-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(1): 50-60

doi:10.5923/j.economics.20160601.07

Economic Growth, Employment and Poverty Reduction: The Case of West African Countries

Gülten Dursun, Blessing Ogunleye

Department of Economics, Kocaeli University, Kocaeli, Turkey

Correspondence to: Gülten Dursun, Department of Economics, Kocaeli University, Kocaeli, Turkey.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The purpose of this study is to examine the interplay of economic growth and employment in the reduction of poverty amongst West African Countries. Cross sectional country level data between 1991 and 2010 is used to examine the relationship existent between these variables within the West African region. The empirical result of the study supports a positive effect between economic growth and poverty reduction in West Africa. In terms of the influence of employment on poverty reduction, it can be observed that there exists a positive relationship; however, this relationship tends to be statistically insignificant. Employment-intensive growth is necessary but not sufficient within the region’s confine. That is, it is unlikely that the poor possess sufficient skills necessary to take advantage of the new employment opportunities evident within the region; thereby propelling a reduction in broad-based employment growth. In addition to this, employment does not coincide with poverty eradication because it is not in any way linked to the economic sectors that affect the poor.

Keywords: Economic Growth, Employment, Poverty Reduction, West African Countries, Panel Cointegration, DOLS, FMOLS

Cite this paper: Gülten Dursun, Blessing Ogunleye, Economic Growth, Employment and Poverty Reduction: The Case of West African Countries, American Journal of Economics, Vol. 6 No. 1, 2016, pp. 50-60. doi: 10.5923/j.economics.20160601.07.

Article Outline

1. Introduction

- Unemployment is a multidimensional phenomenon, which exhibits an imbalance in economic activities and is often argued to impose a big problem in every society. Also due to the impact of unemployment on the social structure of societies, it is possible to establish its existence as a social phenomenon. The economic and social effects of the rise in unemployment and the complexity of these effects is of major importance in understanding the causes and consequences of this phenomenon and also plays a vital role in the determination of measures necessary to curb its spread. On the other hand, it is necessary to state that economic growth is one of the main objectives of economic policy. In this regard, investment is an important economic tool meant to overcome the problem of unemployment in a given economy and is also one of the most important factors which lead to the achievement of a sustainable economic growth. Particularly, due to the population pyramids of the less developed and developing countries, efforts are on to counter this rising problem. According to UNDP/ILO, more than 20% of the African population comprises of young people between the ages of 15-24. Despite the presence of demographic transformation, there still exists a continual trend of high birth rate. Demographic growth as well as increase in the rate of active population continues to rise. In African countries, most especially West African countries, there is an upward rise in growth rate. The increase in growth rate from time to time reaches a point where it doubles the rate of demographic growth. The rate of unemployment is estimated to between 10-20%1. Amongst the employed population, the level of insecurity has remained quite high. According to ILO, in 2009, the rate of employees found working in vulnerable jobs was 79% and this is not expected to decline until 2015. As a result of the fact that employment creation shows a lower rate of growth when compared with the increase in active population, there continues to be a rise in unemployed workforce (UN, 2013:32).West Africa consists of countries like; Benin, Burkina Faso, Cape Verde, Côte d'Ivoire, The Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone, Togo and happens to be one of the world's poorest regions. Persistent poverty and rising income inequality remains a socio-economic problem amongst West African countries. 28% of the total African population constitutes West Africa. The average population growth rate is 2.2% and 41% of the population live in urban areas. West Africa's largest cities are located on the coast. As of 2012, the total population of the West African region approached 300 million. The non-agricultural population is approximately equal to the agricultural population. In the 1950’s, the population of West Africa as a whole was just 72 million with 92% of its population participating in the agricultural sector (OECD, 2012). In most OECD countries, population growth rate is seen at a rate of 0.03% and considering the increasingly aging population, it can be said that population is rising rapidly in West Africa. In 2020 and between 2030-2035, the population of the West African region is expected to be 400 million and 500 million respectively. In West Africa, as of 2010, the highest population density (number of people per km2) was recorded in Nigeria (171.5), Gambia (153) and Cape Verde (124). In recent years, most especially 2000’s, African economies recorded an annual growth rate of 5% in real terms, a feat considered as quite impressive. According to the IMF's forecast, between 2011-2015, 7 countries from the Sub-Saharan region will be on the direction of being amongst the 10 fastest growing economies of the world (The Economist, 2011). However, it does not imply that this strong economic growth supports poverty alleviation and productive employment. The aim of this study is to examine the dynamic causal relationship between poverty, economic growth and employment in West African countries within the period of 1991-2010 using panel cointegration model. After the introduction, the article consists of three sections. In the second section, the theoretical and empirical connection between economic growth, employment and poverty will be examined. In the third section, the empirical model and data will be appropriately defined. The empirical analysis is shown in section 3, while results will be discussed in chapter 4.

2. Literature Review

2.1. Linkage between Economic Growth, Employment and Poverty

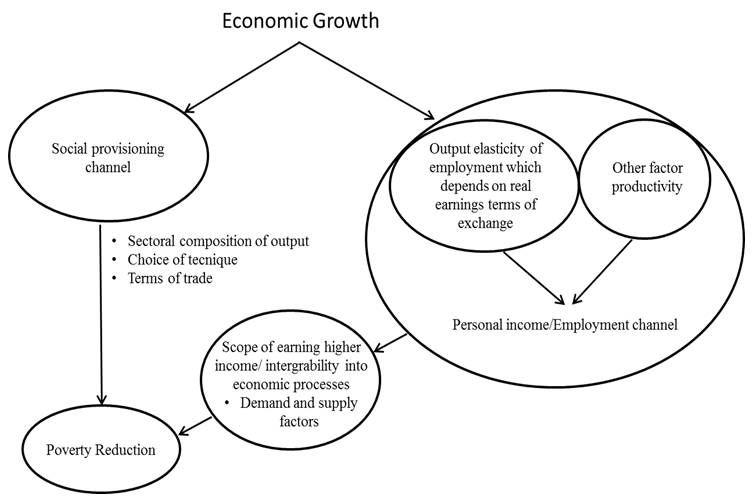

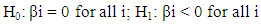

- An Economic growth, poverty reduction and the connection between employment and equity are quite complex but extremely important (Acharya, 2006:4576). In this regard, there is a substantial emphasis of literature (WB, 2006; Khan, 2001; Birdsall et al. 2005, Osmani, 2004). Economic growth is considered to be important in terms of creating new jobs for the poor. High growth rates in the latter stages of development are assumed to eliminate the wage gap between skilled and unskilled labor (Galor and Tsiddo, 1996). The relationship between poverty and employment is understood to be a joint process between the economic growth which brings about an increase in productivity and that which leads to a reduction in poverty. Poverty reduction depends on the strength of each link in the process. These links are economic growth rate, the output elasticity of demand for labor and the ability of the poor members of the labor force to respond to increasing demand for labor. When these connections are simultaneously joint, poverty is said to decline (Khan, 2001:2).Conceptually, the link between growth and poverty can be addressed with strong emphasis on two levels (Islam, 2004:3). Firstly, when taken from a macroeconomic perspective, these links can be conceptualized in terms of the average productivity of the employed labor force. In this case, improvements in productivity will reflect on real wages. In the microeconomic perspective, low efficiency of economic activities occurs through the same link. Relatively low average productivity of labor may be due to lack of sufficient capital or technological ineffectiveness. High growth rates, an increase in productive capacity, together with an increase in efficiency may lead to the emergence of employment opportunities. With a high level of efficiency, the integration of expanding economic activities between the unemployed and underemployed is likely to become possible. Within this process, higher productivity and also an increase in income can be achieved. It should also be noted that, higher expertise or a more advanced technology may require a transition to new jobs.Labor markets especially in developing countries serves as an important mechanism in the transmission process of macroeconomic and structural adjustment policies. A typical labor market is composed of three parts (Agenor, 1996, 2005). First is the rural sector. In some regions of sub-Saharan Africa, a significant proportion of the labor force continues to work in rural areas. The second is the informal urban sector. In this sector, self-employment, limited hired labor, and wage flexibility is very high. Also, the security of workforce is quite low, and regulations directed towards the workforce are insufficient. The third is the formal (private and public) urban sector. In this sector, workers are employed on contract basis and compliance with regulations concerning labor market is relatively high. In the urban sector of developing and less-developed countries, the proportion of informal workers is a big deal. Amongst the most important reasons for this is the fact that, unemployment insurance or pay (compensation) schemes are not properly regulated. In this case, the workers cannot afford to remain unemployed for a long period of time (Agenor, 2005:383).Figure 1 shows the impact of economic growth on poverty through employment channels. This effect occurs as a result of the increase in income of the poor through improvement in the quality and quantity of employment. In this sense, the growth elasticity of employment which shows the growth of employment creation capacity is important. However, higher income elasticity does not translate into higher income for the poor. Some other factors are also important and these include changes in labor productivity, and real gains. But it does not mean all these factors would cause great opportunities for the poor. Poverty reduction is highly necessary. In the same vein, it is important to be able to secure available opportunities connected to the demand and supply of labor. It is therefore necessary for the poor to be located within the sphere of economic processes (Shalini, 2010).

| Figure 1. Virtuous Circle of Links between Growth, Employment and Poverty Reduction. Source: Shailini (2010) |

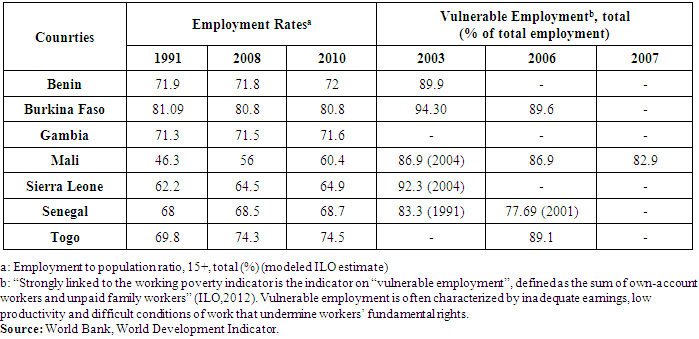

2.2. Growth, Employment and Poverty in West Africa

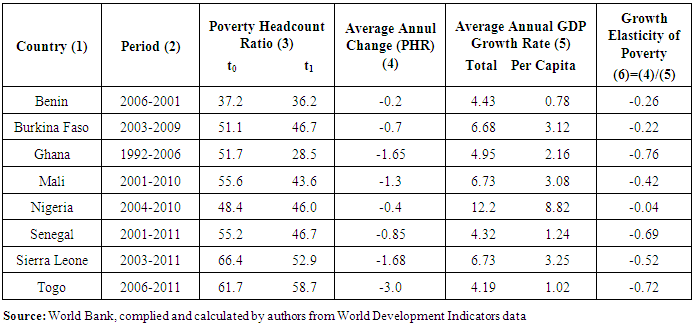

- As in Table 1, by simultaneously observing poverty reduction rate and growth rate per capita income, the relationship between growth and poverty can be properly examined. Between 2004-2010, Nigeria recorded the highest growth rate but could not provide a significant increase in the rate of poverty reduction. Its growth elasticity of poverty is relatively low compared to other countries2.

|

|

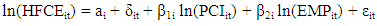

3. Econometric Methods and Data

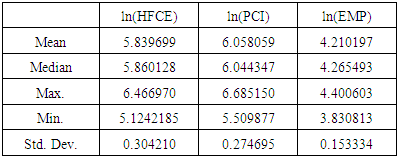

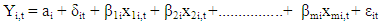

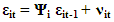

- In this study, the relationship between economic growth, employment and poverty reduction is investigated. This study uses panel data consisting of 7 cross-sections and each cross-section covers a time period of 20 years from 1991 to 2010. Our database includes seven West African countries: Benin, Burkina Faso, Gambia, Mali, Senegal, Sierra Leone, and Togo. Real GDP per capita and Household Final Consumption Expenditure Per Capita data measured in constant 2005 US dollars. We use real GDP per capita as the measure of affluence and economic growth. Employment refers to the employment to population ratio, 15+, total (%) (modeled ILO estimate). All data are expressed in natural logarithms. All data are obtained from World Bank Development Indicators (WDI) database published by the World Bank. The West African region consists of 16 individual countries but the choice of the countries used in this study is constrained by the availability of data; thereby propelling the need for its limitation to 7 countries.The co-integration tests are applied to determine the existence of long-run relationship among the variables. The Engle-Granger (1987) method is a single-equation approach and it only determines the presence of long run relationship. Another property of co-integration is that the variables should be integrated of the same order. For this purpose, the panel unit root test is applied on the series under consideration to check the order of integration. The panel unit root tests differ from the standard (DF and ADF approach) time series unit root tests as (Azomahou at al., 2009): i) The panel data allows for different degree of heterogeneity between the cross-sections; ii) In panel data unit root analysis, one cannot be sure of the validity of rejecting a unit root. The formulation of null hypothesis differs under different panel unit root test; iii) The power of panel unit root test increases with the increase in panel series; iv) The additional component of cross-sections in panel data provides better information as compared to the standard ADF in time series. A number of panel data unit root tests have been proposed such as: Maddala and Wu (1999), Choi (2001), Levin, Lin and Chu (2002, henceforth LLC), and Im, Pesaran and Shin (2003, henceforth IPS). These tests generally based on the AR(1). The LLC test it is assumed that the autoregressive coefficient (which indicates whether or not unit roots are present) is homogenous. Although the autoregressive coefficient is assumed homogenous, the LLC test allows for heterogeneity by allowing fixed effects and country-specific time trend. The IPS test involves computing the ADF test for each individual country and the mean of all countries ADF statistics gives the overall t-test statistic. Maddala and Wu (1999) proposed a panel unit root test based on Fisher (1932). Fisher’s study supports that of Im et al. (2003), which allows for individual unit roots, but improves upon it by being more general and more appropriate for unbalanced panels. Maddala and Wu’s test (ADF-Fisher) is based on combing the observed significance levels (p-values) from the different tests. According to Maddala and Wu (1999:635):“The advantage of this test is that it does not require a balanced panel as in the case of the IPS test. Also, one can use different lag lengths in the individual ADF regression. Another advantage of the Fisher test is that it can also be carried out for any unit root test derived. The disadvantage is that the p-values have to be derived by Monte Carlo simulation. The IPS test is easy to use because there are ready tables available in the paper for E(ti,T) and V(ti, T). However, these are valid only for the ADF test”.This study carries out its estimation based on the model below:

| (1) |

|

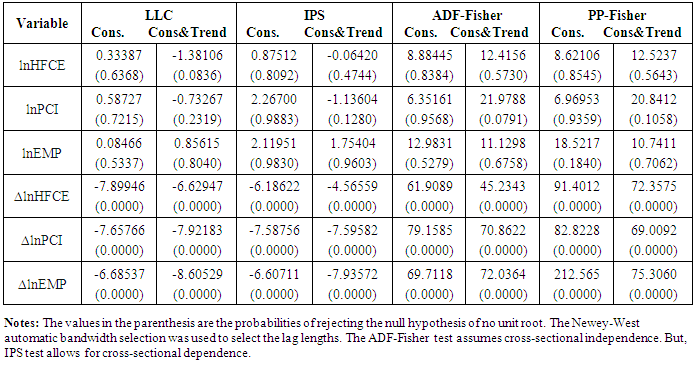

3.1. Panel Unit Root Tests

- The first step of panel co-integration analysis is to investigate the stationarity properties and to determine the order of integration of the variables. For series to be co-integrated they have to be of the same integrated order. Therefore, we used four panel unit root tests LLC, IPS and Fisher- ADF and Fisher- PP tests suggested by Maddala and Wu (1999). In the test equation, two specifications are considered. The first specification includes only an intercept, and second, includes both a trend and intercept. Especially LLC and IPS tests are widely used panel unit root analysis in the literature on panel co-integration. While LLC (2002) suppose that the cross-sectional units share a common unit root process, IPS (2003) presume that the cross-sectional units have individual unit root process.Results for the panel unit root tests are illustrated in Table 4. This table summarizes the unit roots tests for the panel series and shows that all variables which constitute the series is non-stationary and possesses unit root at level (more than the 0.05 significance level) i.e. the acceptance of the null hypothesis of unit root and non-stationarity. To test the order of integration, the panel unit root tests are then applied at first difference.

|

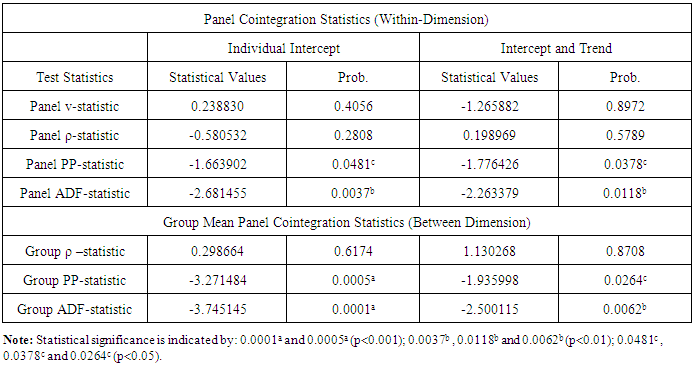

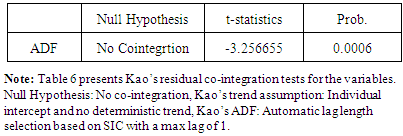

3.2. Panel Cointegration Test

- In this study, the Pedroni (1999) and Kao’s panel co-integration tests are used to examine the existence of a long-run relationship between the variables under study. The implementation of Pedroni’s co-integration test firstly requires estimating the following long run relationship (Pedroni, 1999). The co-integrating equation takes the form:

| (2) |

| (3) |

|

|

|

|

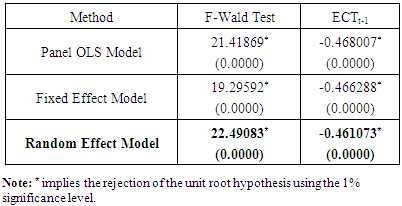

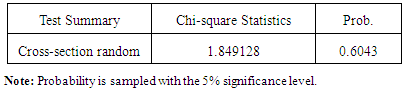

3.3. Panel Causality Test

- Whenever a model is found to be co-integrated it indicates the possible existence of causality (Apergis and Payne, 2009). In a bid to establish the causal relationships between the variables, an error correction model in conjunction with panel data is applied. This includes a test using the Pooled Ordinary Least Squared Regression, Fixed Effect model and Random Effect model. In the pooled regression, the whole observations are pooled together neglecting the cross section and time series nature of the data. By doing this, the coefficients (including the intercepts) are implicitly assumed to be the same for all individuals, leading to a situation whereby we deny the heterogeneity or individuality that may exist amongst the countries under study. Fixed effects regression is the model to use in order to control for omitted variables that differ between cases but are constant over time. It allows for changes in the variables over time so as to estimate the effects of the independent variables on the dependent variable, and is the main technique used for analysis of panel data (Borenstein, et al., 2009). In a case whereby some omitted variables may be constant over time but vary between cases, and others may be fixed between cases but vary over time, then both types can be included by using random effects (Stock and Watson, 2010).The Error correction term captures the long run dynamics of the observed variables and also at the same time indicates long run causality. The rule which governs the Vector Error Correction model states that, the value of the error term’s coefficient must be between -1 and 0, and its probability must maintain a 5% significant level. Table 9 shows that the three models are statistically significant. Therefore, the endogenous adjustment from short run to long run works in all three models. At the end of the first period, the short and long run imbalances will reduce by 46%. Therewithal, the variable is expected to return itself to equilibrium at the end of the second year (1/0.46=2.17). The F-Wald Test indicates the short run relationships between the economic variables under study. The probability of all models tested is statistically significant maintaining a 5% significant level. In this vein, it can be concluded that the three models support the existence of a short run relationship. In conclusion, the empirical analysis portrays the fact that, a long run and short run causality relationship exists between the economic variables under study.

|

|

4. Conclusions

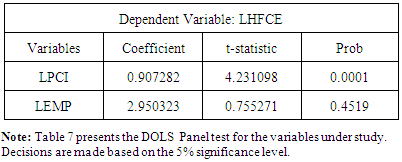

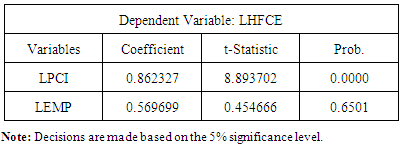

- In this study, we investigated the dynamic causal relationship between poverty, income per capita and employment in seven West African Cuntries within the period of 1991-2010 using panel cointegration technique. Panel unit root tests suggest strongly that these series are integrated variables at order of I(1). The panel cointegration test based on Pedroni residual cointegration tests and Kao residual cointegration tests were used to test the cointegration of the variables. DOLS estimator and FMOLS estimator were employed in order to determine the long-run relationship of the variables amongst the selected West African countries. Panel cointegration tests shows the evidence of a cointegration relationship amongst the variables of our model. According to the results obtained from the study, the FMOLS and DOLS’ co-integration coefficients of the seven countries shows that per capita income has a positive and statistically significant influence on poverty. It however reveals that, employment has no influence on poverty. This is a quite reasonable outcome. When we take a critical look at the employment structure of West African countries, it is obvious that a large majority of total employment has the attributes of non-productive employment (in terms of, vulnerable employment, low quality employment, and underemployment). The West African economies engage in an intensive production of primary commodities and depend solely on the export of these goods. As a result of this, employment is of low quality and this dependence stands as one of the greatest obstacle preventing the attainment of a high and sustainable income growth within the West African region. In this regard, an encouragement of ‘inclusive growth’ through a long-term improvement in the quality of employment will be able to create an impact in poverty reduction.In conclusion, after determination of the long-term co-integration relationship between the variables, the Error Correction model (VECM) was used in examining the causal relationship existing between the variables. The Error Correction term’s negative and statistically significant nature indicates the significance of the model. This means that deviations from equilibrium value of poverty amongst West African countries in the short run are corrected in the long run. According to the obtained lagged coefficients, conclusions were made that in the long run, per capita income has a positive influence on poverty reduction. The important policy implication is that policies aimed at improving employment will have delayed effects on poverty, but it should be noted that this effect is insignificant. This means that eradicating poverty is not purely a question of generating economic growth and employment opportunities but in the meantime providing that both the quantity and quality of available work is such that it can lead to poverty reduction (Bell and Newitt, 2010). Our results support studies by Kraay (2004).

Notes

- 1. In West Africa, it is quite difficult to gather accurate statistics particularly on youth employment. When calculating the unemployment rate, the informal economy and employees working under poor conditions are not taken into consideration. The proportion of the young unemployed in West Africa is one of the world’s highest which was recorded as 18% in 2005. Due to conflicts that arise in certain countries like SierraLeone and Liberia, youth unemployment is much more higher with its rate at 60% and 88% respectively (YEN-WA, 2008). 2. A section of debates made on poverty reduction strategies is associated with the contribution of economic growth to poverty reduction. When elasticity is at a reasonable height, poverty reduction strategies will often depend on economic growth. At the point where elasticity is low, growth as well as the deterioration in income distribution should be taken into account (Bourguignon, 2003).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML