Ubesie Madubuko Cyril, Ananwude Amalachukwu Chijindu, Esomchi Juliet Nnenna, Onyia Florence Ifeoma

Department of Accountancy, Enugu State University of Science and Technology, Enugu, Enugu, Nigeria

Correspondence to: Ubesie Madubuko Cyril, Department of Accountancy, Enugu State University of Science and Technology, Enugu, Enugu, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

This study ascertains the effect of private sector credit on development of small and medium scale enterprises in Nigeria. To realize this objective, a hypothetical deductive research design was applied using time series data sourced from Central Bank of Nigeria statistical bulletins from 1986 to 2015. Prior to estimating the model, sensitivity analysis of serial correlation LM, heteroskedasticity, Ramsey rest specification and multicollinearity tests were performed. The result of the Auto-Regressive Distributive Lag (ARDL) evidence the presence of a long run relationship between private sector credit and small and medium scale enterprises development. In terms of the effect analysis, the granger causality test unveils that private sector credit has significant effect on development of small and medium scale enterprises, while real exchange rate was found to significantly affect small and medium scale enterprises development. There is need for financial institutions to continue extending credit to the private sector at affordable cost. Although, most financial institutions operate with the aim of making profits, it is worthy for management to have it at the back of their hearts that the development and growth of Nigeria is for the good of all. The Central Bank of Nigeria should through monetary policy assuage an exchange rate system that will reduce volatility in exchange rate of Naira against other currencies to motivate SMEs to expand production owing to the income they will earn if the exchange is stable.

Keywords:

Private sector credit, SMEs development, Real exchange rate

Cite this paper: Ubesie Madubuko Cyril, Ananwude Amalachukwu Chijindu, Esomchi Juliet Nnenna, Onyia Florence Ifeoma, Private Sector Credit and Small and Medium Scale Enterprises Development Nexus in Nigeria: An ARDL Approach, American Journal of Economics, Vol. 7 No. 5, 2017, pp. 263-270. doi: 10.5923/j.economics.20170705.08.

1. Introduction

The development of Small and Medium Scale Enterprises (SMEs) is pivotal for growth and development of an economy owing to its great potential to generating employment. Credit is one of the most important factors challenging the survival and growth of SMEs in both developed and developing countries [19]. The economic benefit of SMEs activities in Nigeria are hardly felt as they are faced with a lot of challenges: liquidity constraints (short term finance offered by deposit money banks at high interest rate), lack of managerial skills, high labour and operational cost, among others amidst frequent fluctuation in macroeconomic environment. Notwithstanding these characteristics of the small and medium scale enterprises in Nigeria, these enterprises are highly important to the extent that they are expected among others, to provide the avenue for the birth and growth of indigenous entrepreneurs [16], serve as a conduit for the mobilisation of savings into the real sector of the economy and being labour-intensive, provide jobs for the unemployed. [7] does not only see small and medium scale enterprises as an incubator of economic growth but also as contributing substantially to gross domestic product (GDP), export earnings and employment opportunities. For SMEs to contribute meaningfully to the economic development in Nigeria, the maturity pattern of their loans should be on a long term nature rather than of short term period hence, bank loans can better strengthen the productivity of SMEs and their overall contribution to the economy in terms of increasing employment creation and social welfare, if they can get these loans on a long-term basis otherwise, it will have an adverse effect on the economy as there will be limited capacity to invest, restricted productivity, inhibited incomes, escalate unemployment and domestic savings remain low [17]. In Nigeria, the governments at various levels have formed different policy incentives aimed at boosting the performance of small businesses in order to reduce the level of poverty and enhance economic development [2]. Accordingly, the Nigerian governments acting alone and sometimes in concert with international agencies had formulated and implemented policies and programmes that centre on finance, training and the provision of infrastructure for the SMEs. Apart from their potential for ensuring a self-reliant industrialization, in terms of ability to rely largely on local raw materials, small and medium scale enterprises are also in a better position to boost employed raw materials. Small and medium scale enterprises are also in a better position to boost employment, guarantee a more even distribution of industrial development in the country, including the rural areas, and facilitate the growth of non-oil exports.It is strongly believed that one of the major contents of 2005 Nigerian banking sector consolidation was to make Nigerian banks expand their branch networks and mobilize more funds to lend to small and medium scale enterprises and of course, other deserving sectors of the economy [6]. It follows that consolidated Nigerian banks would be able to extend or give more credit to small and medium scale enterprises and with more funds; small and medium scale enterprises could function maximally, expand and grow in every ramification. The issue at stake is how to deal with contradictory and conflicting reports or findings of previous researchers. On one side of the coin, bank managers claim that consolidation increased credit size to small and medium scale enterprises, owners of small and medium scale enterprises hold that consolidation did not increase their credit size or base and thereby failed to solve their financial problems, while on the other hand, consolidated banks rather than financing small and medium scale enterprises resorted to bigger ticket otherwise bigger firms financing [9]. However, it does not follow the expectation that the stronger and reliable a bank, the more the tendency to lending to small and medium scale enterprises. It is the aim of this study to ascertain significantly the effect of private sector credit on SMEs development in Nigeria.[1, 3-5, 20] utilized various econometric tools in an attempt to empirically assess the linkage between private sector credit and small and medium scale development in Nigeria. This study contributes to knowledge by using a broader time series data from 1981 to 2015 as against [1] from 1980 – 2010; [3] from 1992 – 2011; [4] from 1993 – 2012; [5] from 1985 – 2010 and [20] from 1981 to 2013. Secondly, Nigeria is a developing country with record of high inflationary tendency, hence we control the plausible effect of inflation on the purchasing power of money which is lacking in the studies of [3, 4, 20]. Thirdly, in determining the long run nexus between private sector credit and SMEs development, Johansen co-integration technique was the statistical tool employed (see the works of [3, 4, 20]) but this study deviated by applying the ARDL methodology which takes into consideration the different order of integration of financial time series data.

2. Review of Related Literature

2.1. Conceptual Clarification

There are divergence views by scholars on the exact meaning of SMEs but, all acknowledged its growth capacity, while different opinion arises on assets base, operating capital and labour force. The Federal Government of Nigeria in its N200b credit guarantee scheme, defined SME’s as an enterprise that has asset base (excluding land) of between $3, 326 and $3, 326, 724 (based on the exchange rate of the local currency against the US dollar as at the time of the enactment by the Central Bank of Nigeria) and labour force of between 11 and 300. [10] defined SMEs in relation to employment. He classified an organization with 1 to 10 employees as micro/cottage industry, 11 to 100 workers as small scale industry and medium scale industry from 101 to 300 workers and considered above 300 workers as large scale. He further noted that in Japan, any Industry with up to $976, 944 (based on the exchange rate of the Japanese Yen against the US dollar at the 1999 when the Japanese SME basic act was revisited) and less than 299 workers should be classified under small and medium scale enterprises. [14] sees SMES as business enterprises whose total costs excluding land is not more than $1, 343, 362 (based on the exchange rate of the local currency against the US dollar as at the time of the promulgation). Central Bank of Nigeria in its monetary policies circular No. 22 of 1988 views small scale industries as those enterprises which have annual turnover not exceeding $110, 212 (based on prevailing exchange rate of the local currency against the US dollar) [6]. Similarly in 1990 the Federal Government of Nigeria defined small and medium scale enterprises for the purpose of deposit money bank loans as those enterprises whose annual turnover does not exceed 500,000 thousand naira and for merchant bank loan those enterprises with capital investment not exceeding 2 million naira (excluding the cost of land) or a minimum of 5 million naira. [14b] contends that in the wake of SFEM, and SAP era in 1993, this value has now been reviewed and subsequently, increased to five million naira. Since this happened, there may be a need to classify the small and medium scale industry into micro and super-micro business, with a view to providing adequate incentives and protection for the former. This is to say that, even though SMEs is definable with much or less the same indicator (No of employees, rate of turnover, etc) the indicators are not the same in all countries all the time. In other words while number of employee and rate of turnover are the indicator, the number of employee and total amount of turn over for defining SMEs in different countries are certainly not the same. For instance, the employee requirements in Britain is 200, with 2million pound turnover, the same cannot be said of Japan with 100million Japanese yen as paid up capital and 300 paid employees. While in Nigeria, the paid employees are usually not considered important, but more importantly is the turnover of 500,000 especially for the purpose of Deposit money and Mortgage bank loans [8].[15] argue that finance is a major constraint to small and medium scale enterprises. This observation is in agreement with the stand of World Bank (2001) that almost 50% of micro, 30% and 37% of the small and medium scale enterprises, firms are financially constrained in Nigeria as opposed to 25% of the large firm’s constraint. In agreement with the said constraint, [9] states that the major reasons for the small and medium scale enterprises financial inaccessibility or constraint is the stringent conditions attached to loans and credit approvals by bank in Nigeria. In Nigeria, funds for financing small businesses can be sourced from personal savings, loans and grants from relatives/friends, business associates. These sources have little or no legal formalities, frequently not enough and also leading to ambiguous terms and conditions which might even affect a firm’s strength. It is true, Nigerian banking industry (commercial, agricultural and investment banks) muster funds from government and international institutional financing agencies like World Bank, using Central Bank of Nigeria (CBN) as an arrow head. Such funds are geared towards development and establishment of small firms. Most often the funds are available to SMEs through equity participation and venture capital activities. Availability and accessibility of funds like this were spelt out in section 21 of the Banks and other financial institutions Act of 1991. SME principals may not like to share control of their businesses, and most likely would like to resist outside control/intervention. As a result, they may be reluctant to apply for such loans. In addition, most SME principals perceive such funding as misdirected because the real needy target group hardly ever receives them. Indeed, there is a strong contention that funds disbursed are given not based on merit or need but rather on favouritism [12].

2.2. Theoretical Foundation

Following the loan pricing theory of Thompson Reuters in 1965, [18] opine that bank should consider the problems of adverse selection and moral hazard since it is difficult to forecast the borrower type at the start of the banking relationship. From this reasoning, it is usual that in some cases the interest rate set by banks is not commensurate with the risk of the borrowers. From the finance-economic growth nexus perspective, financial intermediation functions of the banking system would in no small measure in development of the SMEs. Analysts believe that the use of supply leading theory is more result-oriented at the early level of a country’s development than later. Hence, [8a], holds that, “the more backward the economy relative to others in the same time period, the greater the emphasis on supply-lending finance”. Several researchers like [13] and [11] supported the findings using supply leading theory. According to Keynesian Theory of Consumption, Savings, Investment and Interest rate, an increase in investment results in an increase in income, while peoples’ propensity to consume will lead to lack of savings. It then follows that when a fraction or a part of the people is spending, they put back part of the income into the economy, which brings about a small increase in investment which has a large cumulative effect on income and the increased income leads to more purchase and consumption which will definitely raise the Gross Domestic Product (GDP). [21] observes that Keynesian theory makes it clear that higher interest rate makes it more expensive for Small and Medium Scale Enterprises (SMEs) to borrow money, which means that companies invest less and when they do that, income is reduced such that the amount left over for saving equals the lesser amount now invested. In recession, the aggregate demand of economies falls, in other words, business and people tighten their belts and spend less money. Lower spending results in demand falling and a vicious circle ensure job losses and further falls in spending. Therefore, this theory propounds that government should borrow money and boost demand by pushing money into the economy.

2.3. Empirical Results

From empirical perspective, [1] studied on growth effect of small and medium scale enterprises financing in Nigeria, 1980-2010. Multiple regression was the method of analysis employed. After the analysis, lending rate was found to have negative effects on economic growth whereas bank’s credit to small and medium scale enterprises is significant at 5% critical level. [4] analysed the contribution of commercial banks loan to small and medium scale enterprises on the growth of the Nigeria economy for the period 1993-2012. With the use of co-integration and error correction model approach they conclude that commercial banks loans to small and medium scale enterprises does not reveal any significant effect on Nigerian economic growth due largely to lack of access to credit occasion and by inability of the traditional financial institutions’ (commercial banks) to provide their credit needs. [3] examined the impact of bank lending and macroeconomic policy on the growth of small and medium scale enterprises in Nigeria, with the use of time series data from the Central bank of Nigeria 1992-2011 and ordinary least square regression technique for analysis, the study reveal that commercial bank credit finance has significant positive impact on the growth of small and medium scale enterprises. The impact of banking sector credit on the growth of small and medium enterprises in Nigeria was assessed by [5]. Annual time series data from 1985 was 2010 was collected and used in the study while descriptive statistics, correlation matrix and error correction model was used to test the formulated hypotheses. The result of the study showed that banking sector credit has significant impact on the growth of small and medium enterprises in Nigeria as it has positive impact on some major macro-economic variables of growth such as inflation, exchange rate, trade debts etc. [20] determined the impact of banking system credit to small and medium scale enterprises and economic growth in Nigeria with the use of annual data from 1981 to 2013. The study employed ordinary least square (OLS) and co-integration econometric method with the use of sequential modified LR test statistic. The study finds that through the volume of credit to small and medium scale enterprises kept increasing year by year largely because of increase in population and economic activities, the credit to small and medium scale enterprises as a percentage of total credit to private sector declined. Again they note that bank credit to small and medium scale enterprises is not significant and does not contribute meaningfully to economic growth in Nigeria.

3. Empirical Strategy and Data

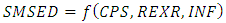

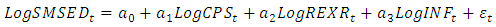

The effect of private sector credit on SMEs development was determined through hypothetical deductive research design using data from Central Bank of Nigeria for a period of thirty years, that is, from 1986 to 2015. We applied the granger causality test to determine the effect of private sector credit on SMEs development. We chose this statically tool on the conviction that it help in ascertaining the predicting power on a variable, and for a variable to have effect on another, it should show significantly its power to predict change in another variable. The long run nexus between private sector credit and SMEs development was assessed by application of the ARDL methodology. The ARDL takes into account the different level that variables can achieve stationarity. Small and Medium Scale Enterprise Development (SMED) is the dependent variable and proxied with wholesale and retail component of Real Gross Domestic Product (RGDP). Credit to Private Sector (CPS), real exchange rate (REXR) and Inflation Rate (INF) are the independent variables. Real exchange rate and inflation were added a control variables capable of influencing SMEs operations. Heteroskedasticity, Multi-collinearity, Serial Correlation and Ramsey RESET test were conducted to validate the model. The functional model of this study is stated as: | (3.1) |

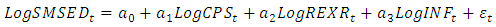

The variables in the model were logged to eliminate the possible influence of any outlier capable of affecting the output of the estimation thus: | (3.2) |

Where SMSED is SMEs development, CPS is credit to private sector; REXR real exchange rate and INF is inflation rate.  is coefficient of the constant,

is coefficient of the constant,  are the coefficients of the independent variables and

are the coefficients of the independent variables and  is the error term.

is the error term.

4. Results and Data Analysis

4.1. Summary of Descriptive Statistics

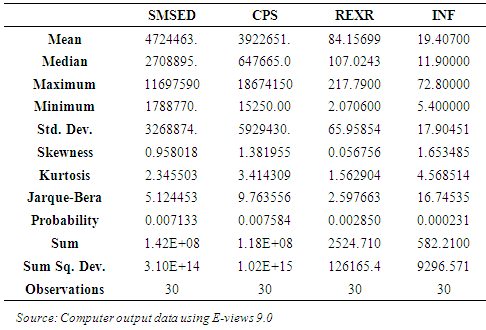

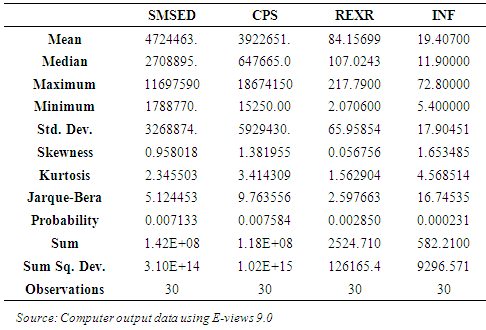

The summary of the descriptive statistic of the variables were depicted in Table 1. The average of the variables were 4724463, 3922651, 84.16 and 19.41, while the 1708895, 6476651, 107.0 and 11.90 were respectively the median for SMSED, CPS, REXR and INF. For the maximum and minimum values, 11697590 and 1788770 for SMSED, 18674150 and 15250 for CPS, 217.79 and 2.07 for REXR and 72.8 and 5.40 for INF. The standard deviation of the data were entailed to be 3268874, 5929430, 65.96 and 17.09 accordingly for SMSED, CPS, REXR and INF. The date were all positively skewed towards normality as shown by the positive values of the skewness statistic. The Kurtosis value shows CPS and INF are leptokurtic in nature as the Kurtosis statistic are higher than 3. The Jarque-Bera suggests that all the variables were normally distributed as the p-values are significant at 5% level of significance.Table 1. Descriptive Statistics

|

| |

|

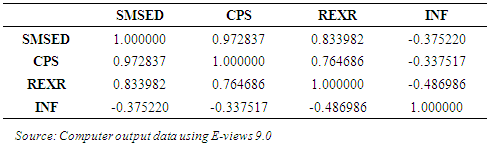

4.2. Sensitivity Analysis

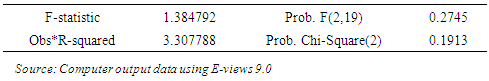

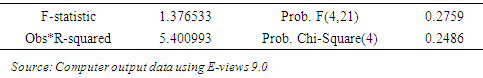

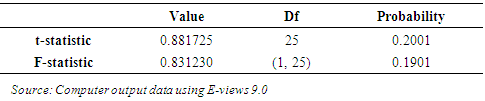

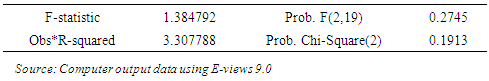

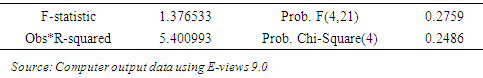

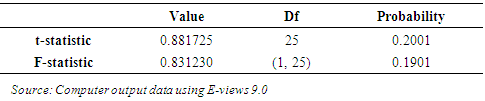

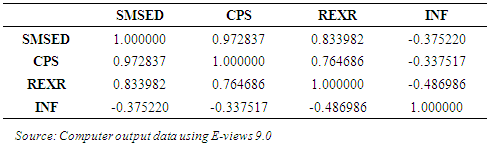

Four diagnostic test tools: serial correlation LM, heteroskedasticity, Ramsey reset specification and multicollinearity tests were employed to ensure that the model complied stringently with standard economic model. The p-values for serial correlation LM (Table 2), heteroskedasticity (Table 3) and Ramsey reset specification (Table 4) are insignificant at 5%, an indication that the assumptions of these sensitivity analysis were satisfied by the model. In terms of the correlation between real exchange and inflation which were the two control variables introduced in the model were disclosed to be -0.48 (Table 5). This is an insight that no problem of multicollinearity in the model.Table 2. Serial Correlation LM Test

|

| |

|

Table 3. Heteroskedasticity Test

|

| |

|

Table 4. Ramsey Reset Specification

|

| |

|

Table 5. Correlation Matrix

|

| |

|

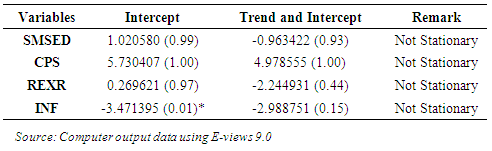

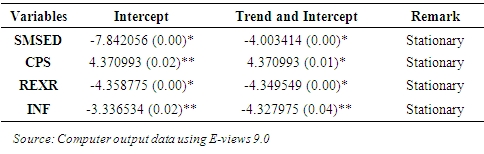

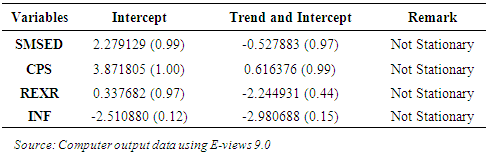

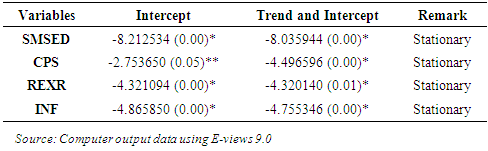

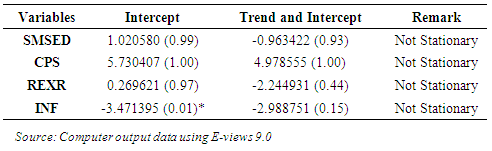

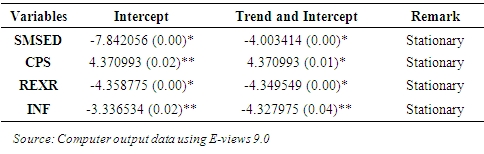

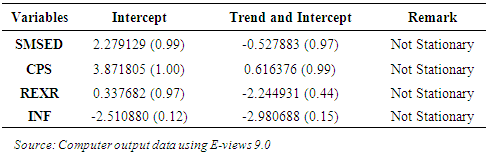

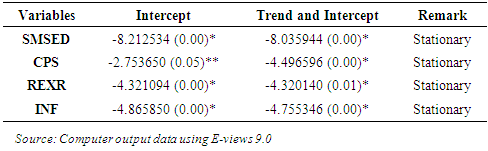

4.3. Stationarity Test

Stationarity test for the data were checked via the Augmented Dickey-Fuller (ADF) Test and Phillips Perron (PP). The test were carried out at level and first difference form in two dimensions intercept and trend intercept. Stationarity for the data would not be achieved at level but was satisfied at first difference. Table 6-9 provide an insight on the stationarity of the data.Table 6. Result of ADF Test at Level

|

| |

|

Table 7. Result of ADF Test at First Difference

|

| |

|

Table 8. Result of PP Test at Level

|

| |

|

Table 9. Result of PP Test at First Difference

|

| |

|

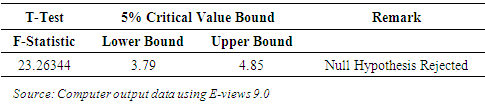

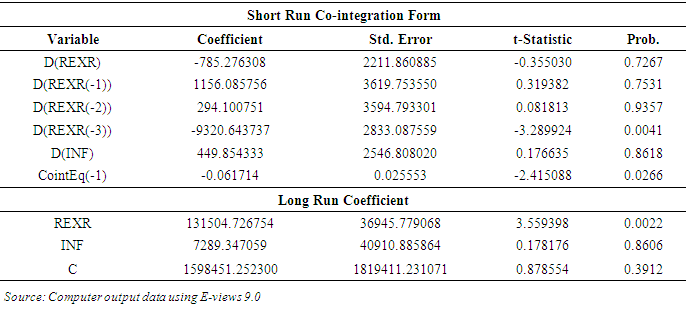

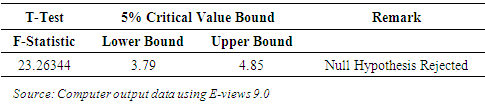

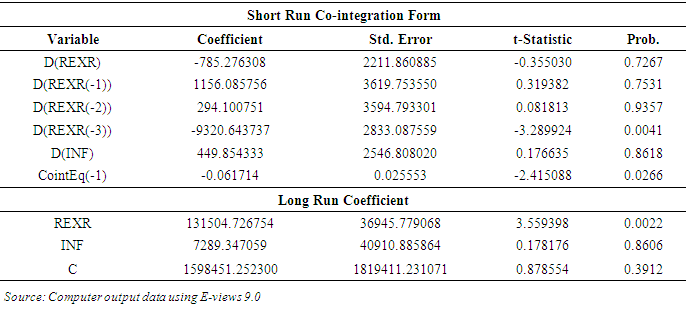

4.4. Co-integration Relationship

The long run relationship for the variables in the model was assessed using the Auto-Regressive Distributive Lag (ARDL) model. The result in Table 10 shows that there is a long run equilibrium relationship between credit to private sector and SMEs development in Nigeria. F-statistic of 23.26 is higher the lower bound (3.79) and upper bound (4.85). SMEs is driven by private sector credit. After identifying the presence of a long relationship between SMEs development and private sector credit, this paper proceeded to ascertaining the speed of adjustment to equilibrium and the result disclosed in Table 11. The error correction showed the expected negative sign and significant at 5% which suggests that the model shift towards equilibrium following disequilibrium in previous periods. From Table only 6.17% of error in previous year that was corrected in current year.Table 10. Bound Test for SMSED, REXR and INF

|

| |

|

Table 11. ARDL Error Correction for SMSED, REXR and INF

|

| |

|

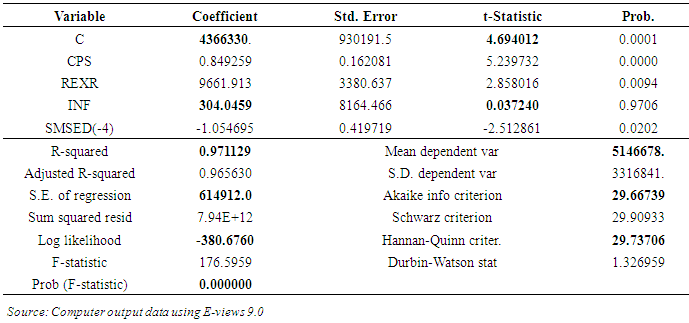

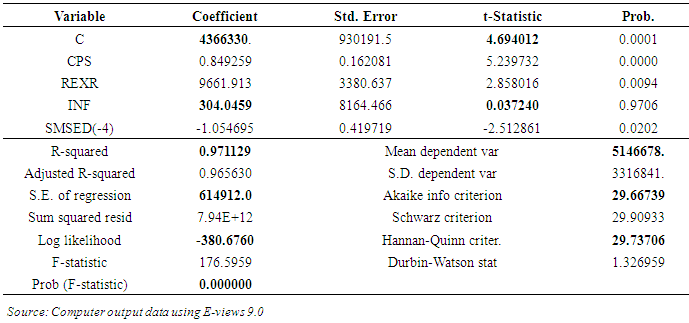

4.5. OLS Relationship

The short run relationship was determined using the OLS technique of data analysis and the outcome revealed in Table 12. The revelation from Table 12 is that credit to private sector and real exchange rate have positive significant relationship with small and medium scale enterprises development in Nigeria, while inflation was found to insignificantly and positively associated with small and medium scale enterprises development. Small and medium scale enterprises development would be valued 4366330 million where credit to private sector, inflation and real exchange rate maintain a constant trend. A percentage rise in credit to private sector would amount to N0.84 million in small and medium scale enterprises development. A unit appreciation in real exchange rate would increase small and medium scale enterprises development by a factor of N8, 661.91 million, while surprisingly, a percentage rise in inflation rate results in N304.05 million upsurge in small and medium scale enterprises development. The Adjusted R-squared entails that 96.56% changes in small and medium scale enterprises development was accounted by credit to private sector, real exchange rate and inflation. The F-statistic of 176.59 and p-value of 0.0000 is a suggestion that credit to private sector, real exchange rate and inflation statistically and significantly explained the variation in small and medium scale enterprises development within the period studies. The Durbin Watson value of 1.32 is not that quiet close to the benchmark of 2.0, however, the deficiency in connection with the Durbin Watson was corrected using the serial correlation LM test in Table 2 which unveils that the variables in the model were not serially correlated.Table 12. OLS Regression Result for Small and Medium Scale Enterprises Growth and Credit to Private Sector. Dependent Variable: Small and Medium Scale Enterprises Growth

|

| |

|

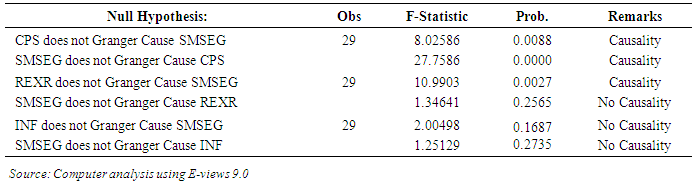

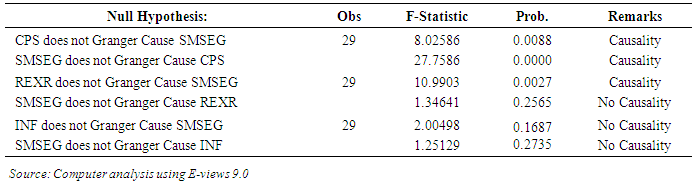

4.6. Granger Causality Test

This study determined the effect of private sector credit to SMEs development by application of the granger causality test. The choice of this statistical tool is based on the fact that it shows the predicting power of variable against the other. The result in Table 13 discloses a bidirectional relationship between private sector and SMEs development. This implies that private sector credit has significant effect on SMEs development in one hand, while on the other hand, SMEs development significantly affects private sector credit. It was also observe that there is a unidirectional relationship between real exchange rate and SMEs development as causality flows from real exchange rate to SMEs development at 5% level of significance. No relationship identified for inflation and SMEs development as evidence by insignificant p-value for inflation.Table 13. Pairwise Granger Causality for SMSEG, CPS, REXR and INF

|

| |

|

4.7. Discussion of Findings

The positive relationship between credit to private sector and small and medium scale enterprises development as revealed by OLS output in Table 12 is an affirmation of the granger causality test in Table 13 on the significant effect of private sector credit on SMEs development in Nigeria. This is evidence that deposit money banks private sector credit significantly influence SMEs development in Nigeria. This findings also points to the relevancy of the private sector in economic growth and development in Nigeria. This is hinged to the notion that Nigeria is a developing country and SMEs operations are vehemently in the control of the private sector. This study relying on the result in Table 12 and 13 asserts that private sector credit is good driver of SMEs development as it provides SMEs with funds to operate efficiently and effectively. This result aligns with previous studies of [3, 4]. The unidirectional relationship between real exchange rate and SMEs development is an indication that appreciation in the real exchange rate is an important fundamental for growth and development of SMEs. This finding indicates the need for government to entrench exchange appreciation and stability in its fiscal and monetary policy framework. The exchange rate of Naira against world major currencies such as British Pound, US Dollar, European Euros, etc. is nothing to write home about. The real exchange rate depreciates day by day due to Nigeria’s low export and over reliance on importation for consumption.

5. Conclusions and Recommendations

The role of SMEs in economic growth and development cannot be understated based on the influence it exerts on poverty reduction, unemployment and improving citizens’ welfare. Following theoretical literature with respect to emerging economies, this study has shown that in the Nigeria’s business environment, deposit money banks credit to private is a sin qua non for SMEs development. This will in no small measure spur growth and development of the Nigerian economy. The results emanating from this study have empirically depicted relevancy of the private sector in determining the direction of Nigeria’s national output. The fiscal policy of the government should encourage not only investment in the public sector but the private sector as a delicate paraphernalia to sustainable growth and development based on the status of Nigeria as an emerging economy that is open to both internal and external shocks based on integration with international financial system geared towards exiting from a transitional economy to an industrialized nation.There is need for financial institutions to continue extending credit to the private sector at affordable cost. Although, most financial institution operate with the aim of making profits, it is worthy for management to have it at the back of their heart that the development and growth of Nigeria is for the good of all. The Central Bank of Nigeria should through monetary policy assuage an exchange rate system that will reduce volatility in exchange rate of Naira against other currencies to motivate SMEs to expand production owing to the income they will earn if the exchange is stable.

References

| [1] | Afolabi, M. O. (2013). Growth effect of small and medium scale enterprises financing in Nigeria. Journal of African Macroeconomic Review, 3(1), 12-15. |

| [2] | Akande, O. O. & Ojokuku, R. M. (2008). The impact of entrepreneurial skills on small business performance in Lagos-South-Western Nigeria. Paper presented at International Council for Small Business, 53rd World Conference, Halifax, Nova Scotia, Canada. |

| [3] | Bassey, N. E, Asinya, F.A. & Amba, E.A. (2014). Bank lending macro policy variables and the growth of small and medium scale enterprises in Nigeria. International Journal of Business and Social Science, 5 (9), 5-6. |

| [4] | Imafidon, K. & Itoya, J. (2014). An analysis of the contribution of deposit money banks to small scale enterprises on the growth of Nigerian economy. International Journal of Business and Social Science, 5 (1), 9-11. |

| [5] | Bello, Y. & Muhammadu, B. (2015). Presentation of Acceptance Speech on the Occasion of 2nd Convocation Ceremony of Kaduna State University, Kaduna held on Saturday, 12 Dec.2015. |

| [6] | Central Bank of Nigeria (2010). Statistical Bulletin. Central bank of Nigeria Publication. |

| [7] | Eigbe, O.E., (1996). Financing small and medium scale enterprises (SME’s) in Nigeria: Problems and prospects, CBN Debt Trends. 2(1), 10-27. |

| [8] | Fatai, A. (2011). “Small and Medium Scale Enterprises in Nigeria: The Problems and Prospects” (www.thecje.com/journal/index.php/economicsjournal/article/.../8). [8a] Gerschenkron, A. (1962). Economic backwardness in historical perspective. Cambridge, MA: Harvard University Press. |

| [9] | Idowu, I. O. (2014). Production of Vitrified Porcelain Tiles Using Local Raw Materials from South Western Nigeria. Journal of Emerging Trends in Engineering and Applied Sciences, 5(6), 421- 428. |

| [10] | Jamodu, M. S. (2011). Establishing small and medium scale enterprises: Problems and Prospect. A paper presented at the Institute of Chartered Accountants of Nigeria (ICAN) Zonal conference held in Jalingo, Taraba State, 8th – 11th March, 2011. |

| [11] | Levine, R. (1997). Financial Development and Growth: Views and Agenda, Journal of Economic Literature, Vol. 35, pp. 688-726. |

| [12] | Mambula, C. (2002). Perceptions of SME growth constraints in Nigeria. Journal of Small Business Management. 40(1), 58-55. |

| [13] | Mckinnon, R. (1973). Money and Capital in Economic Development, Washington, D.C. Brookings Institution. |

| [14] | Nigerian National Council of Industries (2009). Overview of Small and Medium Scale Enterprises in Nigeria. An Information Booklet, Abuja. 1-33. [14b] Ogechukwu A. (2006). The role of small scale industry in national development in Nigeria. Texas Prentice Hall. |

| [15] | Ogujuiba, K. K., Ohuche, F. K. and Adenuga, A. O. (2004). Credit Availability to Small and Medium Scale Enterprises in Nigeria. Importance of New Capital Base for Banks –Background and Issues, http://www.ideas.repec.org/p/wpa/wuwpma/0411002.htm. |

| [16] | Ogun, O. and Ayanwu, J. C. (1999). Financing Small and Medium Enterprises in Nigerian Lesson from International Experience. Nigerian Financial Review. 8(1), 91-93. www.cenbank.org/documents/efr.asp. |

| [17] | Ojo, J. A. T. (1999). Roles and Failures of Financial Intermediation by Banks. CBN Bullion. 23(3), 10-12. |

| [18] | Stiglitz, J. and Weiss, A., (1981). Credit rationing in markets with imperfect information. American Economic Review. 71(3), 393–410. |

| [19] | Taiwo, J. N., Falohun, T. O. and Agwu, M. E. (2016). Small and medium scale enterprises Financing and its effects on Nigerian Economic Growth. European Journal of Business Economics and Accountancy. 4(4), 3-7. |

| [20] | Uremadu, S.O., Ani, O.I., & Odili, O. (2015). Banking System Credit to small and medium scale enterprises and Economic Growth in Nigeria: A co-integration approach. Journal of Economics and sustainable development, 6(1), 8-9. |

| [21] | Uzonwanne, M. C. (2015). Deposit money banks and financing of small and medium scale enterprises in Nigeria. Journal of Economic and Sustainable Development, 6(8), 51-65. |

is coefficient of the constant,

is coefficient of the constant,  are the coefficients of the independent variables and

are the coefficients of the independent variables and  is the error term.

is the error term. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML