-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(4): 163-170

doi:10.5923/j.economics.20170704.01

Impact of Foreign Direct Investment on the Economic Growth of Pakistan

Najabat Ali 1, Hamid Hussain 2

1School of Economics, Shanghai University, Shanghai, China

2Institute of Business Administration (IBA), Karachi, Pakistan

Correspondence to: Najabat Ali , School of Economics, Shanghai University, Shanghai, China.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Foreign direct investment (FDI) is generally considered as a key driver of global economic integration. FDI inflows are often seen as important catalyst for economic growth in the developing countries. The current paper attempts to analyse the impact of foreign direct investment (FDI) on the economic growth of Pakistan. The study utilizes time series data over the period of 1991-2015. The study uses correlation and multiple regression analysis techniques for analysis of data. The results of the study reveal that FDI has a positive impact on the economic growth of Pakistan. The study recommends that government should bring reforms in the domestic market to attract more FDI in Pakistan.

Keywords: Impact, FDI, Economic Growth, Pakistan’s Economy

Cite this paper: Najabat Ali , Hamid Hussain , Impact of Foreign Direct Investment on the Economic Growth of Pakistan, American Journal of Economics, Vol. 7 No. 4, 2017, pp. 163-170. doi: 10.5923/j.economics.20170704.01.

Article Outline

1. Introduction

- Foreign direct investment (FDI) is defined as “an investment involving a long-term relationship and reflecting a lasting interest and control by a resident entity in one economy (foreign direct investor or parent enterprise) in an enterprise resident in an economy other than that of the foreign direct investor (FDI enterprise or affiliate enterprise or foreign affiliate).”1 While economic growth is defined as “Economic growth is an increase in the capacity of an economy to produce goods and services, compared from one period of time to another.”2There is a widespread belief among international institutions, academicians, policymakers and researchers that foreign direct investment (FDI) has a huge positive impact on the economic growth of the developing countries. By now it is well recognised that FDI can significantly benefit the economy of the host country and this may be the reason that governments of many countries around the globe formulate strategies that attract foreign direct investment in their countries. In addition to the direct capital financing, FDI can benefit the host country through technology spill overs, human capital formation, creation of competitive business environment, enterprise development and integration of international trade. Therefore, many emerging economies have liberalised their FDI regime and formulated FDI favourable policies. Many international institutions, politicians and economists consider Foreign Direct Investment as a major tool of the economic growth of a country as well as the solution of economic issues. Foreign Direct investment plays a major role in the economic expansion when there is a shortage of domestic savings.3 Foreign Direct Investment (FDI) has been emerged as a catalyst for accelerating the economic growth of developing countries. It is not only an important source of capital inflows but also a major source of technology transfers in the host country. The capital inflows and technology transfer are considered as accelerators for economic growth, so foreign direct investment (FDI) is more likely to promote the economic growth of the host country.4 Foreign direct Investment promotes the economic growth of a host country through various channels but the most important channels are technology transfer and spill overs. Technology transfer can be taken place in the host country through multinational firms while spill overs could be occurred by the interaction of domestic firms through the interaction of multinational firms with domestic firms, suppliers, customers and work force. Therefore, FDI can have a positive impact on income.5Despite the fact that many studies established the idea that FDI has a positive impact on the economic growth of a host country, there are some studies that argue that the relationship between FDI and economic growth is ambiguous. For instance, Aitken and Harrison states that the net impact of foreign direct impact on the host country is very small.6 Borensztein et al is of the view that FDI can only contribute in the economic growth, if the host country has sufficient absorptive capacity of advanced technology.7 Although, there is no consensus on the effects on FDI on the economic growth of the host country but the number of studies that show the positive effects of FDI is much higher than those which focus on the negative effects.8

2. Literature Review

- A substantial literature rationalises the influence of foreign direct investment on the economic growth of a developing country. The FDI impacts the recipient’s economic growth by its influence on domestic physical capital accumulation, some through its effects on human capital accumulation and through augmenting technological advancement particularly by spillovers. The existing literature highlights the effects of foreign direct investment on the economic growth of a developing country particularly Pakistan. The current literature also sheds light on the channels through which FDI contributes significantly to a country’s economic growth. Lee and Tcha (2004) indicates that FDI is the most effective way to achieve economic growth. Most of the authors consider FDI as a major engine of economic growth in a host country. In 2002, Organisation of Economic Cooperation (OECD) reported the fact that FDI is considered as the only source of economic growth and modernisation for the countries with weak economies. Carkovic and Levine (2002) states that FDI is given a lot of importance by many governments, particularly the governments of developing countries treat FDI in a very special way. In case of developing countries, they don’t have enough savings, so they usually rely on FDI inflows for capital. According to Hanson (2001) there are many examples of special treatment offered to foreign investors by the governments of the developing countries such as tax holidays, import duty exemptions, provision of land for facilities and some direct subsidies. So, these are some common examples which have been seen to encourage foreign direct investment in the host countries. According to Ford et al (2008) countries have their own public agencies which are given task to attract foreign investments in the country by using public funds. So, it shows that the governments are even ready to incur some costs to attract investments. Hill (2000) emphasized on the fact that foreign direct investment plays a positive role in the economic growth of the host country through transfer of capital, technology and management resources. He further states that these resources have the potential to speed up the economic growth of the host country and the most notable thing is that these resources can only be transferred to the host country through FDI. Har Wai Mun et al (2008) studied FDI and economic growth relationship in Malaysia and their study term FDI as a good source of economic growth. Beside capital FDI brings several more benefits in the host country like employment, management resources, modern technology and competitive goods. Balasubramanyam et al (1996) analysed the impact of foreign direct investment on the developing economies by using cross section and OLS regression. He found that FDI has a positive effect for those countries which have outwardly oriented trade policy but not for those countries which have inwardly trade policies. Although, foreign direct investment is considered as the vehicle of the economic growth of the host country but some estimated benefits may prove vague if the host economy is not able to take advantage of the new technologies or know-how transferred from FDI. Durham (2004) examined the effects of foreign direct investment (FDI) on economic growth using data on 80 countries. He founds that sometimes FDI has insignificant and adverse effects on the economic growth of the developing countries. He is of the view that the impact of FDI is dependent on the absorptive capacity of the host country. Zilinske (2010) states that the effects of foreign direct investment can be positive as well as negative. For instance, greenfield FDI has more positive effects than mergers and acquisitions or sometimes M&A has negative externalities on the economic growth of the host country. Carkovic and Levine (2002) analyses the impact of FDI on the economic growth and their study came up with the conclusion that foreign direct investment has adverse effects on the economic growth of the host country. Buckley et al. (2002) and De Mello (1999), articulated in their studies that the impact of FDI is dependent on the economic and social conditions and its environmental quality of the host country. The environmental quality includes savings and financial development, trade openness, human capital development and technological development of the host country. So, the impact of foreign direct investment on the economic growth of the host country is still debatable. A large number of studies have been conducted so far to find out the effects of FDI on the economy but there is no consensus. Some studies came up with the findings that FDI has positive impact on the economy while others with negative impact. Some studies have found that the impact of FDI depends on the absorptive capacity of the host country that includes political, economic and technological condition of the host country.

3. FDI in Perspective of Pakistan’s Economy

- Foreign Direct Investment (FDI) has been emerged as the most significant source of external capital flows to developing countries in the recent decades and it has become an important part of capital formation in the developing economies. A higher level of saving and investment is required to increase capital formation in developing countries but the developing countries like Pakistan lack the desired amount of domestic savings. So, there is a gap between saving and desired level of investment which can be filled by external capital inflows. Foreign direct investment is one of the important sources of capital inflows. Jawaid (2016) investigated the relationship between the foreign direct investment (FDI) and the economic growth of Pakistan over the period 1966-2014. By applying Autoregressive Distributed Lag- Error Correction Model (ARDL-ECM) technique, he found that FDI has a significant impact on the economic growth of Pakistan both in short run and long run. Khan (2007) examined the link between foreign direct investment, domestic financial sector and economic growth for Pakistan over the period 1972 to 2005. The empirical study is based on the bound testing approach of cointegration advanced by Pesaran, et al. (2001). The results obtained from the empirical study suggest that FDI has a positive impact on economic growth both in the short-run and the long-run if the domestic financial system has achieved a certain level of development. Moreover, the study suggests that better domestic conditions not only attract FDI but also helps in maximising the benefits of foreign direct investment.Malik and Khola (2015) analysed the impact of FDI and trade openness on economic growth of Pakistan. By utilizing time series data from 2008-2013, the study concluded that FDI, trade openness and domestic capital positively affect the economic growth. Higher FDI replaces obsolete technology by advanced technology and educates the labour force of the country. Moreover, it is suggested that government should take some solid measures such as stabilizing the exchange rate in order to increase FDI in Pakistan. Tahir et al (2015) analysed the relationship between foreign remittances, foreign direct investment, foreign imports and economic growth by using time series econometric techniques covering the data over the time period of 1977 to 2013. The study found that foreign remittances and foreign direct investment have significantly positive role in the economic growth process of Pakistan. Moreover, it is recommended that that policy makers should take appropriate measures to increase foreign remittances and FDI, so that long run economic growth could be achieved in the long run.Younas et al (2014) examined the impact of FDI on economic growth of Pakistan by using Two- Stage Least Squares estimation techniques. The results obtained from the study show that there exists a positive relationship between foreign direct investment and economic growth. The study came up with the recommendations that government should ensure political stability and enhanced domestic investment in order to attract more FDI in Pakistan. Falki (2009) investigated the impact of foreign direct investment on the economic growth of Pakistan by using production function based on the endogenous growth theory covering the period 1980-2006. The results obtained from the study show that there is a negative and statistically insignificant relation between GDP and FDI inflows of Pakistan. Atique et al (2004) analysed the impact of FDI on the economic growth of Pakistan under export regimes. The study concludes that the growth impact of FDI tends to be higher under an export promotion trade regime as compared to an import substitution regime by utilizing the data for Pakistan over the period 1970–2001. The findings of the study show that Pakistan FDI plays a pivotal role in the economic development of Pakistan, so it is recommended that the government’s outward looking strategy should include foreign direct investment as an essential part in addition to export promotion strategy.

4. Methodology and Data

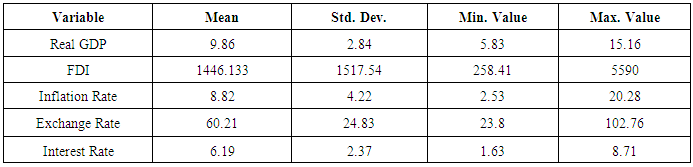

- Secondary data sources are used to assess the impact of FDI on the economic growth of Pakistan. The study analysis time series data over the period of 1990 to 2015 for the following variables; Foreign Direct Investment (FDI), inflation rates, exchange rates and interest rates. Data has been obtained from World Development Indicators (WDI) database published by World Bank and State Bank of Pakistan. A descriptive survey research design is adopted in the research study. The summary of the statistics of all variables is given below in Table 1.

4.1. Descriptive Statistics

- GDP, FDI, Inflation rate, Foreign Exchange Rate and Interest Rate The study findings on GDP, FDI, Inflation rate, Foreign Exchange Rate and Interest Rate are given below.

|

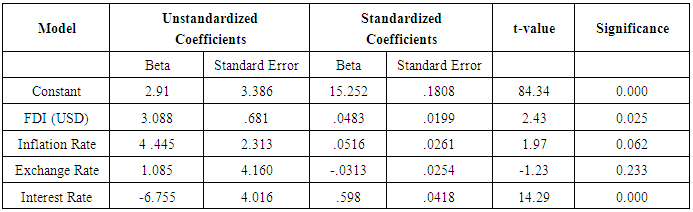

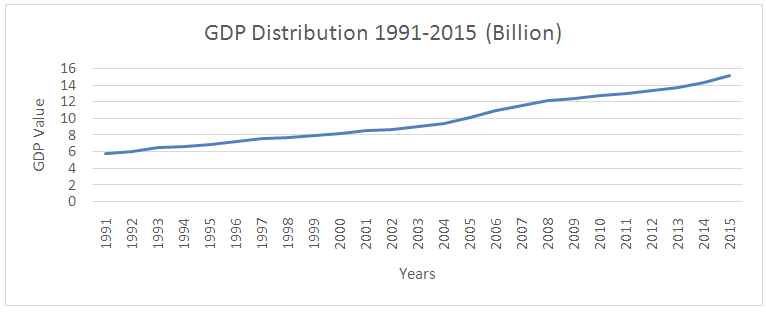

4.1.1. Gross Domestic Product

- The findings on the GDP real values are shown in Table 1 above and Figure 1 below.

| Figure 1. GDP Distribution |

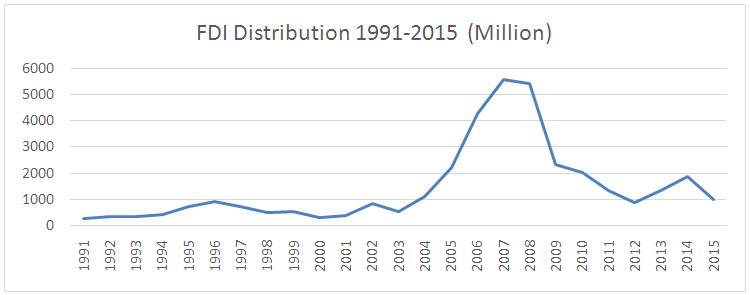

4.1.2. Foreign Direct Investment (FDI)

- The findings on the FDI values are shown in Table 1 above and Figure 2 below.

| Figure 2. FDI Distribution |

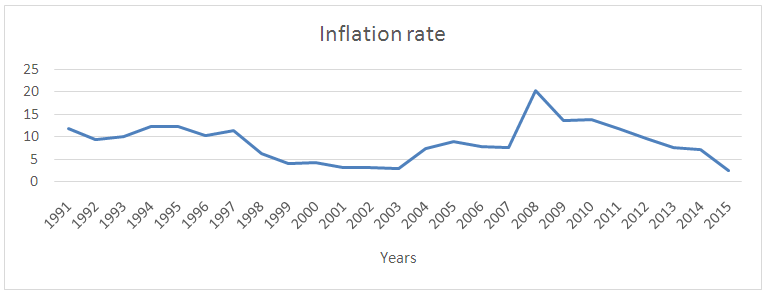

4.1.3. Inflation Rate

- The findings on the inflation rate nominal values are shown in Table 1 above and Figure 3 below.

| Figure 3. Inflation rate |

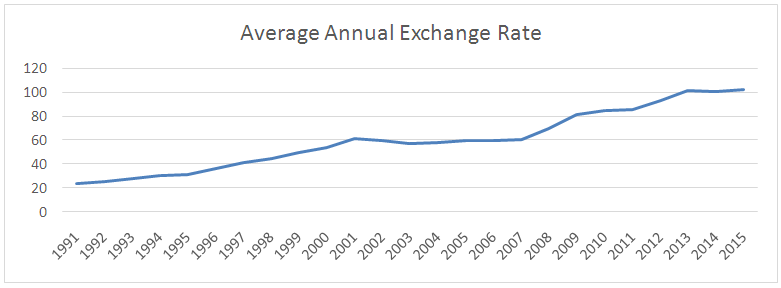

4.1.4. Exchange Rate

- The findings on the exchange rate nominal values are shown in Table 1 above and Figure 4 below:

| Figure 4. Exchange Rate |

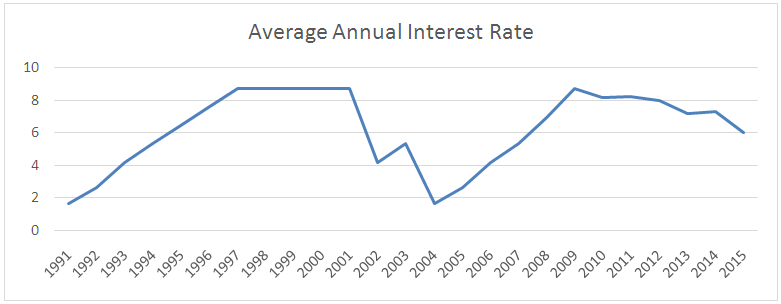

4.1.5. Interest Rate

- The findings on the interest rate nominal values are shown in the Table 1 above and Figure 5 below:

| Figure 5. Interest rate |

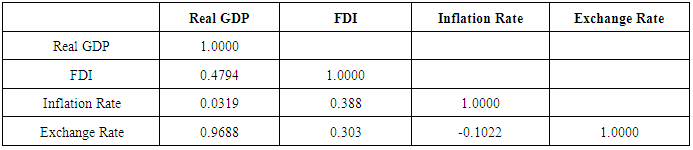

4.2. Correlation Matrix

|

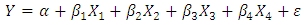

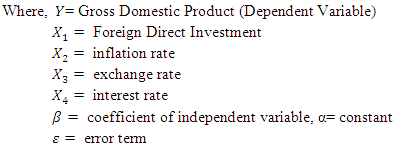

4.3. Model Specification

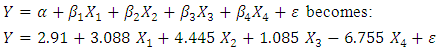

- To determine the relationship between foreign direct investment and economic growth in Pakistan, the study conducts multilinear regression analysis among the variables. The regression model specification is as follows;

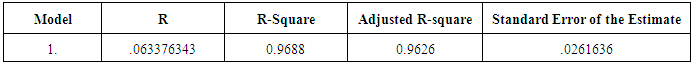

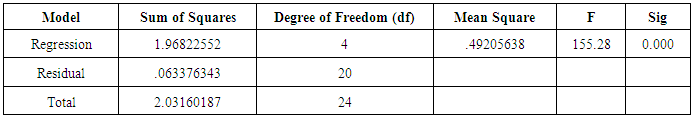

4.4. Multiple Regression Analysis

- The study conducts multiple regression analysis to determine the relationship between foreign direct investment and economic growth in Pakistan. The findings of the study are presented in the tables below.

|

|

|

Where Y represents GDP, which is dependent variable, X1 is FDI, X2 is inflation rate, X3 is exchange rate and X4 is interest rate. According to the equation, by taking all the factors i.e. FDI, inflation rate, exchange rate and interest rate constant at zero, GDP will be 2.91. The findings of the data reveal that a unit increase in foreign direct investment (FDI) will lead to 3.088 rise in GDP; a unit increase in inflation rate will result in 4.445 increase in GDP; while a unit rise in exchange rate will lead to 1.085 increase in GDP. At 5% level of significance and 95 % level of confidence, FDI had a 0.0025 level of significance; inflation rate had a 0.062 level of significance; exchange rate had a 0.233 level of significance and interest rate had a 0.000 level of significance. Blomstorm, et al., (1992) found that FDI flows have significant effect on economic growth and it acts as a driving force in economic growth process. Podrecca and Carmeci (2001) came up with the findings that investment is the most important determinant of economic growth as identified by neoclassical and endogenous growth models. Cockcroft and Riddell (1991) and Meier (1994) found in their study that firms choose a location for investment because of the comparative advantage in terms of low inflation rates, availability of raw materials, good infrastructure, adequate labour force and low capital cost. Castilla (2005) found that employment generation is another positive impact of FDI. Ramirez (2006) found that FDI allows for technology transfer and specialized knowledge which in turns favours and increase in productivity. Baracaldo (2005) that productive FDI usually results in long lasting and stable capital flows as they are invested in long term assets. Jawaid (2016) and Khan 2017 found in their studies that FDI has positive impact on the economic growth both in the short run and long run.

Where Y represents GDP, which is dependent variable, X1 is FDI, X2 is inflation rate, X3 is exchange rate and X4 is interest rate. According to the equation, by taking all the factors i.e. FDI, inflation rate, exchange rate and interest rate constant at zero, GDP will be 2.91. The findings of the data reveal that a unit increase in foreign direct investment (FDI) will lead to 3.088 rise in GDP; a unit increase in inflation rate will result in 4.445 increase in GDP; while a unit rise in exchange rate will lead to 1.085 increase in GDP. At 5% level of significance and 95 % level of confidence, FDI had a 0.0025 level of significance; inflation rate had a 0.062 level of significance; exchange rate had a 0.233 level of significance and interest rate had a 0.000 level of significance. Blomstorm, et al., (1992) found that FDI flows have significant effect on economic growth and it acts as a driving force in economic growth process. Podrecca and Carmeci (2001) came up with the findings that investment is the most important determinant of economic growth as identified by neoclassical and endogenous growth models. Cockcroft and Riddell (1991) and Meier (1994) found in their study that firms choose a location for investment because of the comparative advantage in terms of low inflation rates, availability of raw materials, good infrastructure, adequate labour force and low capital cost. Castilla (2005) found that employment generation is another positive impact of FDI. Ramirez (2006) found that FDI allows for technology transfer and specialized knowledge which in turns favours and increase in productivity. Baracaldo (2005) that productive FDI usually results in long lasting and stable capital flows as they are invested in long term assets. Jawaid (2016) and Khan 2017 found in their studies that FDI has positive impact on the economic growth both in the short run and long run. 5. Conclusions and Recommendations

- The study aims to analyse the impact of foreign direct investment (FDI) on the economic growth of Pakistan over the period 1991-2015. The study utilized correlation and multiple regression analysis to determine the impact of FDI on the economic growth of Pakistan. The results of the study reveal that FDI has a positive impact on the economic growth of Pakistan. Correlation analysis also suggests that FDI and GDP are positively related to each other. So finally, the findings of the study reveal that FDI positively affects the economic growth in Pakistan. Therefore, the study recommends that government policy makers should bring reforms in the domestic market in order to attract more FDI in Pakistan.

Notes

- 1. UNCTAD, T. (2008). Development Report 2008. New York and Geneva, 31-40.2. Investopedia dictionary3. Mencinger, J. (2003). Does foreign direct investment always enhance economic growth? Kyklos, 56(4), 491-508.4. Wang, M., & Wong, S. (2009). What Drives Economic Growth? The Case of Cross‐Border M&A and Greenfield FDI Activities. Kyklos, 62(2), 316-330.5. Gao, T. (2004). FDI, openness and income. The Journal of International Trade & Economic Development, 13(3), 305-323.6. Aitken, B. J., & Harrison, A. E. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American economic review, 605-618.7. Borensztein, E., De Gregorio, J., & Lee, J. W. (1998). How does foreign direct investment affect economic growth?. Journal of international Economics, 45(1), 115-135.8. Vissak, Tiia, and Tõnu Roolaht. "The negative impact of foreign direct investment on the Estonian economy." Problems of Economic Transition 48.2 (2005): 43-66.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML