-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2018; 8(1): 14-17

doi:10.5923/j.economics.20180801.03

Impact of Corruption on Public Debt: Evidence from Sub-Saharan African Countries

Njangang Ndieupa Henri

The Dschang School of Economics, University of Dschang, Cameroon

Correspondence to: Njangang Ndieupa Henri, The Dschang School of Economics, University of Dschang, Cameroon.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper investigates the impact of corruption on public debt on a panel of 29 Sub Saharan African countries for the period 2000 – 2015 using the system generalized method-of-moment (GMM) estimator. Whereas a large literature agrees on the damaging nature of corruption for any economy, few quantitative studies have explicitly test the effect of corruption on public debt. This study aims to address this gap in the literature by providing an empirical study on how corruption affect public debt in Sub-Saharan African countries. Results show that corruption has a positive effect on public debt in the sample countries. In policy terms, Sub-Saharan African countries must intensify the fight against corruption in order to make their public spending more efficient and especially to reduce the sovereign debt.

Keywords: Corruption, Public debt, GMM

Cite this paper: Njangang Ndieupa Henri, Impact of Corruption on Public Debt: Evidence from Sub-Saharan African Countries, American Journal of Economics, Vol. 8 No. 1, 2018, pp. 14-17. doi: 10.5923/j.economics.20180801.03.

Article Outline

1. Introduction

- Systemic corruption is becoming widespread. According to [1], out of the 176 countries covered by the report, 69% score below 50 and the majority of Sub-Saharan African countries are well below average. However, the consequences of corruption on the public debt are very unclear.The literature agrees on the damaging nature of corruption for any economy. Corruption has been shown to reduce economic growth [2-7], highlight poverty [8, 9], discourages foreign direct investment [10-12], limits capital productivity [13], reduces state income [14-15] and promotes tax evasion [16]. However, there exist no equal empirical supports for the likely adverse impact of corruption on public debt. Reference [17] analyzed the effect of corruption on the public debt from a sample of 126 countries over the period 1996-2012. By applying both OLS, fixed effects, GMMs and the instrumental variables method, they show that an increase in corruption increases the public debt. Reference [18] by applying the GMM method to a wide range of countries over the period 1995-2015, conclude that corruption increases public debt. [19] in the Spanish autonomous communities found that corruption was a significant determinant of public debt. [20] in the case of OECD countries found similar results.Our paper attempts to contribute to this recent literature by providing a first empirical study on how corruption affects public debt of Sub Saharan African countries. The results show that corruption increases public debt in Sub-Saharan African countries.The rest of this paper is organized as follows. Section 2 presents the data and the methodology. Section 3 summarizes the empirical results and section 4 concludes.

2. Data and Methodology

2.1. Data Description and Sources

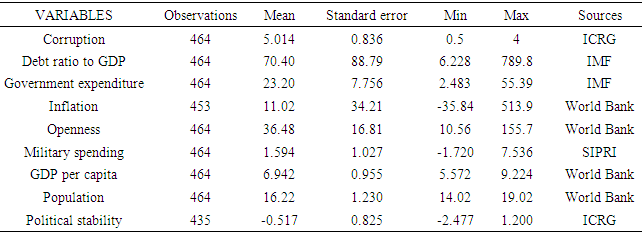

- For this study, we use a sample of 29 sub-Saharan African countries over the period 2000 - 2015. This period is selected based on the availability of data. The dependent variable in our study is the ratio of public debt to GDP, measured by the ratio of general government gross debt to GDP. This data is obtained from the World Economic Outlook (WEO) database of the International Monetary Fund (IMF).Our main independent variable is Corruption. We have used the International Country Risk Guide (ICRG) corruption index for our main analyses. The ICRG corruption index has been chosen for two principal advantages: firstly, The ICRG corruption index has the longest time period coverage (since 1984) and cover many African’s countries (36 countries). Secondly and according to [21], because the ICRG corruption index is not a composite index, its year-to-year comparison is more reliable than other indicator such as Transparency International and World Governance Indicators. The ICRG corruption index is from 0 (most corrupt countries) to 6 (least corrupt countries). The controls variables are selected in accordance with the previous literature [17-18], although it is not identical. Among these controls variables, we have Government expenditure as a percentage of GDP, population growth, inflation rate, openness measured as the sum of import and export as a percentage of GDP, military spending as a percentage of GDP, GDP per capita and political stability. Descriptive statistics and different data sources are presented in Table 1.

|

2.2. Specification of Model

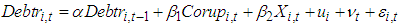

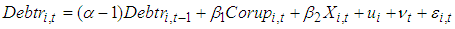

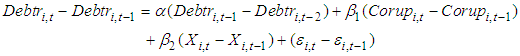

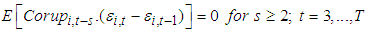

- The purpose of our empirical analysis is to examine the impact of corruption on public debt in Sub-Saharan Africa. To this end, we employ a specification that is broadly similar to others (e.g., [16-17]). By controlling the variables widely used in the literature, we formulate the following model

| (1) |

| (2) |

| (3) |

and

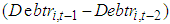

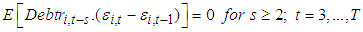

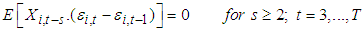

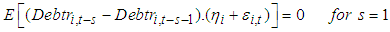

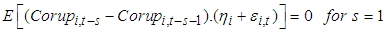

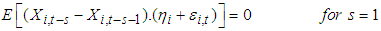

and  , [24] proposed that the lagged levels of the regressors are used as instruments. It is valid under the assumptions that the error term is not serially correlated and the lag of the explanatory variables are weakly exogenous. This strategy is known as Difference GMM estimation and the moment conditions can be listed as follows:

, [24] proposed that the lagged levels of the regressors are used as instruments. It is valid under the assumptions that the error term is not serially correlated and the lag of the explanatory variables are weakly exogenous. This strategy is known as Difference GMM estimation and the moment conditions can be listed as follows: | (4) |

| (5) |

| (6) |

| (7) |

| (8) |

| (9) |

3. Empirical Results and Discussion

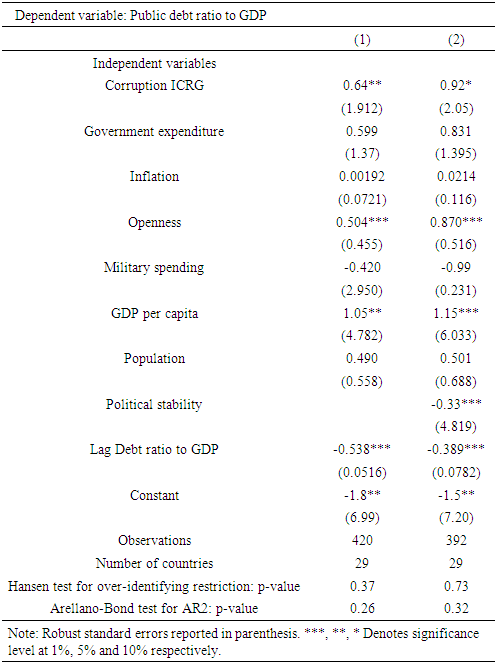

- The results of the system GMM are reported in Table 2. Columns (1) and (2) give us estimates of the impact of corruption (ICRG corruption) on the public debt.

|

4. Conclusions

- The main objective of this paper was to analyze the impact of corruption on public debt of 29 Sub-Saharan African countries during the period 2000 – 2015. Other variables such as, government expenditure, inflation, openness, GDP per capita, military spending, population and political stability were used as control variables. The results suggest that the corruption measured by the ICRG corruption index has a statistical and significant influence on public debt.Based on these findings, an important policy recommendation emerges. Several African countries have set up anti-corruption structures, but the results are still very mixed. Sub-Saharan African countries must therefore intensify the fight against corruption in order not only to make their public spending more efficient but especially to reduce the debt.In policy terms, Sub-Saharan African countries must intensify the fight against corruption in order to make their public spending more efficient and especially to reduce the sovereign debt.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML