-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(5): 241-249

doi:10.5923/j.economics.20160605.01

Evaluating the Impact of Monetary Policy on the Growth of Emerging Economy: Nigerian Experience

Obadeyi J. A.1, Okhiria Adebimpe O.2, Afolabi Victor K.3

1Department of Accounting and Finance, Faculty of Social and Management Sciences, Elizade University, Ilara- Mokin, Nigeria

2Department of Hotel Management and Tourism, Faculty of Social and Management Sciences, Elizade University, Ilara- Mokin, Nigeria

3Department of Banking Supervision, Central Bank of Nigeria (CBN), Lagos, Nigeria

Correspondence to: Obadeyi J. A., Department of Accounting and Finance, Faculty of Social and Management Sciences, Elizade University, Ilara- Mokin, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study evaluated the impact of monetary policy on the growth of emerging economy: Nigerian experience. It was not a gain saying that monetary policy played significant roles in any country’s financial growth and development both in high and low income economies, but are constrained by fiscal dominance, high cost of funds, high inflation etc., but exchange rate, interest rate, money supply and foreign reserve are some of the significant monetary policy indicators that can ascertain national economic growth. The study covers between 1990 and 2012, the scope is considered because it fell within the era of market-based monetary period. Automated Statistical Package Technique (ASPT) was used to analyse the model. The Ordinary Least Square (OLS) technique was adopted in the study in order to assess the relationship among the economic variables. The paper concludes that the major problem of monetary policy was as a result of the CBN’s inability to control the money supply and bank credits, which were very essential for measuring and proffering solution to the substantial credit spreads between short-term central bank policy rates and the rates facing households and firms in the economy. The study recommended that the government should implement countercyclical policy that would lead to the desired expansion of output (and employment); though, it entailed an increase in the money supply, which would also result in an increase in prices, but policymakers should commit to holistic policies, rules and regulations that would remove full discretion in adjusting monetary policy.

Keywords: Monetary Policy, Money supply, Economic growth, Exchange rate, Nigeria

Cite this paper: Obadeyi J. A., Okhiria Adebimpe O., Afolabi Victor K., Evaluating the Impact of Monetary Policy on the Growth of Emerging Economy: Nigerian Experience, American Journal of Economics, Vol. 6 No. 5, 2016, pp. 241-249. doi: 10.5923/j.economics.20160605.01.

Article Outline

1. Introduction

- In recent years, Central banks have always critically explained monetary policy framework and remained exact about the targeted objectives with reference to policy goals; this was as a result of global financial crunch that hit Nigeria in the first quarter of 2008, which started in Europe, part of Asia and America in 2007; which had however compelled Central banks around the world to be confronted with a new and complex set of challenges, which were apparently marked by threats to the liquidity and solvency of financial institutions [1-3]. The economic lull situation of recent era precipitated the CBN to further inform and educate the general public about the macroeconomic models on which economic policy analysis was based, and which were made available to banking institutions, non- banking institutions, financial markets and the public at large so as to enhance credibility, high employment, price stability and to stem depression as experienced in 1930s during the ‘big bang’ regime [4-6]. Monetary policy was regarded as the major economic stabilization ‘tools’ that is used to measure, regulate, control the volume, cost availability, and direction of money and credit within an economy in order to achieve some specified macro-economic policy objectives; such as employment generation, balance of payment equilibrium, rapid economic growth, etc. The formulation and implementation of monetary policy was the primary responsibilities of the monetary authorities; and the Central Bank of Nigeria (CBN) with acting capacity as an agent of government, which oversees and directs the overall money supply towards achieving major economic policy objectives [1]. The policy goals play major roles in the achieving the objectives of full employment, price stability, economic growth and stability by providing link between the external and government sector and other sectors. Monetary policy was the process of adjusting the supply of money in the economy to achieve some combination of inflation and output stabilization [7]. To sustain monetary stability in an economy, it remained the ability of CBN to implement policies through the Deposit Money Banks (DMBs) that guarantee development of the economy via expected changes in the level of money supply and the reserves of banks; however, this process could easily be influenced by the CBN through various monetary policy instruments to adjudge the trend –behaviour of reserves; therefore, it is now obvious that a higher degree of monetary policy predictability is particularly relevant for banks, non-banks and financial markets, where the inaccurate prediction of a central bank’s actions can lead to large financial losses. It is therefore in the interest of financial market and other participants in the financial sector to understand what central banks do and to take note of what is communicated [8, 9, 5].

2. Literature Review

- [10] argued that monetary policy encompass action of the apex regulatory authority (CBN) that directly affect the availability and the cost of both investment and commercial bank’s reserves balances; and indirectly affecting the overall monetary and credit condition in the economy. He added that the rationale behind this statement was to ascertain the expansion of money and credit that will be adequate for the long run needs of an emerging economy such as Nigeria. The assertion of [10] was further supported by another scholar, [11]. [11] claimed that monetary policy was assessed in order to achieve the national economic goals, off full employment without inflation and balance of payment equilibrium through the control of economic supply of money and credit. [12] and [6] argued that the targeting of inflation to be a single digit and exchange rate policy to remain one of the CBN’s monetary policy target were only based on an assumption as an essential tools of achieving macroeconomic stability in any economy (emerging market, developing and developed economies).[13] and [9] argued that monetary policy decisions of Central Banks could create surprises which may affect outcomes from household decisions as regards jobs to offer and where to have shelter, as well as firms to undertake decisions on hiring and investing in physical capital, which may turn out well or poorly depending on the course of monetary policy and its unimaginable effects on the economy. Though, during economic recession period, consumers take decisions to stop spending as much as they used to, thereby leading to business production declines, the leading firms would be forced to lay off workers and stop investing in new capacity; and foreign appetite for the country’s exports may experience a total decline; this scenario however examines the decline in aggregate demand to which government could respond with a policy that leans against the direction in which the economy is headed [14, 1].[1] asserted that in the long run output is fixed, so any changes in the money supply only cause prices to change. But in the short run, because prices and wages usually do not adjust immediately, changes in the money supply can affect the actual production of goods and services. This is could be seen as one of the reasons the monetary policy is generally conducted by central banks such as a meaningful policy tool for achieving both inflation, price stability and growth objectives.

2.1. The Nigerian Banking and Monetary Policy System

- During the past two years, central banks worldwide have cut policy rates sharply, some cases to zero. Nonetheless, they have found unconventional ways to continue easing policy [7, 1]. The Monetary Policy Rate (MPR) is the rate at which banks borrow from Central Bank to cover their immediate cash shortfall. The higher the cost of such borrowing, the higher also will be the rate banks will advance credit to the real sector. Unfortunately, reverse is the case in Nigeria, the monetary policy rate has increased from 12% to 13% in 2014 [15]. The present MPR- 13% position is as a result in the response to the uptick in food inflation, and its reduction will lead to reduction in core inflation, Gross Domestic Growth; the decision was as a result of structural nature of inflationary pressures [15]. The Nigerian banking system started in the late 19th century, but grew with influence of colonial masters, who introduced banking services in Nigeria. Banking activities, mostly commercial, was not regulated in Nigeria until 1952, when the Banking Ordinance was promulgated. The Ordinance Act of 1952, led to the establishment of Central Bank of Nigeria (CBN) in July 1, 1958, started operation in 1959; but with amended CBN Act, 2007, the apex bank has continued to play the traditional roles of regulating the stock money in order to promote monetary stability, sound financial system, to achieve high employment opportunities, rapid economic growth, price stability, effectively managing inflation and creating enabling environment to achieve national economic growth. However, these objectives among others have been realized via the use of monetary policy tools [16, 6]. The global economic activities are towards downside risks to growth trend, including the softening commodity prices, and heightening threats to financial system in the emerging economies (i.e. including Nigeria). Developments in the international oil market have intensified the risks and vulnerabilities due to decline in global price; and where oil importing country (i.e. United States), which has also emerged as a major oil exporter calls for concern [17]. However, CBN use methods to stabilize the economy via economic parameters such as Open Market Operations (OMO). These operations are conducted wholly on Nigerian Treasury Bills (TBs) and complimented with the use of reserve requirements, the Cash Reserve Ratio (CRR) etc. The Cash Reserve Ratio (CRR) is the amount of cash that banks have to keep with the Central Bank and is often used to control excess liquidity in the economy. Cash Reserve Requirement (CRR) has increased from 50% to 75% on all government deposit with commercial banks and increase from 12% to 15% on private deposit with commercial banks [17]. The adoption of 75% on public deposit and 15% on private deposit of CRR would not protect the pressure on exchange rate and inflation as a result of continuous increase in government spending culture most especially during election year -2015. But, it is good to know that these set of instruments are used to influence the monetary aggregates via a monetary processes. Changing monetary policy has a very crucial effects on aggregate demand, and thus on both output and prices. There are number of ways in which policy actions get transmitted to the real economy, which may be via the interest rate channel. During the rise in borrowing costs of CBN, consumers are a likely to involve in finance and businesses, which may hardened the likelihood of channelling funds to investment opportunities; and this reduced the level of economic activity, but with a consistent lower inflation, this would likely result to lower demand, which usually means lower prices. It must be noted that a rise in interest rates also tends to reduce the net worth of businesses and individuals (i.e. making it tougher to qualify for loans at any interest rate and reducing spending and price pressures). Also, banks’ profits are less in general and not willing to lend; it further leads to an appreciation of the currency, as foreign investors seek higher returns and increase their demand for the currency [7]. [1] further argued that through the exchange rate channel, exports are reduced as they become more expensive, and imports rise as they become cheaper. In turn, GDP shrinks. Monetary policy has an important additional effect on inflation through expectations. Many wage and price contracts are agreed to in advance, based on projections of inflation, if policymakers hike interest rates and further communicate anticipated hikes at appropriate time, this may convince the public that policymakers are serious about keeping inflation under control. Long-term contracts will then build in more modest wage and price increases over time, which in turn will keep actual inflation low. It must be noted that the Minimum Rediscount Rate (MRR) was used as the price-based technique to influence the movement of cost of funds in the economy; though, the changes in this rate provides a platform for the monetary disposition of the Bank. This rate has continuous been pecked within the range of 26 and 8 percent since Structural Adjustment Programme (SAP) regime in August, 1986. However, to compliment the use of the MRR, the CBN eventually introduced the Monetary Policy Rate (MPR) in 2006 which establishes an interest rate corridor of either plus (+) or minus (-) two (2) percentage points of the prevailing MPR [18, 19].

2.2. Interest Rate, Inflation Rate and Economic Growth in Nigeria

- Interest rate is the rental payment for credit usage by borrowers, investors and returns for parting with lenders’ liquidity. Also, Interest rate may be regarded as the price of the credit that is ambiguous due to inflationary pressure. The low interest rate regime attracts lower cost of borrowing by investors, with increase in investment and the purchase of consumer durables. A low interest rate strengthens the banks to relax the lending policy in order to promote and guild firms and household spending pattern. A low interest rate can force local currency to be devalued, as a result of demand for domestic goods rises, most especially when imported goods become costly. These factors among others would necessitate economic growth, consumer spending pattern and investment [20, 21]. However, economic growth is a proportion of a country’s potential output. Economic growth has re-examined the reality behind the disparity in growth rate of countries overtime; and this act has influenced government decisions on spending pattern and tax rate regime in order to realize easy growth rate [22]. The average real GDP rate was less than 6% in 1970s, and later became worse, until the economic reform of August, 1986. Since then, positive GDP has been sustained till date, (5.5%), but at a very low rate.Inflation remains the continuous rise in prices of goods and services without corresponding increase in output. The Nigerian economy seemed to have experienced moderate inflation before the economic reform in 1986. There exists a positive relationship between inflation and growth in the short run, but economies with continuous increase in inflation rate may be forced to face some macro-economic challenges - low purchasing power of the local currency, poor price system and fluctuation of exchange rate etc. (CBN, 2014) Within three months, inflation dropped to 8.6% in March from 9.5% as recorded in February 2013. It shows that the monetary tightening policies of CBN have not kept employment to full employment, and increase the value of the domestic currency (naira). [23] argued that the instability in the financial market and banks, have shown that the Central Bank’s inability to actively manage the monetary policies have negative effect on the economy, thereby leading to increase in demand for dollars and with undesirable effect on resource allocation. High inflation has been found to have undesirable consequences on economic parameters. Inflation was 12.24% in 2012 and 9.1% as at June, 2013, 7.1% in 2014 and as February, 2015, it was 8.2%. Nigeria has experienced high inflation, thereby targeting the real interest rate on a negative trend most of the time. This act has made interest rate to be difficult to control, and the real interest rate remaining negative, savings and investment have remained low, and the economy has experienced weak industrial infrastructure. [19] argued that the high rate of inflation in the economy has tendency to reduce demand for bank’s financial assets and hence, impair the process of financial intermediation in the banking sector as deposits would move from the banking system into real estate and inventory speculations among others.

3. Methodology

- To evaluate the impact of monetary policy on the growth of emerging economies: Nigerian experience requires establishing the association between the variables for this study; Ordinary Least Square (OLS) technique was adopted in order to effectively capture the relationship between monetary policy variables and economic growth and arrive at a logical conclusion. The OLS minimizes the sum of squared errors and "fit" a function with the data [24]. The secondary source of data was adopted, such as references, books, internet, CBN online annual Bulletin of 2012. In this study, the equation is estimated in order to know the extent to which the predetermined variables chosen influence the endogenous variables in the equations, and to investigate the functional relationship between gross domestic product (Measures real economic activity) and inflation rate (measures the increase in the general level of prices for goods and services), interest rate (monetary policy rate), money supply (broad money), and exchange rate (real effective exchange rate). However, model specification is presented below:

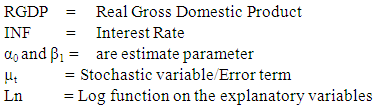

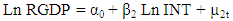

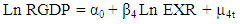

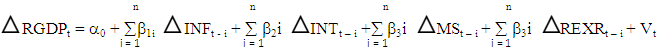

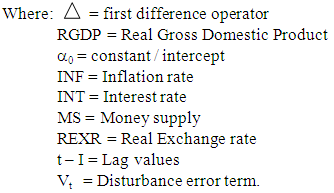

Where, Yt is a function of independent variable which is Xtµt is a stochastic variable, it is a variable that influences the dependent variable but not included in regression equation parameter.α0 and β1 are estimate parameters / regression coefficients of the equation.Given the above assumptions about the stochastic variable, the unexplained or residual part of the regression equation is assumed to be zero or completely ignored since the expected value is zero. Therefore, it was concluded that there is no relationship that exists between the dependent variable and the stochastic variable. Hence, the above model adopts these models for the study as stated thus:MODEL I

Where, Yt is a function of independent variable which is Xtµt is a stochastic variable, it is a variable that influences the dependent variable but not included in regression equation parameter.α0 and β1 are estimate parameters / regression coefficients of the equation.Given the above assumptions about the stochastic variable, the unexplained or residual part of the regression equation is assumed to be zero or completely ignored since the expected value is zero. Therefore, it was concluded that there is no relationship that exists between the dependent variable and the stochastic variable. Hence, the above model adopts these models for the study as stated thus:MODEL I | (1) |

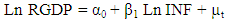

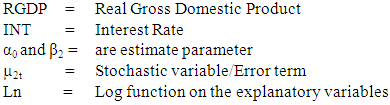

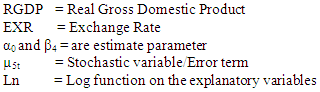

MODEL II

MODEL II | (2) |

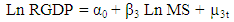

MODEL III

MODEL III | (3) |

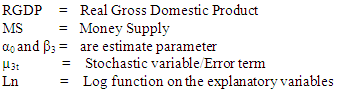

MODEL IV

MODEL IV | (4) |

MODEL V

MODEL V | (5) |

| (6) |

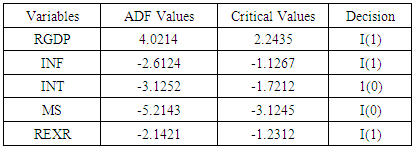

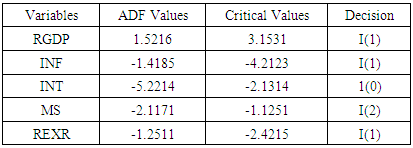

However, because the study entails time series data, the ordinary least square (OLS) method cannot be applied unless it is established that the variables concerned are stationary. For this paper, we have applied unit root test to check the stationarity of the variables under study. Specifically, the Augmented Dickey-Fuller (ADF) and Phillip-Perron test (PP) are used; the ADF and PP are used to avoid spurious regression thereby subjecting each of the variables used to unit root test so as to determine their orders of integration since unit root problem is a common feature of most time series data.

However, because the study entails time series data, the ordinary least square (OLS) method cannot be applied unless it is established that the variables concerned are stationary. For this paper, we have applied unit root test to check the stationarity of the variables under study. Specifically, the Augmented Dickey-Fuller (ADF) and Phillip-Perron test (PP) are used; the ADF and PP are used to avoid spurious regression thereby subjecting each of the variables used to unit root test so as to determine their orders of integration since unit root problem is a common feature of most time series data.4. Empirical Result

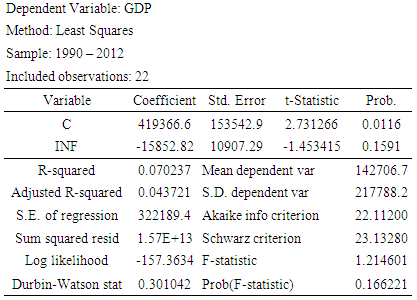

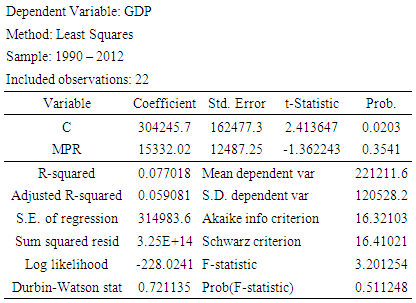

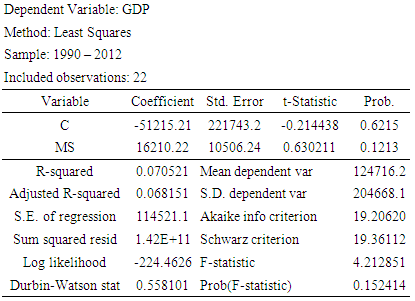

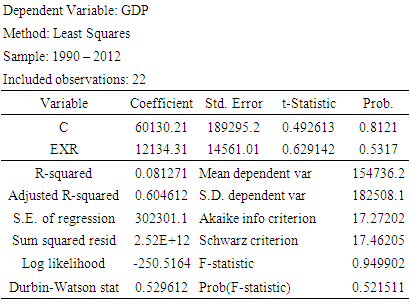

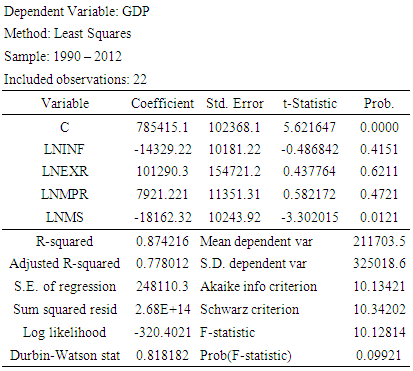

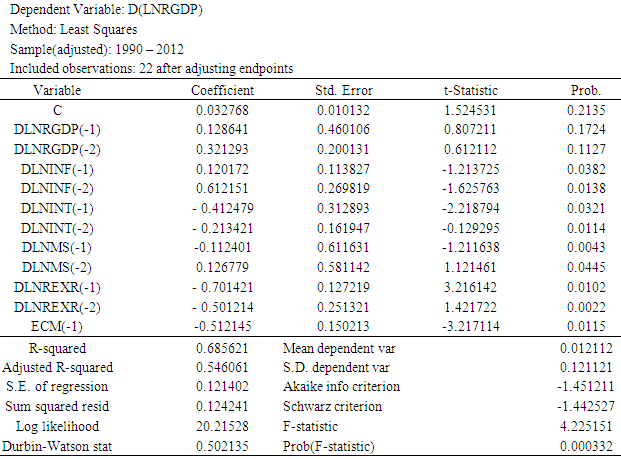

- The regression test in table 1 below showed that the relationship between real gross domestic product and inflation with R2 (0.07), Adjusted R-squared (0.044), Durbin Watson Statistics (0.30), which is far and less from 2; this shows auto correlation on the explanatory variable also with a high significant probability of 0.17 less than the significant level of 5%; akaike info criterion = 22.11 and Schwarz criterion = 23.13 (both akaike info criterion and Schwarz criterion show the extent on how insignificant variables are removed to the minimum), f statistics-1.214601. The negative t-statistics (-1.5) result on inflation shows that high inflation (2-digits) or above 6%-7.5% may affect national economic growth resulting to targeting the real interest rate on a negative trend most of the time. The result further shows that the two variables i.e. dependent and independent variables are statistically related. The economic implication of the rightly signed parameter is that the increase in inflation makes naira to have less purchasing power. Nigerian economy is growing very fast, which remains a good trend, but it may allow shortages because the people (i.e. consumers) are demanding for goods and services faster than the supplied trend. Therefore, it is an option for CBN to introduce countercyclical monetary technique in order to completely abate increasing inflation rate.

|

|

|

|

|

|

|

|

|

5. Conclusions

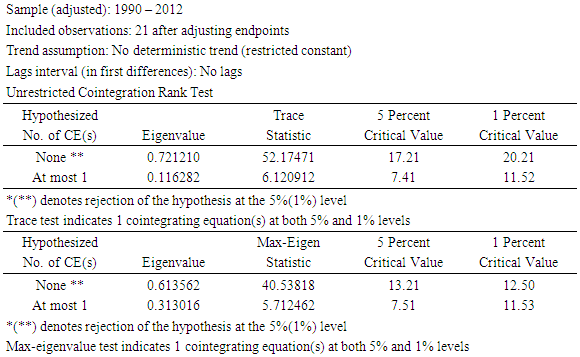

- This study helps to evaluate the impact of monetary policy on the growth of emerging economy: Nigerian experience. The study affirmed a long-term existing relationship among real gross domestic product interest rate, inflation, money supply and exchange rate. The paper observed that the improvement recorded in 2014 (i.e. Nigerian economy the best in Africa and the world) could be attributed to the slight high purchasing power in the country during the period, as well as the application of monetary policy measures by the CBN to mop up excess liquidity in the economy. The study shows that interest rate, money supply and exchange rate will automatically assist in the mobilization and utilization process of financial resources to achieve a desired national economic growth, but the administration of monetary policy structure is weak in Nigeria. The paper discovers that Nigerian Government aspiration of 10% GDP growth rate appears to be rather too ambitious because the crucial economic indicators (monetary policy -rate interest rate, inflation rate, money supply and exchange rate etc. have not been well examined during monetary policy committee meetings. The inability of Monetary Policy Committee (MPC), policymakers, regulators and other concern stakeholders to effectively maximize policy objective may serve as a shortcomings limiting the objective of price stability, stable exchange rate and national economic growth. CBN and NDIC should formulate policies and initiatives to re-position the banks, non-financial institutions and financial market in order to actively play its roles in the growth of the Nigerian economy. The paper further recommends a greater synergy existence between monetary and fiscal policies as economic stability stimulus, because continued expansionary monetary policies among developed countries would be required, but negative spillover effects into capital-flow and exchange-rate volatility must be thoroughly controlled and managed.

ACKNOWLEDGEMENTS

- We acknowledged Prof. ‘Demola Jolayemi, former Dean of Faculty of Humanities & Management Sciences, and Prof. Fadayomi, T.O., (Professor of economics), Dean of Faculty of Social & Management Sciences, Elizade University for their support and helpful comments.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML