-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2018; 8(5): 209-212

doi:10.5923/j.economics.20180805.01

Analysis of the Determinants of Inflation in Nepal

Sunil Kumar Chaudhary, Li Xiumin

School of Economics, Northeast Normal University, Changchun, China

Correspondence to: Sunil Kumar Chaudhary, School of Economics, Northeast Normal University, Changchun, China.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study examines the impacts of macroeconomic variables on the inflation in Nepal during 1975-2016. The variables considered for the study is limited to the use of broad money supply, real GDP, Indian prices. The results suggest that all variables considered are significant in long run implying that these variables are the determinants of inflation in Nepal. The results are consistent with monetary theory. The money supply and Indian prices cause inflation in the long-run based on an OrdinaryLeast Squares regression model.

Keywords: Inflation, Consumer Price Index, Money Supply M2, Real GDP, Nepal

Cite this paper: Sunil Kumar Chaudhary, Li Xiumin, Analysis of the Determinants of Inflation in Nepal, American Journal of Economics, Vol. 8 No. 5, 2018, pp. 209-212. doi: 10.5923/j.economics.20180805.01.

Article Outline

1. Introduction

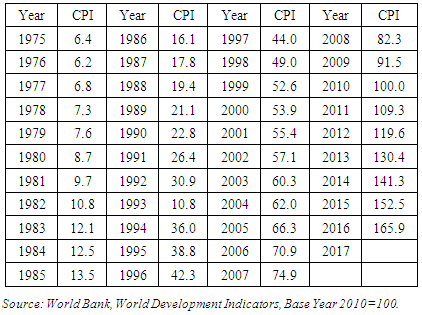

- The price level and its growth, inflation, is an important economic indicator. Inflation can be defined as the persistent rise in the general price level across the economy over time. Inflation is an increase in the volume of money and credit relative to available goods resulting in a substantial and continuing rise in the general price level (Webster’s New Collegiate Dictionary, 1973ed.). More precisely, inflation is a substantial and continuing increase in the volume of money and credit relative to available goods, resulting in a substantial and continuing rise in the general price level. There is an important distinction between this definition and a popular misconception that results from our attempts to measure the general price level. There are various indices which measure the price level, such as; consumer price index (CPI): wholesale price index (WPI); sensitive price index (SPI); gross domestic product (GDP) deflator and so on. In Nepal, there are three main price indices, namely: the CPI; the WPI; and the Salary and Wage Rate Index (SWRI). The main focus for measuring the cost of living is placed on CPI. This is because CPI measures inflation impact which is the final measure of prices on households. Through this procedure, we tend to think of inflation as an increase in the price indexes so that any increase in an index is labelled “inflation”.A continuous rise in price level is termed as inflation (Parkin & Bade, 2001). Inflation is an ongoing process whereby prices are rising persistently year after year. Shapiro (2010) defines inflation as a rising price level. If such a rise in price level persist for long it is known as inflation. Consumer price index, gross domestic product deflator and other several indices measure the changes in price level. The use of these measures is purposely applied wherever appropriate. However, the rate of percentage change in consumer price index as a measure of inflation is widely used. We also here adopt this definition of inflation for our purpose.Inflation is everywhere and is interestingly touchy issue in macroeconomics. All daily newspapers cover the news about inflation. There is no dearth of literature on inflation. It is the mostly discussed issue all over the world among policy makers and academia. It is because of the fact that its effects are widespread and severe and the impacts are far reaching. Inflation has been the major concern for the government since it has serious implication for the living of common peoples. Moreover, it affects several macroeconomic variables such as saving, investment, real interest, real wage, real income and level of employment. Inflation depreciates domestic currency and the imports become more expensive which further push up the domestic prices. In short, inflation is a burning issue in the macroeconomics and main objective and function of central bank is to control inflation.Table 1 shows that price index (base year 2010) has increased persistently over the years. It has increased by little over twenty-five times (from 6.4 to 165.9) during 1975-2016. This means the purchasing power of the Nepalese rupee has decreased by the same speed. The impact of rising prices on the real sector is stylized fact. It constrains the rise of per capita real GDP and thereby reduces the standard of livings of the common people in the country. The stationary price level has thus been one of success parameters of the government. However, it has been a Herculean task to achieve in developing countries. In case of Nepal, however, there appear some positive signals in slowing down the speed of price rise in the later years. For instance, CPI took nine years to double from 6.4 in 1975 to 12.5 in 1984; it doubled even faster within six years between 1985 and 1991 and it took eight-year period between 1991 to 1999. This has, however, turned upside down since the doubling period lengthened to 11 years between 1999 and 2010. This clearly indicates that prices have accelerated at slower motion especially after 1991’s political change. One of the reasons for this might be relatively improved supply situation of the commodities during this period. Partly because Nepal’s improved bilateral relation with India in the changing context and partly because of the sharply improved trade openness index due to trade liberalization policy adopted by the government during early 1990s (Bowdler & Nunziata, 2004). Some empirical studies substantiate that trade openness index has important bearing on the combating hyperinflation. This paper attempts to examine the relation between inflation and other related variables that influence the inflation in the country and suggest policy implications.

|

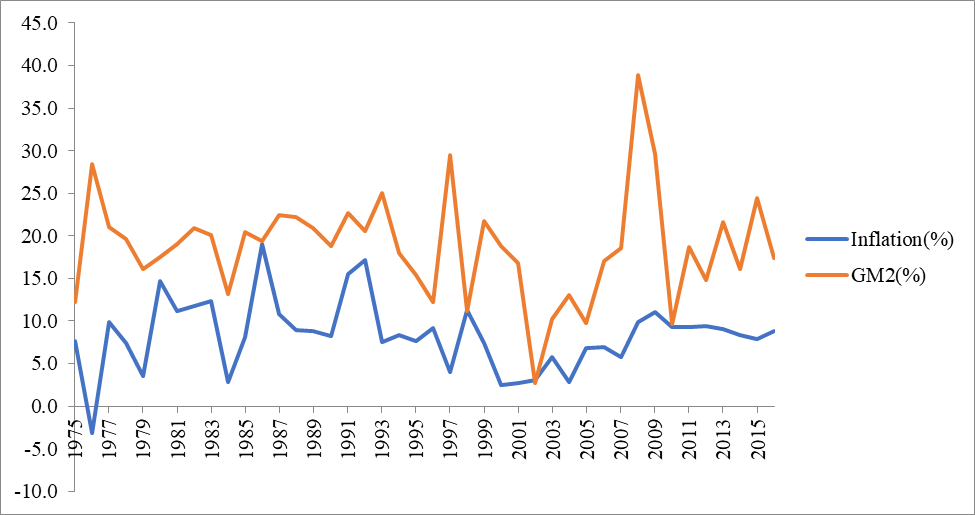

| Figure 1. Relationship between Inflation and Money Supply, 1975-2016 |

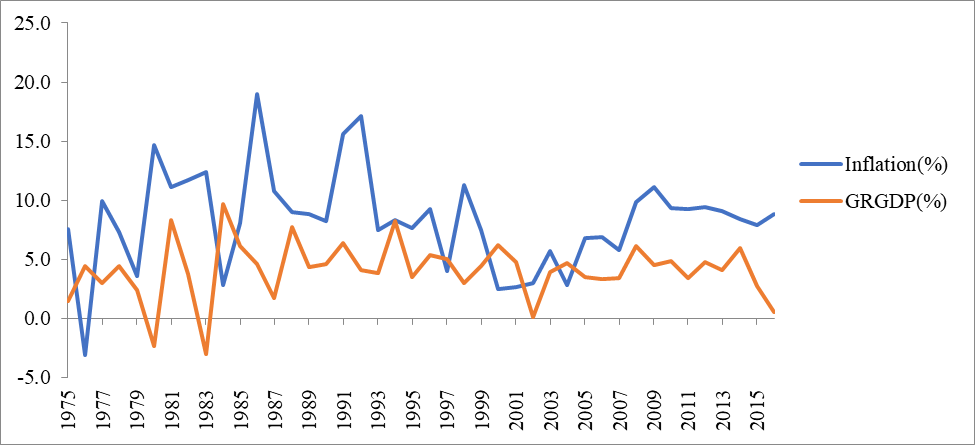

| Figure 2. Inflation and Growth Rate of Real GDP, 1975-2016 |

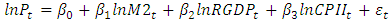

| Figure 3. Inflation in Nepal and India during 1975-2016 |

2. Literature Review

- Several studies explain the relationship between inflation and other macroeconomic Variables. Some empirical studies such as Pahlavani & Rahimi (2009) find that even the international inflation and expected inflation have influential bearings on domestic inflation. Others such as Khan et. al. (2007) constructed econometric model to study inflation incorporating fiscal and monetary policies of the government in Pakistan. In reality, evident from empirical studies suggests that several factors including money supply play roles in macro-economy. Vuyyuri & Sethaiah (2004) finds that budget deficits cause inflation in India. In a study for Pakistan’s inflation, Khan (2007) finds that the most important determinants of inflation in 2005-06 were adaptive expectations, private sector credit and rising import prices whereas, the fiscal policy’s contribution to inflation was minimal. Bayo (2011) on the study for Nigeria reveals that fiscal deficits, money supply, interest and exchange rates are cause of inflation in Nigeria during the period under review. Pahlavani & Rahimi (2009) states that inflation in Iran is largely determined by money supply, exchange rate, GDP, expected inflation rate and imported inflation along with dummy variable. Kumar (2013) finds that money supply and imports index is the most important variables in explaining inflation in India while Laryea & Ussif (2001) states that inflation in Tanzania is largely influenced by monetary factors both in the short run or the long run.A study for NRB notes that Indian prices have a significant bearing on variation of domestic prices in the country (NRB, 1994:100). Besides, they find that an increase in money stock causes price rise and the gradual depreciation of the exchange rate of domestic currency has been partly responsible for the price rise in Nepal. A study by Neupane (1992) finds that one-year lagged money supply, cost of holding real balances, budget deficits, low output growth rates and import prices are the important determinants of price inflation in Nepal. NRB (2001) reveals that there is no structural shift in money price relationship in Nepal. This study finds that broad money has stronger relationship with inflation compared to narrow money. Mathema (1998) finds that a rise in wages in industrial sector causes national inflation while Koirala (2008) discloses a significant relationship between inflation and inflation expectations in Nepal. Koirala (2013) again finds non-constant time varying parameters of both the constant and autoregressive of order one AR (1) coefficient of inflation over the long run. He opines that the changes in the expectations of rational economic agents on macroeconomic policies due to the lack of policy commitment, credibility and dynamic consistency might have contributed for this. Paudyal (2013) finds that variables such as budget deficits, Indian prices, broad money supply, exchange rate and real GDP influence inflation in Nepal.Nguyen (2015) investigates effects of fiscal deficit and broad money M2 supply of in Asian countries: Bangladesh, Cambodia, Indonesia, Malaysia, Pakistan, Philippines, Sri Lanka, Thailand, and Vietnam in the period of 1985-2012 and finds out broad money M2 and fiscal deficit are significant determinants of inflation. Tran (2018) analyse the effectiveness of monetary policy transmission channels in restraining inflation in case of Vietnam for 2001-2015 and suggests that inflation rate increases with the policy rate.Empirical studies in several other countries have shown that a set of explanatory variables such as real gross domestic product (RGDP), budget deficits (BD) or government expenditure, exchange rate (EXC), imported price (MP), broad money (M2) and expected inflation (Pe) explain the variation in price level (P). We examine these variables to explain the inflation in Nepal. In our case, CPI series is a measure of price level and among the independent variables real GDP, the liquidity or money supply (M2) and the imported price is consumer price index of India (CPII) since Nepal’s imports from India accounts 65.7 percent for 2016, which includes goods of daily consumption such as vegetables, clothes, medicines, transport equipments and petroleum products (TEPC, 2016).

3. Methodology and Data

3.1. Methodology

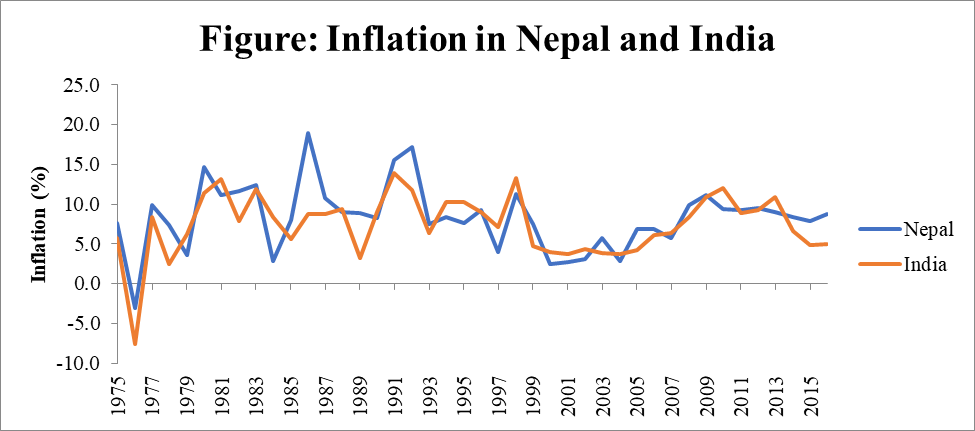

- The quantity theory implies that inflation is a monetary phenomenon in the very long-run. That is the sustained inflation is a function of monetary growth. However, a number of complementary factors that may contribute to sustained inflationary pressures in the long run. In addition, external shocks, such as higher prices in trading partners could increase inflationary pressures in the long-run.In order to investigate the determinant of inflation in Nepal, this paper uses ordinary least square multiple regression model. We consider price level in Nepal as dependent on money supply (M2), Real GDP of Nepal and Consumer Price Index of India as independent variables. We use log form of all variables for the regression purpose. The model equation is:

| (1) |

3.2. Data

- Our study covers the period 1975-2016. The data for CPI, Money Supply, Real GDP of Nepal and CPI of India is taken from the World Bank: development indicator. The data for money supply and real GDP are in the national currency of Nepal.

4. Empirical Results

- This study deals with multiple OLS regression model to observe the impact of macroeconomics variables which affects the inflation in Nepal during the period 1975-2016.

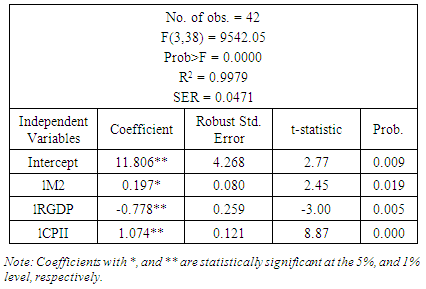

|

5. Conclusions

- The main aim of this paper was to establish the relationship between inflation, money supply, real GDP and imported price (CPII) by reviewing relevant studies using Nepal as the reference country. It is clear that the growth of money supply, the growth rate of real GDP and import price are the main determinants of inflation in Nepal. This study suggests that prices in Nepal are highly dependent on Indian prices because of a weaker supply of domestic production supplemented by the increased imported goods from India. Inflation control is not an easy task for country like Nepal which shares open border with big country and is heavily dependent on the imported goods for the daily consumption and materials for other development purposes. In this context, dominant factor for inflation is supply shock generated outside the country. Thus, inflation control becomes more challenging and complicated for the monetary authorities since the monetary and fiscal policies framed to control the inflation seem to have lesser implications. However, it does not imply that there is no room for such policy implications at all. This empirical study suggests that, given the open border with India and liberalized trade regime, there exists higher prospect of Indian domination on the domestic prices in Nepal.Based on the above results, the study makes the following recommendations: (i) to establish mechanism for monitoring price developments in India to ensure harmonization of domestic prices; (ii) to study the implication of capital mobility between India and Nepal; (iii) to adjust the monetary policy formulation based on the above results.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML