-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(6): 292-300

doi:10.5923/j.economics.20170706.04

The Role of Government in Improving Competitiveness of Business: An Emerging Quest and Dissent for Bailouts in Uganda

Alex Nduhura, Benedict Mugerwa, Paul Wanume, John Paul Settumba, Henry Bagambe, Hannington Businge

Uganda Management Institute, Uganda

Correspondence to: Alex Nduhura, Uganda Management Institute, Uganda.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper describes bailouts as a contentious issue but rather critical element for improving competitiveness of business in Uganda. Existing research points reveals that bailouts on the large have not yielded expected returns. In some instances though bailouts have saved firms, employment and enabled firms to bounce back in national tax revenue base. Based on interviews, documentary reviews and monitoring of talk shows on television and radio, this paper concludes that bailouts are not bad a practice by governments but lack of an objective and systematic framework to guide the process of managing bailouts. The outcome of this study point to the need to develop a framework that would enable bailout to support business recovery and competitiveness. These findings of this study are relevant not only for Uganda but for countries with similar situations such as Syria, European Union(EU), Greece that are faced with challenge of firms that are exposed to receivership, filing for bankruptcy and liquidation amidst a lack of bailouts framework, increasing the role of government in improving business competitiveness.

Keywords: Bailouts, Competitiveness, Leverage bailout framework

Cite this paper: Alex Nduhura, Benedict Mugerwa, Paul Wanume, John Paul Settumba, Henry Bagambe, Hannington Businge, The Role of Government in Improving Competitiveness of Business: An Emerging Quest and Dissent for Bailouts in Uganda, American Journal of Economics, Vol. 7 No. 6, 2017, pp. 292-300. doi: 10.5923/j.economics.20170706.04.

Article Outline

1. Introduction

- Bailouts and competitiveness are inseparable in national development agenda. The justification behind such a phenomena is guided by the view that bailout are vital to sustain supply flows of essential services and products, critical for national growth and development. The strive for competitiveness continues to dominate national agenda. Amidst this trend, bailouts and competitiveness have become a disturbing but interesting phenomena as the rate of ailing businesses in Uganda continues to rise. The relationship between economic success of a country and her international competitiveness has is also seizing momentum than ever before (Ajitabn & Momaya, 2016:1). From policy implementers to the grass root of business concept development, the question of what makes business competitive dominates minds of policy makers, scholarly literature, business consultants, analysts and owners of business in cruise and start ups. Despite being promoted as a fallacy, the term competitiveness has and continues to dominate national agenda. Routed in the American financial crisis in the 1990’s, the concept of bailouts has become more popular. Porter (1995) tends to suggest that national competitiveness is about national prosperity which is not inherited but made. Based on this assertion, governments world over are seeking strategy to improve national competitiveness. Defining competitiveness has been associated with the state of a country in relation to others. In line with this perspective, Porter (2007) defines competitiveness as a country’s share of world markets for its products. In similar notion. Krugman (1994) argues that competitiveness is the ability of a country to export more than it imports. On a narrower level, (Krugman 1994) argues that a firms too can be competitive and notes that a firm is competitive if it’s able to pay corporation taxes, pay its workers, staff and bond holders. If the business fails to service the cited obligations, it’s argued that it will loose market position and go out of business. Quite interesting in the premise of competitiveness has been a relatively new concept ushered in the competitiveness framework of Uganda and the business community, bailouts. While bailouts have been proposed with quest, on the other hand, dissent exists.

2. Background

- Bailouts have dominated debate and media reviews of late. In line with growing local firm competitiveness, many thoughts have arisen on whether cash bailouts to a list of estimated 65 firms is worthwhile or not. The dissent is motivated by the assertion that beneficiaries of bailouts are usually politically connected and that their financial performance significantly worsens than among bailed-out firms, those that are politically connected exhibit than their none connected peers at the time of and following the bailout (Faccio, Masulis, & McConnell, 2006).Some views though quite diversionary while others unifying in some sorts keep coming (Mukungu, 2016). Some views have come along with critical thought that tends to propose a fix. However, views in the air have far provided a muddy terrain where narrowing to the right decision seems to be creating a journey to a destiny, where the brave don’t dare go.Such dilemma, has created continues complexity amongst politicians, publics and policy makers on next direction to take. Making the right choice appears to have become, a decision delayed and difficult from the circles of policy makers, tax payers, analysts, prospective firm beneficiaries. Amidst this dilemma are onlookers such as development partners who have chosen to remain silent as the government of Uganda (state) ponders to find the quick fix and right piece to complete the cash bail out puzzle game. It is therefore imperative that the discussion of cash bailouts and competitiveness of local business firms in Uganda continues. To provide a ground breaking answer to which way we go, we explore the concept of business competitiveness, the role of the state in supporting business survival and competitiveness, arguments for and against cash bailouts while providing guidance on the best fit in this puzzle.

3. The Origin

- Uganda has over years manifested impressive economic growth averaged at 5.5% (World Bank, 2014), and growth in tax revenue (URA, 2014). Alongside this trend Uganda has enjoyed celebration as the most enterprising country for some time but sadly, most new firms have not lived to witness celebration of their heritage (World Bank; 2013:3). Dramatic changes in Uganda’s business environment pause a threat to the country’s competitiveness at international, national and firm levels. Increased firm failure to repay bank loans, outcry for bailouts amidst protest from the an outburst of public protest in addition to shocks suffered by unprecedented civil war and unrest in South Sudan, scale of bad loans, threatens the competitiveness of business enterprise in Uganda. This situation justifies assertion that competitiveness is not inherited (Porter, 2001). With Uganda’s reliance on tax revenue to fund over 70% of its national budget (Republic of Uganda, 2016), the current trends are threatening! Defining the new journey of competitiveness appears never to remain the same. It requires new thinking and practice based on well researched thoughts that will guide new strategy and policy for both government and owners of capital on a mechanism to reboot not only national competitiveness but business competiveness. One of such strategy that is currently being considered is bailouts to ailing firms. To avert this trend, a study is undertaken to explore, the contextualization of competitiveness and emerging roles of government and owners of capital in improving national and business competitiveness.

3.1. Bailouts

- A bailout is a colloquial term for giving financial support to a company or country which faces serious financial difficulty or bankruptcy. A bailout is a form of state intervention into the economy with important redistributive effects Grossman & Woll, 2014; Coombs, 2009; Wall, 2010). Schneider & Tornell (2003) suggest that a bailout is a systematic guarantee given to lenders as a shield for a critical mass of borrowers’ defaults, (Sheinder & Tornell, 2003). Principally, a bailout refers to support provided by governments to prevent firms or individual businesses from collapsing.

4. Arguments for Bailouts

- Crises are inevitable (Das, 2012). Crisis tends to be felt more in financial and credit markets. Schneider & Tornwell (2005) also argue that bailouts happen only when there is a critical mass of defaults. As long as there are financial markets, there will be boom and bust cycles, (Das, 2012) ushering in moments of crisis. Government bailout is where a Government provides financial support to the State Owned Enterprises, state corporations or county Governments when facing financial difficulties or bankruptcy. Moments of economic crisis require that the state and companies engage in what may appear to be odd. The objective of odds is to enable nations and business thrive (Porter, 1985; Cerny, 1990; Cerny, 1997). Michael & Felix (2015) in a study of 548 banks that were bailed out under a troubled Asset Relief Program (TARP) in USA reveal that only 138 could not survive. This reveals that when a bailout is undertaken, 75.2% survival rate of business firms can be achieved. Economies that have progressed need to be supported by governments to avoid rescinding in turmoil that may be difficult to reboot. Continuous, monitoring of economic situation would help governments to sense economic fevers and offer timely prescriptions and bailouts. Failure would results into a who moved my cheese scenario (Johnson, Bracken, Lowenheim, Hamby, 2010).In advocating for bailouts, the Group of Seven (G7) suggests that bailouts protect the integrity of the international financial system. They argue that bailouts; help to protect investor from shocks beyond their control, provide safeguard jobs, helps to avoid the credit freeze while enabling funds to flow throughout the economy, protect economy from sliding into a recession and may enable firms to avoid toxic profits for instance firms may be able to sale their assets in future at a better price realizing better returns as the value may have risen enough to make a profit. This is in line with Gupta et,al (2012) that advocates cautiously for bailouts. Citing Keynesian theory and General Theory of Employment, Interest and Money, Gupta et,al (2012) argues that the state should boost economic growth and improve stability of the private sector (Onyango, 2016). Further assertion is made that micro actions of individuals and firms can result into aggregate macroeconomic outcomes in which the economy that can make the economy operate below its potential output (Anand, Gupta & Dash, 2012; Culpepper & Reinke, 2014). There is agreement in the Keynes Theory that presupposes that managing depression requires that governments to provide stimulus package through a reduction in interest rates and investment in infrastructure. In similar thought (Shahabian, 2011) argues that governments should always bail out ailing firms in order to protect the stability of economies by turning bailouts into government shareholding equity in bailed firms. Giannetti & Simonov (2013) argue that government recapitalisation results into positive abnormal returns for clients of recapitalised banks. In a review of bank state recapitalisations, findings revealed that recapitalised bank are able to extend more credit to clients and increase investements. Bailouts support job creation though jobs created may be slightly lower than comparable firms (Giannetti & Simonov, 2013). In Kenya, bailouts outs are synonymous with Kenya Airways and more recently troubled Kenyan regional retail chain stores brands (osendo, 2016).However, governments should explore maximizing their investments by boarding off their shareholding as soon as the firms turn back to profit (Debrah & Toroitich, 2005). This is aimed at protecting tax payer, (Shahabian, 2011).

5. Arguments against Bailouts

- Despite the views of proponents of bailouts, in Uganda bailouts and across the world bailouts have not been welcomed with ease. While others view bailouts as an unethical encroachment on an already constrained public purse, others view them as exploitation of the tax payer to reward political stewards. Koetter & Noth (2015) suggests still some bailouts do not achieve the business survival objective, citing that on average 25% of firms bailed out will not survive. Poole (2009) argue that bailouts distort risk assessments. In this line of thought, Gupta et,al (2012) reveals that on the defensive, the defendants argue that bailouts increase public debt, increase tax burden on tax payers, the real benefit is difficult to calculate, exposure of state sympathy to poor governance and limitation of sympathy to a small clique. While survival of business after bailouts remains at contravaersary, the cost of bailouts has in most times construed to be high and constraining to tax payers. Globally this is evident. In the United Kingdom, the United a Labour government injected $111 billion into two of its largest banks (Culpepper & Reinke, 2014). In the USA, bailouts to rescue ailing banks of upto $125 billion are a common phenomenon (Culpepper & Reinke, 2014). The costs of bailouts may at times extend to regional trading blocs to which a country in distress belongs. For instance to reboot Greece’s economy the European Commission had to extend over Euro 80billion and an extra Euro 30billion from International Monetary Fund (IMF) (Ardagana & Caselli, 2014). Caprio & Klingebiel (1996) show that the cost of bailing out a system can reach as high as 55% of GDP in developing countries. Despite the high costs associated with bailouts prolonging resolution can produce catastrophe (Montinola, 2003).In India, politically connected firms are significantly more likely to be bailed out than similar no connected firms (Faccio, Masulis, & McConnell, 2006).In Kenya, bailouts by 2008 had cost the state $600million to $1billion (Bandiera, Kumar & Pinto, 2008). In Uganda, bailouts have been ushered by the state. Elswhere, bailouts have been tabled in public domain. However, in Uganda the release of bailouts is planned silently and have often times been brought to the public notice by fractured but patriotic media houses. Bailouts in millions of dollars have been released to reboot businesses but have been grossly characterized by elite corruption and orchestrated by political emotions and ideology (Tangri & Mwenda, 2008).

6. Methodology

- The study adopted an exploratory design. The objective of the design was to navigate views across communities in answering the following questionsResearch questions; Q1: Do bailouts improve competitiveness of nations and business? Q2: What is the roles of the state and business in improving their taste of competitiveness? Q3: Are bailouts justifiable or not? Q4: What are the conditions for successful bailout programmes Q5: What are the alternative to bailouts?Population and sampling; The study purposively targeted 100 respondents that included candidates for bailouts (10) and respondents from the general public were 90. Members of the public included; discussants on popular radio and television talkshows, politicians, scholars on strategy and policy, business men and women, members of Uganda Debt network, bankers. Saturation was reached at 74 respondents.Data Management & Ethical ConsiderationsData CollectionInterviews: The open-ended interview technique, combined with the use of a neutral questioning technique to probe responses was adopted. This allowed respondents to share virtually any aspects of their situations or of the documents that were influencing their decisions, with no preconceived restrictions or expectations to limit their responses. Focus groups: We listened further to respondents to gain a contextual analysis on bailouts and their role in improving national competitiveness. This is in line with Ely (2005). Listening was guided by the works of Vandergrift (2007). The study monitored and listening to focus 4 focus groups on popular television stations with programmes that focused on bailouts. Focus groups comprised of at least 5 members. Listening to such nature of focus groups was further guided by the works of Kitzinger (1994).Documents review: The reviewed a range of documents that related with the research theme;National Media with wide circulation (ABC), the East African Newspaper, peer reviewed scholarly articles, Uganda’s Vision 2040, reports and national registry records. These sources were granted varying level of time to express their views and perceptions on bailouts and competitiveness of business. In retrieving insights on ongoing bailout spree, we reviewed scholarly and empirical literature (white papers) on bailouts in USA, United Kingdom and Asia. We further analyzed the list of registrar of companies in Uganda to understand if they are genuine. Responses from 75 responses are retrieved as saturation of data sets in with variability of data following similar trends. According to Guest, Bunce & Johnson (2006) this approach is appropriate. The content analytic technique provided an unobtrusive means of data description, based totally upon an inductive examination of the responses.Data AnalysisResponses from responses were recorded. Listening from television was transcribed and later combined with other data to form themes against common responses were analysed.

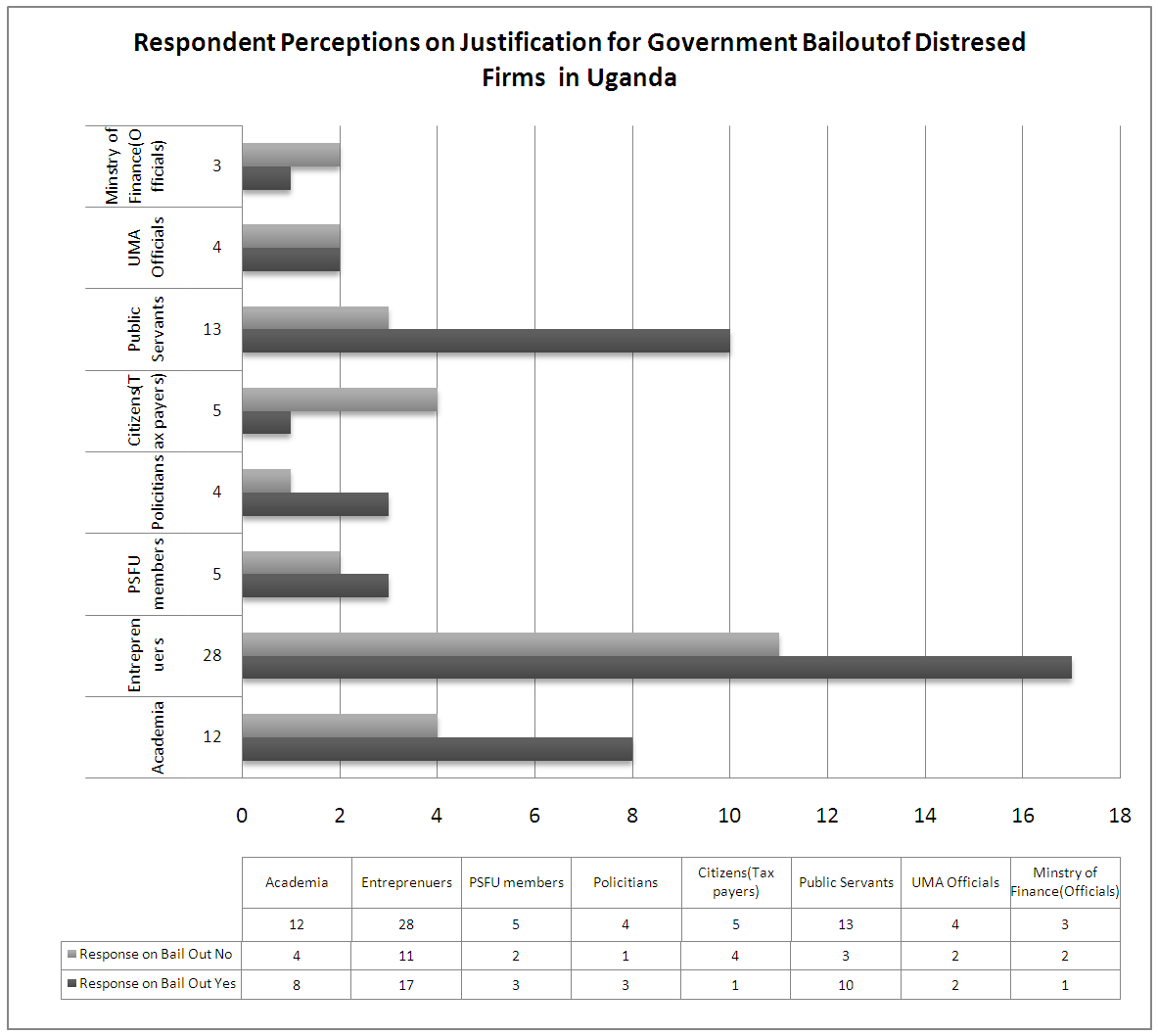

| Figure 1. All sources 3rd July 2016 to 13tt August 2016. [Note: Total N=100, S=75 (45) Yes (29) No] |

7. Findings and Discussions

- The study retrieved the following findings Theme 1: Definition of Competitiveness of a NationFindings reveal that a nation is considered to be competitive, if products produced can be competitively priced in country and in foreign markets (Porter et, al 1995). Owners of capital unlike analysts believe that a state is competitive if it is able to make businesses competitive. Reliable access to affordable & low interest credit, reliable electricity and engagement in policy formulation and review that defines as pillars necessary to drive competitiveness (Ajitabn & Momaya, 2016:2) & (World Competitiveness Report, 1989:2). A nation is competitive if its international competitiveness is felt at the industry level (WCR, 1989; 43). At industry level, exists firms or businesses that must be seen to be competitive they are able to produce products that provide better products than its competitors provide (Porter, 1995).Competitiveness at the sector level is often considered the result of the strategies and actions of firms that operate in that sector. The terms sector and industry are considered equivalent and used inter-changeably.Theme 2: Perspectives on Competitiveness of a BusinessThere is general consensus among respondents that a business is competitive if it is able to create and take to the market high quality and competitively priced products. However, a minor school of thought manifests with 20% of respondents alluding that a business is competitive if it is able to celebrate at least 5 of its birthdays.Theme 3: The Influence of Competitiveness of a Business & Impact on Competitiveness of a NationFindings that business firms enable competitiveness of nations through;• Produce quality products that match the tastes of both the local and international markets• Make revenue that contributes to GDP and growth in Per capita income which in turn attracts local economic development and foreign direct investment• Provide employment which help to reduce constraints on already constrained public service for example “Am able to pay for my medical bills, giving chance to the “needy of the needy” to take my share of what I would have utilized”. These views are shared by Krugman, 1994; Chauca, 2003 & Gupta et al, 2012; Poudel & Hovey, 2013; Sigdel & Koirala, 2015).Theme 4: Role of the State in Supporting Competitiveness of a BusinessRespondents on the large (61%) believe that the state needs to increase investment in critical sectors (transport, energy, and agriculture). Irrespective of initial opinion, 80% of respondents believe that a bailout to business is important but were skeptical on where the process of awarding the cash bailouts would be transparent and equitable. Sceptism also was skewed on whether the bailout money wouldn’t be used to pay debts other than invest to improve business health. A minority of respondents (20%) suggest that government must provide an interest cap on bank loan interest rates proposing central bank rate (CBR) up to plus 5 to 10% is ideal however, skeptiscm ensued on whether this wouldn’t scare away investors in the banking sector resulting into a credit squeeze that would then bring back the economy and business into distress. Careful percentages benchmarked from at least the East African region should be considered. Some respondents memory recapped how the war in South Sudan had impacted on business in Uganda and conclude that national stability is not enough in business and thus governments should play a key role in ensuring stability of foreign markets where their citizens trade. This view is shared in with (Porter 1998, Shahabian 2011 & Debrah & Toroitchi, 2005).Theme 5: Role of a Business in Supporting Own CompetitivenessThe findings reveal despite government support, businesses should be held responsible for poor performance and that the slogan “Gavumenti Etuyambe” a local Luganda language word meaning “the state should help us” must stop. Respondents revealed that firms should take up loans that they can afford to pay back. There was also a feeling that some loans are secured for business but diverted into accumulating personal wealth at the expense of business needs. Media reviews suggested that one affected businessman in the 65 had “secured a government loan of $2 million but had only invested $1million and that the state had resorted to taking over factory belonging to the businessman”. Some respondents (40%) reveal that business firms must monitor to detect any signs of distress at any time and take measures to restructure business operations to avoid early enough from being falling in a “ditch”. Krugman (1994) asserts that business must be able to strive for their own competitiveness. Furthermore, amidst competitive forces, Porter (1998) argues that firms must strive to develop strategy to secure own competitive edge.Theme 6: Can a Bailout Support National and Business CompetitivenessRespondents on the large, agree that efficient and effective business process, coupled with corporate governance structures staffed with professionals and clear terms of appointment of Board members is key to realizing the benefits of government or state bailouts. Eighty (80%) of respondents agree that cash bailouts enable firms to repay formerly hard to pay loans, enable product improvement. This in turn enables firms to pay staff creating employment, pay taxes which enables governments to secure tax revenue necessary for public investment in roads, healthcare and education, “perquisites’ for business and national competitiveness” However, there is skeptism that with lack of a bailout framework bailouts will not achieve their intended purpose. These line of thought is in agreement with Grossman & Woll, 2014; Porter, 2008; McGee, 2009) that believes that bailouts are need to prevent something worse from happening.Theme 7: Conditions for Successful Bail out SchemesOn whether bailouts can improve business and national competitiveness, 61% of respondents agree that bailouts despite their odds can help to improve national and business competitiveness. However, a set of conditions for bailouts is recommended in order for the state to retrieve a return on investment for bailouts. This is supported by the view that unless such conditions are set, bailouts are likely to be beneficial to some special interests at the expense of the general public (McGee, 2009). The conditions that are recommend for successful bailouts include;• Establish a legal framework ratified by parliament. A review of media revealed a remark from a member of Uganda’s Public Accounts Committee who also doubles as a member of Parliament that remarked “a bailout requires making a charge on the consolidated fund and such action cannot be done arbitrarily without Parliament’s sanction”.• Investigate tax compliance by proposed bail out candidates “I think bailouts are financed by tax payers money. There is need to explore of the bailout candidate are up to date with tax compliance”.• Create a framework for managing conflict of interest.” Politicians are likely to bail out firms that supported the incumbent government. For example “about 3 companies on the list of 65 contributed millions of shillings towards the current government elections recently.’• Set up a well-defined criteria for bailouts with the following; recruitment criteria, selection criteria, apportionment of bailout with scientific formula based on past performance, assets and liabilities, proposed management initiatives, base case, worst case and best case scenarios. “Personally, I think there are many more deserving companies that out there in the market, have not made it to the shortlist of 65 since maybe they are not well connected”.• Ensure that corporate governance structures are in place. A scholar remarked, “One of the companies cited is a sole proprietorship without a Board of Directors as required by Companies Act and government should not risk investing in a company where one man steals the show”.• Recovery mechanism for the cash bailout. One respondent remarked that ,”the bailout yield will not be felt if the money is not treated as a loan with a clear repayment plan like it was in the case of General Motors in the USA.• Performance monitoring of bailout progress. Respondents feel that tracking progress of business improvement is important to ensure sustainable bailout.• Receivers should be appointed to oversee the process of recovery of firms bailed out by the state. The auditor general should audit bail out firms and publish reports in the national newspapers of wide circulation but operationally, monthly performance reports should be provided to Accountant General of government.• Bailed out firms should repay bail out funds. The timing or repayment period should start immediately when bailed out firms have bounced back to profit.• From the time of bouncing back to profitability, the bailed out firms should commence on repayment of state bailout loan for a period to 10 years at Central Bank Rate (CBR).Theme 8: Alternatives for BailoutsFindings reveal that despite bailouts may at times be costly to the state. The study findings reveal some alternatives to bailouts • Business restructuring. Respondents argue that this will require negotiating restructuring of debt whereby distressed business owners can with the help of government negotiate delayed payments for debt provided to distressed banks. Others suggest that review of operations is likely to help business owners with opportunity to identify waste and unnecessary business expenditures impacting on distress, which can them be eliminated. Internal controls are also suggested in the restructuring process.• Sale off of non-performing assets. Sixty percent (60%) of respondents argue that struggling firms need to board off equity to retrieve necessary cash for operations. “One of the 65 should sale off his luxurious estate and pay off his own loans other than making tax payers pay his loan at the expense of their effort while he stays on the large living a life of luxury” This line with TARP bailouts scheme in USA that required that bailout candidates eliminate hefty bonuses for top executives.

8. Lessons from International Experience

- Bailouts can help industry and nation’s improve their competitiveness and reduce exposure to recession. Bordo & Schwartz (2000), shares in this argument. Based on USA experience, the bailout of General Motors (GM) and American Insurance Guarantee (AIG) bailouts can help businesses and nations to recovery. From the edge of bankruptcy, the bailout has enabled GM to return to profit, contributing to USA tax revenue. For instance for years 2013 to 2015 GM has paid tax in excess of USD4,252,000.In the Nepal, it is argued that involving the private sector in rescue packages can a times be tricky (arm-twisted investors will pull their money out elsewhere), but it needs to be attempted, Jeffrey (1999:2). Reflecting on an IMF program on bailout of private sector firms, it is argued by Jeffrey (1999) the country and businesses were able to recover after two years, and attained its pre-crisis level of production. This is just the length of time it took Mexico after December 1994. Ravi & Martin (2013) advise that the success of a bailout programme will be influenced by setup of prudent corporate governance structures among bailout recipients.In East Asia, strict legal and regulatory environment is perceived to be critical in reducing economic distress, Ulrich (2012:19). Further the idea that recapitalization of distressed firms can save the economy from sinking in deeper trouble is mooted but requires a well-designed programme (Ulrich, 2012:19). There is some disparity in though that suggests that economic distress needs to be solved by seeking external support from lending agencies, Jeff (1998).Filing for bankruptcy should also be viewed as an alternative (Skeel, 2013).

9. Conclusions

- A synthesis of views suggests that bailouts can reboot an ailing business community and national competitiveness. There is in consensus with Keynes theory of Employment, Interest and Money, Krugman, 1994; Gupta, 2014; and Porter, 2008, there is evidence that a bailout of companies supports business and national competitiveness. Evidences from the aftermath of firms like General motors (USA) American Insurance Guarantee (AIG), banks in Europe and Asia ratify this claim. Despite the gap in failure to provide a framework for successful implementation of bail out schemes by traditional promoters of competitiveness, findings from the study suggest a basis from which a framework can be developed. In deriving competitiveness at business and national level both firms and the government have roles to play. It is evident that a bailouts are a mere parachute for business and national competitiveness and other strategic interventions may be explored as alternatives at national and within business operations.

10. Implications for Policy Making and Review

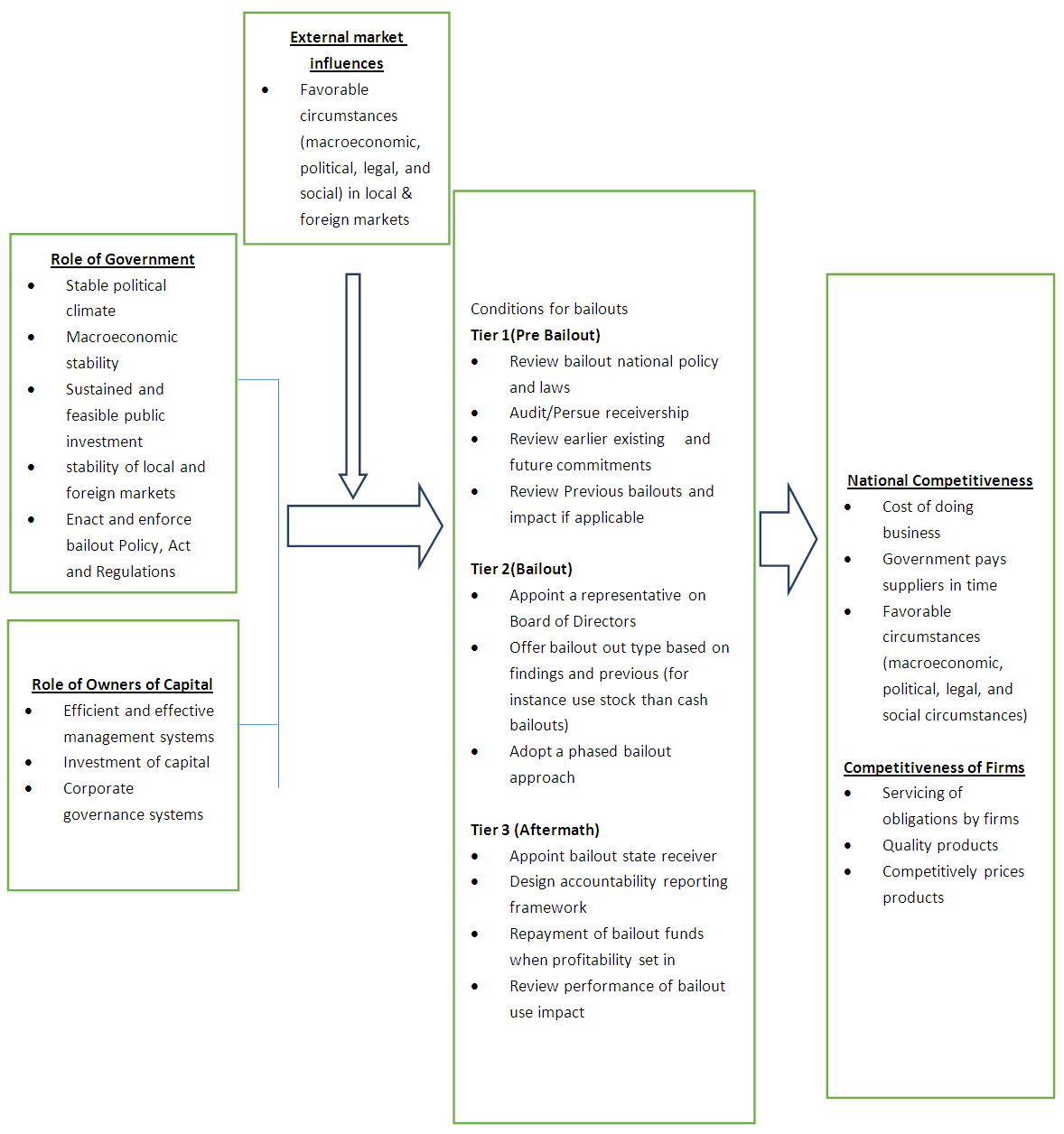

- Based on the findings from the discussion, it is evident that bailouts can be adopted to reboot business and national competitiveness. Bailouts can deliver positive impact on competitiveness by enabling firms to pay debts leading to reduced exposure to credit squeeze, prevent employment from being lost, enable companies to invest in quality and competitively priced products and can broadly help national economy from sinking into a depression. However, it is also evident that the path to implement bailouts in Uganda is unclear. It is against this background that, the following recommendations are derived.A legal or policy instrument providing procedures for bailout situations in should be considered. Key issues that may be reflect in include; set principles for guiding bailout systems, criteria for identifying applicants from the market, criteria for selection of bailout candidate-employment creation, compliance with tax, contribution to corporate social responsibility, recovery mechanism, scope of bailout , audited financial accounts among other factors.Critical analysis of financial of candidates for bailouts. This requires the appointment of an external competent certified auditor to validate a case for a need for a bailout. Other roles such as that provided for an appointed receiver should be considered.Firms should be able to submit a recovery plan with deliverables tied to timescales before a bailout can be accepted. The recovery plan should include; putting in place corporate governance structures, value chain analysis audit. The recovery plan should be presented with a business case to a select committee of Parliament preferable the budget committee given the financial implications associated with bailouts. Establish monitoring bailout recovery plan. To retrieve a return on investment on bailouts, there is need to consider develop and agree on a monitoring and evaluation framework between the government as a bailer and bailee (rescued company). Aspects that need to be monitored include; financial performance, human resource ceiling and performance, shareholding to ensure that it’s stable throughout the bailout recovery period to avoid withdrawing the benefit that the bailout seeks to recover.Conclusively, we propose a framework that guides future implications for future discussion, policy, laws, regulations practice and research on bailouts and competitiveness.The framework suggests that competitiveness of nations can be influenced by the role of government and owners of capital. In this context, the framework reveals that bailouts, act as a function among other factors that influence competitiveness ta national and business level. An in-depth analysis of the framework suggests that the role of government and owners of capital will be influenced by external market influences in a foreign market where local firms sale and market their products.

| Figure 2. Leverage Framework for Bailouts (2017) |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML