-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(4): 194-200

doi:10.5923/j.economics.20170704.05

Oil and Non-Oil Foreign Direct Investment and Economic Growth in Nigeria: An Empirical Evidence from Autoregressive Distributed Lag Model

Mustapha Hussaini 1, Abdullahi Ahmed Mohammed 2, Sagiru Mati 3

1School of Preliminary Studies, Sule Lamido University, Jigawa, Nigeria

2Department of Economics, Northwest University, Kano, Nigeria

3Department of Economics, Northwest University, Kano, Nigeria.

Correspondence to: Mustapha Hussaini , School of Preliminary Studies, Sule Lamido University, Jigawa, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The paper examines the impact of both oil and non-oil foreign direct investment (FDI) on economic growth in Nigeria for the period 1980. The paper employed ARDL Approach to Cointegration and conditional EC Model in order to ascertain the long run and short-run relationships between the two categories of FDI (oil and non-oil), investment, export and economic growth. Bound cointegration test established that there is long run equilibrium relationship among the variables. Evidence from short run and long run elasticities shows that while non-oil FDI has positive effect on the growth of GDP, oil FDI exerts a negative effect on the economy and this may be due to the high profit repatriation and low level of domestic employment in the subsector. The result further shows that domestic investment has significant positive effect on economic growth, the coefficient of export is also positive although insignificant. In this study, we show that economic growth in Nigeria is largely propel by increasing inflows of FDI in the non-oil sectors, real export of goods and services and increased domestic investment.

Keywords: FDI, Oil and non-oil FDI, Economic growth, ARDL

Cite this paper: Mustapha Hussaini , Abdullahi Ahmed Mohammed , Sagiru Mati , Oil and Non-Oil Foreign Direct Investment and Economic Growth in Nigeria: An Empirical Evidence from Autoregressive Distributed Lag Model, American Journal of Economics, Vol. 7 No. 4, 2017, pp. 194-200. doi: 10.5923/j.economics.20170704.05.

Article Outline

1. Introduction

- Foreign Direct Investment (FDI) has long been a burning topic of great interest and debate in several economies around the world. In the literature, there are many reasons as to why FDI has become a much-discussed topic of interest by scholars and policy makers. One key fundamental to note is the dramatic increase in the annual global capital flow from 1985 to 2013. This equalled $60 billion to an estimated $1.45 trillion respectively, resulting in the projection that FDI flows could rise to the tune of $1.6 trillion in 2014, $1.7 trillion in 2015 and 1.8 trillion in 2016 (World Trade Organization, 1996; United Nations Conference on Trade and Development, 2014). The keen interest in FDI is also part of a broader interest in the forces propelling the ongoing global integration of the world economy. The spectacular and diverse forms of FDI during the last three decades represented an importance force generating greater economic integration (Patibandla, 2014; Sethi and Sucharita, 2009; Mody, 2004; WTO, 1996). FDI is also viewed as a way of increasing the efficiency with which the world’s scarce resources are used. Specifically, it brought in capital to capital-scarce economies (Tekin, 2012; Egbo et al., 2011; Mody, 2004; WTO, 1996). Developing countries in sub-Saharan Africa and specifically Nigeria has been one of the main receipts of FDI particularly since the lunching of structural adjustment programme (SAP) in 1986. In effect, this not only provide foreign investors the opportunity to invest in various sectors of the economy but also ends the policy of restriction on the repatriation of profits and capital out of the country. However, with many years of increasing FDI inflows in the country, there are many unanswered questions on the benefits or impacts of foreign investors to Nigerian economy. One of those questions is whether FDI in one sector has spill over effect to another sector over time. In what follows, this study derive a strong motivation by the need to answer this particular question by assessing the impact of oil and non-oil FDI on Nigeria economy. There are numerous past empirical studies that dealt with the impact of FDI on economic growth in Nigeria (Uma et al., 2015; Babalola et al., 2012; Olokoyo, 2012; Adegbite and Ayadi, 2010; Ayanwale, 2007), however, until quite recently, limited number of these studies assess FDI contributions to oil and non-oil sector in Nigeria. This call for an empirical study that would be used to find an evidence to support oil FDI and non-oil FDI growth hypothesis in Nigeria.The purpose of this paper is to assess the impact of disaggregated FDI on economic growth by using ARDL-bound testing approach to cointegration. The results of this analysis have important implications for the implementation of future policies to attract foreign capital investment in Nigeria. Fundamentally, the paper1 adds two distinctive contributions to the existing knowledge. First, this is one of the very first papers to investigate the link between oil and non-oil FDI and economic growth in Nigeria by including real domestic investment and real export of goods and services as determinants of rates of growth. Second, the paper examines oil and non-oil FDI-growth relationship using autoregressive distributed lag (ARDL) bound-test approach. The study used ARDL bound-test framework in particular because it has a number of advantages compared to other conventional methods such as Engle and Granger`s (1987) and Johansen (1988) methods. For instance, the first two conventional cointegration methods estimate long-run relationships in the context of system equations, whereas the ARDL method uses only a single reduced from equation (Pesaran et al., 2001). It has also additional advantage over other cointegration approach because order of integration of the series does not matter in applying the ARDL bound testing. Especially if stationarity is not found in the variables. Drawing from the Literature reviewed, evidently, the relationship between FDI and growth is conditional on the macroeconomic dispensation the country in question is passing through. In fact, Zhang (2001) asserts, “the extent to which FDI contributes to growth depends on the economic and social condition or in short, the quality of the environment of the recipient country”. In essence, the impact FDI has on the growth of any economy may be country and period specific, and as such, there is the need for country specific studies.

2. Empirical Literature and Theoretical Framework

2.1. Empirical Literature

- The empirical literature contend that FDI is one of the driving forces for economic growth for both developed and developing countries. Although, the evidences are ambiguous with a wide range of contradictory empirical result, available evidence from developed countries seems to suggest there is a perfect positive correlation between economic growth and FDI (Apergis et al., 2008; Lipsey and Sjoholm, 2001; Liu et al., 2000). On the contrary, there are number of studies from developing countries that tried to measure the impact of FDI on economic growth but the results are not so clear, with some finding showing positive spillovers (Aurangzeb and Stengos, 2014; Kokko, 1994; Blomstrom, 1986) and others such as Aitken et. al. (1997) reporting limited evidence. Still others find no evidence of positive short-run spillover from foreign firms. The mixed result from some of these studies are attributed in most cases to forward and backward linkages that wasn’t necessarily attained (Anand and Sen, 2000; Aitken et.al. 1997) which suggest arguments of FDI encouraging increased productivity due to competition may not be true in practice (Aitken et al. 1999). Other reasons include the fact that transnational corporations (TNCs) tend to locate in high productivity industries and, therefore, could force less productive firms to exit (Smarzynska, 2002). Cobham (2001) also postulates the crowding out of domestic firms and possible contraction in total industry size and or employment.The review shows that the debate on the impact of FDI on economic growth is far from being conclusive. The role of FDI seems to be country specific, and can be positive, negative or insignificant, depending on the economic, institutional and technological conditions in the recipient countries. The rest of the paper is organised as follows. In the next section, we review empirical and theoretical issues, followed by methodology of the study, results and discussion and conclusion and recommendations.

2.2. Theoretical Framework

- That FDI and economic growth exhibit a positively correlation, is situated in growth theory that emphasizes the role of improved technology, efficiency and productivity in promoting growth (Lim, 2001). The effect of FDI on economic growth can be analysed in the standard growth accounting framework. To begin with, it is assume that capital stock to consist of two components: domestic and foreign owned capital stock. So,Kt = Kdt + KftWe adopt an augmented Solow production function (Solow, 1956) that makes output a function of stocks of capital, labor, human capital and productivity with some few modifications to allow us include another variable into the model. Using a Cobb–Douglas production function we can show that:

| (1) |

| (2) |

3. Econometric Methodology

3.1. Model Specification

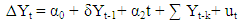

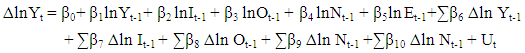

- The foregoing suggests that a general empirical model of disaggregated FDI on Nigeria’s economic growth can be express thus:

| (4) |

| (5) |

3.2. Unit Root Test

- The study employs ADF unit root test as preliminary analysis. This is vital in order to provide meaningful policy analysis with the results. As it is important to distinguish between correlation that arises from a share trend and one associated with an underlying causal relationship. To this end, our data were tested for unit root (nonstationarity) by using the Augmented Dickey–Fuller test (ADF) (Dickey and Fuller, 1979) both with constant and deterministic trend. The following equation present the possible form of the ADF test:

| (6) |

3.3. ARDL Approach to Cointegration

- To investigate the long-run relationship among the variables under consideration, the bounds test for co-integration within ARDL (autoregressive distributed lag) modelling approach is adopted in the study. Pesaran et al. (2001) developed the model and can be applied regardless of the order of integration of the variables (irrespective of whether regressors are purely I (0), purely I (1) or mutually cointegrated. In simple form, the ARDL modelling approach involves estimating the following conditional error correction models:

| (7) |

| (8) |

4. Results and Discussion

4.1. Stationarity Test

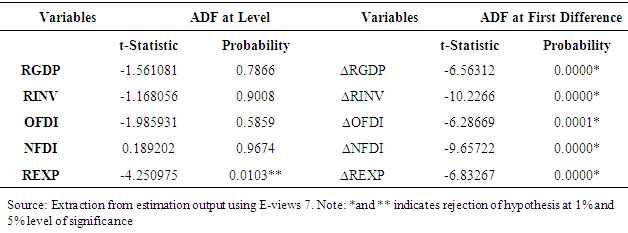

- Table 1 reports the result of ADF unit root test. The test indicates that, all the variables are found to be stationary in their first difference at 1% level of significance except REXP, which is stationary both at level, and in first difference. Thus, the test obviously revealed that the variables are a mixture of I (1) and I (0), none is I (2). This gives room for the ARDL approach to cointegration.

|

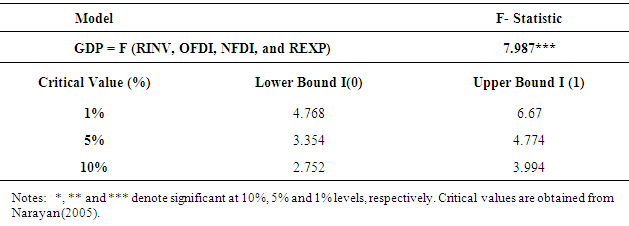

4.2. Bound Test Result

- Having confirmed the absence of I (2) in our variables, the next important task is to check whether there exists a long run relationship among the variables. To achieve that, we estimate the equation using ordinary least squares (OLS) technique and then conduct a Wald test in Eviews 7 and conduct a wald test to confirm the existence of causality among the dependent and independent variables. The table below present the result the bound test based on ARDL approach test.

|

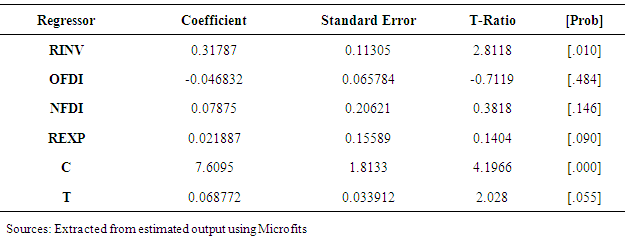

4.3. Long Run Estimates

- Since the existence of long run cointegration relationship is confirmed in the model, we begin by presenting the long run estimates and then bring the short run estimates in the next section.

|

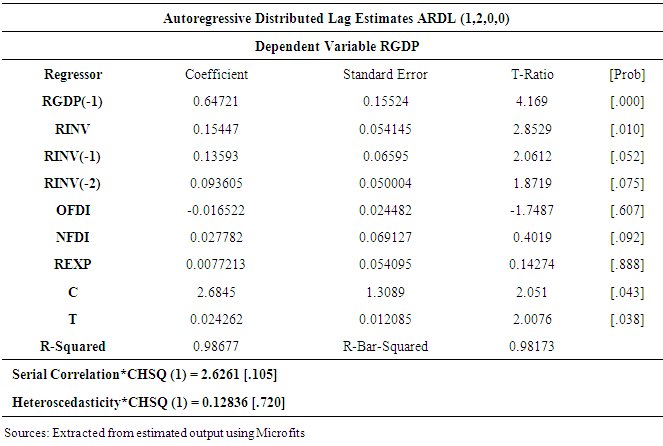

4.4. Short Run ARDL Estimates

- The result of the ARDL estimates above present the short run estimates of the variables. The result shows that the coefficient lagged RGDP and RINV are significant at 1 percent level, that of NFDI, constant term and time trend are all significant at 5% level. In terms of theoretical expected signs, all the coefficients conform with theoretical underpinnings except OFDI that have negative sign which may be due to the high rate of profit repatriation and poor linkage with the real sector of the economy. Although two of the coefficients are insignificant in the model, the regression result fits reasonably looking at the R squared adjusted (0.98173) and the passes the diagnostic tests of non-existence of autocorrelation and heteroskedasticity (see Table 4).

|

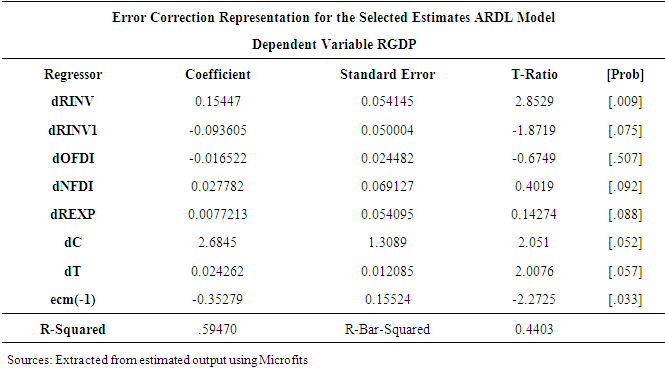

4.5. Estimates for Error Correction Model

- The error correction regression result in the table above, shows that, the error correction coefficient is estimated to be -0.35279 with probability of 0.033, is statistically significant. This means that 35.28 per cent of the adjustment takes place every year. This implies that, full adjustment occurs – 100% (1/30.28) x 100 = 3.3 years. That is to say any short-run deviation will take about 3.3 years to adjust to long-run equilibrium.

|

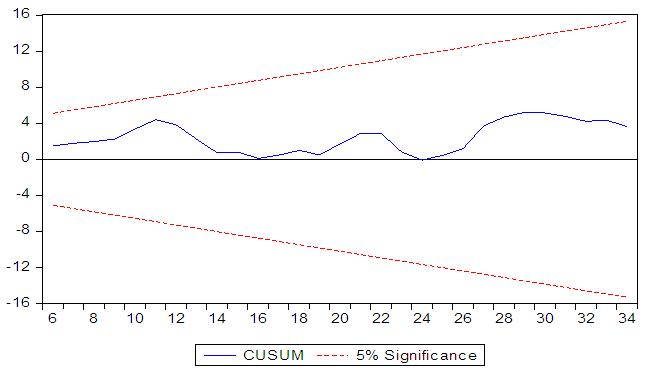

| Figure 1. Plots of Cumulative Sum of Squares of Recursive Residuals |

5. Conclusions

- By and large, our result based on the short-run estimations and their discussions revealed that foreign direct investment in the non-oil sectors contribute to economic growth and that domestic investment and export are also complementary to economic growth in Nigeria over the period of study. In fact, economic growth has been driven by increase in the level of domestic investment, growth of exports and foreign direct investment as expected. Thus, there is positive relationship between Non-oil FDI and GDP although the overall effect of Non-oil FDI may not be very significant as expected due to the poor macroeconomic conditions and poor institutional frameworks that will allow the benefits of FDI to be maximized.Based on our findings, the paper suggests that Government must provide appropriate environment to attract more FDI inflows (particularly manufacturing FDI, which has greater effect on growth). Such measures as relaxation or elimination of restrictions on profits and capital remittances, opening of formerly “priority” sectors to investors and provision of adequate security among others should be put in place.There is also the need for more efforts to ensure that the positive “spillover” effects associated with FDI offset the short-term costs associated with the implementation of these incentives. Once the reverse flows of profits and capital are deducted from the gross inflows of FDI into the country, the contribution of FDI to the financing of private capital formulation may be highly jeopardized. The oil sector also, needs to be integrated into the economy. A major policy in this direction is the liberalization of the sector. This will lead to increased private participation, higher employment generation with possible multiplier effects on the economy as a whole.The result equally suggests the need to increase export for greater growth performance. This can be achieved through policies that aimed at ensuring greater private (domestic and foreign) participation in the economy that will eventually leads to increase in exports.

Note

- 1. It is clear in the literature that, attempts to find a consistent relationship between the extent of FDI inflows and national economic growth do not produce strong and consistent relationships and that bulk of the FDI inflows into Nigeria were invested into the extractive industry if not of recent.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML