-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2018; 8(6): 231-236

doi:10.5923/j.economics.20180806.01

Teaching Introductory Economics: Critique of the Traditional Way of Teaching Production Costs

Sergei Peregonchuk

Faculty of Business and Entrepreneurship, The National University of Samoa

Correspondence to: Sergei Peregonchuk, Faculty of Business and Entrepreneurship, The National University of Samoa.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The paper examines critically the current method of teaching one of the core topics in Introductory Economics. The area of my criticism of the traditional Production Costs theory as it had been currently taught in many universities across the world is that it inevitably creates in the minds of beginning students a false perception that “things have costs”. The Economic Way of Thinking as the alternative approach to the traditional way of teaching Introductory Economics disarms this popular idea and affirms that “only actions have costs”. The discussion is done in the form of dialogue between the author and a reader.

Keywords: Economic education, Teaching introductory economics, Undergraduate curriculum, Cost-benefit principle

Cite this paper: Sergei Peregonchuk, Teaching Introductory Economics: Critique of the Traditional Way of Teaching Production Costs, American Journal of Economics, Vol. 8 No. 6, 2018, pp. 231-236. doi: 10.5923/j.economics.20180806.01.

Article Outline

1. Introduction

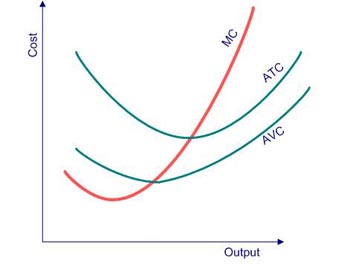

- If you flip through the pages of any classical textbook on Introductory Economics written by G. Mankiv, P. Krugman, R. Lipsey, M. Parkin or A. Layton and taught in North American, European or Australian universities you will discover that practically every page of it is riddled with formulas or graphs. Some Introductory Economics textbooks have been converted into a course on analytic geometry or calculus. I would not see any problems with this approach if all the beginning students were destined to apply to graduate schools and pass PhD exams. But in reality only a few of them follow that path. In this paper I want to examine critically the current traditional method of teaching one of the fundamental topics in Introductory Economics course - Production Costs- to identify the consequences of that approach on the application of the Production Costs concept to everyday economic and social issues. After studying this topic using one of the classical textbooks mentioned above the beginning students will be able to derive rigorously the behaviour of the marginal and the average cost curves. They get a good understanding of the relationship between these two types of costs. Students also can do calculation of different elements of costs of production and they are equipped well enough to express them in monerary terms. But they have no clue how to apply that knowledge to everyday practice of business firms. And not because they did not grasp well enough the production costs theory but because that theory by its nature – which is perfectly flawless in the realm of its assumptions - can not be immediately applied to real world issues. That is why many students who successfully passed “rigorous” economics tests based on the use of math failed the tests when they asked to apply the principle of opportunity cost to everyday economic problems. I must confess here that I was one of them. When I go back to my studies of Economics at the University of Illinois (Urbana-Champaign) and the University of Manitoba I remember that I had firmly embraced the concept of production costs. At that time I was naïve enough to believe that the good understanding of the behavior of cost curves and the grasping of technics of quantitative methods were the main roads to success in understanding the economic world around me. And for many years I passionately passed that conviction on my Mount Royal University students loading them with formulas and graphs. Until later on I had a chance to come across Paul Heynes’s “The Economic Way of Thinking”. That textbook had dramatically changed my way of teaching Introductory Economics. I hope that some of my colleagues may experience the same story.But let us go back to our analysis. Below I have identified the most important area of the analysis of the costs of production where I would like to draw a borderline between the current traditional method (I will refer to it as “The Traditional Approach”) and its alternative - “The Economic Way of Thinking”. For that purpose I will contrast two classical textbooks written by R. Lipsey and R. Frank/ R. Bernanke – they will represent the “The Traditional Approach” - with the Paul Heyne’s textbook which will speak on behalf of “The Economic Way of Thinking”. The area mentioned above is associated with the question: “Do “things” have costs?”.

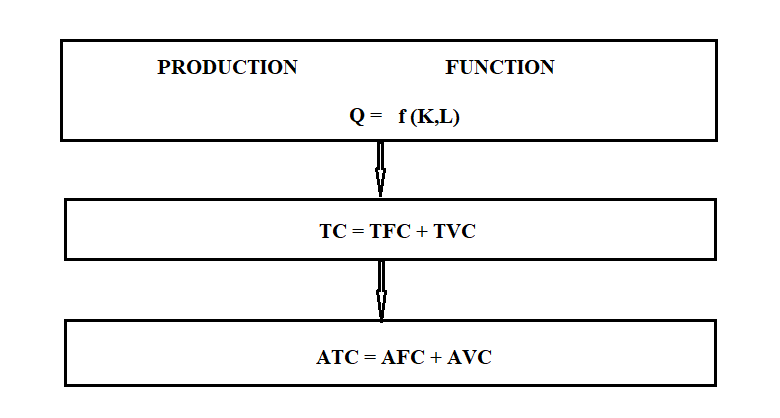

2. Do “Things” Have Costs?: The Traditional Theory of Production Costs

- Due to a popular belief “things” do have costs. It seems like it makes a perfect sense. You get accustomed to this belief from your childhood: you remember that day when for the first time in your life your Dad gave you fifty cents to come to your favorite candy store to purchase a little box of your favorite candies (Yes, in 1960th you could do that!). Later on when your parents did their regular Sunday’s shopping in their favorite shopping mall you saw price tags everywhere you go. It seems like commodities were live creatures and they were talking to you: “We are all good. But, unfortunately, we have costs – to obtain us you need to spend your money”. Thus, little by little, observing the real world around you, an idea that “things” have costs has been firmly rooted in your mind from the early childhood. That idea was strengthened later on when you were taking Introductory Microeconomics during your undergraduate studies. Let us walk together through the relevant pages of the most popular in North America textbooks written by R. Lipsey and R. Frank/R. Bernanke and see how both authors treat the concept of “costs of production”. You have to be patient though because the journey will not be easy and short. But I will try to do my best to make it evident to an objective reader that in the realm of “The Traditional Approach” “things” do have costs. R. Lipsey in chapters 7 and 8 “develops a theory of how costs vary with OUTPUT” [3, p. 160]. The basic element of that theory is “a simplified production function: Q= f (L,K)where Q is quantity of OUTPUT per period of time, L is the flow of labour services employed in production, and K is the flow of capital services used. The letter f stands for the relation that links the inputs to the output”. [3, p. 161] Given that production function R. Lipsey derives two basic types of costs in the short-run – totals and averages. In the beginning let me reproduce definitions of different types of total costs: “Total costs are the sum of all costs that the firm incurs to produce a given level of OUTPUT. Total cost is divided into two parts: total fixed cost and total variable cost. Total fixed costs are all costs of production that do not vary with the level of OUTPUT. Total variable costs are total costs of production that vary directly with the level of OUTPUT” [3, p. 166]. The relationships between these types of total costs can be summarised below TC = TFC + TVCwhereTC – total costs,TFC – total fixed costs,TVC – total variable costs.Having defined “totals”, R. Lipsey gives definitions of “averages”. “Average total cost is the total cost of producing a given level of OUTPUT divided by the number of units of OUTPUT. …Average fixed cost is the total fixed cost divided by the number of units of OUTPUT…. Average variable cost is the total variable cost divided by the number of units of OUTPUT.” [3, p. 167]The relationships between these types of average total costs can be summarised below ATC = AFC + AVCwhereATC – average total costs,AFC – average fixed costs,AVC – average variable costs.Now let us carefully analyse the above definitions of costs trying to identify the nature of all of them. For that purpose I am going to ask you a couple of questions which will help you to accomplish that task: “What is common between these definitions of “totals” and “averages”? Do you see any pattern in these definitions? What is the key word that unites all of them?” I hope that after an objective investigation you will agree with me that the answer to all three questions above is “OUTPUT”. Now let us walk through the relevant pages of R. Frank/R. Bernanke textbook (Ch. 8 “Behind The Supply Curve”). The authors’ treatment of “costs of production” – as you will see in a bit- is essentially the same as in R. Lipsey’s textbook: the core of the theory of “costs of production”, its starting point is the Production Function. The authors give a classical definition of a “hypothetical “Production Function as they call it:” A production function is the relationship between the quantity of inputs a firm uses and the quantity of output it produces” [1, p.193] In the paragraph “From The Production Function To Cost Curves” R. Frank and R. Bernanke explain how information about firm’s production function can be translated into information about costs. So, let us see how they define different types of costs to make a comparison with R. Lipsey’s treatment of costs. In the beginning the authors present “totals”:“The total cost of producing a given level of OUTPUT is the sum of the fixed cost and the variable cost of producing that quantity of OUTPUT… A fixed cost is a cost that does not depend on the quantity of OUTPUT produced. It is the cost of the fixed input. .. A variable cost is a cost that depends on the quantity of OUTPUT produced. It is the cost of the variable input.” [1, p.197] After that they define different “averages”:“The average total cost is total cost divided by the quantity of OUTPUT produced…Average fixed cost is fixed cost divided by the quantity of OUTPUT… Average variable cost is variable cost divided by the quantity of OUTPUT…” [1, p.203-204]Now, let us analyse the above definitions of costs asking ourselves the same three questions as we did in R. Lipsey’s case: “What is common between these definitions of “totals” and “averages”? Do you see any pattern in these definitions? What is the key word that unites all of them?”. After careful analysis we can see that the answer to those three questions is “OUTPUT”. And there is no surprise that we inevitably arrived at the same conclusion about the nature of these different types of costs. At this point we can ask ourselves legitimate questions: “Why this is the case? What is the reason for that?”. As we have seen above, the main block on which the theory of costs is built in both textbooks is the Production Function Q= f (L,K). Dependent variable Q (“OUTPUT”) plays a key role there. As a result, all different definitions of costs naturally come out from the Production Function and they are tightly fastened to the variable Q. Graphical representation of that situation is given below on Figure 1:

| Figure 1. Causality relationships between Production Function and Total and Average Costs |

| Figure 2. Marginal Cost (MC), Average Total Cost (ATC) and Average Variable Cost |

3. Dialog at “After Eight Inc.”

- To help you to see the real problem with the idea that “things have costs” let us detour through the office of “After Eight Inc.” - a small Calgarian company manufacturing kitchens. They currently hired John Smith who graduated from the Bissett School of Business at the Mount Royal University. John was a diligent student of Principles of Economics and due to his efforts in his Microeconomics class he was able to win - over many candidates - a managerial position at “After Eight Inc.”. One that day an owner of “After Eight Inc.” - who has been recently concerned by the rising costs of kitchen boxes - comes to John’s office and asks him: “John, as far as I know it costs us $150 to produce a kitchen box. I want to understand why this is the case”. John responds: “Sir, as you know, an oak sheet is the main component of our kitchen box. In order to obtain the sheet from our Edmonton supplier “Oakwood Limited” we pay $120 for it”. The owner says: “OK. I am aware of that. But why we must pay them that price? Can we get a better price from someone else?”At this point John scratches his head – it was not an easy question for him - and a thought was rising in his head: “O, now I am in trouble…”. But after a while a smile is showing up on John’s face. He has remembered that he was an A+ student in his Microeconomics class and to his delight a phrase from his favorite “Principle of Economics” textbook written by R. Lipsey has come to his mind. With a great relief he says to the owner:” I really doubt, sir. As you know, we obtain our oak sheets on a very competitive market. I learnt in my Microeconomics class at the Bissett Business School that “majority of firms can’t influence the prices of the inputs that they employ; instead, they must pay the going market price for their inputs” [3, p. 166].”The owner responds grimly: “My boy, I know pretty well that we must pay the “Oakwood Limited” the going market price for the oak sheet, although I did not have a chance to go to a business school to study Principles of Economics. But I agree with you that we are stuck at this point and we have no other choice as to follow the market. Although I am still curious, why the market price we pay to the “Oakwood Limited” to obtain the oak sheet is exactly $120? Could you enlighten me on that? ” And a big smile showed up on owner’s face. John already knew that if someone sees that big smile on the face of the boss he or she could be in a trouble. But he answers boldly: “Sir. Unfortunately, R. Lipsey’s “Principle of Economics” textbook which I studied in my Business School does not shed light on this question. It does not go beyond this point and just only states that producers must pay the going market price. But a couple of days ago I had got across a very interesting book on Economics which, probably, can illuminate us on your question. Let us meet in a week and I will inform you about my findings”. The textbook John had in his mind was “The Economic Way of Thinking” by Paul Heyne. After careful study of Heyne’s chapter “Opportunity Cost and the Supply of Goods” John - to his ultimate delight - was able to discover that Paul Heyne does go beyond the limits put on the theory of costs of production by the traditional quantitative approach. He couldn’t resist his excitement and had phoned his boss: “Sir. Sorry for disturbing you. But I diligently studied “The Economic Way of Thinking” for the last week and it seems like I have figured out the answer to your question about the nature of $120 we must pay to obtain a single sheet of oak. It will not be easy for me to explain to you all the details over phone but at this point I can only say that the key to the solution is to use the concept of opportunity cost on which the whole construction of “The Economic way of Thinking” is built. Let me know when next time we can meet and I will tell you all the details”.I hope that the above conversation between John Smith and the owner of “After Eight Inc.” have helped you to see a very important difference between “The Traditional Approach” and “The Economic Way of Thinking” with respect to the theory of costs of production. That difference lies not only in the realm of theory. It has a very powerful application to the analysis of everyday economic situations.

4. Do “Things” Have Costs?: The Economic Way of Thinking

- Students that learnt the concept of the costs of production by the traditional way of teaching of Principles of Economics were trained well enough not to miss raw materials, labour time, the machinery or tools when they do calculation of costs of production. They also know how to express the value of these inputs in monetary terms. They were taught that the sum of these values is the cost of production of a good in question (remember how well John Smith responded to the owner’s question about the dollar value of the costs of production of a kitchen box).“The Economic Way of Thinking” teaches that the calculation the costs of production that way is not necessarily wrong. But it leaves one very important question unanswered: “Why did it cost the producers whatever it did cost, in monetary terms, to use these inputs? “ [2, p. 64]. When the owner of “After Eight Inc.” asked John Smith why the company must pay its supplier “Oakwood Limited” exactly $120 for a single sheet of oak he responded that the theory of the costs of production which he had learnt in his Business School was not able to give an answer to that question. The reason why “The Traditional Approach” to the theory of costs of production was impotent to shed light on the above question is that “The Traditional Approach” takes into consideration only quantitative side of the theory leaving aside the most important qualitative side of it – opportunity cost- which reflects deep economic nature of the costs of production. "The Economic Way of Thinking” teaches that “the concept of opportunity cost asserts that the amount of money a producer must pay for any resource, human or physical, will depend upon what the owner of that resource can obtain from someone else, and this amount will depend upon the value of what that resource can create for someone else” [2, p.65]. “After Eight Inc.” must pay to “Oakwood Limited” exactly $120 for a single oak sheet because “Oakwood Limited” has a dozen of other buyers who are willing to pay $120 for the sheet. In that situation “After Eight Inc.” does not have any other choice as to pay “Oakwood limited” the “best opportunity” value. Therefore, “The Economic Way of thinking “asserts that the value of foregone opportunities – which is the nature of the concept of opportunity cost- becomes the costs of producing a kitchen box. Let us pause for a bit at this point and make some conclusions about the above discussion. Our reader would say:” OK. Now I have a better idea about the difference between “The Traditional Approach” and “The Economic Way of Thinking” with respect to the theory of costs of production. I understand that “The Traditional Approach” is perfectly legitimate within realm of its assumption - Production Function. And I realize that both textbooks equip beginning students with some practical skills valuable at the market place. But at the same time “The Traditional Approach” inevitably produces in the mind of a student a false impression that “things” have costs. I remember that due to the conversation with his boss John Smith discovered a fundamental flaw in his critical economic thinking (in the beginning John was not able to respond properly to his boss’s question: “Why the market price we pay to the “Oakwood Limited” to obtain the oak sheet is exactly $120?”). That flaw could have disastrous consequences for John’s future career at “After Eight Inc.”. Fortunate for him, “The Economic Way of Thinking” came to the rescue in time and saved his image as a well-trained manager.”

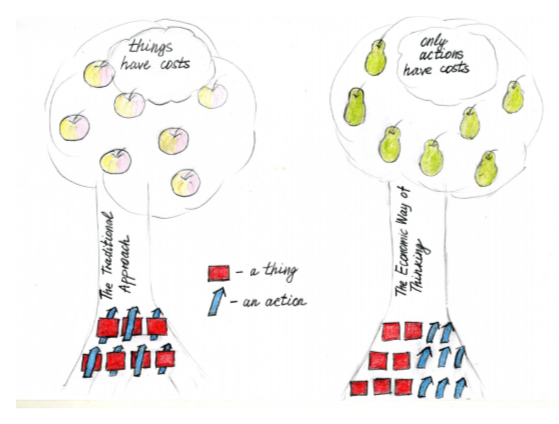

5. “Actions” vs “Things”

- Now we are coming to the most fundamental area which serves as a borderline that separates “The Traditional Approach “from “The Economic Way of Thinking” with respect to the concept of production costs – the relationship between “actions” and “things”. The reason why John Smith was not able to find an answer to his boss’ question is because neither R. Lipsey not R. Frank/R. Bernanke never pay attention to the difference between “actions” and “things”. Picture 1 below provides a visual illustration of the difference between the two approaches.

| Picture 1. Visual illustration of the difference between the two approaches with respect to “actions” and “things” |

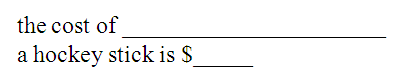

| Picture 2. A form for conducting an experiment with a hockey stick |

6. Conclusions

- Now as we have looked deeply into the nature of the concept of costs let us make some practical advices to those who are confronted with some questions about “costs”. First of all, before making any conclusions about dollar value of costs we need to ask ourselves “To Whom” these costs are applied. Without making our minds about a person who would bear the costs all discussions about costs do not make much economic sense. Secondly, after you figured out the question “To Whom” you must turn your attention to a Relevant Action which that person will be performing. Because – as you have learned from the above discussion - only actions have costs. Applying consistently this approach to different economic settings you will form in your mind a proper economic way of thinking about multitude of real life issues associated with “costs”.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML