Method S. Simbachawene , Xiang Ju Li

School of Economics and Finance, Xian Jiaotong University, Xian, China

Correspondence to: Method S. Simbachawene , School of Economics and Finance, Xian Jiaotong University, Xian, China.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

We analyse the impact of mineral resource tax revenue in respect to economic growth (GDP) in Tanzania; the results reveal total taxes and royalties paid by large mining companies operated in Tanzania does not significantly contribute to the economic growth in term of GDP. The average total taxes revenue comprises 0.45% of the average country GDP from 1996 to 2016. Policymakers shall improve and strengthen mining tax systems through reforms on existing resource tax structure and establish a well-designed resource tax model that will capture economic rent significantly as well as ensure investors earn at least minimum returns on mining investment.

Keywords:

Resource tax, GDP, Economic growth, Ridge parameter

Cite this paper: Method S. Simbachawene , Xiang Ju Li , Does Ridge Coefficient Deliver Alpha? The Analysis of Mineral Resource Tax Performance in Tanzania, American Journal of Economics, Vol. 8 No. 2, 2018, pp. 76-82. doi: 10.5923/j.economics.20180802.02.

1. Introduction

Tanzania undergoes various economic reforms since independence for the purpose of achieving various economic objectives, in 1961 to 1967, major reforms focused on transformation and establishment of strong institutions to promote economic growth and increase the standard of living. Followed by numerals of reforms such as national economic survival program (NESP) in 1981, structure adjusted program (SAP) 1983-1985, economic recovery program (ERP1) 1986-1989, economic and social action program (ESAP) 1989-1992, enhance structural adjustment facility (ESAF) 1996-1999, Poverty Reduction and growth facility (PRGF 200-2002), etc. [15]. All these reforms were intended to improve country economic growth. The mining sector is among the sector which experienced major reforms during the 1990’s; these experiences include reforms on trade liberalisation and privatisation which intended to attracts an inflow of foreign direct investment in mining sectors. The reforms in Mining sector aligned with the legal framework and other supportive policies such as Tanzania mineral policy 1997, Tanzania Investment policy 1997, Mining Act 1998, as a results of these reforms Tanzania was ranked number three in gold production per tones extracted in Africa [11].Tax revenue reforms as part of these economic reforms which intended to boost mining sector performance, Since 1990's to date various tax reforms were carried on to create incentive and relief for the purpose of attracting and encouraging prospective investors to invest in the mining sector. These tax incentives include tax exemption, tax holiday, tax relief, zero or low tax rates, deduction allowances, capital allowances, etc. The main question comes, does all these government efforts in reforming mining sector and the existing of foreign direct investment aligned with Mwalimu Nyerere [12] ideology which belief natural resource should benefit or contribute significantly to the country’s economic development?.The first objective of this paper is to assess the contribution of resource tax revenue to the country economic growth in term of GDP. The second objective is to provide an opportunity for the policy makers to understand the impact of resources taxes in respect to existing mining tax policies. The third objective is to provide a recommendation for the area of improvement, and finally, findings contribute to the literature review. This paper consists six sections, brief literature reviews presented in section two, followed by the methodology of the study in section three, data and empirical analysis explained in section four, discussion of resource tax in section five and conclusion and policy recommendation provided in section six.

2. Brief Literature Review

One of the frequently question in mineral economics is how does taxation contribute to the economic growth; this question was analysed with some tax researchers; however, the country taxation systems, a collection of resources taxes and royalty rate varies across the nations. Many countries, especially in developing nations, are struggling to ensure that, the existing mineral resources policies benefit the country development, but the ability of the country to capture economic rent significantly depends on many factors, which include how well resource tax system designed to capture taxes and royalty. Some of the research studies analysed the country economic performance in relation to resource tax, oil and petroleum taxes, forest tax, etc. [9, 10, 17, 18]. Apart from Tanzania, other countries experience mining policies reforms since 1970’s for the purpose of attracting investors as well as balancing long-term interest such as comprehensive tax regulation covering mine rehabilitation, the benefit of the local community from mining operation and raising government revenue. If the government failed to address and tackle these fundamental interests, will results in loss of the government revenue and quality of life [14].The mining industry is one of the important economic sectors, which contribute to the economic development in many countries especially in developing countries [1], many developing nations characterised with huge deposits of minerals resources and oils, but countries lack understanding of managing these natural resources to generate economic prosperity [5]. Studies indicate countries with rich in natural resources such as mineral reserves and oil tends to grow slowly economically compared to those countries with less rich in resources [7]. However other studies indicate significantly contribution of the mining sector in the country economic growth, studies which examine the performance of mining industry in Ghana for the past 40 years, revealed the growth in mining revenue is a result of the strong correlation between price and production. Hence the existing economic policies in mining sector suggested existing mining policies should continue being implemented so as to promote and encourage investment in mining sector [13].Countries vary on mining policies in respect to the allocation of economic rent captured; other countries have policies that support investment policies by taking resource rent tax from mineral extraction and reinvested back to the nation to establish and promoting industrialisation in the manufacturing industry. [4] Nevertheless, other research findings link between mineral resource and curse, [2] examine the existence of resource curse or blessing at local and regional scale in Australia and found resources have blessed local economies but have experienced some adverse effects in some part of the country. Apart from benefit derived from mining economic activities but also there are some risks associated with extraction of natural resources, research studies reveal adverse effects and severe impact to the local communities and nation that may damage other economic development. Government and mining companies have to take full responsibilities of all challenges and negatives impact that may arise due to the mining operation. [6] Mining activities in Jordan caused severe social, health and environmental impact and failed to benefit the local community; the government advised to develop and change its policies and rules that will redistribute part of mining taxes or wealth to the local community, which will also help to offset the local cost of mining. [16], these findings are similar to [8] who found the existence of substantial poverty around the community and presence of conflicts between the mining companies and the local community in Tanzania. Additional efforts to ensure the natural resources benefit country development as Mwalimu Nyerere legacy belief, the current Hons. President J.P. Magufuli appointed two technical committees to examine a mining company regarding various mineral ore export disputes. Committee chaired by Professors Abdulakharim Mruma and Nehemia Ossoro; reports reveal several allegations include noncompliance with laws, tax revenue issues, a discrepancy of mineral concentrates records, etc. As the results of committee’s reports, In July 2017 the Tanzania Parliament approved three bills, which attract re-negotiation regarding a dispute as well as introducing new mining policy reforms on taxes and royalty. The royalty on diamond and gemstones increased from 5% to 6% while royalty for metallic minerals increased from 4% to 5%. The government acquired 16% non-dilutable free interest share with additional of up to 50% base on tax incentives granted to mining companies, no exportation of raw mineral resources, withholding tax of 5% on the sale of minerals by resident person and imposing 1% on mineral gross value as clearing fee for domestic use or export.

3. The Methodology of the Study

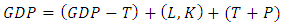

Taxes as the primary source of government revenue need considerable attention to ensure its efficiency and level of contribution to the economic development. The concept of assessing the impact of resource tax on economic growth derived from the GDP function under the expenditure approach. Following Saheed at al: 2014, the three-factor GDP function given by:- | (1) |

Whereby:-C - is the consumption, I -is the Investment, G -is the Government activitiesThe three three-factor explanatory variables expanded into the following:-Consumption is the disposable amount left after deducting taxation from taxable amount, the consumption function given by:- | (2) |

The production output depends on the level of investment; production is the function of labour and capital that generate output and given by:- | (3) |

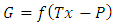

Government activities contribute to the economy through tax revenue (Tx) and public policies (P) implication, government function given by:- | (4) |

Substitute equation 2, 3 and 4 into the equation 1  | (5) |

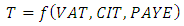

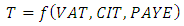

whereby tax is the function of Value Added Tax, Corporate Income Tax, Pay as You Earn, three variable tax function is given by:- | (6) |

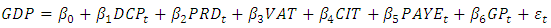

Substitute equation 6 into equation 5  | (7) |

Transform equation 7 into linear equation form  | (8) |

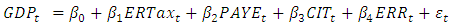

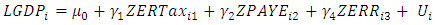

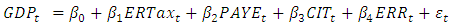

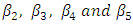

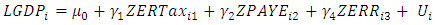

Restrict equation 8 into four explanatory variables to align with the objectives of this research, which is to conduct an empirical analysis of resource tax with the addition of three non-related taxes variables, and the value of production (PRD) transformed into production value added of mineral resources (ERR)The restricted least square regression estimates given by:-  | (9) |

Whereby:-  is the gross domestic product,

is the gross domestic product,  is a constant,

is a constant,  are the coefficient to be estimated, ERT is the of environmental resources tax, PAYE is the total country taxes of Pay As You Earn, CIT is the Corporate Income Tax paid by non-resources companies and ERR is the of value added from mining and quarrying, and

are the coefficient to be estimated, ERT is the of environmental resources tax, PAYE is the total country taxes of Pay As You Earn, CIT is the Corporate Income Tax paid by non-resources companies and ERR is the of value added from mining and quarrying, and  is the error term.The analysis begins with identifying data characteristics to ensure that all conditions met and results are correct and reliable.

is the error term.The analysis begins with identifying data characteristics to ensure that all conditions met and results are correct and reliable.

3.1. Research Hypothesis

The research question intends to find whether the resource taxes have significantly influenced the growth of the economy in term of GDP, Government received payment of resource tax in a different form such as taxes, royalties, fees and charges, etc. The research hypothesis intend to assess the impact of total taxes and total royalties paid by large mining companies in respect to the country GDP. The research questions:-  : Resource tax does not does not influence economic growth in term of GDP

: Resource tax does not does not influence economic growth in term of GDP  : Resource tax significantly influence economic growth in term of GDP

: Resource tax significantly influence economic growth in term of GDP

4. Data and Empirical Analysis

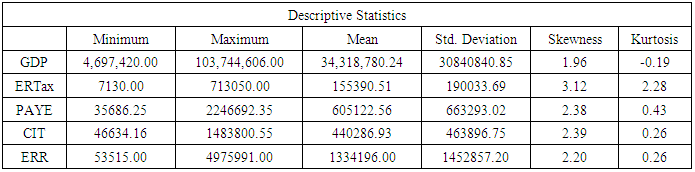

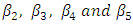

The analysis use resource tax (ERT) as the total amount of royalties and all taxes paid by large mining companies, data obtained from the annual report of Tanzania Mining Auditing Agency (TMAA). The gross domestic product (GDP), mining resource and quarrying (ERR) were obtained from Tanzania Bureau of Statistics, non-mining corporate income tax (CIT) and pay as you earn (PAYE) were obtained from Tanzania Revenue authority and data are in time series which cover period of 21 years from 1996 to 2016.Table 1. Summary of Data Descriptive Statistics

|

| |

|

Descriptive data statistics for independent variables indicate the mean value of resources tax (ERT) is 155,390.51, which is equal to 0.45% of the mean GDP. The mean value of other variables is 605,122.56 for pay as your earn (PAYE), corporate income tax of Non-resource companies is 440,286.93 and value added of resource mining is 1,334,196.00, which comprise to 1.76%, 1.28% and 3.89% of the mean GDP respectively.Table 2. Pearson Correlation

|

| |

|

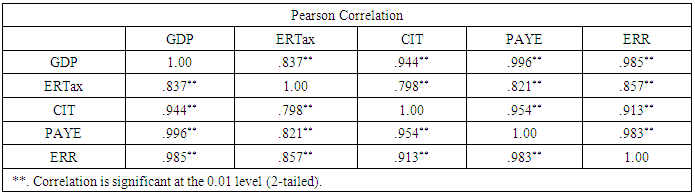

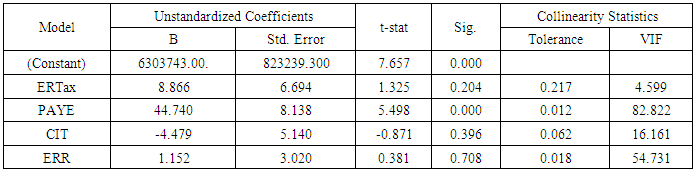

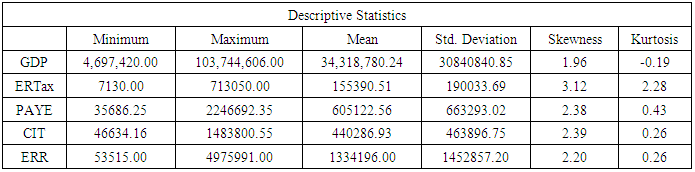

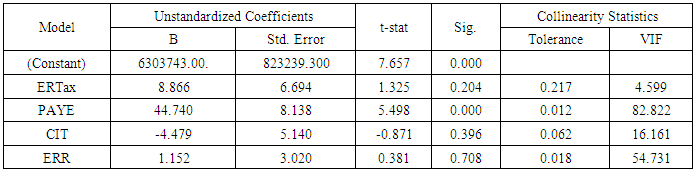

The correlation of the variables indicates there is very high correlation within the variables, which implies there is multicollinearity, which confirmed by a diagnosis of tolerance and VIF as indicated in table 3. Table 3. Statistics and Multicollinearity Diagnosis

|

| |

|

Multicollinearity analysis test indicated all explanatory variables except ERTax (VIF>10) and ERTax (T<0.2), the t statistics results indicate PAYE, is statistically significant (P value <0.05) while ERTax, CIT and ERR are not statistically significant (P Value >0.05), and R square is equal to 99.74%. These three results statistically confirmed data have multicollinearity problem.

4.1. Ridge Regression

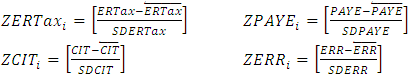

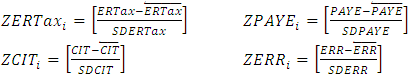

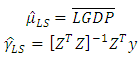

In dealing with multicollinearity problem, we drop CIT variable and transform the dependent variables into logarithm form, and in order to avoid multicollinearity problem, we employ ridge regression analysis. This is the better statistical technique for analysing data that suffer from multicollinearity, Arthur Hoerl first introduced the model in 1962 which improved the method by obtaining accurate results from least square estimates which are biased, and its variances are large that depart far from the true value. [3] Ridge regression analysis uses standardised variables, which allow compatibility in term of a unit of measurement, also reduce round-off errors, increase interpretability and enable to compare the regression coefficient of the different variables. [3]The Ridge regression analysis proceeds with restricted equation and transforms into the standardised least square equation of GDP into LGDP as follows:-.  | (10) |

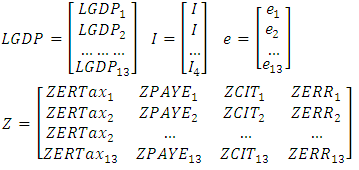

Whereby:- Following [3] equation 10 as standardised GDP function equation in matrix form given as:-

Following [3] equation 10 as standardised GDP function equation in matrix form given as:- | (11) |

Whereby:-  the value of

the value of  and

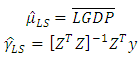

and  in a Least Square is given by:-

in a Least Square is given by:- In the ridge estimate, the value of

In the ridge estimate, the value of  is maintained and let value of

is maintained and let value of  the become:

the become:  | (12) |

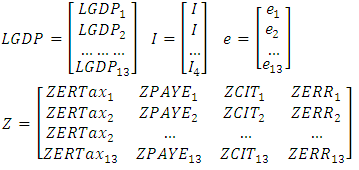

The "I" value represent Inverse Matrix, the script "T" represent Transpose Matrix an, the value of parameter "K” obtained from the following formula:- | (13) |

is the least square estimates from

is the least square estimates from  and

and  is the number of variables which is equal to equation 4 (ERT, CIT, PAYE and ERR).The Value of "K" determined by using ridge parameter by tracing it in the graph of Variance Inflation Factor (VIF) of LGDP and added back to the ridge estimates to obtain accurate and statistically reliable results. The Variance Inflation Factor (VIF) used to measure how closely independent variables related to other variables given by-

is the number of variables which is equal to equation 4 (ERT, CIT, PAYE and ERR).The Value of "K" determined by using ridge parameter by tracing it in the graph of Variance Inflation Factor (VIF) of LGDP and added back to the ridge estimates to obtain accurate and statistically reliable results. The Variance Inflation Factor (VIF) used to measure how closely independent variables related to other variables given by- | (14) |

The coefficient of  is considered to be serious and exactly multicollinearity when the value of

is considered to be serious and exactly multicollinearity when the value of  and the value of VIF is infinite

and the value of VIF is infinite  and it uncorrelated with other variables when

and it uncorrelated with other variables when  = 0 and

= 0 and  [3].The analysis employ the restricted equation with the fitted standardized ridge regression model with K (ridge parameter) equal to zero and equation 9 become:-

[3].The analysis employ the restricted equation with the fitted standardized ridge regression model with K (ridge parameter) equal to zero and equation 9 become:- | (15) |

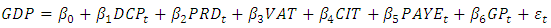

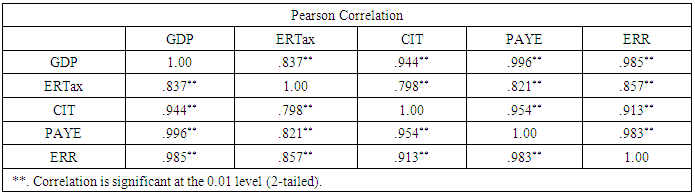

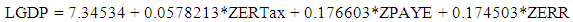

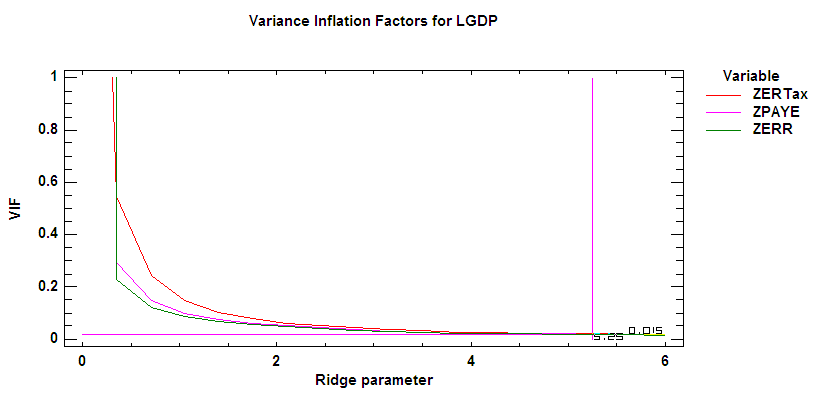

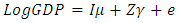

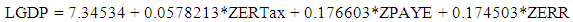

The current value of the ridge parameter (K) is 0.0, which is equivalent to ordinary least squares. In order to determine a good value for the ridge parameter, the Variance Inflation Factor of LGDP used to find the value of ridge parameter (K) through tracing the value into the graph (Figure 1) which range between 0 and 1. | Figure 1. Variance Inflation Factor for LGDP |

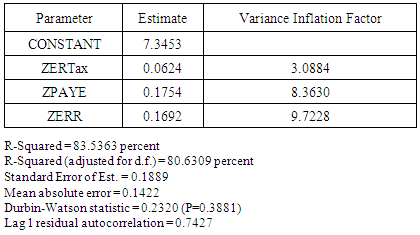

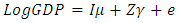

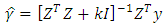

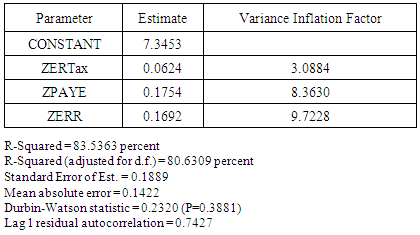

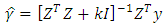

The variance Inflation Factor for LGDP traced ridge parameter value (K) and obtained 0.015 as shown on figure 1, the parameter is added to the ridge regression model and provide the following fitted output equation:-LGDP = 7.34534 + 0.0623804*ZERTax + 0.175414*ZPAYE + 0.169228*ZERRTable 4. Model Results for Ridge Parameter = 0.015

|

| |

|

The traced value of the ridge parameter is 0.015; the R-Squared statistic indicates that the model as fitted explains 83.54% of the variability in LGDP while adjusted R-Squared statistic is 80.63%, which is more suitable for comparing models with different numbers of independent variables. The standard error of the estimate shows the standard deviation of the residuals is 0.188863. The mean absolute error (MAE) of 0.14216 is the average value of the residuals. The Durbin-Watson (DW) statistic tests the residuals to determine if there is any significant correlation based on the order in which they occur in the data. Hence, with statistical evidence, we failed to reject the null hypothesis (P<0.05) that the resources tax does not significantly influence with economic growth in term of GDP. Further, the prediction model indicates that increase 1% of resource tax will increase Tanzania GDP by 0.062%; Increase 1% of taxes collection on PAYE will increase country GDP by 0.18%. In addition, an increase of 1% of ERR output tends to increase the country GDP by 0.17%, while other three variables when are equal to zero, the country GDP will remain at 7.3% constant.

5. Discussion of the Empirical Analysis of Resource Tax

Resource tax coefficient comprises very low per cent in term of country GDP growth prediction compared to other two tax variables, Tanzania is developing the country in which natural resource taxes expected to contribute significantly to the economic growth (GDP). The 0.062 coefficient convey signals that existing tax structure on resource tax is not sufficient to capture tax from resource extraction to increase country GDP, as the results, total tax revenue paid by large mining companies operating in Tanzania does not significantly contribute to the country GDP in term of direct taxes and royalty. Taxation records indicate corporate rate tax (CIT) for many years have not paid or paid little by large mining companies. In the year 2001 to 2004 no any large mining company paid corporate tax to the government, and from 2005 to 2009 minimal amount of tax was received by the government with a total minimum of Tshs 0.88 billion (400,000 USD) to a maximum of Tshs 3.21 billion (1.45 million USD). However, from 2010 to date, there is a slight increase in the payment of taxes by few companies, but still other companies do not pay corporate tax. All these large mining companies are foreign companies and privately owned, probably the existence of weakness in the tax systems such as too much tax exemptions and deductions allowable, which increase mining operating cost are among the causes of the government to lose corporate tax revenue. Also reports reveals other factors which contribute to less tax payment is delaying on government bodies to take action on unresolved queries' between mining companies and Tanzania Revenue Authority, Commissioner of mining and local government regarding various tax matters such as unpaid royalty, unpaid services levy, claimed unallowable deductions, etc. this contributes to less payment of tax to the government.

6. Conclusions and Policy Recommendations

The empirical analysis indicates that the large mining companies operated in Tanzania do not significantly contribute to the economic growth in term of GDP. The total taxes (corporate income tax, Royalty, PAYE, Withholding tax,) paid by large mining companies contribute to an average of 0.45% of average GDP from 1996 to 2015. This implies that without major continuous reforms on resource taxation, extraction of these minerals resources will not benefit a country significantly in term of GDP contribution. Tanzania is a developing country in which income from environmental resource tax expected to contribute significantly to country GDP. However, other variables such as corporate income tax and mining resource (mining and quarrying) are insignificant except pay as you earn (PAYE), which indicate significance to country GDP. With reference to the empirical results, the existing tax structure in the mining sector needs immediate reforms with the primary objective of improving the ability of the government to benefit from its natural resource economically and protecting environmental. These reforms on existing tax structure and tax treatment shall focus on the primary objectives of establishing mining taxation model that will increase the ability of the government to capture economic rent significantly as well as mining investors to earn at least minimum returns on investment. The government shall also consider reviews on mining taxation treatment; reduce the number of tax incentives or exemptions given to mining companies, considering establishment of accounting standards under Tanzania characteristics in respect to resource taxation which will reflect locals, national laws, economic condition, cultural, etc. and ensure compatibility with Tanzania environment to enhance fair tax treatment between government and mining companies. For example, transaction allowable for operating cost suggested to be reviewed and customised to establish limits, such as cost included reversing impairment loss on assets, capitalisation of development cost, etc. these allowable expenditures are huge and tends to increase operating cost and reduce the amount of profit before tax. An additional area, which needs limits or monitoring, includes minerals pricing system and financing cost.The new tax system shall improve and protect environmental resources, protecting local community, compensate environmental damage, fair tax treatment between government and investors, and a country shall benefit from resources economically. If no such benefit or non-existence of fair condition and treatment, the government may consider the closure or no new mining sites to protect natural resources for future generation.Apart from these findings, we also suggest further research on the impact of resource tax policy that will include all players in the mining sector as well as develop resource tax model that will enable investors to earn at least minimum returns and government to benefit on its natural resources economically. We also encounter some limitation of unavailability of data; however, did not significantly affect our findings.

References

| [1] | Arango S, Jaramillo P, Olaya Y, Smith R, Restrepo OJ, Saldarriaga-Isaza. (2017). Simulating mining policies in developing countries. Socio-Economic Planning Sciences, doi: 10.1016/j.seps.2017.04.002. |

| [2] | David A. Fleming and Thomas G. Measham (2015). Understanding the resource curse (or blessing) across national and regional scales: Theory, empirical challenges and an application. Australian Journal of Agricultural and Resource Economics, 59, 624–639. |

| [3] | David Birkes and Yadolah Dodge. (1993). Alternative Methods of Regression. John Wiley & Sons, Inc. |

| [4] | Dodo J. Thampapillai, Jan Hansen and Aigerim Bolat. (2014). Resource rent taxes and sustainable development: A Mongolian case study. Energy Policy 7, 169–179. |

| [5] | Fernando M. Aragón and Juan Pablo Rud. (2013). Natural Resources and Local Communities Evidence from a Peruvian Gold Mine. American Economic Journal: Economic Policy 5(2), 1–25. |

| [6] | Frank Winde, Doug Brugge, Andreas Nidecker and Urs Ruegg. (2017). Uranium for Africa- An overview on past and current mining activities: re-appraising associated risks. Journal of African Earth Sciences 129, 759-778. |

| [7] | Jefrey D. Sachs and Andrew M. Warner. (2001). Natural Resources and Economic Development The curse of natural resources. European Economic Review 45, 827-838. |

| [8] | Kitula, A. G. (2006). The environmental and socio-economic impacts of mining on local livelihoods in Tanzania: A case of Geita District. Journal of Cleaner Production 14:3-4, 14:3-4. |

| [9] | Ling Tang, Jiarui Shi, Lean Yu and Qin Bao. (2015). Economic and environmental influences of coal resource tax in China: A dynamic computable general equilibrium approach. Journal of Resources, Conservation and Recycling. |

| [10] | Michael Alexeev and Andrey Chernyavskiy. (2015). Taxation of natural resources and economic growth in Russia’s regions. Economic Systems. |

| [11] | Muhanga, M. (2016). Mining Sector Reforms in the Context of Fifty Years of Independence in Tanzania: A reflection of Mwalimu Nyerere’s legacy. Research on Humanities and Social Sciences Vol.6, No.21, ISSN (Paper) 2224-5766 ISSN (Online) 2225-0484 (Online). |

| [12] | Nyerere, J. K. (1968). Freedom and Development. Dar Es Salaam: Government Printers. |

| [13] | Obed Owusu, Ishmael Wirekob and Albert Kobina Mensahc. (2016). The performance of the mining sector in Ghana: A decomposition analysis of the relative contribution of price and output to revenue growth 50. Resources Policy, 214–223. |

| [14] | Philip Andrews-Speed and Christopher D. Rogers. (1999). Mining taxation issues for the future. Resources Policy 25, 221–227. |

| [15] | P. Haidari K.R. Amani, Samuel M. Wangwe, Dennis Rweyemamu, Rose Aiko and Godwill G. Wanga. (2004). Understanding Economic and Political Reform in Tanzania. Dar es Salaam: Economic and social Research Foundation (ESRF). |

| [16] | Rami Al Rawashdeh, Gary Campbell and Awwad Titi. (2015). The socio-economic impacts of mining on local communities: The case of Jordan. The Extractive Industries and Society, http://dx.doi.org/10.1016/j.exis.2016.02.001. |

| [17] | Sabah Abdullaha and Bruce Morley. (2014). Environmental taxes and economic growth: Evidence from panel causality tests. Energy Economics Volume 42 , Pages 27-33. |

| [18] | Zakaree S Saheed, J.A. Abarshi and Ibrahim S. Ejide. (2014). Impact of Petroleum Tax on Economic Growth in Nigeria (1970-2012). International Journal of Education and Research, 297-308. |

is the gross domestic product,

is the gross domestic product,  is a constant,

is a constant,  are the coefficient to be estimated, ERT is the of environmental resources tax, PAYE is the total country taxes of Pay As You Earn, CIT is the Corporate Income Tax paid by non-resources companies and ERR is the of value added from mining and quarrying, and

are the coefficient to be estimated, ERT is the of environmental resources tax, PAYE is the total country taxes of Pay As You Earn, CIT is the Corporate Income Tax paid by non-resources companies and ERR is the of value added from mining and quarrying, and  is the error term.The analysis begins with identifying data characteristics to ensure that all conditions met and results are correct and reliable.

is the error term.The analysis begins with identifying data characteristics to ensure that all conditions met and results are correct and reliable.  : Resource tax does not does not influence economic growth in term of GDP

: Resource tax does not does not influence economic growth in term of GDP  : Resource tax significantly influence economic growth in term of GDP

: Resource tax significantly influence economic growth in term of GDP

Following [3] equation 10 as standardised GDP function equation in matrix form given as:-

Following [3] equation 10 as standardised GDP function equation in matrix form given as:-

the value of

the value of  and

and  in a Least Square is given by:-

in a Least Square is given by:- In the ridge estimate, the value of

In the ridge estimate, the value of  is maintained and let value of

is maintained and let value of  the become:

the become:

is the least square estimates from

is the least square estimates from  and

and  is the number of variables which is equal to equation 4 (ERT, CIT, PAYE and ERR).The Value of "K" determined by using ridge parameter by tracing it in the graph of Variance Inflation Factor (VIF) of LGDP and added back to the ridge estimates to obtain accurate and statistically reliable results. The Variance Inflation Factor (VIF) used to measure how closely independent variables related to other variables given by-

is the number of variables which is equal to equation 4 (ERT, CIT, PAYE and ERR).The Value of "K" determined by using ridge parameter by tracing it in the graph of Variance Inflation Factor (VIF) of LGDP and added back to the ridge estimates to obtain accurate and statistically reliable results. The Variance Inflation Factor (VIF) used to measure how closely independent variables related to other variables given by-

is considered to be serious and exactly multicollinearity when the value of

is considered to be serious and exactly multicollinearity when the value of  and the value of VIF is infinite

and the value of VIF is infinite  and it uncorrelated with other variables when

and it uncorrelated with other variables when  = 0 and

= 0 and  [3].The analysis employ the restricted equation with the fitted standardized ridge regression model with K (ridge parameter) equal to zero and equation 9 become:-

[3].The analysis employ the restricted equation with the fitted standardized ridge regression model with K (ridge parameter) equal to zero and equation 9 become:-

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML