Deny Setiawan, Anthony Mayes dan Hilmah Zuryani

Faculty of Economics, Riau University, Pekanbaru, Indonesia

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

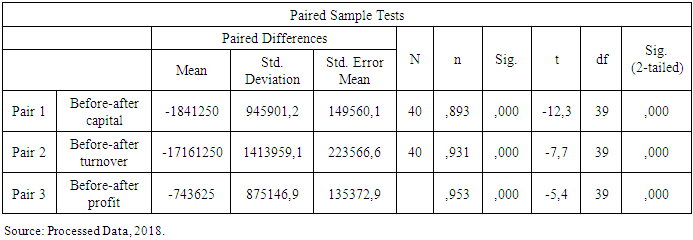

Economic development becomes a necessity if a country wants to improve the standard of living and welfare of its people. Economic development is an important agenda for every country, which aims to improve people's welfare. In other words, economic development is a conscious and directed effort from a nation to improve the welfare of its people through the utilization of available resources. One effort that can help economic development is the MSME sector (Micro, Small and Medium Enterprises). This study will look at the extent of the effect of productive zakat on the development of micro-recipients of zakat (mustahik) in Dumai City. The analytical method used in this study is a descriptive method to analyze the sources and uses of zakat funds and the management of productive zakat funds distributed by the Dumai City Amil Zakat Agency. While the quantitative analysis used in this study is Validity Test and Research Instrument Reliability Test and uses a different test analysis method or Paired T-test. The end result is the Capital Variable, the results of different tests using the Paired T-test the capital variable is known to the results of the correlation between two samples worth 0.893 with a probability number of 0.000 <0.05. Business Turnover Variables, different test results using Paired T-test Business turnover variables, it can be seen that the correlation between two samples is 0.931 with a probability number of 0.000 < 0.05. Variable profit/Operating profit, different test results using Paired T-test profit/Operating profit variable is known to be the result of correlation between two samples with a value of 0.953 with a probability number of 0.000 < 0.05.

Keywords:

Productive Zakat, Business Capital, Sales Turnover and Business Profit

Cite this paper: Deny Setiawan, Anthony Mayes dan Hilmah Zuryani, Analysis of the Role of Productive Zakat Funds on the Development of Zakat (Mustahik) Micro Business Development in Dumai City (Case Study of the Amil Zakat Nasional City of Dumai City), American Journal of Economics, Vol. 8 No. 6, 2018, pp. 237-243. doi: 10.5923/j.economics.20180806.02.

1. Introduction

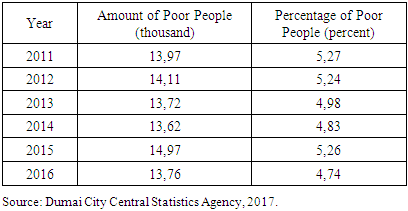

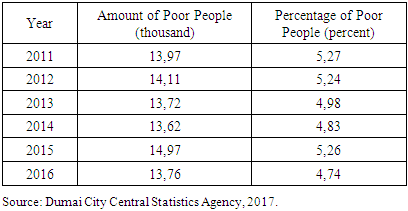

Economic development becomes a necessity if a country wants to improve the standard of living and welfare of its people. Economic development is an important agenda for every country, which aims to improve people's welfare. In other words, economic development is a conscious and directed effort from a nation to improve the welfare of its people through the utilization of available resources.Historically, there are still people who are not capable or in other words poor until now. This problem certainly must get special attention so that the poverty level can be resolved with the policies that have been made. If the poverty of a country has decreased, its economic development can be said to be successful. The problem of poverty does not only occur at the national level, but at the regional level also experiences the same problems. All regions in Indonesia have different levels of poverty.Riau Province as one of 34 provinces in Indonesia also has poverty problems from years that have not been resolved completely. Based on data at BPS (Central Bureau of Statistics) of Riau province in 2017 that poverty in Riau province in 2011 was 8.47 percent and in 2016 amounted to 7.98 percent, in other sense that poverty in Riau province had decreased by 0.49 percent from 2011 to 2016.Riau Province with 12 districts/cities, consisting of 10 regencies and 2 cities, also experienced complex problems related to poverty. Dumai City as one of the cities in Riau province, which is certainly an example or reflection for other districts, is expected to contribute to the settlement of economic problems that exist in Riau province. The problems experienced are certainly not much different from other districts/cities, related to poverty, unemployment, and other economic problems.Table 1. Number of Poor Population and Percentage of Poverty in Dumai City in 2011-2016

|

| |

|

Based on Table 1, we can see that the number of poor people and the percentage of poverty in Dumai City has fluctuated every year. This must be an important point for the government to be able to solve the poverty problems in Dumai City by issuing policies in economic development that can reduce poverty.One effort that can help economic development is the MSME sector (Micro, Small and Medium Enterprises). According to Partono and Soejoedono (2002), in economic development in Indonesia SMEs have always been described as sectors that have a very important role, this is because SMEs can absorb labor that is low-educated and lives in small-scale business activities both traditional and modern.In terms of developing this productive business, there have been many efforts made by the government, but in reality there are still many people who have not felt that assistance. Efforts that have been made by the government such as loans from government-owned banks, collateral-free credit distribution and others. In addition, the existence of micro institutions is also quite helpful such as Microfinance Institutions (MFIs), Baitul Maal Wa Tanwil (BMT), and other Islamic financial institutions.One of the Islamic financial institutions in charge of collecting and distributing funds to the public and is an official lemabaga is the Amil Zakat Institution/Lembaga Amil Zakat (LAZ) or the Zakat Agency/Badan Amil Zakat (BAZ). The Amil Zakat Institution is helping the government with the aim of improving the welfare of the community, both in the fields of economic education, health, and even distribution of income. The potential of BAZ and LAZ is very large in helping to get out of poverty.The Zakat Agency/Badan Amil Zakat (BAZNAS) in Dumai City also became a productive zakat distributor, providing assistance to the recipients of zakat (mustahik). Based on the data, in 2017 BAZNAS Dumai city has distributed productive funds to 187 mustahik people (BAZNAS of Dumai city, 2018). The funds distributed, as additional business capital to the mustahik, so that the business carried out is able to run sustainably. This study will look at the extent of the effect of productive zakat on the development of micro-recipients of zakat (mustahik) in Dumai City.

2. Literature Review

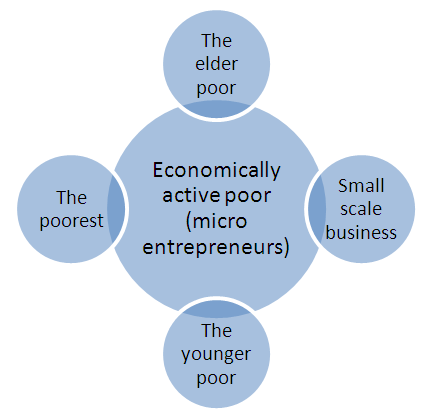

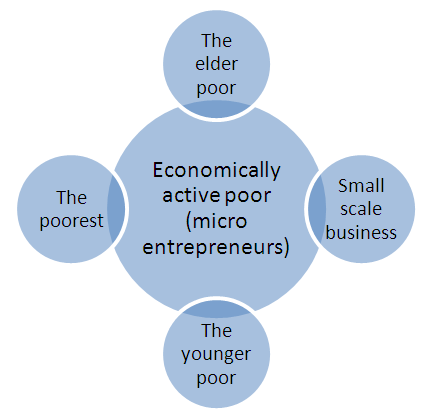

a. Definition of Zakat and Zakat DistributionEl Madani (2013) describes zakat as developing, increasing, many, blessings and can be interpreted as "the plant has tithed" when the plant grows, "the living has tithed". Shadaqah is also called zakat, because shadaqah is the cause of developing and blessing of wealth. However, this term is then affirmed, if it refers to zakat then it is called Shadaqah obligatory, whereas other than zakat it is called shadaqah or alms. Zakat can purify the soul and property for those who fulfill it.According to Qardhawi (2002), the role of zakat is not only limited to poverty alleviation. However, it also aims to address other social problems. The concept of zakat basically does not experience significant changes from time to time, the only difference is the operational problem of gathering and empowerment, because the concept of fiqh of zakat states that the zakat system seeks to bring together the Muslim surplus with the Muslim deficit.As for the method of terrorism and empirical distribution of zakat, including:1) Mustahik Zakat posts. In the distribution of zakat funds, the recipient of zakat (mustahik) is very clearly regulated. Spending or utilizing zakat funds outside of existing provisions must have a strong legal basis. In one hadith narration Abu Daud Rosululloh said regarding the distribution of zakat funds.2) Zakat Management Institution. The existence of the Amil Zakat Institution is a solution to the collection and distribution of zakat funds. The existence of zakat management institutions has also been explained in the Al-Qur'an and Hadith. The implementation of zakat is not only based on QS at-Taubah verse 103, it is also based on the letter At-Taubah verse 60 concerning groups that are entitled to receive zakat.3) Utilization of Zakat. Utilization in zakat is closely related to how it is distributed. The condition is because if the distribution is right on target and effective, the utilization of zakat will be more optimal in Law No. 23 of 2011 concerning Management of Zakat, explained that utilization is: (a). Zakat can be utilized for productive business in the context of handling the poor and improving the quality of the people and (2). The utilization of zakat for productive business as referred to in paragraph (1) is carried out if the basic needs of mustahik have been fulfilled.Furthermore, in the utilization of zakat funds, there are several conditions that must be met by the zakat dealer or zakat management institution. This was included in the Decree of the Minister of Religion of the Republic of Indonesia No. 373 of 2003 concerning the management of zakat funds. The types of zakat fund utilization activities include: (a). Social Based, (b). Based on economic development, (c). Creative Productive, (d). Zakat in Productive Enterprises and (e). Alms and Poverty.b. Micro Business and ProblemsOne of the government's efforts to reduce poverty is by empowering MSMEs. Understanding of SMEs is not always the same in every country, depending on the concept used by the country. Micro-enterprises can cover at least two aspects, namely employment and grouping of enterprises, seen from the amount of labor that can be absorbed. In Indonesia’s economy, micro enterprises are considered to have a very important role, because Micro Business mostly absorbs workers with low education and lives in small businesses. | Figure 2.1. Economically Active Poor (Source: Taufik, 2011) |

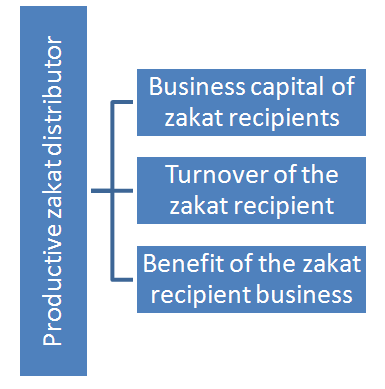

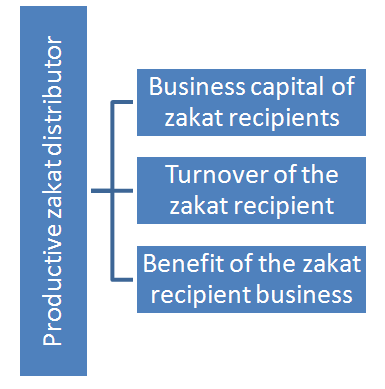

This study describes the role of productive zakat funds so that the operational basis of thinking uses the small business theory and theoretical framework related to zakat. Therefore, the theoretical framework is used as a reference point in creating a conceptual framework in order to know the answers to the problem formulation. Law No. 23 of 2011 concerning Management of Zakat, explained that utilization is: (a). Zakat can be utilized for productive business in the context of handling the poor and improving the quality of the people and (2). Utilization of zakat for productive business. Therefore the conceptual framework of this research is structured as follows: | Figure 2.2. Framework |

3. Research Methodology

This research was conducted in Dumai City, Riau province, with the consideration that Dumai City is one of the two cities in the province of Riau after the city of Pekanbaru as the capital of Riau province by seeing abundant resources. This research was carried out for 6 months.Researchers determine the sample based on the number of people who receive productive zakat in Dumai City with the provisions of 20%-50% of the total population or recipients of productive zakat totaling 187 people (BAZNAS city of Dumai, 2018), namely with a total sample of 40 recipients of zakat (mustahik) productive funds. With a random sampling technique, where all individuals in the population either individually or together are given the same opportunity to be chosen as sample members (Sugiyono, 2012). In this study two methods of data collection were used, namely primary data and secondary data.The analytical method used in this study is a descriptive method to analyze the sources and uses of zakat funds and the management of productive zakat funds distributed by the Dumai City Amil Zakat Agency. While the quantitative analysis used in this study is Validity Test and Research Instrument Reliability Test and uses a different test analysis method or Paired T-test.

4. Research Results and Discussion

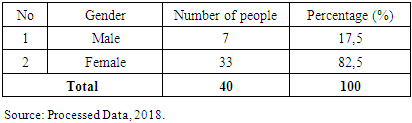

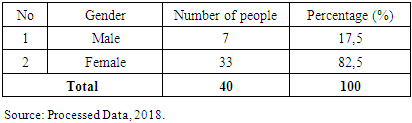

I. Characteristics of RespondentsThe general characteristics of respondents, especially the recipients of productive zakat funds in BAZNAS Dumai City, were obtained based on a survey conducted in Dumai City, with the number of respondents as many as 40 people receiving productive zakat (mustahik). The general characteristics of these respondents are explained from several criteria, such as the following:1. Gender. The total number of respondents who received productive zakat funds amounted to 40 people, with male smaller than female.Table 2. Characteristics of Respondents by Gender in Dumai City

|

| |

|

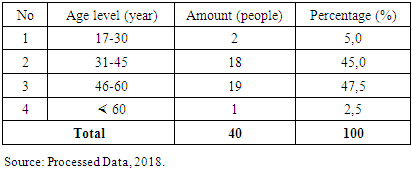

Based on the table 2 respondents with male gender is greater, namely 7 people or 17.5% and women 33 people or 82.5%. Because women who act as helpers of the family head in improving his family's economy in the sense that women help their husbands at work. So that women or wives not only become housewives, but they participate in raising the economy of their families.2. Age Level. The age level of respondents can describe how physical ability to manage their business, the age of a person can influence the way of thinking in developing their business, the description of the age level of respondents is presented in the following table:Table 3. Characteristics of Respondents Based on Age Levels in Dumai City

|

| |

|

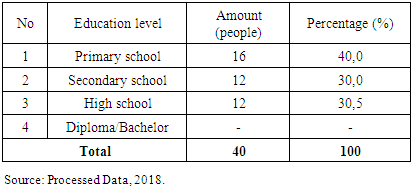

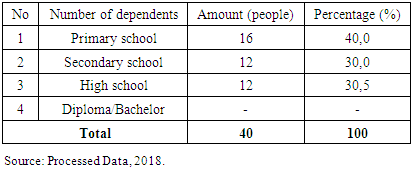

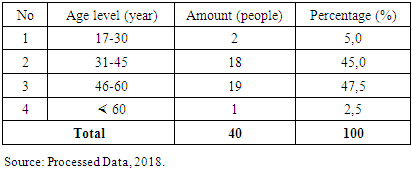

In terms of age, the majority of respondents were in the very productive age group, namely 31-45 years (45.0%) and 46-60 years (47.5%). This indicates that the majority of respondents are productive groups who still have hope to improve and improve their quality and ability so that they can free themselves from the poverty trap. Only 2.5 percent are in the age group above 60 years.3. Level of Education. Education referred to in this study is formal education. The level of population education is one of the factors that determine the growth rate of an area, so there is a possibility that the region will develop faster or progress when compared to other regions with low levels of education, because the better the way of thinking, the more creative and innovative developing and able to compete. To better know the level of education of respondents can be seen in the following table:Table 4. Characteristics of Respondents Based on Level of Education in Dumai City

|

| |

|

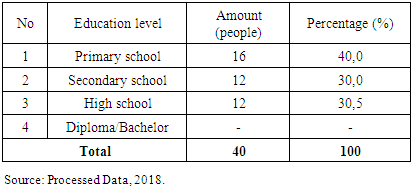

Meanwhile, in terms of education, the majority of respondents only have elementary education (40%). This illustrates that in general the mustahik recipients of productive zakat are low educated. Only 30.0% claimed to have high school/equivalent education. What was very surprising was that none of the respondents who had attended tertiary education. This condition shows that education can be a variable that must get attention when the government intends to break the chain of poverty. The higher the education, the greater the opportunity to have economically well-established families.4. Amount of Dependent. Many people argue that the level of household income will affect the quality of the family itself, where the quality/quality of humans is strongly influenced by the adequacy of basic needs. From the results of the study, it is known the number of dependents of each respondent. For more details can be seen in the following table:Table 5. Characteristics of Respondents Based on Number of Dependents in Dumai City

|

| |

|

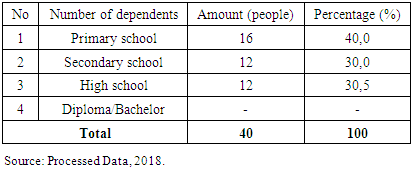

Furthermore, 100% of respondents were married with the majority of the size of the family being dependent, ranging from 0 to 3 people (57.5%). This fact illustrates that in general respondents have a relatively heavy family burden. However, there are about 42.5% of respondents who have a very heavy burden due to the large number of family members who are dependent, which is more or equal to 4 people.5. Respoden type of business. This type of business will determine the level of income of the recipient of the productive zakat recipient funds. From the results of the study, it is known the type of business of each respondent. For more details can be seen in the following table:Table 6. Characteristics of Respondents by Type of Business in Dumai City

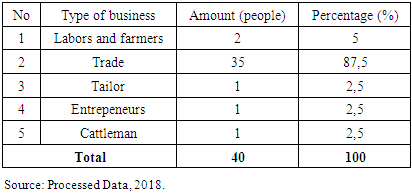

|

| |

|

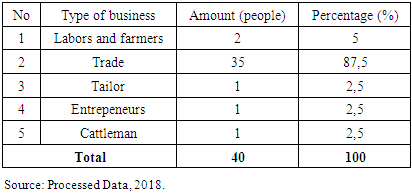

From an economic standpoint, the majority of respondents worked as traders (87.5%), followed by workers and farm laborers (5.0%). This condition shows that the merchant profession is the profession that absorbs the most workers from the lower middle class.6. Respondents' Business Capital Resources. The source of capital is certainly one of the considerations worthy of whether or not the recipient of zakat is to get productive zakat funds that will be given by BAZNAS, so for more details we can see in the table below:Table 7. Characteristics of Respondents Based on Capital Resources in Dumai City

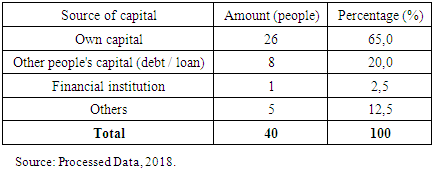

|

| |

|

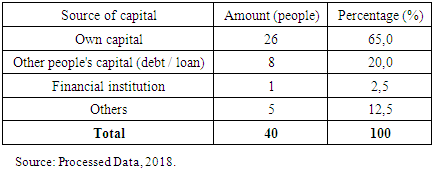

In terms of initial capital, the majority of respondents' capital sources are from their own capital (65%), followed by other people's capital (debt/loan) (20.0%), 2.5% financial institutions and others by 2.5%. This shows that the recipients of productive zakat start a business with their own capital which is certainly classified as small capital. As we know that many small people are afraid to borrow capital because they are worried that they will not be able to pay the capital loan. Indeed there are also respondents whose initial capital comes from loans, this they do of course with relatives or relatives who would not expect interest from the loan.For respondents who make loans to financial institutions, they usually do to increase the capital they have so that the business they want to work can run. While 12.5% of respondents have sources of capital that come from others, such as parental assistance, funds sourced from the government (PNPM) and others.II. Respondents' opinions regarding BAZNAS's productive earning zakat program in Dumai CityRespondents' opinions regarding the performance of productive zakat can be seen in the following table:Table 8. Assessment of Respondents on Baznas Performance

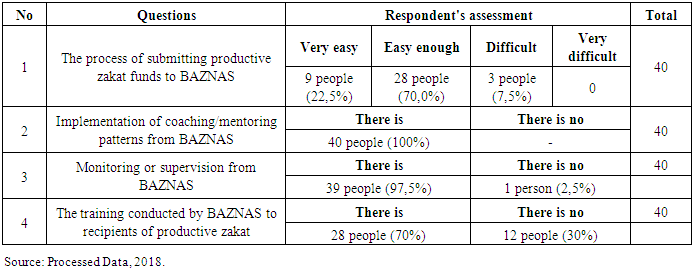

|

| |

|

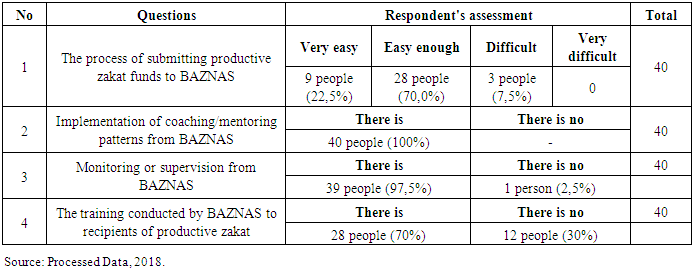

Regarding the process of applying for business funds in the BAZNAS program, the majority of respondents said that the process of submitting productive zakat funds was quite easy as many as 28 respondents or 70.0%, followed by respondents who stated that the process of submitting productive zakat funds was very easy as many as 9 respondents or around 22.5%. While respondents who stated that it was difficult in the process of submitting productive zakat funds were 3 respondents or 7.5% of the total respondents and no respondents stated that it was very difficult in the process of submitting productive zakat funds. This indicates that the requirements for applying for financial assistance for the Earning Alms program do not make it difficult for the mustahik who want to apply for assistance.One of the characteristics of the productive zakat program is that there is a pattern of assistance for the mustahik. This can be seen in the table above. Based on the table above as many as 40 respondents or 100% stated that the pattern of assistance was carried out by BAZNAS in Dumai city and went well enough. It means that the assistance role carried out by Baznas after the distribution of business funds was mustahik who received assistance running well and helped the recipients of zakat in carrying out his business.III. Analysis of the Role of Productive Zakat Funds on the Development of Micro Business of Productive Zakat Recipients (Mustahik)The role of productive zakat funds will already be seen from the previous discussion, but in this discussion we will discuss how much the role of productive zakat funds to the development of the mustahik micro business, to answer this, then the table below will be presented in full.Table 9. The Role of Productive Zakat Funds on the Development of Micro Business of Productive Zakat Recipients (Mustahik) in Dumai City

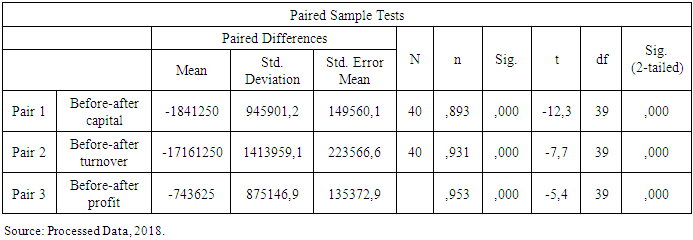

|

| |

|

Capital Variables. Different test results using the Paired T-test, the capital variable is known to be the result of the correlation between two samples valued at 0.893 with a probability number of 0.000 < 0.05. This can mean that the capital relationship between before and after receiving capital assistance has a close or positive relationship. Judging from the Paired T-test, it is known that sig. (2-tailed) for the respondent's capital is 0.000 < 0.05, which means that Ho is rejected. This means that the respondent's capital before and after receiving capital assistance is different, which means the provision of business capital assistance provides benefits in increasing the respondent's capital.Business Turnover Variables. The results of different tests using the Paired T-test of business turnover variables, it can be seen that the results of the correlation between two samples is 0.931 with a probability number of 0.000 < 0.05. It can be interpreted that the turnover relationship between before and after receiving capital assistance has a close or positive relationship. With the Paired T-test, it is known that the sig. (2-tailed) for the respondent's capital is 0.000 < 0.05, which means that Ho is rejected. This means that the business turnover of respondents before and after receiving capital assistance is different. Providing business capital assistance can significantly help increase the turnover of respondents.Variable Profit/Operating profit. Different test results using Paired T-test the profit/operating profit variable is known to be the result of the correlation between two samples with a value of 0.953 with a probability number of 0.000 < 0.05. This can mean that the capital relationship between before and after receiving capital assistance has a close or positive relationship. Judging from the Paired T-test, it is known that sig. (2-tailed) for the respondent's capital is 0.007 < 0.05, which means that Ho is rejected. This means that the profit/operating income of the respondent before and after receiving capital assistance is different. This means that the provision of business capital assistance can significantly increase the business profits of respondents.

5. Conclusions and Suggestions

The results of the research that has been done can be concluded that the characteristics of mustahik who obtain productive zakat funds from the baznas are dominated by the gender of women, where based on this study women reached 82.5%. The characteristics of the Baznas mustahik education background in Dumai City that received productive zakat funds were dominated by the community with an elementary education background and then followed by junior and senior high schools. The provision of zakat funds is also dominated by mustahik which has a productive age of 46-60 years reaching 47.5%.Overall mustahik assesses that the program for submitting productive zakat funds has run quite well and is quite easy, this is stated by 70% of respondents involved in this study and very well assessed from 22.5% and only 7.5% of the total respondents who stated not good.From the empirical data above, it can be concluded that although the zakat funds collected are still quite small, it has a significant impact on efforts to alleviate poverty through productive zakat programs. And zakat is an effective financial instrument in the problem of the capital of the poor. This can be seen from the development of business capital, sales turnover and business profits that have increased after the existence of productive zakat funds received by the mustahik. This shows that zakat is the right instrument in empowering the poor.This study is undeniable evidence that the instrument of zakat has tremendous potential. To that end, so that the productive zakat program can run effectively and there is a significant increase in the welfare of the poor, it requires the efforts of all Muslims whether the government, the Zakat Agency, the community in Indonesia, in developing zakat according to its potential, so that zakat can be utilized accordingly with its function. In addition, in order to be effective in achieving the goal of increasing the independence of mustahik businesses, programs that are right on target and effective are needed, one of which is training, mentoring, and supervision in managing funds for those in need, so that funds allocated to mustahik will ultimately improve their welfare, and take him out of poverty.In addition the results of this study also provide suggestions as follows: (1). The program of productive zakat funds in Dumai City has been proven to improve the economy of the mustahik who are the recipients of zakat funds. Therefore, the utilization program of productive zakat funds as business capital as carried out through the productive zakat fund program needs to be continuously developed by zakat management institutions in Indonesia. It is intended that the function of zakat as an instrument to alleviate poverty can run more optimally, (2). For the provision of data the partners (mustahik) who participated in the business assistance program needed updating the data for the month, because this is very influential on the income of each mustahik itself whether experiencing an increase or decrease in daily income. And re-record for income before joining the program for coaches and mentors, if you want to make further business assistance programs. The data surveyed must be clear, complete and in accordance with the villagers. And for people who have participated in business assistance programs it would be better reported to the village government to be clearer and recognized that this program was recorded, (3). The scale of earning zakat must be expanded, not only recipients who have business. So that poverty rates can be minimized and people get a more decent life and (4). In further research, it is necessary to analyze the indicators of poverty of the poor who do not participate in economic empowerment programs. This aims to look at the level of success of the program by comparing changes in poverty indicators of the poor who follow economic empowerment programs with the poor who do not follow them.

References

| [1] | Ananda, Fitra. 2011. Analysis of Micro and Small Business Development After Obtaining Mudharabah Financing from BMT AT TAQWA HALMAHERA in Semarang City. Thesis Is Not Published, IESP UNDIP Semarang. |

| [2] | Asnaini. 2008. Zakat Produktif dalam Pesrpektif Hukum Islam. Yogyakarta: Student Library. |

| [3] | The Central Statistics Agency of Dumai City. 2017. Dumai in Numbers. |

| [4] | BAZNAS city of Dumai. 2018. www.baznas.kotadumai.go.id. |

| [5] | Chapra, Umer. 2000. Islam dan Pembangunan Ekonomi. Jakarta. |

| [6] | Gema Insani Irawan, Febianto & Ashany, Arimbi Mardilla. 2012. The Impact of Qardhul Hasan Financing Using Zakah Funds on Economic Empowerment (Case Study of Dompet Dhuafa West Java). September 2012. Asian Business Review, Vol 1, Issue 1. |

| [7] | Gema Insani. Fernandy, Shandy Dwi. 2011. Analysis of the Effectiveness of Empowerment of Zakat, Infaq, Alms, and Endowments (ZISWAF) National Amil Zakat Institutions Semarang Branch of Caring Justice (PKPU) on INTEGRATED ROSMILING and Care Clinic Programs. Thesis Is Not Published, IESP UNDIP Semarang. |

| [8] | Hasan, M. Ali. 2006. Zakat dan Infak. Jakarta: Kencana Perdana Group Hafidhuddin, Didin. 2002. Zakat Dalam Perekonomian Modern. Jakarta. |

| [9] | Karim. A. Adiwarman. 2007. Ekonomi Mikro Islam. Jakarta: Raja Grafindo Persada. Karim. A. Adiwarman. 2007. Ekonomi Makro Islam. Jakarta: Raja Grafindo Persada. |

| [10] | Kartika Sari, Elsi. 2006. Pengantar Hukum Zakat Dan Wakaf. Jakarta: PT Grasindo. |

| [11] | Kusuma, Dimas Bagus Wiranata & Sukmana Raditya. 2010. The Power of Zakat in Poverty Allevation. Seventh International Conference. Madani, El. 2013. Zakat Fiqh. Yogyakarta: Diva Press. |

| [12] | Miftah, Kindy. 2007. Dampak Instrumen Dana Zakat Nasional Terhadap Pertumbuhan Konsumsi dan Investasi Privat Agregat: Studi Kasus Perekonomian Pada Empat Negara Musim (Analisis Data Panel 1981-2000). Thesis Is Not Published, IE UI Depok. |

| [13] | Minhaji, Akh. 2003. Teori Komprehensif Tentang Pajak dan Zakat. Tiara Wicana Mustofa. |

| [14] | Nasution, et al. 2008. Indonesia Zakat and Development Report 2009. Depok: CID. |

| [15] | Nugraha, Garry. 2011. Effect of Earning Zakat Funds on Business Benefits of Mustahik Zakat Recipients (Semarang City BAZ case study). Thesis Is Not Published, IESP UNDIP Semarang. |

| [16] | Nurzaman, Mohamad Soleh. 2010. Zakat and Human Development: An Empirical Analysis on Poverty Allevation in Jakarta, Indonesia. International Conference on Islamic Economics and Finance. Depok. University of Indonesia. |

| [17] | Qardhawi, Yusuf. 2005. Zakat Spectrum in Building a populist economy. Jakarta: Zikrul. |

| [18] | Ridwan, Muhammad. 2005. Baitul Maal Wa Tanwil Management (BMT). Cet2, Yogyakarta: UII Press, h. 207-208. |

| [19] | Sarea, Adel. September 2012. Alms as a Benchmark to Evaluate Economic Growth: An Alternative Approach. International Journal of Business and Social Science. Vol.3. No. 18. |

| [20] | Sarif, Suhaili & Kamri, Nor Azzah. 2009. A Theoretical Discussion of Zakat for Income Generation and Its Fiqh Issues. Jurnal Syariah. Vol.17, No 3 (2009) 457-500. |

| [21] | Sartika, Mila. 2008. Effect of Productive Zakat Utilization on Mustahiq Empowerment at LAZ Solo Peduli Surakarta Foundation. Journal of Islamic Economics, July 2008. Vol. II, No. 1. |

| [22] | Supriyatno, Eko. 2005. Islamic Economics Macro Islamic and Conventional Approaches. Yogyakarta: Graha Ilmu. |

| [23] | Taufik, Muhammad. 2011. Development of Micro Credit in the World: Challenges, Opportunities and Strategies for the Future. Thesis Is Not Published, IPB Management and Business Study Program. |

| [24] | Wan Yusoff, bin Wan Sulaiman. 2008. Modern Approach of Zakat as an Economic and Social Instrument for Proverty Alleviation and Stability of Ummah. Journal of Economics and Development Studies. April 2008. Vol 9, No. 1: 105-118. |

| [25] | Wulansari, Sintha Dwi & Achma Hendra Setiawan. 2014. Analysis of the Role of Productive Zakat Funds on the Development of Mustahik Micro Businesses (Zakat Recipients) (Case Study of Semarang City Zakat Houses). Diponegoro Journal of Economics. Vol. 3, No. 1, Year 2014, Page 1-15 http://ejournal-s1.undip.ac.id/index.php/jme ISSN (Online): 2337-3814. |

| [26] | www.disdagkop-UKM.dumai.go.id. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML