-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(3): 155-161

doi:10.5923/j.economics.20170703.06

The Impact of the Public Expenditure on Employment and Income in Algeria: An Empirical Investigation

Belarbi Abdelkader1, Saous Cheikh2, Mostéfaoui Sofiane2

1University of Dr. Moulay Tahar, Saida, Algeria

2University of Ahmad Draia, Adrar, Algeria

Correspondence to: Mostéfaoui Sofiane, University of Ahmad Draia, Adrar, Algeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study seeks to analyze the impact of the public spending in Algeria on the economic variables which are: the income and its distribution, prices and the employment. It attempts to investigate whether the public spending had reached its objectives concerning the increase of the individuals' purchasing power and the decrease of the unemployment rate or not. The empirical study covers the period of 2000-2012 and its shows that the public spending had a positive impact on the employment and the consumption cost of the Algerian citizens, while the incomes are affected by the monetary illusion since the rise of the former was accompanied by an augmentation in the consumption commodity prices.

Keywords: Public spending, Income, Employment, Prices, Algeria

Cite this paper: Belarbi Abdelkader, Saous Cheikh, Mostéfaoui Sofiane, The Impact of the Public Expenditure on Employment and Income in Algeria: An Empirical Investigation, American Journal of Economics, Vol. 7 No. 3, 2017, pp. 155-161. doi: 10.5923/j.economics.20170703.06.

Article Outline

1. Introduction

- Algeria witnessed during the last period huge financial capabilities; the fact that led to establish an economic development policy based on financing diverse projects. This view serves the sustainable economic development factors by targeting three key points: income and its distribution, the employment situation, and citizens' purchasing power. These mechanisms aim at ensuring the decent living for the Algerian people through the several spending programs and the achieved projects during the period 2000-2012. This issue raises the question about the effects of the public expenditure programs on the living situation of the Algerian people. To analyze the subjects, the paper figures out first the reality of the public spending and the income in Algeria. At the second point, it investigates the situation of the employment in Algeria. The last point, the paper analyzes the impact of the public expenditure on the income and the employment in Algeria during the period 2000-2012.

2. The Reality of the Public Spending in Algeria

- The public spending is considered as one of the financial policies pillars adopted by the Algerian government to achieve the economic, social and political goals. In this context, Algeria's relying on spending policy is not a random choice, but rather a condition imposed by the factors that shape the figure of the Algerian economy in general. The adoption of this process (spending as a way to boost development) is due to what offers to the general public in terms of satisfaction and pleasure. In fact, many factors had contributed to the rise of the public spending in Algeria, such as: the increase in the oil prices, the available of the financial surpluses, scheduled projects in the public expenditure programs, the rise in the imports' prices, the weakness of the productive capacity of the Algerian economy, the limitation of the private sector in Algeria which leads the public sector to hold the burden of the economic development, inflation resulting from rising costs of the production factors without any effective rise in the production capacity, weakness of the markets and the fragility of the financial institutions in Algeria which oblige the process of development to rely heavily on the public sector to achieve the aspirations of the economic and social life of the individuals. All these are factors that contributed particularly in the rise and increasing trend of the public spending in Algeria. The volume of the funds spent enabled the Algerian government to carry out a range of development programs known by the economic plans. During the period stretching from 2000 to 2009, Algeria maintained two fifth economic plans: the first plan (2000-2004) and the second fifth plan (2005-2009). In addition to this, Algeria witnessed the launch of various development programs such as: the sustain development programs and the supplementary programs. Hence, the Algerian government by this package of programs wants to bolster the economic development and build a strong basis for a durable and sustainable development. However, this framework leads to ask the question about the ways of how the public funds are shared between the national income components. This subject leads to highlight the ups and downs of the public expenditure programs as well as their goals and results in such a way to understand the reason behind these spending programs and their results.

2.1. The Public Spending Programs under the Economic Recovery and the Development Programs

- 1. The spending programs of the economic recovery: Algeria had adopted a plan to boost the growth since 2001 through the launch of an intensive initiative called the economic recovery program and in some cases; it is called the supporting economic growth program. The cited program stretched from 2001 to 2004. The economic growth before 2001 witnessed modest and volatile rates and did not allow revitalizing the economy and creating the necessary productive dynamism. Additionally, the period before that date showed a high level of unemployment and a continual decrease of the purchasing power of the individuals. Thus, to remedy these economic pitfalls, a heavy program of spending had been adopted taking as an advantage the rise in the oil prices.

2.2. The Program of the Economic Recovery

- This program refers to the financial allocations approved in April 2001 by the Algerian state in order to realize the quality transition in economic growth rates. The total amount of this program was esteemed by 525 Algerian billion dinars, or nearly $ 7 billion dollars spread over the period from 2001 to 2004. The program of economic recovery aims to serve the following targets: - To increase productivity; - To Increase the income of individuals- To reduce poverty and improve the standard of living- To create jobs and reduce unemployment- To support regional and territorial harmony and revitalize the rural spaces.In fact, these goals can only be achieved through the strict attention to the following channels:- The revitalization of the aggregate demand by the adoption of the Keynesian doctrine rather than the neoclassical one brought by the International Monetary Fund. This doctrine is based on programs based on enhancing the aggregate demand as a mechanism to stimulate the economy through the fiscal policy;- The support of agricultural investments and SMEs from being efficient productive facilities that contribute directly to create and increase the value added; - The creation and the completion of the infrastructure necessary for the economic development;- The development of the human resources.

2.3. The Content of the Economic Recovery Program

- The economic recovery program tends to enhance the productive capacity and to generate wealth via a package including different aspirations to sustain: projects and infrastructure 40.1%, human and local development 38.8%, fishing and agricultural sector 12.4%, reforms support programs 8.6%. In this field, the number of the projects belonging to the economic recovery program reached approximately 15974 projects divided as follows: Irrigation, Agriculture and Fisheries (6312), Housing, Urbanism and Public Works (4316), Education, Vocational Training and Higher Education (1369), Cultural Infrastructure (1296), Public Utility Businesses and Administrative Structures (982), Telecom and Communication Industry (623), Health, Environment and Transport (653), Social Protection (223), Energy and Investigation Studies (200).

2.4. The Growth Supplementary Program

- The initiative pursued by Algeria known by the economic program recovery had contributed largely in improving growth and the macroeconomic indicators. The growth scheme had been supported by launching a complementary program to sustain and continue the package of the reforms. For instance, the supplementary program is an economic project looks at creating a specific dynamism to the economy and to boost the growth mechanisms. The main financial support of this program was the unexpected rise in oil prices that arrived at 53 Dollars/ barrel in 2004. In addition to this, the supplementary economic program covered the period between 2005 and 2009 and aimed to achieve a set of objectives such as: the renovation, progress and expansion of the public services, the improvement of the individual standards of life, the development of the infrastructure and human resources, the increase of the economic rates. These objectives are outlined effectively by a package including specifically the merits of each sector according to its priority and contribution to generate wealth as follow: the improvement of the living conditions of the population by 45%, the development of the basic facilities (40.5%), the support of the economic development (8%), the development of the communication technology (1.1%) and the total amount allocated for this program is estimated by 4202.7 trillion dinars.

2.5. The Reality of the National Income and Its Distribution in Algeria

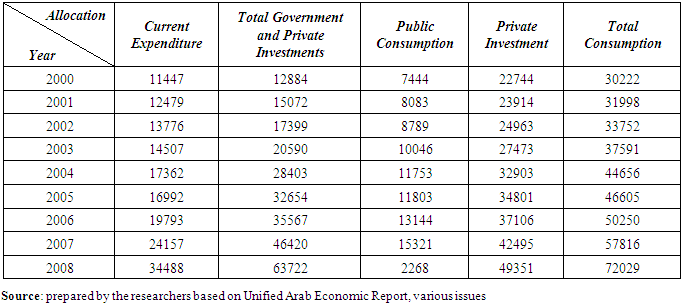

- The public spending in Algeria in the period from 2000 to 2012 has had a positive impact on the development of the national income and its allocation as it is shown by the following table:

The above table shows clearly that the public spending impacts positively both the investment and the consumption as the increase of the former leads to augment the level of national income components. This issue refers to basic macroeconomic consideration stating that spending is also one of the national income components. However, as the table indicates, the total consumption took the largest part of the spending amount; and this justifies the weakness and the fragility of the investment and the productive capacity of the Algerian economy. Concerning the import and export businesses which are not indicated because of the quasi-absolute dominance of Algeria on oil exporting and consumers goods importing.

The above table shows clearly that the public spending impacts positively both the investment and the consumption as the increase of the former leads to augment the level of national income components. This issue refers to basic macroeconomic consideration stating that spending is also one of the national income components. However, as the table indicates, the total consumption took the largest part of the spending amount; and this justifies the weakness and the fragility of the investment and the productive capacity of the Algerian economy. Concerning the import and export businesses which are not indicated because of the quasi-absolute dominance of Algeria on oil exporting and consumers goods importing. 2.6. The Situation of Employment in Algeria

- In the context of the employment, Algeria had launched several programs in an attempt to boost the employment and decrease the unemployment rate. These programs are the following: - Program of Pre-Employment Contracts (PEC): these contracts are addressed to the university graduates, academic people and higher technicians who are aged between 19 and 35 years old. The purpose of this employment mechanism is to enable these individuals getting the necessary experience for their complete integration in the labor market. This program hired 59781 individuals in 2004 compared with 5200 individuals hired in 2003. However, the PEC did not find a large acceptance from the individuals because of the feeble amounts of the financial compensations and the possibility of not being included in the work after the period of the contract. In this perspective, the number of jobs had reached 258869 during the period 1999-2008.- The Activity Compensation of the Public Utility (ACPU): the number of individuals who had benefited from this program in 2004 was 180000. - The National Agency for Young Support (NAYS): This agency was established in 1996 in an attempt to assist the unemployed young people in the creation of small facilities which their costs are under 10 million dinars. In 2004 and under this program, 6677 small organizations were created by which more than 18980 jobs were provided. The statistics show that during the period 1999-2008 the number of jobs created reached the level of 258869 jobs.- The National Fund of Unemployment Insurance (NFUI): the purpose of this devise is the integration of the unemployed people and the preservation of their jobs. In this framework, it helped to safeguard 1837 jobs in 2004.- The National Agency of Employment Management (NAEM): this agency was established in 2004 and it is addressed to help the unemployed young people, craftsmen as well as women. The value of the credits provided is between 50000 and 400000 Dinars. - The National Plan for Agricultural and Rural Development (NPARD): this program attempts to develop the agricultural sector via creating 822187 jobs during the period of 2001-2004. The idea of this plan came from the consideration that the agricultural sector can boost actively the economic development and expand its scope.- Jobs Paid for Local Initiatives (JPLI): Government had adopted a program established in 1990 in order to decrease the level of the unemployment. The latter is alleviated according to this program by integrating people in the professional life. This program is also designed to create paid jobs for local initiatives in enterprises or public offices for a period stretching from 3 to 12 months. This fact led to hire 72500 young people in 2004; most of them were concentrated at the service sector. - Programs of the Economic Recovery (PER): this program was launched in 2001 and lasted till the year 2004 when a financial envelope estimated by 525 billion dinars had been allocated to recover the national economy, promote the business jobs and rehabilitate the suitable environment for the economic development through three axes: the poverty reduction, creating jobs, spatial and regional economic harmony. In fact, this program has provided 751812 jobs including 296300 permanent and stable ones by a percentage of 46.3%. The division of these jobs between sectors is as follow: agricultural sector (65.3%), fishing and marine resources (14.02%), and to a lesser extent for the housing and jobs of public utility of high density (9.814%).- The National Agency for Development and Investment (NADI): this agency aims to encourage investments via the services and the tax exemptions that have been offered. This situation led to create more jobs and bring down the unemployment. Since the establishment of this agency, the number of the jobs created reached 178166 jobs by a financial fund of 743.97 billion dinars.

3. The Empirical Study

3.1. Methodology of the Study

- This study attempts to investigate the relationship between the public spending, income, unemployment and prices in Algeria by analyzing the correlation between these variables through the following methodology: - Matrix correlation- Co-integration Test and Error Correction Model (ECM)- Unit Root Test and Johanson Co-integration Test.

3.2. Stationarity of the Time Series

- The study of the time series stationary requires the analysis of the stability in order to check whether there is homogeneity between the time series or not.

3.2.1. The Stationarity of the Public Spending Series

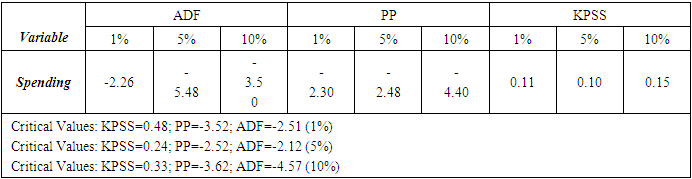

- The following table shows the results of the tests applied on the time series of the public spending and the tests of the first order:

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order.

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order.3.2.2. The Stationarity of the Income Time Series

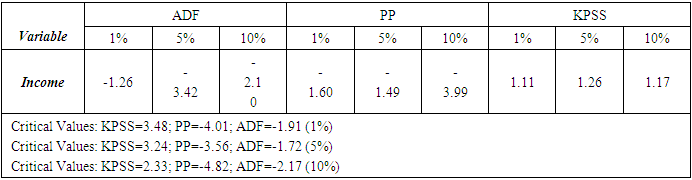

- By the tests applied on the time series of the national income and the first order tests, the table shows the following results:

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order.

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order.3.2.3. The Stationarity of the Employment Time Series

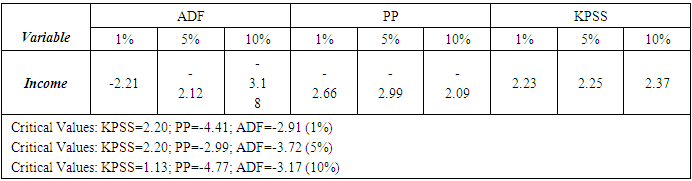

- According to the tests applied on the employment time series by the number of jobs created both in private and public sectors and the first order tests, the following table indicates the results:

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order.

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order.3.2.4. The Stationarity of the Price Time Series

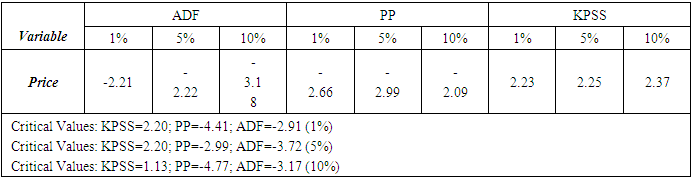

- The following table shows the results of the tests applied on the time series of the public spending and the tests of the first order:

The absolute statistical value (t) is smaller than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is non stationary. Concerning the KPSS, we observe that the estimated value is bigger than the scheduled value of the test which means that the time series is non stationary at the first order and we pass to the test of the second order:

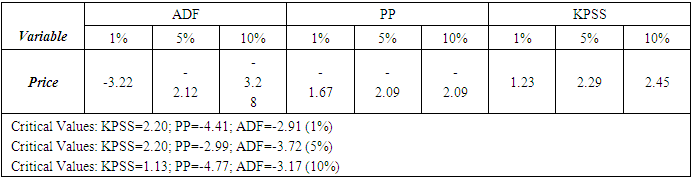

The absolute statistical value (t) is smaller than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is non stationary. Concerning the KPSS, we observe that the estimated value is bigger than the scheduled value of the test which means that the time series is non stationary at the first order and we pass to the test of the second order: The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order. These results make the passage to the other tests possible.

The absolute statistical value (t) is greater than the scheduled value (Mackinnon) of the ADF and PP tests of the first order. It means that it has a statistical significance at 1%, 5% and 10%. This issue implies that the time series is stationary. Concerning the KPSS, we observe that the estimated value is smaller than the scheduled value of the test which means that the time series is stationary at the first order. These results make the passage to the other tests possible.3.2.5. The Economic Interpretation of the Time Series Stationarity

- The stationarity of the times series concerning the evolution of the public spending, the employment, the income as well as the prices during the period 2000-2013 means that the public spending, income and the prices are exogenous variable and thus; their stationarity at the first order means that the Algerian economy has not been affected by the reflects of the international crisis 2008. Additionally, the stationarity of the price time series at the second order implies that Algeria depends heavily on import and export and hence; it has been affected largely by the outburst of the international crisis 2008. This statement argues that the prices in Algeria are strongly sensitive to the movements of the international trade.

3.2.6. Granger Causality Tests

- This section is devoted to study the causality between variables in an attempt to derive the models to be specified. This means to analyze whether there is a short term relationship between the variable and if there is any possibility to take a long term period or not. For this purpose, the following tests are undertaken:

3.2.6.1. The Causality Test between Spending and Income

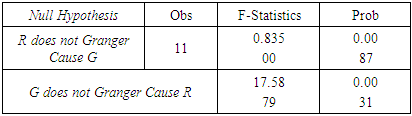

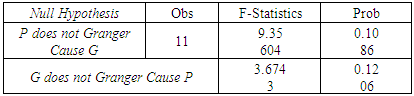

- According to the data used and via the package of Eviews 8.0; the following results are shown by the table:

In case where the variability of the public spending is due to the variability of the income, we not that the probability corresponding the Fisher Statistic F is smaller than 5% which means that the public spending impacts the income, while in the case of the variability of the income which is due to that of the public spending, we observe that the probability corresponding the Fisher Statistic F is smaller than 5%. This statement mean that the income causes change in public spending (the relationship between income and public spending is bi-directional).

In case where the variability of the public spending is due to the variability of the income, we not that the probability corresponding the Fisher Statistic F is smaller than 5% which means that the public spending impacts the income, while in the case of the variability of the income which is due to that of the public spending, we observe that the probability corresponding the Fisher Statistic F is smaller than 5%. This statement mean that the income causes change in public spending (the relationship between income and public spending is bi-directional). 3.2.6.2. Causality Tests between Public Spending and Employment

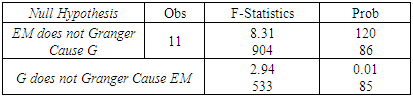

- According to the data used and via the package of Eviews 8.0; the following results are shown by the table:

In case where the public spending changes according to the change of the employment, we note that the probability corresponding to the Fisher Statistic F is smaller than 5%, which means that the employment impacts the public spending. About the impact of the public spending on the employment, we observe that the probability corresponding to the Fisher Statistic is bigger than 5%. This fact implies that the relationship between the employment and the public spending is of one direction (the public spending impacts the employment).

In case where the public spending changes according to the change of the employment, we note that the probability corresponding to the Fisher Statistic F is smaller than 5%, which means that the employment impacts the public spending. About the impact of the public spending on the employment, we observe that the probability corresponding to the Fisher Statistic is bigger than 5%. This fact implies that the relationship between the employment and the public spending is of one direction (the public spending impacts the employment).3.2.6.3. Causality Tests between Public Spending and Prices

- According to the data used and via the package of Eviews 8.0; the following results are shown by the table:

In case where the variability of the public spending is due to that of the employment, we note that the corresponding probability of the Fisher Statistic F is greater than 5%, which means that the change in the public spending does not change the prices; while in inverse case (the prices cause a change in the public spending), the corresponding probability of the Fisher Statistic F is bigger than 5%. This implies there is no relationship between the public spending and the prices.

In case where the variability of the public spending is due to that of the employment, we note that the corresponding probability of the Fisher Statistic F is greater than 5%, which means that the change in the public spending does not change the prices; while in inverse case (the prices cause a change in the public spending), the corresponding probability of the Fisher Statistic F is bigger than 5%. This implies there is no relationship between the public spending and the prices. 3.3. Causal Models between the Economic Variables

- After both the stationarity and the causality tests, it seems that there is a possibility to build a model figuring out the relationship between the public spending and the income as well as that between the public spending and the employment. However, it is not possible according to the previous tests to suggest a model showing the relationship between the public spending and the prices but it is possible to build the error correction model of this relationship after demonstrating the possibility of this model building.

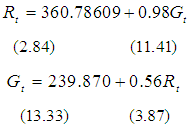

3.3.1. Model of the Public Spending and the Income

- The following model shows the long term bidirectional relationship between the public spending and the income. The model causality is written as:

3.3.2. Model of the Public Spending and the Employment

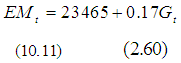

- The following model shows the long term one directional relationship between the public spending and the income. The model causality is written as:

3.3.3. The Error Correction Model between Public Spending and Price Changes

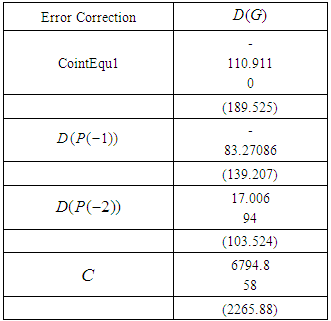

- According to the previous tests, it is shown that the series of the public spending and the prices are not of the same stationarity order. This fact makes the building of the co-integrated model between these two variables not possible. Thus, we use the Johansen Test to check the possibility to pass to the error correction model. After the test, the null hypothesis has been rejected which implies that there is a co-integrated relationship between the variables. According to the output of the Eviews software, the study results are shown by the following table:

The results above show that there is a long term relationship between the public spending and prices in Algeria. The positive sign of the second difference coefficient means that this relation has been developed from the short term to the long one while the co-integration has a negative sign which grew in the second difference of the prices variability.

The results above show that there is a long term relationship between the public spending and prices in Algeria. The positive sign of the second difference coefficient means that this relation has been developed from the short term to the long one while the co-integration has a negative sign which grew in the second difference of the prices variability.4. Conclusions

- Algeria has undertaken various programs in an attempt to develop and recover the economy. These programs had focused much on the mechanism of how to improve the life standard of the individuals. This view stems from the economic doctrine stating that the welfare and the high standard living of the individuals (Economics of the Individual Welfare) contributes to a greater extent in the development and the prosperity. According to the empirical analysis, it is clearly stated that there is a moral impact of the public spending on the individual incomes via the creation of various jobs which looked at increasing the growth rates outside the hydrocarbon sector. The big number of jobs created contributed in the rise of the consumption level both public and private, but it has no impact on the prices because of the monetary illusion that accompanied the augmentation in the individuals' incomes (The increase in incomes goes along with the increase in the prices).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML