-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(1): 79-85

doi:10.5923/j.economics.20160601.10

Economic Consequences of IFRS Adoption in Indonesia

Fitriany, Sidharta Utama, Aria Farahmita, Viska Anggraita

Fakultas Ekonomi UI, Kampus UI Depok, Jawa Barat, Indonesia

Correspondence to: Fitriany, Fakultas Ekonomi UI, Kampus UI Depok, Jawa Barat, Indonesia.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study examines economic consequences around IFRS adoptions proxied by price impact, bid ask spread and cost of capital. There are 3 incentives: reporting incentive, reporting behaviour and reporting environment. This research found that on average, liquidity and cost of capital do not change around IFRS adoptions. Our findings imply that we have to exercise caution when interpreting capital-market effects around IFRS adoption as they also reflect changes in reporting incentives or in firms’ broader reporting strategies, and not just the standards.

Keywords: Consequences, IFRS adoption, Reporting incentives

Cite this paper: Fitriany, Sidharta Utama, Aria Farahmita, Viska Anggraita, Economic Consequences of IFRS Adoption in Indonesia, American Journal of Economics, Vol. 6 No. 1, 2016, pp. 79-85. doi: 10.5923/j.economics.20160601.10.

Article Outline

1. Introduction

- Indonesia has adopted IFRS gradually since 2007 and there are some new standard effective since 2012. IFRS has three main characteristics (that principles-based), more use of fair value as the basis for assessment and disclosure more. Standards that are principles based only regulate matters of principle not rule detail. IFRS requires more extensive disclosures that users of financial statements to get more information so that it can consider that information for decision making.Adopting IFRS would have seven benefits as well, namely improving financial accounting standards (SAK), reduce costs of SAK, enhance the credibility and usefulness of financial statements, improving the comparability of financial reporting, increase financial transparency, lower cost of capital funding opportunities through the capital market, improve the efficiency of financial statements.However, in practice, implementing new standards is not easy. Many businesses have complained about difficulties in implementing the new standards in the company. Costs for investments in the field of technology and information to support the application of IFRS is high. Furthermore, the costs of IFRS training for employees are also high. In addition, the condition of the legislation that are not necessarily in sync with IFRS.Implementation of IFRS-based accounting standards have been studied for most of the European countries, which already requires the implementation of IFRS since 2005. Previous research can be grouped into two categories: research that tests the quality of accounting after the implementation of IFRS and research that examine the economic consequences of the application of IFRS. Barth & Lang (2005) Verriest et al. (2010) and Beuselinck et al. (2010) found that quality improved after the implementation of IFRS. However, Hung & Subramanyam (2007), Beuselinck et al. (2008), Garcia-Osma and Pope (2010), Capcun et al. (2010), and Cascino & Gascen (2010) found that the quality of accounting did not increase after the implementation of IFRS. Research Daske et al. (2008), Beuselinck et al. (2010), Florou & Kosi (2010) found that IFRS bring positive economic consequences for the company, but Clarkson et al. (2009) found the opposite, the adoption of IFRS did not improve the quality of financial reporting.Daske et al., (2009) investigated the effects of the adoption of IFRS on the cost of capital, information asymmetry and liquidity of the market. According to Daske (2007), in adoption of IFRS give a lot of discretion to management in implementing these standards so that in practice there is a high variation in its application both in terms of disclosure or accounting policies. Some companies have a greater incentive in terms of quality of reporting than other companies. For example, the company that is a subsidiary of listed company on the US capital markets will have a greater incentive to produce higher quality financial statements compared to local companies that do not go public. As a result, there are some companies that has a great commitment in implementing IFRS for transparency in order to reduce information asymmetry (serious adopters), meanwhile there are also companies that only apply IFRS to fulfill the provisions in accordance with IFRS (cosmetics adopters). Companies that have a strong commitment to implement IFRS by earnestly substance will reduce the asymmetry of information, uncertainty, and risk estimate that will result in lower capital costs and higher market liquidity (Daske et al., 2007).Companies that just implementing accounting standards IFRS with cosmetic purposes will have a low commitment to transparent financial statements. While the company that is sincerely applying IFRS accounting standards will have a strong commitment to transparent financial statements. Previous research has found higher transparency will reduce the estimation risk that will ultimately reduce the cost of capital (Daske et al., 2007 and Lambert et al., 2007). Daske et al. (2007) examined the economic consequences of the voluntary adoption of IFRS around the world and split the company into two: the label adopters (companies that not sincerely adopt IFRS) and serious adopters (companies that adopt IFRS in full). Daske et al. (2007) found that the impact of IFRS adoption on market liquidity and the cost of capital on a serious adopters significantly more powerful than the companies that belong to the "label adopters". This shows that if the adoption of IFRS is not done in earnest (just cosmetic), then it will not have a significant impact on the level of transparency and does not reduce the asymmetry of information, market liquidity and the cost of capital. In this study, the term serious adopters replaced with substantive adopter (companies that perform substantive changes in applying IFRS).This research will examine wheather adoption of IFRS has economic consequences because there are differences between companies in making substantial changes with respect to the reporting and disclosure of their accounting policie. IFRS adoptions that are part of a serious commitment to transparency are likely to reduce information asymmetry, uncertainty and estimation risk, and hence should be rewarded with a lower cost of capital and higher market liquidity (e.g., Leuz and Verrecchia, 2000; Lambert et al., 2007a).

2. Hypothesis Development

- Reporting incentives between firms are different and the strength of enforcement also differs considerably across countries (e.g., Ball et al., 2003; Leuz et al., 2003; Ball et al., 2005; Lang et al., 2006; Burgstahler et al., 2006). For these reasons, one frequently voiced concern is that some firms may adopt IFRS merely as a label without making material changes in their reporting policies (e.g., Ball, 2001, 2006).Provided that market participants can differentiate between “label” and “serious” adopters, we should observe differential market reactions and economic consequences. IFRS adoptions that are part of a serious commitment to transparency are likely to reduce information asymmetry, uncertainty and estimation risk, and hence should be rewarded with a lower cost of capital and higher market liquidity (e.g., Leuz and Verrecchia, 2000; Lambert et al., 2007a).The initial idea of this research is that the underlying motivation of manager to change accounting standards play an important role to look at the economic consequences around the adoption of IFRS.In the process of the adoption of IFRS, there are companies, which adopt IFRS only the name, without making any material change in reporting. But there are also companies that actually make changes because it has an incentive to increase transparency.Important antecedents for this paper are studies highlighting the role of firms’ reporting incentives in explaining observed accounting properties and actual practices. IFRS, like any other set of accounting standards, afford management with substantial discretion as their application involves judgment and the underlying measurements are often based on private information. The way in which firms use this discretion likely depends on managers’ reporting incentives, which are shaped by many factors, including countries’ institutional frameworks, various market forces, and firm characteristics. In this paper, we emphasize and test the role of firm-level incentives in the context of IFRS adoptions. Based on these arguments, the proposed hypothesis is:H1: Economic consequences around IFRS adoption depend on management reporting incentives

3. Research Design

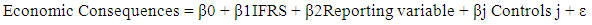

- To test the hypotesis 1, we estimate the following model:

| (1) |

| (2) |

4. Data and Sample

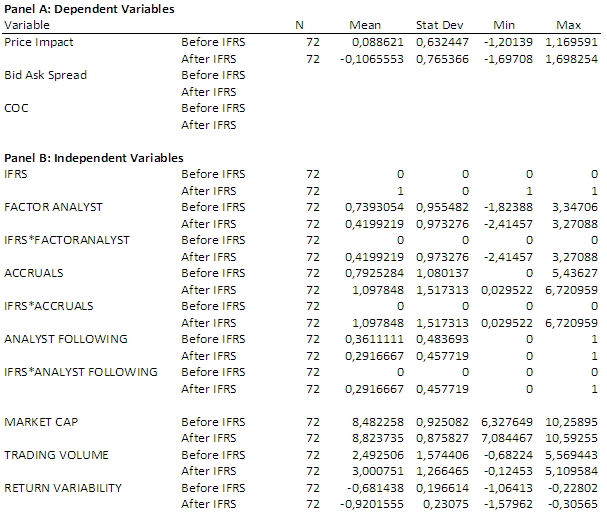

- This research uses companies that are listed on Indonesian Stock Exchange (BEI) from 2012 to 2013. Data collected from the Thomson Reuters Eikon and Annual Report each company. Samples includes only listed companies in Indonesia and excludes financial companies (ie. banks, insurance and investments corporations) because those companies have special financial statements structure so that their earning quality measurement does not equal with the other industries. Indonesia has started adopt IFRS gradually since 2007, but only a few standard. Indonesia intensively implementing IFRS in 2011 and 2012, So that the data taken one year before and after the convergence of IFRS, 2010 (before adoption) and in 2013 (after adoption). For model 1 Limitation of number of data is due to incomplete data such as analyst following and stock returns.

5. Result

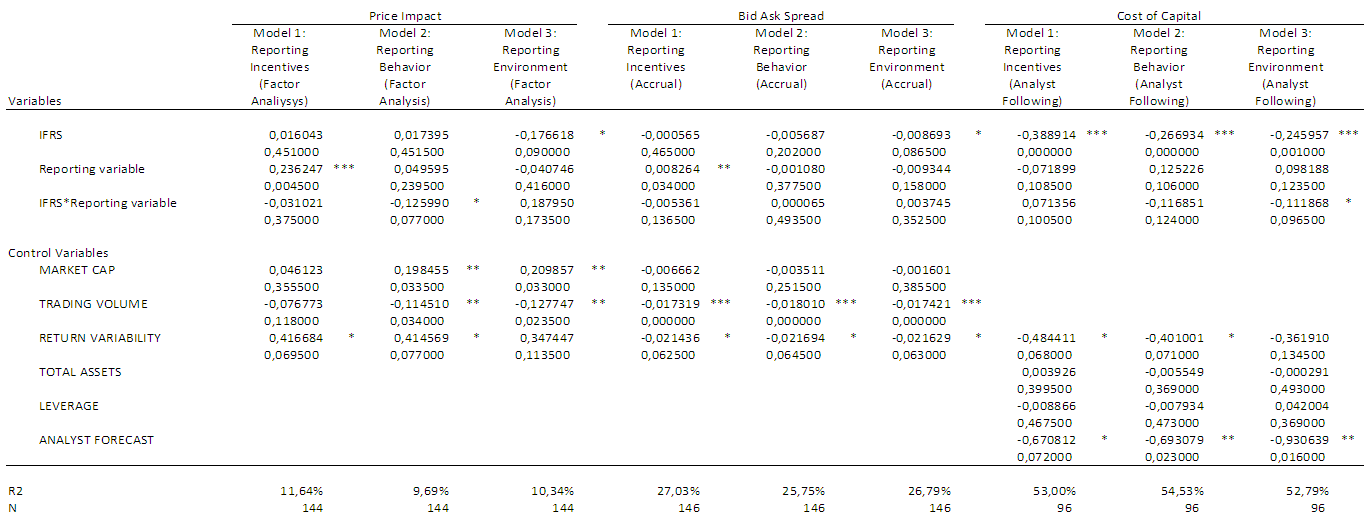

- For each dependent variable, we estimate three regressions using either the level of the Reporting Incentives, the Reporting Behavior, or the Reporting Environment variable. If these proxies capture incentives for more transparent reporting, they should exhibit a negative coefficient in the model. Table 2 presents results. Using price impact as dependent variable, the coefficients on IFRS are insignificant, suggesting that liquidity before IFRS is similar with after IFRS.We begin our analysis by examining average differences in market liquidity and cost of capital between firms reporting under IAS and firms reporting under local GAAP. There are 3 dependent variables: price impact, bid ask spread and cost of capital. For each dependent variable, we estimate three regressions using either the level of the Reporting Incentives, the Reporting Behaviour, or the Reporting Environment variable. If these proxies capture incentives for more transparent reporting, they should exhibit a negative coefficient in the model. Using price impact as dependent variable, the coefficients on IFRS are insignificant, suggesting that liquidity of firms before IFRS was not different with after IFRS adoption. Only one reporting variables (reporting incentive) that are significantly associated with price impact (liquidity), but with different direction. The result shows the higher incentives for transparent reporting, the higher the more illiquid the stocks. The different in the result maybe because factor analysis have not capture all of the attribute of reporting incentive. The control variable that is significant only for market cap and trading volume, but the result is the higher the market cap, the higher the liquidity. Correlation between trading volume and price impact is negatively significant.For bid ask result, one model suggest that firms reporting under IFRS have significantly lower spread, the other two model are insignificant, suggesting that firms reporting under IFRS—on average—have similar bid ask spread as firms reporting under non IFRS. The result also shows that the higher incentives for transparent reporting, the higher the bid ask spread. This result is not as expected. Maybe because factor analysis have not capture all of the attriburte of reporting incentive. The control variables, trading volume and return variability have negatively associated with bid ask spread. The higher the trading volume and return variability, the lower the bid ask.

| Table 1. Result – Without Variabel Interaction |

| Table 2. Result – With Variabel Interaction |

|

|

|

6. Summary

- This paper aims to examine the economic consequences associated with IFRS adoptions in Indonesia. We focus on firm-level heterogeneity in the consequences, recognizing that firms can differ in their motivations and ways to adopt IFRSWe find little evidence that IFRS adoptions are, on average, associated with an increase in market liquidity or a decline in the cost of capital. Our findings imply that we have to exercise caution when interpreting capital-market effects around IFRS adoption as they also reflect changes in reporting incentives or in firms’ broader reporting strategies, and not just the standards.The limitation of this paper is that small number of sampel because limitation on data availability. Accrual using in this model is simple, future research could use another measurement of accrual for proxy of transparant reporting. Factor analysis used in this research have not capture all of the attribute of reporting incentive. Future research could add another attributes.

ACKNOWLEDGEMENTS

- This research was financially supported by the Research Grant for year 2015 from Universitas Indonesia.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML