-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2017; 7(1): 15-24

doi:10.5923/j.economics.20170701.02

Innovation Investment: An Empirical Study of Technology Public Listed Companies in Malaysia

Selvarajah Krishnan, Sheena Sara Suresh Philip

International University of Malaya-Wales, Kuala Lumpur, Malaysia

Correspondence to: Selvarajah Krishnan, International University of Malaya-Wales, Kuala Lumpur, Malaysia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Malaysia empowers to achieve innovation and becoming an advanced country by 2020. However, the innovation level among companies is still relatively low and it is not sufficient for Malaysia to accomplish the goals of the Eleventh Malaysia Plan (2016-2020) which is to increase enterprise innovation by 2020. The Eleventh Malaysia Plan introduced a strategy to improve innovation at enterprise level which is through strengthening the governance mechanisms. The purpose of this study is to examine the relationship between innovation investments and firm performance. This study uses empirical data on 14 technology public listed companies (PLCs) in Malaysia that is observed for year 2010-2014. Based on this data-set, the findings indicate that there is a positive relationship between innovation investments and firm performance for the technology PLCs. Higher director’s commitments and characteristics that are considered to help boost the innovation investments and firm performance. The finding contributed to the small and medium companies to involve on innovation and gain on return on investment. Further, strengthening the governance mechanism, increasing the demand-driven research through streamlining the public sector funding and strengthening the industry-academia collaboration and stimulating private financing for R&D, commercialization and innovation.

Keywords: Innovation Investment, Technology Companies, Malaysia

Cite this paper: Selvarajah Krishnan, Sheena Sara Suresh Philip, Innovation Investment: An Empirical Study of Technology Public Listed Companies in Malaysia, American Journal of Economics, Vol. 7 No. 1, 2017, pp. 15-24. doi: 10.5923/j.economics.20170701.02.

Article Outline

1. Introduction

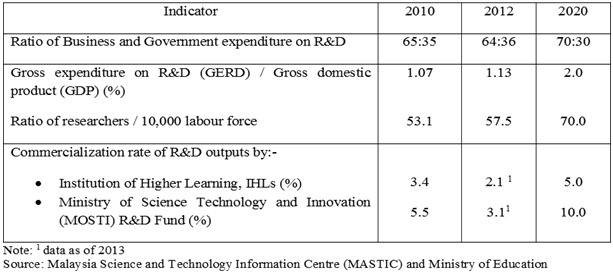

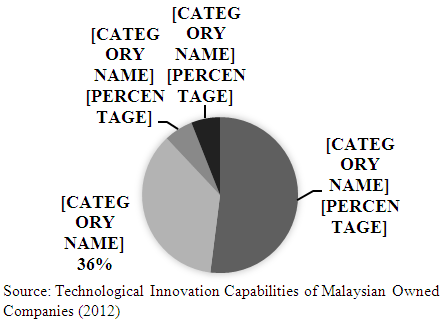

- Innovation is an important and critical element for Malaysia’s development plan as it acts as a facilitator on the productivity and competitiveness of the country. R&D investments and activities comes with uncertainty, inter-temporal and information asymmetries which brings the R&D activities to the principle-agent problem highlights (Zhao, 2013). The Tenth Malaysia Plan (2011-2015) report that several measures had been undertaken to strengthen the innovation ecosystem in Malaysia. This includes investing in research, development, commercialization and innovation. As a result, Malaysia ranked 33rd out of 143 nations on the Global Innovation Index (GII) and 20th out of 144 nations in the Global Competitive Index (GCI) in 2014 (Eleventh Malaysian Plan, 2016-2020). However, the Eleventh Malaysia Plan (2016-2020) posit that the outcomes and returns on the investment that was conducted in research, development, commercialization and innovation have to be further improved in order to enable Malaysia to achieve its aim of translating innovation to wealth and becoming an advanced country by 2020. The issues and challenges that hampered the innovation-driven stage in the Tenth Malaysia Plan (2011-2015) were the lack of coordination in R&D, commercialization and innovation initiatives, inefficient utilization of resources, lack of critical thinking skills, low innovation in companies and low commercialization of R&D outputs (Eleventh Malaysia Plan, 2016-2020). The Malaysia Productivity Corporation (MPC) studied on the Technological Innovation Capabilities of Malaysian Owned Companies (MyTIC) in 2012 and reports that merely 27 percent of the large companies and medium-sized companies in Malaysia spend RM1 million or more a year on R&D and innovation. MyTIC also report that the top 30 local Malaysian conglomerates measured based on the market capitalization spend an average of only 0.3 percent of its annual revenue on R&D investments class which is shown in Figure 1.

| Figure 1. Malaysian Companies Innovation / Technology Activities (%) |

|

2. Literature Review

2.1. Innovation Investment

- Innovation is the scientific, technological, commercial, organizational and financial activities which would guide in the development and application of technologically new or upgraded products and services (OECD / Eurostat, 1997). Innovation is a process of equipping in new and improved capabilities which would increase the utility of the production and process (Drucker, 1985). These new innovative ideas will stimulate the behavior of the economic agents (Hashi and Stojcic, 2012). Innovation is any newly instituted ideas, practice or material artefacts that is relevant to the development of a product for a particular market (Szeto, 2000). Stezo defines innovation as a process that leads to both improved technology and the creation of much efficient ways of getting things done. Innovation helps firms to have a strategic orientation to overcome problems it face in its daily operations while trying to sustain its competitive advantage among other competitors (Hit, Ireland, Camp, and Sexton, 2001; Kuratko et al., 2005). The OECD / Eurostat (1997) posit that when new technology and human capital is introduced it would increase the organization’s productivity and support it to produce at cost lesser than its competitors. Further, Khodakarami and Zukarnain (2015) argue that innovation behavior which are human behaviors that could be related to problem recognition, idea generation, supporting idea and idea implementation and these innovation behaviors could lead to sustainable development (environmental, society, and economics sustainability). Meynard, Aggeri, Coulon, Habib, and Tillon (2006) also added that sustainable development generally needs a considerable amount of investments in terms of innovation. Lau (1998) stated that R&D or innovation undertakings of a company are the most critical investment to ensure that the company continuously improves and enhances the existing products and processes in the firm. This shows that innovation is not only done to improve and come up with fresh products or services but also related to other activities in the firm like marketing and organization. Innovation allows firms to distinguish itself from its competitors through new and different products, processes and organizational developments (Gunday, Ulusoy, Kilic, and Alpkan, 2011). Innovation input could be examined based on the R&D expenses, number and quality of researchers whereas, innovation output could be examined base on the number of patent count, new products, new product accomplishment and the patent profits. Most researchers used R&D expenditure as the principle measure for innovation investments (Hashi and Stojcic, 2012). Moreover, recent researchers that used R&D expenditure as a measurement for innovation investments did obtain adequate results (Hashi and Stojcic, 2012; Mat Rabi et al., 2010). Besides that, the countries that achieved the highest number of patents per capita are typically the ones with the utmost amount of business R&D investments (Jaumotte and Pain, 2005). Thus, the approved innovation performance measures are the number of patented products or processes, R&D expenses as well as the new product declarations that is made to the market (Alpkan, Ceylan, and Aytekin, 2002). Since this study is on innovation investments or inputs, R&D expenses would be used as suggest by Acs et al. (2002).Balkin, Markman, and Gomez-Mejia (2000) stressed that R&D investments is the primary source of innovation for the firms to remain competitive in today’s economy and it is critical for many business contexts. The researchers acknowledge that innovation capabilities could be created through large expenditures in R&D (Balkin et al., 2000; Dalziel, Gentry, and Bowerman, 2011) which would in turn enhance the firm’s competitive advantage (David, O’Brien, Yoshikawa, 2008). Chen (2014) opined that R&D investment is an important input for companies to be able to innovate more products and services, to differentiate from existing or new competitors and to develop intangible capital.Hobday (2002) and Lee, Ventakatraman, Huseyin and Iyer (2010) puts forth that the evolution of technology based firms is crucial for most countries around the world. In Malaysia, the emphasis on the growth of technology-based industries had begun since 1991 (Felker and Sundaram, 2007). To support the high technology industries, Lai and Yap (2004) added that Malaysia has founded and developed numerous technology parks in 1997 and also established the Multimedia Super Corridor (MSC) that were projected to invite and encourage multimedia software and development projects from abroad. Malaysia provides more support for firms with favorable tax treatment or exemptions for expenditures related to R&D (Lai and Yap, 2004; Ng and Hamilton, 2016).McCann and Arita (2006) posits that high-technology industries depend considerably on science and technology in its operations and are observed as being closely related to innovation. McCann and Arita reiterated that due to the high-technology industries rapid change in technologies and relative short product life cycle, innovation should be the core activity for this industry. Ng and Hamilton (2016) studied on the experiences of eight high-growth technology companies in Malaysia and New Zealand and found that there were no difference in growth driver for both countries and the growth was driven by innovation. They revealed that the high-technology firms in both countries faced four obstacles which includes severe rivalry, small firm size, lack of qualified employees and financial capacity. The high-technology companies in both Malaysia and New Zealand sustained high R&D investment that are reflected based on the firm size and type of innovation. Coad and Rao (2008) stress that innovation is the critical capability for the technology based companies that is competing in dynamic market. They argue that innovation is accompanied by employee engagement, commitment to R&D and customer focused flexibility. Sofian, Mustafar, Yusoff and Heng (2014) supports that R&D resources and capability did influence the business performance of the 138 technology based companies in Malaysia.Zulkifli (2012) studied on 100 MSC-status firms in Malaysia and found that innovation was evident in most of the knowledge-intensive firms especially for firms that are able to develop purely new product, develop advancements on an existing product, obtain patents or copyrights for the product and introduces an enhanced production process with new technology. The sub-sector of the MSC-status companies includes software development, creative multimedia, hardware design, shared services, support services, internet-based business, and outsourcing. Lin, Chen, and Wu (2006) reports that R&D investments is a good strategy to exchange short-term profitability for long-term intellectual assets for U.S. firms with technology patents. Huang and Liu (2005) provided evidence that integrating both the innovation capital and information technology capital was able to positively influence the performance of the electronic and biochemical firms in Taiwan.

3. Methodology

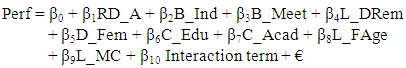

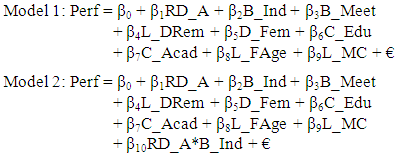

- The quantitative method is used in the development of the conceptual framework, hypothesis, data collection and analysis techniques of this study (Mat Rabi et al., 2010; Zhao, 2013; Zhang et al., 2014; Marinova et al., 2016). Quantitative data is in a raw form and it has to be processed and analyzed to turn them into information that would be meaningful and useful to researchers (Saunders, Lewis, and Thornhill, 2009). Previous studies found that innovation investments (R&D expenditures) leads to higher firm productivity, value and overall performance (Wakelin, 1998; Goto and Suzuki, 1989; Griliches, 1986; Lichtenberg and Siegel, 1991; Radiah and Rashid, 2009; Gunday et al., 2011). Although, Mat Rabi et al. (2010) report that innovation investments has a negative relationship on firm performance (ROE and ROA), Loof (2000) provided evidence that innovation has a positive relationship on return on assets (ROA), employment growth, sales of new products, sales per employee, value added per employee and operating profits per employee. A number of prior studies found that innovation through R&D activities contributes to the firm’s growth especially for the high-technology industries (Chan et al., 1990; Huang and Liu, 2005; Sofian et al., 2014; Cortez, Ikram and Pravini, 2015). Krusinskas, Norvaisiene, Lakstutiene and Vaitkevicius (2015) reported that high and medium-high-technology enterprises are better in terms of return on assets, productivity and volumes of export compared to medium-low and low-tech enterprises in the small manufacturing industries in Lithuania. They also reported that although the high-tech sector was able to get ahead from the medium-high-tech sector by their innovation activities, the medium-high-tech was better in terms of their operational efficiency. Moreover, there are researchers who reiterated that both technology and non-technology firms would achieve higher firm performance if the firms are actively involved in R&D or innovation (Thornhill, 2005). Following these studies, Hypothesis H1 (T) (NT) is suggested:H1: There is a positive relationship between innovation investments and firm performance for the technology PLCs.According to the agency theory, the involvement of independent non-executive directors or outside directors within the BODs provides an effective monitoring role (Williams, Duncan, Ginter, and Shewchuk, 2006). While, recourse dependency theorist extends that independent outside directors can provide inputs like information and knowledge into R&D decision-making and the directors can provide resources directly for projects that adds shareholder value (Pfeffer and Salancik, 1978; Hillman and Dalziel, 2003). Shamsher and Zulkarnain (2011) opined that independent directors are expected to independently monitor the management’s work and decisions.According to Chung et al. (2003), Le et al. (2006) and Chouaibi et al. (2010), there is a positive relationship between innovation investments (R&D expenditures) and firm performance for firms with higher proportion of independent directors. Firm’s performance and value could be enhanced by increasing the number of independent directors as they will be better able to manage firm’s performance without any conflict of interest (MacAvoy and Millstein, 1999; Adam and Mehran, 2003). Consistent to these findings, Coles, Daniel and Naveen (2007) suggests that the presence of independent directors would bring better discipline managerial behaviors compared to inside directors. However, in Malaysia, recent empirical studies found no relationship between independent non-executive directors and firm performance (Leng, 2004; Che Haat, Abdul Rahman, and Mahenthiran, 2008; Mohd Ghazali, 2010). This led researchers to question on the actual independency of the independent directors in Malaysia (Meng, 2009; Annuar, 2012). Moreover, it was found that these studies was conducted before the Malaysian Code of Governance was revised in 2007. The revised code of governance emphasized the need for boards to contain at least “one-third of independent non-executive directors”. Therefore, it is expected that the revised code of corporate governance in Malaysia would have a positive effect over firm performance.Nevertheless, the empirical evidence on the association between board independence and firm performance is still relatively ambiguous this is because there were researchers who found that board independence had no significant relationship on firm performance (Mehran, 1995; Kor, 2006; He and Wang. 2009; Bhagst and Black, 2001), while, there are studies that found a negative association between board independence and firm performance (Agrawal and Knoeber, 1996; Barnhart and Rosenstein, 1998; Devos, Prevost, and Puthenpurackal, 2009; Chen et al., 2014). Moreover, Chen (2013) argues that firms that are competing on innovation should think about giving extensive weight to the appointment of more independent directors. This was also supported by Zona et al. (2013) where they observed that outsider ratio has an influence on firm innovation. This is because the independent directors could serve as effective guardians and provide resources to motivate and encourage chief executives officers (CEOs) to focus on innovation.The methodology that is used in this study is based on the empirical studies of Le et al. (2006), Mat Rabi et al. (2010), Zhao (2013), Zhang et al. (2014), Honore et al. (2015) and Marinova et al. (2016). Empirical means the data and information are obtained through actual evidence, experience, experiment and observation. Empirical study refers to the need to use the employed hypothesis that could be tested using observation, evidence and experiment. Research methods that is used to gather empirical measurements using quantitative methods. This study is conducted using the quantitative method where numerical data on innovation investments, corporate governance characteristics and firm performance is collected from annual reports and databases, then analyzed using statistical methods. Figure 2 shows the empirical cycle by De Groot (1969).This research is conducted using secondary data. Secondary data is used as the data are available and are ready to be used and analyzed. All the secondary data that is used in this study is collected from company’s annual reports and databases. Survey or questionnaires is not constructed and used for this study as this study focuses on secondary data analysis. The company’s annual reports is obtained from the main market of Bursa Malaysia. In addition, data on the market capitalization of the PLCs is attained from the Thomas Reuters Datastream. The R&D expenditure is collected from the Wharton Research Data Services (WRDS) database. The data on the financial variables, for instance, the ROA, ROI, firm age and company’s corporate governance characteristics is gathered manually from the annual reports. All data is collected and analyzed for year 2010-2014. The specific years are selected as the period is during the Tenth Malaysia Plan (2011-2015) and studying the effects during these years would determine if the strategy of strengthening governance mechanisms helps the Eleventh Malaysia Plan (2016-2020) to achieve its goal of fostering enterprise innovation. The Statistical Package for Social Science (SPSS) software is used to analyze the data collected for this study. This study uses the secondary data (2010-2014) that is obtained from the selected PLCs annual reports and databases. The purpose of the data is to gauge the performance of the technology and non-technology based PLCs with innovation investments (R&D expenditure) and also to examine the moderating or interacting effects of the corporate governance characteristics. The secondary data and tests are parametric as it involves numeric data. The analysis begins by analyzing the descriptive statistics. Followed by, analyzing the correlation between the variables using the Pearson Correlation test. Correlation analysis is done to express the strength and direction of the relationship between two variables. The issue of multicollinearity is also tested through the Pearson Correlation, Variance Inflation Factor (VIF) and Tolerance analysis. Further, the simple linear regression and hierarchical regression technique is conducted to test the interaction effect of the moderating variables (Keizer, Dijkstra, and Halman, 2002; Chung et al., 2003; Le et al., 2006; Mat Rabi et al., 2010). Basically, the general model is regressed first to determine the ‘direct effect’ of the independent, moderating and control variables on the firm performance (ROA and ROI). Then, the regressions is conducted separately to study the influence of each moderation or interaction terms on the relationship between innovation investments and firm performance. This is done separately for both technology and non-technology PLCs using ROA and ROI as proxy to firm performance. The accustomed model of this study is developed as below:-

The specific models for each of the interaction term are demonstrated as the following:-

The specific models for each of the interaction term are demonstrated as the following:-

4. Results

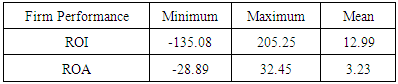

- The descriptive statistics for the technology PLCs. The maximum ROI and ROA obtained by the technology PLCs is 205.25% and 32.45% respectively. The minimum ROI and ROA is -135.08% and -28.89% which points out that some of the companies within the sample faced financial loss during the financial year of 2010-2014. Shown that the technology PLCs spend a maximum of 1.3% and an average of 0.3% of the total assets on R&D.

4.1. Correlation Analysis

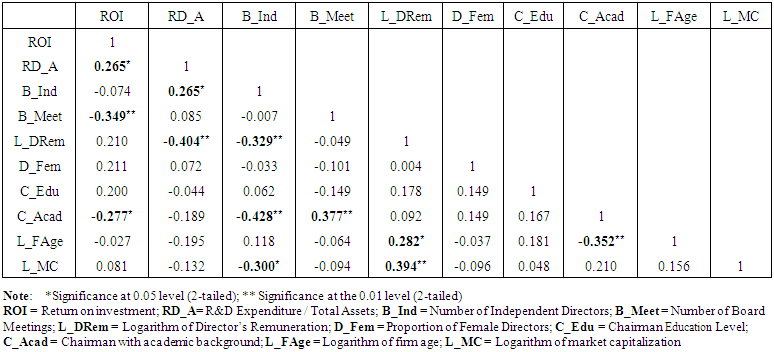

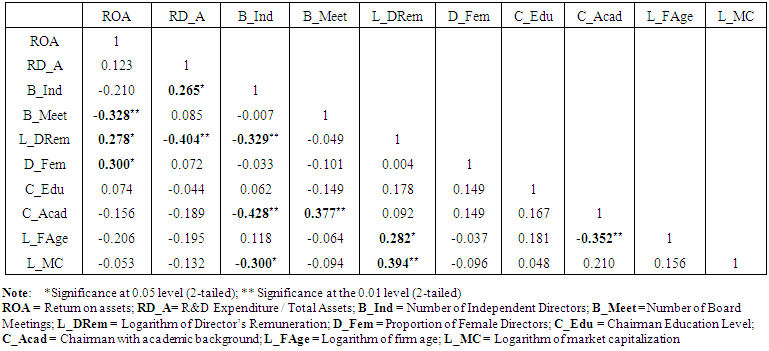

- The correlation analysis is intended to determine the strength and direction of the linear relationship between two continuous variables. The Pearson Correlation Matrix for the technology PLCs using ROI and ROA as a proxy to firm performance. There is a positive and significant association at 95% confidence level between the RD_A and ROI at 0.265 (P < 0.05). Therefore, consistent with Hypothesis 1, there is a positive association between innovation investments and firm performance (ROI) for the technology PLCs as shown in Table 2 and Table 3.

| Table 2. Pearson Correlation Matrix for Technology PLCs (ROI) |

| Table 3. Pearson Correlation Matrix for Technology PLCs (ROA) |

4.2. Multicollinearity Test

- The presence of multicollinearity is tested before conducting the regression analysis. Pallant (2005: 2010) suggest that when the independent variables are highly correlated with one another with r > 0.09, multicollinearity is said to exist which may result in a poor regression model. Inspection of all the correlation interaction, as presented in Table 1, 2, Table 3, show that the independent variable (RD_A) in this study had values not more than 0.300 or r < 0.7, which prove that the issue of multicollinearity in the regression model is considered negligible (Selvarajah and Sulaiman, 2014). The moderating variables (corporate governance characteristics) and control variables are also inspected and it is found that all the values are not more than 0.500 or r < 0.7 which indicates that there is no multicollinearity. In addition, Table 4 show the Tolerance and Variance Inflation Factor (VIF). The tolerance value for technology is below 0.10 and the VIF value is below 10 which also indicates that there is no multicollinearity issue within the data studied (Pallant, 2010).

|

4.3. Regression Analysis

- The simple linear regression analysis is conducted to determine the direct effect of the dependent (ROI and ROA) and independent variables (RD_A) as shown in Model 1. The hierarchical regression analysis is conducted to study the moderating effects of the each moderators (CGC) as presented in Model 2. The analysis is conducted separately for the technology and non-technology PLCs using both ROI and ROA as proxy to firm performance.Regression Analysis for PLCs

The F-value is statistically significant at 0.000 (P < 0.0005) and the adjusted R2 is 0.358 and 0.421. Based on the analyses in Model 1, it is found that the RD_A has a significant positive relationship on ROI at 0.335 (P < 0.01). Model 1 also show that the RD_A has a significant positive relationship on ROA at 0.214 (P < 0.10). Therefore, Hypothesis 1 is supported as there is a positive relationship between innovation investments and firm performance (ROI and ROA) for the technology PLCs. The results presented in Model 1 show significant relationship between B_Ind, L_DRem, D_Fem, C_Edu, C_Acad, L_FAge and ROI. While, the results presented in Model 1show significant relationship between B_Ind, L_DRem, D_Fem, C_Acad, L_FAge and ROA.

The F-value is statistically significant at 0.000 (P < 0.0005) and the adjusted R2 is 0.358 and 0.421. Based on the analyses in Model 1, it is found that the RD_A has a significant positive relationship on ROI at 0.335 (P < 0.01). Model 1 also show that the RD_A has a significant positive relationship on ROA at 0.214 (P < 0.10). Therefore, Hypothesis 1 is supported as there is a positive relationship between innovation investments and firm performance (ROI and ROA) for the technology PLCs. The results presented in Model 1 show significant relationship between B_Ind, L_DRem, D_Fem, C_Edu, C_Acad, L_FAge and ROI. While, the results presented in Model 1show significant relationship between B_Ind, L_DRem, D_Fem, C_Acad, L_FAge and ROA. Model 2 show that the F-value is statistically significant at 0.000 (P < 0.0005) and the adjusted R2 is 0.379 and 0.422. From the analysis in Model 2, number of independent directors has a significant and negative moderating effect between RD_A and ROI at -0.815 (P < 0.10). The negative sign indicates that the lesser independent directors impacts RD_A and ROI. Model 2 found that the number of independent directors does not moderate the relationship between RD_A and ROA. Therefore, Hypothesis 2 is not supported as the higher number of independent directors does not moderate the relationship between innovation investments and firm performance (ROI and ROA).

Model 2 show that the F-value is statistically significant at 0.000 (P < 0.0005) and the adjusted R2 is 0.379 and 0.422. From the analysis in Model 2, number of independent directors has a significant and negative moderating effect between RD_A and ROI at -0.815 (P < 0.10). The negative sign indicates that the lesser independent directors impacts RD_A and ROI. Model 2 found that the number of independent directors does not moderate the relationship between RD_A and ROA. Therefore, Hypothesis 2 is not supported as the higher number of independent directors does not moderate the relationship between innovation investments and firm performance (ROI and ROA). 5. Discussion

5.1. Firm Performance (Proxy ROI and ROA)

- This study uses two proxies to firm performance which includes ROI and ROA. Using multiple measures would help to capture the effect of the variables more consistently and systematically (Morrow, Johnson and Busenitz, 2004; Abebe and Alvarado, 2013). From the analysis conducted, both ROA and ROI showed consistent direct effect on innovation investments for both technology and non-technology PLCs. However, it is found that the corporate governance characteristics has more impact on the relationship between innovation investments and firm performance when the ROI was used as a proxy to firm performance for the technology PLCs. This might be due to the ROI that is higher than the ROA for the technology PLCs as shown in Table 2 and summarized in Table 5 below. This shows that the technology PLCs are efficient in utilizing the invested capital on innovation investments.

|

6. Conclusions

- This study contributes ways in provide solutions to the issues and challenges that had been faced by firms. The importance of conducting innovation investments in order to improve firm performance particularly for the technology PLCs, provides evidence on the effectiveness of integrating specific to improve the level of innovation investments and firm performance, asserts the importance of involving the BODs and shareholders in the innovation investments and activities of the firms. This study proves that academic theory in the form of agency and resource dependency theory could be used as a tool to increase innovation investments and firm performance among the Malaysian PLCs. Hence, combining both this theory helps to develop an effective corporate board.The Malaysian PLCs are firms with higher market capitalization, this means that the conclusion validated from this study might be only appropriate for larger firms and conducted only upon a small sample of 14 technology PLCs in Malaysia. Furthermore, this study only used data for 5 years (2010-2014) and therefore, the results may not be generalized for the periods before the governance reforms or crisis (Subramaniam and Shaiban, 2011). Finally, there may be an element of bias as only PLCs reporting on the details of R&D expenditures and corporate variables of interest are included in this analysis (Gul and Kealey, 1999; Che Haat et al., 2008). Future research should study on a larger sample pool which would allow for better statistical analysis research. Hence, future research could work to enlarge the current sample by studying on the full sample of the technology and non-technology PLCs on the Main and ACE market of Bursa Malaysia. Future research should also consider incorporating the unlisted companies as samples (Marinova et al. 2016). In addition, conducting the study on a longer time frame with more recent data and relevant corporate governance issues is proposed. Future studies could also conduct a cross-sectional analysis and compare it among other ASEAN countries in order to determine the effectiveness of innovation investment to improve firm performance as well as the moderating effects of corporate governance. Besides that, future study could also test the mediating effects of CGC on the relationship between innovation investments and firm performance. This is to regulate if CGC has a stronger mediating effects rather than moderating effects. Other than that, future studies may also want to consider other aspects of corporate governance such as ethnicity and board diversity on the relationship between innovation investments and firm performance. Finally, future studies could test the relationship examined in this study using different proxies to firm performance such as earnings per share (EPS), return on equity (ROE) and market performance using Tobin-Q. Other proxies to innovation level or R&D could also be used such as number of patent count and number of new project or product success. As researchers do not identify a uniform measure to firm performance and innovations, testing the relationship using different proxies of firm performance and innovation would provide opportunity to validate the existing findings of this study (Subramaniam et al., 2011).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML