-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(6): 300-305

doi:10.5923/j.economics.20160606.02

Depreciation of the Ghanaian Currency between 2012 and 2014: Result of Activities of Speculators or Economic Fundamentals?

Karikari Amoa-Gyarteng

School of Business, Ghana Baptist University College, Ghana

Correspondence to: Karikari Amoa-Gyarteng, School of Business, Ghana Baptist University College, Ghana.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper assessed the decline in the exchange rate of the Ghanaian cedi against the US dollar. Regression analysis of select economic fundamentals (Interest Rate, GDP Growth Rate and Inflation) with exchange rate was done. The paper assessed whether activities of speculators led to the rapid decline in the value of the cedi against the US dollar between January 2012 and December 2014. Within the period, the cedi/dollar exchange rate had a statistically significant linear relationship with interest rate and inflation but not GDP growth rate. Consistent with existing literature, this paper posited that activities of speculators only had a transient or no effect on the cedi/dollar exchange rate.

Keywords: Currency Depreciation, Speculation, Economic fundamentals

Cite this paper: Karikari Amoa-Gyarteng, Depreciation of the Ghanaian Currency between 2012 and 2014: Result of Activities of Speculators or Economic Fundamentals?, American Journal of Economics, Vol. 6 No. 6, 2016, pp. 300-305. doi: 10.5923/j.economics.20160606.02.

Article Outline

1. Introduction

- Exchange rate is defined as the price of a currency in relation to another. According to Mussa (1984), the exchange rate of a currency is its purchasing power compared to a foreign currency. As explained by Bondo (2003), there are two types of exchange rate regimes; Fixed and Floating. A fixed exchange rate regime exists when the exchange rate is fixed by a central bank. A floating exchange rate regime is where the exchange rate is subject to demand and supply forces (Bondo, 2003).According to Bawumia (2014), Ghana operated a fixed exchange rate regime at the time the country was a British colony. Ugochukwu (1996) explained that this resulted in a no exchange rate depreciation and inflation was also largely unchanged. In 1983, Ghana adopted a floating exchange rate regime and the foreign exchange market was liberalized (Bawumia, 2014). This resulted in the exchange rate of the local currency beginning to be determined by demand and supply forces. There was depreciation of the cedi when demand for foreign currency increased. Conversely, an increase in supply of foreign currency resulted in an appreciation of the local currency.Between 1965 and 2014, the cedi cumulatively lost 99.999% of its value compared to the US dollar (Bawumia, 2014). The cumulative depreciation of the cedi against the US dollar in 2013 and 2014 was 14.6% and 31.2% respectively (BOG, 2015). The steep depreciation of the local currency in an open economy such as Ghana results in increased cost of doing business and increased cost of living (Bawumia, 2014). Depreciation results in price hikes in utilities and petroleum products as the exchange rate is a component in their pricing (Bawumia, 2014). When there is depreciation, importers will have to spend more cedis for their goods which have the same dollar value. When this happens, prices of goods and services increase leading to inflation. For local firms that have loans denominated in foreign currency, they will have to pay a higher amount of cedis for the foreign denominated debt.

2. Review of Literature

2.1. Speculator Activities

- Christian (1998) explained currency speculation as the phenomenon whereby market participants buy foreign currency purposely to sell when the rate is higher. According to Christian, speculators may work to deepen economic crisis by using the forward exchange markets inter alia, in the hopes of benefiting from the fallout. Speculators can profit from the forward market in which they commit to sell (or buy) a foreign currency in the future at an exchange rate that is fixed presently. In this instance, the market participant would have hedged against possible devaluation (or appreciation) of the currency in the future. Speculative attack as attested to by Krugman (1995) is a situation in which investors alter the composition of their portfolios, diminishing the domestic currency proportion and increasing the proportion of foreign currency. When national monetary authorities are not able to defend the domestic currency, depreciation sets in.Alves et al. (2000) explained that speculative attack on a currency can also happen as a result of foreseeable future deterioration in macroeconomic fundamentals. The local currency is only prone to speculative attacks when the fiscal position of the country is weak (Alves, et al.) In small open economies such as Ghana, speculators can cause exchange rate volatilities (Schreber, 2011). The presence of speculators may increase liquidity but Schreber contends that they are not beneficial to an economy and that it is essential to identify and block their disruptive influence on a currency.

2.2. Speculation and Exchange Rate Movements

- Cheung and Chinn (2000) conducted a survey on foreign exchange dealers and concluded that speculators possess superior information compared to the rest of the actors in the market. In the view of Barua (2008), with their superior information, speculators could engage in activities that may destabilize currencies. When speculators change their net positions, it may be indicative of an anticipated future direction of exchange rate movements.According to Barua (2008), coefficients relating to speculators have a huge effect on currency depreciation. This position is supported by Flood and Rose (1995) who explained that macroeconomic fundamentals do not have a short term effect on exchange rate movements especially in a volatile floating regime. Gaynon and Chabond (2007) found that speculative activity is a key driver of currencies. Baccheta and Chabond (2007) explained that in the short run exchange rate is not directly correlated to macroeconomic fundamentals but speculation.Friedman (1953) acknowledged that activities of speculators have an effect on exchange rates but dismisses the notion that profitability speculators may be destabilizing. Speculators may only be destabilizing when they sell low and buy high (Friedman) and because they are prone to exchange rate risk, they cannot be destabilizing. Carlson and Osler (2000) however contradicted this position on the grounds that it does not take into account interest rate and its influence on activities of speculators. According to Carlson and Osler (2000), when foreign interest rates are high, speculators demand for foreign currency is also high resulting in a rise in the foreign currency relative to the local currency. When this happens, they engage in carry trade and take a short position in the low interest local currency whilst taking a long position in the high interest foreign currency (Gagnon & Chabound, 2007).

2.3. Profit Possibilities of Speculation in International Currencies

- Ghosh (2003) identified speculation as a deliberate assumption of risk by taking a net open position in the spot exchange market or forward exchange market. A speculator may project that an expected spot rate of exchange a month from today (s~) may be higher than a one year forward rate of exchange, he might decide to buy foreign currency forward. In this instance, his net profit is s~-F per unit of the foreign currency (Ghosh).Conversely, if the expected spot rate of exchange is going to be lower, the speculator will take the opposite action. Ghosh (2013) explained that if s~>s (1+r)/ (1+r*), the speculator will buy foreign currency in the forward market. If s~<s(1+r)/(1+r*), he will sell foreign currency spot. Ghosh illustrated various kinds of currency speculation including:a) Forward Speculation: In this instance, the speculator buys or sells forwards contracts to earn profits by taking the opposite position in the spot market when the forward contract matures.i. If s~>F: speculator will buy foreign currency forward. Profit per unit of a foreign currency = (s~-F). ii. If s~=F: speculator will purchase or sell foreign currency forward. Profit per unit of a foreign currency is zero (s~-F)iii. If s~<F: Speculator will sell foreign currency forward. Profit per unit of a foreign currency = (F- s~)b) Spot Speculation: According to Ghosh (2003), spot speculation is the instance where the investor buys or sells forex in the spot market today in the hopes of making profits in the future by taking the opposite position in the future spot market. If a participant speculates in the spot market, his profits will be s~-s(1+r)/(1+r*).Arbitrage profit= F-s (1+r)/(1+r*). Ghosh (2003) arrived at the same position as Tsiang (1959, 1973) on the fact that spot speculation is analogous to the combined capacity of forward speculation and arbitrage. Kearns and Manners (2004) used weekly data on the positions of different types of participants in currency markets and concluded that speculation is profitable. A speculator’s only motivation to trade in currency markets including currency futures markets is to make profits and not to hedge his foreign exchange exposure (Kearns & Manners). In the same study of Kearns and Manners, speculator profits are adjudged to be robust even when it is adjusted for transaction cost.

2.4. Destabilizing Effects of Speculation

- Brunnetti and Buyuksahin (2009) tested the hypothesis that speculative trading is destabilizing by using a data set from the Commodity Futures Trading Commission of the United States. The conclusion from that study showed that speculative trading in futures markets does not destabilize an economy and that it even reduces volatility levels. Aguiar (2002) argued that even though currency trading determines how exogenous shocks are reflected in the equilibrium exchange rate, national authorities can reduce speculative incentive to separate shocks by smoothing the exchange rate.Speculators are moved by capital gains (Aguiar, 2002) and therefore a permanent shock to a fundamental economic indicator portends minimal capital gains which will invariably lead to decreasing speculative activity. Governments therefore, can reduce the incentive for speculators to respond to shocks and this will lead to less speculation and consequently an exchange rate that can stand transitionary shocks (Aguiar).

2.5. Effect of Economic Fundamentals on the Strength of a Currency

- Speculation aside, gyrations in currency markets have also been widely attributed in literature to underlying economic fundamentals. Indicators that contribute to the strength or otherwise of a currency are Interest Rate, Gross Domestic Product Growth Rate and Inflation inter alia.Interest Rates. Sanchez (2005) concluded that exchange rates and interest rates are negatively correlated when depreciations are expansionary and when they are contractionary, correlation is positive. In effect, interest rates have a varying effect on foreign exchange rates depending on whether depreciations are expansionary or contractionary. Money demanded on an individual rate and aggregate level is determined by interest rates and therefore as explained by Krugman and Obstfeld (2006), when there is a change in money supply both domestic interest rates and exchange rates are affected. When there is an increase in domestic money supply, domestic interest rates are lowered and therefore the rate of return on domestic deposits is lowered. This results in a depreciation of the local currency (Krugman & Obstfeld).Hnatkovska et al. (2008), however posited that empirical evidence in this area is not conclusive. In a study where they used an optimizing model of a small open economy, Hnatkovska et al. concluded that higher domestic rates increase demand for deposits and in the process appreciates the currency. On the contrary, organizations require bank loans and their net incomes diminish when interest rates are raised. Higher interest rates raise government’s fiscal burden which can lead to higher inflation. Hnatkovska et al. explained that when this happens, currency depreciation sets in. Inflation. Inflation and exchange rate movements have been shown in literature to have a positive correlation by several researchers. Hyde and Shah (2004) found that in a small open economy, depreciation of the local currency will lead to higher import prices and ultimately, higher domestic prices. Hyde and Shah further stated that when the price of imported products increases, demand for goods will raise prices.Kamin (1996) depicted a direct correlation between real exchange rate and inflation in Mexico. In a study involving real exchange rate, output, price index and interest rates in the United States, Kamin and Roger (2002) buttressed the position of Kamin (1996) and concluded that depreciation increases inflation.Gross Domestic Product. Gross domestic product is an indicator of a country’s macroeconomic development (Haggart, 2000). According to Rodrik (2008), there is a correlation between exchange rates and the development status of a country. Ito et al. (1999) concluded that an increased growth in the economy leads to an appreciation of the value of a domestic currency. The reason is that there will be an upsurge in demand for the local currency.

3. Methodology

- This study is an analysis on foreign exchange determinants in Ghana. It involves three economic indicators and the interbank cedi/dollar foreign exchange rate. The independent variables are GDP growth rate, interest rate (BOG prime rate) and inflation. The dependent variable is the interbank cedi/dollar foreign exchange rate. A multiple regression analysis was used to determine the predictors of interbank cedi/dollar foreign exchange rate under the following model:

Where fx = interbank cedi/dollar foreign exchange rate;

Where fx = interbank cedi/dollar foreign exchange rate;  = other factors that influence fx; β0 = Constant; β1 = Coefficient of interest rate; β2 = Coefficient of inflation; β3 = Coefficient of GDP.Data for this study is secondary and it was gathered from the Bank of Ghana Statistical Bulletin. The study covers a month by month data of the selected economic indices covering January 2012 to December 2014. The data is freely available on the website of Bank of Ghana and permission for analysis is implied (Tripathy, 2013).

= other factors that influence fx; β0 = Constant; β1 = Coefficient of interest rate; β2 = Coefficient of inflation; β3 = Coefficient of GDP.Data for this study is secondary and it was gathered from the Bank of Ghana Statistical Bulletin. The study covers a month by month data of the selected economic indices covering January 2012 to December 2014. The data is freely available on the website of Bank of Ghana and permission for analysis is implied (Tripathy, 2013). 3.1. Objective of the Study

- To identify the determinants of interbank cedi/dollar foreign exchange rates in Ghana between 2012 and 2014.

3.2. Hypotheses

- To achieve the objective of the study, the following hypothesis will be tested:Ha0: There is no statistically significant linear relationship between the interbank cedi/dollar foreign exchange rate and the Bank of Ghana prime rate between January 2012 and December 2014.Ha1: There is a statistically significant linear relationship between the interbank cedi/dollar foreign exchange rate and the Bank of Ghana prime rate between January 2012 and December 2014.Hb0: There is no statistically significant linear relationship between the interbank cedi/dollar foreign exchange rate and Inflation between January 2012 and December 2014 in Ghana.Hb1: There is a statistically significant linear relationship between the interbank cedi/dollar foreign exchange rate and Inflation between January 2012 and December 2014 in Ghana.Hc0: There is no statistically significant linear relationship between the interbank cedi/dollar foreign exchange rate and GDP growth rate between January 2012 and December 2014 in Ghana.Hc1: There is a statistically significant linear relationship between the interbank cedi/dollar foreign exchange rate and GDP growth rate between January 2012 and December 2014 in Ghana.

3.3. Analysis of the Data

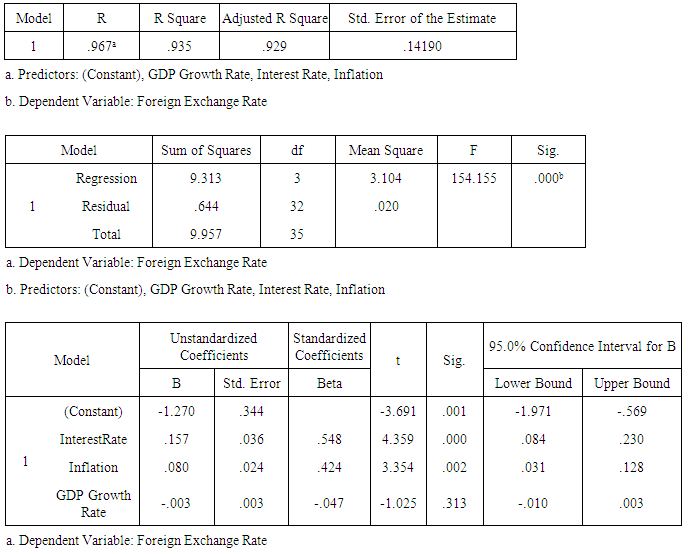

- SPSS version 20 was used to store and perform the statistical analysis. A plot of studentized residuals against predicted values showed linearity. A visual inspection of a plot between studentized residuals and unstandardized predicted values proved homoscedasticity and there was no multicollinearity. The regression model is a good fit for the data as there is a strong linear association between the interbank cedi/dollar foreign exchange variable and the three macroeconomic independent variables with an R value of 0.967. The entire model explained 93.5% of the variability of interbank foreign exchange rates between the dollar and the cedi. The adjusted R2 was 92.9% indicating a large effect size (Cohen, 1988). Interest rate, inflation and GDP statistically significantly predicted interbank cedi/dollar foreign exchange rate F(3,32)= 154.155, p< 0.0005. The coefficient for interest rate is 0.157. A 1% increase in interest rate is associated with an increase in cedi/dollar interbank foreign exchange rate of 0.157 with all other variables constant. Consequently, an increase in interest rate results in a depreciation of the cedi against the US dollar. The p value is 0.00 indicating that the slope coefficient is statistically significant. There is a linear relationship between interest rates and cedi/dollar foreign exchange rates and therefore the null hypothesis Ha0 is rejected.The coefficient of inflation is 0.080 indicating a unit increase in inflation will result in 0.080 increase in the cedi/dollar exchange rate and therefore a depreciation in the value of the cedi. Inflation statistically significantly predicted the cedi/dollar exchange rate between 2012 and 2014 as p < 0.05 and therefore the null hypothesis Hb0 is rejected.The coefficient for the GDP growth rate is -0.003 and holding the other independent variables constant, the interbank cedi/dollar foreign exchange rate increased by 0.003 for each additional decrease in the GDP growth rate. The p value for this coefficient is 0.313 indicating that it is statistically not significant and therefore the null hypothesis Hc0 is not rejected. Among the variables tested, the beta weight for interest rate is the highest and the lowest is GDP. According to Courtville & Thompson (2001), beta weights assess variable importance. Interest rate therefore, is the variable with the most significant effect on the interbank cedi/dollar foreign exchange rate.

3.4. Summary of Multiple Regression Analysis

4. Conclusions

- Meese and Rogoff (1983) concluded in their seminal article that macroeconomic indicators including interest rates and prices explain exchange rate changes in the medium and long horizons. Klitgaard and Weir (2004) posit that for tracking exchange rate movements in the short run, actions of speculators and not macroeconomic fundamentals are useful.This paper assessed the cedi/dollar exchange dynamics over a 36 month period. Within that horizon, interest rate and inflation were found to be determining factors in exchange rate movements. This paper takes the position that activities of speculators only have a transient effect on a currency( Klitgaard & Weir, 2004) and a permanent shock to macroeconomic fundamentals will lead to very little gains for that segment of market participants (Aguiar, 2002). According to Alves et al. (2000) a local currency is only prone to speculative attacks when the fiscal position of the country is weak. When economic fundamentals are strong, speculators will have minimal incentives to operate within an economy. The results of this study indicate that economic fundamentals are strongly associated with foreign exchange cedi/dollar rates (Kamin, 1996; Rodrick, 2008; Krugman & Obstfeld, 2006).Accordingly, if foreign exchange rates in Ghana are strongly and positively related to economic indices then activities of speculators only had a marginal or no effect on the strength or otherwise of the currency. Stabilizing macroeconomic fundamentals such as interest rate and inflation should be the focus of policy makers in Ghana if depreciation of the cedi is to be curtailed.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML