-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2018; 8(1): 18-22

doi:10.5923/j.economics.20180801.04

Role of Institutions in Affecting the Course of International Trade in Pakistan

Najaf Ali, Ye Mingque

School of Economics, Shanghai University, Shanghai, China

Correspondence to: Najaf Ali, School of Economics, Shanghai University, Shanghai, China.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Institutions got great consideration in 1990s as a significant factor that can affect the economic prosperity of countries. With the reason, that several countries with the same endowments and geographic characteristics, were experiencing different level of growth levels. International trade being important factor economic development is also affected by the institutions. This paper inspects the effect of different institutions of Pakistan like Business Freedom, Freedom from Corruption, Trade Freedom, Property Rights, and Monetary Freedom is tested on the international trade of Pakistan. For this purpose, Multiple Linear Regression Model is used. The study concludes that all the institutions have significant impact on the global trade of Pakistan.

Keywords: Institutions, Economic Freedom, Business Freedom, Freedom from Corruption, Trade Freedom, Property Rights, International Trade

Cite this paper: Najaf Ali, Ye Mingque, Role of Institutions in Affecting the Course of International Trade in Pakistan, American Journal of Economics, Vol. 8 No. 1, 2018, pp. 18-22. doi: 10.5923/j.economics.20180801.04.

Article Outline

1. Introduction

- All through during the last two centuries, emerging economies that were moderately growing in 1800 have experienced higher and speedy growths than those that were moderately poor. This growth design has brought about "dissimilarity, no doubt": that is, an enduring increment in the proportion of per head GDP in fast-growing economies contrasted with that of low-income countries [1]. In any case, this growth sample started changing from 1980, after that few of the fastest developing countries on the planet have equally been low-income countries. Consider isolates economies along with wage quintile in the light of 1980 for per head GDP, and setups consequent populace weighted growth rates. Development of the deprived quintile found the middle value of 4 percent for per head capita, while progress in the wealthiest quintile (for the most part OECD economies) was fewer than 2 percent. Weighting growth rates by national size is unmistakably essential here, on the grounds that this outcome depends principally on faster development in Asian nations that were huge and poor in 1980: Vietnam, China, India, and Bangladesh.This fastest development in deprived areas is a critical improvement on the world economic map. In view of it two long-haul patterns have arrived at the end, at any rate briefly, maybe for all time. To start with, since variations in the circulation of assets amongst people in the world have been driven basically by contrasts in growth rates amongst nations, the relentless ascent in worldwide disparity somewhere from 1800 to 1980 has transformed into a humble, albeit presumably not factually huge decay [2, 3]. Second the quantity of outrageous poor on the planet (living on under $1 every day at PPP) to crest around 1980, at an expected 1.4 billion. While the total population has developed by 1.6 billion, since 1980, the quantity of outrageous poor declined by 200 million. In 1980, the tremendous dominant part of the world's poor lived in the four Asian countries noted above, and that is the place in the main part of this destitution diminishing has happened.In 1990s the role of institutions came into the consideration of the economic researchers as to how different institutions of an economy can alter the course of different components of the economy. The role of institutions on the international trade has also been under consideration, as international trade is a major driving factor of economic growth.

1.1. Economic Freedom

- Economic Freedom can be described as "An aspect of human liberty that is concerned with the material autonomy of the individual in relation to the state and other organized groups. The highest form of economic freedom provides an absolute right of property ownership, fully realized freedoms of movement for labor, capital, and goods, and an absolute absence of coercion or constraint of economic liberty beyond the extent necessary for citizens to protect and maintain liberty itself”.Insightful research connecting economic freedom and trade is uncommon. Especially, Rose (2000), in researching the impacts of exchange rate instability and currency unions on international trade, finds a measurably critical relationship between trade among countries and economic freedom. Depken II & Sonora (2005) to find that the economic freedom of a nation positively affects the fares from the U.S. to that nation. Anderson & Marcouiller (2002) utilize an alternate arrangement of information assembled by the World Economic Forum and find that trade extends drastically when it is bolstered by solid institutions – particularly, by a lawful framework able to do authorizing business contracts and by straightforward and fair detailing and execution of government economic strategy.

2. Literature Review

- Economic development has been under the consideration of economists since long, consequently several fundamental questions emerged. Like; what are the reasons of sectoral asymmetries in the economies [7]? What are the institutional measures that promote human capital development and innovation, hence leading to the social and economic progress [8]? Why in some societies, rules and institutions play a positive role in enhancement of technological innovations, and in some societies they do not [9]? How has the demographic behavior influenced in a unified growth theory [10]? How the institutional emerged in the countries to promote and enhance the development, under socio-economic conflicts between the countries [11]?According to Douglass & Thomas (1973) private order institutions can be the substitute for the public order institutions, where the market will function freely. In the past, societies were expected to have lacked public order institutions, and their enforcement in economic activities. While some have accepted that view that the substitution between private order institutions and public order institutions may occur in the form of networks, guilds, communities, and private judges. Yet the role of civic order institutions remained significantly important in order to foster the economic and social progress [11]. A strong and wealthy government emerged as beneficial public order institutions, both economically and socially. This triggered the idea of power in the hands of parliament in Britain in 1688 onwards [13, 14].Acemoglu (2001) in his study found that developed and developing countries having two fundamental roots cause of the difference in social and economic growth levels. Geographic hypothesis is not very important for development, as there exists some correlation between Geo graphic growth and development but not show any causation, but institutional hypothesis showed great causation which changes the fortune of any economy.Acemoglu, Johnson, Robinson, & Thaicharoen (2003) studied that hair to more occupied institutions from colonial rules and facing high social and economic instability after World War 2. Twos Stage Least Squares method is applied to examine the role of institutions volatility and Macroeconomic policies result shows that economic crisis and volatility are cause of effect of institutions on economic output. Dollar & Kraay (2003) showed the role of institutions and trade on social and economic development, Better performance of institutions lead's to such situation where high level of growth exists. Institutions and trade used as the independent variables and GDP as dependent variable so above both independent variables have great influence on GDP.Berridge, Bootman, & Roderick (2003) explained that there exists difference between developed and developing countries on bases of average income. Institutions; international trade and geographically are three factors which determine the income level. However, according to this concept if any country wants to become developed then it must have three types of institutions which might be said as market stabilizing, market legitimizing and market regularity. Asfaw & Admassie (2004) inspects the performance of institutions in the improvement procedure of African economies; they highlighted the growing problems of African economies, according to them these developmental problems could be because of the weak institutional management and irresponsible behavior of their organizational system.Rohini & Udry (2005) worked on the relationship between development and institutions; it’s used microdata which showed a positive relationship between development and institutions. Cointegration result showed M2 and government expenditure has a negative impact on social economic development in the long run. Hussain, Adnan, Mohammad D. Sulaiman (2009) worked on the long-run relationship between M2 government expenditure and social development. Cointegration result showed M2 and government expenditure has a negative impact on social economic development can in Pakistan, where annual time series data is used from 1977 to 2007.Milgrom, North, & Weingast (1990) examined the expansion of international trade in the medieval as in the case of Champaign fair, and argued that it was made possible by private order courts, whereby the judges were private, and they used to keep the record of the traders. This resulted into a culture that the merchants used to ask the private judges regarding the reputation of the trader to which they are going to trade. Private judges convinced the merchants to avoid dealings with the traders whose reputation is not sufficiently good. These judges were also expected to impose fines and penalties to the traders for misconduct, and any violation of the agreed upon contracts. And if the traders would not pay the fines, they were to lose all the future opportunities of trade there. Even in the absence of enforcement of security or property rights and contracts by the State, private judges combined with the private order institutional arrangements, lead traders and merchants to fulfill the contracts [22].The role of public order institutions on economic and social development by socio-political institutions proved to be favorable in promoting growth. According to North, Wallis, & Weingast (2009) open access social order has fostered the economic development, while close access social order has hindered the same. Hence, difference between political and economic institutions which has triggered the economic growth, and those which slowed it down, emerged [24]. This resulted into the classification of the systems on the basis of precision of the constraints. This distinction of the institutions was based on the generalized and the specific institutions. The potential of this distinction is expressed in the pretext of institutional footings for economic and social development.At the same time, the quality of good governance significantly alters the course of economic development, as well as per capita income [25]. Moreover, there exist causality between the institutions and the income. It is revealed that there is two directions of causality between income and institutions. This hypothesis was tested by adopting different techniques; some has used the two-stage least square method [26]. Chong & Calderon (2000) has adopted a more rigorous approach, to estimate the causality between these two variables. They found that causation is in both directions. Meaning thereby, both institutional quality and the economic development can alter the course of each other significantly [27].

3. Data & Methodology

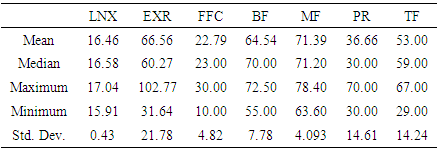

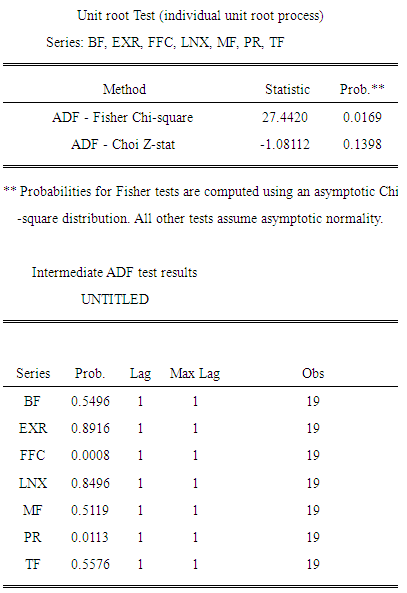

- In order to check the impact of institutional quality, the data on the Economic Freedom, is taken from the Heritage Foundation on different index, like EXR represents exchange rate, FFC is Freedom from Corruption, BF represents the Business Freedom, MF denoted as Monetary Freedom, PR is for Property Rights, and TF is for Trade Freedom. While LNX represents the natural log of the exports of Pakistan, which is taken from COMTRADE. The data is taken

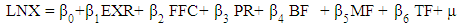

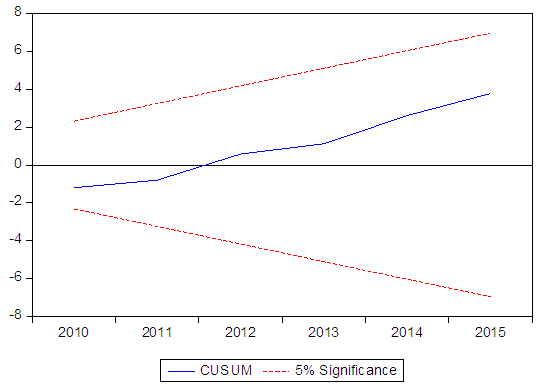

| (1) |

|

4. Results and Discussion

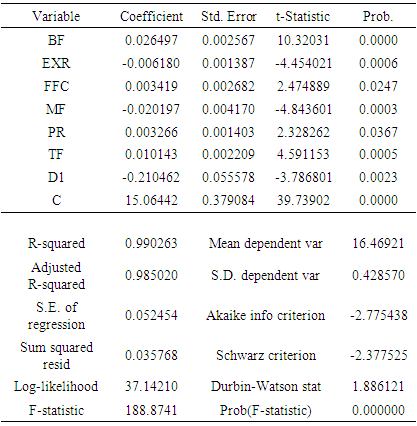

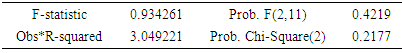

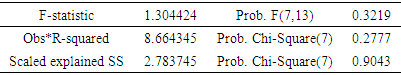

- The estimation results by employing Multiple Linear Regression Model are given under in Table 2. The estimation results given in the Table 2, show that Business Freedom, Freedom from Corruption, Property Rights, and Trade Freedom have significant positive impact on the international trade of Pakistan. While, monetary freedom and exchange rate have significant and negative impact on the international trade of Pakistan. R-squared shows the goodness of fit. F-stat shows that the model is overall significant. While the Durbin Watson stat is closer to two that implies that there is no autocorrelation in the residuals. Figure 1 below shows that the residuals of our model are normally distributed.

|

| Figure 1 |

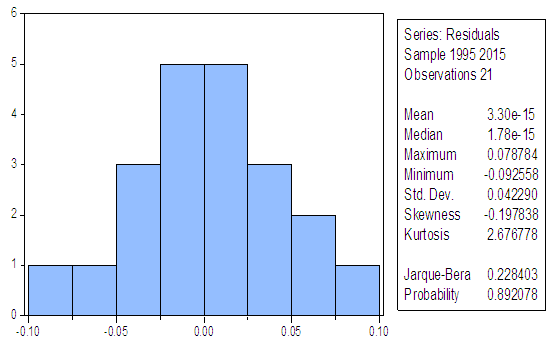

| Figure 2. CUSUM Stability Test |

|

|

5. Conclusions

- Institutions are important in affecting the course of international trade in Pakistan. The study concludes that both economic and political institutions have impact on International trade. Where Business Freedom, Trade Freedom, Property Rights and Freedom from Corruption have significant positive impact on the international trade. On the other hand exchange rate and monetary freedom have a negative impact on the exports of Pakistan. The study suggests that the property rights enforcement should be focused along with the business freedom to enhance the potential of gains from international trade. Moreover, exchange rate fluctuation should be controlled in order to have stability and long-term trade patterns.

Appendix 1

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML