-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(2): 63-75

doi:10.5923/j.economics.20170702.01

Public Debt Interest Free Borrowing from the Central Bank

Randa I. Sharafeddine

Azm University, Faculty of Business Administration, Lebanon

Correspondence to: Randa I. Sharafeddine, Azm University, Faculty of Business Administration, Lebanon.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this article, we will discuss a system in which the State would have the right to obtain financing from its Central Bank. This article explores the possibility for a Central Bank to finance the State's investments at zero interest rate 0%, like was the case when they had this right. This article starts focusing on the monetary creation and its control, which has been transferred from the States to the Central Banks and then to the Commercial Banks. It explores the reasons of this changes and the situation it created, particularly regarding the public debts that started at this time and which kept on growing ever since. We are going to see how States put themselves in a weak position that led them to be deep in debt today. Also, we will imagine how States could be quite free from their current public debt, especially with the example of the French public debt. This study will show that this model is viable, and would allow the collectivity to pay back the public debt and lower the taxes at the same time.

Keywords: Public Debt, Interest Free Borrowing, Central Bank, Competitiveness, Sustainability

Cite this paper: Randa I. Sharafeddine, Public Debt Interest Free Borrowing from the Central Bank, American Journal of Economics, Vol. 7 No. 2, 2017, pp. 63-75. doi: 10.5923/j.economics.20170702.01.

Article Outline

1. Introduction

- The high public debt can impact competitiveness and the future growth performance of an economy in the long run. The government cannot provide services efficiently if it has to make high-interest payments on its past debts, and firms cannot operate efficiently when inflation rates are out of hand. The stability of the macroeconomic environment is important for business and for the overall competitiveness of a country. In sum, the economy cannot grow in a sustainable manner unless the macro environment is stable.Public debt is a major problem that most of the States in the world are facing today; we feel concerned about the public debt and have thought several times about how States end up so deep in debt. This problem gets bigger and bigger every year, it happens that sometimes politicians talk about reducing it when elections are approaching, but in fact, this problem is never taken care of. But who is going to pay it back? And how did the States develop such an enormous debt?For taking the monetary creation subject further and using it to analyze the financial system, and find in there solutions to its instability, a very interesting book, written by Nobel Prize 'Maurice Allais'1, titled ''the financial crisis: for deep reform of the financial and monetary institutions'', linking monetary creation and financial system. It was really helpful and led me to take this article one step further. Maurice Allais believes that the way out of such crises is best achieved through structural reforms through, adjusting the rate of interest to 0% and revising the tax rate to about 2%. Those reforms would take time to implement and would face many interests, but at the end, they would benefit the collectivity and it would especially aim at making our financial system more stable, before it collapses.

1.1. The Link between Public Debt and Competitiveness

- High public debt can impact competitiveness and the future growth performance of an economy in the longer term. In general, the impact of public debt on competitiveness depends to a large extent on how it is spent. The accrual of public debt can enhance competitiveness if it is used to finance investments that raise productivity, such as upgrading schools or supporting research. However, if debt is used to finance present consumption, it burdens the economy in the long run with little tangible benefit. Indeed, in addition to crowding out private investment, which may also reduce growth, higher debt implies that interest payments and debt service will take up a bigger share of the government budget, forcing a reduction in public spending in other areas.Public spending cuts may have an adverse effect on competitiveness, especially if investments in growth-enhancing areas are affected. There is no doubt that reducing public investments for health, education, research and development (R&D), or the maintenance of infrastructure will erode competitiveness over the medium to longer term. R&D and education especially are among the areas that matter most for the competitiveness of advanced economies. Investments in these areas should therefore be preserved as much as possible. Given the importance of public investment in the competitiveness, enhancing areas such as education or innovation for future competitiveness, policymakers must measure very carefully the effects of reducing such investments, as this may endanger future growth and prosperity. This would have the unfortunate effect of converting short-term financial difficulties into longer-term competitiveness weaknesses. Policymakers should therefore focus on measures to enhance competitiveness that would strengthen their countries’ growth potential and thus improve the budgetary situation. In peripheral European economies that have accumulated debt over the past years while their competitiveness has not improved, competitiveness enhancing reforms would support economic growth and thus create a virtuous cycle that could make high debt burdens more sustainable.According to Hugh Dalton (1929) “a distinction on public debt is often drawn between "reproductive debt" and "deadweight debt". The former is debt which is fully covered, or balanced, by the possession of assets of equal value; the latter is debt to which no existing assets correspond. Public debt, which is fully covered by public assets, is analogous to the capital of a company, and the creditors of the public authority are analogous to debenture holders in such a company. The interest due to them is normally obtained from the income-yielding power of the assets, or, in other words, is normally paid out of income derived by the public authority from the ownership of property or the conduct of enterprises. The interest on deadweight debt, on the other hand, must be obtained from some other source of public income, generally, that is to say, from taxation”.

1.2. Money Creation

- We know that money creation is the basis of our financial system. The Commercial banks now control the economy, while the State has given away this economic regulation power. Banks can now create almost as much money as they want, as long as they make profit out of it, and they do. They don’t care, and it is not their role, about economic stability and Social equity…Two Theories of Money Creation Compete since the Early of the Nineteenth Century:- The Currency Principle: supported by David Ricardo2, this theory holds that the amount of currency in circulation must be regulated according to the desire of the banks to create, or not the money, where profit maximization plays the main role in money creation;- The Banking Principle: this theory is contrary to freedom of monetary creation, and this is based on the needs of growth in the economy supported by Ludwig Von Mises3 (1912).The monetary creation appeared when bankers who kept people's gold gave banknotes in certification of deposit, banknotes that were used to pay on markets. Then basing on the fact that chances for all the depositors to come at the same time asking for their gold was really low, they started issuing more banknotes than they had gold. The monetary creation was born, contingently, by chance.In history, money has taken various forms through a process of dematerialization, objects, base metals, precious metals, paper, and finally electronics. However, these currencies have been living together before being preferred or abandoned. The most important was probably the gold that was used as bargaining chips long before becoming used as a convertible currency in order to ensure their stability. For example, in the early 20th century, a gram exchanged against 0.29 grams of gold and 7.32 grams a pound, which gave us a pound to 25.24 francs. Thus gold was the basis of the international financial system.In 1914, France abandoned the gold for banknotes, but kept the convertibility of bank money in gold. In 1944, at Bretton Woods, the ounce (31 grams) is set to $35. Then, even if central banks keep gold in their coffers, demonetization of gold at the international level is effective in 1976 when a reference to gold is removed in the IMF Articles of Agreement.Today, gold represents nothing since money isn’t convertible into gold anymore. Money has nothing to see with something material. It is created by banks and only depends on people’s trust that other people are willing to accept banknotes in payment of merchandises or services. In our economies, commercial banks are the one allowed to issue money and Central Banks aren’t, not even to finance their State’s investment.Did you know that when you borrow money from a bank, the bank issues the money, meaning it creates it from nothing, ex nihilo? If you're not familiar with our monetary system, it's normal. No one knows this fact, even if it the basis of our financial system. Lending money, for banks, doesn't mean ''I lend you some money I have'' but ''I trust you to be able to pay me back''. The bank actually creates the money when you need it. This is how the quantity of money we have on earth has been growing so much over the years. Money is created by banks from nothing to be then lent to borrowers against interests. How can commercial banks create almost as much money as they want, and then lend something they didn't own in the first place charging interests? How the monetary creation power that at first belonged to States was, through successive steps, transferred from the States to the private bank? Banknotes and coins are only a fraction of the existing currency; deposit money now represents over 90%. This is partly why, as the Central Banks are called ''emission institute'', their power of action is relatively low. They still play an independent and effective role with the effect of their interest rate that has effect on the global economy.Banks create money purely and simply, ''ex nihilo'', in other words, from scratch. They create the money by writing a simple book by entering their balance sheet assets and liabilities in the amount of credit. Appropriations do deposits, and not vice versa.Thus, when a credit is granted by an institution with the power to create money, that money will be accepted as payment in the same way that a currency would represent a deposit of gold. Maurice Allais, Nobel laureate in economics, reminds us in his book; Today’s world wide crisis: For deep reforms of financial and monetary institutions: "Basically, the credit mechanism leads to a creation of means of payments scratch [from scratch], because the holder of a deposit with a bank considers it a cash available, while at the same time, the bank has lent the greater part of this deposit, which re-filed or not a bank, is considered an available cash by its recipient".At each credit transaction, there is duplication. In total, the credit mechanism leads to a creation of money out of nothing by mere book entries.''As a result of this process, banks have really slim cover for the money they create. Most of the money they create only corresponds to debt, and banks would be only able to give to their customer more than 20% of their money back. But of course, the system assumes that not everybody is going to ask for his money at the same time. The following scheme represents the portion of the money circulating that is more or less covered by money banks actually own.

2. The Bank of France

- Since the advent of the euro and the establishment of the European Central Bank, the Bank of France was deprived of any real power over monetary policy. But it was long the heart of the French monetary system, sometimes saving, sometimes disparaged. Here is a brief history of this institution.Under Napoleon, with Canteleu and perregaux, proposed to make what later became the bank of France, a genuine issue of Institute, funded by the public, but independent of it. In April 1803 it received the exclusive privilege of issuing banknotes. In return for this favor it must come to the aid of various governments for their funding. This will be first to finance wars and to meet expenses of any kind.From 1911, the treaties had the Treasury as the standing creditor, the Institute emission is induced to finance the First World War and its consequences: it became the military arm of the State for distribution of credit and monetary stability.The bank of France will become a creditor of the State, but will eventually oppose the demands of more and more insistent advances of governments. The influence of government becomes final with the nationalization of July 1936 which transformed the Bank of France in a State monopoly, so that even if continues to behave like an ordinary school, it grants credits based on the economic needs of the nation.Then, on 30 January 1973, involving the reform of the statutes of the State Treasury which is Article 25 which blocks any possibility of advance of the Bank of France to the Treasury: '' the Treasury cannot be a presenter of its own affects the discount of the France''. It's the end of the period when the public debt was free. Then this idea will be reinforced in 1992 when the Maastricht Treaty in Article 104 (cited below).Treaty of MaastrichtArticle 104.1No ECB and central banks of member States, grant overdrafts or any other type of credit institutions or organs of the Community, central governments, regional authorities, local or other authorities public law, or public undertakings of Member States the purchase directly from them by the ECB or national central banks of debt instrument is also prohibited.--------------------------------------------------------------------------------------------------------The Euro was introduced in Europe in January 1999. Nevertheless, banknotes and coins denominated in Euro became effectively present in the market starting January 2002. This was considered as a big revolution in the world of money. What happened is that several countries decided to let go of their domestic currency in order to adopt a single currency, the Euro. Consequently, the monetary policy among these countries has been unified under the governance of the European Central Bank (ECB) and the national central bank of each member state.

2.1. How the Public Debt in France Came about

- According to Salim Lamrani4 (2012), France till 1973 did not have a debt problem and the national budget was balanced. The state could borrow directly from the Bank of France to finance the building of schools, road infrastructure, ports, airlines, hospitals and cultural centers, something that it was possible to do without being required to pay an excessive and inflated interest rate. Thus, the government rarely found itself in debt. Nonetheless, on January 3, 1973, the government of President George Pompidou -- Pompidou was himself a former general director of the Rothschild Bank -- influenced by the financial sector, adopted Law no.73/7 focusing on the Bank of France. It was nicknamed the "Rothschild law" because of the intense lobbying by the banking sector which favored its adoption. Formulated by Olivier Wormser, Governor of the Bank of France, and Valéry Giscard d'Estaing, then Minister of the Economy and Finance, it stipulates in Article 25, that "the State can no longer demand discounted loans from the Bank of France." As a result, the French state is now prohibited from financing the public treasury through zero interest loans 0% from the Bank of France. Instead, it must seek loans on the open financial markets. Therefore, the state is forced to borrow from and pay interest to private financial institutions, when until 1973; it could create the money it used to balance its budget through the Central Bank. With this quasi-monopoly, commercial banks now have been granted the power to create money through credit, whereas previously this had been the exclusive prerogative of the Central Bank, that is to say of the state itself. As a result, commercial banks are getting rich off the backs of taxpayers.Furthermore, thanks to the fractional reserve banking system, private banks can lend up to six times more than the amount they actually have in reserve. Thus, for every euro they possess, they can loan six euros through the system of money creation through credit. As though this were not enough, they can also borrow as much money as needed from the Central Bank at a rate of 0 percent to 18 percent, as we see in the case of Greece. Today, money creation through credit accounts for 90 percent of all money in circulation in the euro zone.This situation has been denounced by the French economist and Nobel laureate, Maurice Allais, who wished to see money creation reserved to the state and the Central Bank. "All money creation must be the prerogative of the state and the state alone: Any money creation other than that of the basic state-created currency should be prohibited in a way that eliminates the so-called 'rights' that have arisen around private bank creation of money. In essence, the ex nihilo money creation practiced by the private banks is similar -- I do not hesitate to say this because it is important that people understand what is at stake here -- to the manufacture of currency by counterfeiters, who are justly punished by law. In practice both lead to the same result. The only difference is that those who benefit are not the same." Today, French debt has grown to over 1,700 billion euros. Between 1980 and 2010, the French taxpayer paid more than 1400 billion euros to private banks in interest on the debt alone. Without the 1973 law, the Maastricht Treaty and the Lisbon Treaty, the French debt would be hardly 300 billion euros. France pays 50 billion euros in interest annually, making this the largest item in the national budget, coming even before education. With that kind of money, the government would be able to build 500,000 public housing units or create 1.5 million jobs in the public sector (education, health, culture, leisure), each with a net monthly salary of 1,500 euros. In this way, French taxpayers are robbed of over 1 billion euros weekly, money that accrues to the benefit of the private banks. Clearly, the state has given the richest group of people in the country the fantastic privilege of enriching themselves at taxpayers' expense. And it has asked for nothing in return, and has not made the slightest effort to do so.Moreover, this system allows the financial world to subject the political class to its interests and dictate economic policy through the rating agencies, which are in turn financed by private banks. Indeed, if a government adopts a policy contrary to the interests of the financial market, these agencies lower the rating scores awarded to states, something that has the immediate effect of increasing interest rates.Meanwhile, when the state and the European Central Bank bailout ailing private banks, they do so with interest rates lower than those same financial institutions charge the state. In reality they are conducting de facto nationalizations without receiving the slightest benefit, for example, being granted decision-making authority within the banks administrative councils.The credit system established in France in 1973, and since ratified by the treaties of Maastricht and Lisbon, has but a single goal: to enrich private banks off the backs of taxpayers. It is unfortunate that a debate on the origins of public debt is not occurring in the media or in Parliament itself, even though resolving the debt problem would require nothing more than restoring the exclusive right of money creation to the Central Bank.

2.2. How Private Banks Are Getting Rich off the Backs of the Citizens

- The Financial crisis of 2008 had its impact on the Eurozone and resulted in very large current account deficits and massive public debts. This rendered financial institutions very risky and resulted in a lack of confidence among investors. What’s more, it implied a reduction in potential output and an increase in unemployment rates. The restriction in credit availability and the increase in interest rates made it hard for countries with very high debt burden to finance their debt payments. Increasing exports was a possibility for peripheral countries to be able to repay their debt. However, this was not possible due to price competitiveness. Furthermore, the reduction in income and austerity measures made the situation even more difficult because of recession. Tension is rising across the Eurozone and the prospect of member states, leaving the Euro is highly probable.According to Salim Lamrani (2012), all European countries find themselves confronted with debt problems that impact sustainable public finances. The crisis has spared France, the world's fifth largest economic power, something that makes private banks quite happy.No European nation has been spared the problem of public debt, even if the severity of the crisis varies from one capital to another. On the one hand, there are the "good students," such as Bulgaria, Romania, the Czech Republic, Poland, Slovakia, and the Baltic and Scandinavian states, all of which enjoy a debt lower than 60 percent of their GDP. On the other hand, there are the four "dunces" whose public debt surpasses 100 percent of their GDP: Ireland (108 percent), Portugal (108 percent), Italy (120 percent), and Greece (180 percent). Between the two extremes are found the rest of the European Union countries, such as France (86 percent), whose debt oscillates between 60 percent and 100 percent of GDP. High public debt levels generally bring about higher interest rates across the economy, which in turn raise the cost of finance for businesses, crowding out the private investment that is so crucial for growth. Moreover, as public debt levels rise, governments are under pressure to raise taxes, which can further suppress business activity.Still, it is common knowledge that the austerity policies promoted by the European Union, the European Central Bank and the International Monetary Fund that are currently being applied across the Old world, are economically inefficient. In fact, they result in the opposite of what was intended. Rather than restarting growth, they reduced expenditures; depressed salaries and retirement benefits; dismantling public services, including education and health care; destroying the work code and social benefits, in addition to the catastrophic social and human consequences that this causes, inevitably lead to a reduction in consumption. Inevitably, companies cut production and wages and lay off workers. As a logical consequence, the resources that flow from the state are cut back, while the entities dependent upon the state explode, creating a vicious cycle, for which Greece is the poster boy. Because of this, several European countries now find themselves in recession.

3. Monetary Creation Power

- Now, who should have the control over the monetary creation power? Why can’t States be financed by their Central Bank? What are the issues? We will see in a first time that the interdiction to the Central Banks to finance States is responsible for the French public debt and try to imagine an alternative system. This is why we will enlarge the question to who should have the control over the monetary creation power? and why?From a couple of decades, the economic and finance world is going on a deregulation trend. This deregulation is based on the idea that markets are the best solution to maximize resources allocation and therefore the States should not interfere with the market or the less the better. It is in this global idea that the monetary creation power has been entirely given to commercials banks and taken from Central Banks and States’ control.This is how from 1973 in France the State had to borrow the money it needed from commercial banks instead of being able to borrow it from the Banque de France, like it was possible before. This means when it borrows money, the State now has to pay interests to the banks since commercials banks have to protect themselves against inflation plus they have to be profitable and so to fix interests rates over the inflation rate.Today, in modern economies, central banks cannot finance government deficits to zero, or at least to a limited rate of inflation, as was the case that there are few decades in France and elsewhere worldwide.When tradable treasury bonds were created in 1985, it was to modernize the management of public debt. These vouchers are now open to all stakeholders. This has resulted, more or less directly, a sharp increase in public debt from 20% in 1980 to 64% in 2007. The State was the largest issuer of securities monetary and financial liabilities in recent years.Certainly, today, all States are in debt in a manner somewhat similar to that of France. In addition, in November 2005, the rating agency Standard & Poor's said that the quality of the French public debt deteriorated, while remaining at AAA rated (highest rating on a scale of existing. The OAT (fungible Treasury bonds) with a yield above 4% are more than ever the licensee in a context of crisis in which investors and investors looking for attractive returns, but above all safe.The weight of these interests in the annual State budget is something very heavy. In France, it corresponds, for example, to the whole of the income tax. The payment of interest on debt is the second-largest expense in the State budget, after that of National Education. He therefore created a huge crowding and simply due to interest payments. Imagine what could be the public finances without the burden of this debt!This economy of debt begins to pose problems and show its limits more or less. We say that fiscal policy is sustainable if it does not lead to an accumulation of "excessive" debt that is to say at a level of debt, no major changes, could not be covered by future budget surpluses. The financing of this debt excludes the use of a "Ponzi scheme" where the State would issue indefinitely new loans to pay interest and principal payments due. The borrowing capacity of the State is limited in quantity.

4. Modern Economies

- In a globalized economy, it is hardly conceivable that States will still have the power to create money they need because it contradicts the principles of free competition. Indeed, States would be too tempted to use these indirect free credits to help their businesses. Moreover, the Maastricht Treaty prohibiting central banks to finance the States is indicative of the fact that economies are subject to Community rules can use each ticket as it wishes.Also, according to Dominique Plihon in his book "Money and its mechanisms", one of the main reasons that prompted the French public authorities to modernize the capital markets is the need to finance public deficits in good condition. Indeed, when the Bank of France had the power to refuse granting of credits to the State, it could have the effect of reducing stimulus plans by providing insufficient funding, for example. The State now borrowing on the markets is sure to have the money it needs when it needs it, even build up a debt that will be reimbursed during better days.So are the ideas that have led governments in a context of deregulation, to shift the power of money creation in the private side. The most worrying is the increasing debt of States exponentially, and likely eventually to undermine market confidence in the solvency of the States. This would result in an increase in interest rates Treasury bills, adding to a little more weight in the interests of the State budget, and to a more distant perspective, the denial of economic agents to finance that debt. However, solutions exist, as we shall see in the next section.This Decision Has Been Taken for the Following Reasons:- The State can now borrow all the money it needs for its investments and operation without having to ask the Banque de France and have its action dependent on this institute's willingness or not loan the money;- The Banque de France was indirectly controlled by politics and the agenda may push them to ask for more money than they really need. This can lead to an excessive creation of money, leading to inflation and so to the currency's loss of value. It is mechanical. Indeed, the monetary management has to be led on a long term basis and politics trend to think too short;- Finally, having to borrow money with interest would be an incentive for governments to have balanced budget since having an increasing debt would not be maintainable on a long term orientation.

4.1. Money Control and Public Financing

- We know that money creation is the basis of our financial system. In this section, after stating how important the power of money creation is, we will discuss the system in which the State would have the right to obtain financing from its Central Bank. This theory is based on the fact that a State is deemed unable to default its debts. We are going to see how States put themselves in a weak position that led them to be deep in debt today. Also, we will imagine how States could be quite free from their current public debt, especially with the example of the French public debt.“Give me control over the currency issue of a nation, and I shall not worry about those who make its laws”. This quotation comes from the founder of the dynasty of Rothschild, one of the most famous families in the business world; Mayer Amschel Rothschild, Rothschild banking dynasty founder, 1743-1812.More recently, so what happened to the world crisis whose magnitude was forgotten since the 30s, banks cut loans to companies and individuals for fear of future insolvency of these economic agents. What happened on the side of government? It was obliged to guarantee a share of personal deposits to prevent bankruptcies, and to inject money into the economy out of its pocket. The economy depends on the willingness of banks to take risks and the State is powerless to the whims and desires of banks to grant credits or not.

4.1.1. What would be a Budget without the Interests?

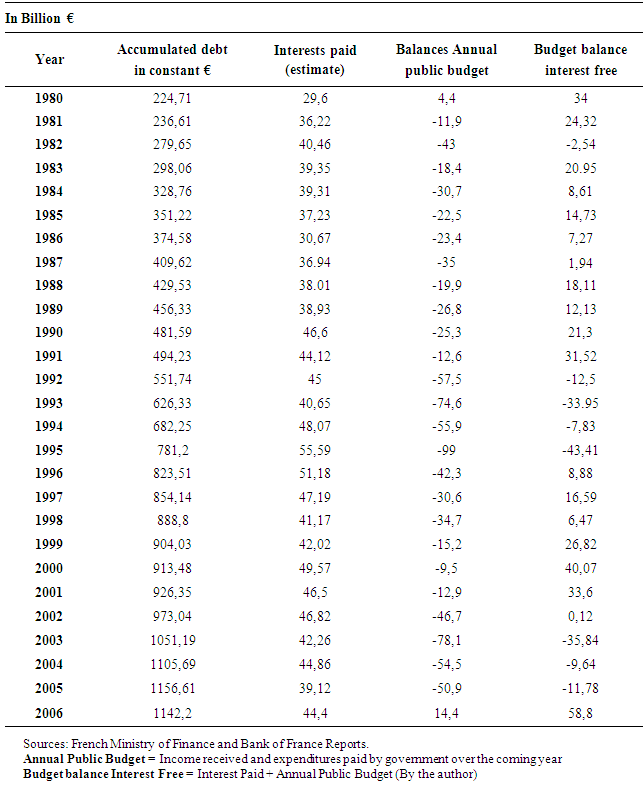

- After seeing the catastrophic situation of the French public debt since the abandonment of the power of money creation to commercial banks, what would be the French State without the weight of this debt and to what extent it might be possible to return to funding from the State Bank of France to zero. To begin, what would have been even balances the annual budgets of the State from 1980 to 2006 without the burden of debt interest (see Table 1).

|

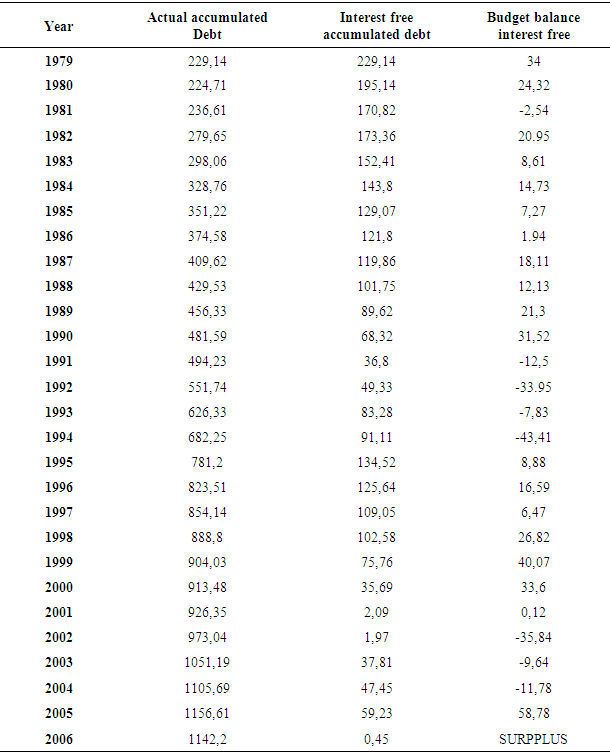

4.1.2. Could the French State be Debt-Fee?

- We are now going even as the current debt of France, whose amount was the recall of a 209.5 billion Euros in 2007, could be close to zero if the ban had not been done in the State to borrow from the Central Bank in 1973. Our previous calculations and estimates have allowed us to make an annual budgetary balance by including a payment of interest (these data are therefore the current situation of France), and secondly the same pay without the payment of such interest. We will thus calculate what would become the debt of France if it did not have to pay the interest since 1973. The results of these calculations appear in the table 2 below (in billions of Euros).

|

4.1.3. The Monetary Creation Political Control

- All things being equal, where power changes hands, some lose, others gain. Here, the big winners are the banks and other private investors. The banks win because they are now only able to issue credit therefore the currency, then retrieving the interest on the amounts issued. Of course, the majority of this money is issued to finance companies and consumer products. In this case it is normal that they are protecting themselves from the risk of non-repayment of these agents "fallible”, beyond the fact that they must first protect themselves against inflation through interest rate at least equal to inflation.But when the money is used to buy treasury bonds, while the prohibition is made to the Bank of France to do the same, there is some unfairness. Remember that T bills, including the quality of the debt is still rated AAA, the best rating possible, are owned 60% by foreign investors. Thus, each year, 40 billion Euros leave the State to land in the hands of these speculators happy to find these safe investments.Who Benefits?From one perspective, this amounts to take from the production system that sum, which is approximately equal to 100 million € per day for the refund to pensioners. In addition, 60% of the debt is held by foreign investors, the money thus outside the French circuit is probably neither imposed nor reinvested in France. All this is problematic as its borrowed money comes from money created ex nihilo by commercial banks. The borrowing by the State could be conceived at the time or money was representative of a certain quantity of gold that could become scarce in nature. But now it is totally paperless, it does not have the same rationale. Central Bank, founding texts of the European Union as the Treaty of Lisbon or Maastricht as well as ECB attest this ban in a very formal way, a point where it will be hard to come back.''Then we must proclaim a fundamental right of man is to be effectively protected against unfair operation, if not dishonest, the market economy is currently allowed or even encouraged by inappropriate legislation." Maurice Allais, Today’s world wide crisis.

4.2. What if States can be Funded by Central Bank?

- We’ve seen so far that the States have given the monetary creation power to the commercial banks, forbidding itself to be financed by its central bank. This resulted as the creation of a massive public debt. Now, we will propose an alternative system to the system in place now that could solve the problem of debt without the risk of creating a large imbalance somewhere.Basic Principles:- We assume monetary creation is removed from private banks.- The State is an economic agent whose solvency is considered indisputable.- Currency is in essence a collective, whose total privatization can therefore be considered illegitimate.- Only investment expenses are concerned, operating expenditure should be financed by the tax.

4.3. Central Bank Allowed Financing the State

- Again, the State is an economic agent whose solvency is considered to be infallible. State loans are qualified assets without risk that is to say that the State is supposed never lacking in debt. Also, State bonds rates them even qualified for rate of return without risk.From this observation, in this system, the State would be entitled to be funded by its Central Bank interest-free, just as it did forty years ago. The State may thus find a budget balanced without changing its tax policy. We remain in the approach to zero-rated funding strictly reserved for public investment, by admitting that the risk of non-repayment is null.On the other hand, we have to face the risk of excessive use of this power of monetary creation. As we saw earlier, inflation is the main threat to this configuration of power. Also, the establishment of its needs will therefore have to be more or less in line with the anticipation of future growth of GDP and other economic expectations such that it balances budgets.Deadlines would be imposed in order that these credits are a promise to pay in a distant future, and a maximum debt ratio would be allowed to State. If deadlines are not met, the State could even have its borrowing possibilities frozen.

4.4. A Necessarily Independent Central Bank

- To manage State investment funding, an organization's main objective would be the guarantor of monetary stability, e.g. a Central Bank. It would be strictly independent of the Government, that is to say, that the Government would have no direct or indirect means of action on it.To do this, the leaders of this bank would access the function by election or appointment any other medium imaginable for any independent policies, trade unions, captains or other persons having direct interests with the Central Bank. They would later have a long and non-renewable term in order to minimize the influences of the voting or decision makers (masses or specific individuals) always.This does not mean that Central Bank shall have the power to decide what will be done to create money, making it responsible for fiscal and monetary policy, and depriving the power to govern the economy elected Government. The Central Bank will only decide quantities it can grant to Governments based on their sustainable growth needs and their future ability to refund money.

5. The Use of the Central Bank

- This theory would be based upon the following ideas: a State can’t fail to pay back is debts; the money is something collective and it can’t be totally privatized; only investments’ financing are considered. Besides, we are not talking of taking the monetary creation power back from banks.The State would be able to borrow the money it needs in order to invest in whatever needs to be done. Those investments and the money generated to pay it back would be planned in advance over a certain period of time. In case of late payments, loans could be frozen until previous have been paid back to prevent any massive debt creation. The State would be loaned the money from an independent Central Bank. Independent from the politics powers in order not to influence its action from the politics’ electoral agenda. If the Central Bank would be able to accept or not the loans requests from the government, it would not be able to discuss what the government would do with it, in order to leave them the power of directing the economy, what they are actually elected for. The Central Bank would have for only worries the State’s ability to respects pay back plans, and the currency stability. Since we are today using the Euros, those decisions need to be taken from a global Central Bank like the BCE (Banque Centrale Européenne), which would allow loans for each State individually.Those financing would allow States to get back good budgets balances and on a long term to pay back the public debt. States would save a lot of money that people would get back paying less taxes. The only losing parties would be private investors that would lose the goods and risk free return on investment of public obligations.It would give back the States the economic power they lost. It would give them back a capacity of action that used to be huge, but which has been reduced over time. This power reduced, the State is weak when it needs to regulate the economy. And wherever the State has its control reduced, others forms of power appear, and, when this happens by accident, it is rarely for the best.

5.1. Consequences and Learning

- As we just saw, today, the world economy is based on a comprehensive system of credits that is to say from promises to pay in the future, drawing from each other, that might be in the form of a pyramid of debts. For immediate, almost all experts see hardly any other solution, if required by commercial banks, the institutes emission pressures and the IMF, that the creation of new means of payment to face of depreciation and interest of their debts, even by weighing even this burden for the future payment.Let’s go back to the subprime crisis and this incredibly early prediction by Thomas Jefferson:« I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The monetary creation power should be taken from the banks and restored to the people, to whom it properly belongs. »Thomas Jefferson, 1743 – 1826, The Writings of Thomas Jefferson, Memorial Edition.After taking a look at what happened, we can have second thoughts about this quotation. How the world could have been so blind to the pervert effects of the uncontrolled credit mechanism while a man warned us centuries ago, with a disconcerting accuracy?For the past decades, a wave of deregulation has blown over the financial world, involving the disappearance of any obstacle to the free movement of goods, services and capital. According to this theory, the disappearance of all obstacles to these movements would be both necessary and sufficient for optimal allocation of resources throughout the world condition. Every country and every social group would see their situation improved. Market was seen as likely to lead to a stable balance, completely effective, that could operate on a global scale. In all circumstances, it was appropriate to submit to this discipline.Supporters of this theory, this new fundamentalism, had become too dogmatic as supporters of communism before its final collapse with the fall of the Berlin wall in 1989. This liberal orientation has been reinforced by the communism doctrine collapse. Since an omnipotent State wasn’t the solution, an omnipotent market was at the time the best system for everyone. For them, the application of this globalist doctrine was needed in all countries, and if difficulties presented in this application, they could be only temporary and transitional. The total opening towards the outside was a necessary condition, and evidence was given by the extremely rapid progress of emerging countries of the world. For developed countries, the removal of tariff barriers or other was a condition of their growth, as it showed conclusively the undoubted success of the Asian Tigers, and repeated yet; the West had to follow their example for unprecedented growth and full employment.Such was fundamentally the doctrine of global and uncontrolled economy which had imposed itself upon the world and which had been considered as opening a new golden age at the dawn of the 21th Century. This doctrine established the undisputed creed of all the big international organizations these last two decades, including but not limited to the World Bank, the International Monetary Fund, the World Trade Organization, the Organization for Economic Cooperation and Development, or the Organization of Brussels.Two major factors have played a decisive role in this global crisis of unprecedented magnitude after the crisis of 1929:1. Potential instability in the financial and monetary system global;2. Globalization of the economy both in monetary terms and in real terms.

5.2. Here is the Learning to Understand out of It

- 1. With the monetary creation control, private banks are responsible for inflation and deflation which means expansion period and crisis following it; they accept crisis. They are not responsible for economic stability while they bear the tools to ensure it.2. Banks don't bear the responsibility of economic stability. They are interested in profit. But the credits (loans mortgages) they grant are responsible of the economic periods.3. The credit system is naturally instable. To be healthy, it has to be controlled4. The monetary creation power cannot be given to private banks and needs to be controlled by the collectivity, meaning the State, meaning a Central Bank.In fact, what had to happen is reached. World economy, which was devoid of any real regulatory system and was developed in an anarchic framework, could not only lead sooner or later to major difficulties.Indeed, at the basis of contemporary crisis is the uncontrolled loan of credits by private banks allowing expansion as long as investors trust the future, which can last a while. During this time, economic agents contract huge debts (like mortgages or other company’s investments) that are profitable only if the situation keeps up. When doubts about the future start showing up, people who had taken engagement or invested too much money can’t get a return on their investment or simply pay back their loans. Banking institutions need to be reformed also because they are instable. They finance long term investments with money they have on a short term basis from their savers.As a result, we assist today to the collapse of the global free trade doctrine, which was gradually imposed by the existing system. The free market was considered as the invisible power for optimal allocation of resources throughout the world. In fact, what had to happen? The global world economy, which was devoid of any real control, which was developed in an anarchic framework, could only reach, sooner or later, to major difficulties.''Indeed, the new order world, or the so-called world order has collapsed and could only collapse. Evidence of the facts eventually outweighs the doctrinal incantations.''Mr. Allais, today’s worldwide crisisWhat have we seen so far? Money is something immaterial and can be created at will. The question of money creation is purely political. In major developed countries, the States have then contracting enormous debts.Commercial banks have the power to create the money at will, whenever they judge it good for them. They are somehow responsible for economic stability, without officially bearing this responsibility. The financial world is built over a pyramid of debts, making economic agents inter-dependents. This financial system, which has developed in an anarchic manner, has led to several crises against which States have been powerless.

5.3. The World in a Tight Situation

- More recently, Maurice Allais saw in 1999, in The Global crisis today as "inappropriate" the current structure of money supply. He believes the current system is unstable and risky, liabilities and claims are not necessarily the same horizon and the risk of massive liquidity withdrawals by savers is always possible. Thus, according to Allais, "The entire global economy today is based on gigantic pyramids of debt, building upon each other in a delicate balance." He calls for a system where money creation is not the rule, in a framework of fixed exchange rate regime.In major developed countries, the States have given up the control of the money to the private sphere. This had for effect to force them to borrow money from the commercial banks, paying them interest, which lead States contracting huge debts. The paying back of the public debts is still a question. This led the States to be deeply in debt, which make it hard for them to borrow money when it is necessary. For example, to avoid banks to go bankrupt.In the meantime, the financial world has been deregulated over the decades. Commercial banks and investors has been let free to create complex financial products, speculate on inflation, trade in hedge funds and so on. The anarchy in which the world has grown led it to happen fragile, unsure, and unstable. Economic agents are interdependent and the fall of one takes many down with it. And there’s few the State can do about it because, as said earlier.1. States are in deep debts and their borrowing capacity is weak2. Private banks are the only one controlling the money creation3. Commercial banks are therefore responsible of economic stability, without officially bearing the burdenThose three facts make today’s world instable. There is a need for a change. When the crisis struck, everyone admitted it. Banks, newspapers, States, public opinion, economists… Despite their weak action power, all over the world, States saved the banks when the system was in danger. If they hadn’t done so, the whole system may have collapsed, on a worldwide basis. No one wants it to happen. This would be a major disaster. Therefore, there is an urgent need for deeply reforming the financial system, to strengthen it. Otherwise, the next crisis may be the last.We are now going to set up the bases of what should be the new system. We are going to look at the weaknesses of the current system, and try to make it safer, stronger, more reliable, and more ready to face crises. A system that would eliminate, or at least reduce, the amplitude of the expansion / crisis periods the economy has been growing around.With an experience of at least two centuries, all kinds of disorders and the estate expansion and recession periods observed constantly, must be considered as two major factors that have amplified them significantly are creating money and purchasing by ex nihilo credit mechanism and financing of long-term funds borrowed short-term investments. However, it could easily be fixed to these two factors by overall reform which would otherwise terminate cyclical fluctuations, at least to considerably reduce the scale.In fact, as we saw in the first part, the current system of credit, including historical origin was entirely contingent, and seems totally irrational, and this for five reasons:1. Creating irresponsible money and buying power by commercial banks;2. Financing long-term funds borrowed short-term investments;3. High sensitivity of the cyclical credit mechanism;4. Financial instability it creates;5. And finally the impossibility of any effective system by the public credit control and Parliament, due to its extraordinary complexity.

5.4. This Reform must be based on Two very Basic Principles

- • Monetary creation should be the State and the State only. Any other than the currency basis by the Central Bank monetary creation must be impossible, so that disappear ''false rights'' currently resulting from the commercial banking currency creating.• Any financing of a given asset must be done according the borrower capacity to pay back the loan at the time of the loan, not speculating on long term predictions.The mechanism of credit reform should thus make impossible both currency ex nihilo creation and borrowing short-term to fund long term loans , by not only allowing loans to haul more than borrowed funds deadlines. As we saw previously, enables banks to finance investments in the long term on the basis of loans of depositors in the short term, resulting in permanent and potential system instability.Creation of Scriptural currency depends on a dual commitment, willingness to banks to lend, and the willingness of economic agents to borrow. In times of prosperity, this dual desire exists and the Scriptural currency increases. In times of recession, this dual desire disappears, and the Scriptural currency decreases. Indeed, without the creation of money and you can purchase scratch allows the credit system, never extraordinary increases in stock market courses there before major crises are possible. Thomas Jefferson wrote:“Bank paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs. It is the only fund on which they can rely for loans; it is the only resource which can never fail them, and it is an abundant one for every necessary purpose. Treasury bills, bottomed on taxes, bearing or not bearing interest, as may be found necessary, thrown into circulation will take the place of so much gold and silver, which last, when crowded, will find an efflux into other countries, and thus keep the quantum of medium at its salutary level. Let banks continue if they please, but let them discount for cash alone or for treasury notes.”Thomas Jefferson, 1743 – 1826, The Writings of Thomas Jefferson, Memorial Edition.Thomas Jefferson, doesn’t want to suppress the banks. They are in fact a need for economic expansion, supplying financings, loans, and means of payments. They enhance the economic growth. But the monetary creation must be controlled by a central bank, and according to the actual economic growth.This double condition implies a profound change of banking and financial structures based on total banking activities dissociation as they find today and their allocation to three categories of separate and independent institutions:1. Deposit banks ensuring only, for any operation of loan, cash receipts and payments, custody deposits of their customers, the costs invoiced to it, and cannot contain any discovered; customer accounts. The bank's fees would be source of the income the Bank would get.2. Lending banks that would offer loans and mortgages at specific terms, and lending funds that they had to borrow on a longer terms, the total loan amount not exceeding the total borrowed funds;3. Business banks that would find their funding borrowing directly from the private sphere or the lending banks, and investing the funds borrowed in the economy.In principle, such a reform would make impossible monetary creation and ex nihilo by banking and borrowing short-term purchasing power to finance more long term loans. It would only shorter than those corresponding to the borrowed funds maturity loans. Lending banks and merchant banks use intermediaries between savers and borrowers. They would be subject to a mandatory requirement: borrow long-term to lend in the shorter term, contrary to what happens today.In the current system, the three banks are one in most of the cases. This drives them dependent from one another. The money you save is used by the business section of the bank to invest. It also covers (on a fractional basis) the loans the bank grants. If one of them encounters difficulties, it can drag the other down. If the stock market in which the savers’ money is invested goes down, the bank can go bankrupt and the person who just deposited his money loses it.In the new order, those three activities would be separated. This strongly reduces the risk of systemic crisis. If the stock market goes down, it doesn’t mean that people’s savings are going to be in danger in case of the business bank goes bankrupt.

6. Conclusions

- The monetary system as it stands today has appeared contingently, by accident. The principle of monetary creation ex nihilo has allowed the worldwide economy to grow faster, but in a more and more anarchic, or liberal, environment. Its control and benefits now belong to the private sphere, which is not only unfair, but also generator of crisis.The commercial banks now control the economy, while the State has given away this economic regulation power. Banks can now create almost as much money as they want, as long as they make profit out of it, and they do. They don’t care, and it is not their role, about economic stability and social equity.The legal (and non-mechanical) obligation for the States to borrow the needed funds to finance its investments from the money markets has gained. Promoting liberalism, States deprived themselves from the capacity to be financed by its Central Bank. It has been the case in France since 1973. Ever since, States are deep in debt. It created the need for States to lower its investments and higher taxes to pay private investors. This had for main effect the paralyses States’ budget and capacity of action. The worst being that if the State had, during all these years, been able be financed by its Central Bank, meaning without having to pay interest, countries would not be so deep in debt.In addition to be unfairly controlled by the private sphere, the monetary creation system is generator of economic instability. Potentially unlimited quantities of currency that can be offered by commercial banks allow speculators to invest as much as they want, as long as they trust the future. This creates periods of fast economic growth that always ends up in crises when they are too fast. Crises that follow are attributable to uncontrolled and unreasoned investments by commercial banks.For these two reasons at least, the monetary creation control must be given to a Central Bank. This independent entity would be granted the possibility to finance the State’s investment at no interest. Profits made in interests by the money created would be used to repay the existing debt. This would give the public the power to 1) easily borrow money when the situation requires it 2) ensure the economic competitiveness, stability and growth. The increased control of the Central Bank over the supply of money evolution would keep it in congruence with the actual economic growth, thus preventing over monetary creation, resulting in crises.

7. Recommendations

- After having analyzed the current global financial system weaknesses, we would advocate the following recommendation:1. The power of monetary creation must be restored to the collectivity, which it belongs to. It must not be given to politics, but to an independent Central Bank that would have for role to control the supply of money and economic stability.2. The banking industry has to be split up in three independent entities: deposit, lending and investment banking. This would protect depositor from bankruptcy and banks from massive withdrawal risks.3. Stock markets need to quote stock prices on a daily basis, trading software need to be forbidden, and banks should not be able to speculate for themselves.The main objectives would be the end of expansion and recession periods, through a better economic stability; a fairer distribution of the income resulting from money creation; and the building of a more reliable global financial system for competitiveness and sustainability.

Notes

- 1. French economist Maurice Allais, Nobel Prizewinner in Economic Science in 1988.2. David Ricardo was a British political economist. He was one of the most influential of the classical economists, along with Thomas Malthus, Adam Smith, and James Mill. Born: April 18, 1772, London, United Kingdom. Died: September 11, 1823, Gatcombe Park, United Kingdom.3. Ludwig Heinrich Edler von Mises was a theoretical Austrian School economist of the classical liberal school. Born: September 29, 1881. Died: October 10, 1973, New York City, New York, United States.4. Salim Lamrani (2012), Doctor, Paris Sorbonne, Paris IV University, Lecturer, University of La Reunion. Translated from the French by Larry R. Obeig.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML