-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(3): 110-124

doi:10.5923/j.economics.20170703.02

Indonesian Macro Economics Modelling Mundell - Fleming Approach in 2000-2010

Syamri Syamsuddin1, M. Ismail2, C. F. Ananda2, M. Khusaini2

1Doctoral Program of Economics Science, Faculty of Eco and Business, University of Brawijaya, Indonesia

2Faculty of Economics and Business, University of Brawijaya, Indonesia

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Macro economic modeling in Indonesia is not separated from the real world economic dynamics and science dynamics developments as well as a number of strategic issues, such as economic growth and inflation. The analytical methods used in this study is Autoregression Vector Analysis Method (VAR). VAR model treats all variables systematically operates without question the exogenous and endogenous.The study results show that (first), the consumption equation shows that the variable real interest rates, disposable income and previous disposable income significant influence spending the consumption onlag=1. To review investment equation shown by different real GDP and Investments previous period no significant effect against investment expenditures with negative line onlag=1 (second). That level of exchange rate, export of the previous period and the real GDP of the USA have a significant effect against to the Indonesian export. To review the real USA GDP variable indicates negative relationship. The phenomenon showed that at short term the high real USA GDP became reduce purchasing goods domestic exports, in theory should increase purchases of Indonesian export goods inlag=1, (Third). From simultaneous test shows that the variable import only influenced by the exchange rate onlag=1, with positive relation when the dollar strengthened or otherwise negatively related to depreciation of the domestic currency, (fourth). Real interest rates does not show a significant influence on money supply. Variable of the money supply influenced significantly by the real GDP on the current period, real GDP of the previous period and the previous period of money demand which each variable influence on the lag=1, (fifth). That the Indonesian economy had a tendency with backward looking characters, shown by all variables behavior goods market (IS curve), so the IS curve as real sector position as activator macro-economy, still more tiedon backward looking aspect than its with monetary instruments that in setting policy is forward looking, (sixth). In simultaneous the amount of disposable income on the current period and previous period positive effect against to consumption expenditures. It means instrument on tax had negative effect to consumption expenditures. Interest rates negatively impact consumer spending, and subsequent effect on the aggregate demand and short-term economic equilibrium. With simulation test, the interest rate is positively related to consumption and investment, and subsequently on aggregate demand, (seventh). That the exchange rate variable significant effect on exports and imports, each with a positive response. However with more big amount of elasticity of exports from the elasticity of imports, (eighth). Assuming other factors considered permanent (ceteris paribus) then with rise in real interest rates and the depreciation of the variable exchange, giving impact at decreasing national income (real output). Both instruments (the real interest rate and exchange rate) affects at real GDP and second instrument used by the monetary authority through interest rate line and exchange rateaffects on real output.The study results indicate macroeconomic models Mundell-Fleming approach to macro economic based for developing country, review model is a version of the IMF's macro-economy cointegrated and able to explain the phenomenon of Indonesian macro economy, but the modelingyet fully able to predict the macro-economic balance of the long term.

Keywords: Indonesian Macroeconomic Modeling and Mundell-Fleming Approach

Cite this paper: Syamri Syamsuddin, M. Ismail, C. F. Ananda, M. Khusaini, Indonesian Macro Economics Modelling Mundell - Fleming Approach in 2000-2010, American Journal of Economics, Vol. 7 No. 3, 2017, pp. 110-124. doi: 10.5923/j.economics.20170703.02.

Article Outline

1. Introduction

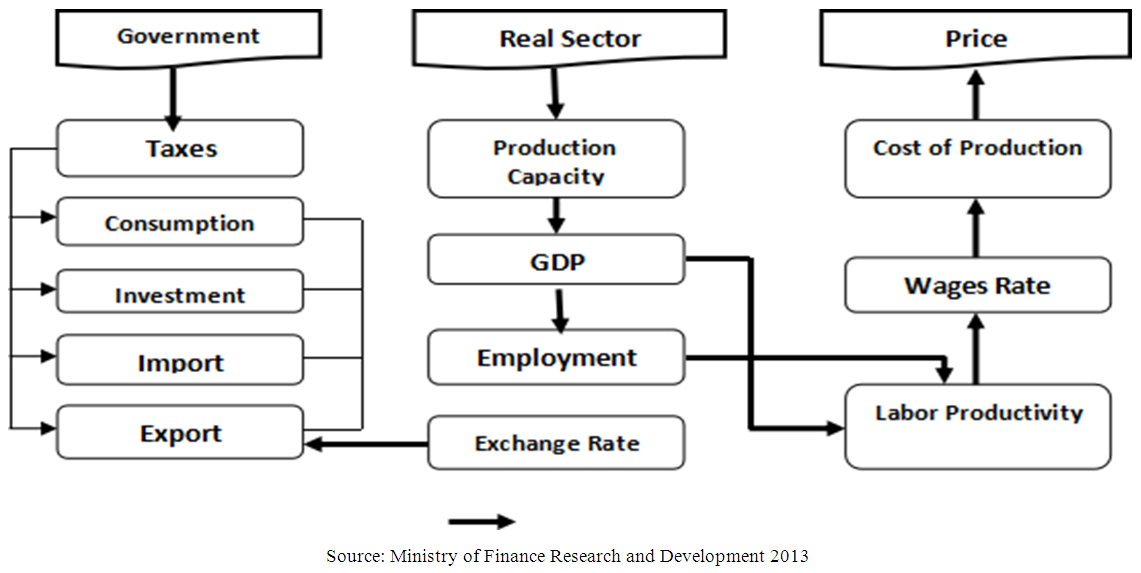

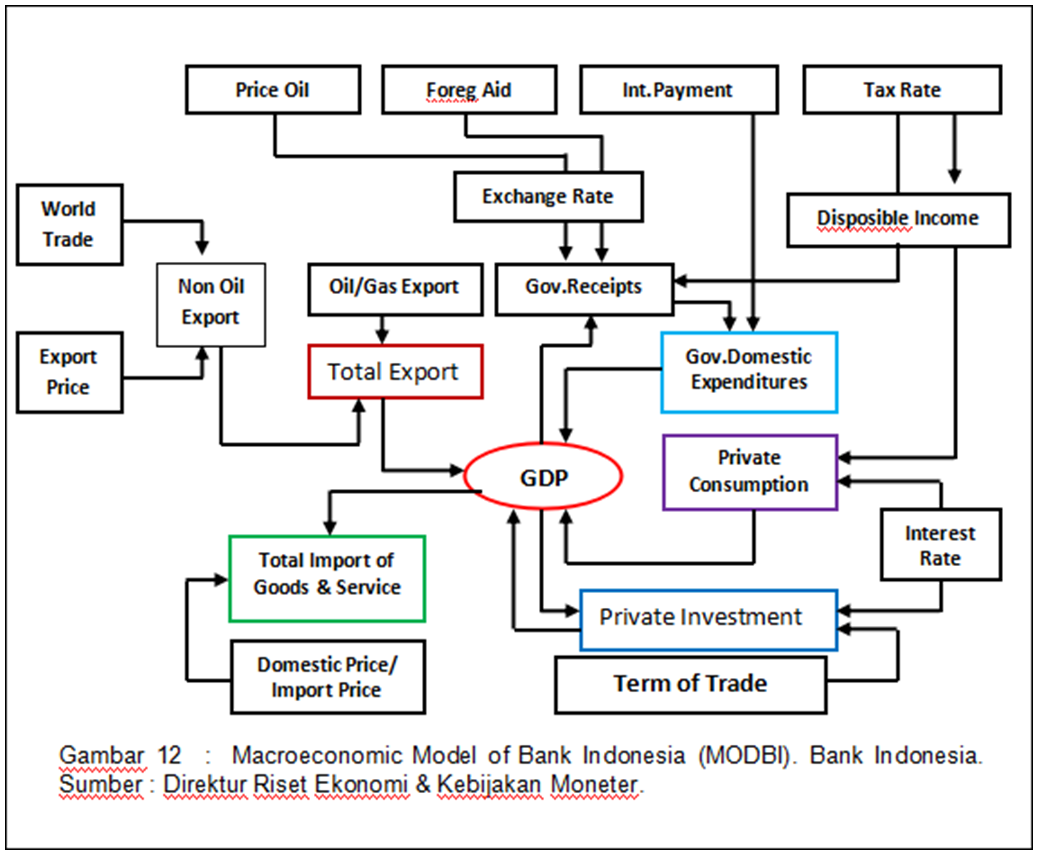

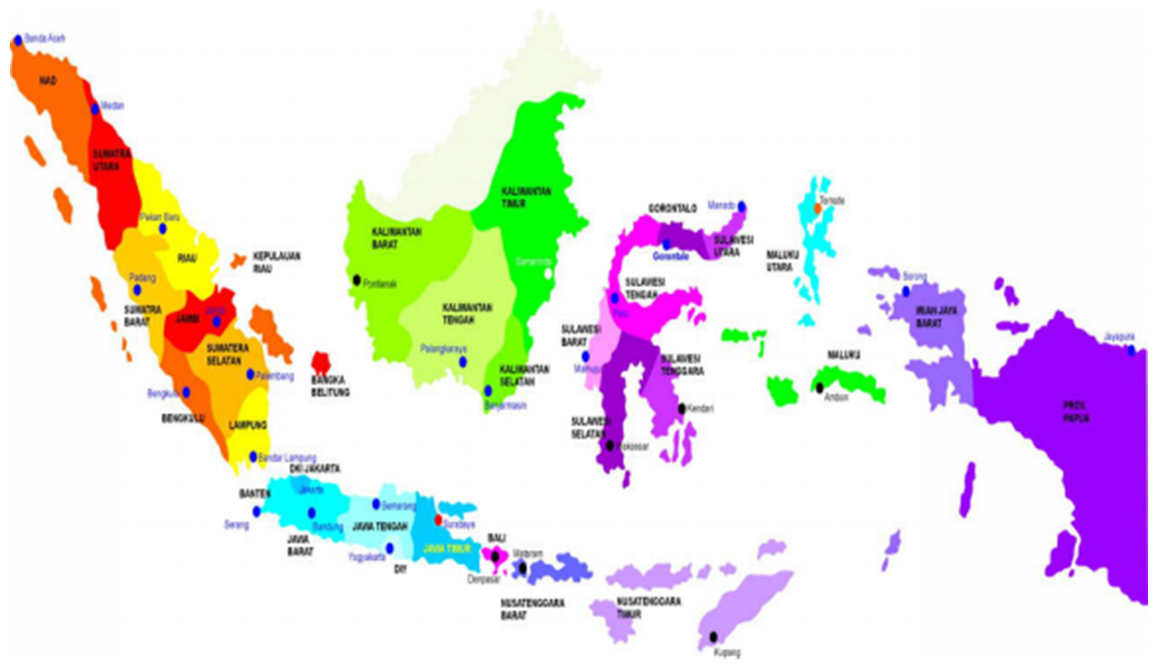

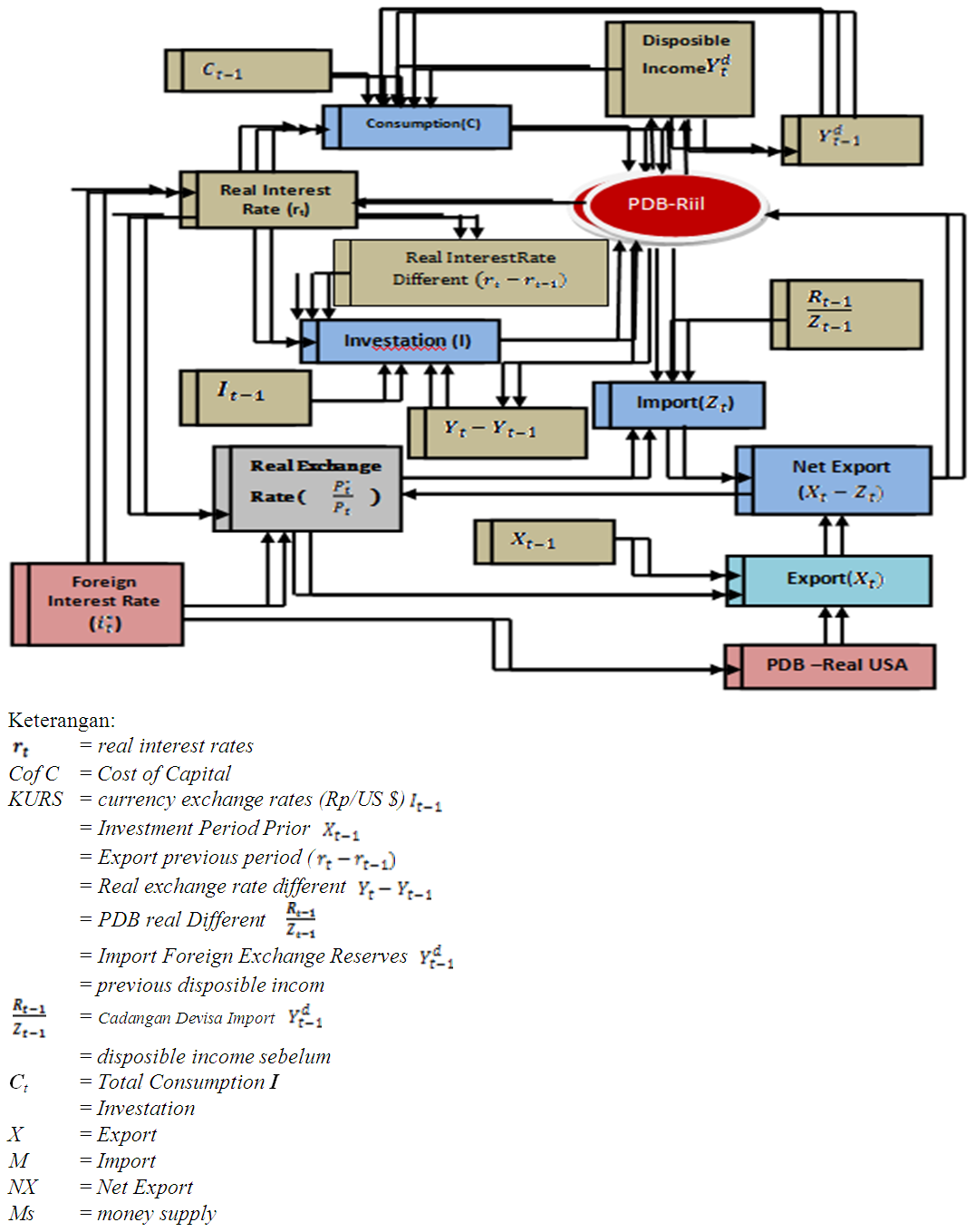

- On the economy in Indonesia there are three macro-economic models which have a characteristic that is characteristic of the institution related to the duties, responsibilities and authority are different, the first Model MODFI macroeconometric model used by the Fiscal Policy Office, Ministry of Finance of Indonesia; the second MTO97 as macroeconomic models developed by National Development Planning Agency (Bappenas) and, third macroeconomic models developed by Bank Indonesia is known as MODBI macroeconometric models.From the characteristics of the three models, in implementation of macroeconomic models dominated by Keynes traditional sect based short-term macroeconomic models that try to reach the final goal is the stability of the national economy. Model MTO97 trying to combine the real sector with monetary interests in the dynamics of the global economy affects the interests of the domestic economy. In other words macroeconomic model developed by Bappenas adopt fiscal and monetary policy instruments in the dynamics of international trade as a policy variable to the end of the medium-term target. Macroeconomic models are built Bapenas construction of more complex models, a modeling framework Macroeconomic Mundell-Fleming built IMF. This model includes the dynamics of the goods market (IS) and money market (LM) in the dynamics of international trade. This is evident from the equation block the government sector (IS), the money market (LM) and balance of payment represent characteristic of Mundell-Fleming model version of the IMF. It illustrated by three main blocks of the equation, namely the policy variables of fiscal policy through the mechanism of the state budget (APBN), which is then expected to be the trigger growth in the domestic market so as to encourage the real sector, then simultaneously able to maintain the stability of the market price by a specific inflation target.Ministry of Finance that the task of managing the state budget to stimulate economic growth by relying on taxes as an instrument of aggregate demand To meet the needs and duties of the Ministry of Finance to develop a model institution MODFI (Figure 1.1). The macroeconomic models imply control of fiscal policy, including consumption, investment and political state budget (APBN) to manage natural resources for the expansion of investment and employment.Another rationale inherent in the model MODFI is the economic potential of the region to optimize expand employment opportunities and boost fiscal policies, including the expansion of investment and consumption market performance by ignoring the domestic monetary mechanisms. In money MODFI models included variable exchange rate as an endogenous variable, it due to that intervention on their currency values made possible through coordination with Bank Indonesia as the monetary authority.By contrast in the MODBI model exchange rate is an endogenous variable. n the model MODEL interest rate derivatives specified in equation (derived equation) and determine the balance of the money market. So far, the level of foreign interest has not given a role in the model. Equilibrium model or Computable General Equilibrium (CGE), data-based SAM (Fully SAM-based CGE model) and use tables Input-Output (IO) is absolutely necessary to predict fiscal variables as basic data.Bank Indonesia that the task of controlling the principal national economic stability rely on instruments Bank Indonesia interest rate (BI rate) and exchange rate instruments in MODBI macroeconometric models with the ultimate objective is to stabilize the economy and economic growth, where BI rate is expected to have an impact on production and consumption, and at the same time are also expected to drive trading non-oil exports. Exhange rate instruments may also act as a driver of international trade at the same time safeguarding the interests of the national economy and the management of foreign loans. In this case it appears that Bank Indonesia still include that foreign borrowing is still used as a policy variable in MODBI Bank Indonesia.

| Picture 1. Chart of MODFI Macroeconomic Model |

| Picture 2 |

2. Research Method

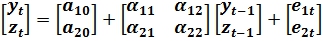

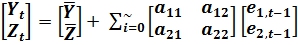

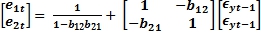

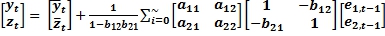

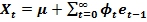

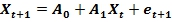

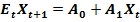

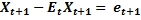

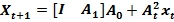

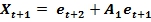

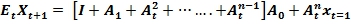

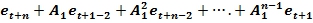

- This study uses Autoregression Vector Analysis (VAR). VAR models systematically treat all variables without questioning exogenous and endogenous. VAR modeling emphasized on several other facilities, namely (Gujarati, 2003): (1). VAR model is a model of a-theoritic, (2). Forecast or forecasting generated is not too appropriate when used for policy analysis, (3). The biggest challenge is to have a level VAR (lag) right, (4). In the VAR model data must be stationary on the level, if not, should be taken way to stationery data. In the various steps of this process are steps that are not easy, and (5). On the VAR are predictions Input Response Function (IRF) to find the response of the dependent variable in the VAR system to shock and error term.VAR analysis is used for study purposes only wanted to see the relationship just because as there is no term VAR cointegration can reduce proofreaders for their cointegration. Forms of this test include:1. Analysis of Impulse Response FunctionsThe Impulse Response (IR) allows you to search the current response and any future shocks from the variable component of a variable. Analysis of Impulse Response function can be formulated in Vector Moving Average (VMA) model of VAR standard regression models (1.1) and (1.2) can be written as follows: (Enders, 2004, p.305)

| (1.1) |

| (1.2) |

sequentially. Next, using matrix algebra functions, with the vector error as follows:

sequentially. Next, using matrix algebra functions, with the vector error as follows: | (1.3) |

| (1.4) |

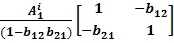

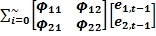

with

with  elements (i) as the following equation:

elements (i) as the following equation: | (1.5) |

| (1.6) |

the effect of the structural shock of Y and Z. or can be simplified into:

the effect of the structural shock of Y and Z. or can be simplified into: | (1.7) |

| (1.8) |

e:

e: | (1.9) |

| (1.10) |

| (1.11) |

| (1.12) |

| (1.13) |

| (1.14) |

| (1.15) |

| Figure 3. Research Location Map |

3. Empirical Result

3.1. MundellFleming’s Macroeconomic Simulation Model

- Simulation for Economic macro model Mundell Fleming in Indonesia will be conducted by two (2) assumptions. Both of these assumptions are as follows: (1). Assumed when interest rates rise by 1 point on average in 2011 and (2). Assumed when the exchange rate depreciated by 5% on average in 2011. Both measures such estimates used to see the changes in endogenous variables when both variables are changed in accordance with the assumptions mentioned above. Simulations technique on this study is the simulation technique with use data outside the sample. Sample research which used in this study starting from the first quarter 2000 to the fourth quarter of 2010. The fourth quarter of 2011 will be used as the baseline of simulation techniques. Using the results of the macroeconomic model estimation above will be simulated the conditions of macroeconomic variables in 2011. By changing these two variables, it can be seen the effect of each endogenous variable in each of simultaneous equations in 2011.

3.1.1. Simulation 1: Interest Rate Value Rises 1 Point in 2011

- In simulation 1, assuming other factors remain (ceteris paribus) there are no expectations, so that the nominal interest rate is equal to the real interest rate, then by changing the interest rate to rise any one point in 2011, will give the impact of changes on two existing equation on the Mundell Fleming's macro model. The second equation is the equation of consumption (Ct) on equation Investments (It). Based on simulation results, can be seen that, assuming other factors remain (ceteris paribus) there are no expectations, so that the nominal interest rate is equal to the real interest rate, then every risen 1 point in the interest rate, would have an impact on the increase in consumption (Ct) on average 0.97% in 2011. Then, the simulation has an impact on the increase in investment (it) amounted to 2.5% on average each quarter in 2011.The deposit rate became one of the attractions for people to save or doing consumptive loans and productive loans. Therefore, economic policymakers in some developing countries have traditionally put more emphasis on the need to keep interest rates low to encourage the private sector to invest not necessarily be justified, because the massive urgently needed reviewing investment behaviour can be seen how big the response of investment to changes in interest rates imposed. Excess money supply in the community will be able to result in instability of prices in the market. The money supply exceeds the amount of the commodity supply will lead to inflation, or inflation occurs because of the gap between the economic ability to desires for goods and services.Most studies show that the macroeconomic environment has an important effect on the stock market capitalization of portfolio investment techniques such as gross domestic product, exchange rates, interest rates, demand deposits and money supply (Kurihara 2006; Ologunde, Elumilade and Saolu, 2006). With the integration of the economy of Indonesia and other countries because Indonesia is a small country embraced the open economic system, then the investment can be done through various means, including but not limited capital activity in the form of deposits, bonds or stocks. From the companies that need funds, often the stock market is an alternative way of external funding, with a relatively low cost than the existing banking system. In the case of financial markets, the results of research Ologunde et al (2006) found that the rate will have a positive impact on the level of stock market capitalization. Part of their findings as well is that the government develop a level the stock has a negative influence on the development of stock levels of government.Investments related to whether an investment project is feasible or not. Dorbusch, Fischer (1990: 269) divides investments into three parts, namely first: fixed investment company consisting of corporate spending on durable machinery, equipment and buildings such as manufacturing facilities and other machinery equipment. These investments are also called business fixed investment. Second: is a residential investment generally consists of housing investment, and the third is the inventory investment.Investors will compare the opportunity cost of capital funding sources. For the case in Indonesia, empirically detected by the model showed that the correlation direction (positive) between the real interest rate with the amount of investment. It provides information that the rise in real interest rates increase investment, also to increase profits from the financial markets such as stocks gained both in the form of dividends and capital gains as a source of corporate funding, so that investment increases.

3.1.2. Simulation 2: Exchange Depreciated by 5% in 2011

- In the second simulation, assuming the condition of the other factors remain (ceteris paribus) and there are no expectations, the exchange rate depreciated by 5% in 2011, it will have an impact on the change in the other two equations. Second equation that considers the exchange rate variable as an exogenous variable is the export equation (Xt) and import equation (Zt). Based on simulation results, it can be concluded that the depreciation of the exchange rate by 5% in 2011, will have an impact on the increase in exports (Xt) amounted to 50.7% on average. Then, the simulation also resulted in increased imports amounted to 1.97% on average in 2011.In the second simulation, assuming the exchange rate depreciated by 5% in each period, then it will impact change in the other two equations. The second equation that considers the exchange rate variable as an exogenous variable is the export equation (Xt) and import equation (Zt). The real exchange rate of the currency of a country can be said to be a determinant of a country's exports and imports. The depreciation of the real exchange rate of currency related countries International trade with Indonesia caused the relative price of goods the country's products cheaper than the relative price of goods from outside the country. Consequently exporting countries whose currencies depreciated will increase and decrease imports.In contrast, the US exchange rate appreciation will cause US goods become more expensive so it makes lowers net exports to the United States. The weakening of the rupiah is still potential to increase domestic reserves, which gives an opportunity to the increase in the balance of payments (balance of payment) which will continue on increasing domestic inflation. An increase in domestic inflation will be responded by a policy to raise interest rates by Bank Indonesia to investment in the real sector will decline, because the cost of capital and reduced ability to compete with domestic products, as well as the increasing burden of debt repayment of principal and interest abroad in domestic currency (rupiah) was very burdensome.As a result of the interest rate that does not have a significant impact on inflation, indicating the proliferation of investor expectations for inflation. In theory also stated that if the increase in interest rates on deposits cause the amount in excess of the marginal efficiency of capital in the capital markets, the financial sector, particularly the stock market showed a decrease in stock value, as investors in the stock market is more likely to deposit funds in commercial banks or will invest funds abroad (capital flight).Judging from the effectiveness of the model equations export and import equation to predict the actual conditions classified as effective as shown by the curve of the movement of the actual value coincides with the curve predictive value of the test sample macro equation model in Figure (4) and Image (5), especially for the short term. From the test results of the estimation of the simultaneous equation can be expressed their countercyclicality in fiscal policy in Indonesia. Characters fiscal policy tends to Indonesia more cyclical, even procyclical. Limited financial resources as one reason the government runs a deficit budget will reduce purchasing power will affect on reducing consumption. From the other side with an increase in government spending will affect the Gross Domestic Product (GDP), which is usually more dominant than tax increases. This shows that fiscal policy by controlling government spending is more effective than taxes in stimulating the growth of GDP, especially in times of recession.

| Figure 4. Interest Rate Monetary Transmission Line. Source: Research Study on 2015 |

3.2. The Impact of simulation on National Income Calculation (Yt)

- Simulations have been calculated above can also be used to compare the value of national income before the simulation (Yt baseline fourth quarter of 2011) and the national income after simulation (Yt simulation for the year 2011). Assuming an increase of 1 point in the variable interest rates and the depreciation of 5% for the exchange rate, then the simulation can also change the income calculation scheme nasional. dampak on the increase in national income, the impact on the national revenue increase by 43%. An increase in national income is more dominated by the increase in exports is relatively large percentage is 50.7% of its contribution to national income, so that the increase of national income is shown by the increase of foreign exchange reserves (△ Net Export) was fantastic, reached 48.73%.From the results of simultaneous test and simulation models, it can be stated monetary transmission through real interest rates and the exchange rate is as follows:a. Interest rate channel of monetary transmission: Hiking interest rates Indonesia's economy further emphasize the importance of price in financial markets to the real sector activities. In this regard, the monetary policy set by Bank Indonesia will influence the development of a variety of interest rates in the financial markets and further affects inflation so the real output. Bank Indonesia as the monetary authority, usually relying on interest rates (interest rate) to control the money supply. This may imply that the government can regulate the velocity of money in the economy. In the early stages of Bank Indonesia policy affects interest rates will affect short-term rates as the interest rate of Bank Indonesia Certificates (SBI) and the interest rates on the money market (interbank), which in turn affects the deposit rates offered by commercial banks to the public, as well as interest rate, loaded credit to the debtor. The process of change in the interest rates of commercial banks to the public generally does not run automatically, but there is a grace period (time lag) caused either bank internal factors in the management of assets and liabilities, as well as external factors the government's policy of non-bank and external shock. In the next stage is the transmission path of the interest rate of the financial sector to the real sector which is largely determined by the demand for consumption and investment. Because the interest rate significantly affects consumption expenditure of simultaneous test, it indicates that the interest rate is also a component of people's income from deposits (income effect), while on the other side of the loan interest rate for the ciety as finance consumption (substitution effect).Another side effect of the interest rate on the investment is not significant simultaneous test but after simulating the real interest rate turned out to give a high enough signal affects investment, due to an increase of 1 point in interest rates could increase investment 2.5%. From the description above, the transmission of monetary policy through interest rate can be illustrated: When the interest rate of Bank Indonesia (BI-rate) is derived will push down interbank rates and so the decline in interest rates on deposits and lending rates. At the nominal interest rate very low, monetary expansion will result in increased prices and inflation expectations, resulting in real interest rates will also fall. Behavior expectations will affect monetary policy will be conducted by the monetary authorities, in this case is Bank Indonesia. At the rate of inflation exceeds the tolerance limit, then decrease the degree of persistence of inflation or otherwise will have an impact on the increasing role of monetary policy and inflation control efforts. Empirically, in this study, there are limitations of the model illustrates the phenomenon of persistence of inflation won in Indonesia because the estimated macroeconomic models do not present a model of inflation as it ought to be used to determine the degree of persistence of inflation. For information that can be described, in particular for the case in Indonesia as input presented research findings by Alam (2008) in a study stating that the general behavior of the backward-looking in Indonesia still quite dominant in the formation of inflation expectations, but there is a tendency decreased after the period of the crisis year 1997. Behavioral looking forward tends to increase in the period after the crisis than before the crisis. Furthermore, it is said that the implications of the decline in the backward-looking behavior, the degree of persistence also declined. A decrease in the degree of persistence, especially in the group of imported goods. The degree of persistence tends to increase Asia-year in the period of crisis.The decline in real interest rates would lower the cost of capital and the cost for holding domestic cash, which will further stimulate business spending and consumption on the lag = 1, once gus also increase investment. Increased consumption expenditures will increase aggregate demand and further raise real output. In the short term increase in aggregate demand and the real output is on the role of consumption expenditures that take place on the lag = 1. In the next phase (priode medium), the increase in aggregate demand will push inflation (demand inflation) in addition to the inflation fueled by expectations of prices and inflation, so that the exchange rate increase and the domestic currency (Rupiah) depreciated which encourages exports and imports as well as spending increased investment , due to exchange rates in this study significant and positive impact both on exports and imports, which is indicated also by the elasticity of exports is greater than the elasticity of imports. So that the increase in exchange rates are still able to generate additional income, and so on from one side to encourage the increase of the real output over the medium term, and on the other hand has the potential to raise the money supply affects inflation back on the increase. The increase in inflation will affect the monetary authorities re-determine the policy of inflation control DMI for the desired stability. In keseluraha flowchart can be seen in Figure 5.

| Figure 5. Monetary Policy Transmission Line Exchange Rate. Source: Research Study on 2015 |

, this argument indicated the earlier period

, this argument indicated the earlier period  of significant export variables with a negative relationship and variable exchange rate is significant in a positive relationship. In terms of investment can be explained that in theory stated that the investment is made through a variety of ways, including in the form of activities placements in the form of deposits, bonds or stocks, both inside the country and abroad are made possible because of the free market with a flexible exchange rate is explained that the traffic capital and macroeconomic balances are at the same time domestic interest rates with interest rates abroad. For the entrepreneur or investor.From the companies that need funding, often the stock market is an alternative external funding, at a cost lower than the banking system. From the companies that need funding, then the stock market is an alternative to external funding, at a cost lower than the banking system. In the event of shocks to the exchange rates that make the weakening rupiah against the US dollar, then the price of goods will also be affected to rise, the positive response to the export and import, and then in real GDP increased in the short term. Conversely if shocks on GDP, the export will respond negatively to a short-term positive and stable in the long term. The positive response variable import shocks exchange rates in the short term because Indonesia still imports many components of input to produce goods in the country, even with dependence on imports of primary goods, such as the need flour and soy to produce tempeh, tofu, soy, and so on. An increase in input costs for imports will push up prices of goods and services, or inflation (cost puss inflation). Under conditions of the domestic currency to depreciate and inflation will reduce the demand for domestic goods and services and the effect on increasing demand for the securities (financial assets). Increasing demand for stocks sheets is already happening at the time of monetary expansion that makes the interest rate is very low, and subsequently result in the spread of interest rates on domestic and overseas widened. From the other side of the investor will purchase consideration through a portfolio of financial assets between domestic or overseas. Conditions provide opportunities for enormous capital flight, due to low-interest rates.Capital mobility can actually contribute to the effectiveness of monetary policy within a flexible exchange rate system to increase national income. This is due to the effects of depreciation undertaken for monetary expansion have an impact on the relative prices of goods and services both domestic and overseas. If the depreciation of the domestic currency is greater than an expansionary monetary policy that lowers the price of domestic goods relative to foreign prices. This illustration can be emphasized, that if an expansionary monetary policy to do more permanent, depreciation widened and the price of domestic goods relatively cheaper, the expansionary monetary policy more acceptable, because it raises real output.Investment decisions in the global market can be done through a wide range of alternative options, including the form of fund investment activities in the form of deposits, bonds or stocks. In a banking context, the government needs to be careful, because no one can estimate the depth and breadth of the global financial crisis in Menyikapi this problem, the government, and the monetary authorities have taken several steps that may be considered appropriate to reduce the concern/distrust towards capability and liquidity commercial banks, including Bank Indonesia.

of significant export variables with a negative relationship and variable exchange rate is significant in a positive relationship. In terms of investment can be explained that in theory stated that the investment is made through a variety of ways, including in the form of activities placements in the form of deposits, bonds or stocks, both inside the country and abroad are made possible because of the free market with a flexible exchange rate is explained that the traffic capital and macroeconomic balances are at the same time domestic interest rates with interest rates abroad. For the entrepreneur or investor.From the companies that need funding, often the stock market is an alternative external funding, at a cost lower than the banking system. From the companies that need funding, then the stock market is an alternative to external funding, at a cost lower than the banking system. In the event of shocks to the exchange rates that make the weakening rupiah against the US dollar, then the price of goods will also be affected to rise, the positive response to the export and import, and then in real GDP increased in the short term. Conversely if shocks on GDP, the export will respond negatively to a short-term positive and stable in the long term. The positive response variable import shocks exchange rates in the short term because Indonesia still imports many components of input to produce goods in the country, even with dependence on imports of primary goods, such as the need flour and soy to produce tempeh, tofu, soy, and so on. An increase in input costs for imports will push up prices of goods and services, or inflation (cost puss inflation). Under conditions of the domestic currency to depreciate and inflation will reduce the demand for domestic goods and services and the effect on increasing demand for the securities (financial assets). Increasing demand for stocks sheets is already happening at the time of monetary expansion that makes the interest rate is very low, and subsequently result in the spread of interest rates on domestic and overseas widened. From the other side of the investor will purchase consideration through a portfolio of financial assets between domestic or overseas. Conditions provide opportunities for enormous capital flight, due to low-interest rates.Capital mobility can actually contribute to the effectiveness of monetary policy within a flexible exchange rate system to increase national income. This is due to the effects of depreciation undertaken for monetary expansion have an impact on the relative prices of goods and services both domestic and overseas. If the depreciation of the domestic currency is greater than an expansionary monetary policy that lowers the price of domestic goods relative to foreign prices. This illustration can be emphasized, that if an expansionary monetary policy to do more permanent, depreciation widened and the price of domestic goods relatively cheaper, the expansionary monetary policy more acceptable, because it raises real output.Investment decisions in the global market can be done through a wide range of alternative options, including the form of fund investment activities in the form of deposits, bonds or stocks. In a banking context, the government needs to be careful, because no one can estimate the depth and breadth of the global financial crisis in Menyikapi this problem, the government, and the monetary authorities have taken several steps that may be considered appropriate to reduce the concern/distrust towards capability and liquidity commercial banks, including Bank Indonesia.4. Conclusions

- The results of this study explain that theoretically and empirically, gives the following conclusions:(1). Mundell-Fleming model testing version of the IMF which has been built by Huque at-all (1990) of the results of formulating a macroeconomic model of 31 developing countries (including Indonesia) who embraced the open economic system. (Small open economy). Overall macroeconomic models is cointegrated macroeconomic Indonesia and is able to explain the phenomenon of macroeconomic Indonesia for short and medium term, but this model has not been able to fully predict the long-term macroeconomic balance.(2). The results of the analysis of simultaneous same equations consumption indicate that the variable real interest rates, disposable income and disposable income period before its significant influence on the consumption expenditures lag = 1. For the investment equation shown by different real GDP and the investment period before a significant effect on investment spending in the negative direction on the lag = 1, an interesting phenomenon was shown that short-term real interest rates did not significantly affect investment behavior, but the negative effect on consumption expenditure. No interest rate relationships tendency direction (positive) with an investment though not significantly. These figures indicate that in Indonesia have demonstrated financial market developments that broaden the investment alternatives for economic players and weakening the power of monetary instruments in controlling the volatility of macroeconomic Indonesia, allegedly because of the crisis of confidence in the monetary authorities and the growing expectations. For long-term needs of consumption and investment spending positively related to real interest rates, so the increase in interest rates would raise aggregate income.(3). That the exchange rate, exports, and GDP the previous period rill USA significantly influence the Indonesian export. For variable real GDP the USA indicates a negative association. This phenomenon shows that in the short term the higher the real GDP of the USA reduced their purchases of domestic exports, theoretically should add to the purchase of Indonesian exports to the lag = 1. This fact indicates that Indonesian products are less able to compete with the products of other countries in the US market, including with ASEAN countries such as Thailand, Malaysia, and Singapore. Furthermore, the effect of exchange rate illustrates that the importance of the price of financial assets on economic activity for the transmission of monetary policy lies in the influence of financially in foreign currencies related to economic activity, good effect due to changes in the exchange rate of the domestic currency as well as the flow of funds in and out due to the activity of foreign trade.(4). Of simultaneous test shows that variable import only influenced by the exchange rate on the lag = 1.dengan positive relationship when the strengthening US dollar, or otherwise negatively related to depreciation of the domestic currency. These results contradict the theory it should, but in the case of Indonesia can occur because of the degree of dependence on imports is still strong Indonesia reflected by the constant parameter and scale parameter exchange rates. Indonesia's dependence on imported products indicated on the products of primary needs, including rice and soybeans as well as components input a secondary product.(5). Real interest rates showed no significant effect on the money supply. Variable The money supply is significantly affected by real GDP running period, real GDP of the previous period and the previous period money demand that each variable influence on the lag = 1. With simultaneous test, it requests the amount of money as the model estimated exhibits behavior backward looking than real GDP and the demand for money prior periods as well as real GDP periods walk, while the interest rate (interest rate) is not significant or not clearly affect the demand for money, there are indications related direction (positive) to money demand. This illustration indicates a change in the behavior of economic agents, the mechanism of interest rates in the monetary transmission is not effective in influencing the money supply. This may be because the economic trusted agents have been reduced to the monetary authority, which promotes behavior change from considering the bank interest rates to economic agents' expectations.(6). That the Indonesian economy has a tendency to character backward looking, which is shown by the entire variable behavior of the market for goods (curve IS), so the IS curve as the position of the real sector as a driver of macroeconomic, still tied to aspects of backward looking than the monetary instruments in establish policy is forward looking.(7). Simultaneously the amount of disposable income and the previous period running positive effect on consumption expenditure. This means tax instruments have negative effects on consumption expenditure. Interest rates negatively impact consumer spending and subsequent effect on the aggregate demand and short-term economic equilibrium. With simulation test, interest rates positively related to consumption and investment, and subsequently on aggregate demand. This illustration shows a lack of compatibility with the hypothesis in one theory concludes that fiscal and monetary policies with effective influence on real output. Kebijakanfiskal (fiscal policy) is expansive, with fiscal stimulus, the bias increase aggregate demand (aggregate demand) is by consumption and investment. Under conditions of price rigidity, a short-term real output will be enhanced by the amount of expenditure consumption.(8). That the exchange rate significant variable have an effect on exports and imports, respectively with a positive response. But with the amount of export elasticity greater than the elasticity of import. This illustration indicates that if there was a strengthening exchange rate or currency rupiah depreciated, will increase the volume of domestic exports and imports, but with a response rate of more exports than imports response rate give the chance to increase domestic reserves, further increasing the balance of payments (balance of payment) which will continue on increasing domestic inflation, so the macroeconomic have an effect to Indonesia more widely both in the real and financial sectors.(9). From the simulation results illustrate that, assuming other factors held constant (ceteris paribus), then with the rise in real interest rates and the depreciation of the exchange rate variable, an impact on the decrease in the national income (real output). Both instruments (the real interest rate and exchange rate) impact on real GDP and the two instruments used by the monetary authorities either through interest rates or exchange rates lane (exchange rate) impact on real output. In terms of fiscal policy and monetary policy can not be run separately, and not quite executed simultaneously by simply relying on coordination. Fiscal policy and monetary policy should be carried out in an integrated and synchronized with reference to the real deposit interest rate and exchange rate.(10). With simultaneous test, turned out to demand the money from the model estimated exhibits behavior backward looking than real GDP and the demand for money prior periods, as well as real GDP periods, walk, while the interest rate (interest rate) does not significantly affect the demand for money, there are indications related direction (positive) to money demand. This illustration indicates a change in the behavior of economic agents, the mechanism of interest rates in the monetary transmission is not effective in influencing the money supply. This may be the cause of the economic trusted agents has been reduced to the monetary authority, which promotes behavior change from considering the bank interest rates to economic agents' expectations. As well as the money supply either M1 or M2 is affected by the growth of economic activity, so as if the reverse flow (feedback) which strongly influenced the movement of primary money. Thus the old paradigm that states the amount or quantity of money in circulation could be controlled entirely by the power of monetary are not applicable. Therefore, monetary management through quantitative targets looks increasingly less tenable.The results of this study also provide advice, such as: (1). This model can be developed to include instruments external and internal shock shock, in order to have the ability to better capture the shock disorder that appears in destabilizing the economy. Instruments internal shock is the central bank to enter into the model the role of the banking sector and foreign interest rates outside, in this case, the USA real deposit interest rates, so that the resulting model may be used to analyze the strategic policies to deal with internal will be immediately shocked, when shocks are suddenly arriving mainly large write-off of the assets, the Bank Indonesia may have a rules to have a stimulus in the form of cuts in the BI-rate at the same time when the shock. Selanjutnya also enter the foreign interest rate instruments will be easier to face external shock, such as changes in foreign interest rates suddenly that will affect the nominal exchange rate is expected to continue in riel exchange rate and real output and capital flight, which would shatter the domestic economy seriously.Delay in taking monetary policy action in the face of the shock, then to restore the economy to a stable position will be more difficult and require a large fee, (2). Bank Indonesia as the monetary authorities must be careful to detect that monetary policy is no longer effective monetary instruments rely solely on anticipation of economic fluctuations harm the economy of Indonesia. It is worth considering entering overseas ethnic instruments, particularly America interest rate and inflation expectations in the use of the macroeconomic model estimation and (3). Ministry of Finance as fiscal authority, to consider monetary instruments, especially rate exchange (MODFI) into the model, which is still positioned as exogenous. Furthermore, in determining the macroeconomic policy should not do partially, and not enough to strengthen coordination but must be integrated and synchronization for both instruments of monetary and fiscal instruments can affect each other and significant. Therefore, in addition to monetary instruments also need to consider fiscal instruments such as taxes into the estimation model, so the model is integrated and able to answer a long debate between the views of Mazhap Ricardian and Keynesian.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML