-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(5): 249-258

doi:10.5923/j.economics.20170705.06

Macroeconomic and Household Welfare Impact of Increase in Minimum Wage in Nigeria: A Computable General Equilibrium Model

Philip Terhemen Abachi, Paul Terhemba Iorember

Department of Economics, Benue State University, Makurdi, Nigeria

Correspondence to: Philip Terhemen Abachi, Department of Economics, Benue State University, Makurdi, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Given the down turn of economic activities in Nigeria and the agitation for minimum wage increase, this study investigated the impact that increases in minimum wage will have on households welfare in Nigeria using a Computable General Equilibrium Model. The study formulated two scenarios – increase in minimum wage of workers by 211% and 150%, being increase from N18,000 to N56,000 and from N18,000 to N45,000 respectively. The data used for the study is a reformatted Social Accounting Matrix for Nigeria. The simulation results of scenario one revealed that, a 211% increase in the minimum wage of workers will increase agricultural output, industrial output and exports while imports will be depressed marginally and then lead to increase in households welfare indicators of income, consumption and savings by 6.76%, 5.0% and 3.61% respectively. The result of scenario two revealed that, increasing minimum wage by 150% will lead to increase in agricultural output, industrial output and exports while imports will fall and then households’ welfare indicators of income, consumption and savings will increase by 5.75%, 4.83% and 2.96% respectively. Similarly, the study found that, the Hicksian Equivalent variation as a measure of welfare impact of the policy is positive and high in all the simulations. The study concluded that an increase in minimum wage of workers has positive and significant impact on household welfare in Nigeria. Therefore, it is recommended among others that the government should as a matter of urgency accede to the demand of the organized labour and increase the minimum wage of workers from N18,000 to N56,000 (211% increase) and ensure that it is fully implemented across board.

Keywords: Minimum Wage, Household Welfare and Computable General Equilibrium

Cite this paper: Philip Terhemen Abachi, Paul Terhemba Iorember, Macroeconomic and Household Welfare Impact of Increase in Minimum Wage in Nigeria: A Computable General Equilibrium Model, American Journal of Economics, Vol. 7 No. 5, 2017, pp. 249-258. doi: 10.5923/j.economics.20170705.06.

Article Outline

1. Introduction

- The global debate on the choice of an appropriate income policy as a response to inflation and a tool for boosting household welfare, reducing poverty and ensuring macroeconomic stability has been changing profoundly between minimum wage legislation and price control mechanisms. However, the focus of this study is on minimum wage rather than price control due to the fact that, the Nigerian economy is largely market driven and prices of goods and services are determined by the market forces. Proponents of minimum wage increases such as Fanti and Gori (2011) and Watanabe (2013) have argued that increases in minimum wages serve as engine of macroeconomic growth, assist low-skilled individuals during downturns in the business cycle, reduce income inequality and reduce poverty. Samuel (2015) noted that, the main idea of fixing minimum wages is to ensure that low-wage-low-skill workers earn “decent” wages from their jobs. Moreover, it can “pull” households that are below the poverty line to somewhere above the poverty line since it raises household income. In addition, it creates and sustains at least, a “subsistence standard of living” for poor and low-skilled workers. However, a review of the literature provides little empirical support for these claims. Minimum wage increases redistribute gross domestic product away from lower-skilled industries and toward higher-skilled industries and are largely ineffective in assisting the poor during both peaks and troughs in the business cycle (Sabia, 2014). Card and Krueger (1995) opined that, minimum wage increases may not be the most efficient way to achieve poverty reduction and improve household welfare. This is because, while increases in minimum wages reduce poverty levels, they also lead to higher levels of unemployment. Specifically, the category of workers most likely to suffer from minimum wage increases is low-skilled workers. Such workers are easily substituted for high-skilled workers. Unemployment increases most amongst them. This is worsened by the fact that jobs that require low skills and those that pay low wages are the most likely to decline when minimum wages increase (Neumark, 2014). Therefore, as far as efficiency is concerned, the ability of minimum wages to reduce poverty and improve household welfare is not costless (Lustig and McLeod, 1996). Similarly, Folawewo (2007) noted that wage increase brought about by minimum wage increases is usually counter-productive. Apart from leading to a rise in general price level, wage increases, are always followed by threat of reduction in government workforce, and in some cases, such threats have resulted into massive laid-off in the civil service (Olaleye, 1974; Owoye, 1994). Also, wage increases in Nigeria do not match up with the rate of increase in prices. As a result, there are always agitations from the labour unions for persistent wages and salaries increase as it is the case in Nigeria presently.Aside the divergent findings about the poverty reduction and macroeconomic effects of minimum wage increases in an economy, the household welfare effect of the income policy (minimum wage increases) has received little attention in literature especially for Nigeria. More so, most of the studies reviewed in this paper have used partial analysis in analyzing specific economic effects of the income policy in an economy rather than general equilibrium analysis which according to Adams (1987) is most appropriate in analyzing macroeconomic effect of an economic policy. This study therefore analyses the impact that different levels of increases in minimum wage will have on macroeconomic variables of agricultural output, manufacturing output, export and import prices and on household welfare indicators of income, consumption and savings in Nigeria using Computable General Equilibrium model. The study is significant because it is one of the few studies on the effect of minimum wage in Nigeria that adopts Computable General Equilibrium approach and is coming up at the time when agitations for increase in minimum wage is palpable in Nigeria. Hence, the study is not only timely but also contributory to the existing body of literature on both minimum wage and Computable General Equilibrium model. The findings of the study will provide insight and understanding to the government and policy makers on the impact of increase minimum wage on both macroeconomic variables and household welfare indicators. Therefore, the study can be said to be of immense benefit to the policy makers and economic planners in terms of using its findings in formulating and implementing appropriate policy measures towards accelerating economic growth and improving living conditions of the people.

2. Empirical Review

- Several studies have investigated the impact of minimum wage on different aspects of the economy using varying methodologies. Mwangi, Simiyu and Onderi (2015) analysed the effects of minimum wage on the labour market and income distribution in Kenya using CGE. The study found a positive effect of minimum wage increase on household income and consumption, as well as government income. However the focus of the study was on income distribution rather than welfare. Also Erero (2016) used CGE model to investigate the effect of minimum wage in South Africa and found that an increase in the national minimum wage has a negative and distortive impact on the reported macro-economic variables. This is particularly seen by a decline in GDP, employment and welfare. These findings as it were are not based on Nigerian data and the failure to disaggregate welfare into income, consumption and savings does not explicitly capture the household impact. Adams (1987) used macroeconometric model to simulate the effect of changes in minimum wage on economic variables and found mixed outcomes; while it affects unemployment positively, it has negative effect on real wage and real gross national product. The study did not evaluate the household welfare effect of the policy. In Nigeria, Falawewo (2007) used Computable General Equilibrium model to analysed the effect of minimum wage policy in Nigeria. The study found that increase in minimum wage had a positive effect on the economy but could not include household savings which is also a major component of household welfare. Atseye, Takon and Ogar (2014) and Nwoke (2017) used partial equilibrium models to examine the impact of minimum wage on the Nigerian economy. The studies found positive effects on the economy but could not utilized the CGE model to address the economy-wide effect of the policy options. Akpansung (2014) investigated the effect of minimum wage increase on unemployment during democratic era using least squares and granger causality techniques. The study found that increases in minimum wage leads to increase in unemployment levels. No attention was given to welfare effect of the policy.

3. Theoretical Framework

- Utility Theory and General Equilibrium TheoryThis study is anchored on two theories: the Utility Theory and the General Equilibrium theory. The utility theory as espoused by Gossen (1854), Walras (1874), Marshall (1890) and Hicks and Allen (1939) posit that a consumer is assumed to be rational. Given his income and market prices of various commodities, he plans the spending of his income so as to attain highest possible satisfaction or utility. On the other hand, the general equilibrium theory developed by Arrow, Debreu and McKenzie in the 1950s seeks to explain a situation where all prices are in equilibrium; each consumer spends his given income in a manner that yields him the maximum satisfaction. Thus, the economy is in general equilibrium when commodity prices make each demand equal to its supply and factor prices make the demand for each factor equal to its supply so that all product markets and factor markets are simultaneously in equilibrium. This equilibrium position is sensitive to government intervention through the instrumentality of the minimum wage variation.The theoretical underpinning of welfare impact of an economic policy such as increase in minimum wage is found in the utility theory. The theory posits that a consumer is assumed to be rational and therefore spends his income in a way that gives him highest welfare. The general equilibrium theory on the other hand seeks to explain a situation where both commodity prices and factor prices are simultaneously in equilibrium in the various markets. While the utility theory is useful in the estimation of the welfare impact of the policy change, the general equilibrium theory on the other hand addressed the economy-wide perspective of the study and as well formed the bedrock for the methodology of the study.

4. Methodology

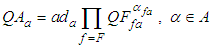

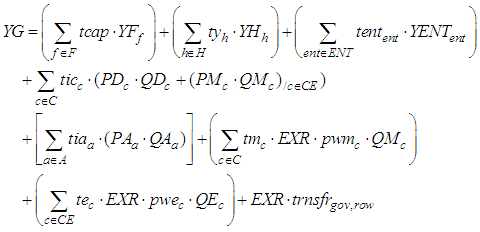

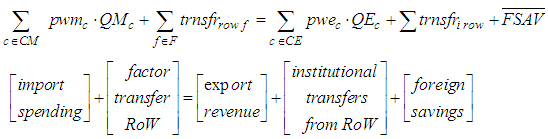

- The appropriate methodology to capture the macroeconomic and welfare impact of an income policy such as increase in minimum wage is the Computable General Equilibrium model (CGE). The CGE model belongs to a category of multisectoral models. It is useful in carrying out economy-wide impact of specific policies (Adenikinju, Falokun, Aminu and Fowowe, 2012). The choice of CGE model for this study is based on a number of reasons; first, given that an increase in minimum wage will have economy-wide effects on the Nigeria economy, CGE provides a framework for capturing such effects. Second, CGE models are also adept in addressing issues of optimization and in this case, utility optimization. CGE provides tools that can be relied upon to carry out such optimization exercise (Adenikinju et al, 2012). Also, the appropriateness of CGE model for this study is defined by the temporal structure (essentially static analysis) and the nature of data employed. Model Specification and DiscussionThe CGE model used in this study follows closely that of Lofgren, Harris and Robinson (2002) model which was also used by Anuwat (2010). The functions used are constant elasticity of substitution (CES) of both the Cobb- Douglas and the Leontief types. The structure of the model is divided into four major blocks: production and trade; price; institutions and system constraint blocks. The choice of these blocks is based on the macroeconomic nature of the study. Production and Trade blockIn this block, it is assumed that each producer maximizes profits subject to its production function, which uses the Cobb-Douglas production technology. There are two primary inputs: capital and labour which are influenced by increases in wages. Therefore, the activity production function can be expressed as;

| (1) |

is the activity level,

is the activity level,  quantity demanded of factor

quantity demanded of factor  from activity

from activity  is the production function share parameter or value-added share for factor

is the production function share parameter or value-added share for factor  in activity a and

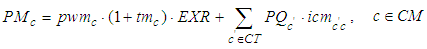

in activity a and  is the production efficient parameter.Price BlockIn the price block, domestic import price of commodity c in equation 2 is the product of world import price

is the production efficient parameter.Price BlockIn the price block, domestic import price of commodity c in equation 2 is the product of world import price  the tariff adjustment

the tariff adjustment  and exchange rate (EXR) plus transaction costs to move the commodity from the border to the domestic demander.

and exchange rate (EXR) plus transaction costs to move the commodity from the border to the domestic demander.  | (2) |

is import price in LCU (local-currency units) including transaction costs,

is import price in LCU (local-currency units) including transaction costs,  is cost, insurance and freight (c.i.f.) import price in FCU (foreign-currency units),

is cost, insurance and freight (c.i.f.) import price in FCU (foreign-currency units),  is import tariff rate,

is import tariff rate,  is exchange rate (LCU per FCU),

is exchange rate (LCU per FCU),  is composite commodity price (including sales tax and transaction costs),

is composite commodity price (including sales tax and transaction costs),  is quantity of commodity c’ as trade input per imported unit of c.The export price in LCU in equation 3 is the price received by domestic producers when they sell their output in export markets. Since export price is exogenously determined, increase in minimum wage will likely increase effective domestic demand and reduce the incentive to export.

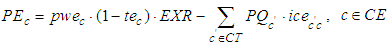

is quantity of commodity c’ as trade input per imported unit of c.The export price in LCU in equation 3 is the price received by domestic producers when they sell their output in export markets. Since export price is exogenously determined, increase in minimum wage will likely increase effective domestic demand and reduce the incentive to export. | (3) |

is export price in LCU (local-currency units),

is export price in LCU (local-currency units),  is free on board (f.o.b.) export price in FCU (foreign-currency units),

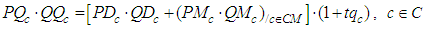

is free on board (f.o.b.) export price in FCU (foreign-currency units),  is export tax rate.The absorption for each commodity is the total domestic spending on commodities at domestic prices (PQc ⋅QQc). It can be expressed as the spending on domestic outputs (PDc ⋅QDc) plus imports (PMc⋅QMc) including an upward adjustment for sales tax as shown in equation 12. Therefore, the composite price (PQc) can be derived by dividing equation 4 by the composite supply (QQc). Increase in minimum wage will influence household spending behavior.

is export tax rate.The absorption for each commodity is the total domestic spending on commodities at domestic prices (PQc ⋅QQc). It can be expressed as the spending on domestic outputs (PDc ⋅QDc) plus imports (PMc⋅QMc) including an upward adjustment for sales tax as shown in equation 12. Therefore, the composite price (PQc) can be derived by dividing equation 4 by the composite supply (QQc). Increase in minimum wage will influence household spending behavior. | (4) |

is quantity of goods supplied to domestic market (composite supply),

is quantity of goods supplied to domestic market (composite supply),  is quantity sold domestically of domestic output,

is quantity sold domestically of domestic output,  is quantity of imports of commodity, and

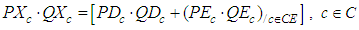

is quantity of imports of commodity, and  is rate of sales tax (as share of composite price inclusive of tax).Domestic output value at the producer price (PXc⋅QXc) is the value of domestic sales (PDc⋅QDc) plus the export value (PEc⋅QEc). This can be expressed as equation 5. The producer price (PXc ) is derived by dividing equation 5 by the domestic output (QXc). Increases in minimum wage will likely affect domestic output given that, the volume of domestic sales will rise due to the changes in the purchasing power of the households.

is rate of sales tax (as share of composite price inclusive of tax).Domestic output value at the producer price (PXc⋅QXc) is the value of domestic sales (PDc⋅QDc) plus the export value (PEc⋅QEc). This can be expressed as equation 5. The producer price (PXc ) is derived by dividing equation 5 by the domestic output (QXc). Increases in minimum wage will likely affect domestic output given that, the volume of domestic sales will rise due to the changes in the purchasing power of the households. | (5) |

is aggregate producer price for commodity,

is aggregate producer price for commodity,  is aggregate marketed quantity of domestic output of commodity and

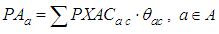

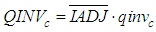

is aggregate marketed quantity of domestic output of commodity and  is quantity of exports. Equation 6 describes activity price (PAa), which is the sum of producer price times the yields of commodities. Similarly, activity price defined as gross revenue per activity unit is affected by increase in output yield due to increase in minimum wage.

is quantity of exports. Equation 6 describes activity price (PAa), which is the sum of producer price times the yields of commodities. Similarly, activity price defined as gross revenue per activity unit is affected by increase in output yield due to increase in minimum wage.  | (6) |

is activity price (gross revenue per activity unit),

is activity price (gross revenue per activity unit),  is producer price of commodity c for activity

is producer price of commodity c for activity  , and

, and  is yield of output c per unit of activity. Equation 7 describes, the value-added price, defined as the activity price minus the value added tax and input cost per activity unit.

is yield of output c per unit of activity. Equation 7 describes, the value-added price, defined as the activity price minus the value added tax and input cost per activity unit. | (7) |

is value-added price,

is value-added price,  is value added tax rate (indirect tax)

is value added tax rate (indirect tax)  is composite price and

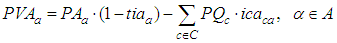

is composite price and  is input per activity unit.Institution BlockEquation 8 defines the income of factor f (YFf ) (capital and labour) as equal to the sum of the average factor prices (WFf ) multiplied by the quantity demanded of factor f (QFfa) with distortion wage (WFDISTfa). This factor income is split among domestic institutions after payment of direct factor tax and transfers to the rest of the world. Labour income belongs to households inform of wages whereas capital income is subtracted from the payment of tax on capital before flowing to household and enterprise. Changes in minimum wage will affect total factor income.

is input per activity unit.Institution BlockEquation 8 defines the income of factor f (YFf ) (capital and labour) as equal to the sum of the average factor prices (WFf ) multiplied by the quantity demanded of factor f (QFfa) with distortion wage (WFDISTfa). This factor income is split among domestic institutions after payment of direct factor tax and transfers to the rest of the world. Labour income belongs to households inform of wages whereas capital income is subtracted from the payment of tax on capital before flowing to household and enterprise. Changes in minimum wage will affect total factor income.  | (8) |

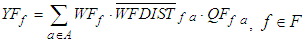

is held constant with the assumption that, the increase in minimum wage will not result to wage distortion and QFfa is employment level.Household income is the sum of factor incomes, transfers and remittances from abroad. Households’ disposable income is either saved or consumed. Equation 9 defines household consumption expenditure as household income net of indirect taxes and savings. Increasing minimum wage will likely affect household consumption ceteris paribus.

is held constant with the assumption that, the increase in minimum wage will not result to wage distortion and QFfa is employment level.Household income is the sum of factor incomes, transfers and remittances from abroad. Households’ disposable income is either saved or consumed. Equation 9 defines household consumption expenditure as household income net of indirect taxes and savings. Increasing minimum wage will likely affect household consumption ceteris paribus.  | (9) |

is share of net income,

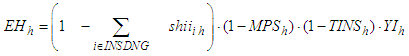

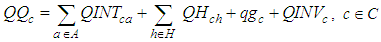

is share of net income,  is a set of households, TINSh is direct tax rate for households, MPSh represents marginal propensity to save for household h and YIi is the income of institution i (in the set INSDNG).Equation 10 defines quantity demand for investment for each commodity. It multiplies base-year investment demand (qinvc) by investment adjustment factor (IADJ).

is a set of households, TINSh is direct tax rate for households, MPSh represents marginal propensity to save for household h and YIi is the income of institution i (in the set INSDNG).Equation 10 defines quantity demand for investment for each commodity. It multiplies base-year investment demand (qinvc) by investment adjustment factor (IADJ). | (10) |

| (11) |

| (12) |

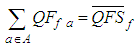

| (13) |

is quantity demanded of factor f from activity a and

is quantity demanded of factor f from activity a and  is total quantity supplied of factor f.Similarly, equilibrium in the commodity market expressed in equation 14 is the equality in composite commodity supply and demand.

is total quantity supplied of factor f.Similarly, equilibrium in the commodity market expressed in equation 14 is the equality in composite commodity supply and demand.  | (14) |

| (15) |

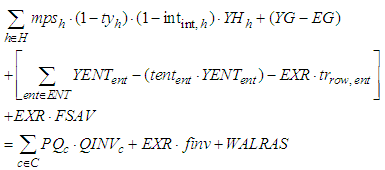

is foreign savings (FCU) (exogenous variable).Another macro constraint is the saving-investment balance as shown in equation 16. Total savings are the sum of savings from households, enterprises, government and the rest of the world. In contrast, total investment is the sum of the value of domestic investment and foreign investment. The WALRAS variable is introduced in this equation in order to check whether the saving-investment balance holds. If the model works, the value of WALRAS will be zero (Anuwat, 2010).

is foreign savings (FCU) (exogenous variable).Another macro constraint is the saving-investment balance as shown in equation 16. Total savings are the sum of savings from households, enterprises, government and the rest of the world. In contrast, total investment is the sum of the value of domestic investment and foreign investment. The WALRAS variable is introduced in this equation in order to check whether the saving-investment balance holds. If the model works, the value of WALRAS will be zero (Anuwat, 2010). | (16) |

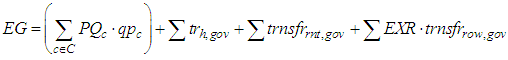

5. Evaluation of Macroeconomic and Welfare Impact of the Minimum Wage Policy

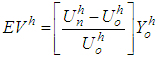

- The macroeconomic variables or indicators of interest in this study are agricultural output; industrial output; exports and imports. The choice of these variables is based on the sensitivity of the variables to the structure of the Nigerian economy. The variables were selected to account for both the aggregate domestic demand and current account dynamics. On the side of welfare, Obi-Egbedi, Okoruwa, Aminu and Yusuf (2012) identified three basic components/indicators of household welfare namely; households consumption, income and savings. To evaluate the implications of the minimum wage policy options on household welfare in Nigeria, the Hicksian Equivalent Variation was estimated by calculating welfare gains/losses from simulation results. Following Olopoenia and Aminu (2007), Annabi, Khondker, Raihan, Cockburn and Decaluwe (2006) and Devarajan, Thienfelder and Suthiiwart (2001). The Hicksian Equivalent Variation (EV) is given by

| (17) |

is the income of household h before the policy change,

is the income of household h before the policy change,  is the utility of household h before the policy change,

is the utility of household h before the policy change,  is the utility of household h after the policy change and

is the utility of household h after the policy change and  is the Equivalent Variation of a household h. A policy is said to have impact on households if the calculated value of the equivalent variation is greater than zero (i.e, if EV > 0). The greater the value of the equivalent variation, the more impactful the policy is to the households.

is the Equivalent Variation of a household h. A policy is said to have impact on households if the calculated value of the equivalent variation is greater than zero (i.e, if EV > 0). The greater the value of the equivalent variation, the more impactful the policy is to the households.6. Data Sources

- The main source of data for this paper is the updated Social Accounting Matrix (SAM) constructed from (i) 2006 SAM which is the most recent for Nigeria (ii) Sectoral output data for year 2015 reported by the Central Bank of Nigeria (2015) (iii) Year 2015 households’ income and expenditure data for Nigeria reported by the National Bureau of Statistics (NBS) (2015) and the CBN (2015). The 2006 Nigeria SAM was built for the dynamic CGE (DCGE) that examined the agricultural growth and investment options for poverty reduction in Nigeria. It comprises 61 sectors/activities out of which 34 are under agriculture and 12 under manufacturing; 12 household groups and 3 factors of production. It also includes an account for government and the rest of the world (Nwafor, Diao and Alpuerto, 2010). However, to achieve the objectives of the study, these sectors (Agriculture and Industrial) and the household groups are aggregated to construct the SAM Table.

7. Estimation and Analysis of Result

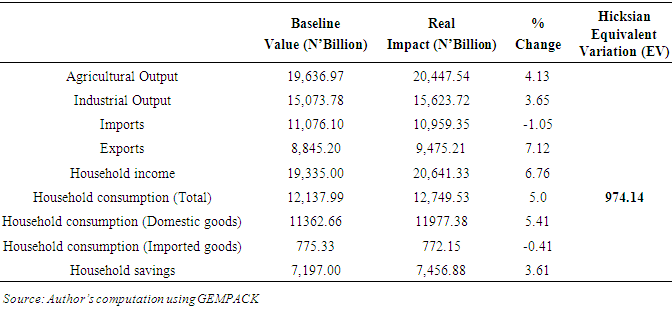

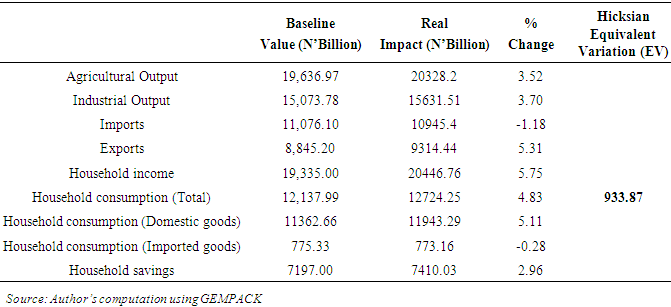

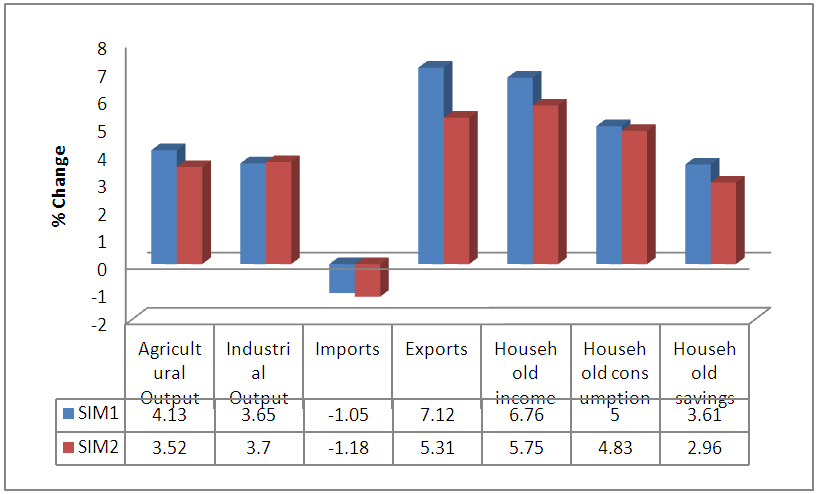

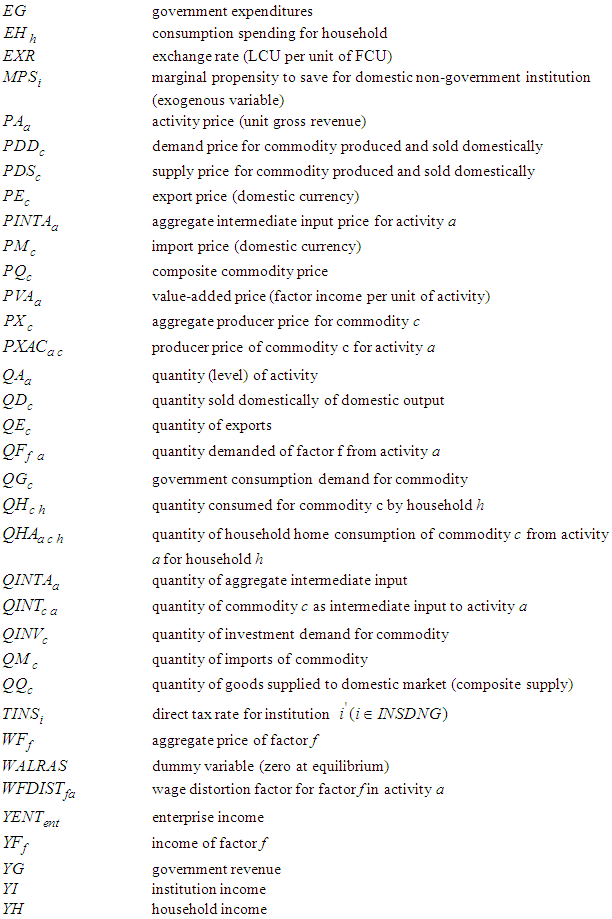

- The simulation results of the two scenarios is presented in Tables 1 and 2 respectively.

|

|

| Figure 1. Graphic Presentation of percentage change in simulations 1 and 2 |

8. Conclusions and Policy Recommendations

- All the two policy options (211% and 150% increase in minimum wage) simulated indicated that, increase in minimum wage have positive impact on macroeconomic variables of agricultural output, industrial output, export and imports in Nigeria. This finding is consistent with the findings of Falawewo (2007) who found that increase in minimum wage had a positive effect on the economy. The finding on the other hand is inconsistent with the finding of Erero (2016) who found that an increase in the national minimum wage has a negative and distortive impact on the reported macro-economic variables. The study also found that increase in minimum wage has positive impact on household welfare indicators of income and consumption and savings in Nigeria. The positive values of the equivalent variation for all the two policy scenarios indicated that, the policy of increasing minimum wage has positive impact on household welfare in Nigeria with the 211% increase having greater impact. This finding is consistent with the finding of Mwangi, Simiyu and Onderi (2015) who found a positive effect of minimum wage increase on household income and consumption.Based on this, government should as a matter of urgency comply with the demand of the organized labour and increase minimum wage of workers from N18,000 to N56,000 (211% increases) or from N18,000 to N45,000 (150% increase) and ensure that it is fully implemented at all levels of governance. This increase in minimum wage apart from directly increasing households income and consumption levels, will raise aggregate demand and spur economic activities within the economy which will in turn ensure positive economic growth.

Appendix A: Mathematical Summary Statement for Standard CGE Model

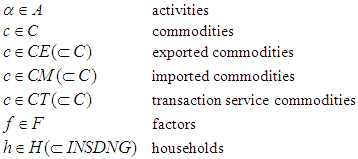

- Sets

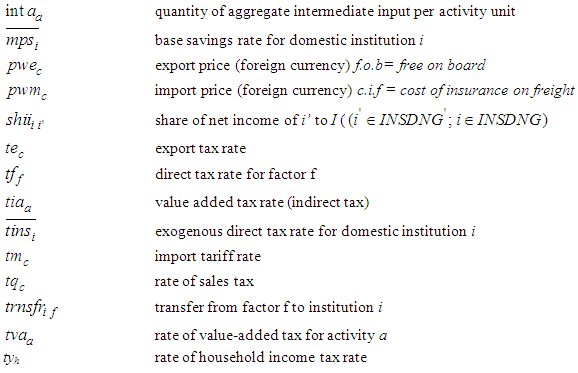

Parameters (Latin Letters)

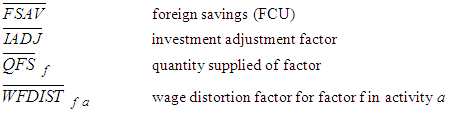

Parameters (Latin Letters) Exogenous Variables

Exogenous Variables Endogenous Variables

Endogenous Variables

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML