-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(6): 334-343

doi:10.5923/j.economics.20160606.04

An Application of AHPTOPSIS Model for Evaluating the Optimal Individual of Extending Loan in SCF Ecosystem

Cheng Shian Lin , Chun Yueh Lin

CTBC Financial Management College, Tainan, Taiwan

Correspondence to: Chun Yueh Lin , CTBC Financial Management College, Tainan, Taiwan.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The critical concept of supply chain finance (SCF) is looking for a core target in a supply chain and delivery of credit. Using the transaction records from the target to the members, the financier will be able to provide a higher level of cash flow to the ecosystem. However, financiers provide the SCF service can improve their profits, but there are many risks implied in SCF activities from the target to supply chain (SC) members. Therefore, this paper presents processes to evaluate the optimal individual of extending loan for financiers combining the analytic hierarchy process (AHP) and the technique for ordering preference by similarity to the ideal solution (TOPSIS). In the first place, construct the criteria and sub-criteria by modify Delphi method. In the second place, the AHP is used in obtaining the weights of criteria and sub-criteria. In the third place, the TOPSIS approach to rank the optimal individual of extending loan in terms of their overall on multiple evaluation criteria. Furthermore, this study applied a case study of smartphone industry SC to assess the optimal alternative. Importantly, the proposed model can provide academic support to the decision-makers in the financiers with a valuable objective guide for evaluating the individual of extending loan of smartphone industry SC programs to obtain optimal solution in their actual administration of SCF service practices.

Keywords: Supply chain finance (SCF) ecosystem, Analytic hierarchy process (AHP), the technique for ordering preference by similarity to the ideal solution (TOPSIS), Smartphone industry supply chain, Individual of extending loan

Cite this paper: Cheng Shian Lin , Chun Yueh Lin , An Application of AHPTOPSIS Model for Evaluating the Optimal Individual of Extending Loan in SCF Ecosystem, American Journal of Economics, Vol. 6 No. 6, 2016, pp. 334-343. doi: 10.5923/j.economics.20160606.04.

Article Outline

1. Introduction

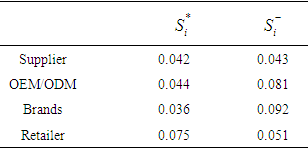

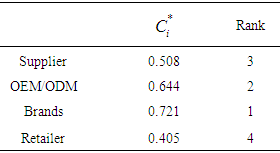

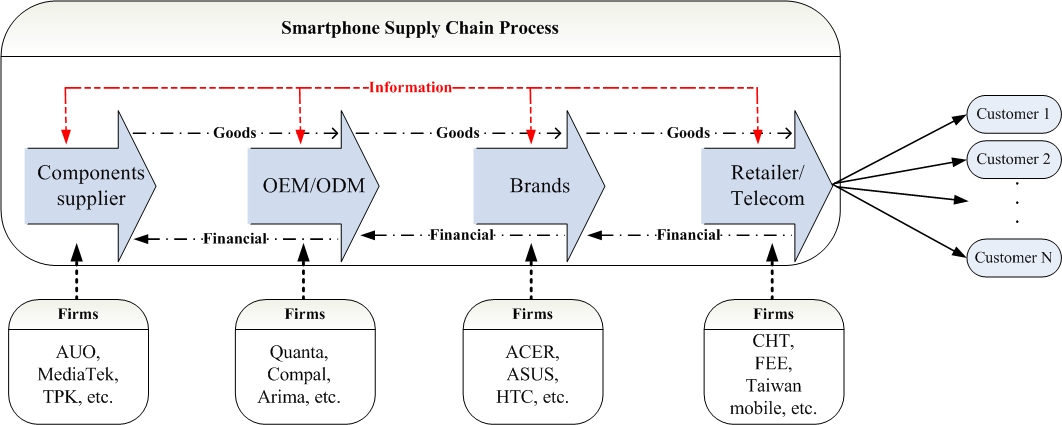

- In recent years, the development of a globalized economy has led to intense competition in the market which has led to many industries implementing supply chain management (SCM). The SCM can reduce the propagation of unexpected/undesirable events through the network and can influence decisively the profitability of all the SC members and co-ordination of all the input/output flows (materials, information and finances) (Simchi-Levi et al. 2000; Guillen et al. 2007). SCM systems rely on financial flows in addition to manufacturing, logistics and marketing activities to coordinate the flow of goods, services and money between separate stages in the supply chain (Blackman, et al. 2013). The financial processes that can be seen are important to any industry when they have implemented the SC activities. Hence, finance institutions to look in a very zealous way for Small-Medium sized Enterprises (SMEs) and provide working capital or more credit (loan level) to them and then expand the market share. This concept is the basis of Supply Chain Finance (SCF) that can enhance the efficiency of finance flows in a SC activity. The idea of SCF was proposed in 2006 (Berger and Udell, 2006). Pfohl and Gomm (2009) proposed the details of the definition of SCF is the inter-company optimization of financing as well as the integration of financing processes with customers, suppliers, and service providers in order to increase the value of all participating companies. Randal and Farris (2009) found that SCF can strengthen the SC by collaborative management of cash-to-cash cycles and sharing the weighted average cost of capital. The SCF services can create a financial win-win for the buyer, the seller and the financial intermediary (More and Basu, 2013). In the financiers’ opinion, the biggest feature of SCF is to find an individual of extending loan in the SC, and improve the financial constitution based on this individual, which extends the good credit of individual to the upstream and downstream firms and lifts the lid on lending without taking on unacceptable risk (Wang et al. 2013; Liu, 2007). The three flows of typical SCM system (financial, goods and information) is shown in Figure 1 and then Figure 2 is shows the ecosystem of SCF. For instance, if the individual of extending loan is the manufacturer, SC members (upstream/downstream) can extend the individual of extending loan to improve the working capital efficiency then it can solve a problem that most SMEs face when they have low credit to loan funds. Therefore, the individual of extending loan in a SCF ecosystem is a critical actor when a bank or financial sector wants to provide these new financial services.

| Figure 1. The three flows of the traditional SCM system |

| Figure 2. The ecosystem of SCF |

| Figure 3. The Smartphone industry SC process. (Source: Ali-Yrkko et al., 2011; Linden, et al., 2009) |

2. Evaluation Processes

- This study adopts the modify Delphi, AHP and TOPSIS method. The processes are show in Figure 4. The modify Delphi method is to collect experts’ view and point out the determinants of the evaluation model, then calculation of the weighted criteria by AHP, finally ranking the optimal alternative through TOSIS. The AHPTOPSIS processes are follows.

| Figure 4. The evaluation processes of optimal individual of extending credit |

2.1. Modify Delphi Method

- The Delphi method collects and analyzes the results of anonymous experts who communicate by means of writing, discussion and feedback with respect to particular issues. Anonymous experts share knowledge, skills, expertise, and opinions until they achieve a mutual consensus (Sung, 2001). The procedure of Delphi as follows (Wu et al., 2007):A. Select the anonymous experts.B. Conduct the first round of the survey.C. Conduct the second round of the questionnaire survey.D. Conduct the third round of the questionnaire survey.E. Integrate expert opinions and reach a consensus.Steps C and D are normally repeated until a consensus is reached regarding a particular topic (Sung, 2001). The results of literature reviews and expert interviews can be applied to identify all common views expressed in the survey. Furthermore, step B is simplified in order to replace the conventionally adopted open style survey; when this is done it is commonly referred to as the modified Delphi method (Sung, 2001). This study develops a quality evaluation criterion for evaluating the CO in smartphone industry supply chain ecosystem by using the modified Delphi method, as well as by conducting interviews with nameless experts.

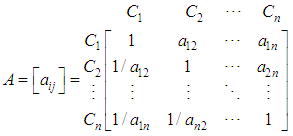

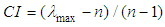

2.2. Calculating the Weights of Criteria by using AHP

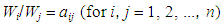

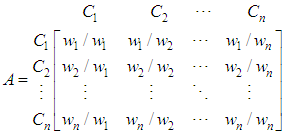

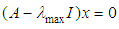

- Saaty (1980) proposed the AHP model to solve the complexity decision problem. As a decision-making method that deconstructs a complex multicriteria decision problem into a hierarchy. AHP incorporates the evaluations of all decision makers into a final decision, without having to elicit their utility functions on subjective and objective criteria, by pairwise comparisons of the alternatives (Saaty, 1990). The AHP steps are as follows.Establishment of pairwise comparison matrix A. Let C1, C2, ..., Cn denote the set of elements, while aij represents a quantified judgment on a pair of elements Ci, Cj. The relative importance of two elements is rated using a scale with the values 1, 3, 5, 7 and 9, where 1 refers to ‘equally important’, 3 denotes ‘slightly more important’, 5 equals ‘strongly more important’, 7 represents ‘demonstrably more important’ and 9 denotes ‘absolutely more important’. This yields an n-by-n matrix A as follows:

| (1) |

and

and  In matrix A, the problem becomes one of assigning to the n elements

In matrix A, the problem becomes one of assigning to the n elements

a set of numerical weightss

a set of numerical weightss  that reflect the recorded judgments. If A is a consistency matrix, the relation between weightss Wi and judgments aij are simply given by

that reflect the recorded judgments. If A is a consistency matrix, the relation between weightss Wi and judgments aij are simply given by  and

and | (2) |

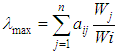

max would be

max would be | (3) |

| (4) |

| (5) |

| (6) |

the estimate is accepted; otherwise, a new comparison matrix is solicited until

the estimate is accepted; otherwise, a new comparison matrix is solicited until

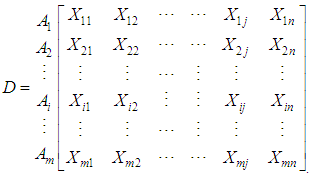

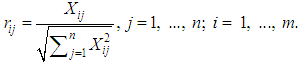

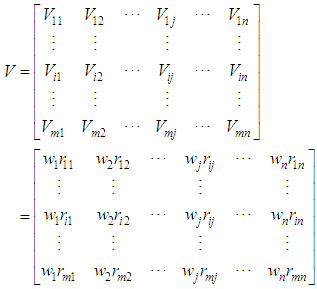

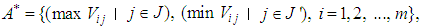

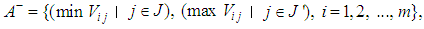

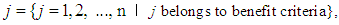

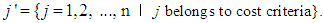

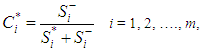

2.3. Ranking the Optimal Individual of Extending Loan by using TOPSIS

- Saaty (1980) indicated that the hierarchy concept can be used to deconstruct a complex multi-criteria problem. The AHP is also an evaluation principle that prioritizes the hierarchy and consistency of judgmental data provided by a group of decision makers. There are many studies that have applied AHP to construct a hierarchy architecture within multi-criteria decision-making problem (Adhikary, et al., 2013; Ashis, 2013; Shahin and Pourhamidi, 2013; Yazdani-Chamzini, et al., 2013). However, the AHP method utilized on positive ideal solution and negative ideal solution problems are not effective. Thus, this research integrated the TOPSIS model into the traditional AHP and then improves the evaluating efficiency.The TOPSIS was first proposed by Hwang and Yoon (1981). Shyur and Shih (2006) present an effective model using both ANP and modified TOPSIS techniques for strategic vendor selection. Chen and Tzeng (2004) applied TOPSIS to selecting an expatriate host country. TOPSIS has thus been successfully applied to a diverse array of problems. However, TOPSIS is thus ineffective when applied to ambiguous problem. The underlying logic of TOPSIS is to define the ideal solution and the negative ideal solution. The ideal solution is the solution that maximizes the benefit criteria and minimizes the cost criteria; whereas the negative ideal solution maximizes the cost criteria and minimizes the benefit criteria. The optimal alternative is the one, which is closest to the ideal solution and farthest to the negative ideal solution. The ranking of alternatives in TOPSIS is based on ‘the relative similarity to the ideal solution’, which avoids from the situation of having same similarity to both ideal and negative ideal solutions. The calculation processes of the method are as following:I. Establish a decision (D) matrix for alternative

| (7) |

| (8) |

from the AHP is accommodated weight. This matrix can be calculated by multiplying each column of the R with its associated weight wj. Therefore, the weighted normalized decision matrix V is equal to

from the AHP is accommodated weight. This matrix can be calculated by multiplying each column of the R with its associated weight wj. Therefore, the weighted normalized decision matrix V is equal to | (9) |

| (10) |

| (11) |

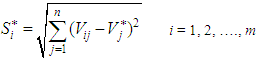

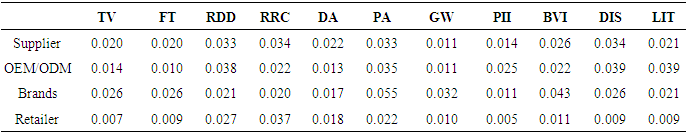

V. Calculate the distance between idea solution and negative ideal solution for each alternative:

V. Calculate the distance between idea solution and negative ideal solution for each alternative: | (12) |

| (13) |

| (14) |

that is, an alternative i is closer to

that is, an alternative i is closer to  as

as  approaches to 1.VII. Rank the preference order A set of alternatives can be preference ranked according to the descending order of

approaches to 1.VII. Rank the preference order A set of alternatives can be preference ranked according to the descending order of

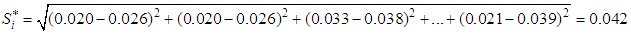

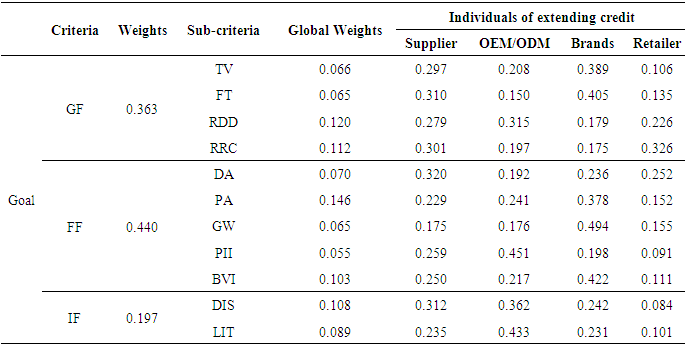

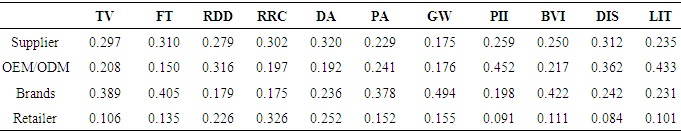

3. Case Implementation

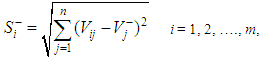

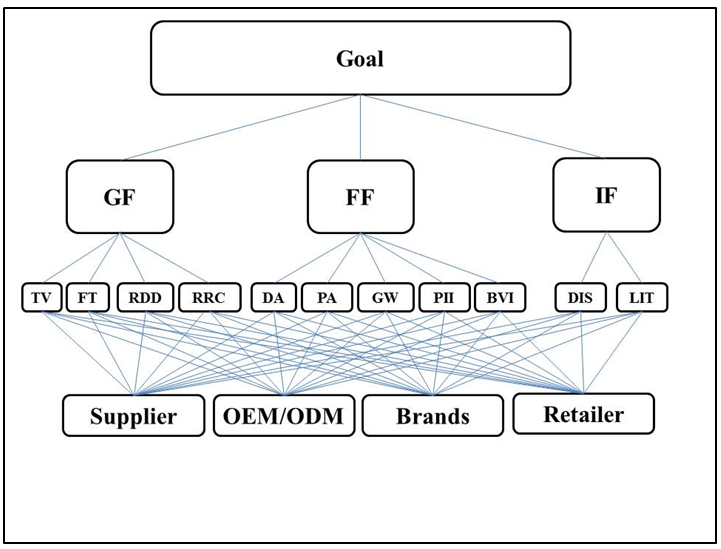

- This study constructed indicators to evaluate the optimal individual of extending loan in smartphone industry SC for financier and the research framework as shown in Figure 5. An evaluation model is constructed based on the modify Delphi method to assess the optimal individual of extending loan by using Expert Choice 2000 and Excel 2010. This framework for evaluating the optimal individual of extending loan comprises the following steps:

| Figure 5. Research framework to evaluate the optimal individual extending credit |

|

|

|

First, determine the ideal solution and negative ideal solution using formulae (12) and (13).

First, determine the ideal solution and negative ideal solution using formulae (12) and (13).

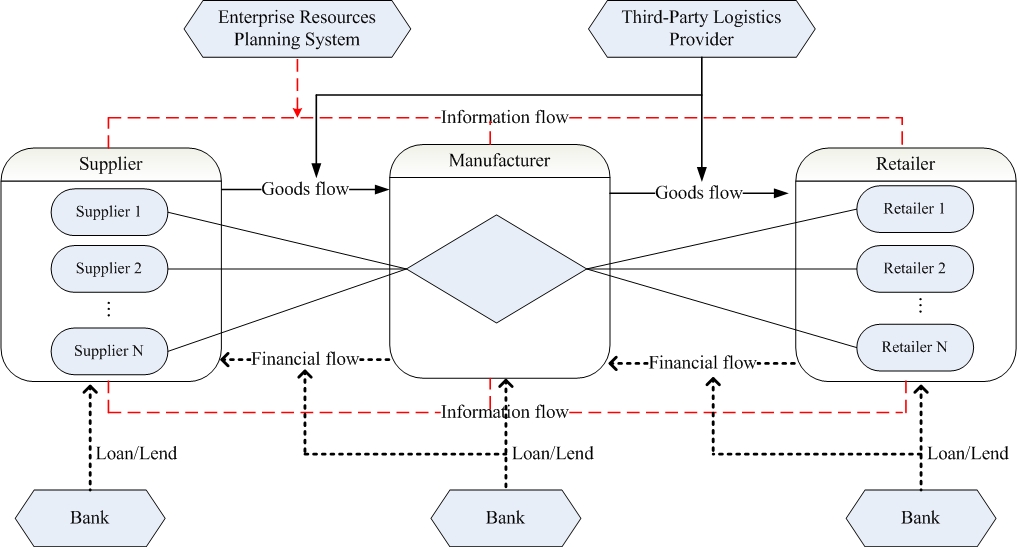

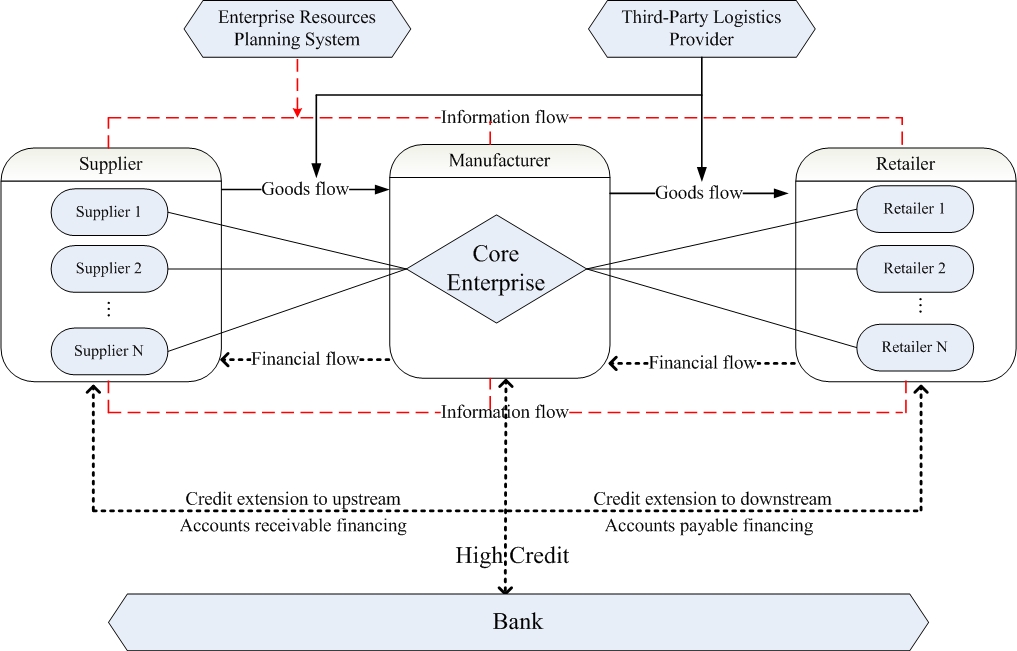

Table 4 shows the

Table 4 shows the  and

and  . Next calculate the relative closeness to the ideal solution of each alternative,

. Next calculate the relative closeness to the ideal solution of each alternative,  using formulae (14) and rank the “Brands” performs the best (see Table 5).

using formulae (14) and rank the “Brands” performs the best (see Table 5).

|

|

4. Conclusions

- The financial flows that can be seen are important to any industry when they have implemented the SC activities. SCF is new type of financial service that can be enhance the financial efficiency of an SC. The key concept of SCF is the delivery of credit. Using the transaction records from the individual of extending loan to the members, the financier will be able to provide a higher level of cash flow to the ecosystem. Financial sectors would be upgrading their operations and profits through SCF activities. Yet, SCF service can help the financial sectors to improve their operations, but there are many risks implied in SCF activities from individual of extending loan to relative members. Because various multi-criteria decision-making concerns are complex that have the characteristic of minimal costs and maximal benefits in evaluate the optimal individual of extending loan, the AHP method cannot solve this characteristics. Hence, this paper presents a method for applying a combination of the AHP and the TOPSIS in the decision-making process to evaluate the optimal individual of extending loan of smartphone industry SC. This will allow for more efficiency in the financial flow of smartphone industry SC.AHP can combine quantitative and qualitative factors to handle different groups of factors, and to combine the opinions of many experts. TOPSIS can define the ideal solution and the negative ideal solution. The ideal solution is the solution that maximizes the benefit criteria and minimizes the cost criteria; whereas the negative ideal solution maximizes the cost criteria and minimizes the benefit criteria. The administrators of the financiers are often not equipped with objective decision-making processes or evaluation the criteria to determine the optimal individual of extending loan when they want to provide the new SCF services and the systematic risks in a SC are very high, combination of AHP and TOPSIS can solve the hierarchical and minimal costs and maxial benefits of all criteria becomes an effective tool for the administrators to obtain an accurate solution. Academically, the AHP-TOPSIS model can provide decision makers or administrators of the financiers with valuable guidance for measuring the optimal individual of extending loan of smartphone industry SC. Commercially, the proposed model can provide administrators with a useful instrument to assess the optimal individual of extending loan in smartphone industry SC for financier furnish the SCF services. Finally, the limitations of this study include 2 parts. First, the characteristic of decision factors are independent in research framework namely that is the method hypothesis of AHP. Second, this study applied the case of smartphone industry to assess the optimal individual of extending load in SCF ecosystem. Hence, the structure of SCF ecosystem is based on the smartphone industry supply chain. The future research would be focus on the evaluation of lending level from the optimal individual to their members and forecast the lending risks in a supply chain finance ecosystem.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML

and

and