-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(2): 76-87

doi:10.5923/j.economics.20170702.02

Spatial Price Transmission and Asymmetry in the Togolese Maize Market

Koffi Yovo

Department of Agricultural Economic, Agricultural School, University of Lome, Lome, Togo

Correspondence to: Koffi Yovo, Department of Agricultural Economic, Agricultural School, University of Lome, Lome, Togo.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper examines whether spatial asymmetric price transmission exists in maize market in Togo. The evidence presented here, uses the monthly retail maize price data over the period 2000-2015 for ten maize markets: Lome, the biggest consumer market and nine big rural markets in Togo. The findings strongly support the asymmetric price responses hypothesis. In fact, both the symmetric error correction mechanism of Engle and Granger and the asymmetric error correction mechanism of Enders and Granger indicate that the speed of rural markets’ price adjustment is higher than the speed of Lome’s price adjustment. Moreover, the asymmetric analysis model of Enders and Granger appeared to be more robust since it enabled to detect the presence of asymmetry in the transmission of positive and negative price variations. Indeed, the model of Enders and Granger revealed that the asymmetric transmission according to the positive or negative variations dominates the maize market in Togo. The presence of wholesale traders, with collusive behaviour and some producer’s organizations engaged in collective sales in rural markets could explain such results.

Keywords: Price transmission, Asymmetric adjustment model, Maize markets

Cite this paper: Koffi Yovo, Spatial Price Transmission and Asymmetry in the Togolese Maize Market, American Journal of Economics, Vol. 7 No. 2, 2017, pp. 76-87. doi: 10.5923/j.economics.20170702.02.

Article Outline

1. Introduction

- During the past three decades, most governments of Sub-Saharan African countries reduced their level of intervention on the market of the agricultural products. This deregulation’s policy aims to improve the effectiveness of the markets whose mechanism was disturbed by the strong public intervention. It is for this purpose, the cereals markets and specifically that of maize was liberalized in Togo in 1987 (Yovo, 2015). The policy of liberalization is based on the principle that coordination by the market without any direct control of the government is a more effective organization. This policy aims to remove the various dysfunctions to make the competition more dynamic in order to improve the efficiency of the markets by facilitating arbitrage. The arbitrage is defined as the process of exchange between actors and various segments of the market with the objective to draw a profit of the price differences exceeding the costs of transaction. In other words in a market economy, the actors react when they observe opportunities to make profits by buying in areas where the prices are low and by selling in areas where prices are relatively high. If arbitrage is effective, the price differences reflect transaction costs. In this case the markets are integrated (Bassolet and Lutz, 1999). Thus, the success of trade liberalization policy depends on the force of the agricultural markets to transmit the signals of price from an area to another. This transmission is as fast as the markets are perfectly integrated. When markets are integrated, they provide the appropriate economic incentives to the producers by getting their prices right (Kherallah et al., 2000). Getting the producer prices right is expected to result from the improvements in the efficiency of the domestic markets, as a result of the removal of administrative controls, and from a vibrant participation of the private sector.Some studies such as Alderman (1993), Dercon (1995), Badiane and Shively (1998) and Yovo (2015) have generally assumed symmetric price responses in the sense that a shock of a given magnitude to the central market would elicit the same response in the local markets, regardless of whether the shock reflected a price decrease or a price increase. However, as documented in the literature on price relationships, certain characteristics associated with imperfect competition e.g., market concentration, government intervention, etc.., menu costs in the case of perfectly competitive markets and inventory behavior of traders can contribute to asymmetric price responses (Scherer and Ross, 1990; Roberts, et. al., 1994).In the specific case of Togo, the general concern raised is that the transmission of price changes between rural and urban markets may be different. This occurs in such a way that powerful actors in that particular market segment try to make profits in excess of normal rates of return. Precisely, Farmers often complain that decreases in farm prices are more fully and rapidly transmitted to the urban markets than equivalent increases in consumers’ price. Therefore, it may be useful to test for the existence of price asymmetry between rural and urban Markets in Togo. Previous studies conducted on the performance of Togolese cereals markets (Koffi-Tessio, et. al., 2003; Yovo et Homevoh, 2006; Yovo, 2015) addressed the issues of market integration and the impact of liberalization and information service on markets integration. These studies provide useful information about the performance of the cereals markets in the post-liberalization period and indicate the presence of market integration. However, the degree of price transmission between rural and urban markets is largely unknown. This information gap should be addressed in order to fully understand the performance of the spatial marketing system. More precisely, the article tries to answer the following question: did the rural markets and urban markets react in the same way for price increases or decreases in maize markets in Togo? To respond to this query, the article begins with the literature review on the asymmetric price transmission (section 2). Section 3 describes the methodology and data used for the analysis. Section 4 presents and discusses the results. Finally the section 5 draws a conclusion and provides some policy implications aiming to improve agricultural markets functioning.

2. Literature Review

- Asymmetric price transmission (sometimes abbreviated as APT) refers to pricing phenomenon occurring when downstream prices react in a different manner to upstream price changes, depending on the characteristics of upstream prices or changes in those prices. The simplest example is when prices of ready products increase promptly whenever prices of inputs increase, but take time to decrease after input price decreases (Meyer and von Cramon-Taubadel, 2004; Peltzman, 2000). Meyer and von Cramon-Taubadel (2004) classified asymmetry in the context of price transmission according to three criteria. The first criterion refers to whether it is the speed or the magnitude of price transmission that is asymmetric. A second criterion allows APT to be classified as either positive or negative. The third criterion for classifying APT refers to whether it affects vertical or spatial price transmission. According to the latter, the issue of Asymmetric Price Transmission received a considerable attention in economic literature for two reasons: Firstly, its presence is not in line with predictions of the canonical economic theory (e.g. perfect competition and monopoly), which expects that under some regularity assumptions (such as non-kinked, convex/concave demand function) downstream responses to upstream changes should be symmetric in terms of absolute size and timing. Secondly, because of the size of some markets in which Asymmetric Price Transmission takes place (such as petroleum markets), global dependence on some products (again oil) and the share of income spent by average household on some products (again petroleum products), Asymmetric Price Transmission is important from the welfare point of view. One must remember that APT implies welfare redistribution from agents downstream to agents upstream; it has serious political and social consequences.Peltzman (2000) in particular finds, in an extensive study of 282 products and product categories, including 120 agricultural and food products, asymmetric price transmission to be the rule rather than the exception. This leads him to the conclusion that the standard economic theory of markets is wrong, because it does not predict or explain the prevalence of asymmetric price adjustment.As regards to the causes of APT, a commonly cited source of asymmetric price response is market power (Scherer and Ross, 1990). Oligopolistic middlemen in food markets may react collusively more quickly to shocks that squeeze their marketing margins than to shocks that raise them, resulting in asymmetric short-run transmission. In this case, price increases in the central market are transmitted more rapidly to the local market than price reductions. Similarly, asymmetric price transmission could occur if traders in the local market believe that competitors will follow an increase in local market prices as prices in the central market rise, but that they will not respond to falling prices in the same manner. The role of inventories as a source of asymmetric price response is also well documented in the literature (Blinder, 1982; Fiamohe et Frahan, 2012). Commodity price changes often send signals to inventory holders, leading to either accumulation or release of stocks. The anticipation of price increases in the central market in the next period creates an incentive for traders to increase their stock holdings by buying larger quantities of a given commodity at the present date. The increased supply from inventories in the local market puts downward pressure on prices so that they do not rise as much as they would in the absence of inventories. If on the other hand, central market prices are expected to decline, there is an incentive for traders to reduce their inventory holdings, which tends to moderate the initial downward pressure on local market prices in the next period. In either event, current local market price will not adjust fully to a change in the current central market price (Wohlgenant, 1985).The presence of search costs in locally imperfect markets is also frequently cited as one of the reasons for asymmetric price adjustment in commodity markets (Blinder, et. al., 1998). In many areas, firms may enjoy local market power due to the lack of similar firms in the neighbourhood. As a result of search costs, customers of these firms may not be able to acquire complete information about prices offered by other firms, although they face a finite number of choices. Even if customers observe a price increase at a particular outlet, they may be uncertain as to whether prices in other shops have increased. Under these conditions, firms can raise their prices quickly as prices in central markets increase and lower them slowly in response to price reductions in the central market (Abdulai, 2000).Evidence of APT was found in the gasoline market where it was concluded that retail gasoline prices respond more quickly to increases in crude oil prices than to decreases (Borenstein, et. al. 1997). Several agricultural markets such as oranges, lemons, dairy products, pork, and beef have also been found to exhibit evidence of asymmetric price transmissions between the producer and retail levels in America and Europe (Karrenbrock, 1991). London Economics (2003) analyses the mutual relationship between retailer and producer prices of a number of goods in Austria, Denmark, France, Germany, Ireland, Netherlands, Spain and UK. In this study the authors also employ a variation of the Von Cramon-Taubadel (1998) for the price series which turn out to be cointegrated. Empirical evidence supports the presence of asymmetric price transmission in the producer-retail relationship for the markets of Danish carrots and of UK bread, and in the retail-producer transmission mechanism for the UK lamb market.In Africa, some studies highlight APT in maize market. Goletti and Babu (1994) using Kinnucan and Forker (1987) model, showed that in Malawi, retail prices reflect price increases on the wholesale market-segment more rapidly than price decreases, indicating a rent for retailers. In Benin, Lutz (1994), did not find APT in maize market, except between two pair markets: Bohicon-Pobé and Azove and Ketou. He concluded that competition on the markets does not allow groups of traders to manipulate prices. In Ghana, Abdulai (2000) using both the threshold cointegration and asymmetric error correction models reveal that wholesale maize prices in local markets (Accra and Bolgatanga) respond more swiftly to increases than to decreases in central market (Techiman) prices. Accra prices are found to react faster than Bolgatanga prices to changes in Techiman market prices. The National Department of Agriculture in South Africa (2003) uses the model of Von Cramon- Taubadel (1998) to study the farm-retail transmission in the South African markets of maize meal, bread, fresh and long life milk, cheddar cheese and cooking oil. Monthly data over the period January 2000-July 2003 are used to obtain the impulse response functions for farm price increases and decreases, which suggest the presence of asymmetric transmission for all considered cases. By reviewing the econometric models used in the different studies, Frey and Manera (2007) found that the most popular econometric models are: the autoregressive distributed lag (ARDL) model, the partial adjustment model (PAM), the error (or equilibrium) correction model (ECM), the regime witching model (RSM) and vector autoregressive models. The choice of a model depends on the author’s perception on the behaviour of actors and the nature of data. Among the 69 papers reviewed by Frey and Manera (2007), which provide a total of 83 estimated models, only 11 models show no evidence of asymmetries of any kind. Very often, models are chosen arbitrarily.

3. Methodology

3.1. Modelling Asymmetric Price Transmission

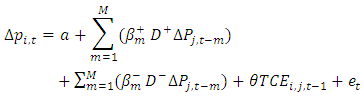

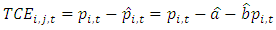

- Most analysis of the transmission of food prices between different markets use the modified model of Houck (1977). This model consists in splitting on positives and negatives prices changes variables. The general form of modified Houck model is expressed as follow:

| (1) |

corresponds to prices variation on the market

corresponds to prices variation on the market  in month

in month  and

and  represents the price on market

represents the price on market  in month

in month  and

and  are the dummies variables with

are the dummies variables with  and

and  otherwise;

otherwise;  and

and  otherwise.

otherwise.  corresponds to the term of error correction of the long term equation expressed as follows:

corresponds to the term of error correction of the long term equation expressed as follows:  | (2) |

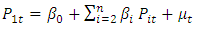

According to von Cramon-Taubadel and Loy (1996) and Meyer and von Cramon-Taubadel (2004), all the variants of the Houck model are incompatible with the cointegration relation between the price series because they do not take into account the possibility of a long-run equilibrium relationship between the price series examined. For example, Hassan and Simioni (2004) explain that retail and shipment prices may differ in the short term due to seasonal factors. If such discrepancies persist over time, the mechanisms underlying the functioning of the market in question should constrain these prices to return to a long-term relationship, what the variants of the Houck model could not explain. The standard cointegration and error correction models according to Engle and Granger are also commonly used to examine agricultural markets. However, Enders and Granger (1998) and Goodwin and Piggot (2001), Hansen and Seo (2002), Meyer and Von Cramon-Taubadel (2004) and Meyer (2004) criticized the forms of specification of these models because they do not enable to represent the asymmetry of the cointegration relation due to the non-stationarity of the transaction costs. Enders and Siklo (2001) explained that the cointegration approach of Engle and Granger (1987) may be incorrectly specified if the transmission is asymmetric.Due to the criticism of the variants of the Houck model and the size of the transaction costs on the Togolese cereal markets, the model proposed by Enders and Granger (1998) is used to examine the nature of the relationship between prices observed in maize markets in Togo. The choice of this model is also justified because of the simplified form of its specification which uses the null value as a threshold delimiting two price variation regimes. According to Hansen (1996), thresholds delimiting adjustment regimes for unknown values cause inference problems due to the presence of nuisance parameters in threshold models. However, this author proposes a statistical test to test the statistical significance of the selected thresholds.According to Engle and Granger (1987), when non-stationary series are integrated of the same order, it is possible to establish a long-term relationship between them as follows:

According to von Cramon-Taubadel and Loy (1996) and Meyer and von Cramon-Taubadel (2004), all the variants of the Houck model are incompatible with the cointegration relation between the price series because they do not take into account the possibility of a long-run equilibrium relationship between the price series examined. For example, Hassan and Simioni (2004) explain that retail and shipment prices may differ in the short term due to seasonal factors. If such discrepancies persist over time, the mechanisms underlying the functioning of the market in question should constrain these prices to return to a long-term relationship, what the variants of the Houck model could not explain. The standard cointegration and error correction models according to Engle and Granger are also commonly used to examine agricultural markets. However, Enders and Granger (1998) and Goodwin and Piggot (2001), Hansen and Seo (2002), Meyer and Von Cramon-Taubadel (2004) and Meyer (2004) criticized the forms of specification of these models because they do not enable to represent the asymmetry of the cointegration relation due to the non-stationarity of the transaction costs. Enders and Siklo (2001) explained that the cointegration approach of Engle and Granger (1987) may be incorrectly specified if the transmission is asymmetric.Due to the criticism of the variants of the Houck model and the size of the transaction costs on the Togolese cereal markets, the model proposed by Enders and Granger (1998) is used to examine the nature of the relationship between prices observed in maize markets in Togo. The choice of this model is also justified because of the simplified form of its specification which uses the null value as a threshold delimiting two price variation regimes. According to Hansen (1996), thresholds delimiting adjustment regimes for unknown values cause inference problems due to the presence of nuisance parameters in threshold models. However, this author proposes a statistical test to test the statistical significance of the selected thresholds.According to Engle and Granger (1987), when non-stationary series are integrated of the same order, it is possible to establish a long-term relationship between them as follows: | (3) |

represents the error term. Engle and Granger (1987) examine the cointegration relation between the

represents the error term. Engle and Granger (1987) examine the cointegration relation between the  series by testing the non-stationarity of residues

series by testing the non-stationarity of residues  from of the estimation of the long-term relationship (3). The non-stationarity of these residues is tested on the basis of the following relation:

from of the estimation of the long-term relationship (3). The non-stationarity of these residues is tested on the basis of the following relation: | (4) |

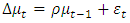

represents the first difference between

represents the first difference between  and the error term

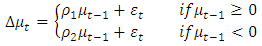

and the error term  a white noise. Enders and Granger (1998) then split relation (4) as follows:

a white noise. Enders and Granger (1998) then split relation (4) as follows: | (5) |

and

and  respectively represent the positive and negative adjustment parameters of the lagged error term

respectively represent the positive and negative adjustment parameters of the lagged error term  and the term

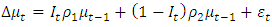

and the term  the error term. The system of equations (5) can be written in another way:

the error term. The system of equations (5) can be written in another way: | (6) |

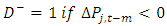

is an indicator variable defines as follows:

is an indicator variable defines as follows: | (7) |

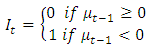

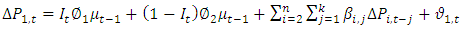

are within the interval [0 2]. According to them, in so far as there is a cointegration relationship between the series, the standard error correction model (ECM) according to Engle and Granger (1987) can integrate the positive and negative adjustment parameters to give an Asymmetric Error Correction Model (AECM) as follows:

are within the interval [0 2]. According to them, in so far as there is a cointegration relationship between the series, the standard error correction model (ECM) according to Engle and Granger (1987) can integrate the positive and negative adjustment parameters to give an Asymmetric Error Correction Model (AECM) as follows: | (8) |

represent the parameters of adjustment of the positive and negative deviation and the term

represent the parameters of adjustment of the positive and negative deviation and the term  a white noise. The adjustment of the variations of the variable is symmetric when the parameters

a white noise. The adjustment of the variations of the variable is symmetric when the parameters  are significant and equal. In this case, the Engle and Granger MCE becomes a specific form of the asymmetric ECM of Enders and Granger.The F-test of Enders and Granger allows to test the null hypothesis

are significant and equal. In this case, the Engle and Granger MCE becomes a specific form of the asymmetric ECM of Enders and Granger.The F-test of Enders and Granger allows to test the null hypothesis

3.2. Data

- The data used are nominal1, monthly retail maize prices for the periods from January 2000 to December 2015. These time series are extracted from the price database of DSID, ANSAT and RESIMAO. DSID and ANSAT are the two departments of the Ministry of Agriculture which is in charge of prices statistics. RESIMAO is the market information system network of West Africa. The study considered ten markets: Lome, the capital of Togo. This is the main consumer market of maize. It records the most important and regular deficits in maize despite the convergence of maize produced in the others regions. This is due to the concentration of the population whose main staple food is maize. Lome stands for urban market in the sample. The nine others markets are the big rural maize markets. They are selected on the basis of the importance of the maize volume transaction they established with Lome as well as the availability of price series. They are: Ahepe, Assahoun in caostal region, Tohoun and Anie in Plateaux region, Tchamba in central region, Bassar and Ketao, in Kara region, Gando and Cinkasse in Savannah region (see the map in appendix).

4. Results and Discussion

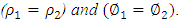

- Before analysing the asymmetric price transmission between maize markets, it is interesting to describe the evolution of time series of maize prices in the nine rural markets in comparison with Lome series.

4.1. The Evolution of Maize Price in Rural Markets

- Figure 1 in appendix depicts the evolution of maize prices in rural markets compared to Lome as reference market over the period 2000-2015. It shows that maize prices have increased over the period 2000-2015. Particularly, over the period 2007-2008, the prices growth has reached a peak due to the food crisis that affected West African countries and which main characteristic was the increase of food staff prices. By examining figure 1, it appears that maize prices are generally higher in Lome than in other markets. This is due to the fact that Lome, being the capital, is the largest maize consumption pole in the maritime region, which has a permanent chronic deficit. The analysis of figure 1 shows that the margins which correspond to the difference between the maize price in Lome and the price in rural markets vary considerably from one market to another. They are more important in some markets such as Gando, Tchamba and Bassar whereas in Ahepe, Assahoun, Ketao, prices are close to the prices of Lome.Margins can also be viewed as the remuneration of wholesale traders who buy maize in localities where prices are relatively low and resale it in Lome where the markets prices are high. This arbitrage explains the importance of the flow of maize converging from the rural markets into the market of Lome.

4.2. Tests of Symmetric and Asymmetric Transmission of Price Changes

- Firstly, the unit root and cointegration tests are performed to assess the long-term integration of the markets, and then the transmission test was conducted by estimating the symmetric and asymmetric error correction models.

4.2.1. Tests of Symmetric and Asymmetric Cointegration between Maize Price Series

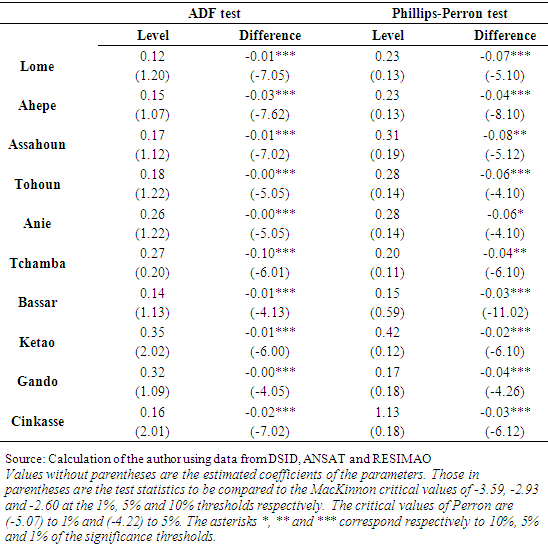

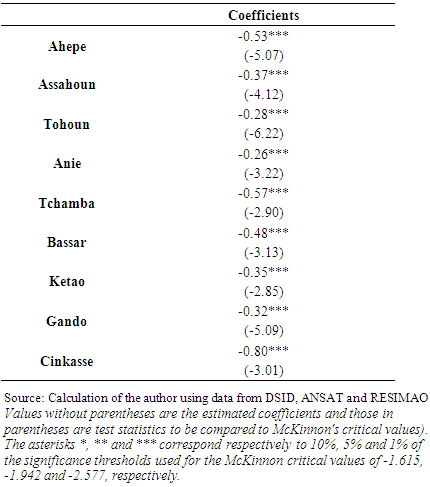

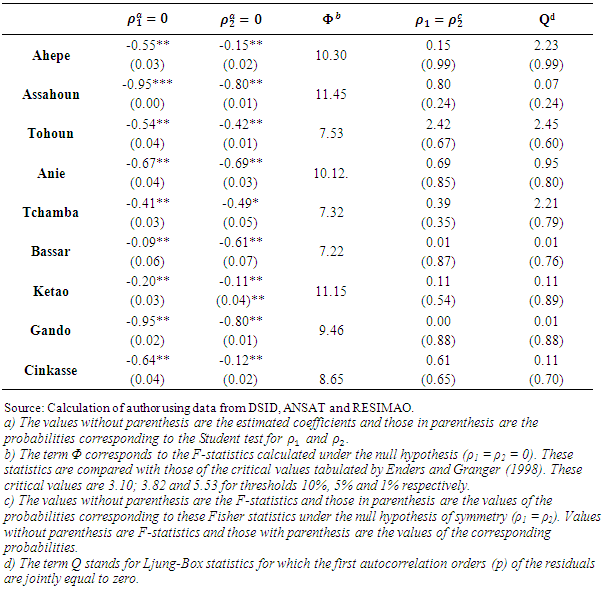

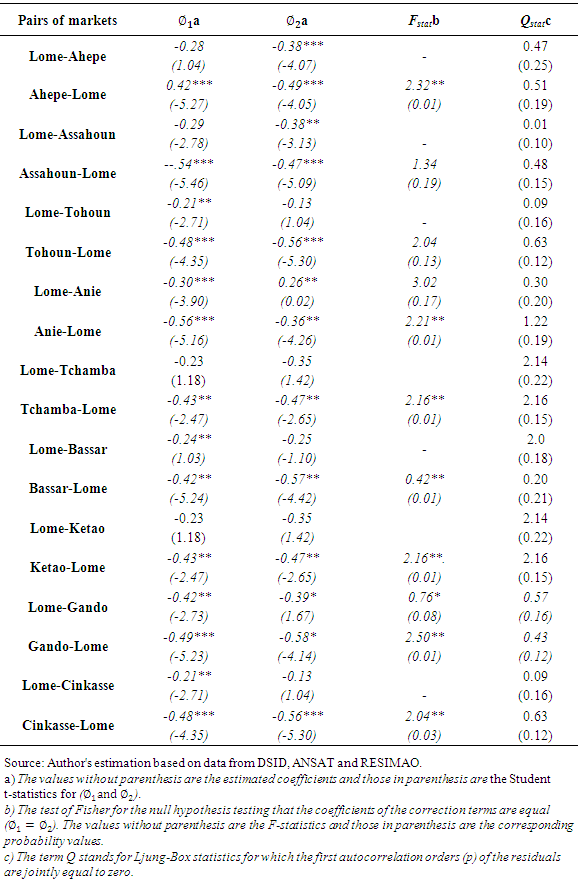

- In this paragraph, we examine the tests of symmetric and asymmetric cointegration between maize price series.Tests of standard cointegration We test the cointegration relationship between the price series observed in the market of Lome and those observed in each rural market using equation (3). In general, prices of agricultural products are affected by seasonal variations. The periods of heavy rains during which roads linking markets are impracticable may explain this seasonality. The presence of seasonality does not allow capturing the intrinsic evolution of a series and thus its relation with another. To take into account this seasonality, the introduction of dummy variables is the most used solution. Abdulai (2000) suggests identifying seasonal periods based on observable a priori information on the functioning of markets. He suggests correcting only these seasonal periods by introducing the corresponding dummy variables. This identification of months of high seasonality being subjective, our approach consists in seasonally adjusting all price series using the moving averages method in order to remove any cyclical influence.The null hypothesis of unit roots specifying the non-stationarity of the seasonally adjusted price series is tested using the augmented test of Dickey-Fuller and Phillips-Perron without trend. The optimum number of lags is selected from the Schwartz criterion. The results of the unit root tests reported in Table 1 (appendix) indicate that all series are non-stationary in level and integrated in first difference.Since the price series are stationary in first difference, the null hypotheses of absence of cointegration and symmetry of the cointegration relation between the markets are tested using the equation (3). The results presented in Table 2 (appendix) are obtained by estimating cointegration relationships (3) for non-integrated series of the same order. The estimated coefficients are very significant for each pair of markets considered.Table 2 (appendix) shows the results of the cointegration tests according to Engle and Granger carried out on the residues resulting from the estimation of the relation (3). According to this test, the zero hypothesis of no cointegration between the price series is rejected for all market pairs. The comparison of statistics calculated under the null hypothesis with the critical values of the McKinnon table confirms the cointegration relationship between the price of Lome series and the nine rural markets.Analysis of asymmetric cointegration between maize price seriesAs mentioned earlier, Enders and Granger (1998) modified the standard cointegration test of Dickey-Fuller so that the hypothesis of a cointegration relation between prices can be tested without maintaining the symmetry hypothesis in the long-term adjustment. Indeed, the Dickey-Fuller standard test based on the symmetric adjustment hypothesis may tend to reject the assumption of cointegrated price series in the presence of asymmetry in the cointegration relation. As in the standard cointegration test, the asymmetric cointegration test is based on the stationarity of the residue. Enders and Granger (1998) use the F-test to test the hypothesis that the coefficients

and

and  are jointly different from zero (the critical values are given in Enders and Granger (1998)).Table 3 (appendix) shows the results of the tests of the asymmetric cointegration relation between the price series according to Enders and Granger. The Ljung-Box test is also performed to ensure that residues are not correlated. The Ljung-Box statistics denoted Q also reported in Table 3 (appendix) indicates that residues are not significantly correlated. The null hypothesis is rejected by comparing the Fisher statistics to the critical values of the table of Enders and Granger (1998) for all market pairs.

are jointly different from zero (the critical values are given in Enders and Granger (1998)).Table 3 (appendix) shows the results of the tests of the asymmetric cointegration relation between the price series according to Enders and Granger. The Ljung-Box test is also performed to ensure that residues are not correlated. The Ljung-Box statistics denoted Q also reported in Table 3 (appendix) indicates that residues are not significantly correlated. The null hypothesis is rejected by comparing the Fisher statistics to the critical values of the table of Enders and Granger (1998) for all market pairs.4.2.2. Analysis of Prices Transmission between Maize Markets

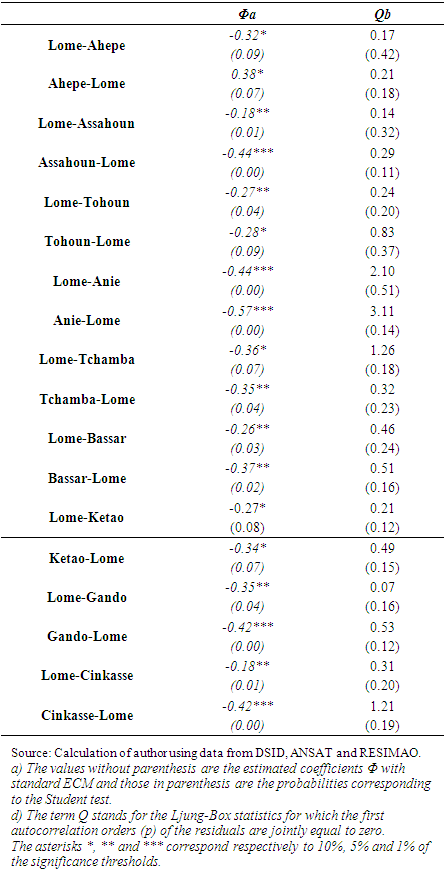

- Since there are cointegration and symmetry relations between Lome market and all rural markets, we test the transmission of prices between markets. First, in compliance with the Granger representation theorem (1987), we test the transmission of prices using the standard error correction model (ECM). Then, considering the presence of significant transaction costs, we examine the asymmetric price transmission between symmetrically cointegrated market pairs using the Enders and Granger asymmetric error correction model (AECM) represented by the equation (8). The Schwartz criterion is used to determine the number of lag that must be considered in the estimated models for each pair of markets (Enders, 1995).Symmetrical prices transmissionThe results of the standard ECM test presented in Table 4 (appendix) indicate that the price transmission is in both directions, i.e. from the market of Lome to the nine rural markets, on one hand, and from the rural markets to Lome market on the other hand. The adjustment speed of the pairs Lome - rural markets is ranged from -0.55 to -0.18 with an average of -0.23. The adjustment speed of the pairs rural markets - Lome, is ranged from -0.57 to -0.20 with an average of -0.40. Overall, the speed of price adjustments of the rural markets is greater than the speed of price adjustments in the market of Lome.Asymmetric price transmissionThe results of the estimation of the asymmetry relation (8) according to Enders and Granger are presented in Table 5 (appendix). The Schwartz criterion is used to determine the number of lags considered in the estimated models for each pair of markets. The Ljung-Box test is also performed to ensure that the residues are not significantly correlated. It appears that, unlike the standard error correction model, the asymmetric error correction model detects 15 over 18 cases of asymmetry in the transmission of positive and negative price changes observed on pairs of maize markets. Overall, the speed of adjustment is 34% for positive deviations and 41% for negative deviations. It means that within one month, on average, 34% of the positive deviations and 41% of the negatives deviations are eliminated from the long-run equilibrium relationship. Moreover, as the results obtained from the standard error correction model presented in Table 4, the results in Table 5 generally show that the speed of long-term prices adjustment between the pairs rural markets-Lome is higher than the prices adjustment between the pairs Lome-rural markets. Overall, these results indicate that prices asymmetric transmission do exist in the Togolese maize market. In general, price asymmetry is manifested in three ways. When upward price movements in one market are not transmitted in the same way to another market as downward price movements. Asymmetry is also observed when a price in a market increases faster than it falls, or when the rate of adjustment of equilibrium prices differs from one market to another. These three manifestations of market failure have been highlighted in the maize market in Togo. One important finding is that, maize prices adjust more rapidly in rural markets than in Lome market. How can we explain this result? The presence of wholesale traders often, with collusive behaviour and the importance of the role they play in the exchange of maize, seemed to be highlighted by the results. These wholesale traders who are more present in the rural markets adopt different strategies to preserve their commercial margins. Given that they exploit trade information better than retail traders in Lome, they influence the pricing and transmission of prices by controlling market supplies. Because they have a collusive behaviour in the local market, they are led to correct price disequilibria more quickly.For example, when prices decline in Lome market, wholesale traders due to their collusive behaviour reduce the supply in Lome market either by storing their products or by marketing them to other markets where the conditions of transport and arbitrage are better. This strategy consists in increasing the price level in the market of Lome. In the case of prices increase in this market, trade between Lome market and the rural markets continues. In addition, by prefinancing the agricultural activities, traders can also position themselves as unavoidable buyers. This positioning can result in incomplete transmission of prices between markets.Conclusion and Policy ImplicationsThis paper examined the transmission of maize prices between Lome, the biggest consumer market and nine rural markets in Togo. The use of a symmetric error correction mechanism (MCE) and an asymmetric MCE resulted in a convergent result regarding the speed of price adjustment which is higher in rural markets than in Lome, the consumer market. Moreover, the asymmetric analysis model of Enders and Granger appeared to be more robust since it enabled to detect the presence of asymmetry in the transmission of positive and negative price variations. Indeed, the model of Enders and Granger revealed that the asymmetric transmission, according to the positive or negative variations, dominates the maize market in Togo. The presence of wholesale traders, with collusive behaviour and some producer’s organizations engaged in collective sales in rural markets could explain such results.On the one hand, the wholesale traders who are more present in the rural markets adopt different strategies to preserve their commercial margins. Due to the fact that they exploit commercial information better than individual traders in Lome, they influence the pricing and prices transmission by controlling market supply. Because of their collusive behaviour in the rural market, they are more likely to correct price disequilibrium from the central market.On the other hand, the farmers' organizations increasingly active in the marketing of maize, through bundling would have a significant impact on the transmission of price changes. By collective agreement on sale prices of the maize, these organizations would also exercise some power in these markets. The hypothesis that rural markets respond very little to shocks from consumer markets is not confirmed. The asymmetric transmission of positive and negative variations of maize prices is a major economic and social concern since it implies a redistribution of well-being between consumers and farmers. In order to ensure fairness through a symmetrical transmission of price changes, it is important that the government invest more in the rehabilitation and construction of rural roads and roads to facilitate trade between different markets in order to reduce transaction costs. The market power exercised by certain intermediaries could be mitigated if the public authority improves the efficiency of information services.One limitation of this research is related to the choice of a model which assumes the null values as threshold delimiting two price variation regimes.It would be interesting for future research to use Threshold Auto- Regressive (TAR) model which assumes that economic agents only act to move the system back to equilibrium when the deviation from equilibrium exceeds a critical threshold, whereby the benefits of this adjustment exceed the costs.

Appendix

| Figure 1. Graphic of Price series on studied markets with Lome as reference |

|

|

|

|

|

| Figure 2. |

Note

- 1. We use nominal instead of real prices because traders’ arbitrage is not based on real but on nominal prices. Moreover, monthly inflation of cereals prices was not so important in Togo to affect significantly the efficiency of traders’ arbitrage during the most period of study.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML