-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(2): 107-115

doi:10.5923/j.economics.20160602.03

Does Corporate Social Responsibility Solve ROA Problem in Indonesia Telecommunication Industry?

Anisah Firli1, Nikmatul Akbar2

1Telkom University, Indonesia

2PT Telekomunikasi Indonesia, Community Development Program Division, Indonesia

Correspondence to: Anisah Firli, Telkom University, Indonesia.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Indonesia Telecommunication is faced by negative score of ROA also decreasing ROA within the last three years. This research aim to prove CSR that exclude from usual variable used in increasing ROA. This research used seven categories (78 items) to measure CSR activity in telecommunication industry that listed in Indonesian Stock Exchange. Panel least square with 3 years horizon (2012-2015) is used to analysis the data. From hypothesis testing, CSR has significant effect on ROA. This research proves that CSR can solve ROA problem in Indonesia Telecommunication Industry. From this research result, increasing in 1% CSR makes 73,9% increasing in ROA. CSR gives very high R Squared (95,87%) to ROA. CSR can be an addition alternative strategic to increase ROA. This research also gives implication to the investor to invest in Telecommunication Company that concern in CSR program, it means those companies can more effectively manage their asset to generate income.

Keywords: Corporate social responsibility, CSR, Financial performance, ROA, Telecommunication Industry

Cite this paper: Anisah Firli, Nikmatul Akbar, Does Corporate Social Responsibility Solve ROA Problem in Indonesia Telecommunication Industry?, American Journal of Economics, Vol. 6 No. 2, 2016, pp. 107-115. doi: 10.5923/j.economics.20160602.03.

Article Outline

1. Introduction

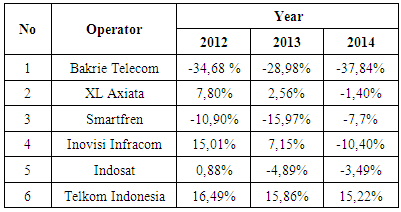

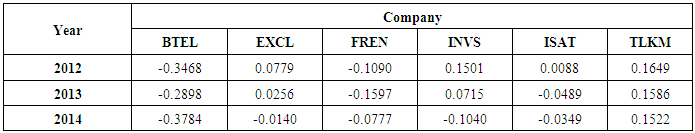

- Shift from monopoly to competition era of the Indonesia telecom industry, they must compete their strategy with the competitor such as; market, price, product, corporate image, etc. In doing their business which is network based, they need to manage their asset / infrastructure such as a costly part of their financial spending. As a costly part, some operators choose to build their own infrastructure while others prefer to outsource. Moreover, telecom industry serves the product by using technology that has shorter lifecycle. So that, each operator must manage their asset to generate income. Return on Asset (ROA) in Telecom industry becomes an important part to measure the financial performance. ROA is measures overall effectiveness of management of generating profits with its available assets. Within last three years, Return on Asset of Telecom industry decreases till negative (See Table 1).

|

2. Litterature Review

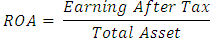

- A Firm need to analyse its internal financial to evaluate financial performance in light of competitor’s performance and determine how the firm might improve its own operation. Measuring financial performance by using financial ratios can give information from income statement and balance sheet about the firm’s financial health (Titman, 2011: 76). Gitman & Zutter (2012: 70-85) Financial ratios can be divided into five basic categories; liquidity, activity, debt, profitability and market ratios. Liquidity, activity, and debt ratio measure risk. Profitability ratios measure return. Market ratios capture both risk and return. (1) Liquidity ratios measured ability of the firm to satisfy its short term obligations. Ratios in this category are Current Ratio, Quick Acid Test Ratio.(2) Activity ratios measured the speed with which various account are converted into sales or cash- inflows or outflows. This ratio measure how efficiently a firm operates along a variety of dimensions. Ratios in this category are Inventory Turnover, Average Collection Period, Average Payment Period, Total Assets Turnover(3) Debt ratios measure the proportion of total assets financed by the firm’s creditors. Ratio in this category are Debt Ratio, Times Interest Earned Ratio, Fixed Payment Coverage Ratio(4) Profitability ratios measure the profitability of the firm, evaluate firm’s profit with respect to given level of sales, a certain level of assets, or owners’ investment. Ratio in this category are Gross Profit Margin, Operating Profit Margin, Net Profit Margin, Earning Per Share, Return on Total Assets, Return on Common Equity(5) Market Ratios measure by its current share price to certain accounting values. Ration in this category are Price/Earnings Ratio, Market/ Book RatioReturn on Asset often called the Return on Investment (ROI) measures overall effectiveness of management of generating profits with its available assets. Horne & Wachowicz (2012:180) Formulas of ROA is earning after tax divided by total assets

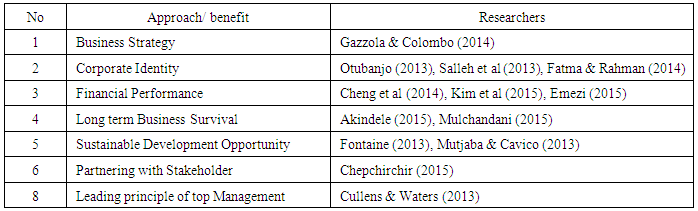

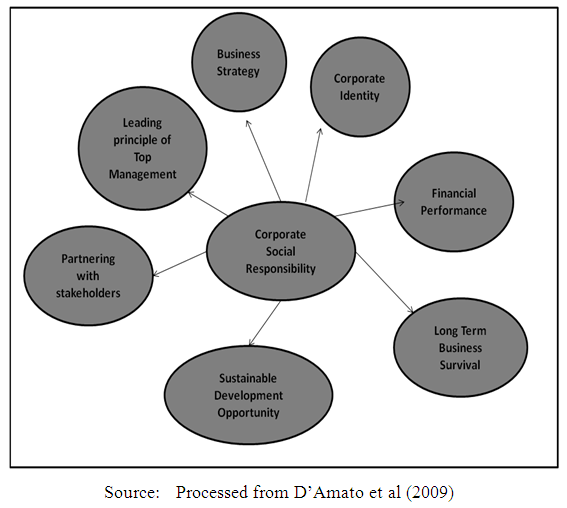

The higher score of ROA means that management is better perform in generating profits with total asset of the firm. A firm can increase ROA by push sales; do the business to be more efficiency; minimize cost; activity of managing asset, ect. Some studied try to prove other variable that has positive impact to ROA. One of the variables is CSR.CSR has become a mainstream business activity; more firms provide regular public statement about CSR, more company report includes detail on CSR activities, more firms have voluntary external certifications for social and environmental standard, more firms invest in CSR (Kitzmueller & Shimschack, 2012). CSR defines as voluntary services given by the company to be socially responsible to the growth and development of the environment and society which it operares (Adeneye & Ahmed, 2015). Wissink (2012) defines CSR as company actions to include the interest of its stakeholders in the economics, social and environment domain in its business operations and to a company’s actions aimed at guaranteeing the continued existence, at least at an equal level, of the company, society and the environment at large. D’ Amato et al (2009) describe some approaches to implementing CSR that can be seen at the following figure:

The higher score of ROA means that management is better perform in generating profits with total asset of the firm. A firm can increase ROA by push sales; do the business to be more efficiency; minimize cost; activity of managing asset, ect. Some studied try to prove other variable that has positive impact to ROA. One of the variables is CSR.CSR has become a mainstream business activity; more firms provide regular public statement about CSR, more company report includes detail on CSR activities, more firms have voluntary external certifications for social and environmental standard, more firms invest in CSR (Kitzmueller & Shimschack, 2012). CSR defines as voluntary services given by the company to be socially responsible to the growth and development of the environment and society which it operares (Adeneye & Ahmed, 2015). Wissink (2012) defines CSR as company actions to include the interest of its stakeholders in the economics, social and environment domain in its business operations and to a company’s actions aimed at guaranteeing the continued existence, at least at an equal level, of the company, society and the environment at large. D’ Amato et al (2009) describe some approaches to implementing CSR that can be seen at the following figure: | Figure 1. Approaches to Implementing CSR |

|

3. Methods

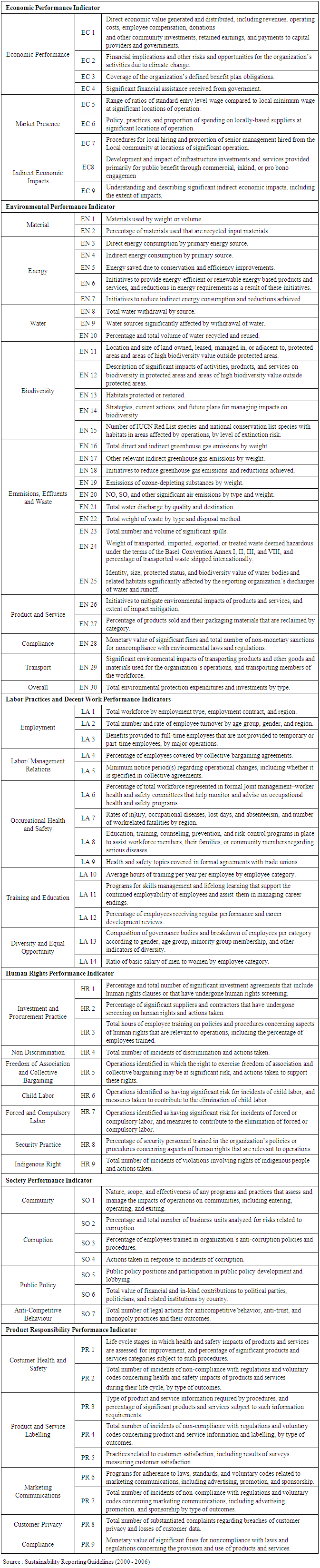

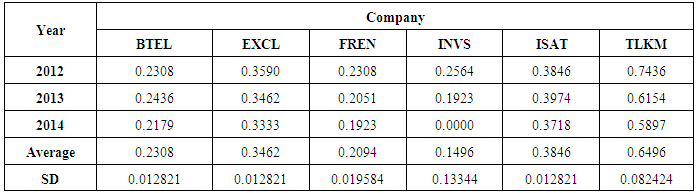

- Data collected from annual report and financial report of six telecommunication companies listed in Indonesian Stock Exchange period 2012-2014. Those six companies are Bakrie Telecom, XL Axiata, Smartfren Telecom, Inovisi Telecom, Indosat, Telekomunikasi Indonesia. Step (1) We checklist 78 items of CSR for each company for 3 years period, (2) We calculate ROA score for each company for 3 years period, (3) We Use Panel Least Squares Analysis to answer the research question we had decided before (using Eviews 9 for WindoWS Software)We test hypothesis of our research:H1: CSR has significant impact on ROA in Indonesia Telecommunication Industry (2012-2014)Item CSR adopted from Global Reporting Initiatives as seen at Table 3. Table 3 shows the six major dimensions: Economic Performance Indicator, Environmental Performance Indicator, Labor Practices and Decent Work Performance Indicators, Human Rights Performance Indicator, Society Performance Indicator, Product Responsibility Performance Indicator. Economic Performance Indicator consists of Economic Performance (measured by item EC 1-EC 9), Market Presence (measured by item EC5-EC7), and Indirect Economic Impacts (measured by EC8-EC9). Environmental Performance Indicator consist of Material (measured by EN 1-EN2), Energy (measured by EN3-EN7), Water (measured by EN 8-EN 10), Biodiversity (measured by EN 11-EN 15), Emmisions Effuents and Waste (measured by EN 16- EN 25), Product and Service (measured by EN 26-27), Compliance (measured by EN 28), Transport (measured by EN 29), Overall (measured by EN 30). Labor Practices and Work Performance Indicators consists of Employment (measured by LA 1-LA 3), Labor/ Management Relations (measured by LA 4-LA 5), Occupational Health and Safety (measured by LA 6-LA 9), Training and Education (measured by LA 10- LA 12), Diversity and Equal Opportunity (measured by LA 13-LA 14). Human Rights Performance Practice consists of Investment and Procurement Practice (measured by HR 1- HR 3), Non Discrimination (measured by HR4), Freedom of Association and Collective Bargaining (measured by HR 5), Child Labor (measured by HR 6), Forced and Compulsory Labor (measured by HR 7), Security Practice (measured by HR 8), Indigenous Right (measured by HR 9). Society Performance Indicator consist of Community (measured by SO1), Corruption (measured by SO 2- SO 4), Public Policy (measured by SO 5- SO 6), Anti-Competitive Behavior (measured by SO7). Product Responsibility Performance Indicator consists of Consumer Health and Safety (measured by PR 1-PR 2), Product and Service Labeling (measured by PR 3-PR 5), Marketing Communication (measured by PR 6- PR 7), Customer Privacy (measured by PR 8), Compliance (measured by PR 9)

|

4. Results and Discussion

- Step 1

|

|

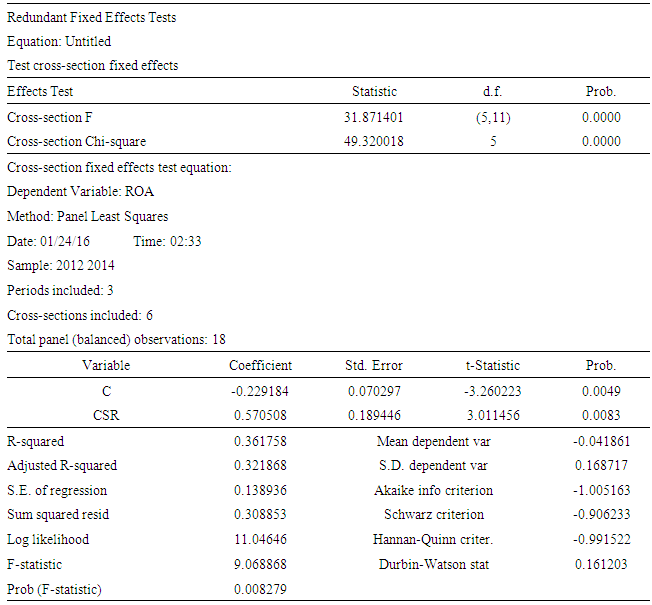

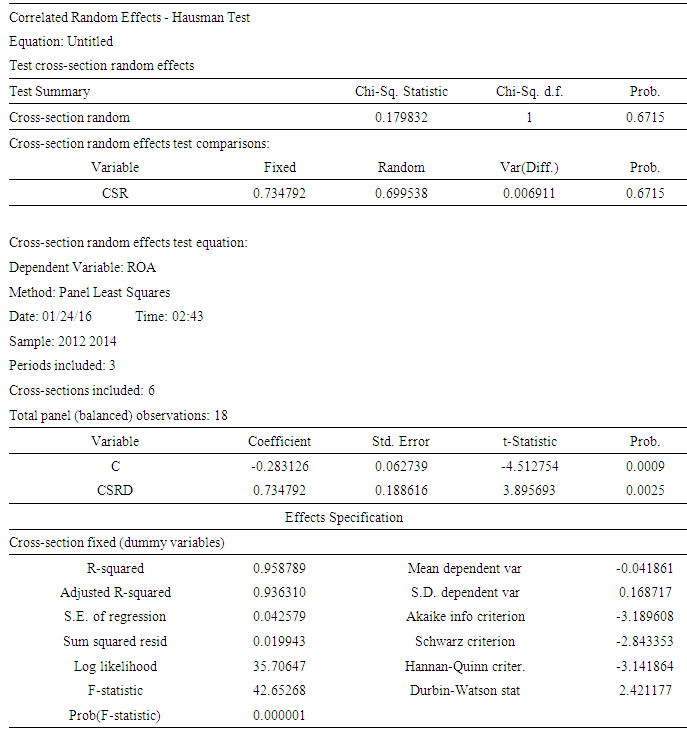

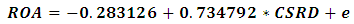

It means, if CSR = 0, ROA = -0.283126. Increase in 1% CSR make Increase in 73,5% of ROA. R Square (95,875%) indicates total influence score of CSR variable on ROA. From Table 7 we can see total t score 3.895693, it’s more than t table (2.1199). We accept H1 hypothesis; CSR has significant impact on ROA in Indonesia Telecommunication Industry (2012-2014)

It means, if CSR = 0, ROA = -0.283126. Increase in 1% CSR make Increase in 73,5% of ROA. R Square (95,875%) indicates total influence score of CSR variable on ROA. From Table 7 we can see total t score 3.895693, it’s more than t table (2.1199). We accept H1 hypothesis; CSR has significant impact on ROA in Indonesia Telecommunication Industry (2012-2014)

|

|

5. Conclusions

- From the basic research question does CSR solve ROA problem in Indonesia Telecom Industry?. We have proven by the empirical data from the Telecom Industry; CSR can be one of alternatives as business strategic to solve ROA problem in Indonesia Telecom Industry. Increasing 1% in CSR makes 73,9% increasing in ROA. We also found very high R square (95,87%). We found solution specifically for telecom industry with high asset characteristics based industry. The company can allocate more resources to be more responsible in social to achieve better financial performance specifically in ROA of the company. This research also gives implication to the investor to invest in Telecommunication Company that concern in CSR program, it means those companies can more effectively manage their asset to generate income.

ACKNOWLEDGEMENTS

- We say thanks to Fakultas Ekonomi dan Bisnis Program Studi Manajemen Bisnis Telekomunikasi dan Informatika, Telkom University and also Lembaga Penelitian dan Pengabdian Masyarakat, Telkom University for supporting us for this research morel. We concern to give suggestion from the academic view to the business practice to solve problem in Telecommunication Industry to bring us more competitive and sustainable as a industry.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML