-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(5): 240-248

doi:10.5923/j.economics.20170705.05

Environmental Tax as an Instrument to Restore Coastal Pollution in Banyuwangi Regency

Herman Cahyo Diartho

Faculty of Economics and Business, University of Jember, Indonesia

Correspondence to: Herman Cahyo Diartho, Faculty of Economics and Business, University of Jember, Indonesia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Activities related to preservation of the environment are not yet fully able to overcome and suppress the destruction and pollution of the good being done by members of the public or business entity or industry groups. In response to this, in fiscal perspective there are some fiscal schemes that could be done to implement the green economy (green economy) that supports the preservation of the environment. Two of the standout instrument is subsidies and taxes. Subsidies have the characteristics of positive externalities which may be a reference to the transition to a green economy. Such subsidies can support in terms of price, tax incentives and grants directly to related environmental activities (Hanley, n. and c. l. Spash, 2013). The application of the idea of environmental tax assignment in addressing the problems of environmental degradation in the coastal area of Banyuwangi Regency is done through several stages: (1) planning. Set goals and processes necessary to deliver results in accordance with environmental tax assignment policy. In the determination process of the policy required the existence of a review of the Government's response to the State of the environment from all aspects in order to make the purpose of this policy can be achieved. The review should include the following matters, namely: (a) the identification of all aspects of environmental conditions. For example, environmental conditions before he did, when he did, nor the policy the policy, (b). The identification of the applicable legislation and (c). Identification is also the response of the public, the concerned business entity, and the Government's response to this policy, and (2) implementation and operation. In the implementation of the environmental tax assignment policy required the existence of a sustainable relationship between the Government and the community. The Government is expected to give guidance, knowledge development, and be held responsible for the policy that you created. Whereas the community is expected to support the Government's policy to create a better environment by means of adhering to regulations that have been made and agreed upon. If both of these things can be done then the purpose of this policy can be achieved. After the passing of this policy, the Government should always supervise and evaluate these policies in order to be able to walk better. The policy is only done in the scope of this little diaharapkan can be enacted and applied more broadly to the circumstances of the creation of a better environment.

Keywords: Environmental Tax and Restored Coastal Pollution

Cite this paper: Herman Cahyo Diartho, Environmental Tax as an Instrument to Restore Coastal Pollution in Banyuwangi Regency, American Journal of Economics, Vol. 7 No. 5, 2017, pp. 240-248. doi: 10.5923/j.economics.20170705.05.

1. Introduction

- The issue of the environment is one of the important issues discussed in various forums both on the national and international levels. The importance of the environmental issues it is inseparable from the desire of many parties to save Earth from destruction and pollution occurred. With the increasingly rampant in various news media that Peel about destruction and environmental pollution that occurs in areas of Indonesia. Therefore, the local Government District of Banyuwangi start to think a breakthrough that can suppress the pace of the destruction and pollution of the environment, namely the application of the tax plan with the environment, particularly in coastal regions began to happen the degradation of the environment.Environmental policy is in fact directed at the prevention, control, and countermeasure of the pollution and perusakannya. Environmental tax is not an instrument that is new in environmental management. Given the tax environment is instrumental in the financing environment, especially in case of pollution and destruction of the environment. Though not new, but has never been implemented than other instruments. (Fauzi, a. 2004). In terms of taxation, the role or function of an environmental tax is not much different from the functions of taxation in General. There are two main function of tax i.e. budgeter and regulerend. Budgeter function is a function to fill the coffers of the area, and regulerend function is a function which regulates the business activities which have the documents analysis on environmental impact (AMDAL).Activities related to preservation of the environment are not yet fully able to overcome and suppress the destruction and pollution of the good being done by members of the public or business entity or industry groups. In response to this, in fiscal perspective there are some fiscal schemes that could be done to implement the green economy (green economy) that supports the preservation of the environment. Two of the standout instrument is subsidies and taxes. Subsidies have the characteristics of positive externalities which may be a reference to the transition to a green economy. Such subsidies can support in terms of price, tax incentives and grants directly to related environmental activities (Hanley, n. and c. l. Spash, 2013).It is therefore necessary to economic instruments, including fiscal instruments. Tax environment is one of the commonly used fiscal instruments to address the question of environmental pollution. A discourse concerning environmental taxes has been frequently discussed by various circles. Planned environment tax will be set in the amount of 0.5 per cent of the turnover of the company and charged especially in the manufacturing industry that has spent over Usd 300 million per year environmental tax levy of 1 will be implemented by the local Government District of Banyuwangi and incorporated into the Original Area Revenue (PAD). In general taxation environment based on the consideration that the industrial activities that could potentially pollute the environment in order to contribute to the improvement of the environment.Environment tax will be charged to the manufacturing industry because the industry is not considered environmentally friendly and have input with large as well as pollution levels in the production process generates waste output that could potentially pollute the environment of the coastal area. A potential manufacturing industries produce waste. The development of the industrial sector in the Regency of Banyuwangi has increased every year, the industry there is no exception in the coastal area. The development of the manufacturing industry followed with the growing magnitude of the liquid waste generated by industry. Liquid waste generated by the manufacturing industry is one of the many waste containing contaminants that are difficult to break down in the coastal environment. Indonesia's average liquid waste produced textile industry contains 750 mg/l suspended solids and 500 mg/l BOD (Biological Oxige Demand). Comparison of COD (Chemical Oxigen Demand) and BOD ranging from 1.5:1 to 3:1.2. Given the potential magnitude of such waste is produced, in anticipation of the tax applied against environmental tax value assignment required an environment that reflects justice and propriety. (Potter, c., m. Soeparwadi, and a. Gani. 2004).Relevant fiscal policy related management and preservation of the environment that there is already able to contribute significantly to environmental preservation efforts. This is a major factor that encourages the Government of Indonesia to start to think a breakthrough that can suppress the pace of the destruction and pollution of the environment, namely the existence of the plan of implementation of the tax environment. The consequences that the Government planned to enact environmental taxes in the Bill (the BILL) tax areas and Regional Retribution (PDRD). The Government through the Ministry of finance will apply tax worth 0.5% of manufacturing beromzet a minimum of Rp 300 million. (Tim INDEF (Institute of Development of Economics and Finance, 2007).Fact against increasing damage to the environment by industry groups then tax environment should not be worn over the turnover of the company but rather based on the principle of polluter pays (polluter pays principle/PPP) so that it meets the principle of Justice. Environmental taxes are applied based on PPP means that the greater the level of pollution caused then tax will be subject to the higher and vice versa. Liquid waste from industry groups including the types of waste that are potentially big polluting the waters of the coastal region in particular. Industry groups in the coastal area are constantly removing liquid waste quantities sufficiently large and contains various pollutants. The content of pollutants in liquid waste industrial groups derived from the remnants of chemicals used in the production process, impurities are separated from the fibers, as well as the remains of the fibers apart by chemicals.The selection of the measures to cope with the environmental degradation of the coastal area is also related to the political will of the Governments of the region itself. In fact, ways to overcome the crisis of the global environment also souls imprisoned in geopolitical schemes of capitalism. There should be a strong desire of the local Government District of Banyuwangi to continue doing the ways of improvement of the environment. When environmental taxes are really applied, should local governments can enact Banyuwangi Regency green tax or tax environment, as one of the sources of funding for the activities of the coastal area rehabilitation and conservation.The above descriptive braced against the opinion of (Mc Gillivray and Bell's, 2000) that the tax environment (green tax) is one of the concrete steps the Government particularly in Banyuwangi local governments respond against environmental degradation phenomena that occur in coastal areas. This paper will explore and discuss about the application of environmental taxes tax as an instrument to restore coastal area pollution in Banyuwangi Regency. The concept of environmental taxes is expected to address the reduction of pollution and destruction of the environment, particularly in coastal areas.

2. Research Methods

- This research seeks to understand the behavior of individuals or communities in the "setting" (or situation) of a particular social, as well as to answer questions in research issues concerning environmental taxes are expected to address the reduction of pollution and destruction of the environment, particularly in coastal areas. A qualitative approach based on interpretive paradigms and constructive, which is very different from the approach of the positivistic as pillars of quantitative research (Sugiyono, 2010; Creswell, 2010). Qualitative research has a wide range of methods, one of which is research methods Phenomenology. As part of the qualitative approach, the research of Phenomenology was selected by researchers in order to be better able to identify the nature of the experience of the individuals or the community about certain phenomena (Creswell, 2010; Kuswarno, 2009).1. Objects, units of analysis, and the subjects of this research Object at once the unit analysis (unit of analisys) includes a tax environment which is expected to address the reduction of pollution and destruction of the environment, particularly in coastal areas. While the subject of this research is the person who has relevant information and understand the process of managing and maintaining tax environment either as perpetrators directly or through other people who understand the object of research. Therefore, the subject of this research is a resource person or informants to uncover phenomena in institutional tax environment.2. Data collection Strategy the strategy or how to collect and acquire data in qualitative research that was already public, namely: observation (observation), interviews (interviews), and documentation (docs), which can be supported by hardware recorder in audio and/or visual (audio visual materials). In this study, observations made in nonpartisipan which means researchers don't position themselves to become citizens but only ' accompany ' or observing them in their activity. If the presence of researchers (in close in the sense of physically) can interfere with their activity, then conducted observations in the distance or indirectly by the use of another person who is believed to be an intermediary researchers. Interview strategy was also used in this research via the research question reference is already prepared. The underlying question is meant to give referrals (guidelines) for researchers or intermediary researchers in an effort to reveal the phenomenon of tax environment.As for the question of research or researchers used intermediaries in interviewing informants who do are open, insightful, informal, and unstructured. Documentary techniques in principle is a method used to search historical data is customarily used in the study of social science, particularly the study of history.Considering the research data are obtained in the form of qualitative data (among other intangibles statement, symptoms, nonverbal actions which can be recorded in the description of the sentence, or numbers, or pictures/photos, etc.), then in this study using model data analysis from Miles and Huberman (1992) by activity/process called encoding (coding).Model analysis done in 3 (three) and activities can take place in parallel, with a brief description of: (a). data Reduction is sorting, concentration, simplification, pengabstraksian, and transforming raw data have been obtained from the process of collecting data in the field; (b). presentation of data, done by arranging a series of information so as to allow the withdrawal of summary data and recommendations. In this activity, the researchers tried to use the way to present it in the form of a narrative in text, chart or image/plots, as well as the matrix/table of text that can be through the method of content analysis; and (c). draws conclusions that have been drawn, then verified during the process of research is underway. The verification referred to in the form of reviews or thoughts back on the record results of airy may take place at a glance or take a long time, as well as exchange ideas (discussion) with the informant to expand the definition of who can be done through group discussions focus (focus group discussion = FGD). Location of the study can be seen in the map (Figure 1).

| Figure 1. Research Location Map |

3. Discussion and Results

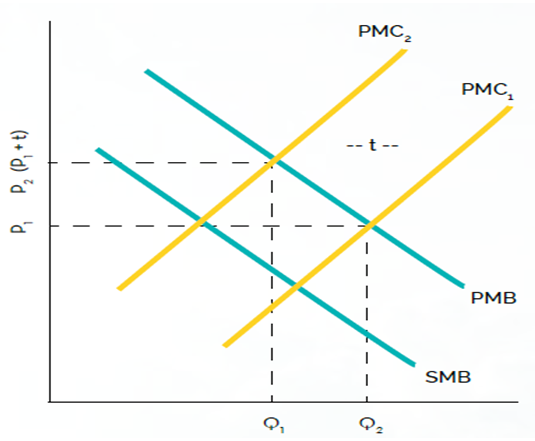

- Environmental tax (green tax) is one of the concrete steps of the regional Government of Banyuwangi Regency in responding to the issue of environmental degradation of coastal areas. The concept of a tax, as it is known by many parties, has four main functions, i.e. functions of budgeting, (collecting funds from the community to the activities of the State), the regulatory functions (functions for rule to achieve specific objectives), function stability (the Government's objectives related to stabilize prices in certain conditions, for example, inflation, and more), and the function of the Equalization of income (tax is used as a means of increasing employment opportunities that later can increase people's income).There are two public discourse about the concept of environmental taxes, i.e. the concept of application of environmental taxes and the granting of the tax credit. With environmental taxes, meaning that any company that aggravating environmental conditions will be subject to a compulsory levy (the polluter pays principle). This concept is certainly reaping a lot of controversy especially from among entrepreneurs. Moreover, the calculation of the tax imposed is derived from the amount of the cost of production. This will be new spending post besides the environmental costs such as the cost of inspection of the amdal has been applied previously. In effect, the production costs will rise, profits declined, and other multiplier effects.Banyuwangi Regency is one of the areas in Indonesia that has the level of damage to the environment of the coastal region is high and tends to be getting worse every year. Some of the main indicators of environmental degradation of coastal areas is done by men such as fishing that over fishing, industrial waste disposal, water pollution, environmental pollution, and others. Waste from various industry groups left for granted without any processing can also cause environmental damage. The impact of waste in coastal area of pembuanan perceived by people around the coastal area. The local Government of Banyuwangi Regency will not be able to designate certain people/industries to pay for losses from the impact of this waste. This waste is an environmental goods and services, e.g. industry/people can get rid of waste kelingkungan without removing the charge, there is no incentive to think of the consequences to the environment from these actions. To cope with this need for incentive strategies. Environmental tax is the alternative means of local Government District of Banyuwangi to repair or protect the environmental quality of coastal areas.1. The determination of the Environmental Tax as the idea in tackling the problems of environmental degradation of Coastal AreaTax Assignment lingungan (Green Tax) with good will internalize the external cost of production from a business entity or industry. This will encourage businesses/industries to reduce the next results will cause the environment to be more clean. Environmental tax is not an instrument that is new in environmental management. Environmental taxes are financing instruments in the environment, in particular in case of pollution and destruction of the environment. One example of a country that is applying the polluter pays principle "is the Netherlands is also a member of the Organization for Economic Cooperation and Development (OECD).The local Government of Banyuwangi Regency would do the poll tax to businesses/industries that dispose of waste and produce dumped into the environment of the coastal area as the cost over environmental damage that has been done. The fees received by each agency/industry effort will vary depending on the amount of waste generated, so the more waste generated and disposed of into the environment of the coastal area of the higher taxes paid. In the tax system, polluters are given the freedom to dispose of the waste, but polluters will be charged for each unit of emissions waste is disposed of. The existence of this policy the polluter/industry groups can seek their own incentives to reduce emissions so as not to pay taxes. Things that can be done by the polluters, for instance: (a) Mensubtitusi materials that pollute the environment with materials that do not pollute the environment; (b) processing waste generated is berguana, as it becomes compost; (c) Replace the dirty fuel source; and (d). Change input-recycling-switch to output a more eco-friendly.Of course to do that all of the necessary existence of socialization as well as from the regional Government of Banyuwangi Regency since businesses/industries that face is a business entity that will certainly distress to implement waste reduction way above. Costs that must be incurred for using environmentally friendly production is also not cheap especially for small businesses. To that end, local governments may have budgeted funds for the improvement of the environment.This levy is an instrument of the most effective pollution controls, because it is a permanent incentive to reduce pollution and costs penanggulangannya (Kusnadi Hardjasoemantri, 1996; 191). In doing this, local governments levy Banyuwangi Regency must be given regulatory authority so that it can run efficiently and not arbitrarily do levy taxes. The authority that should Harken to Act No. 18 of the year 1997 as amended by Act No. 34 of the year 2000 about local tax and Regional Levies.The application of the idea of environmental tax assignment in addressing the problems of environmental degradation in the coastal area of Banyuwangi Regency conducted over several stages below: (1). Planning. Set goals and processes necessary to deliver results in accordance with environmental tax assignment policy. In the determination process of the policy required the existence of a review of the Government's response to the State of the environment from all aspects in order to make the purpose of this policy can be achieved. The review should include the following matters, namely: (1) the identification of all aspects of environmental conditions. For example, environmental conditions before he did, when he did, nor the policy policy, (2). The identification of the applicable legislation and (3). Identification is also the response of the public, the concerned business entity, and the Government's response to this policy and (2). Application and operation. In the implementation of the environmental tax assignment policy required the existence of a sustainable relationship between the Government and the community. The Government is expected to give guidance, knowledge development, and be held responsible for the policy that you created. Whereas the community is expected to support the Government's policy to create a better environment by means of adhering to regulations that have been made and agreed upon. If both of these things can be done then the purpose of this policy can be achieved.After the passing of this policy, the Government should always supervise and evaluate these policies in order to be able to walk better. The policy is only done in the scope of this little diaharapkan can be enacted and applied more broadly to the circumstances of the creation of a better environment.2. The Pigouvian Tax: internalization of Externalities The environmental damage of coastal area becomes important, because most of the service environment is a public good (non-private). For example: sea water, coastal biodiversity, to a beautiful natural landscape. Public goods are non-excludable and non-rivalry means consumption it does not hinder the other party to consume the same. Thus, access to natural resources in the coastal region somewhere will be enjoyed in the same level for free (don't have a monetary price). The absence of monetary and price its non-privat encourages behavior that often ignores the efforts to maintain the quality and quantity of public goods, especially in the context of economic activity.Economic activity is based on the perspective of anthropocentric generally only aims to simply achieve satisfaction (utility) or optimizing profits. So, at a time when economic activity is done, often there is a there is a byproduct that is not the main purpose of the event. This is often referred to as externalities. Externalities can be categorized into two: negative and positive externalities. In terms of Economics, environment, exposure to negative externalities on the flight.The activity of the existence of such negative externalities make a difference levels of welfare (welfare) earned by the offender and the community. The benefits received by the offender is far greater than the benefits received by the community. This is because the perpetrators (of the individual) pursues the satisfaction of running economic activity and the benefits of public goods received, whereas the community received only benefits from the quality of the public goods that decrease its quality. This can be illustrated on the example of the factory/manufacturing industry in the coastal town of Kutai Kartanegera. Business owners factory/manufacturing industry aims to produce quality products in large quantities in order to earn income. Factory/industrial waste is not processed yet directly dumped into the sea in coastal areas near the factory. Communities around the coastal area which is largely urban/House of fishermen adversely affected due to the polluted sea.One powerful way in preventing damage to the environment or correct the economic activity that causes negative externalities is through the efforts of internalize externalities that occur. The idea is simple. The cost of the negative externalities that arise from an activity considered in the cost constraints faced by perpetrators of activity (internalization). If the previous negative externalities costs did not become the responsibility of the ' anyone ', due to its non privat and don't have a "price", now these costs should be borne by the offender.Internalization of externalities is often associated in what is called a pigouvian tax. Pigouvian tax is derived from an economist United Kingdom, namely Arthur c. Pigou. In his book, The Economics of Welfare (1920), Pigou exposes about the distinction at the expense of marginal individuals as perpetrators of economic and social marginal costs. It is in this framework that later became the entrance to the internalization of externalities an attempt through the tax mechanism. The tax will ultimately lead to increased cost structure so that the correct amount of the quantity of goods produced. As a result, activities that result in negative externalities will be reduced. Thus, the pigouvian tax is simply attempting to move the cost of damage incurred into the fee structure of the perpetrator (individuals or companies). The picture below describes the concept of a pigouvian tax in the graph.

| Figure 2. Pigouvian Tax |

4. Conclusions

- The results of the research have been done kesimulan produces some of them, namely: (1) the concept of environmental tax that will be applied in Banyuwangi Regency preferably involve parties from the academia which significantly controlled by either the concept of tax policy environment, green and environmental taxation § taxes, which are already applied in several other countries. So come by the tax policy formulation environment that easily from the administrative side but in accordance with the principle of environmental taxation § taxes/green which has a role in the efforts of the management and protection of the environment, (2). There are a number of fiscal policy, in the form of taxes and levies, related environmental management in the Regency of Banyuwangi. Among them are the motor vehicle Tax (PKB), the motor vehicle fuel tax (PBBKB) and the tax on groundwater. Whereas in terms of retribution, there is retribution permits interference.Most policies have an effect on the management of the environment tax is ground water. Because this policy provides benefits directly to the environment in the form of restrictions of utilization and use of but in fact, these functions become lame if viewed other policies are still not contributing enough to the environment. Environmental financing policy assessed is still not taking a major role in the efforts of the management and protection of the environment. Until now, the Government does not have a postal receipt which can be used for the efforts of the management and protection of the environment and (3). In fact, there are still other options in an attempt to repair the damage to the coastal area in Banyuwangi Regency side of taxes. It can be started with an increased sensitivity of the community in terms of tax payments. That way, when a later proceeds will be used as an instrument of environmental conservation of the coastal region then it can be performed optimally. The existence of a balancing in the enforcement of green tax and green incentive, without such an alignment in the implementation, then within the next five years, it is not impossible level of environmental damage in the region of Banyuwangi Regency will increase rapidly.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML