Paniz Haji Karimian

Economics Department, Tehran University, Tehran, Iran

Correspondence to: Paniz Haji Karimian, Economics Department, Tehran University, Tehran, Iran.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

Cooperation between banks and insurance institutions has gained much attention in European countries in recent years. This cooperation causes changes in the structure of industries and economy, changes that banks and insurance companies can not afford to ignore them. History of a country, its culture, its past trade experiences, and changes in the environment and laws and regulations, all affect the attitude of the managers toward bancassurance. Presence of a supportive environment is a crucial for the development of bancassurance. This study investigates the effect of bancassurance on the profitability and productivity of banks using an ARDL approach (Autoregressive-Distribution Lags), for the time interval of 1992-2016 and the target population of Iranian banks that are active in insurance operations including Mellat Bank, Parsian Bank, Saman Bank, and Eghtesad Novin Bank. The results suggest that there is a positive significant relationship between an increase in bancassurance activities on the one hand, and profitability and productivity of banks on the other hand. Thus, it is recommended that banks other than those in the target population, devote special attention to this topic.

Keywords:

Insurance-bank, Profitable, Productivity, ARDL approach

Cite this paper: Paniz Haji Karimian, The Effect of Bancassurance on Bank Productivity and Profitability, ARDL Approach (Evidences from Banking Industry in Iran), American Journal of Economics, Vol. 7 No. 4, 2017, pp. 177-185. doi: 10.5923/j.economics.20170704.03.

1. Introduction

Insurance companies and insurance industry of any country in general, are among the most important financial institutions in financial markets which not only provide security for economic activities but could also play a crucial role in the mobility of financial markets and financing investment funds. The role insurance plays, underscores the economic significance of addressing the insurance industry; since on the one hand insurance, it sets the ground for expanding activities pertaining to production and services, and on the other hand, it plays a crucial role in strengthening the economy of the society and boosting economic growth. In insurance institutions, the cash required for investments is provided by the net insurance premium revenues. Thus, from the beginning, such industry is capable to use received insurance premium as a resource for investments that leads to a growth in the amount of capital and eventually, a growth in domestic production [4]. Furthermore, financial performance has always been among the prevailing issues in the finance literature and a main concern for business practitioners in organizations of all sorts. The reason is that a sound financial performance implies the organizational wellbeing and eventually its survival. A high performance reflects the high effectiveness and efficiency of the management in using the organizational resources and this in turn is widely beneficial to the economy of the country.The ground for founding bancassurance is to make it possible for the banks to provide more services and more diverse products to their clients. Thus, banks could either receive commissions or share in the profit from insurance premiums, or act as a rentier. It is predicted that the share of traditional sales of the insurance companies in sum will decrease from 76% in 2000 to 51% in the forthcoming years.The aim of bancassurance is to absorb the liquidity via the money markets and to channel it into the capital markets while encountering a crisis in the monetary market. Bancassurance brings about a focus on offering mixed financial products and a rise in the number of skilled labor force in banking field and insurance field, both. However, the integration of the delivery of financial services in Iran is still in its preliminary stages. Limited experiments in the field of insurance services are being conducted in some branches of Parsian Bank, Saman Bank, Eghtesaad-e-Novin bank and Mellat Bank. That said, developing and promoting bank-insurance enterprises in Iran requires more studies. Previous studies have generally mentioned the significance of the potential of bank-insurance enterprises. However, none has attempted to introduce a proper design for bancassurance in Iran or present a feasibility study of them. Therefore this study could fill the gaps in this field so that the design presented here – if approved by the experts of this industry- could be applied by the relevant companies and that would be the first steps in establishing a successful bancassurance industry in Iran, as seen in other countries. The aim of this research is to introduce a proper design for bancassurance through a feasibility study and an evaluation of the effect of bancassurance on the profitability and productivity of banks in Iran.

2. An Overview of the Theoretical Literature and Past Researches

There are various definitions of bancassurance. Generally speaking, bank-insurance enterprises are institutions which are formed according to the co-ownership, intercorporated investment, or Joint Venture models and offer insurance and banking services. In the traditional model of bancassurance, bank branches deliver insurance services and in essence, the bank is the main shareholder of the insurance company, appoints the CEO of the insurance company and imposes plans on it. However, in the advanced model, the bank branches, besides delivering various insurance services (issuance and compensation), also supervises the insurance branches of grade 2 and lower and manages the activities of the network of the real agents and other branches of the bank. In general, models of bancassurance are different in terms of the form of cooperation and ownership [8]. Bancassurance is not necessarily a company independent of insurance and banking institutions. However, there are bank-insurance enterprises which are essentially independent from banks and insurance companies. Successful examples of the latter kind were active in U.S, France and Germany in early 20’th century and between 1935-1970. This kind of bank-insurance institutions caused a decrease in management flexibility, expert interferences among trade complexes, complexity in monitoring the performance of the complex and problems in generating symmetrized portfolios. Therefore, joint ventures and holding ownerships prevailed like a bank that owns an insurance company or is its main shareholder, or an insurance company that is the owner or the main shareholder of a bank (Pikarjou, Daghighi Asli, and Hasanzade, 1389). In countries with bancassurance, like France, banks offer mixed insurance products (a mix of life and non-life insurance products) as products related to bank loans, in addition to simple life and non-life products. The structure of bancassurance depends on the specific economic, social, cultural and legal circumstances of the host market, as well as the infrastructures of the market and needs of the consumers, in defining different designs of bancassurance, some characteristics are as follows.

2.1. In Terms of Ownership

Activity as an integral organization: i.e. the ownership of bancassurance is independent’Ownership based on a joint venture between legal shareholders and an insurance company;Ownership based on subsidiary in which the bank-insurance company is a subordinate of a parent company and acts to the benefit of the parent company.

2.2. In Terms of Sale Network

* insurance agents are based in bank branches and bank receives part of their revenue;* bank acts as an agent and as a representative of all insurers sells insurance policies and receives a commission in proportion to the insurance premium;* bank receives an agent identification number from the insurance company and is authorized to issue insurance policies and receives a commission in proportion to the insurance premium;* sales are conducted via a combination of networks (internet, ATMs, post).

2.3. In Terms of Products Categories

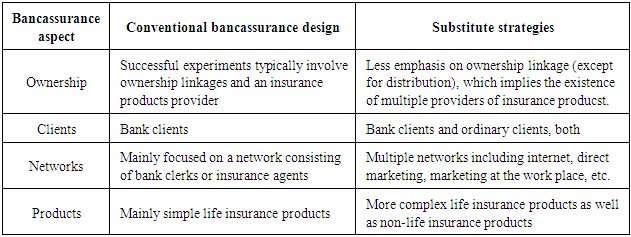

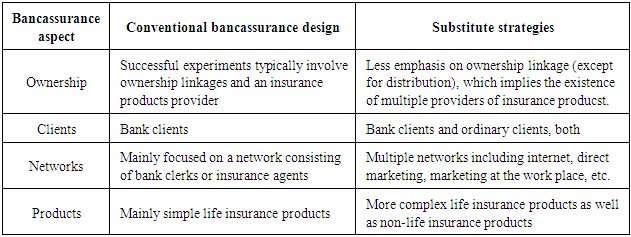

* Providing simple insurance products as bank deposits;* Providing mixed insurance products that are a mix of insurance and banking products, such as credit life insurance;* providing insurance consultant services;* providing insurance packages according to the needs of the clients.Life insurance is a considerable category in most statistical analyses in the bank-insurance due to its tax exemption.In table 1. The aforementioned aspects are compared between traditional designs and advanced designs of bancassurance.Table 1. A comparison between traditional designs and advanced designs in terms of various aspects of bancassurance

|

| |

|

Two important variables while choosing bancassurance structure are the degree of financial controls and operational composition. Financial ownership could be on a range from 0% to 100%, as the insurance company activities could be completely independent from banking entity or managed as an integrated retailer. Considering the abovementioned variables, the available designs are as follows:- a financial organization for combining insurance and banking activities, which causes a diversification in the revenues and sets a basis for bigger investments, though it has no operational synergy with respect to cross-sell. Its advantages are its simplicity and revocability, lack of need for making changes to the structure, independence of banks and insurance enterprises from each other and an increase in their competition.- An insurance company that is completely integrated with the bank on an operational level and sells mainly to the collective clients; needless to say that this model has little flexibility.- a joint venture between a bank and an insurance company. In this model, cross-selling is done for the joint clients and we witness a synergy in human resources and knowledge and economic growth.- a distribution agreement which is the most common structural model according to the Finaccord study in 2003. It is in the form of an exclusive or non-exclusive agreement for selling the products of the insurance company to the bank clients.Choosing a proper model for bancassurance depends to the specific supervisory, legal and cultural conditions of each country. There is no single model suitable for all conditions, freedom of choice while selecting from different bancassurance models should be according to the operational efficiency and cost efficiency of the model.Four common models for bank-insurance enterprises are as follows [2]:Model 1: bank is the main shareholder of the insurance company and bank branches can provide different kinds of insurance services or just individual insurance policies. In this model, bank branches act as agencies of the insurance company and provide services to the bank clients.Model 2: insurance company is the main shareholder of the bank and bank branches supervise the regional sale network. Bank branches could substitute the insurance branches and act in the field of insurance products related to the clients of the bank branches. In this design, insurance branches supervise the legal representatives and bank branches.Model 3: bank and the insurance company work according to a unilateral contract, bank branches are like insurance agencies and supervise the local sale network and provide insurance products related to the bank clients. In this model, insurance branches supervise the legal representatives and bank branches.Model 4: there is a bilateral contract between the bank and the insurance company. Bank branches supervise the local and regional sale networks and could substitute the insurance branches and provide insurance products for the clients, weather they are bank clients or not. Furthermore, insurance branches also supervise the legal representatives and bank branches and provide some banking services. In this model, real and legal representatives are allowed to provide some banking services and involve in financial intermediation.The first model is traditionally implemented worldwide, the second model is rarely seen and the third, and in particular the fourth model are implemented on an advanced level. The main product of bank-insurance enterprises is life insurance and its main advantage is it tax exemption. Moreover, for most bank-insurance enterprises, non-life insurance is considered useful for increasing market share and gaining clients’ royalty.In what follows we will address the result of the past studies concerning the bancassurance designs and some of their internal components.Most advanced countries in bancassurance, use model 1 in an advanced manner, i.e. a model in which the bank is the main shareholder of the insurance company. The September 11th event gave rise to changes in the regulations for the activities of new institutions and altered them into the bilateral contracts of model 4. Due to the existence of two separate regulatory institution (Central Insurance of I.R.I and Central Bank), an integral implementation of bancassurance models is not possible. The model in which the bank is the main shareholder of the insurance company, is traditionally prevalent in Iran. The only way to change and to join the advanced integral global models is through a change in the ownerships. The global trend is a shift toward financial holdings and bancassurance enterprises supervised by such holdings [2].According to Peykarjou (1383), choosing a proper bancassurance model depends to the supervisory, legal and cultural conditions of each country. Selling life insurance policies via bank branches is a proper substitute for long-term and medium-term bank deposits. He asserts that in most Asian countries, life insurances are provided by bank-insurance enterprises and non-life insurances are provided individually (and not collectively) with an emphasize on relevant insurance policies of the bank. A study by Fiordelisi and Ricci (2010) shows that the cost efficiency of bank-insurance enterprises that work fully integrally is more than that of bank-insurance enterprises owned by the bank or independent insurance companies. However no significant difference has been mentioned with respect to the profit efficiency. In their study, bancassurance models are categorized into three models: cross-selling, a partnership between the bank and the insurance company with a high level of integration and involving they taking advantages of each other’s skills, and finally same management approach.In another study, 5 models of bancassurance are introduced: financial holding companies, shareholding holding companies, developing new joint ventures, pre-competitions alliances, and developing insurance intermediaries. The results show that in Taiwan, bancassurance in the form of a financial holding company (integral partnership and cross-selling) is superior to other models. Satilouras and Dickinson (2005) refer to a model of bank-insurance cooperation in which the insurer is part of the bank and under its control (vertical partnership) and products are designed specifically for the bank clients. On the other hand, there is a horizontal alliance model in which bank reaches an agreement with the insurer (or insurers) so that the insurance products could be provided in the bank branch. The bank can recommend its clients directly to a particular insurer. Depending on the variety and quality of the offered products, the bank might have more than one insurer.

2.4. Research Questions

- does bancassurance have an effect on bank’s profitability?- does bancassurance have an effect on bank’s productivity?

2.5. Research Hypotheses

In this research we attempt to verify the important hypothesis that bancassurance has a significant effect on the bank’s profitability and productivity, while evaluating the feasibility of bancassurance.

3. Presenting the Model and Variables

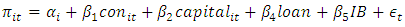

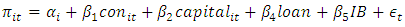

The statistical population of this research consists of the banks which additionally provide insurance services, which are Mellat Bank, Parsian Bank, Eghtesad Novin Bank, and Saman Bank. The profitability model in this research is within the framework of the structure-behavior theory and performance theory and based on foreign studies in this field, such as the study conducted by Athanasoglou et al. (2008). Its general formulation is as bellow:  | (1) |

Where t denotes the time interval of 1992-2016 and I denotes the sections, i.e. private and public banks. The dependent variables are the return on equity of the shareholders as an index of the banks’ profitability; and the sum amount of deposits in the studied banks in comparison to other banks, as an index of productivity of the banks.Market concentration index is an important aspect of the structure of the bank market and probably the most important structural variable of the profitability of the banks. In this research we use Herfindahl-Hirschman Index (HHI) as the effective factor in the profitability of the banks.A bank’s capital, by absorbing the losses, acts like a guard against financial problems and turbulence. Capital ratio is calculated by dividing shareholders’ equity by the net asset value of the bank. This ratio shows bank support’s power of capital from holders of share invested in it. The higher is this rate, the more stable is the bank. Another variable which is effective on the bank’s profitability is the loan-to-assets ratio; it is calculated by dividing the total value of the loans by total value of the bank’s assets, and it indicates what percentage of the value of the assets is paid to the borrowers.The total amount of insurance sales by the banks and their insurance branches is considered the variable for bank-related insurance.

4. The Research Methodology and Evaluation of the Results

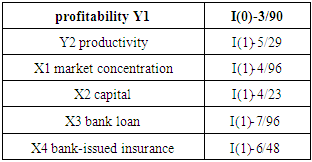

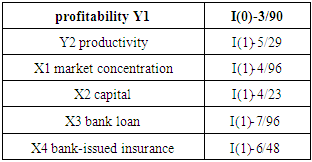

The usual method of econometrics is based on the assumption that the variables of the model are reliable. The presence of unreliable variables in the model makes the usual f-test and t-test lack the required validity. Consequently, the critical distributions yielded by f-test and t-test would not be accurate critical quantities for performing the test and the conducted regression would be false. Therefore, to ensure the stability of the estimated model, unit root test of Dicky-Fuller is performed. A summary of the results is shown in table 2. According to the cointegration theory in the modern economics, while using time series, it is necessary to use methods for estimating the functions that take into consideration the issues of stability and cointegration, since the reliable variables might not be of the same degree and as a result, the Johansen-Jesilius cointegration method would not be useful. In ARDL method (Autoregressive-Distributed Lag), unlike Johansen-Jesilius method in which all variables are required to be of degree one, it is not necessary for the variables to be of the same degree of stability and it is possible to choose the proper model solely by determining proper lags for the variables [5]. Furthermore while conducting studies with small samples (few observations), methods like Engel-Granger are not valid since they can not take into account the short-term dynamic reactions among the variables. The reason is that the resulted estimates of a method like Engel-Graner is not without bias and therefore testing the hypothesis by usual test statistics like t-test, will not be valid. Thus, we consider using models which take into account short-term dynamics and yield more precise estimates of the coefficients [3].Data used in this research are time series, therefore their stationarity should be verified. To verify the stability of data, Dicky-Fuller test is applied.Dicky-Fuller statistic with significance level of 95% and intercept and trend, is equal to -3.65.Least squares method is based on the assumption that the mean, variance and covariance of the time series variables are constant, i.e. variables are stationary. Since this assumption is unrealistic and most variables in economics are non-stationary, in case non-stationary variables are used, the least squares estimator is inconsistent and might lead to conducting a false regression. Engel and granger (1987) and later other econometricians, took a crucial step forward by introducing the concept of cointegration, in order to cope with the problem of instability in time series. Table 2. Stationarity of the variables. Source: results of the research

|

| |

|

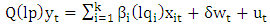

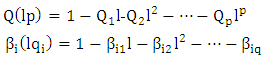

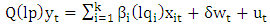

There are different methods for detecting cointegration among time series variables of an economic model, the most important of which are Engel-Granger method (1987), Johansen-Jesilius method (1990) and ARDL (1997). Usually to investigate the cointegration, and due to some disadvantages in Engel-Granger method, Johansen-Jesilius cointegration method is used for stationary variables of order-1, I(1), and ARDL method is used for stationary variables of order-0, I(0), and order-1, I(1). The efficiency of ARDL model is higher in studies with small samples. The general form of the model of ARDL is as follows: | (2) |

Where: l is the lag operator, Wt is a vector of determinant variables (non-probabilistic variables) such as intercept, trend variable, dummy variables or exogenous variables, with constant lags. After establishing the cointegration between the variables, a proper model is estimated and using it, long-term coefficients of the variables are calculated. Afterwards, the dynamic short-term relationship is estimated using Error Collection Model (ECM) which relates the short-term fluctuations of the variables to their long-term values. For modifying the ECM, error terms of the cointegration regression with a lag, is added as an explanatory variable to the first-order difference of other variables of the model. Then, model coefficients are calculated using the least square method.

l is the lag operator, Wt is a vector of determinant variables (non-probabilistic variables) such as intercept, trend variable, dummy variables or exogenous variables, with constant lags. After establishing the cointegration between the variables, a proper model is estimated and using it, long-term coefficients of the variables are calculated. Afterwards, the dynamic short-term relationship is estimated using Error Collection Model (ECM) which relates the short-term fluctuations of the variables to their long-term values. For modifying the ECM, error terms of the cointegration regression with a lag, is added as an explanatory variable to the first-order difference of other variables of the model. Then, model coefficients are calculated using the least square method.

4.1. Analysis of the Results and Findings of the Research

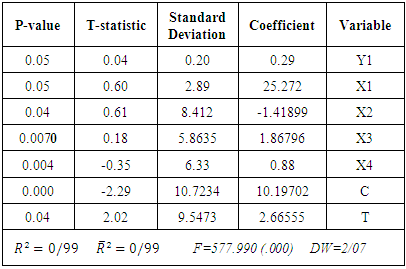

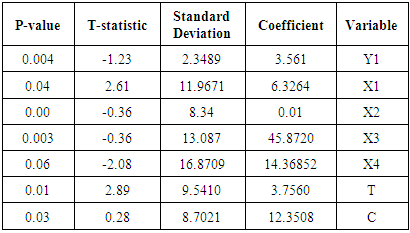

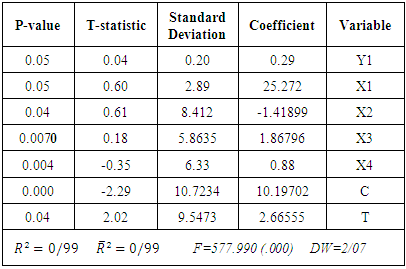

In preliminary model fitting, the dependent variable Y1 is profitability.R2 statistic is equal to 99% and F=577.990[.000] that indicates the good fitness of the model. P-values are all less than 0.05 which is acceptable.The results for the autocorrelation test of the residuals (0.909 and 0.10), error in the function form of the model (0.60 and 0.65), normality of the residuals and heteroscedasticity all indicate the model estimation accuracy.Table 3. Results for the short-term dynamic relationships. Source: results of the research

|

| |

|

Table 4. Diagnostic tests. Source: results of the research

|

| |

|

Table 5. Results for the long-term dynamic relationships. Source: results of the research

|

| |

|

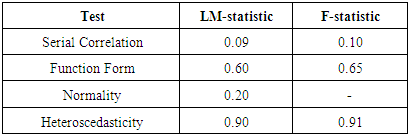

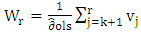

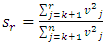

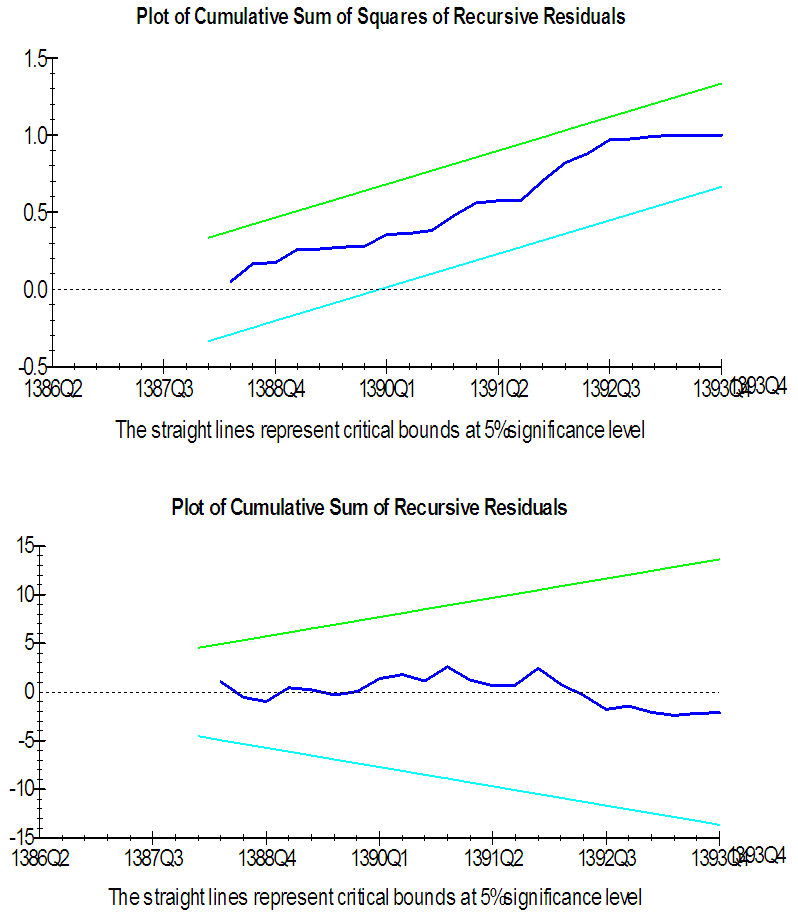

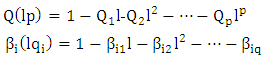

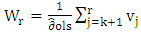

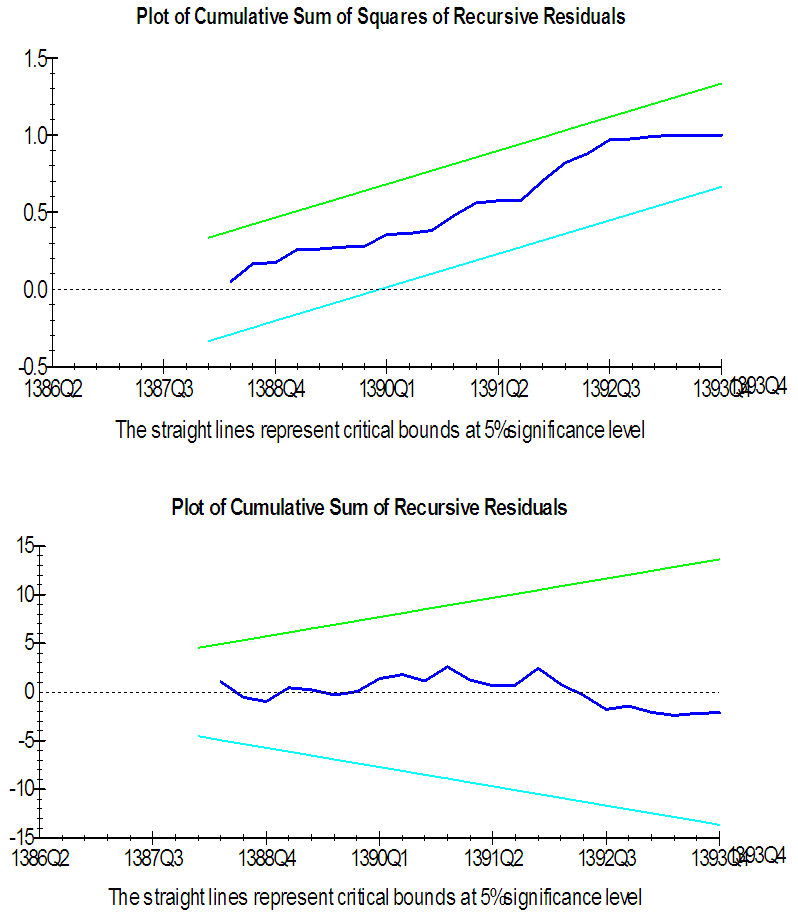

The results of the fitting of the long-term relationship of the variables show that there is a positive significant relationship between bancassurance and profitability, such that with a unit of increase in the sales of bank-issued insurance, profitability is increased by 14 units. Also the positive relationship between bank loans and profitability implies an increase in profitability by each unit increase in bank loans, since bank loans causes a decrease in bank deposits and increase in cash flow. An increase in capital causes only a 0.01% increase in profitability therefore it is recommended that banks, instead of increasing their capital, consider other variables.A coefficient of -0.70 for ECM shows that in each time period (one year in this study), 0.70% of the non-equilibrium of dependent variable can be corrected in each year and it moves to the long-term equilibrium.Model stability testsBrawn et al. (1975) propose CUSUM-test and CUSUMSQ-test as follows: | (3) |

| (4) |

Where r=k+1, …, T and  denotes the estimated standard deviation. Now if

denotes the estimated standard deviation. Now if  and

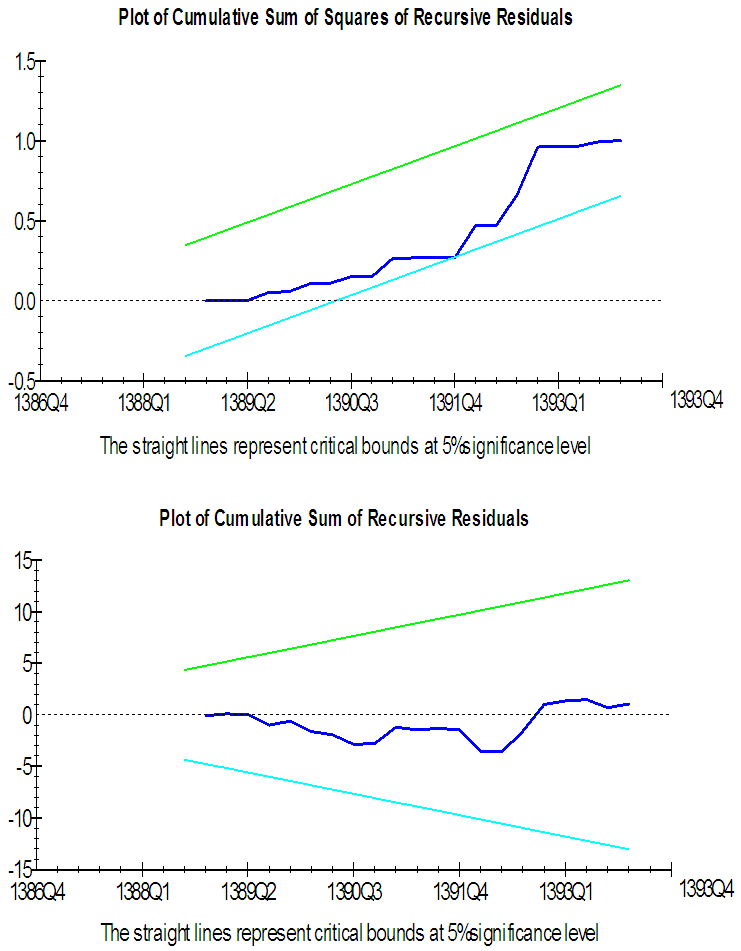

and  are within the boundaries (significance level of 5%) the assumption of stability is accepted and the estimated coefficients are considered stable. Otherwise, the assumption of stability is rejected and it is concluded that the estimated coefficients are instable. If the plot line does fall within the confidence interval, the null hypothesis of the non-existence of structural break is accepted, otherwise (i.e. if it trespasses the confidence interval), the null hypothesis is rejected and the existence of structural break is accepted [3].According to the CUSUM-test and CUSUMSQ-test plots, the null hypothesis of non-existence of structural break is accepted. Thus, the model is structurally stable.In the second model of this study (defined as follows), the effect of bancassurance on productivity (Y2) is investigated:

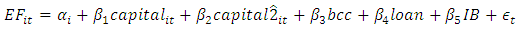

are within the boundaries (significance level of 5%) the assumption of stability is accepted and the estimated coefficients are considered stable. Otherwise, the assumption of stability is rejected and it is concluded that the estimated coefficients are instable. If the plot line does fall within the confidence interval, the null hypothesis of the non-existence of structural break is accepted, otherwise (i.e. if it trespasses the confidence interval), the null hypothesis is rejected and the existence of structural break is accepted [3].According to the CUSUM-test and CUSUMSQ-test plots, the null hypothesis of non-existence of structural break is accepted. Thus, the model is structurally stable.In the second model of this study (defined as follows), the effect of bancassurance on productivity (Y2) is investigated: | (5) |

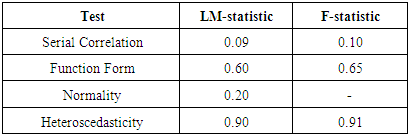

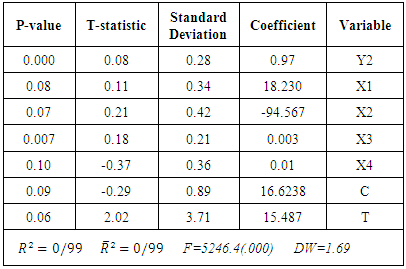

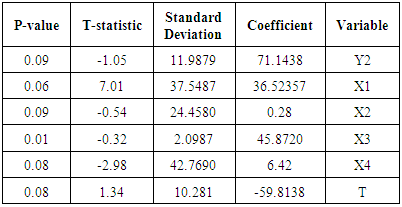

Table 6. Results for the short-term dynamic relationships. Source: results of the research

|

| |

|

| Plot 1. CUSUM-test and CUSUMSQ-test. Source: results of the research |

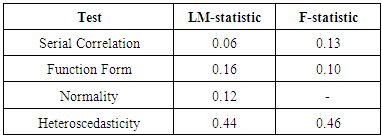

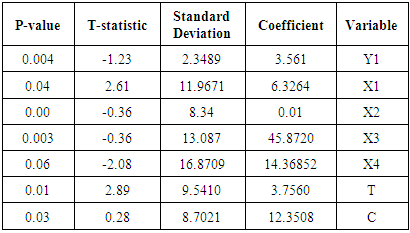

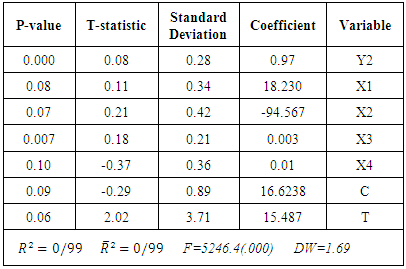

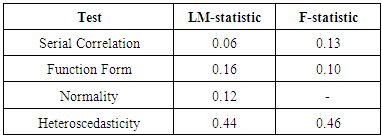

R2 statistic is equal to 99% and DW equals 1.69 and F=5246.4[0.000] that shows that the model is well fitted.Table 7. Diagnostic tests. Source: results of the research

|

| |

|

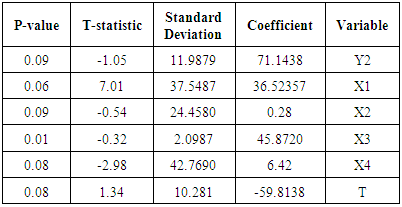

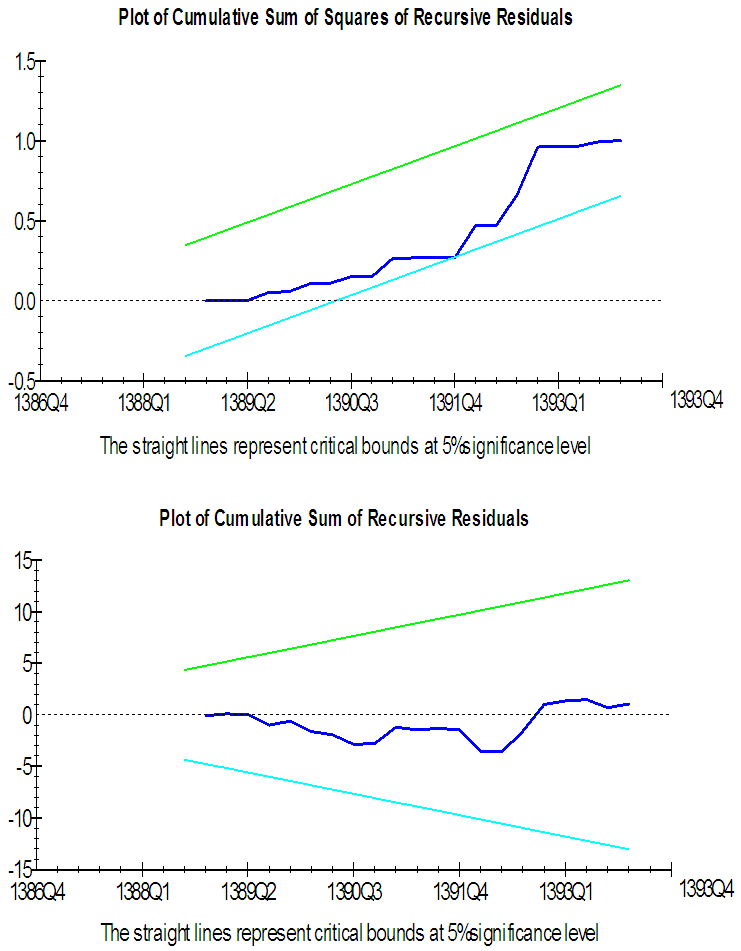

The results for the autocorrelation test of the residuals (0.06 and 0.13), error in the function form of the model (0.10 and 0.16), normality of the residuals (0.12) and heteroscedasticity (0.44 and 0.46) all indicate the model estimation accuracy.A coefficient of -0.02 for ECM shows that in each time period (one year in this study), 0.02% of the non-equilibrium of dependent variable can be corrected in each year and it moves to the long-term equilibrium. According to the CUSUM-test and CUSUMSQ-test plots the model is structurally stable. With a unit increase in the sales of bank-issued insurance, profitability is increased by 6.42 units.Table 8. Results for the long-term dynamic relationships. Source: results of the research

|

| |

|

| Plot 2. CUSUM-test and CUSUMSQ-test. Source: results of the research |

5. Conclusions

During the last three decades, the interaction between insurance industry and money market has expanded considerably in advanced countries and devices for the development of both markets have been developed. One of the innovations in this regard is the foundation of a new financial institution called bancassurance that brought unique advantages to both markets. Bancassurance introduces a strategy by which banks and insurance companies cooperate in a more or less integral manner in order to establish financial markets. One of the main consequences of the formation of this financial institution is the promotion of life insurances as one of the main resources of supplying funds. In fact, by integration of some activities of the banks and insurance companies, the insurance industry has gained a more important role in finance and banks now have access to the funds collected by insurance companies. History of a country, its culture, its past trade experiences, and changes in the environment and laws and regulations, all affect the attitude of the managers toward bancassurance. Presence of a supportive environment is a crucial for the development of bancassurance. Regulatory freedom regarding the acquisition of insurance companies by the banks and selling insurance products via bank branches could be said to be the necessary conditions for the progress of bancassurance.This study attempted to investigate the effect of bancassurance on the profitability and productivity of banks using an ARDL approach (Autoregressive-Distribution Lags). The results of the long-term relationships among the variables indicates that there is a positive significant relationship between bank-issued insurance and profitability of the bank and an increase by unit in the amount of bank-issued insurance results to a 14.36 increase in profitability. Moreover, there is also a positive significant relationship between bank-issued insurance and productivity that shows that an increase by unit in the amount of bank-issued insurance results in increase of 6.42 in productivity. Finally, we recommend that other banks appreciate more the importance of bancassurance.

6. Suggestions

Considering the findings of the research, we suggest the followings:- according to the survey, offering related banking products is of priority. Therefore, it is suggested that experts in this field devise new products to be offered beside banking services.- categorizing bank clients in terms of income and career could help insurance agents to identify the target market of each category and offer products accordingly.- private insurance companies without a bank, and conversely, banks without an insurance company, are advised to enter into cooperation contracts and benefit from bancassurance.- including insurance topics in the initial training programs of the bank employees could be beneficial for a better marketing of insurance services in banks and success of bancassurance.

References

| [1] | Peykarjou, K. (2004). Bancassurance with a special view on Asian market. Journal of banking and economy, 53, pp. 17-29. |

| [2] | Peykarjou, K, Daghighi Asli A.R., and Hasanzadeh, A. (2010). Learning about bancassurance phenomenon in the world and its various aspects. A research commissioned by Monetary and Banking research Institute, pp. 1-173. |

| [3] | Teshkini, A. (1999). Applied econometrics by Microfit, Dibagaran Publication. |

| [4] | Karimi, M. (2011). The affect of variables of company size, debt ration, trade risk and diversification of insurance on the profitability of insurance companies in Iran. Master’s thesis for the degree of Master of Science in Commercial management, Finance subdiscipline, Tehran University. |

| [5] | Nowfarasti, M. (1999). Unit root and cointegration in econometrics, Tehran, Rasa Publication. |

| [6] | Almajali, A., Alamro, S. and Al-Soub, Y. (2012). Factors affecting the financial performance of Jordanian insurance companies listed at Amman stock exchange. Journal of Management Research, 4(2), pp. 266-289. |

| [7] | Bergendal, G. (1995). The profitability of bancassurance for European banks. International Journal of Banks Marketing, 13, pp.27-8. |

| [8] | CMI (Chartered Management Institute) (2003). Dictionary of business and management. |

| [9] | Fields, L.P., Kolari, J.W. and Fraser, D. R. (2007). Bidder returns in bancassurance mergers, is there evidence of synergy?. Journal of Banking & Finance, 31, pp. 3646-62. |

| [10] | Korhonen, P., Koskinen, L., and Voutilanien, R. (2006). A Customer view on the most preferred Alliance structure between banks and insurance companies., Zeitschrift Fur betriebswirtschoft, 76, pp. 139-64. |

| [11] | Korhnon, P. and Voutilainen, R. (2006). Finding the most preferred structure between banks and insurance companies. European of Operational Research, 175, pp. 1285-129. |

| [12] | Staikouras, S.K. and Dickinson, G.M. (2005). An examination of the bank incursion into insurance business. The case of Greece. Paper Presented at the Multinational Finance Society Conference, <http://www.ssrn.com>. [Accessed 1 may 2011]. |

| [13] | Staikouras, S.K. and Nurullah. M. (2007). The sepration of banking from insurance evidence from Europe. Multinational finance Journal Forth Coming, <http://papers.ssrn.com.No3>. [Accessed 14 Jan. 2012]. |

| [14] | Staikouras, S.K. (2006). Business opportunities and market realities in financial conglomerates. The Geneva Papers on Risk and Insurance, 31, pp.124-48. |

l is the lag operator, Wt is a vector of determinant variables (non-probabilistic variables) such as intercept, trend variable, dummy variables or exogenous variables, with constant lags. After establishing the cointegration between the variables, a proper model is estimated and using it, long-term coefficients of the variables are calculated. Afterwards, the dynamic short-term relationship is estimated using Error Collection Model (ECM) which relates the short-term fluctuations of the variables to their long-term values. For modifying the ECM, error terms of the cointegration regression with a lag, is added as an explanatory variable to the first-order difference of other variables of the model. Then, model coefficients are calculated using the least square method.

l is the lag operator, Wt is a vector of determinant variables (non-probabilistic variables) such as intercept, trend variable, dummy variables or exogenous variables, with constant lags. After establishing the cointegration between the variables, a proper model is estimated and using it, long-term coefficients of the variables are calculated. Afterwards, the dynamic short-term relationship is estimated using Error Collection Model (ECM) which relates the short-term fluctuations of the variables to their long-term values. For modifying the ECM, error terms of the cointegration regression with a lag, is added as an explanatory variable to the first-order difference of other variables of the model. Then, model coefficients are calculated using the least square method.

denotes the estimated standard deviation. Now if

denotes the estimated standard deviation. Now if  and

and  are within the boundaries (significance level of 5%) the assumption of stability is accepted and the estimated coefficients are considered stable. Otherwise, the assumption of stability is rejected and it is concluded that the estimated coefficients are instable. If the plot line does fall within the confidence interval, the null hypothesis of the non-existence of structural break is accepted, otherwise (i.e. if it trespasses the confidence interval), the null hypothesis is rejected and the existence of structural break is accepted [3].According to the CUSUM-test and CUSUMSQ-test plots, the null hypothesis of non-existence of structural break is accepted. Thus, the model is structurally stable.In the second model of this study (defined as follows), the effect of bancassurance on productivity (Y2) is investigated:

are within the boundaries (significance level of 5%) the assumption of stability is accepted and the estimated coefficients are considered stable. Otherwise, the assumption of stability is rejected and it is concluded that the estimated coefficients are instable. If the plot line does fall within the confidence interval, the null hypothesis of the non-existence of structural break is accepted, otherwise (i.e. if it trespasses the confidence interval), the null hypothesis is rejected and the existence of structural break is accepted [3].According to the CUSUM-test and CUSUMSQ-test plots, the null hypothesis of non-existence of structural break is accepted. Thus, the model is structurally stable.In the second model of this study (defined as follows), the effect of bancassurance on productivity (Y2) is investigated:

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML