-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(5): 259-262

doi:10.5923/j.economics.20170705.07

The Effect of Commodity Prices on Stock Market Performance in Zambia

Nsama Musawa, Clement Mwaanga

Department of Business Studies Mulungushi University, Kabwe, Zambia

Correspondence to: Nsama Musawa, Department of Business Studies Mulungushi University, Kabwe, Zambia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The recent downward trend of stock markets in Africa has attracted attention from researchers and investors. Among the stock markets that were negatively affected was the Lusaka Securities Exchange (LuSE) in Zambia whose share price index was, down by 26.83%. One of the contributing factors cited was the reduction in commodity prices as the country relies on copper which accounts for more than 70% of its export revenue (www.african-markets.com). Although commodity prices is one of the known factors that contributed to the negative performance, the impact on the stock market is not known. This paper therefore sought to examin the effects of commodity prices (Copper and oil) on the stock market performance and to access if movement in commodity prices can be used by investors on the stock market to forecast expected returns and movements in share prices. The study used Autoregression Distribution Lag, Cointegration analysis and the Vector Error Correction model on stock price index, copper price, and oil price for the period 2004-2016. The results indicated the existence of long- run and short- run relationship between the stock price index, copper and oil prices. Increase in copper price has a positive impact, while increase in oil price has a negative impact on the stock exchange. The findings of the study have implications, firstly policy makers are imformed on the impact of commodity prices on the performance of the Lusaka Securities Exchange. Secondly, investors are also alerted to some extent as they can predict the movement of the stock market returns based on the commodity price movements, hence making sound economic decisions respecting their portfolios. Thirdly, this research has contributed to the empirical evidence on the debate of the association between the commodity prices and stock market performance in developing economies.

Keywords: Stock price index, Commodity prices, Cointergration

Cite this paper: Nsama Musawa, Clement Mwaanga, The Effect of Commodity Prices on Stock Market Performance in Zambia, American Journal of Economics, Vol. 7 No. 5, 2017, pp. 259-262. doi: 10.5923/j.economics.20170705.07.

Article Outline

1. Introduction

- In the past decade the world witnessed fluctuations in the world oil and copper prices. These frustrations have had substantial effects on stock prices. Many studies have shown the continuing and growing interest in the dynamics of commodity price and their significant impact on economic and financial developments. There is growing evidence that commodity prices and stock prices moved together, and that the correlations between them have increased (Ildırar and Iscan, 2016). The commodities, usually acts as input to the production process and have the capacity to affect the outputs which intern affects the performance of the stock markets. The Lusaka stock Exchange (LuSE) price index has been fractuating in the last decade, declining by an average of 26.83% in local currency in 2016. (www.africa-markets.com). The poor results of the stock market were attributed to, among other factors decrease in copper price which the Zambian economy highly depends on for export and increase in the price of oil, which is the major input in the production sector. Although commodity price is one of the known factors the impact on the stock market is not clear. This paper therefore sought to examine the impact of commodity prices (Copper and oil) on the stock market performance and to access if the movement in commodity prices can be used by investors in the stock market to forecast expected returns and share price movements. This study, therefore is important because it contributes to the empirical evidence to the debate of the association between the commodity prices and stock markets performance in developing economies. Further, the findings are important to Investors in the stock market because they can to an extent predict the movement of the stock market, hence making sound economic decisions respecting their portfolios. Hence the will be able to know how to diversify their investment portfolios.

2. Literature Review

- Studies investigating the impact of commodity prices and stock markets have increased. The results from both developing and developed stock markets are mixed depending on the magnitude of the commodities influence on the economy. For example Ildırar and Iscan (2016) researched on the interaction between stock prices and commodity prices of East Europe and Central Asian countries. They used panel data from 10 countries for the period 2012 to 2015. The results showed no relation between commodity prices and stock markets.In another related study, Iscan, (2015) used monthly data ranging from 2002 to 2014 and did a multivariate Johansen test, to investigate the relation between commodity prices and the stock market in Turkey. The study found no relation between commodity prices and stock markets. On the other hand Chong et al, (2014) used Vector Auto Regression (VAR) model and Granger Causality test for analyzing the 10 years data from the year 2003 to 2012 in China and Malaysia. They found mixed results, some of the commodity prices had the short term effect on the stock markets, while others had no effect. Using the approach of Dynamic Conditional Correlation for the Islamic stock market, Chebbi and Derbali (2015), found a strong correlation between commodity returns and stock price index. Similar results were also found by Johnson, and Soenen, (2009) for the stock markets of South and North American countries where they found that stock markets were highly affected by changes in commodity prices after controlling for changes in exchange rates and interest rates. Black et al (2014) equally found a cointegration between stocks and commodity prices.Arfaoui and Ben Rejeb (2016) examined the relationships between oil, gold, and stock prices in china using simultaneous equations system for the period January 1995 to October 2015. Their results revealed significant interactions between all the variables. They found a negative relation between oil and stock prices. Additionally, Nordin et al. (2014) examined the impact of commodity prices (palm oil price and gold price), interest rate and exchange rate on the Malaysian stock market performance. Using the bound test approach between the variables, the findings revealed that the palm oil price had significant influence on the stock market performance. Studies from developing and emerging economies have shown similar results. Mongale and Hinaunye (2014) investigated the effects of the commodity prices and selected macroeconomic variables on stock market performance in South Africa. The paper used quarterly time series data and the estimation covered the period 1994 to 2013. Using Engle-Granger two step econometric techniques, they found that an increase in commodity prices is associated with an increase in stock market performance and there is a positive association between the stock market and macroeconomic variables such as money supply and exchange rate in South Africa.From Ghana, Gyasi (2016) examined the linkage between the Ghana stock exchange market and the commodity price changes – cocoa, crude oil and gold prices, the major exports of Ghana. The study found evidence of a strong linkage between the Ghana’s equity market, gold and crude oil prices. Mutua (2016) investigated the effect of macroeconomic variables and global oil prices on the stock performance of all listed firms in Kenya. Quarterly secondary data for the period of January 2008 to September 2016 was analyzed using linear regression models. A negative correlation was observed between stock price index and global oil prices.In another recent study from Zambia, Musawa and Mwaanga (2017), used Auto regression Distribution Lag, Cointegration analysis and the Vector Error Correction model to investigate the effect of commodity prices interest rates, and exchange rates on the stock price index. The findings of the study revealed that jointly Interest rates, exchange rates, copper and Oil price have a long and short- run impact on that Lusaka Stock Market.

3. Conceptual Framework

- The study aimed at investigating the effect of commodity prices on stock market performance. The commodity prices, which were measured by copper price (US Dollar per ton) and Oil price (US Dollar per barrel) were the independent variables, while stock market performance measured by the Lusaka Stock exchange price index was the dependent variable (Iscan, 2015; Ildırar & Iscan, 2016). Figure 1 below shows the conceptual framework for this study.

| Figure 1. The conceptual framework |

4. Data and Methodology

- Using monthly data ranging from January 2004 to December 2016, covering a period of 12 years, this study employed Auto Regression Distribution Lag (ARDL), and Vector Auto Regression (VAR) based cointegration test methodology by Johansen (1996) to analyze the relationship between commodity prices (copper price and oil price) and LuSE price index in Zambia. This methodology is comparable to Chong et al, (2014) and Iscan, (2015). The data on copper price (US Dollar per ton), oil price (US Dollar per barrel), were collected from the Bank of Zambia while the data on the price index was collected from the Lusaka Securities Exchange (LuSE).

5. Results

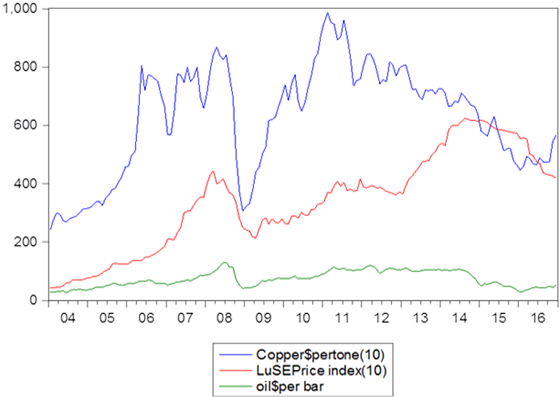

- The data was analyzed both graphically and using econometric models. Figure 2 below shows the graphical analysis of the data on LuSE price index, copper and oil price. The index and copper show an upward trend, which indicates that the two are positively correlated. The oil seems to be stable.

| Figure 2. Graphs showing the LuSE Price Index, the Copper and Oil price. (Source: Bank of Zambia, and Lusaka Securities Exchange) |

5.1. Econometric Modelling

- Vector Autoregression (VAR) based cointegration test methodology by Johansen (1996) and Auto Regression distribution was employed to examine the effect of commodity prices on the stock market in Zambia.

5.2. Diagnostic Tests

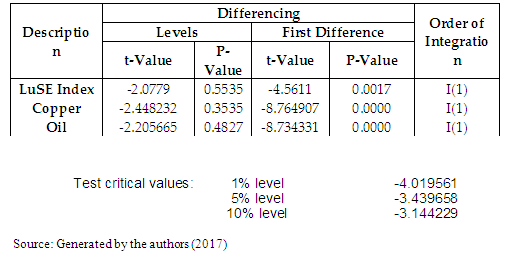

- The following diagnostic tests were done before estimating the relationship the normality test for the dependent variable, multicollinearity of the independent variables and the Unit root test. A test for normality showed that the dependent variable was normally distributed as the Jarque-Bera statist of 5.9063 with the probability of 0.0521 was observed. The test for multicollinearity indicated that there was no substantial correlation between the predictors as the correlation of 0.84 between Copper and oil price was less than 0.9. The correlation is substantial if it is more than 0.9. (Field (2005)).The third diagonist test was the unit root test which was done using the Augmented Dickey-Fuller (ADF) tests under trend and intercept as presented in Table 1 below.

|

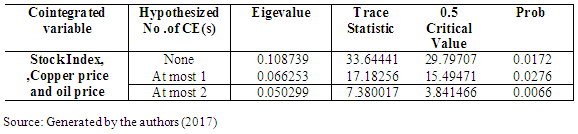

5.3. Long Run Estimation Based on Cointegration Analyzis

- Having done the diagonistic tests, a cointegration test was performed to check the long-run relationship. Using the lag length of twelve which was selected as appropriate based on the sequential modified LR test statistic, the results for Johansson cointegration test in table 2 shows that there is contegration between LuSE Index, copper and oil price. This is indicated by a trace statist value of 33.64441 which is more than the critical value of 29.79707 and a significant probability value of 0.0172. This reaved that there is a long-run relationsgip between, LuSE Index, copper and oil price in Zambia. This result is comparable to Chebbi and Derbali (2015) and Soenen & Johonson (2009).

|

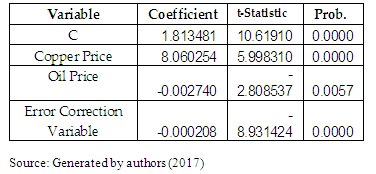

5.4. Short Run Estimation Based on Vector Error Correction Model (VECM)

- The short run relationship was estimated using the vector Error Correction Model. The result show that jointly copper price and oil Price have an impact on the stock market as the constant coefficient of 1.813481 which is statistically significant when lagged by twelve was observed. Copper has the positive short run impact on the LuSE index, while Oil has negative short run impact. Similar results were observed by Chong et al, (2014) for China and Malasyia and Mutua (2016) for Kenya. The negative error correction variable of -0.0002 further confirms the presence of long run relationship among the variables. Table 3 shows the short run results.

|

6. Conclusions

- This study investigated the potential influence of commodity prices (Copper and crude oil) on the stock market performance. By employing the Auto Regression Distribution lag (ARDL), cointegration and Vector Error Correction (Model VECM) the results indicated the existence of long-run and short-run relationships between the stock price index, copper and oil prices. The p copper price was found to have a significant positive influence on the stock market index both in the short and long-run. This result may reflect the importance of Copper as one of the main commodities produced in Zambia. Oil was found to have a significant negative influence on the stock market index, both in the short and long-run. This result may reflect the importance of oil as one of the commodities imported and widely used in Zambia. The result can help investors make informed investment decisions on the stock market as the established relationship could help to project the return depending on the movement of copper and oil prices.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML