-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2018; 8(2): 107-111

doi:10.5923/j.economics.20180802.06

Interest and Institutional Analysis in Bitcoin Rejection by Bank of Indonesia

Rahmah Daniah1, Fajar Apriani2

1International Relations Program Study of Social and Political Sciences Faculty, Mulawarman University, Samarinda, Indonesia

2Public Administration Program Study of Social and Political Sciences Faculty, Mulawarman University, Samarinda, Indonesia

Correspondence to: Fajar Apriani, Public Administration Program Study of Social and Political Sciences Faculty, Mulawarman University, Samarinda, Indonesia.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This research aims to analyze bitcoin rejection by Bank of Indonesia. This is a deductive-qualitative research by data collecting done by library research through literature review from scientific articles. The research focuses on two approaches to political economy policy taken by a country, namely the approach of interest and institutional. The research result showed that there are two reason for the rejection of bitcoin by Bank of Indonesia, first protecting the interests of traders and secondly the existence of the national interest. Therefore, the Government of Indonesia’s response to the existence of bitcoin actually educated its citizens to deny it.

Keywords: Bitcoin, Interest, Institutions, Political economy policy

Cite this paper: Rahmah Daniah, Fajar Apriani, Interest and Institutional Analysis in Bitcoin Rejection by Bank of Indonesia, American Journal of Economics, Vol. 8 No. 2, 2018, pp. 107-111. doi: 10.5923/j.economics.20180802.06.

Article Outline

1. Introduction

- The development of science tends to facilitate various human activities, so that the connectedness of each other is easier, cheaper and faster. The presence of increasingly diverse communications technologies has triggered a narrower ‘narrow’ country border and international business activity is growing very rapidly. Initially, international business activities were conducted only to meet the needs of citizen’s lives, but then the rapid deployment of technology made global capital inflows more integrated. Although its impact is evident from the rising demands of society’s needs, making this position ultimately put the country’s role weaker if it is unable to cope with the high level of transactions. This phenomenon is called the economic globalization as a process where more and more countries are involved in the world economic activity [1]. The presence of economic globalization with increasing trend, making state behavior more integrated by global markets and making the borders of the state increasingly ‘blurred’. This trend then increased due to the support of technological advances and information. In line with the increasing globalization of the world economy, the public’s need for speed, ease and security of financial transactions has also increased, so a secure, cheap and easy payment system is needed for financial mechanism such as value exchanges and individual payment systems, enabling sellers and buyers to buy-sell transactions without having to meet directly because it can be done via the internet or e-commerce [2].The high global financial transactions affect the payment system. Initially in cash and non-cash, then undergoing changes in electronic and virtual form that are integrated with all bank and nonbank providers, using chip based or server based with third party roles [3]. Virtual money then becomes phenomenal in the community as crypto currency as a manifestation of technological developments in e-commerce activities. Until now, there are 100 types of crypto currency, such as Ripples, RonPaul Coin, Litecoin, Ethereum and Bitcoin. However, among all the crypto currencies, bitcoin controls market dominance with the highest market capillation value, followed by ethereum in second [4].Bitcoin is a completely new payment system and money in digital form. Bitcoin is similar to cash and can be used to purchase goods needs via the internet. The bitcoin payment network is not through central authority (bank) or intermediary, but only peer-to-peer only, so it can be said to tend to be easier to transact and cheaper by using bitcoin payment mechanism [5], as long as the perpetrator of the transaction is always connected to each other [6]. Bitcoin called digital currency that can be used to transact with goods in the real world and even its existence can also be used as an asset like gold in real life, so that the term digital gold is used as an investment tool because of its value continues to increase, even digital exchange rate of bitcoin per September 2017 recorded US$ 4,909 per chip, this value is quite large in the volume of transactions in a day [7].The existence of bitcoin without central authority or the bank as a third party makes the number of rejections made by some countries, one of which is Indonesia. As stated by the Head of Center for Transformation Program of Bank of Indonesia, Onny Widjanarko, which states that until now people are not encouraged to use bitcoin transactions and other virtual currency because the rules are not yet clear [8].According to Bank of Indonesia as a legitimate payment system regulator stated that Bank of Indonesia rejected the existence of bitcoin because it is considered not in accordance with some rules applicable in the Indonesian banking world. Then, this paper attempts to analyze the basis of Bank of Indonesia rejection of the existence of bitcoin in Indonesia based on the interest and institutional approach in the determination of political economy policy. While other paper analyze bitcoin in Indonesia used a legal approach in comparing it with other currencies, as in [9].

2. Methods

2.1. Research Design

- This study is a descriptive qualitative study that explains and illustrates the problem by performing data collection, information analysis and reporting of the results. This study explains the causal relationship between institutions policy target and interest target of Bank of Indonesia to bitcoin.

2.2. Data Collection Techniques

- The data in this study is collected through the use of literature review method or library research. So the type of data used in this study is secondary data, where the data relevant to the problems obtained and discussed from various books, journals, reports, documents and materials from the internet. The analytical techniques used in this study is a method of content analysis that explains and analyzed data of research results that have been read and summarized from written sources obtained successfully (documents analysis). The interpretation of data on the law is then analyzed by using deductive method, that is the method which trying to apply the relevant theory in a phenomenon, which in this research is the political economy policy approach from Thomas Oatley, which finally formulated a conclusion from the data [10], and then presents the results of the study.

3. Results and Discussion

3.1. Legislation Underlying the Rejection of Bitcoin by Bank of Indonesia

- Bank of Indonesia regulated the payment system to maintain rupiah stability, in the payment system covering the means of payment and legal procedures in the banking system. One regulated payment system is the procedure for transferring money from one party to another based on a legitimate economic transaction. Means of payment that has been going on is in the form of cash based, non-cash and digital. In its development, with the improvement of technology, the public began to make payments in electronic transactions. Based on an increase in electronic financial transactions, Bank of Indonesia shall issue Bank of Indonesian Regulation Number: 11/12/PBI/2009 concerning Electronic Money, as evidence that Bank of Indonesia recognizes the existence of electronic money in Indonesia. But Bank of Indonesia does not guarantee the trade of electronic money or business actors who trade in electronic money from one currency to another [11].Indonesian Republic Law Number 19 of 2016 concerning Electronic Information and Transactions states that the government has full authority in terminating access or ordering the Providers of Electronic Systems to terminate access to Electronic Information or Electronic Documents that are illegal. On that basis, then the Indonesian Government has the authority to cover all access to electronic information that is considered illegal [12], including bitcoin. In addition, based on the Law of the Republic of Indonesia Number 23 of 1999 concerning Bank of Indonesia in Article 9 states that Bank of Indonesia is obliged to refuse or ignore any form of interference from any party in the framework of execution of its duties, one of shich is to regulate and oversee the payment system that occurred in Indonesia [13]. Indonesian Republic Law Number 7 of 2011 concerning Currency in Article 1 Paragraph (1) explains that currency is money issued by the Unitary State of the Republic of Indonesia hereinafter referred to as rupiah. In the aforementioned article it is clearly stated that Bank of Indonesia is the only institution authorized to conduct expenditure, circulation and/or revocation as well as withdrawal of rupiah to issue and circulate rupiah money, withdraw and eliminate such money from circulation [14].

3.2. Interest and Institutional Approaches in Political Economic Policy Making

- In the analysis of political economic policy-making processes, Thomas Oatley’s view says that all actions of a government are based on the national interest that must be protected in all its economic and political policies. Two approaches offered by Oatley in looking at the political economy policy taken by a country that is the approach of interests and the institutional approach [15]. An interest approach is an approach that prioritizes the objectives or policy objectives being made. An interest approach is an approach that prioritizes the policy objectives or objectives made based on the economic objectives of the actors involved, so that its involvement refers to the economic interests it contains. Usually interest groups are in line with the government if the government policy provides material benefits, such as the existence of foreign exchange (forex) market that profitable traders through the mechanism that has been running. But when it does harm, they become confrontations with the government. The rejection of bitcoin by Bank of Indonesia is the result of the rejection of some interest groups who feel harmed from the existence of bitcoin, because the bitcoin mechanism is not taxed on income.While the institutional approach is an approach that prioritizes the role of actors by using institutions to achieved their interests. Institutions are legally set the rules in taking the country’s economic policy, so that legally the institution has the authority to formulate, establish and enact various economic rules, the formulation is based on the implementation of several variables of national interests of the country. Various informations that bring advantages and disadvantages processed in various mechanisms that ultimately result in decisions through the existence of a binding policy. This frame of mind explains the policy-making behavior of policymakers in their rejection of the existence of bitcoin markets by referring to the legal rules based on the institutions that govern them, so that if the running mechanisms can not be controlled, they existence are denied. The political economy approach is always trying to maintain the form of institutions both regionally and globally openly in order to always create cooperation between actors and institution involved, so that some of the risks that occur can be overcome. These two approaches serve as a framework for research analysis to find answers to the problem of why the Indonesian Government through Indonesian Bank rejects the existence of bitcoin. Bitcoin present since 2009 by the Satoshi Nakamoto pseudonym is considered to be one of the financial revolutions by using peer-to-peer networks to fellow users of internet network media. This financial revolution is present in order to cut the cost of brokers in conventional trading transactions so that buying and selling tend to be cheaper because the transaction is directly. This block chain transactions is more difficult to forge because it tends to be safer in transaction ownership because it is not known by a third party due to bitcoin trading activity as a transaction activity of bitcoin sale based on price agreement of bitcoin member in website. Bitcoin networks run by miner bitcoin, the operators that verify the bitcoin decentralization network achieve a profit that runs automatically without requiring the services of banks or other authority agencies to regulate the amount of bitcoin turnover [4]. Bitcoin set a number of procedures related to the legal user, preventing double-spending by the same user (occurring the difference of nominal balance calculation), recording for each ongoing transaction and able to prevent the occurrence of changes in the ledger record made by the irresponsible party. But how does the Indonesian Government through Indonesian Bank view the existence of the bitcoin within the framework of the political economy policy?

3.3. Targets of Bank of Indonesia’s Interest in Bitcoin

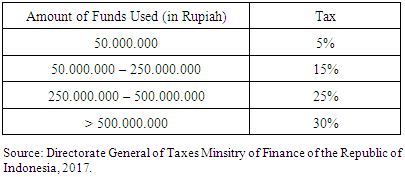

- Interest is the economic goal of the main actors in the political economy system (such as individuals, corporations, trade unions, pressure groups and governments using foreign policy to achieve their interests), making the state in determining its policy can look at the many interests – those interests. Interest groups will support their favorable government policies such as material gains and vice versa they can also oppose governments if they harm them, as interest groups who have enjoyed long-term benefits should face new interest groups. Forex traders or forex in Indonesia has been running forex trading or forex long enough and has reached maximum profit. There are hundreds of traders or brokers officially registered in Indonesia, such as the Commodity Futures Trading Supervisory Agency (in Indonesia called BAPPEBTI - Badan Pengawas Perdagangan Berjangka Komoditi). Traders and stock exchanges that have the legality of brokers and brokerage licenses are quite large in Indonesia amounting to about 200s, have the perception that to be able to become traders in Indonesia must have official permission, in order to create a good and transparent supervision system, especially the existence of trading protection secure. Because if not, then the crime traders become increasingly so that can cause money laundry. Traders as interest groups demand the protection of the country that conducts the trading because in every trading there are taxes and dues entered into the state treasury, so that the traders demand against Bank of Indonesia that any legal trading transactions conducted through the mechanism of the state as a third party who do report and control in transaction inter-traders.The rules of tax enforcement on trading under Indonesian Republic Law Number 36 of 2008 concerning Income Tax in Article 17 stipulates that there is a taxation regime on general income which stipulates that every transaction activity is taxable for the person as a taxpayer of a domestic individual (in Indonesia called Wajib Pajak Orang Pribadi – WP OP) so that every recorded transaction withdraws income from any transaction, including forex is a type of trade or transaction that trades the currency of another country.Table 1 explained that the implementation of trading in Indonesia which took place since 2008 resulted in taxes on traders up to 30% in accordance with the amount of funds used by traders, so traders make demands on the government for the mechanism of bitcoin due to the flow of funds that are not taxable.

|

|

3.4. The Policy Objectives of the Bank of Indonesia in Bitcoin

- Bank of Indonesia is an institution that establishes policy rules legally in taking an economic policy of the Republic of Indonesia. From establishing rules, they allow groups within their country and groups of countries within the international system to reach and execute decisions collectively through legitimate political institutions. Usually this institution has authority in formulating the political system of a country. Bank of Indonesian is granted the authority as a state financial organizing body as set forth in the Indonesian Republic Law Number 23 of 1999 [13] with the aim of maintaining the stability of legal international payment transactions in order to avoid monetary risk. The payment system mechanism is a system related to the transfer of funds from one party to another that involves various components of the payment instruments, clearing and settlement. In practice, the activities of the payment system as well as the providers supporting payment system services such as banks, financial institutions other than banks, and even individuals. The development of bitcoin in Indonesia implies the need for the government to take a firm stance in its obligation to maintain national interest in the form of rejection of the use of bitcoin as a means of payment due to the responsibility to protect its citizen from all forms of threat from illegal transactions that can cause money laundering and of course affect Indonesia’s national interest. Because bitcoin transactions do not go through the supervision of Bank of Indonesia, which will certainly raise the issue of national security, such as the flow of funds for illegal terrorist groups in Indonesia.The uncontrollable existence of bitcoins and the unreliable bitcoin fluctuations as a legitimate payment instrument for the state, under the Indonesian Republic Law Number 7 of 2011 on the legitimate currency provides an excuse for Bank of Indonesia to refuse bitcoin because bitcoin is not part of the Bank of Indonesia payment system and cannot encourage economic activity nationally, such as industrial economics, because the profit is only for traders only, which if left unchecked can lead to inflation. In addition, bitcoin is difficult to use as a medium of exchange because it does not have a system of units of calculation with other systems, so that bitcoin not integrated with the Bank of Indonesian system makes a high risk for its use due to non-fixed value.The flow of money entitled legally under its supervision must be through the Financial Services Authority (in Indonesia called Otoritas Jasa Keuangan – OJK), through the Center for Financial Transaction Reporting and Analysis (in Indonesia called Pusat Pelaporan dan Analisis Transaksi Keuangan – PPATK), the Trade Ministry and the Commodity Futures Trading Supervisory Agency (in Indonesia called Badan Pengawas Perdagangan Berjangka Komoditi – BAPPEBTI) as a legitimate body assisting the Bank of Indonesia in overseeing the circulation of money which enter or exit or in the form of non-cash payments circulating both within and outcisde the country.The basic concept of bitcoin is to create a decentralized authority transaction system because if through Bank of Indonesia it is centralized or if it is managed by a third party, Bank of Indonesia certainly performs its function as a supervisor, especially tight supervision of trader’s customer data, even though this system will not have high risk. While the trading system that occurs between traders is closed and only known by traders who are doing transactions. This transaction process is not through Bank of Indonesia but in a peer-to-peer mechanism and without central authority or agency to oversee transactions, so Bank of Indonesia has no authority and intervenes in bitcoin trading. Thus, the existence of bitcoin has been legally flawed in its circulation which does not pass through the mechanism of the national means of payment perfectly.

4. Conclusions

- Although bitcoin values continue to increase throughout 2017, Bank of Indonesia is actually educating citizens to deny the existence of bitcoin. There are two reasons for Bank of Indonesia’s rejection of the bitcoin community, first, the purpose of the trader’s interest as the party that must be taxed in every transaction, where the existence of legal traders give tax contribution which is beneficial for the national economic activity of Indonesia. Secondly, the objective of government agencies is to emphasize the rules that reject the existence of bitcoin due to national interest, such as maintaining the stability of international payments, avoidance of monetary due to closed trade that has risk of money laundry, for national security such as the flow of funds for terrorist groups due to the absence of direct supervision of state agencies in the form of the Financial Services Authority (OJK in Indonesia), through the Center for Financial Transaction Reporting and Analysis (PPATK in Indonesia), the Trade Ministry and the Commodity Futures Trading Supervisory Agency (BAPPEBTI in Indonesia), and the lack of support for the national economic activities.The hope of the rejection is the Indonesian economy remains stable from the presence of bitcoin which can harm the national economy of Indonesia, although Indonesia in the face of the rejection of the use of bitcoin still experiencing constraints such as the existence of communities that still use bitcoin in the means of payment due to the ease of technology and assume a certain gain others.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML