-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(4): 181-188

doi:10.5923/j.economics.20160604.01

Exports and Imports Cointegration: Further Evidence from the ECOWAS

Olumuyiwa Olamade , Oluwasola Oni

Department of Economics, Caleb University, Lagos, Nigeria

Correspondence to: Olumuyiwa Olamade , Department of Economics, Caleb University, Lagos, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper investigates the long-run relationship between exports and imports in 13 ECOWAS (Economic Community of West African States) countries during 1970-2015. Evidence points to cointegration of exports and imports in eight of the countries using the bounds testing approach to cointegration. The sign and significance of the error correction term estimates reinforce our evidence of cointegration. Estimates of long-run coefficient based on ARDL and two other long-run estimators; Fully Modified OLS (FMOLS), and the Dynamic OLS (DOLS) showed that Benin, Cape Verde, Cote d’Ivoire, Mali, and Nigeria satisfies the sufficient condition for sustainability of their current accounts over the long-run. Finally, CUSUM and CUSUMSQ tests confirmed the stability of the estimated parameters. However, structural breaks in the relationship between exports and imports exist in Benin.

Keywords: Exports, Imports, Cointegration, ECOWAS, Long-run, Sustainability

Cite this paper: Olumuyiwa Olamade , Oluwasola Oni , Exports and Imports Cointegration: Further Evidence from the ECOWAS, American Journal of Economics, Vol. 6 No. 4, 2016, pp. 181-188. doi: 10.5923/j.economics.20160604.01.

Article Outline

1. Introduction

- The internationalisation of production and financial markets and the ever-increasing requirements for economic openness are profoundly increasing the influence of global markets on countries. An important area of influence that has attracted much attention in recent times is the intertemporal change in the current account position of countries. A country’s current accounts position mirrors the changes in its national net indebtedness and the overall healthiness of the economy. Thus, policy makers and academic researchers are interested in the long-run sustainability of the current account. Current account deficits may occur in the short term, permanent or prolong deficits can have serious implications for a country. Persistent deficits might trigger an increase in domestic interest rates, a rapid depreciation of the domestic currency, and exert excessive burden of interest payments on the future generation with the attendant reduction in living standards [1]. Conversely, temporary current account deficits show capital reallocation to countries where capital is most productive and thus may not create problems for a country [2] If cointegration relationship exists between a country’s exports (EX) and imports (IM), then its current account balance is sustainable in the long-run. This relationship attests to the efficacy of macroeconomic policies and put forward that current account deficits are short-run phenomena and are sustainable in the long-run.The import substitution industrialisation policies adopted in most developing countries in the 1970s generates a peculiar trade pattern in the ECOWAS. Industries run on imported machinery and raw materials but produce largely for local consumption, and exports based on primary products are subject to frequent international price shocks. The question arising from this pattern is; can the countries earn enough foreign exchange to cover imports, and avoid the macroeconomic concerns related to unsustainable current account position? This question continually puts the long-run current account sustainability of ECOWAS countries in the spotlight, and provides the motivation for our study using the most current data.

2. Literature Review

- The cointegration of a country’s EX and IM is important for several reasons. First, it implies that the country is not violating its intertemporal budget constraint and has no incentive to default on its international debts [3]. Secondly, cointegrated EX and IM suggests the absence of a productivity gap between the economy and the rest of the world or permanent technological shock to the domestic economy [4]. Thirdly, the long-run convergence of EX and IM is in agreement with modern approach to the current account and hence supports it validity [5]. In addition, [6], and [7] noted that the knowledge of cointegration between EX and IM is necessary for the formulation and evaluation of present and future macroeconomic policies.Following the work of [8], which examined the long-run convergence of EX and IM for the U.S, several other studies have investigated long-run current accounts sustainability for developed countries. These include [9] for Australia, [10], [11], [12], and [13] for the United States, [14] for the G7 and [4] for a group of developed. In addition, [7] used quarterly data from 50 OECD and developing countries to check cointegration between EX and IM. The debt crisis of the1980s and especially the Asian financial crisis have spurred researchers to look at the current accounts time path of developing countries [15]. In a latter study [16] examined the current account behaviour of eight East Asia Countries before and after the financial crisis and find a violation of the sufficient condition for long-run current account sustainability. However, current account imbalances in the countries returned to long-run sustainable path post financial crisis. [17] found EX and IM cointegrated in Singapore from 1976 to 2009 using the bound testing cointegration approach. [18] and [19] found similar results in Pakistan and Bangladesh respectively. In Malaysia, [20] found no evidence of cointegration between Malaysian exports and imports, [21], on the other hand, found cointegration. [22] and [21] failed to show cointegrating exports and imports for India and Indonesia, respectively. The findings of [23] and [24] highlight that current accounts of, respectively, 26 and 48 African countries have been sustainable. [25], [26], and [27] find similar results for Nigeria. [28] conducted a study on the current account sustainability of countries in the Eastern African Community, Economic Community of Central African States, and South African Development Community. Their result supports the long-run sustainability of the current account position only in Botswana. However, [29] relying on panel unit root tests find mixed results for a sample of 37 SSA countries. They show that trade balances are sustainable only when cross-section dependencies are not accounted for. In their study of 44 SSA countries over the period, 1980 to 2011, [30] found the current account globally sustainable in sub-Saharan African countries with the level of sustainability increasing with the degree of flexibility of the exchange rate regime. Likewise, [31] used the Johansen’s Maximum Likelihood cointegration technique for 1985 to 2012 and found a statistically significant cointegrating relationship between exports and imports for South.The Economic Community of West African States (ECOWAS) was created in 1975 by the Treaty of Lagos to promote economic, trade, national cooperation, and monetary union for growth and development of the region. A revised treaty signed in 1993 set the goals of a common economic market and the single currency, among others. According to the Secretariat of the ECOWAS, the community’s trade policy was developed to boost exports to member states as well as to the rest of the world. Imports into the region, therefore, serve to complement exports of goods and services. At 75% of exports and 24% of imports, fuels dominate the external trade of the region. Other major exports include cocoa and cocoa food preparations (5%) and precious stones (3%). The European Union (EU) and the Free Trade Association of North America (NAFTA) constitute major export markets receiving 23% and 34% of exports respectively. Improvement in South-South trade sees Asian countries and the Oceania accounting for 16% of exports. As for imports, fuels hold the first place; motor vehicles, tractors, cycles and other vehicles in the second place; machinery, mechanical appliances and boilers occupy the third place, with machinery and electrical appliances coming fourth. Institutional, regulatory and infrastructural limitations, caps the contribution of trade in services to growth in the region [32].Exports and imports in the ECOWAS play a complementary role in the growth process like other developing economies transiting from import substitution to more outward orientation policies. Exports earn the foreign exchange necessary to develop and to diversify the exports sector, which depends largely on imported inputs. Thus, exports and imports complementarity in the growth process raises concern for the long-run sustainability of the current account as a key objective of macroeconomic policy. This paper, therefore, sets out to look at the long-run convergence of exports and imports in the ECOWAS. Previous studies on this subject variously included few ECOWAS countries in their samples. These studies include those on exports and imports convergence in Sub-Sharan Africa (SSA), Organisation of Islamic Cooperation (OIC), least developing economies, or a group of developed and developing countries. This paper focuses exclusively on ECOWAS countries. [33] checked the long-run current account sustainability of eight ECOWAS countries with dynamic OLS technique. This study covers 13 ECOWAS countries and uses three long-run estimators to find a more robust evidence about current account sustainability in the ECOWAS. The rest of the paper is set in the following order. Section two presents the literature review. Section three the theoretical background of the study. Section four gives the data description and the various estimation techniques. Reports of empirical results and conclusion of the paper are in sections five and six respectively.

3. Theoretical Background

- [8], following [3], provides a simple framework of intertemporal budget constraint that implies a long-run equilibrium between EX and IM. The framework made the assumptions that the representative agent of a small open economy produces and exports a single composite good, has no government, can borrow and lend money in international markets at the world interest rate using one-period financial instruments with the aim to maximize lifetime utility subject to budget constraints. The representative agent’s current-period budget constraint in period t is:

| (1) |

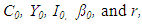

are current consumption, output, investment, international borrowing, and one - period interest rate, respectively.

are current consumption, output, investment, international borrowing, and one - period interest rate, respectively.  is the historically given initial debt size. [8], after making several assumptions including that the world interest rate is stationary and that EX and IM are non-stationary at levels derived a testable model of the form:

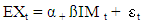

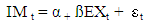

is the historically given initial debt size. [8], after making several assumptions including that the world interest rate is stationary and that EX and IM are non-stationary at levels derived a testable model of the form: | (2) |

| (3) |

must be statistically equal to unity. Using equation (3), current accounts is not sustainable in the long-run: if EX and IM are not cointegrated, and more importantly, if EX and IM are cointegrated but the coefficient

must be statistically equal to unity. Using equation (3), current accounts is not sustainable in the long-run: if EX and IM are not cointegrated, and more importantly, if EX and IM are cointegrated but the coefficient  When

When  current account imbalance is not sustainable in the long-run because imports are growing faster than exports and the country is in violation of its intertemporal budget constraint.

current account imbalance is not sustainable in the long-run because imports are growing faster than exports and the country is in violation of its intertemporal budget constraint. 4. Data and Estimation Technique

4.1. Data Description

- All data used in this study are from the World Bank’s World Development Indicators. EX and IM include both goods and services in current local currency unit. In this way, we are able to capture 13 ECOWAS member countries as continuous data in either constant local currency unit or constant US dollars are not available for many member countries. Measures of exports and imports are in natural logarithms and denoted as LEX and LIM, respectively. The data set covers the following ECOWAS countries for which continuous annual data are available in local currency unit from 1970 to 2015: Nigeria, Benin, Burkina Faso, Cape Verde, Cote d’Ivoire, Gambia, Ghana, Guinea Bissau, Liberia, Mali, Senegal, Sierra Leone, and Togo.

4.2. Estimation Technique

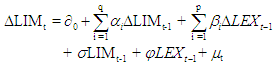

- Our analysis begins with a check of integration and cointegration properties of the data set. We apply the Augmented Dickey-Fuller [34] tests to check for the presence of unit roots in the pair of exports and imports in each country. Empirical literature shows that cointegration between EX and IM may depend on the choice of cointegration techniques. For instance, [14] failed to find cointegration of EX and IM with [35] and [36] cointegration tests. The authors, using a panel cointegration approach based on [37] and [38] found EX and IM cointegration with the cointegration coefficient not significantly different from one. [8] noted that the conventional residual based cointegration methods of [35], [39], and [36] usually found in pure time series literature may be prone to produce misleading results as they ignore the likely change in the structure of EX and IM over time. Furthermore, they fail to take advantage of information across countries, which may lead to efficiency loss in estimation [14]. These arguments strongly recommend the panel based cointegration approaches such as [38], [40], [37], [41], and [42] which corrects the deficiencies noted in residual-based cointegration tests. [43] introduced the autoregressive distributed lag (ARDL) approach to cointegration. The ARDL possess some econometrics advantages compared to other approaches. According to [44], the ARDL possesses better small sample properties than the [35] and [36] approaches and is applicable regardless of whether the time series are stationary, I(0) or nonstationary I(1), or fractionally integrated. Moreover, within the ARDL framework, the OLS estimates of the short-run parameters are consistent, and the ARDL based estimates of the long-run coefficients are incredibly reliable in small samples [45] Based on its advantages, especially in small samples, we adopt the ARDL approach to cointegration in this study.To test the existence of the long-run relationship between EX and IM using the bounds testing procedure, the unrestricted error correction representation of the ARDL (q, p) model for equation (3) is as below:

| (4) |

is a serially independent random error with mean zero and finite covariance matrix. The existence of long-run relationship between EX and IM is tested with the overall F-statistic at the conventional levels of significance. The no cointegration hypothesis;

is a serially independent random error with mean zero and finite covariance matrix. The existence of long-run relationship between EX and IM is tested with the overall F-statistic at the conventional levels of significance. The no cointegration hypothesis;  is tested against the null hypothesis

is tested against the null hypothesis  Cointegration is present if the computed F-statistic exceeds the upper critical bound value, and the null hypothesis of no cointegration rejected. If the computed F-statistic falls between the bounds, then the test becomes inconclusive. No cointegration is present if the computed F-statistic is below the lower critical bound value. Given that EX and IM are cointegrated, the second stage is the computation of the long run and error correction estimates of the ARDL model obtained in equation (4). We estimated the ARDL using the automatic lag option (maximum lag of 4 for both dependent and independent variables). In addition to the ARDL model, we sought further confirmation of sign and magnitude of the estimates of the long-run coefficients using both the FMOLS and DOLS. We check the stability of parameter estimates using the CUSUM and CUSUMSQ tests.

Cointegration is present if the computed F-statistic exceeds the upper critical bound value, and the null hypothesis of no cointegration rejected. If the computed F-statistic falls between the bounds, then the test becomes inconclusive. No cointegration is present if the computed F-statistic is below the lower critical bound value. Given that EX and IM are cointegrated, the second stage is the computation of the long run and error correction estimates of the ARDL model obtained in equation (4). We estimated the ARDL using the automatic lag option (maximum lag of 4 for both dependent and independent variables). In addition to the ARDL model, we sought further confirmation of sign and magnitude of the estimates of the long-run coefficients using both the FMOLS and DOLS. We check the stability of parameter estimates using the CUSUM and CUSUMSQ tests.5. Empirical Results

5.1. Unit Roots Test

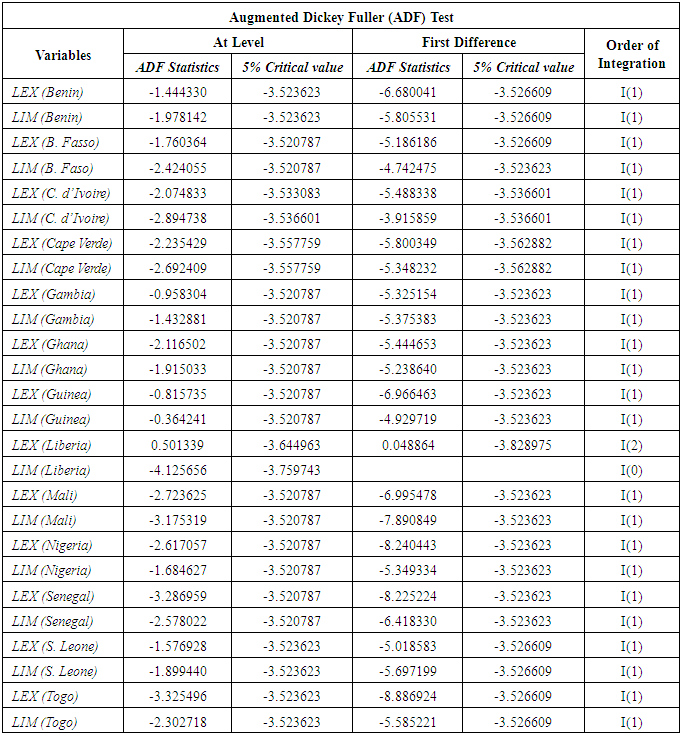

- Presented in Table 1 is the unit roots test results for EX and IM in each of the 13 countries in the study. EX and IM are stationary at the first difference for 12 out of the 13 countries, thus, the null hypothesis of non-stationarity was rejected at 5% level of significance for the 12 countries. EX and IM are integrated of different orders in Liberia. Imports were stationary at level and exports at the second difference. Therefore, Liberia dropped from succeeding analysis.

|

5.2. Cointegration and Long-run Estimates

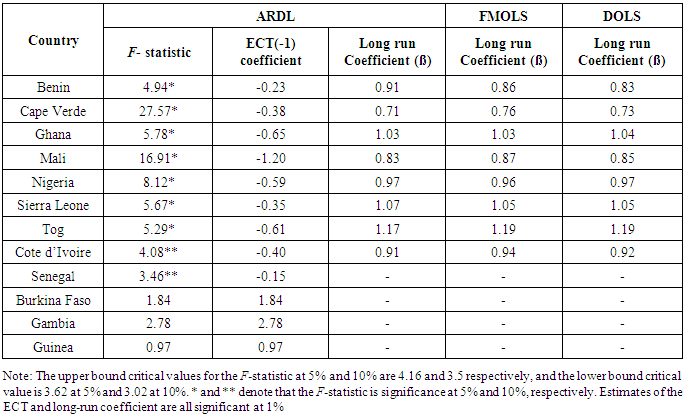

- With the series of EX and IM integrated of order one for 12 countries, we proceed to test for cointegration and report the results in Table 2. The ARDL or bounds testing approach to cointegration admits EX and IM cointegration in eight countries for which the computed F-statistic is higher than the upper bound of the critical values at either 1% or 5% level of significance. Consequently, the null hypothesis of no cointegration can be rejected for Benin, Cape Verde, Ghana, Mali, Nigeria, Sierra Leone, Togo, and Cote d’Ivoire. Though the F-statistic is significant at 10% in Senegal, its value at 3.46 falls within the critical value bands, thus, the test of cointegration is inconclusive. The null hypothesis of no cointegration is not rejected in Burkina Faso, Gambia and Guinea for the reason that the computed F-statistic is less than the lower bound of the critical values. We consequently conclude that there is no long-run relationship between EX and IM in four of the ECOWAS countries- Burkina Faso, Gambia, Guinea and Senegal. These results agreed with [46] who found evidence of EX and IM cointegration in Mali. Although Tang in the same study concluded that EX and IM are cointegrated in Senegal, our test was inconclusive for Senegal. Our results agree with [47] on the existence of EX and IM cointegration in Benin. The two studies differ on Burkina Faso for which we have no evidence of cointegration. Cointegration evidence found Nigeria is consistent with the results of [26] and [27]. In addition, findings of cointegration in Benin, Cape Verde, Ghana, Mali, Nigeria, Sierra Leone, Togo, and Cote d’Ivoire agree with [30].

|

to both confirm the presence of cointegration and find evidence of long-run current account sustainability in the eight countries.Also reported in Table 2 are the error correction term and the long-run estimates. The estimate of the error correction term [ECT (-1)] within the ARDL model is negative as expected and significant at the 1% level for each of the eight countries. This confirms the evidence of cointegrating EX and IM and indicates that short-run trade imbalances are temporary phenomena and are sustainable in the long-run. Estimates of the coefficient of ß are obtained from testing the null hypothesis that the estimated coefficient of LEX is unity

to both confirm the presence of cointegration and find evidence of long-run current account sustainability in the eight countries.Also reported in Table 2 are the error correction term and the long-run estimates. The estimate of the error correction term [ECT (-1)] within the ARDL model is negative as expected and significant at the 1% level for each of the eight countries. This confirms the evidence of cointegrating EX and IM and indicates that short-run trade imbalances are temporary phenomena and are sustainable in the long-run. Estimates of the coefficient of ß are obtained from testing the null hypothesis that the estimated coefficient of LEX is unity  Results from ARDL, FMOLS, and DOLS regressions are positive and statistically significant at 1%. We reject the null hypothesis for three countries- Ghana, Sierra Leone, and Togo. Rejecting the null hypothesis indicates that a one percent increase in exports induces more than one percent increase in imports, implying long-run trade imbalance and consequently unsustainable current accounts position. These results agree with Sissoko and Sohrabji’s (2012) rejection of long-run current account sustainability for Ghana and differ on Togo for which we find no evidence to support long-run current account position.The hypothesis that

Results from ARDL, FMOLS, and DOLS regressions are positive and statistically significant at 1%. We reject the null hypothesis for three countries- Ghana, Sierra Leone, and Togo. Rejecting the null hypothesis indicates that a one percent increase in exports induces more than one percent increase in imports, implying long-run trade imbalance and consequently unsustainable current accounts position. These results agree with Sissoko and Sohrabji’s (2012) rejection of long-run current account sustainability for Ghana and differ on Togo for which we find no evidence to support long-run current account position.The hypothesis that  is not rejected for Benin, Cape Verde, Mali, Nigeria, and Cote d’Ivoire. Imports in each of these countries are fully covered by export earnings during the sample period and are therefore not in violation of their intertemporal budget constraints. The estimated value of ß is closer to unity in Nigeria than in Benin, Cape Verde, Mali, and Cote d’Ivoire and suggests that one naira of imports is balanced by one naira of exports. Specifically, a 1% increase in exports is associated with a 0.97% increase in imports resulting in sustainable current account position during the sample period. This result is in consonance with [27] but contrasts with [26] who found cointegration between exports and imports in Nigeria but the current account position unsustainable in the long-run. [33] also find Nigeria’s current account position unsustainable in the long-run.

is not rejected for Benin, Cape Verde, Mali, Nigeria, and Cote d’Ivoire. Imports in each of these countries are fully covered by export earnings during the sample period and are therefore not in violation of their intertemporal budget constraints. The estimated value of ß is closer to unity in Nigeria than in Benin, Cape Verde, Mali, and Cote d’Ivoire and suggests that one naira of imports is balanced by one naira of exports. Specifically, a 1% increase in exports is associated with a 0.97% increase in imports resulting in sustainable current account position during the sample period. This result is in consonance with [27] but contrasts with [26] who found cointegration between exports and imports in Nigeria but the current account position unsustainable in the long-run. [33] also find Nigeria’s current account position unsustainable in the long-run. 5.3. Stability Test

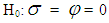

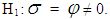

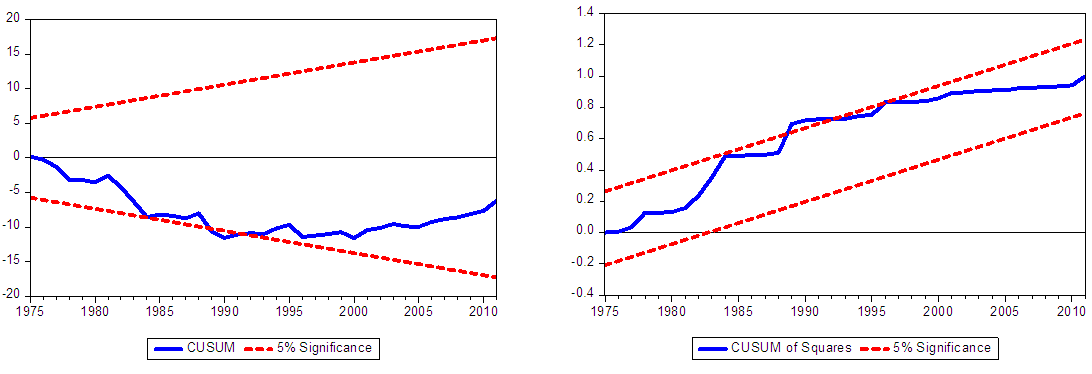

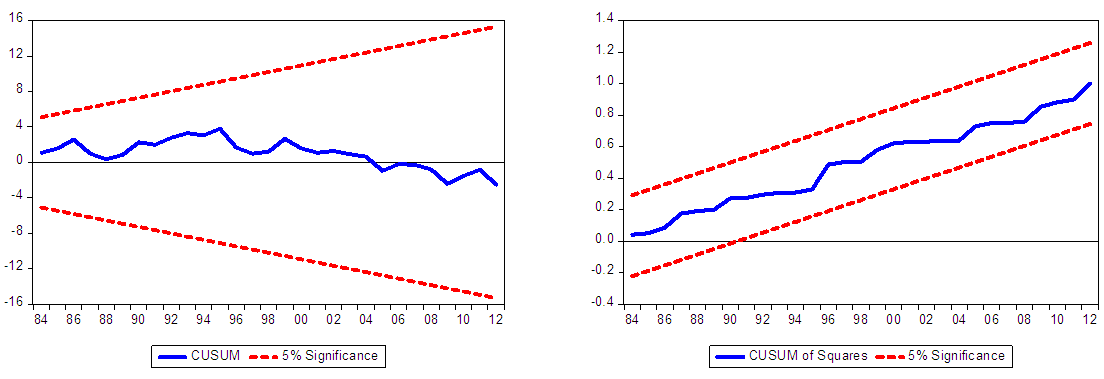

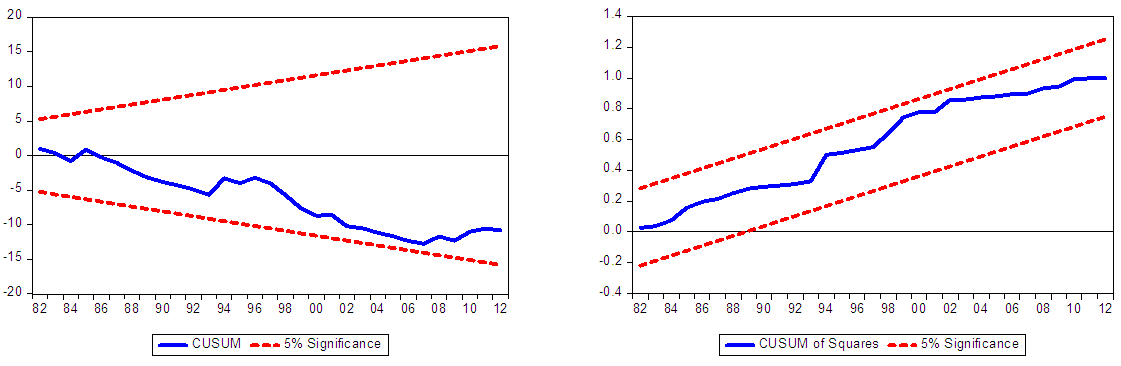

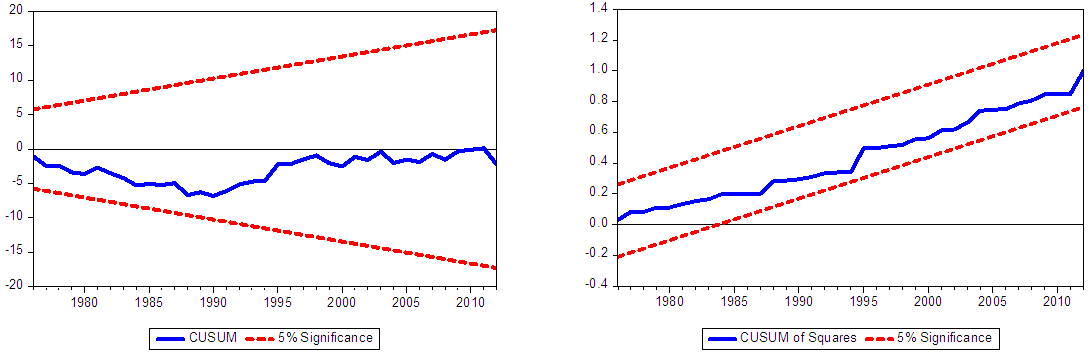

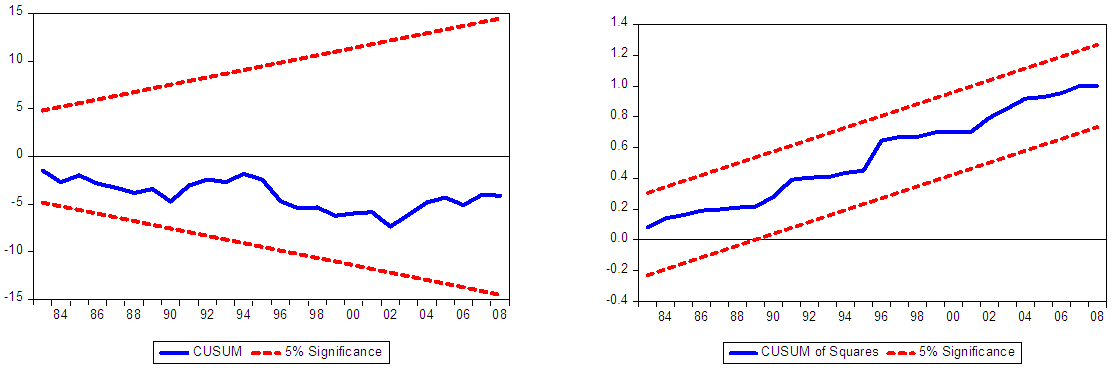

- We use the tests of CUSUM and CUSUMSQ as proposed by [48] to confirm the stability of the estimated parameters. Where the graphs of the CUSUM and CUSUMSQ statistics fall relative to the critical bounds at 5%, significance level informs a decision about the stability of the estimated parameters. If the graphs fall within the critical bounds at 5% level of significance, the coefficients in the ECM are stable and we cannot reject the null hypothesis. Figures 1 – 5 show the graphs of the CUSUM and CUSUMSQ tests of the ECM for Benin, Cape Verde, Cote d’Ivoire, Mali, and Nigeria respectively. That both the CUSUM and CUSUMSQ graphs lie within the critical bonds of 5% for Cape Verde, Ghana, Mali, Nigeria, and Sierra Leone indicate the stability of the ECM parameters. Benin, however, showed evidence of significant structural instability. The CUSUM test found parameter instability between 1989 and 1991. Likewise, the CUSUMSQ reveals instability between 1989 and 1992 during the observed period.

| Figure 1. Benin: CUSUM and CUSUM of Squares Charts |

| Figure 2. Cape Verde: CUSUM and CUSUM of Squares Charts |

| Figure 3. Mali: CUSUM and CUSUM of Squares Charts |

| Figure 4. Nigeria: CUSUM and CUSUM of Squares Charts |

| Figure 5. Cote d’Ivoire: CUSUM and CUSUM of Squares Charts |

6. Conclusions

- This paper examines the cointegration of exports and imports in 13 ECOWAS countries for the period 1970 to 2015 applying the bounds testing approach of the ARDL to cointegration. In addition to the ARDL, we employ two other estimators for the long-run coefficients. After establishing that the variables are stationary in the first difference, we find that exports and imports are cointegrated in eight of the countries investigated; Benin, Cape Verde, Cote d’Ivoire, Ghana, Mali, Nigeria, Sierra Leone and Togo. The ARDL, FMOLS, and DOLS showed that the long-run estimates are positive and statistically significant in the eight countries where we find cointegration. However, only five countries- Benin, Cape Verde, Cote d’Ivoire, Mali, and Nigeria fulfilled the sufficient condition for long-run current account sustainability; they satisfy their respective intertemporal budget constraint. For these countries, the estimate of the long-run coefficients is less than but statistically not different from unity. Based on these results, we can conclude that exports and imports are cointegrated. Current account imbalance is a short run concern, and macroeconomic policies in the five countries have been effective to bring exports and imports into equilibrium in the long-run. The estimated relationship is empirically valid as diagnostic tests revealed that the estimated parameters are stable over time. However, Benin shows evidence of structural instability.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML