S. V. Gribovsky

Director of the St. Petersburg State Enterprise "Cadastral Assessment", Russia

Correspondence to: S. V. Gribovsky, Director of the St. Petersburg State Enterprise "Cadastral Assessment", Russia.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

The article deals with evaluation of сommercial properties. Using the basic formula of the income approach to valuation of assets, we developed the equation of real estate value estimation, which in the process of calculating the value of the property allows us to explicitly show the pricing mechanism for the seller and the buyer of the finished commercial property. It is shown that the proposed approach has certain versatility, as it helps to evaluate both vacant and partially or totally built-up land.

Keywords:

Value, Estimation, Real estate, Property, Investment, Income approach to value, Real property valuation, Market and investment value, Equation of value estimation, Cash flows, Capitalization, Discounting, Investor, Buyer, Seller, Appraiser, Profit of entrepreneurs, Land valuation, Land improvements valuation, Value to a buyer, Value to a seller

Cite this paper: S. V. Gribovsky, Equation1 of Real Estate Value Estimation, American Journal of Economics, Vol. 8 No. 3, 2018, pp. 155-162. doi: 10.5923/j.economics.20180803.05.

Many things we do not understand, not because our notions of weak, but because these things are not included in the circle of our concepts Kozma Prutkov

Kozma Prutkov

1. Introduction

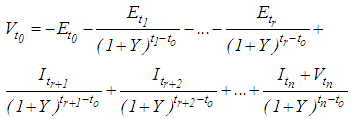

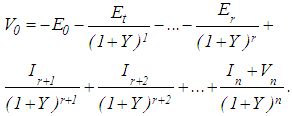

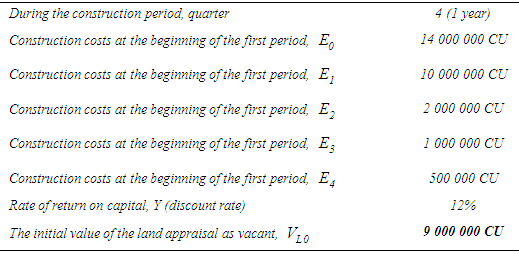

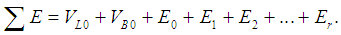

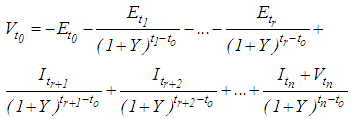

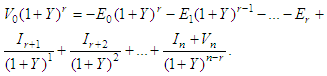

Real estate appraisal as a tool for measuring the value of the real estate property is a process involving the property market simulation by using different approaches. The use of the market approach implies creating a model of the market for comparable properties, whereas under the income approach to value the appraiser essentially simulates the behavior of a typical investor who uses cash on his own account to create or acquire an investment property2, and in the process of this simulation determines the value of the property.Income approach to value an income-producing real property can be defined as a set of methods for evaluating investment properties based on capitalization of current or potential incomes. In this case, the current income will mean income, which a valued object generates at the valuation date, and a potential income − income that can be generated by a valued object in the future.There is [1-4] the direct capitalization method, the yield capitalization method and method of capitalization with the help of income and property models.The direct capitalization method is based on the capitalization of income using the current yield (overall cap rate), pulled from the market for similar properties by analyzing their yields of current income, which the investment property generates. This method is usually used to evaluate smaller commercial properties, which is widely represented in the market.The yield capitalization method is based on the capitalization of future potential flow of income which an estimated property is capable to generate over the forecast period, including proceeds from the resale of the property at the end of the forecast period. In this case for the capitalization of income as the discount rate the yield rate (yield to maturity) is used, determined on the basis of the analysis of the cost of alternative investments.The method of capitalization with the help of income and property models is based on the capitalization of potential income that the estimated property is able to generate, using previously designed models of income and value obtained with certain assumptions about the nature of their change in the forecast period.In terms of evaluation, it should be noted that the base method of the income approach is the yield capitalization method. Direct capitalization method and the method of capitalization with the help of income and property models can be seen as variants of the base method, which are used to value income producing property only under certain assumptions about the nature of changes in income and value.For example, direct capitalization method is fair to value existing commercial real estate, the use of which is the highest and best use, and the state of these properties does not require substantial investments in their repair or reconstruction. The method of capitalization with the help of income and property models may be used to estimate the value of the investment property, income dynamics of which allows the use of a pre-generated math model of capitalizing such income. A typical example is a property that can indefinitely generate a steady unlimited stream of income. To estimate the value of such an object, you can use income model, which represents the quotient of the net income and the rate of return on capital or discount rates.The yield capitalization method (method of capitalization at a rate of return on capital) needs no special assumptions for their use and can be applied to estimate the value of the investment property at any stage of its readiness – from vacant land to the finished commercial real estate property. As a rule, this method is used to measure the value of objects whose construction or type of use you want to modify. These include new building projects, providing land development, or existing real estate objects, which need to be reconstructed. According to the classification given in [1], such objects are referred to as potential properties. The method is also applicable for evaluation of commercial real estate objects requiring redevelopment, fitting-out, or for evaluation of a major mixed-use projects. According to [1] such objects are commonly referred to as distressed properties.Taking into account the above mentioned, the method of capitalization at a rate of return on capital can be defined as a universal method for the evaluation of commercial or likely to be such objects. For example, you can use it to evaluate the land on which there is only a destroyed or a newly built basement. Such objects can be defined as unfinished real estate property or, briefly, unfinished property.The formula, which implements the method of capitalization at a rate of return on capital in the most general form, can be written as follows: | (1) |

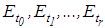

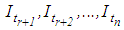

Here  – the property search value indication;

– the property search value indication;  – valuation date or starting time of the process of creating the property;

– valuation date or starting time of the process of creating the property;  – timing of investments or incomes;

– timing of investments or incomes;  – investments in constructing a new building on vacant land or reconstructing of existing land improvements (an old building on the land); r – the number of periods of construction or reconstruction; n – the total number of forecast periods (n>r);

– investments in constructing a new building on vacant land or reconstructing of existing land improvements (an old building on the land); r – the number of periods of construction or reconstruction; n – the total number of forecast periods (n>r);  – net operating income at the appropriate time;

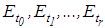

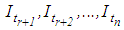

– net operating income at the appropriate time;  – revenue from the sale of a facility investments at the end of the last period; Y – rate of return on capital (discount rate).Note that such record of the discounting formula gives us the ability to assign different duration periods for the various stages of the project. For example, at the initial stage of the creation or renovation of the property the duration period can be defined as the period of the quarter, and at the stage of the operation of the created object property – a year.For the convenience of working with formulas we assume that the starting time is zero: t0=0, and for convenience, we omit the time index «t» in equation (1).So the formula (1) can be rewritten as follows:

– revenue from the sale of a facility investments at the end of the last period; Y – rate of return on capital (discount rate).Note that such record of the discounting formula gives us the ability to assign different duration periods for the various stages of the project. For example, at the initial stage of the creation or renovation of the property the duration period can be defined as the period of the quarter, and at the stage of the operation of the created object property – a year.For the convenience of working with formulas we assume that the starting time is zero: t0=0, and for convenience, we omit the time index «t» in equation (1).So the formula (1) can be rewritten as follows: | (2) |

Note that the choice of the discount rate as a single value for the entire project is only one of the known approaches to discounting the cash flow generated by the investment project at different stages of its implementation. With this approach, the discount rate is calculated by analyzing the internal rates of return of investment projects, comparable to the estimated one [5]. Another approach is based on the fact that the different stages of the investment project are characterized by different risks. And, in this regard, it is recommended (see e.g. [7]), for different stages of the project, to take the following discount rates: higher rates − for stages of construction or reconstruction and lower rates − for the stage of completion of investment in lease. In our view, such an approach is possible, but to use it you must first solve far from a simple task – to support the different rates for different stages of the investment project. The task of choosing the discount rate to estimate the market value refers to the most complex tasks of real estate valuation under the income approach. And if you need some of these rates, the problem of their choice, in our opinion, is complicated by multiple ways.In this article we will choose first a simple but well known approach to discounting, discounting by single value rate equivalent to internal rate of return of the project. Also note that, in our view, the uses of different discount rates are more appropriate in the analysis of investment projects. In these cases discount rates can be guided by the wishes of the investor on the profitability of the various stages of the investment project.The formula (1) or (2) is a formula of discounting cash flows. It can be defined as the basic formula to calculate the efficiency of investment, recommended for the use of the UN and the World Bank, and for real estate appraisal using income approach [1, pg. 634]. The technique of discounting cash flows, in our view, should not be seen as a variation of the income approach, since it is just a tool for calculating the present value of the income stream, which analysts use to measure positive and negative cash flows (revenues and expenses) at different points in time.If you perform some transformation of the formula (2), you can get a useful interpretation of concepts, such as the equation of evaluation, absolute and relative entrepreneurial profit, and entrepreneurial profit in annual figures, the value to the seller and value to the buyer.Let's start with the equation of evaluation.

2. Equation of Real Estate Value Estimation

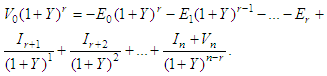

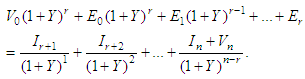

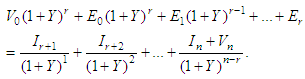

Multiply the left and right part (2) by  :

: The amount of accumulated costs will move to the left side of:

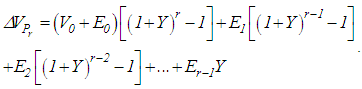

The amount of accumulated costs will move to the left side of: | (3) |

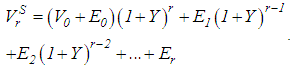

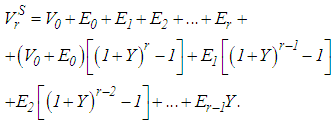

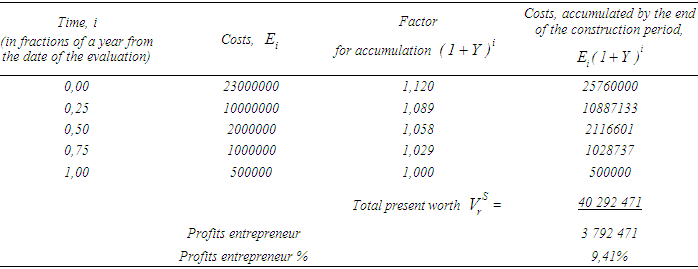

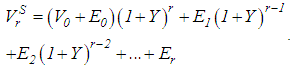

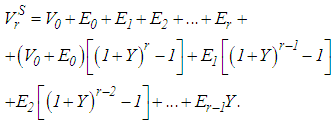

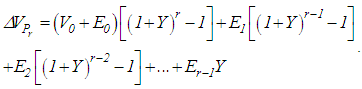

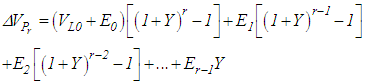

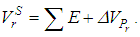

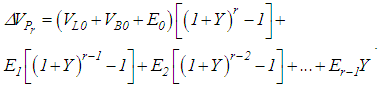

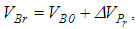

Note that the left-hand side of equation (3) is an accumulated by the time r sum of investment of the investor. The structure of this investment includes the purchase costs of the investment property, which can be regarded as a vacant land or unfinished property. This amount can be considered as a cost price of a created object of investment when assessing the value of the land or the cost price of completed investment in evaluating unfinished property, that is, in fact, the value of built property to the seller: | (4) |

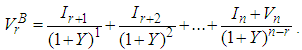

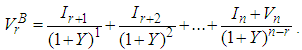

Here, S means the Seller.The right side of equation (3) is the discounted value of the investment property, which can be considered as a value of the finished object of investments at the same time r, received by income approach, or the value of ready property to the buyer (investor): | (5) |

Here, B means the Buyer.In General, the equation (3), first presented in [6], could be described as the equation of value estimation, equalizing supply and demand prices, or the price to the seller and the price to the buyer for the finished object of investment in real estate. Equation (3) can be defined as a kind of "deal" equation, in which the buyer and seller agree on a price, which suit both sides.Close, in fact, technology of appraising a market value of the investment property is presented in the monograph [7, p. 206], with the difference that respected author recommends for accumulating costs and discounting income the use of different rates of interest. The author [7] identifies such approach to this evaluation as a mixed (profitably-cost) approach. In our view, the use of different yield rates into a single investment project is controversial. But this is not important. Importantly, as shown above, the equation (3), at the same or different interest rates, is only a consequence of the basic formula of the income approach (2), and to determine the approach as a mixed (profitably-cost), in our opinion, is erroneous.

3. Entrepreneurial Profit (incentive)

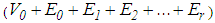

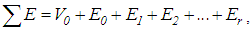

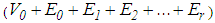

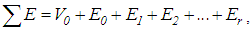

Equation (4) can be represented as follows: We denote the sum

We denote the sum  via

via

| (6) |

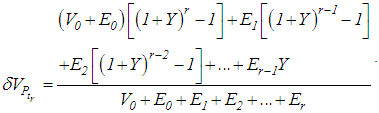

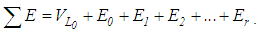

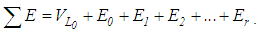

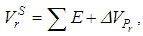

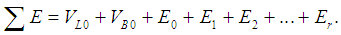

and define it as a direct sum of investments. This amount represents a simple (without taking into account the time value of money) amount of the cost of acquisition of the vacant or built-up land and associated costs for the construction or renovation.The remainder can be characterized as entrepreneurial profit for the period r:The remainder can be characterized as entrepreneurial profit or entrepreneurial incentive3 for the period r: | (7) |

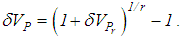

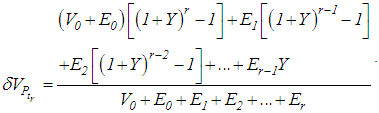

The profit or incentive depends on Y describing the acceptable yield to the investor as compensation for the risk of investing in the project. The more risk, the higher the return will the investor want.The approach, founded on this method of calculating the entrepreneur’s earnings, is based on the concept of imputed costs. There are many definitions of imputed costs, but they are somehow reduced to the fact that the opportunity costs should be understood as a lost income over a certain period of time which the investor could have received if his investment during this time could generate income.In our case, during the period of creation or renovation of real estate, the capital invested in the purchase of land and construction or reconstruction of improvements "does not work" as a source of profit and therefore does not generate a profit. The investor includes this loss of the profit in the price of the object being created.Note that this approach to the calculation of entrepreneur profit provides that its absolute value depends on the amount of investment, the rate of return on capital and on the time during which capital is idle. It is important that the amount of investment, the rate of return on capital and on the time during which capital is idle should be consistent with market indicators.In order to make an entrepreneur profit as a fraction of the total volume of investment it is necessary to divide it by the direct sum of investments: | (8) |

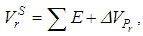

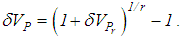

Note that the formula (8) specifies the relative profits of an entrepreneur in the period of construction or reconstruction. To analyze the profitability of investment projects the relative entrepreneur profit on an annual basis is more often used: The value (5) of the built real estate object to the buyer also depends on the rate of return on capital, but in another way − the higher the risk, the less money the buyer has to invest in the acquisition of the built object, as the discount rate is proportional to the risk, and it is in the denominator of the formula (5), which determines the present value of future income.The seller and buyer are interested in the higher rate of return on equity, because the seller can thus expect higher profits and purchasers − to get the built object of investments at a lower price and faster return on their investment.But no matter how much buyers and sellers would like to have a higher rate of return, it cannot be higher than the maximum possible rate of return which exists on the markets for similar projects.In order to trace the mechanism of the value formation during the process of estimation using the proposed approach, let us consider the technology of market value estimation of the improved (built-up) land.To demonstrate the capabilities of the approach we will perform this estimation consistently in two stages: first, we estimate the value of the land as vacant (without improvements), and then estimate the land improvements value. And the total value of a built-up land will be defined as the sum of values obtained at each of the stages. For clarity, we will accompany this technology with the simplified examples for each stage.

The value (5) of the built real estate object to the buyer also depends on the rate of return on capital, but in another way − the higher the risk, the less money the buyer has to invest in the acquisition of the built object, as the discount rate is proportional to the risk, and it is in the denominator of the formula (5), which determines the present value of future income.The seller and buyer are interested in the higher rate of return on equity, because the seller can thus expect higher profits and purchasers − to get the built object of investments at a lower price and faster return on their investment.But no matter how much buyers and sellers would like to have a higher rate of return, it cannot be higher than the maximum possible rate of return which exists on the markets for similar projects.In order to trace the mechanism of the value formation during the process of estimation using the proposed approach, let us consider the technology of market value estimation of the improved (built-up) land.To demonstrate the capabilities of the approach we will perform this estimation consistently in two stages: first, we estimate the value of the land as vacant (without improvements), and then estimate the land improvements value. And the total value of a built-up land will be defined as the sum of values obtained at each of the stages. For clarity, we will accompany this technology with the simplified examples for each stage.

4. Valuation of a Vacant Land

If the object of investments is a vacant land, in this case we should consider as investments the costs to acquire this land and the costs to create the appropriate improvements of the land, depending on the calculated value (market or investment value).The direct sum of investments should be calculated as follows: | (9) |

Here  − the desired value of vacant land on the date of estimation,

− the desired value of vacant land on the date of estimation,  − cost of building land improvements, for example, the construction of the building.Note that as the cost of building land improvements

− cost of building land improvements, for example, the construction of the building.Note that as the cost of building land improvements  in the formula (9) you must consider not only the cost of constructing the buildings, but also all the costs of setting up utilities water, electricity and lighting, as well as the drainage system excreta.Entrepreneur profit for the period r is equal:

in the formula (9) you must consider not only the cost of constructing the buildings, but also all the costs of setting up utilities water, electricity and lighting, as well as the drainage system excreta.Entrepreneur profit for the period r is equal: | (10) |

In general, taking into account entrepreneur profit, the built investment property value to the seller can be written as the sum of the following: | (11) |

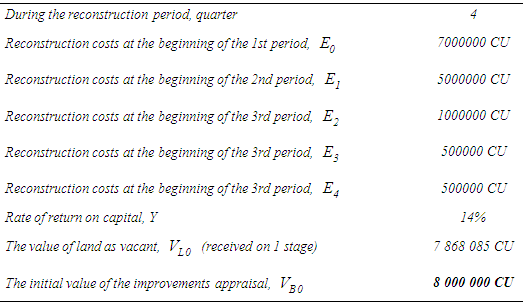

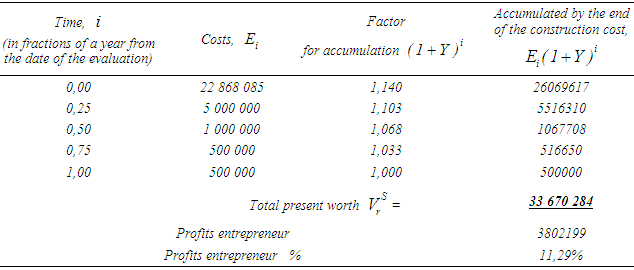

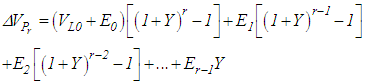

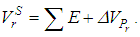

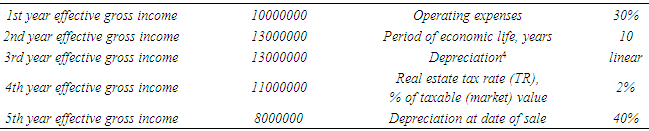

At the chosen rate of return on capital Y and calculated costs E, in equation (11), the land value  is unknown at the date of valuation.The right side of the equation (3) formally looks the same for any asset being valued. It is a formula to calculate the present value of the income stream generated by a built investment property. Note that this value depends on the value formed by the left part of the equation (3), of value estimation, of system of taxation, depreciation and dynamics of the resale price of the asset created.Example 1 (evaluation of the land as vacant). During the analysis of the highest and best use of the land as vacant the appraiser has concluded that it is advisable to build the Office Center for rent on the estimated area of land.Table 1 shows the parameters for the calculation of the value to the seller, while table 2 – the results of this valuation made by the formula (11) corresponding to the data.

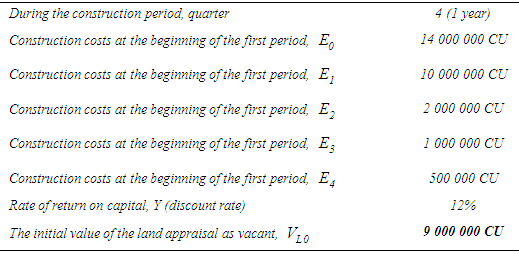

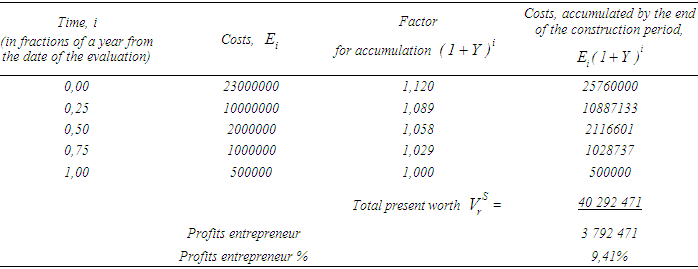

is unknown at the date of valuation.The right side of the equation (3) formally looks the same for any asset being valued. It is a formula to calculate the present value of the income stream generated by a built investment property. Note that this value depends on the value formed by the left part of the equation (3), of value estimation, of system of taxation, depreciation and dynamics of the resale price of the asset created.Example 1 (evaluation of the land as vacant). During the analysis of the highest and best use of the land as vacant the appraiser has concluded that it is advisable to build the Office Center for rent on the estimated area of land.Table 1 shows the parameters for the calculation of the value to the seller, while table 2 – the results of this valuation made by the formula (11) corresponding to the data.Table 1. The parameters for the calculation of the value to the seller

|

| |

|

Table 2. The results of calculation of the value to the seller

|

| |

|

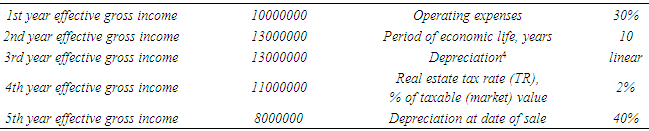

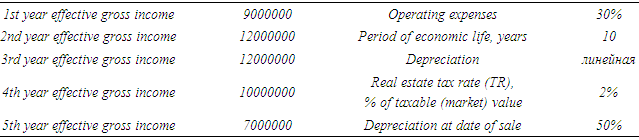

Table 3 presents the initial data for the calculation of the value to the buyer, while table 4 – the results of this valuation obtained from equation (5).Table 3. Initial data for calculating the value to the buyer

|

| |

|

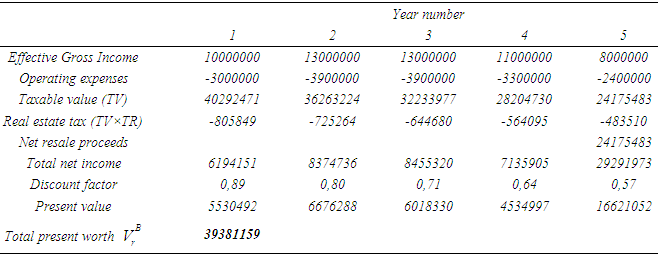

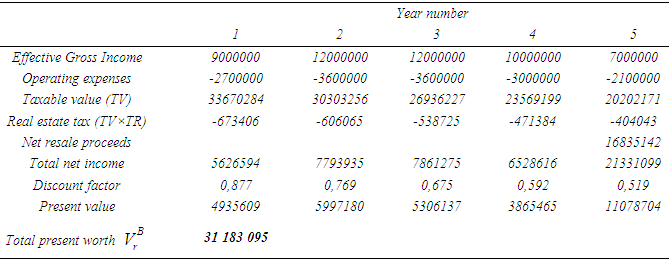

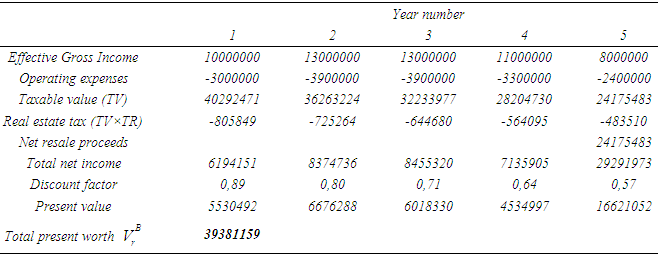

Table 4. The results of calculation of the value to the buyer

|

| |

|

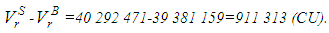

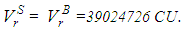

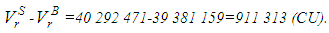

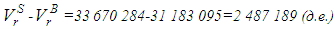

The difference between the values to the seller and the buyer: This difference is eliminated by the method of successive approximations by selection of the desired value of the land as vacant.The results obtained through this task by using the Excel built-in function "goal seek" are the following: desired value of the land as a vacant

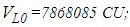

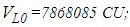

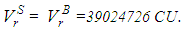

This difference is eliminated by the method of successive approximations by selection of the desired value of the land as vacant.The results obtained through this task by using the Excel built-in function "goal seek" are the following: desired value of the land as a vacant  the value of the constructed property

the value of the constructed property  Note that in this example we used a single discount rate for the entire project. However, the proposed approach allows you to evaluate the investment value of the land using different discount rates. For this it is necessary to carry out their choice, for example, focusing on the requirements of the investor on the payback period for different stages of the investment project, and use them in calculations in formulas (5) and (11).

Note that in this example we used a single discount rate for the entire project. However, the proposed approach allows you to evaluate the investment value of the land using different discount rates. For this it is necessary to carry out their choice, for example, focusing on the requirements of the investor on the payback period for different stages of the investment project, and use them in calculations in formulas (5) and (11).

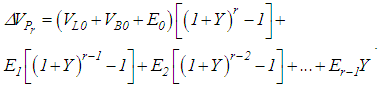

5. Evaluation of Land Improvements

If the object of investment is the improved land, but requiring repair or reconstruction, the entrepreneur profits will look like this: | (12) |

Here  is the cost to acquire the existing land improvements, which are also on the reconstruction period in the "frozen" state and therefore do not generate revenues.Thus the cost of improvements reconstructed by the time r is given by the following sum:

is the cost to acquire the existing land improvements, which are also on the reconstruction period in the "frozen" state and therefore do not generate revenues.Thus the cost of improvements reconstructed by the time r is given by the following sum: | (13) |

here entrepreneur profit  is calculated according to the formula (12).In general, taking into account entrepreneur profit, the reconstructed investment property value to the seller can be written as the sum of the following:

is calculated according to the formula (12).In general, taking into account entrepreneur profit, the reconstructed investment property value to the seller can be written as the sum of the following: | (14) |

where direct sum of investments  is equal to

is equal to | (15) |

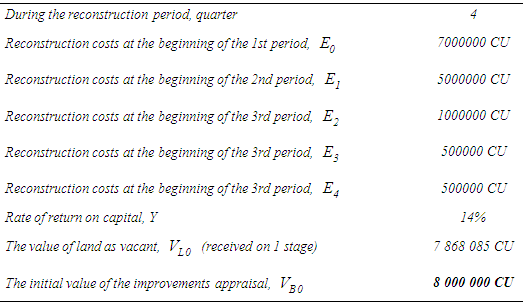

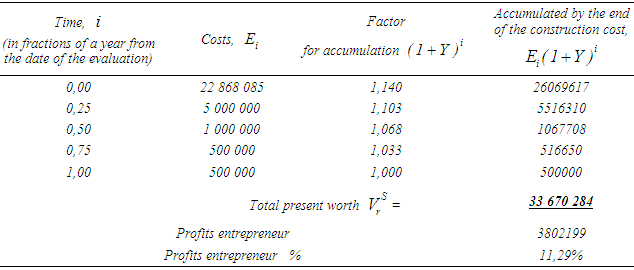

Note that the formula (15) differs from the formula (9) by having therein the value of land improvements  So, let us consider a simplified example of the estimates technique of the market value of land improvements, corresponding to the equation (3), assuming that the value of the vacant land is already known to us from the section "Valuation of vacant land»"5.Example 2 (evaluation of land improvements). In the process of analyzing the most efficient land use the appraiser has concluded that the estimated built-up land is necessary to reconstruct, unlike example 1, into the trading center for the subsequent renting it out.Table 5 shows the parameters for the calculation of the value to the seller, while table 6 – the results of this valuation made by the formula (14) corresponding to the data.

So, let us consider a simplified example of the estimates technique of the market value of land improvements, corresponding to the equation (3), assuming that the value of the vacant land is already known to us from the section "Valuation of vacant land»"5.Example 2 (evaluation of land improvements). In the process of analyzing the most efficient land use the appraiser has concluded that the estimated built-up land is necessary to reconstruct, unlike example 1, into the trading center for the subsequent renting it out.Table 5 shows the parameters for the calculation of the value to the seller, while table 6 – the results of this valuation made by the formula (14) corresponding to the data.Table 5. The parameters for the calculation of the value to the seller

|

| |

|

Table 6. The results of calculation of the value to the seller

|

| |

|

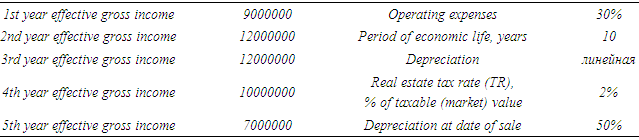

Table 7 presents the initial data for the calculation of the value to the buyer, while table 8 – the results of this valuation obtained from equation (5).Table 7. Initial data for calculating the value to the buyer

|

| |

|

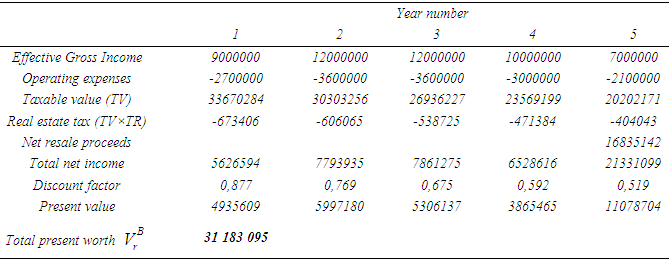

Table 8. The results of calculation of the value to the buyer

|

| |

|

The difference between the values to the seller and the buyer: This difference is eliminated by the method of successive approximations by selection of the desired value of the existing land improvements.The results obtained through the task by using the Excel built-in function "goal seek" are as such: desired value of the existing land improvements

This difference is eliminated by the method of successive approximations by selection of the desired value of the existing land improvements.The results obtained through the task by using the Excel built-in function "goal seek" are as such: desired value of the existing land improvements  =5262660 CU; value of the reconstructed property

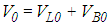

=5262660 CU; value of the reconstructed property  =30549716 CU.The total market value of the land with the existing improvements on the date of the evaluation is the sum of market values:

=30549716 CU.The total market value of the land with the existing improvements on the date of the evaluation is the sum of market values:  =7 868 085+5 262 660=13 130 745 (rounded to 13 100 000 CU).

=7 868 085+5 262 660=13 130 745 (rounded to 13 100 000 CU).

6. Summary

Thus, using the basic formula of the income approach for the value of potential and distressed properties and without changing its essence, we have obtained the equation of real estate value estimation, which in the process of calculating the value of the property allows us to explicitly show the pricing mechanism for the seller and the buyer of the finished commercial property.Thus the value to the seller is formed as the sum of his investments in the acquisition and conversion of the asset and entrepreneur profit, formed by the sum of the opportunity costs incurred due to investments. The value to the buyer is determined in full compliance with the income approach principle – as the present value of future earnings, which object of investment after its construction or conversion can generate.Equation of value estimation enables you to calculate the market or investment value of both vacant and partially or totally improved land.

Notes

1. Equation (math.) − analytical writing of task of finding argument values that are equal to the values of two specified functions, for example, G(x,a,b,c)=F(x,a,b,c,d). So, you need to find the value of x that will make fair equality of functions F and G (the author 's). 2. Here and further under the investment property let us understand a property purchased to generate future income through rent or sale for speculative purposes (the author 's).3. Entrepreneurial incentive is a forecasted or calculated entrepreneurial profit by an appraiser [1].4. Here Depreciation is used to calculate taxable value (the author 's).5. Evaluation of vacant land can be done by any known method of land valuation, for example, by comparing sales of free plots of land, compared to the estimated land (author 's).

References

| [1] | Appraisal Institute. The Appraisal of Real Estate, 12 edition. Chicago, Appraisal Institute, 2001. |

| [2] | Jack Friedman, Nicholas Ordway, Income Property Appraisal and Analysis, NJ: Prentice Hall, 1989. |

| [3] | Harrison H., “Property valuation”. Textbook. Russian edition. - Moscow: RIO-Mosobluprpoligrafizdat, 1994. |

| [4] | Gribovsky S.V. “Evaluation of real estate”. Textbook. - Moscow: "Maroseika", 2009. pp. 427. |

| [5] | Akerson Charles B., Capitalisaition theory and techniques: study guide. Appraisal Institute, Chicago, IL., 2009. |

| [6] | Gribovsky S.V. Evaluation of profitable real estate. Textbook for high schools. – Saint-Petersburg: "Piter", 2001, pp.336. |

| [7] | Ozerov E.S. “Economic analysis and valuation”. – St-Petersburg: «ISS», 2007, pp. 535. |

Kozma Prutkov

Kozma Prutkov

– the property search value indication;

– the property search value indication;  – valuation date or starting time of the process of creating the property;

– valuation date or starting time of the process of creating the property;  – timing of investments or incomes;

– timing of investments or incomes;  – investments in constructing a new building on vacant land or reconstructing of existing land improvements (an old building on the land); r – the number of periods of construction or reconstruction; n – the total number of forecast periods (n>r);

– investments in constructing a new building on vacant land or reconstructing of existing land improvements (an old building on the land); r – the number of periods of construction or reconstruction; n – the total number of forecast periods (n>r);  – net operating income at the appropriate time;

– net operating income at the appropriate time;  – revenue from the sale of a facility investments at the end of the last period; Y – rate of return on capital (discount rate).Note that such record of the discounting formula gives us the ability to assign different duration periods for the various stages of the project. For example, at the initial stage of the creation or renovation of the property the duration period can be defined as the period of the quarter, and at the stage of the operation of the created object property – a year.For the convenience of working with formulas we assume that the starting time is zero: t0=0, and for convenience, we omit the time index «t» in equation (1).So the formula (1) can be rewritten as follows:

– revenue from the sale of a facility investments at the end of the last period; Y – rate of return on capital (discount rate).Note that such record of the discounting formula gives us the ability to assign different duration periods for the various stages of the project. For example, at the initial stage of the creation or renovation of the property the duration period can be defined as the period of the quarter, and at the stage of the operation of the created object property – a year.For the convenience of working with formulas we assume that the starting time is zero: t0=0, and for convenience, we omit the time index «t» in equation (1).So the formula (1) can be rewritten as follows:

:

: The amount of accumulated costs will move to the left side of:

The amount of accumulated costs will move to the left side of:

We denote the sum

We denote the sum  via

via

The value (5) of the built real estate object to the buyer also depends on the rate of return on capital, but in another way − the higher the risk, the less money the buyer has to invest in the acquisition of the built object, as the discount rate is proportional to the risk, and it is in the denominator of the formula (5), which determines the present value of future income.The seller and buyer are interested in the higher rate of return on equity, because the seller can thus expect higher profits and purchasers − to get the built object of investments at a lower price and faster return on their investment.But no matter how much buyers and sellers would like to have a higher rate of return, it cannot be higher than the maximum possible rate of return which exists on the markets for similar projects.In order to trace the mechanism of the value formation during the process of estimation using the proposed approach, let us consider the technology of market value estimation of the improved (built-up) land.To demonstrate the capabilities of the approach we will perform this estimation consistently in two stages: first, we estimate the value of the land as vacant (without improvements), and then estimate the land improvements value. And the total value of a built-up land will be defined as the sum of values obtained at each of the stages. For clarity, we will accompany this technology with the simplified examples for each stage.

The value (5) of the built real estate object to the buyer also depends on the rate of return on capital, but in another way − the higher the risk, the less money the buyer has to invest in the acquisition of the built object, as the discount rate is proportional to the risk, and it is in the denominator of the formula (5), which determines the present value of future income.The seller and buyer are interested in the higher rate of return on equity, because the seller can thus expect higher profits and purchasers − to get the built object of investments at a lower price and faster return on their investment.But no matter how much buyers and sellers would like to have a higher rate of return, it cannot be higher than the maximum possible rate of return which exists on the markets for similar projects.In order to trace the mechanism of the value formation during the process of estimation using the proposed approach, let us consider the technology of market value estimation of the improved (built-up) land.To demonstrate the capabilities of the approach we will perform this estimation consistently in two stages: first, we estimate the value of the land as vacant (without improvements), and then estimate the land improvements value. And the total value of a built-up land will be defined as the sum of values obtained at each of the stages. For clarity, we will accompany this technology with the simplified examples for each stage.

− the desired value of vacant land on the date of estimation,

− the desired value of vacant land on the date of estimation,  − cost of building land improvements, for example, the construction of the building.Note that as the cost of building land improvements

− cost of building land improvements, for example, the construction of the building.Note that as the cost of building land improvements  in the formula (9) you must consider not only the cost of constructing the buildings, but also all the costs of setting up utilities water, electricity and lighting, as well as the drainage system excreta.Entrepreneur profit for the period r is equal:

in the formula (9) you must consider not only the cost of constructing the buildings, but also all the costs of setting up utilities water, electricity and lighting, as well as the drainage system excreta.Entrepreneur profit for the period r is equal:

is unknown at the date of valuation.The right side of the equation (3) formally looks the same for any asset being valued. It is a formula to calculate the present value of the income stream generated by a built investment property. Note that this value depends on the value formed by the left part of the equation (3), of value estimation, of system of taxation, depreciation and dynamics of the resale price of the asset created.Example 1 (evaluation of the land as vacant). During the analysis of the highest and best use of the land as vacant the appraiser has concluded that it is advisable to build the Office Center for rent on the estimated area of land.Table 1 shows the parameters for the calculation of the value to the seller, while table 2 – the results of this valuation made by the formula (11) corresponding to the data.

is unknown at the date of valuation.The right side of the equation (3) formally looks the same for any asset being valued. It is a formula to calculate the present value of the income stream generated by a built investment property. Note that this value depends on the value formed by the left part of the equation (3), of value estimation, of system of taxation, depreciation and dynamics of the resale price of the asset created.Example 1 (evaluation of the land as vacant). During the analysis of the highest and best use of the land as vacant the appraiser has concluded that it is advisable to build the Office Center for rent on the estimated area of land.Table 1 shows the parameters for the calculation of the value to the seller, while table 2 – the results of this valuation made by the formula (11) corresponding to the data. This difference is eliminated by the method of successive approximations by selection of the desired value of the land as vacant.The results obtained through this task by using the Excel built-in function "goal seek" are the following: desired value of the land as a vacant

This difference is eliminated by the method of successive approximations by selection of the desired value of the land as vacant.The results obtained through this task by using the Excel built-in function "goal seek" are the following: desired value of the land as a vacant  the value of the constructed property

the value of the constructed property  Note that in this example we used a single discount rate for the entire project. However, the proposed approach allows you to evaluate the investment value of the land using different discount rates. For this it is necessary to carry out their choice, for example, focusing on the requirements of the investor on the payback period for different stages of the investment project, and use them in calculations in formulas (5) and (11).

Note that in this example we used a single discount rate for the entire project. However, the proposed approach allows you to evaluate the investment value of the land using different discount rates. For this it is necessary to carry out their choice, for example, focusing on the requirements of the investor on the payback period for different stages of the investment project, and use them in calculations in formulas (5) and (11).

is the cost to acquire the existing land improvements, which are also on the reconstruction period in the "frozen" state and therefore do not generate revenues.Thus the cost of improvements reconstructed by the time r is given by the following sum:

is the cost to acquire the existing land improvements, which are also on the reconstruction period in the "frozen" state and therefore do not generate revenues.Thus the cost of improvements reconstructed by the time r is given by the following sum:

is calculated according to the formula (12).In general, taking into account entrepreneur profit, the reconstructed investment property value to the seller can be written as the sum of the following:

is calculated according to the formula (12).In general, taking into account entrepreneur profit, the reconstructed investment property value to the seller can be written as the sum of the following:

is equal to

is equal to

So, let us consider a simplified example of the estimates technique of the market value of land improvements, corresponding to the equation (3), assuming that the value of the vacant land is already known to us from the section "Valuation of vacant land»"5.Example 2 (evaluation of land improvements). In the process of analyzing the most efficient land use the appraiser has concluded that the estimated built-up land is necessary to reconstruct, unlike example 1, into the trading center for the subsequent renting it out.Table 5 shows the parameters for the calculation of the value to the seller, while table 6 – the results of this valuation made by the formula (14) corresponding to the data.

So, let us consider a simplified example of the estimates technique of the market value of land improvements, corresponding to the equation (3), assuming that the value of the vacant land is already known to us from the section "Valuation of vacant land»"5.Example 2 (evaluation of land improvements). In the process of analyzing the most efficient land use the appraiser has concluded that the estimated built-up land is necessary to reconstruct, unlike example 1, into the trading center for the subsequent renting it out.Table 5 shows the parameters for the calculation of the value to the seller, while table 6 – the results of this valuation made by the formula (14) corresponding to the data. This difference is eliminated by the method of successive approximations by selection of the desired value of the existing land improvements.The results obtained through the task by using the Excel built-in function "goal seek" are as such: desired value of the existing land improvements

This difference is eliminated by the method of successive approximations by selection of the desired value of the existing land improvements.The results obtained through the task by using the Excel built-in function "goal seek" are as such: desired value of the existing land improvements  =5262660 CU; value of the reconstructed property

=5262660 CU; value of the reconstructed property  =30549716 CU.The total market value of the land with the existing improvements on the date of the evaluation is the sum of market values:

=30549716 CU.The total market value of the land with the existing improvements on the date of the evaluation is the sum of market values:  =7 868 085+5 262 660=13 130 745 (rounded to 13 100 000 CU).

=7 868 085+5 262 660=13 130 745 (rounded to 13 100 000 CU). Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML