineering sector;• Identification of need-based training and other capacity-building programs to enhance the efficiency as well as the export potential of these Sub-sectors;• Identification of the scope for technology transfer in related sectors of BPC to enhance the productivity; and • Exploring the possible strategies that could be undertaken by Govt. to develop the Light Engineering Sector of Bangladesh.

1.2. Methodology and Data

- The methodology of this study is mixed in nature. Both Qualitative and Quantitative analysis are applied to analyse the data. The study applied a mix of the secondary literature review and interviews with presidents, secretary-generals and other officials of four (4) sector associations namely, The Bangladesh Engineering Industry Owners’ Association (BEIOA), Bangladesh Bi-Cycle & Parts Manufacturers and Exporters’ Association (BBPMEA), National Association of Small and Cottage Industries of Bangladesh (NASCIB), Bangladesh Electrical Merchandise Manufacturers’ Association (BEMMA), and some leading entrepreneurs from the industry. Fifteen (15) key personnel were interviewed for the purpose of the study. Key informant interview, stakeholders consultations etc. have also been conducted. A standard Questionnaire has been developed with a set of questions, including both open-ended and close-ended ones. Different literatures were collected and reviewed to develop a general idea on various aspects of the light engineering sector. Different Industry related policies, such as the National Industrial policy 2016, Export policy 2015-18, the 7th-Five-Year plan, Diagnostic Trade Integration Study (DTIS), published research papers, and newspapers (soft copies) of various formats from internet were used as study tools.

2. Sector Overview

- Meeting 48% to 50% of the total domestic demand and providing backup support to the cement, paper, jute, textile, sugar, food processing, railway, shipping, garments capital machinery, the light engineering sector of Bangladesh is considered to be the ‘mother of all sectors’, according to Bangladesh Business Promotion Council (Talukder and Jahan, 2016). This sector has the potential to play a significant role in the economy and can become one of the major export items for Bangladesh.Light Engineering Sector is classified as a sub-sector of Small & Medium Enterprises (SMEs). An estimate shows that there are about 40,000 light engineering firms in the country where around 0.6 million semi-skilled, skilled and technically educated people and innovative entrepreneurs are actively engaged (Ahmed and Bakht, 2010). The sector is currently contributing 3% to the GDP (Asian Age, 2017). The light engineering industries of Bangladesh are currently producing more than 10000 types of quality machinery, spares and accessories.This sector has consistently grown over the years, and one of the major contributing factors to this is the growing large domestic market demand. Despite various challenges and difficulties, domestic demand has helped it grow and sustain. The price and quality of the products are reasonable, although, there is much to improve. There are challenges in terms of competition with foreign products with the limited variety and quality that Bangladesh produces.The product types of the light engineering sector are: Automobile spare parts, Railway engine & rail line spare parts, Bicycle & cycle rickshaw, Machine tools, Jute & Textiles machines and spare parts, Chemical industries machines and spare parts, Sugar and food industries machines & spare parts, Engineering & metal industries spare parts, Ship industries spare parts, Agricultural machines accessories and spare parts etc.

2.1. Location of the Light Engineering Industry of Bangladesh

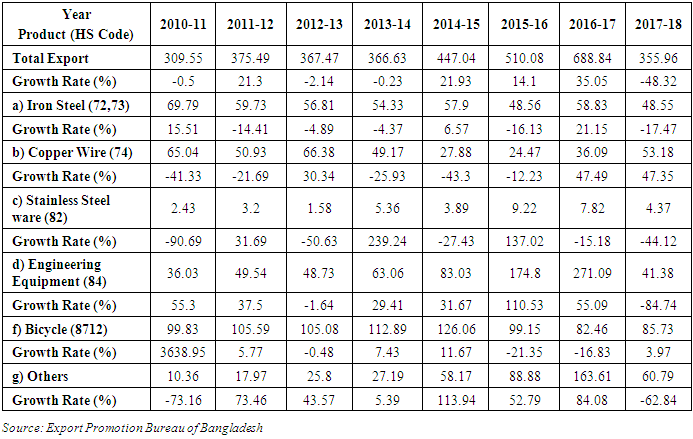

- The SME Foundation has identified 31 light engineering clusters located in 18 districts of Bangladesh with about 7,500 enterprises. LE enterprises are scattered throughout Bangladesh, which implies employment generation in a wider span of areas. Most of the industrial units are located in Dhaka, Chittagong, Narayanganj, Bogra, Gazipur and Kishorganj (See Figure 1).

| Figure 1. Product Map of Light Engineering Enterprises in Different Parts of the Country. (Source: SME Foundation (2008)) |

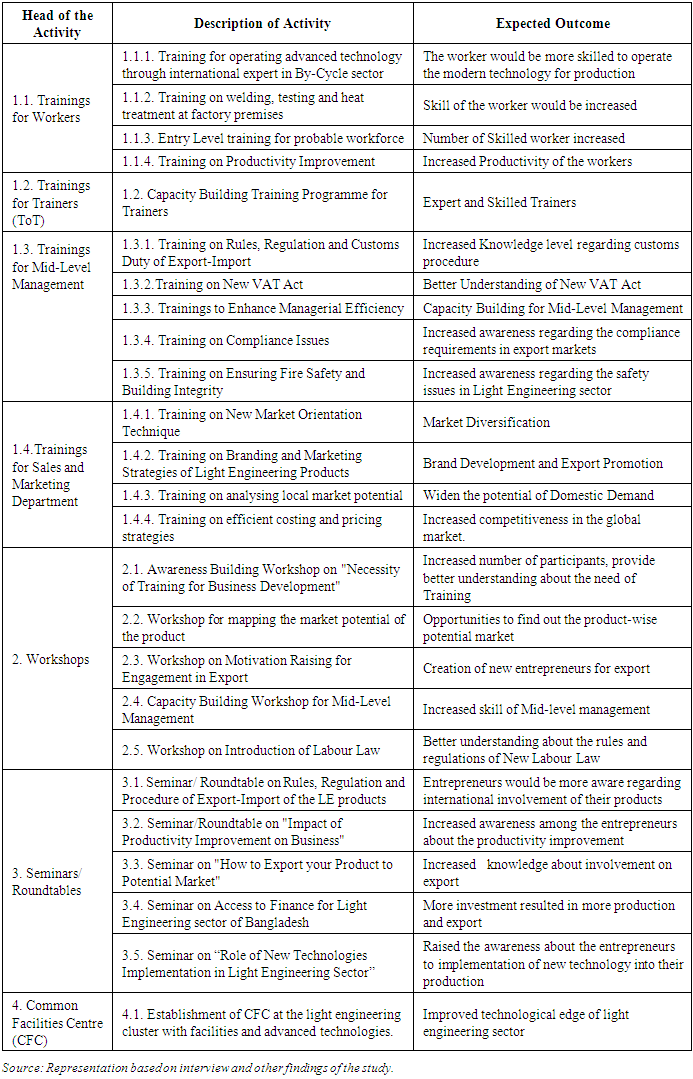

| Figure 2. Export Volume and Growth Trend of Light Engineering Export of Bangladesh |

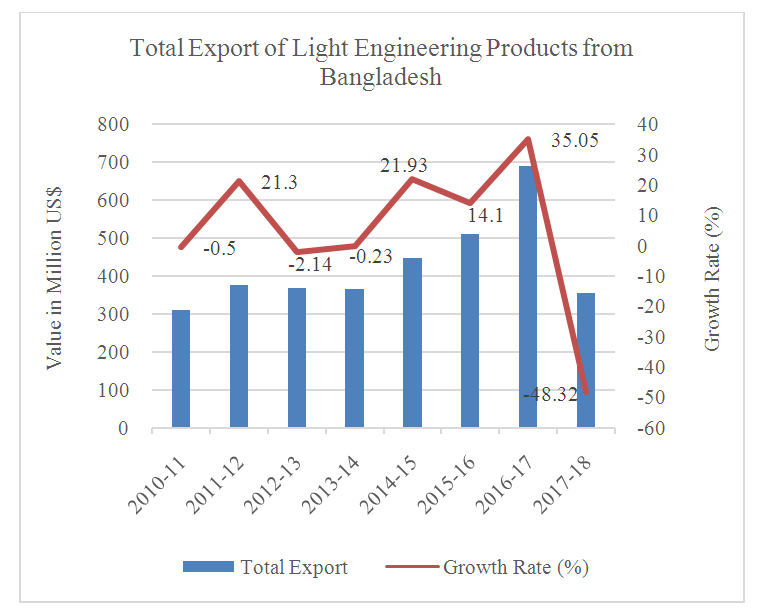

2.2. Export Profile

- A number of potential export-quality light engineering products are exported directly or through subcontracting. These are; spare parts of Paper & Cement mills, Bicycle, Fancy light fitting, Construction equipment, Battery, Voltage stabiliser, Iron chain, Cast iron articles, Carbon rod, Automobile spares, Electronics items, Stainless steel wares etc. It is seen that export of this sector has been growing over the years. However, the growth rate is found to be fluctuating. In FY 2017-18, export of Light Engineering products reduced drastically. The sector faced a negative growth rate of 48.32%, compared to the FY 2016-17. Iron, steel, Bi-Cycle, engineering equipment, stainless steel ware etc. are the major exportable light engineering items.EU is the largest buyer of Light Engineering products of Bangladesh. The country is the 3rd largest bi-cycle exporter to the EU (Dhaka Tribune, 2017). Other destinations include Japan, Middle East, USA, Australia, Turket, and Brazil etc. (Figure 3).

| Figure 3. Different Destinations for the Export of Light Engineering Products from Bangladesh. (Source: EPB Bangladesh) |

2.2.1. Export Destinations of Light Engineering Products

- Light engineering products of Bangladesh is being exported to different destinations across the globe. Major export destinations of the light engineering products include European Union, Japan, China, India, Australia, Africa etc.For Bi-cycle exports, the main market is the European Union. By-cycle export from Bangladesh to EU market is consistently increasing over the years. Imposition of Anti-dumping duty to Chines By-cycle import by the European Commission has been a blessing for Bangladesh and is contributing to the steady growth rate of BD’s By-cycle export to the EU market. Besides these, the Everything but Arms (EBA) facilities under the Generalized Scheme of Preferences (GSP) of EU widens up the opportunities to export more By-cycle from Bangladesh to the EU market.In the post- Brexit situation when the UK leaves the EU, export of Light Engineering products, including By-cycle may face some challenges in terms of price competitiveness, due to rise in the tariff rate, unless a special trading arrangement is reached with the UK.

|

2.3. Backward Linkage of the Light Engineering Sector

- Light engineering sector has a strong backward linkage. For most of the items, raw materials come from ship scrap, which comes from domestic ship breaking industry in 90% of the cases, according to BEIOA, a leading association of the light engineering sector. The rest is sourced from Singapore, where ship scraps from all over the world come for Auction.For export quality bicycles, parts are imported from various sources like china, turkey, Europe. There are high standard and safety requirements and producers have to comply with buyers’ requirements of spare parts, according to the representatives of By-Cycle Association.

3. Government Policies for the Light Engineering Sector

- In the export policy 2015 – 2018, Light Engineering products, including bicycle and auto parts, have been considered as one of the special development sectors. Several points are mentioned in the policy including;v Supply of investment credit at reduced rate of interest on a high priority basis;v Moratorium on income tax;v Various cash assistances;v Export credit on easy terms and reduced rate of interest; andv Subsidized rate for Air Transportation, Duty drawback and bond facilities.A plan has been undertaken to establish ‘Light Engineering Cluster Village’ near Dhaka in order to develop the Light Engineering industry.In the 7th-Five-Year Plan, emphasis has been given to attract FDI in the Light Engineering sector to increase investment, for greater and easier market access, and for easier transfer of technology. To facilitate FDI in the Light Engineering sector, the Govt. is planning to set up Special Economic Zones and hand over these SEZs to investors from Japan, China, India and other countries.In the National Industrial Policy 2016, Light Engineering sector has been considered as one of the Highest Priority Sectors. Several facilities, including cash and investment incentives, would be provided to facilitate the Light Engineering sector of Bangladesh.

4. Findings and Analysis of the Interview Results

4.1. Bangladesh Engineering Industry Owner's Association (BEIOA)

- The Bangladesh Engineering Industry Owners’ Association (BEIOA), the main association of Light Engineering sector with 5000 SME members, who are engaged in the production and marketing of light engineering products. Many of the challenges, obstacles, opportunities and necessities came out from the interview with the representatives from BEIOA.Findings:Separate Industrial Plots for Light Engineering Industries: Most of the Light Engineering Industries are Small or Medium level enterprises. The rules and regulations of the Special Economic Zones, assured by the government is not easy to comply with by those small and medium businesses; BEIOA thinks that this sector requires separate plots with separate regulations and lower fees. Those zones should be developed in such a manner that the whole industry can operate in a systematic approach with better technologies, logistics and other necessary facilities. The area must have Common Facility Centre, which is at present most necessary for the sector;Easy Access to Finance: Financing turns out to be a major challenge for the domestic investors. According to the president of BEIOA, the conditions for accessing finance are stringent, making it inaccessible for the small businessmen.Advanced Technology: Bangladeshi industries are still using manual technologies which results in low quality products in many cases. Moreover, production capacity is not high when manual technologies are used. Therefore, the industries are not being able to meet production requirements of the buyers and are being out of export competition in the world market.Promotional Activities: Both domestic-and international- level promotional activities are necessary for the expansion of this sector. Fairs and other promotional activities at the district level is required for a better domestic market. Participation on international trade fair would provide the opportunities to understand the demand and nature of those markets. Also, there would be a sharing of technology, knowledge and other resources, which would ultimately benefit the sector.Awareness Programs: Various awareness programs were suggested by the BEIOA President. Some of them include awareness regarding norms of doing business, VAT Calculation Procedures, How to get involved in export, Rules and procedures of doing business etc.Policy Support: This sector is enjoying 10% cash incentive by the government, but it needs support in terms of taxes and increased tariff for imported light engineering products for protecting the domestic industries.

4.2. Bangladesh Bi-Cycle & Parts Manufacturers and Exporters’ Association (BBPMEA)

- Among all the Light Engineering Products, Bi-cycle has the major share in export. At present, there are five bi-cycle exporting companies operating in Bangladesh. BBPMEA, the association for bi-cycle manufacturers, works in fostering the sector. Transworld Bicycle Co. Ltd, Uniglory Cycle Industries Ltd, Mahin Cycles Ltd, RFL are the bi-cycle exporting companies of Bangladesh.The needs and requirements of this sector of the light engineering sector are different from the rest, and therefore should be addressed separately, according to the association.Major Challenges Faced by Bi-cycle Sector are as follows-Poor Infrastructure: This sector is mostly export-oriented. The lead time and the cost of production increase due to lack of quality roads, highways and other infrastructural obstacles. Port facilities are also inadequate, which also hampers the business;Documentation: The documentation process for export is quite complicated and requires lots of time and workforce. This works as a barrier to the development of the sector;Complex Customs Clearness Procedures: Customs Procedures also create additional muddles in the process of export; andHigher Competition in the Domestic Market: Low priced Chinese bi-cycles are entering the market freely and creating problems for the local industries. Under-invoicing by importers is creating hassle for the domestic producers.v Requirements:Training for Worker: Currently, the factories are providing technical trainings with the support of BUET. But they need more sophisticated training programme including:- Expert training for operating advanced technology: Technologies in the world are changing fast. The sector requires assistance from international experts in order to train the workers to operate the latest technologies. ;- Trainings on Safety Measures;- Trainings on welding, testing and heat treatment at factory premises; and- Arrangement of Vocational trainings.Training for Mid-level management: Separate and specialized trainings are required for the mid-level management of the Bi-cycle sectors as the professional expertise among the officials of this sector are acute. Following training programs may be beneficial to raise the efficiency of the mid-level managements of this sector:a) Trainings to enhance managerial efficiency;b) Trainings on efficient costing and pricing strategies to increase competitiveness in the global market;c) Capacity building of the workforce; andd) Technical trainings on Export issues.

4.3. National Association of Small and Cottage Industries of Bangladesh (NASCIB)

- National Association of Small & Cottage Industries of Bangladesh (NASCIB) is the foremost private sector trade association involved with the development and promotion of Micro-Small-Medium-Enterprises in the country. Today NASCIB boasts of more than 10,000 members where 25% are women entrepreneurs working hand to hand for the development of MSME in the country.Major Challenges of this sector:Being an association for small and cottage industries, NASCIB faces many difficulties in doing business, especially in export. The President of NASCIB cited some of the major challenges faced by the members of NASCIB.Market Information GAP: The firms are doing business without having proper knowledge of requirements of the market and therefor are not prospering as they could have been;Lack of Laboratory Facilities: It is a common problem for all the members of this sector. Absence of International standard laboratories is one of the major challenges of this sector;Poor Capacity of Export Promotion Bureau: EPB is not in its full function according to NASCIB. Activities of EPB must be focused and aimed towards encouraging exports;Lack of International Branding: Bangladeshi products do not have branding in the international market. The low brand image leads to lack of confidence of the buyers; andPoor Infrastructure Facilities: Lack of roads and highways, quality electricity and gas etc. are creating obstacles for this sector.v Requirements:Trainings: NASCIB recommended many training programs, workshops and seminars that would improve the quality and condition of their member factories and the overall light engineering sector. The issues include new market orientation, Market research, Branding and Marketing Strategies of Light Engineering Products, Productivity Management, Trainers, Technical trainings and Trainings for mid-level management.Workshops:- For Mid-level Management;- Motivation to engage in export; and- Workshops for mapping the market potential of the products.Seminar:- Seminar for awareness building of Entrepreneurs to get involved in export; and- Seminar on Access to Finance for SMEs in Bangladesh of Light Engineering Sector.Research and Development:Establishment of Research and Development facilities at NASCIB premises is necessary to provide effective policy support to the government to increase the sector’s contribution to the economy. This initiatives also facilitate the initiatives to create partnership among all the stakeholders and associations of the light engineering sector to provide market intelligence and other support mechanism for the development of the sector.

4.4. Bangladesh Electrical Merchandise Manufacturers’ Association (BEMMA)

- Bangladesh Electrical Merchandise Manufactures Association (BEMMA) is an association of all electrical merchandise manufacturers of Bangladesh. BEMMA, established in 1985, is registered with the Director of Trade organizations (DTO), Ministry of Commerce, and the Registrar of Joint Stock Companies, Government of the People’s Republic of Bangladesh. It obtained membership from Light Engineering Product-Business Promotion Council (LEP-BPC), Ministry of Commerce and Small & Medium Enterprise (SME) Foundation, Ministry of Industries of the People’s Republic of Bangladesh. BEMMA is an ‘A’ class Member of the Federation of The Chambers of Commerce and Industry (FBCCI), Dhaka. Major findings related to the challenges and opportunities of this sector are as follows:Absence of Internationally Accredited Testing Lab: The first and foremost requirement of the sector is an International-level testing lab, able to comply with C-Standard, which is the required standard for the light engineering sector. The proposal for the lab is approved and, at present, is lying with SME foundation. BPC can work with SME foundation to implement the project.Industrial Zone for Electrical and Electronic Sector: Separate industrial area is required for the sector. The Testing lab can be located in an area where different small, medium and large industries would work as backward and forward linkages to each other.Under-invoicing: Under-invoicing poses a major challenge in competing with foreign products. Chinese products are under-invoiced and brought with lower prices, creating unfair competition for the local products.High cost of Finance: This sector is capital intensive, and requires huge investment. But the cost of finance is quite high, which discourages the investors.v Requirements:Making Electrical and Electronics a Separate Sector: The Electrical sector is not getting the proper nurturing as it is being considered with other categories of light engineering products, whereas this is a completely different area. The needs and necessities of this sector and the required trainings and others are not also similar to the traditional light engineering products. This sector is facing various challenges on its way of prospering;Awareness-building Programme to Encourage both Workers and Management to Receive Training: First of all, it is necessary to spread the awareness among workers and owners on the issue why training is important. Both employers and workers would have to understand that trainings are important in order to enhance productivity;Workshops: Arrangement of different capacity-building workshops to linking theoretical knowledge and practical experiences to reduce the skill gap of this sub-sector.Training For Workers:- Basic Entry level trainings are required for the fresh workers to provide basic understanding and increase their skill;- Specialized Training Programs are required to increase the skill of existing semi-skilled workers to enhance their productivity.Trainings for Mid-level Management:- Training programme on export-import and customs procedures;- Training programme on VAT Act; and- Training programme on cost-accounting for the financial personnel to enhance their skill on Cost and Pricing of the products.Trainings for Marketing and Sales Officials:- Trainings on how to explore new market opportunities;- Trainings on analyzing local market potential; and- Trainings on creating export base.It is seen that businesses with huge investments are making products that are also produced by small firms. This create challenges for the small businesses. Government can take the initiatives to encourage the large firms to invest and produce items that small firms cannot. It was suggested by the association that those large firms should engage in producing raw materials and intermediate products so that those can be used by the small firms for producing finished items.

5. Analysis and Discussion about Findings

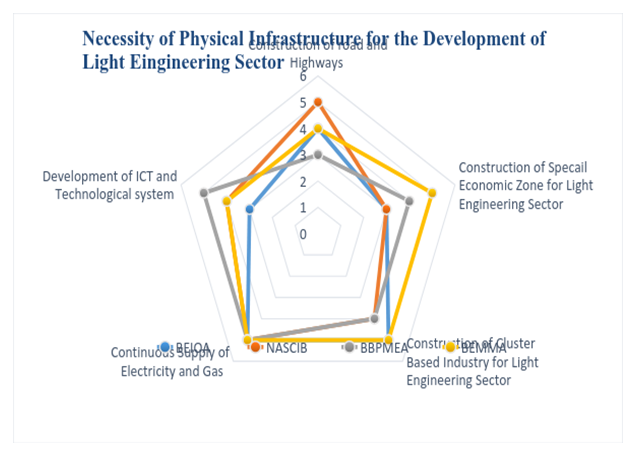

| Figure 4. Physical Infrastructure Requirements for the Development of the Light Engineering Sector of Bangladesh |

6. Major Challenges of Light Engineering Sector

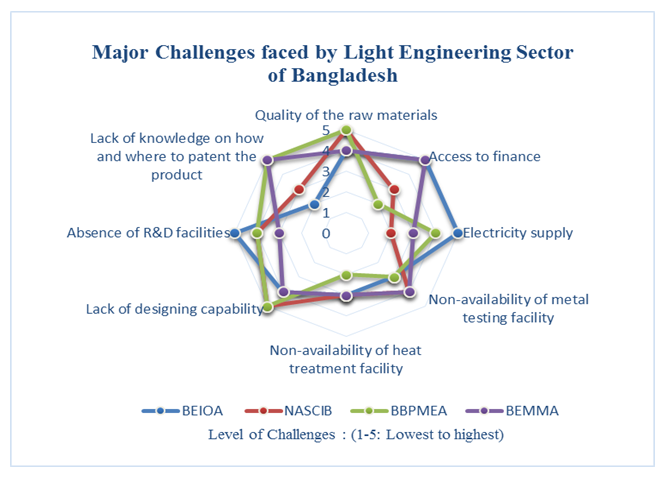

| Figure 5. Major Challenges of the Light Engineering Sector of Bangladesh |

7. Recommendations and Policy Suggestions

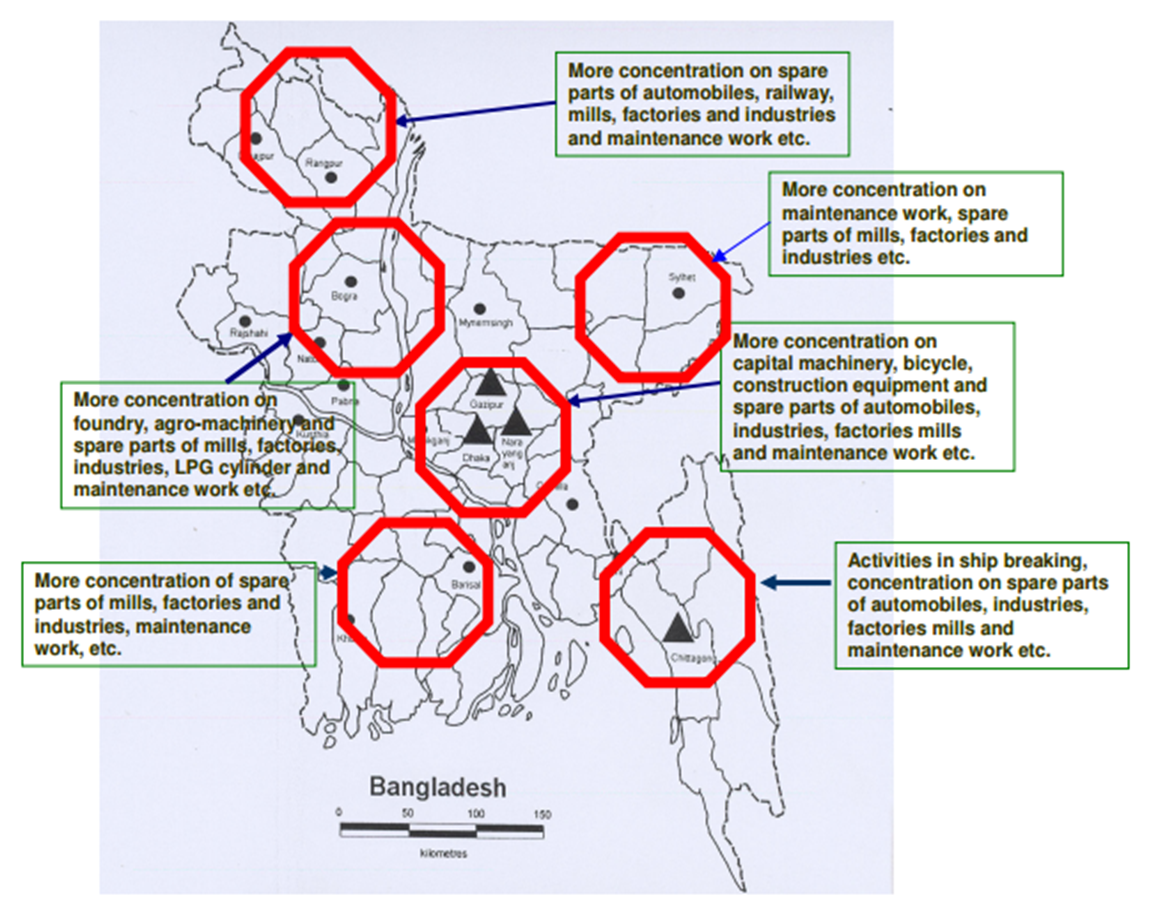

- Establishment of CFC at a light engineering cluster with facilities of metal testing, CNC training and heat treatment, may be jointly used by cluster engineering firms.Setting up of raw material warehouses and testing facility at different clusters of light engineering across the country may ease the material-related constraints.Easy Access to Finance: In most of the cases, cluster-based light engineering firms outside of Dhaka are relying on informal sector financing to meet their needs. For ensuring good credit environment, Bangladesh Bank should introduce special credit facility for commercial banks so that commercial banks can offer loans to light engineering firms at single digit interest rates.Strengthening of BSTI: For testing and certification to meet the international quality standards of locally manufactured Light Engineering products, there is a need to strengthen the BSTI with new technology and skilled manpower to prepare quality standards and conduct quality testing.Trade Remedy Measures to Stop Unethical Business: Domestic producers are facing severe competition in the domestic market due to low-priced imported products. There are scopes for conducting some study to find out the possibilities of ‘Dumping’, done by different countries, which would help take necessary steps to overcome this challenges, if any. To develop adequate skilled manpower for the different sub sectors of the Light Engineering sector of Bangladesh, arrangements to organize the following training programs, workshops, seminars and roundtable discussions by both Public agencies i.e. Business Promotion Council, Export Promotion Bureau, Ministry of Commerce and Private sector association, might have a great impact (see table 2).

|

8. Conclusions

- The local market of the Light Engineering Sector in Bangladesh is large and has strong forward and backward linkages. It has a huge potential to grow, if monitored properly. There are sufficient demands in the various manufacturing concerns, such as textile mills, railways, jute mills, shoe manufacturers, sugar mills, RMG, washing plants etc. If nurtured properly, this sector not only can produce import substituting goods, but also can contribute to the overall export of the country. This study tried to identify the necessary initiatives to mitigate the challenges faced by the different sub sectors of Light Engineering sector of Bangladesh. Further development might require several support programs from the Government. The initiatives of the government and its related agencies may provide the great impetus to enhance the efficiency and overall productivity of this sector. This may lead to the ultimate goal of export diversification of the country through increased volume of export of Light Engineering products. The identified capacity-building programs, suggested (e.g. training programs, workshops and seminars) after consulting respective associations, might be used as important tools and can play a vital role in this regard.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML